SMH Favorite Names++ Coverage: Q3 2025 Edition

Nvidia, TSMC, Broadcom, Qualcomm, Micron, Cadence, Intel, Synopsys, Teradyne, SKyworks, Qorvo

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

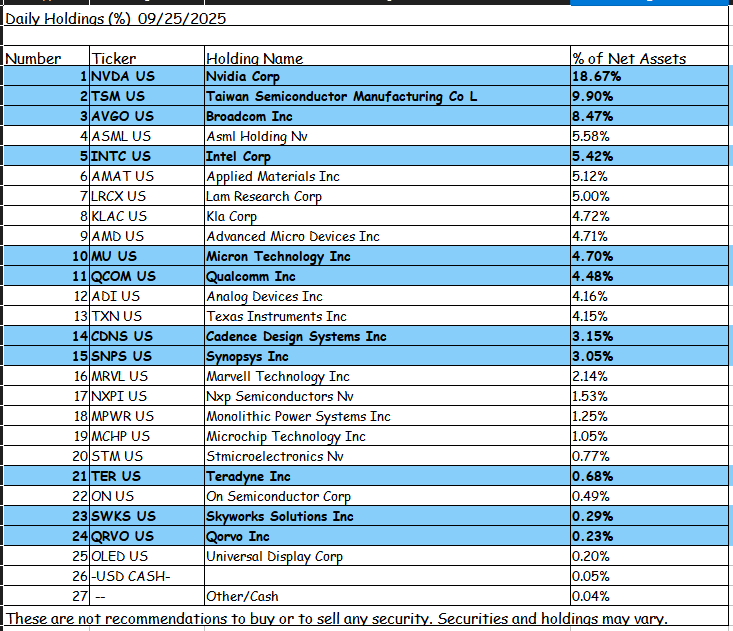

Today I will cover every highlighted company in the market-cap weighted semiconductor ETF. (trading account benchmark)

Only names that are interesting to me at the time of writing get coverage.

Additionally, adding some brief coverage of “++” names that are not in SMH but are correlated with highlighted SMH names in interesting ways.

(I wanted an excuse to talk about Verizon, SiTime, Aehr…)

Thinking of making this a quarterly thing.

NVDA 0.00%↑ TSM 0.00%↑ AVGO 0.00%↑ QCOM 0.00%↑ MU 0.00%↑ CDNS 0.00%↑ INTC 0.00%↑ SNPS 0.00%↑ TER 0.00%↑ SWKS 0.00%↑ QRVO 0.00%↑

Contents:

The “Relatively Safe” AI Trio: Nvidia, Broadcom, TSMC

Intel (heavily biased) Patriotic Pitch

Micron Re-Iteration

Qualcomm Re-Iteration and “Snapdragon Summit” Event Coverage

EDA Majors

Obscure Semicap Corner

Citrini-Style Basket: Apple Modem Acceleration

[PLEASE READ] Detailed Disclosures and Disclaimers

[1] The “Relatively Safe” AI Trio: Nvidia, Broadcom, TSMC

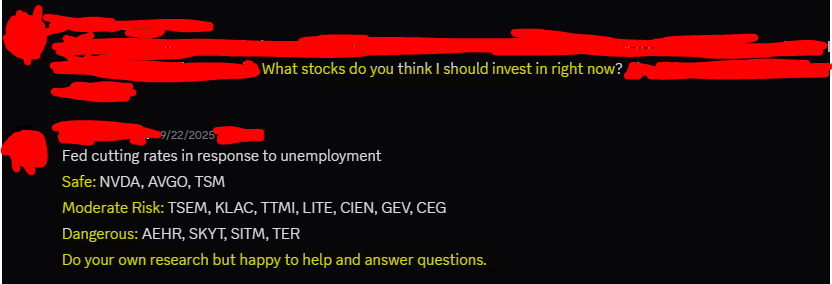

Sometimes, friends ask me for investment advice. I generally try to avoid responsibility and liability, so I tend to give a list of stocks and explicitly say “ask me something more specific”.

Only three stocks are in the “safe” category.

My definition of “safe” is you can blindly buy and hold over a period of at least 2 years, and it will probably work out.

