Qualcomm Q2 FY25: Apple Modem Timeline Accelerated

Every engineer should read their companies quarterly earnings call transcripts.

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

I have a large project in-progress.

Due to recent events, I feel it might be prudent to write a quick shitpost today.

But first… biases!

I had a large short position against QCOM 0.00%↑ going into earnings. Covered today and made some money. No position at this time.

Contents:

Who are these people?

Earnings call overview

Apple Modem Conjectures

Unsolicited Advice

[1] Who are these people?

In general, there are two types of financial analysts.

Sell-side analysts do not invest or own stocks. They typically work for banks or brokerages, providing “neutral” analysis reports to clients. Neutral is in quotes because the banks frequently do business with companies or act as market makers to facilitate trades.

Buy-side analysts are professional analysts. They are the customers of the sell-siders.

Every quarter, the sell-side analysts go on a conference call. Usually, the first 20 minutes is scripted bullshit where the CEO and CFO waste everyone’s time. After that formality, sell-siders are **allowed** to ask questions.

This is important. Company management (CEO/CFO) gets to choose who is allowed to ask a question.

Let’s use Stacy Rasgon (my favorite sell-side analyst) as an example:

Some time ago, Stacy asked a question that pissed off Intel management. He was “taken off the call” (shadow banned) for over a year.

If Stacy puts a sell rating on a stock, he risks getting banned.

Every sell-side report has this table in the disclosures. You will notice that there is a strong bias towards outperform. It takes a lot to get a sell rating.

Each sell-sider asks questions at their own discretion. Sometimes, sell-side asks questions that many of their clients (buy-side) have asked them.

You will understand what the bold sentence means in a moment.

[2] Earnings call overview

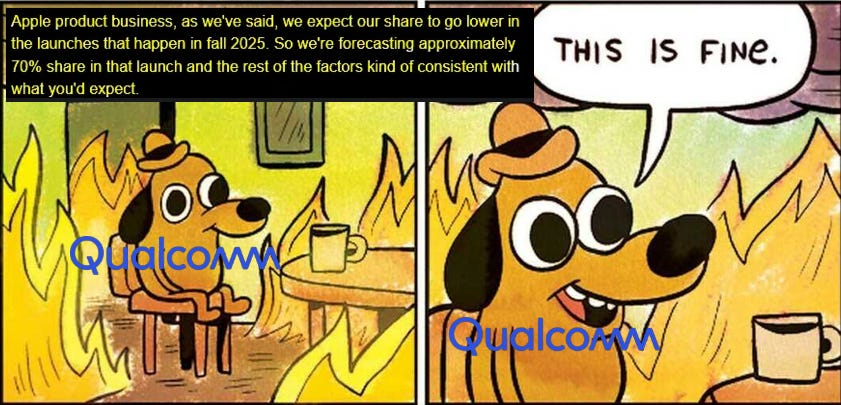

September iPhone launches will be 30% Apple internal modem. This implies the base iPhone and Air both use internal modem while the Pro and Pro Max use QCOM modem.

Previously, consensus was that only the iPhone Air would use Apple C1 modem.

Notice how Qualcomm CFO frontloaded his answer with bullshit before actually answering the question.

Analyst: Are you going to fire a bunch of people now that Apple internal modem is ramping faster than we expected?

CFO: <bullshit word salad>

Take a moment and think.

Why did Ross Seymore of Deutsche Bank ask this question?

It’s because his clients have been talking about this.

This is a public hint to Qualcomm management.

[3] Apple Modem Conjectures

One of the fun things about wireless modems is how many ways there are to test them.

This UXM box is a fake basestation. Highly configurable.

You can put any cellular device in a RF chamber box and hook up some horn antennas to the UXM. Simulate any infra (Nokia, E///, ZTE, Samsung, …) on any carrier config (Verizon, China Mobile, Vodaphone, …)

But the real world is not like an RF chamber. People move around (dopper shift). Reflections from the environment alter the channel.

This is where channel emulators come in.

Between the UXM and horn antennas, you add this box.

Now everything can be tested in a repeatable way.

iPhone 16e was launched at the end of February.

I guarantee you that Qualcomm had a full, detailed performance analyst of this Apple C1 modem within 3-4 weeks. So by end of March.

Only a select group of people would have access to this internal analysis.

Bluntly, the people who defected from Qualcomm to Apple because of money did so two years ago.

The people leaving now seem to know something.

Here is another one. (not director or above level so protecting privacy)

I wonder what the competitive analysis report says. It seems that a lot of people are leaving all at once.

They know they are cooked lol.

[4] Unsolicited Advice

It is important to me that this newsletter as education and entertainment value.

Usually, the educational aspect is on engineering topics and stocks.

For today, I would like to explicitly go into some unsolicited career advice for all the current and future engineers reading this.

One remarkable thing I have noticed over time his how common it is for very smart engineers to have absolutely no fucking idea how their employers business is going.

Engineers frequently go about their day to day work oblivious to the dumpster fire raging in the finance department.

This is because most engineers…

… don’t read earnings call transcripts of their employer.

… trust what management says internally in all-hands meetings.

… are blinded by pride in their work, ignoring economic reality until it is too late.

Every single engineer working at a publicly traded company should adhere to the following recommendations.

Always read every earnings call transcript.

Yes, most of it is boring bullshit.

But there are critical nuggets that can save your ass.

Learning to decipher corpo bullshit speak is a critical skill for your long-term career.

NEVER trust what management tells you in internal all-hands meetings.

THIS DOES NOT MEAN YOU SHOULD SKIP THEM.

Comparing what management says in the earnings call against what they say at the all-hands is incredibly valuable.

Do not get cute and try to collect severance before getting a new job.

When shit goes south, get the fuck out ASAP.

Do not worry about your team.

Save yourself before trying to save others.

Now lets talk stonks.

Qualcomm is an excellent funding short. I intend to re-short in size as the bear market rally continues. My margin equity in trading account is not healthy because I have a truly insane quantity of NVDA call options and some Micron options I kinda need to dump lol.

SiTime and CEVA are both beneficiaries of a faster Apple modem ramp.

I own some SiTime but not as much as I would like. Again, margin equity is in a bad spot and SiTime is only 1.6x leveragable.

CEVA I want to buy into but my portfolio is too degenerate to accommodate at this time.

Qualcomm signed the Apple modem real in 2019 knowing it would probably be over by 2022. Apple repeatedly failed, providing a gift from the heavens to Qualcomm management.

Time.

More time to diversify.

We are now in 2025 and there is no more runway.

Windows on Arm is in a joke of a state.

Auto has done very well but it’s not enough to plug this fruit-shaped hole. Also, I can’t tell if Qualcomm automotive is good or Mobileye is completely incompetent.

These idiots had a 6-year runway and they blew it.

The number of people walking away from all hands meetings after drinking company kool aid and feel better about their lives always seemed unbelievable to me

saw your posting about QCOM just one day after sending request to this company/stock, thank you!

it seems to me I should buy put to QCOM, it likes a sinking ship?

. losing apple

. losing mobile flagship soc market share to Mediatek

. Mobile customer is taping out its own SoC like Xiaomi's Zeku?

. Windows over Snapdragon is over...

.Auto market grow space is limited, cockpit soc has more competitors coming, nvda+mediatek, Chinese SoC providers. ADAS has no price adavantage(like Chinese Horizon), nor ecosystem advantage(NVDA).

. IoT market, no doubt it can not afford its high cost base.

. AI? QCOM is not core player for AI.

whatelse? can someone post some positive points to QCOM stopping my plan of buying put to it?