[$MU Q3 FY24] Memory is Still a Commodity

This time is not different.

IMPORTANT:

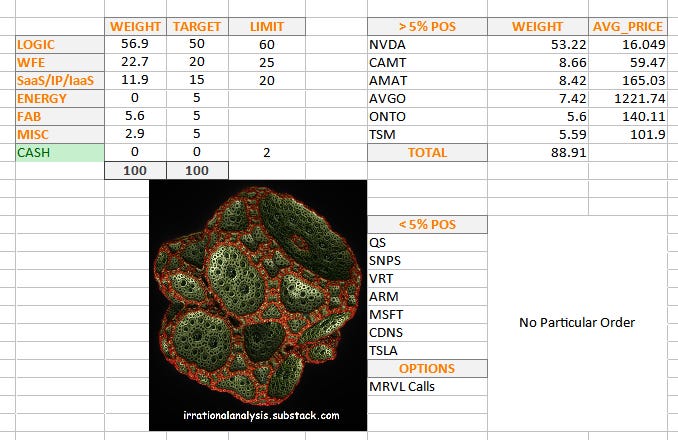

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

Welcome to my somewhat late coverage of MU 0.00%↑ earnings. There is some deeper analysis on the state of memory, HBM, and WFE so hope that makes up for the delay.

Contents:

Micron Earnings

Slides Analysis

Earnings Call Transcript Analysis

Capex and WFE Implications

Samsung HBM Conspiracy Theory

Cocaine Elmo 👃

Conclusion —> Teaser on WIP NAND Idea

[1] Micron Earnings

First, full disclosure.

I put a small amount of (borrowed) money into this gambling opportunity and whiffed half the potential profits. Still pretty good winnings from the Citadel casino.

MU 0.00%↑ had a manic, pre-earnings run up and crashed in after-hours. To understand why, we must go to the slides and transcript.

[1.a] Slides Analysis

HBM revenue numbers have been confirmed and buy-side was not satisfied. All capacity has been sold and basically all pricing has been locked in. This is a sell-the-news situation where all good news is out and nothing is left to hope the stock up.

Micron also talks up datacenter SSDs for AI training datasets. Will expand on this in section [5].

This slide basically killed the stock after-hours. Sell-side was expecting $10B FY25 capex and Micron is implying ~$13B or more. Turns out, this cycle is not different. The profitability people were hoping for is not going to happen. Higher gross-margins of HBM offset by higher capex.

NAND/SSD shows up again in an interesting way. #forshadowing

[1.b] Earnings Call Transcript Analysis

These trends will drive significant growth in the demand for DRAM and NAND, and we believe that Micron will be one of the biggest beneficiaries in the semiconductor industry of the multi-year growth opportunity driven by AI.

Haha no. Logic ( NVDA 0.00%↑ AVGO 0.00%↑ TSM 0.00%↑ ), WFE ( CAMT 0.00%↑ ONTO 0.00%↑ AMAT 0.00%↑ LRCX 0.00%↑ KLAC 0.00%↑ TEL 0.00%↑ ) and SaaS businesses will be the biggest AI winners.

This time is not different. Memory is still a commodity.

Thomas O’Malley (Barclays): Hi, guys. Thanks for taking my question. This is for Sanjay or Mark. So, you’ve given us the fiscal year ’25 kind of Company guidance of several billion in HBM. And then you’ve kind of talked about the share that you’re getting to is equivalent to that of DRAM. So, you kind of saw for that market low teens, total HBM market. I just kind of want to understand, what’s your view of the suppliers to that market? As it stands today, it seems like there’s really two major suppliers. When you look at the out year, do you think that number changes if there is additional qualifications? Would that number change if you were to have a third qualification, aka, the market be bigger? And how did you kind of come up with that total market number? Is that kind of a bottoms-up accelerator forecast? But just kind of how you’re thinking about the market. And did that change or is it contingent upon qualifications of some of your competitors?

