SMH Favorite Names Coverage: Q2 2025 Edition

Nvidia, TSMC, Broadcom, Qualcomm, Applied Materials, AMD, KLA, Micron, Cadence, Intel, Synopsys, Marvell, Monolithic Power

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Today I will cover every highlighted company in the market-cap weighted semiconductor ETF.

NVDA 0.00%↑ TSM 0.00%↑ AVGO 0.00%↑ QCOM 0.00%↑ AMAT 0.00%↑ AMD 0.00%↑ KLAC 0.00%↑ MU 0.00%↑ CDNS 0.00%↑ INTC 0.00%↑ SNPS 0.00%↑ MRVL 0.00%↑ MPWR 0.00%↑

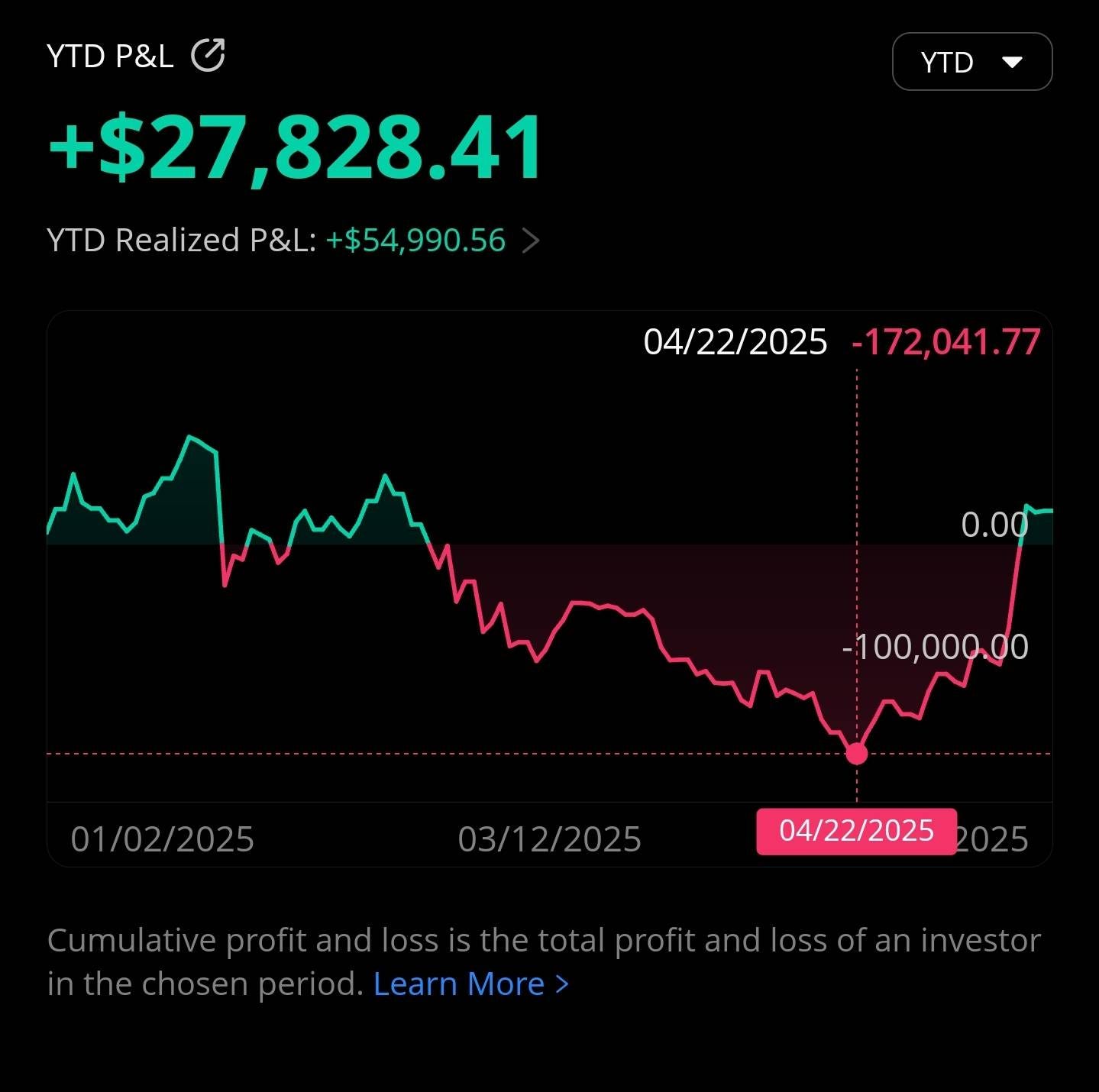

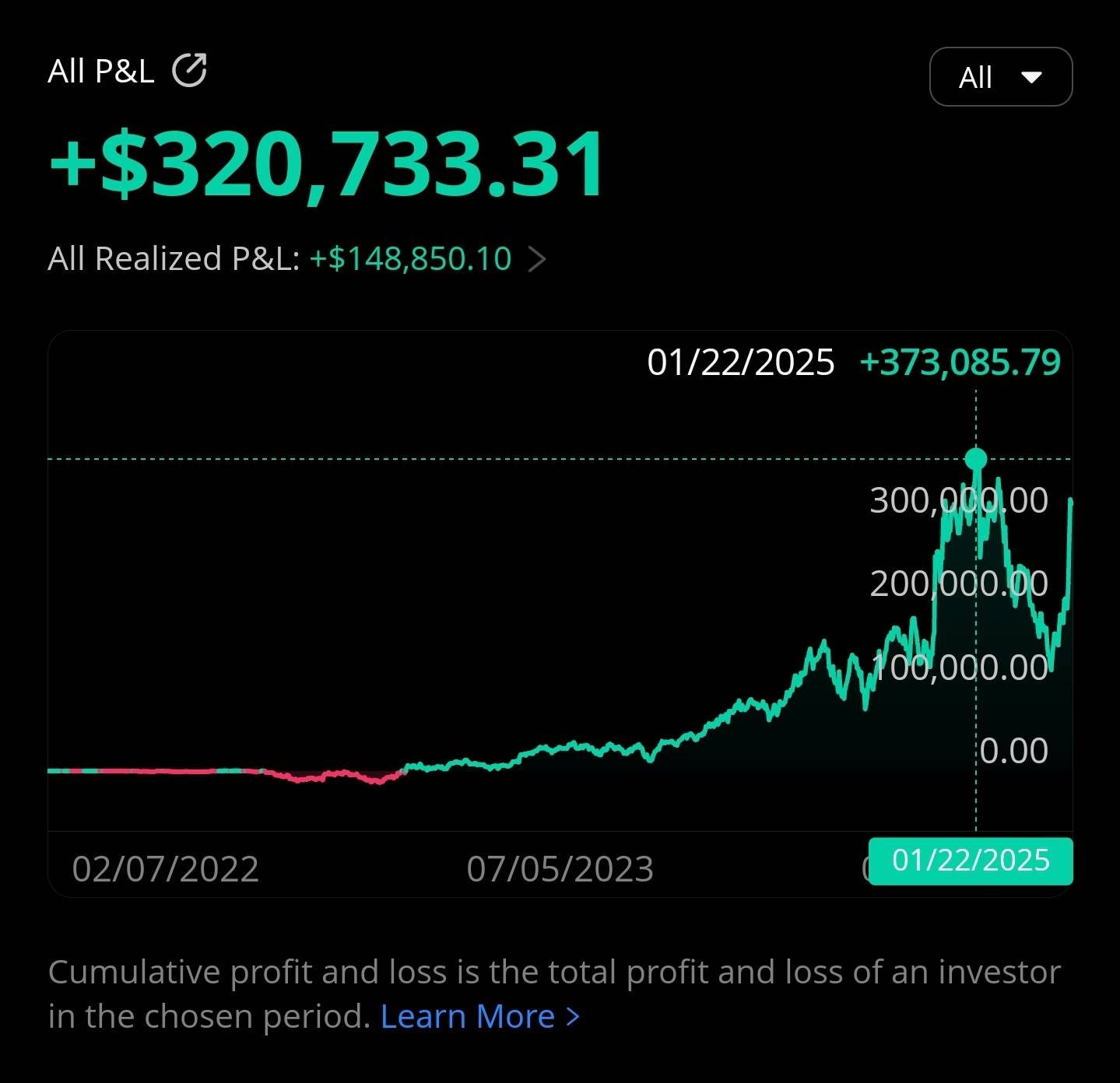

I benchmark my trading account against SMH and… lets just say the last month has been rather volatile.

