Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

This note/idea is largely due to a buyside friend on pointed out how hilarious the recent ONTO 0.00%↑ earnings call was.

Admittedly, I had stopped paying attention to Onto and Camtek.

Contents:

Advanced Packaging Absolute Basics

Hilarious Copium Onto Earnings Call

State of Play

[1] Advanced Packaging Absolute Basics

Semianalysis has an excellent 5-part series on advanced packaging. In the interest of time, I will only explain the bare minimum information for you to understand this long/short idea.

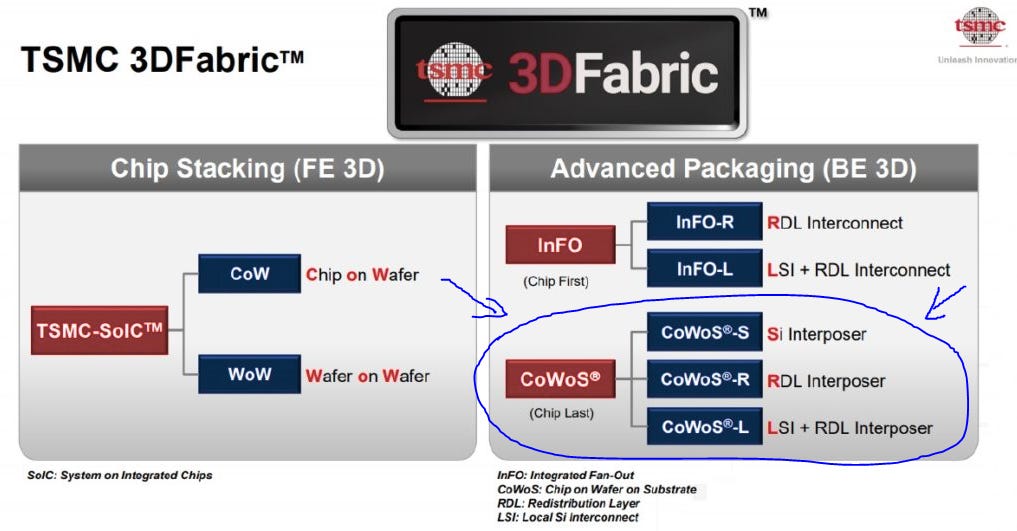

Let’s focus on CoWoS varients.

CoWoS-S is the simplest version. Not many routing options.

CoWoS-R is more complex. It provides a re-routing (re-distribution) layer and better performance when compared to CoWoS-S.

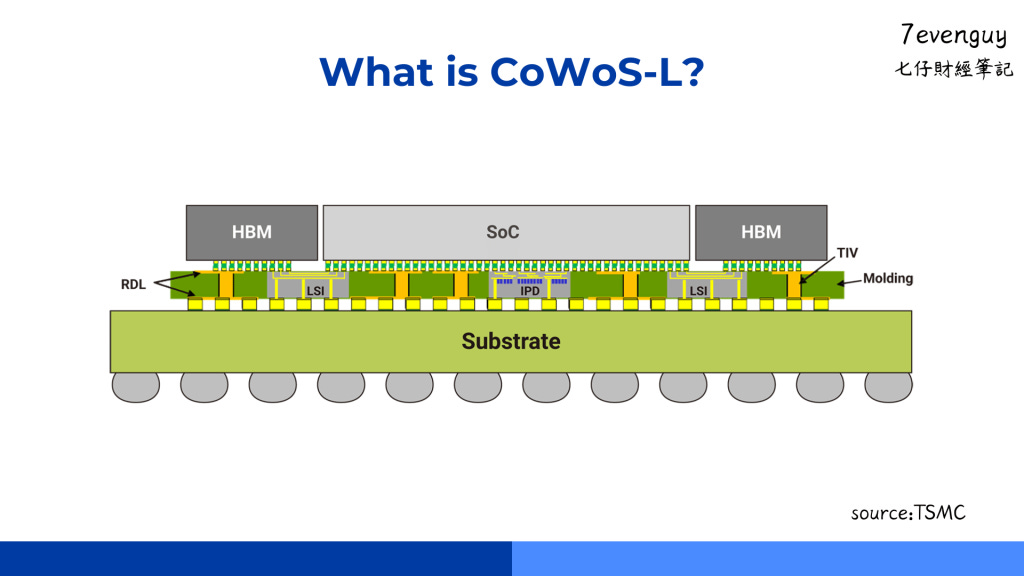

CoWoS-L is an enhanced version of CoWoS-R where tiny silicon bridges (local silicon interconnects) are embedded into the package RDL.

For those of you wondering about Intel Foundry, TSMC CoWoS-L ~= Intel EMIB…

Conceptually, these are very similar technologies from an end users perspective.

Yes, the packaging process and materials science are technically different.

No, I don’t care.