Sanjay Mehrotra: Well, as we have said before, that we see the CAGR for HBM growth, in terms of bit growth CAGR to be well above 50% over the next few years. So, certainly, HBM is a strong growth driver. And again, as we increase our mix of HBM going forward, it will of course be continuing to be accretive to our financial performance, including margins. And we are pleased that with the strong performance that we have, we are sold out for ’25 as well, with a overwhelming part of our output already committed in terms of pricing. So, that points to a strong position that we have in terms of continuing to work toward achieving our goal of getting to our HBM market share to be in line with DRAM share sometime in 2025. And of course, we are working with a broad range of customers, in qualifications, and next year we plan to be shipping to broader set of customers.

Having said all of that, no question that HBM is a complex product for our customers to qualify as well. It’s highly resource intensive, not just for us, but for our customers as well. And this is where we think that our strong product position, highlighting again those attributes of 30% better power than nearest competitor, and a better performance, and really high quality here positions us well when customers work with those resource-intensive qualifications for Micron. And that’s what we are already seeing in terms of our engagement. So, we feel pretty good about our plans here for HBM.

Barclays analyst is asking about the raging dumpster fire that is Samsung. Micron CEO refused to take the bait. I have a detailed theory on Samsung HBM in section [3].

Harlan Sur (JP Morgan): Good afternoon. Thanks for taking my question. Enterprise SSDs are seeing really strong demand pull from AI workloads, right? The team has driven significant share gains in enterprise SSD just over the past few quarters. I think in calendar Q1, I think Micron was the number three global share leader in enterprise SSD. I think it’s now about 20%, 25% of the overall NAND business. I mean, this is a position that we’ve never seen Micron in before. So, I think first question is, are enterprise SSD gross margins accretive to your overall NAND gross margins? And then secondly, I saw your next-gen PCIe Gen5 SSD demo at NVIDIA’s GTC conference. Pretty significant performance uplift on AI workloads versus your Gen4 SSDs. So, are you qualifying these next-gen Gen5 SSDs for AI applications? When do you expect to shift? Just wanted to understand the sustainability of your strong share position here.

Sanjay Mehrotra: Well, thank you, Harlan, for recognizing the strong momentum that Micron’s data center SSD have. And certainly, our data center SSDs are accretive to our overall NAND margins. And we have really great products. I already highlighted in my prepared remarks that we saw tripling of bits that we shipped with our 32-layer NAND AI SSDs going absolutely toward AI data center applications. And we have a broad set of customers that we are working with in terms of growing our share. So, we see — when we talk about sequentially, we had 50% increase in revenue for our data center products, of course, that includes the benefit of our strong data center SSD roadmap. And yes, I mean, we will, of course, continue to work with our Gen5 SSDs in terms of working with customers for qualifying and not prepared to discuss, at this point, specifics regarding timing of some of the roadmap that is in front of us for shipments.

So, yes, in terms of sustainability of the strong improvement to share, we are definitely with our strong product portfolio counting on it. And this will — our SSD momentum, data center SSD momentum, will absolutely contribute also toward my remarks that I said that we will increase our mix of data center revenue in fiscal year ’25 as well. Of course, HBM, high-density DIMMs, these will, of course, be a big part of it. But also, data center SSDs is going to be another big part of our growth in fiscal 2025 related to data center revenue.

Mark Murphy: So, I would just add, Harlan, that the storage business unit delivered operating profit in the quarter.

JPM analyst is interested in NAND/SSD like me. He asked good questions and got no useful information other than the reported quarter had operating profit for storage BU. This implies the last ~8-10 quarters had operating losses in storage lol.

[2] Capex and WFE Implications

At the time of writing, approximately 22% of my holdings are semicap/WFE stocks. Applied Materials, Camtek, and Onto Innovation. (in that order)

A finance friend of mine has been bearishly screaming that semicap is overvalued and we are in a massive bubble. His persistent screeching was enough to scare me from buying more semicap.

Micron’s announcement is great news for semicap bulls. The party continues for at least another 18 months. Possibly up to 36 months.

To be clear, we are in an epic bubble. The AI datacenter buildout is insane. We are gona hit a violent correction at some point but for now… I WILL CONTINUE TO EMBRACE THE BUBBLE.