For those of you worried, don’t be. Webull clearly says I am “safe” in big green letters.

(ignore that my margin equity is less than $24K…)

If I was a professional investor, I would have been fired for such a disastrous drawdown. In fact, risk management would never allow me to do such crazy shit.

Thankfully, I am unprofessional investor. 🤡

In celebration of digging myself out of a negative $172K YTD hole, I thought it would be fun to cover every component of SMH that interests me.

Given how chaotic my trading account is, I will be changing how disclosures are reported going forward.

Every holding will still be disclosed periodically.

I will now separate out my long-only accounts from my highly leveraged degenerate trading (Webull) account.

Long-only accounts will continue to be tracked via manually updated spreadsheet.

Trading account will be excluded from the spreadsheet. Instead, I will just screenshot the entire account to save time.

This post will not have an update for the long-only accounts as I am very busy and do not have time to re-build the manually updated excel sheet.

Full update (all holdings) in a few weeks once my upcoming mega-project on 5G/6G/Telco/Wireless is ready.

It’s a shit ton of NVDA, AVGO, TSM shares with some GEV mixed in.

Nvidia and Broadcom:

These two deserve coverage together.

One of the nice things about running this Substack is I get to meet and talk to people who I never would have interacted with otherwise. From various dayjobs, I have a network of fellow engineers. Through Substack, I have met more engineers and MANY finance people. Professional buy-side investors who manage billions of dollars worth of equities.

This is quite helpful. Learned a lot.

Within the professional investor community, there is a fierce debate between Nvidia and Broadcom.

Nvidia bulls are positive for the obvious reasons.

Note: Nothing over the las 14 months has changed my opinion. Go read the old post. Rack-scale systems (enabled by leading SerDes and systems design) is a massive new moat.

Broadcom bulls (who also tend to be Nvidia bears) typically give the following line of reasoning for their stance.

Nvidia is earning super-normal margins.

Nvidia has high customer concentration amongst the Hyperscalers.

The Hyperscalers are well-funded and have a strong incentive to destroy Nvidia’s margins.

Broadcom is the best semi-custom ASIC partner with the most design wins and best technology.

Long Broadcom, short (or avoid) Nvidia.

Out of all the professional investors/analysts I have spoken with, only one agrees with my take on NVDA+AVGO. I won’t say his name or firm but he works at a large, highly respected institution. One of the smartest and most clever people I have ever met.

Out of all the Hyperscaler ASIC projects, only Google TPU is good. The rest are flops.

Who amongst you is watching the clown show that is Trainium 3 and thinks…

Yes.

Nvidia gross margins will be under pressure because of Hyperscaler ASICs.

Google TPU, the best AI ASIC, still has difficulty gaining meaningful traction from external (3rd party) customers. Google themselves use Nvidia GPUs for internal workloads and GCP has signed a new (large) contract with Coreweave for… more Nvidia GPUs.

Nvidia is out there building bleeding-edge systems while everyone (excluding Google) is trying (and largely failing) to make chips.

Nvidia is at least 18 months ahead of the competition based on engineering merit. They have a history of ruthlessly out-innovating, out-running, and out-competing their opponents. Trust me, I have been following Nvidia+AMD+Intel long before the AI era.

Mr. Leather Jacket is ruthless. If Jensen dies, then maybe Nvidia will regress into becoming a normal company. Until then, conventional wisdom does not apply.