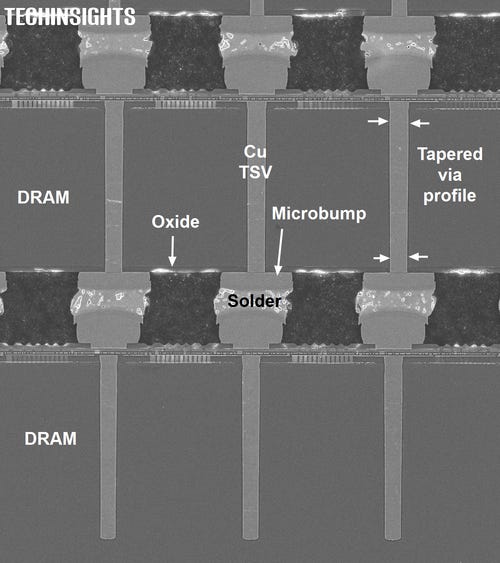

Let’s talk about bump-pitch.

Bump-pitch is how far apart each I/O pad is from it’s nearest neighbor.

Bump-size (diameter) is how big the I/O pad + solder ball is.

The main problem with advanced packaging is aligning all the chips (logic dice, HBM dice) with super small bump-pitch.

For a deeper dive into what goes wrong in advanced packages, check out this semiengineering article.

In short, this shit is very difficult and mistakes are expensive. This is why advanced packaging inspection companies (Onto, Camtek) benefitted so much with the AI boom.

[2] Hilarious Copium Onto Earnings Call

This call is truly legendary.

lol

LOL

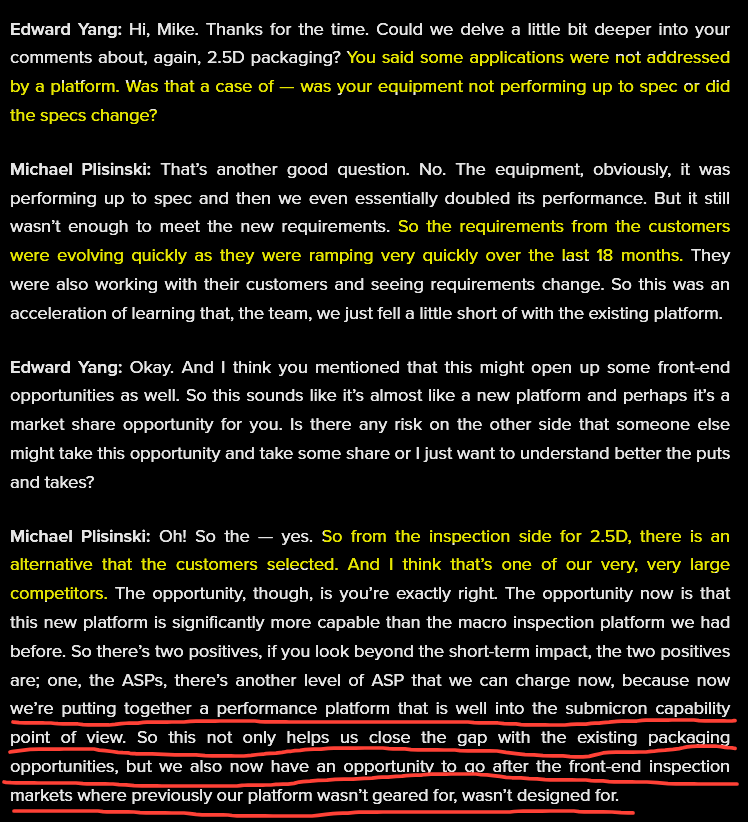

I suspect they failed TSMC qualification for CoWoS-L which has much smaller bump-pitch than CoWoS-S.

Translation: we failed.

LOOOOOL

Well there is tremendous interest… just not in your products.

Confirmation that KLA murdered Onto. Note that KLA traditionally makes “process control” tools for tracking wafter uniformity. These tools have been re-purposed for advanced packaging metrology/inspection.

So the plan is to stop getting punched in the face by KLA in advanced packaging market and instead start to take process control share from KLA.

LOL good luck with that.

[3] State of Play

So how do these inspection tools work?

No idea.

For investment purposes, we already know enough information:

KLA “process control” tools crush Onto when they are re-purposed for advanced packaging inspection.

Onto (an American firm with American manufacturing) cannot easily sell advanced packaging tools to mainland China.

Camtek (an Israeli firm with Israeli manufacturing) ….

…. might also lose to KLA re-purposed tools too but who cares.

They can just sell huge volume to mainland China.

Sidenote: As an aside, Intel Foundry should buy more KLA machines to improve 18A. This is simultaneously a serious/genuine suggestion and a direct insult.

To me, long KLAC 0.00%↑ , short ONTO 0.00%↑ seems like the balanced-risk idea.

The problem I have with this is KLA is not a pure play in advanced packaging.

(I personally strongly prefer pure plays)

The more degenerate option is long CAMT 0.00%↑ , short ONTO 0.00%↑. Both are (almost) advanced packaging pure-plays and using ONTO as a funding short sounds fun.

Extra degenerate points if you go long Camtek before their earnings next week. There is a legit risk of -25% in one day lol.

Currently, I own some KLA shares and trying to figure out what to do on Monday.