EMBRACE MR. LEATHER JACKET

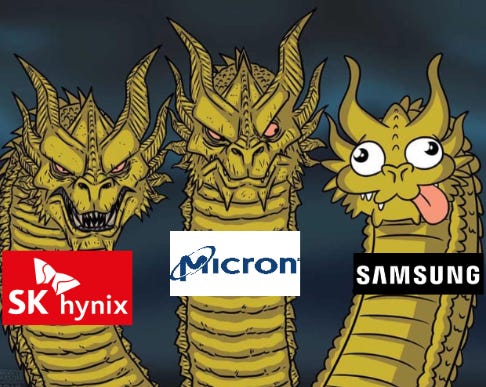

[3] Samsung HBM Conspiracy Theory

First, a baseline of facts based on public leaks, public commentary by competitors, and reporting by Reuters.

Samsung failed qualification with Nvidia in April 2024.

Samsung failed because of heat and power consumption issues.

Samsung’s HBM yield is less than 30%.

SK Hynix has credible HBM yield at 60-70% with some executives claiming 80%.

Micron claims their HBM is 30% more power efficient than the competition.

Let’s first understand how yield works at a high-level.

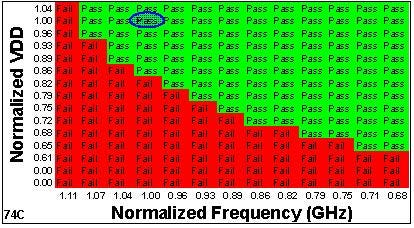

Semiconductor manufacturing (logic and memory) has intrinsic variation. Like all natural processes, it can be modeled with a gaussian.

The voltage a chip runs at, clock speed, and power consumption are decided based on testing and analysis of production samples.

There are two types of yield:

Catastrophic (chip broken)

Parametric (chip too slow and/or too hot)

Parametric yield is a choice.

A company can choose to only sell the top 1% of functional dies (fastest chips, most power-efficient chips) but will hemorrhage money as a result.

On the other hand, a company can instead choose to sell 100% of functional dies but must set the supply voltage very high and clock speed very low such that every chip uses the same settings. You cannot change voltage and clock speed within the same SKU.

Parametric yield decisions must balance profitability and product quality.

Now let’s go into some mind games.

Most of Nvidia’s BOM cost comes from HBM. There is a critical shortage and both SK and Micron are raising prices. Nvidia wants Samsung HBM to pass qualification.

Nvidia’s products have a fixed thermal budget. Because SK Hynix was first to market, all of these Blackwell boards were designed around the power/thermal behavior of SK HBM3e.

Micron claims that their HBM3e is 30% more power efficient. Let’s take their word for it and think about what this means for Nvidia.

The board is designed for a fixed thermal budget.

Micron HBM3e volume is much lower so it does not make sense to create a new SKU with lower power consumption.

Micron is also charging a higher price because of this power efficiency.

What is the logical thing to do?

The answer is to remove some power-delivery components to save money, sacrificing DC-DC efficiency. Micron gets their higher ASP. Nvidia still saves money on BOM. Customer sees no difference. Win-win.

The pictures of Blackwell boards I have seen have a ton of switching regulators. Unfortunately, I can’t make out the part # but let me walk you through a datasheet of an 80A Monolithic power switching regulator. This is intended to be a quick guide.

Switching regulators are a component that converts an input voltage into a (typically) lower output voltage. For example, 12V to 1.8V.

These devices are configurable and have an efficiency curve. As you can see from this plot, this particular “80 amp” marketed part has crap (88%) efficiency at 80A. Peak efficiency is at ~20A. Designers choose how many switching regulators to put in parallel to target a particular efficiency goal.

Essentially, there is a balance between cost (PCB real estate, switching regulators, inductors, filtering capacitors, …) and power/thermal efficiency.

Do you see where I am going with this?

Here are some made up numbers to build an intuitive understanding.

Nvidia saves 300W of power by using more energy-efficient Micron HBM.

Micron charges a higher price so that adds $1K to BOM cost.

Nvidia removes $1.2K worth of power-delivery components, reducing overall VRM efficiency and generating 250W of new waste heat.

The final Micron-HBM SKU uses 50W less power and has $200 lower BOM cost.