TSMC and Intel:

I am going to ignore Intel Products as they are kinda doomed. Intel Foundry is not going to be viable until 2027. 18A is in an unacceptable state. Intel themselves know it and are basically admitting this to investors.

An investor friend of mine attended a private call with Intel Investor Relations (IR). They basically threw Pat Gelsinger (“overly promotional”) under the bus and talked down 18A.

A Background-Proof Guide on Process Development Kits

Irrational Analysis is heavily invested in the semiconductor industry.

TSMC is an incredibly powerful **earned** monopoly. If you want to go long Intel, maybe long-duration (Q4 2026 or later) call options is an option. Shares won’t go anyway for the next 12 months IMO.

Qualcomm:

Qualcomm Q2 FY25: Apple Modem Timeline Accelerated

Irrational Analysis is heavily invested in the semiconductor industry.

Qualcomm stock is “cheap” for good reason. In my opinion, the stock is still overvalued given the many existential risks that keep ramping.

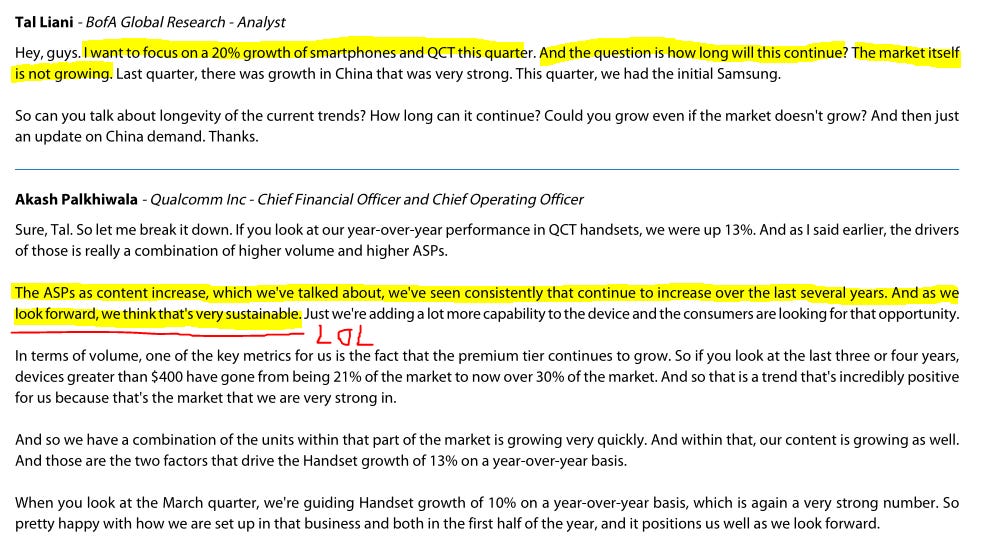

Remember all those sell-side analysts that repeatedly asked Qualcomm management how far they can raise prices?

The largest customers are trying to develop their own chips using ARM CSS and Mediatek/Unisoc thin modems.

One other thing I feel that needs to be pointed out is share with Samsung.

The last few years, Qualcomm has enjoyed 100% market share in the Samsung flagship (Galaxy S) phones. This is because Samsung Foundry has repeatedly and catastrophically failed.

Having 100% share is great. The problem is things can only go downhill from there. If Samsung Foundry delivers a passable process node (lord knows those Fabs need better utilization…) Qualcomm share drops to 80%. Maybe as low as the historical average of 40%.

I think edge AI is stupid.

But let’s assume it is not stupid for a moment.

If Qualcomm edge AI is good…

… why did Google make their own smartphone SoC with their own NPU?

… why is Xiaomi making their own smartphone SoC?

… why is Apple making their own AI-enabled modem?

… why is Qualcomm laptop/PC market share still less than 0.5%?

… why are automotive gross margins still dilutive to the corporate average?

Qualcomm actually does not have anything. It’s a slow burn and excellent funding short in my opinion. Shorting is very dangerous so reminder to always do your own research.

Applied Materials and KLA:

Applied materials whiffed earnings this week.

To understand why I no longer favor Applied Materials, we must understand…

ICAPS

https://www.appliedmaterials.com/us/en/semiconductor/markets-and-inflections/icaps.html

The sneaky thing about ICAPS is that any process node “10nm or larger” is lumped into this category. So… all the PRC-based fabs that are definitely buying equipment for non-export-controlled process nodes have their orders booked as ICAPS.

Applied Materials makes really cool equipment that is critical for the gate-all-around transition.

But… ICAPS is too severe of a headwind for me to invest.

Out of the major semicap companies, I choose to put my own money into KLA.

KLA makes process control equipment. Think of these machines as “uniformity” checkers. As complexity increases, process control intensity dis-proportionally increases. Lord knows Intel Foundry and Samsung Foundry need more process control to improve parametric yield.

Gross margin is one of the first numbers I look at. It is a reflection of the value delivered by the product/service.

Distant #3 position is talking about how Onto and Camtek were both ahead. KLA is apparently murdering both.

AMD:

Several people have pinged me asking about AMD because of the recent social media posts by Semianalysis. Out of respect for Dylan and Doug, I will refrain from commenting.

There is a post they had and I have some disagreements.

AMD does not have an internal 200G SerDes program as far as I am aware of. A lot of the value of NVLink switches is the in-network compute. Doubt that AMD + 3rd party switch vendors will provide a good ecosystem.

“Competitive on paper” is classic AMD. Remember the old 2023/2024 Semianalysis articles on how MI300 would be “competitive on paper”?

Repeatedly, Semianalysis told AMD they need to invest in more internal GPU resources so the AMD first-party software engineers can do their jobs.

Repeatedly, Semianalysis highlights that AMD has $5 billion in cash and should invest in software engineers and GPUs for said software engineers.

Amusingly, AMD ignored this advice and announced a $6 billion stock buyback three weeks after SA published.

AMD is not an AI story. I fail to see how AMD can compete with the Hyperscaler ASIC projects, let alone Nvidia.

But… the stock might be worth a trade. FPGAs (Xilinx) are top notch and may have cyclically bottomed. Honestly don’t know.

Share gains in laptop/PC against Intel is a good story.

Micron:

Micron is a stock that many novice investors get destroyed by. I have seen a lot of remarkably uninformed investment analysis on this name.

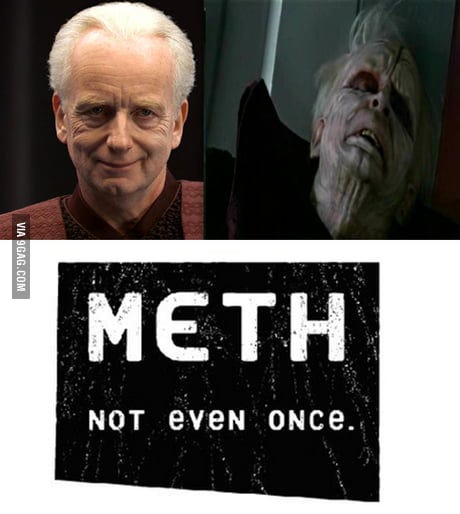

Micron is the crystal meth of semiconductor investing. Incredibly dangerous.

Memory is an incredibly dangerous, violently cyclical market. Without a doubt the most degenerate sub-sector within semiconductors.

If you do not understand the following, you should not touch this stock.

Samsung 12-Hi HBM3e may be qualified by Nvidia soon.

CXMT may flood the market with DDR5.

Cyclical and recessionary pressures may reduce smartphone and PC volumes, decimating the memory industry even as HBM continues to be healthy.

I have covered Micron and memory several times if you are interested to learn more about the crystal meth of semiconductor investing.

Cadence and Synopsys:

Cadence and Synopsys are the EDA (electronic design and automation) duopoly. There exist other players such as Siemens and Keysight but they are negligible.

If you want to design a chip, you have to go through Cadence and/or Synopsys.

In general, companies tend to use tools from both vendors to mix/match and negotiate pricing. For example, a company may use Synopsys RTL synthesis tools but implement physical design with Cadence.