Everybody wins. :)

I grantee you that some Micron employee conducted this exact analysis in order to extract the highest possible ASP from Nvidia.

Now that we understand the dynamic between Micron and Nvidia, let’s take a look at Samsung.

Samsung has bad parametric yields. This means many HBM chips are running too hot. Samsung chose to cut yield down to 30% (hilariously bad), sampled parts to Nvidia, and still got rejected.

This suggests to me that Samsung knew they were not hitting the numbers Nvidia asked for, tried to BS them, and got called out.

There is a rumor that Samsung is trying to re-qualify with Nvidia again in July. Three months is not enough time to actually fix anything. I believe they are simply cutting yield to some number way bellow 30% and re-characterizing the new lot.

Samsung will eventually pass qualification. But at what volume? 🤡

[4] Cocaine Elmo 👃

I previously wrote about Micron, Samsung, and HBM two quarters ago and referenced a certain sell-side analysts report.

Our energetic, potentially intoxicated friend re-affirmed his price-target of $225 right before earnings.

Micron Technology Inc. shares have been feeling the love from Wall Street analysts lately, and Rosenblatt Securities just underscored one of the most bullish outlooks on Wall Street a day before the company’s highly anticipated earnings report.

Rosenblatt’s Hans Mosesmann reiterated his $225 price target on Micron shares MU, -0.53% in a late Monday [6/24/2024] report, with that target implying more than 60% upside from Monday’s close. The target lift comes as Micron is soon due to report results for its fiscal third quarter that will show how artificial intelligence is impacting the business.

”We expect Micron to deliver a beat-and-raise as we enter one of the largest memory cycles in history,” Mosesmann wrote.

I have nothing to add here. Just wanted an excuse to break out the cocaine Elmo meme. Someone please send my artwork to Mr. Mosesmann. Rosenblatt corporate email filters will probably mark my sketchy Proton Mail address as spam.

[5] Conclusion —> Teaser on WIP NAND Idea

First a refresher on my biases. You should not trust me.

HBM news is out. I believe Micron stock has all HBM news for the next 18 months priced in. NAND is not priced in though. I have been working on a NAND/SSD AI idea for quite some time. It will be finished soon. JPM analyst pulled on the right thread.

As for semicap, I continue to believe that AMAT 0.00%↑ , CAMT 0.00%↑ , and ONTO 0.00%↑ are great long-term investments.

I am not buying more semicap. Trying to diversify.

I am also not selling. Bubble has at least another 18 months of inflation to go before popping violently.

You are free to invest however you want. Copy my portfolio. Short/invert my portfolio. Don’t care. I am here to have fun. Remember the giant disclaimers I place at the top of each post.

Embrace the bubble. Embrace the chaos. 😈

![[Q1 CY24] Micron's HBM Party](https://substackcdn.com/image/fetch/$s_!9Jb_!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fef2114e3-e307-4dbc-91d8-508be7d9fdb2_808x427.png)

Funny you say this. Give or take around10 years ago I invested in about a dozen semi stocks (including $MU), based on what I thought were good prospects for them going forward. I foolishly sold a few of them completely (looking at you $AVGO, $TSM and $ARMH). Some I bought back during opportune times ($TSM). Sorry anyway, where am I going with this? Other than the $NVDA and $AMD big winners, guess which one was third best? Yes, $MU of all the things.

The thing with memory is that they get beaten down like crazy at times, so "Mr. Market" gives you the opportunity to buy them real cheap. Try checking returns from any of the lows for $MU and it always beats $SMH. E.g. From start 2013 (not even the exact bottom) returns rarely dips below $SMH. Memory may be a commodity but plenty of money is made in commodities. Strategically Micron is the only one based in the US with some production within the US so not easily threatened by nations that don't share our values. Logic fabs are not enough. You need memory and NAND fabs in the US as well. Micron will never be allowed to die.

Me, I'm happy to keep holding my $MU shares bought cheap and might even buy during a future bust. My philosophy has changed, and I now follow the "Coffee Can Portfolio" like approach. Also see the excellent book 100 baggers by Chris Mayer.

Memory has never really been able to get meaningful P.E. expansion and historically rests ~18.5 which suggests that it might be 30% overvalued.