It is rare for a company to bias heavily in favor of one vendor. Intel almost exclusively uses Synopsys tools and some speculate that may change as Lip-Bu Tan (former Cadence CEO) is now in charge of Intel. This is a meme idea IMO. In reality, a lot of people are about to get fired at Intel and Synopsys will be losing SaaS seats.

Chip design involves many steps.

Broadly speaking, Synopsys has strength in RTL synthesis (“compiling verilog code into logic gates”) while Cadence has strength in analog simulation.

Both companies are competently run, leading to a (mostly) stable earned duopoly.

There are areas of divergence though.

Cadence has significant strength in analog, 3D electromagnetic, and 3D thermal simulation. This has become increasingly important in the chiplet and advanced packaging era. In response, Synopsys is trying to buy Ansys.

https://www.ansys.com/products/electronics/ansys-hfss

HFSS is the leading finite element solver. Synopsys really needs for the Ansys deal to go through. Otherwise, Cadence will have a bundling advantage with Clarity3D.

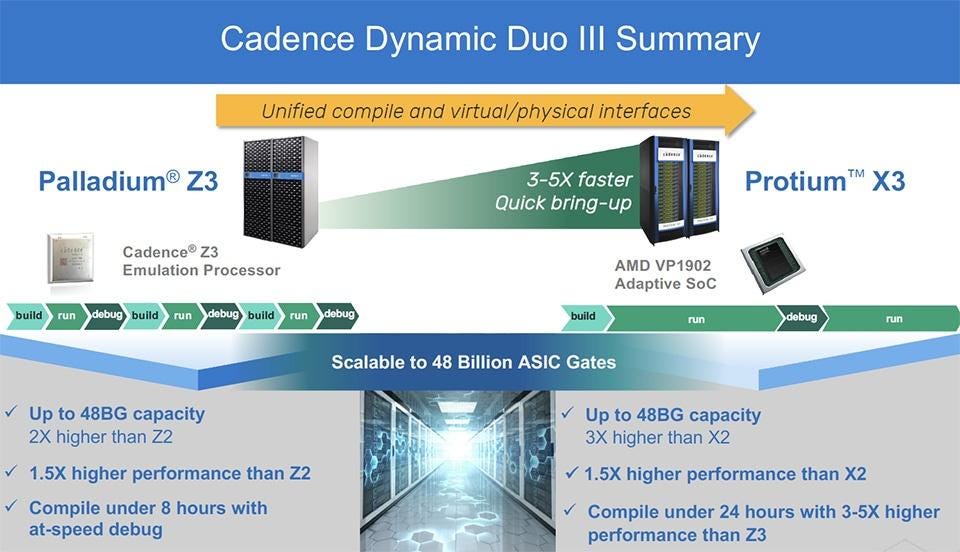

Both vendors sell hardware for emulation and prototyping.

Emulation simulates a chip design in detail, enabling developers to find hardware bugs before tape-out.

Prototyping simulates a chip at a high-level, sacrificing accuracy for much faster speed. This allows software developers to write code for a chip that does not exist yet.

Cadence has an in-house ASIC for emulation and uses AMD/Xilinx FPGAs (in a big box) for prototyping.

Synopsys uses AMD/Xilinx FPGAs for both emulation and prototyping. Go read earnings call transcripts and you will find one of these solutions is outselling the other.

Finally, Synopsys and Cadence both sell IP. This is similar to ARM’s business but with much worse margins and typically no per-chip royalty. “IP” is typically sold as a hard macro. Customers copy-paste the block (Ethernet PHY, memory controller, HBM PHY, …) into their designs.

Again, this is not a good business. It sort of exists as an add-on to the core EDA software. Synopsys and Cadence have you in the door for the chip design software, why not add some IP blocks to that SaaS contract for a little more money?

The valuation discrepancy between Synopsys and Cadence is because of IP.

IP is ~30% of Synopsys revenue but only ~10% of Cadence revenue. Investors (rightfully) discount the IP revenue as lower quality due to the non-recurring nature and lumpiness.

As an aside, there is a pure-play interface IP company called Alphawave.

As you can see, things have not gone well. Qualcomm is currently trying to buy them.

The fact that Alphawave exists at all given the incredible structure advantages Synopsys and Cadence have tells you a lot about this business.

Synopsys and Cadence don’t pay for EDA tools… they are the tool vendors.

Both of them have incredible deal-flow and bundling opportunities.

Alphawave’s continued existence is interesting. Logically, Synopsys+Cadence should have squeezed them out by now.

Marvell:

There are two parts to Marvell, the AI ASIC business and oDSP.

I have covered oDSP and how it is at risk here:

Marvell Losers Folding, ARM Shareholders Baghodling

Irrational Analysis is heavily invested in the semiconductor industry.

All of you should go over there and subscribe if you have not already.

AYZ has very interesting ASP information regarding the oDSP market. Additionally, they covered both Trainium 3 and Maia 2.

For AI ASIC, there are a lot of NRE games going on.

It is common practice for large companies to pay multiple suppliers NRE (non-recurring engineering) for a design before deciding which one to ramp into volume production. Pay up-front money to multiple vendors.

This person from AYZ’s comments section is wrong.

Bro… Microsoft definitely has the resources. It’s just money (NRE), a small handful of engineers, and a few project managers. This is normal lol.

Amazon has pitted Alchip and Marvell against each other for Trainium 3. Currently, Alchip appears to have the upper hand.

AYZ says that Microsoft has paid NRE to both Marvell and Broadcom.

In my opinion, this places Marvell’s perceived Maia 2 design win at great risk. Alchip (using Synopsys SerDes) and Marvell are roughly comparable in terms of quality. The same cannot be said of Marvell and Broadcom.

If you think Marvell SerDes can beat Broadcom SerDes, I don’t know what to say honestly.

Monolithic Power:

Monolithic Power makes high-quality switching regulators.

Primer: Switching Regulators and VRMs

Irrational Analysis is heavily invested in the semiconductor industry.

They lost content with Nvidia to cheaper competitors but apparently have won it back because several of their competitors fucked up.

I explain switching regulators and why they are a dangerous investment in the above post but very quick summary for the lazy:

There are many players in the switching regulator market including Monolithic, Infineon, Analog Devices, Texas Instruments, and many B-Tier and Chinese companies.

Power efficiency and ripple performance (loosely) scale with phases. (put more of these chips in parallel)

It is generally easy to design-out a switching regulator with a new PCB design.

Pricing pressure is a real problem in this market.

Without a doubt, Monolithic Power makes the best switching regulators in the world. In the long term, it’s probably a decent investment. In the short term, the risk of massive volatility due to a design-out is always there. Tread lightly.

Still working on that big project. See you around.

Remember, it’s just money. It’s made up.

![[GB200 NVL72] The Mainframe of Doom](https://substackcdn.com/image/fetch/$s_!_hFr!,w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9b4c8e16-a994-40a1-a08d-07d4a9448536_647x846.png)

![[$MU Q3 FY24] Memory is Still a Commodity](https://substackcdn.com/image/fetch/$s_!vKEo!,w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F248e6d05-dae8-438a-a16b-982b99bffaaa_605x599.png)

![[Q1 CY24] Micron's HBM Party](https://substackcdn.com/image/fetch/$s_!9Jb_!,w_1300,h_650,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fef2114e3-e307-4dbc-91d8-508be7d9fdb2_808x427.png)

Not a mention of Lam ?

Good read. I will say I am rather puzzled of your thoughts on ARM and QCOM.

On one hand, you have stated that ARM designs suck (which is true), which is why QCOM started designing their own micro architectures through the Nuvia acquisition.

ARM memory controllers have been underperforming for 10y+, to the point the SoC may be <2/3 the performance of Nvidia or Qualcomm chip in real world workloads.

But it is not just that plagues Samsung, as their designs were underperforming even when the foundry was in good enough shape to also supply Qualcomm.

What about Mali GPUs? Even Samsung has been wise enough to move away from that dumpster.

Mediatek is in the same boat as everyone else, which is how QCOM got to be where it is.