THIS DOES NOT MEAN YOU DON’T DO YOUR OWN RESEARCH.

YOU STILL DO YOUR OWN RESEARCH. ALWAYS.

I have covered Nvidia, Broadcom, and TSMC rather extensively in the past. Please go look though the backlog to find general opinions and information.

Only new incremental information is Rubin CPX.

https://semianalysis.com/2025/09/10/another-giant-leap-the-rubin-cpx-specialized-accelerator-rack/

Semianalysis has excellent coverage of Rubin CPX.

My only incremental commentary is:

They are 100% right on all technical points and the bullish tone.

It is actually quite easy for Nvidia to build this chip.

They already have GDDR7 PHY for the gaming product line.

Package design is much simpler.

They already have PCIe PHY for various product lines.

Given how amazing this prefill chip is and how easy it is for Nvidia to make it, I am confused why it took Nvidia this long.

Also confused why the ASIC crowd has not thought of this…

Hyperscalers…

A small army of AI hardware startups…

Why are you fools letting Jensen lap you like this?

Nvidia and Broadcom are both great investments.

Stop over-thinking things.

[2] Intel (heavily biased) Patriotic Pitch

Reminder that section [7] has detailed disclosures. I am somewhat concerned by the legal exposure of what I am about to write.

For a deep-dive into VERY RELAVENT technical background, please see this old post from January 2025.

A Background-Proof Guide on Process Development Kits

Irrational Analysis is heavily invested in the semiconductor industry.

Let’s start with valuation.

I had a random idea on how to value Intel and genuinely believe it makes sense.

At the time of writing, I genuinely believe all of the following statements simultaneously. Some of these statements may appear to be conflicting but they make perfect sense in my head.

Intel 18A is dogshit.

Intolerably terrible.

Honestly… flaming dogshit soaked in racoon piss.

Intel 18AP has a real (~70% probability… opinion/number from my ass) at being tolerable-to-decent.

To be clear, not beating TSMC.

Just good enough for a few large companies to move low-priority product lines to Intel 18AP.

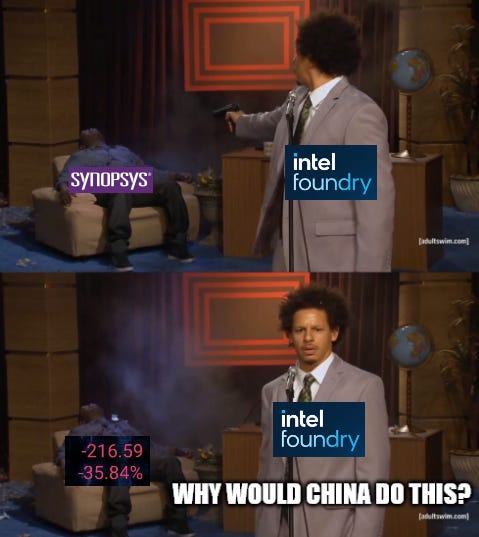

Gelsinger was a genius trying to buy Tower Semi and it is extremely unfortunate that China regulators blocked the acquisition.

The amount of damage inflicted upon America by this decision from the Chinese regulators is incalculable.

Intel desperately needed people with experience on developing external PDKs.

I CANNOT EMPHASIZE THIS POINT ENOUGH.

14A does not matter.

Intel is going to die well before 14A 3rd-party revenue for that node comes in.

It is absolutely critical that Intel secure some meaningful 3rd-party volume for 18AP.

I strongly disagree with anyone who claims Intel can survive with only internal volume on 18A-class nodes. (hard disagree with David Zinsner [Intel CFO] but really respect him)

Intel Products is a zero as far as I am concerned.

Doug OLaughlin tells me this take is wrong.

Many other finance-background people tell me this kind of thinking is wrong.

Still hold this believe for my (irrational) mental model of Intel.

Traditional core (pun-intended) business of datacenter CPU, laptop CPU, and desktop CPU, will never get better.

Nvidia partnership might help stem the bleeding but the party is over.

The entirety of Intel’s valuation should be based on the leading-edge logic fabs, a critical asset that is the only way to prevent a TSMC super-ultra-monopoly.

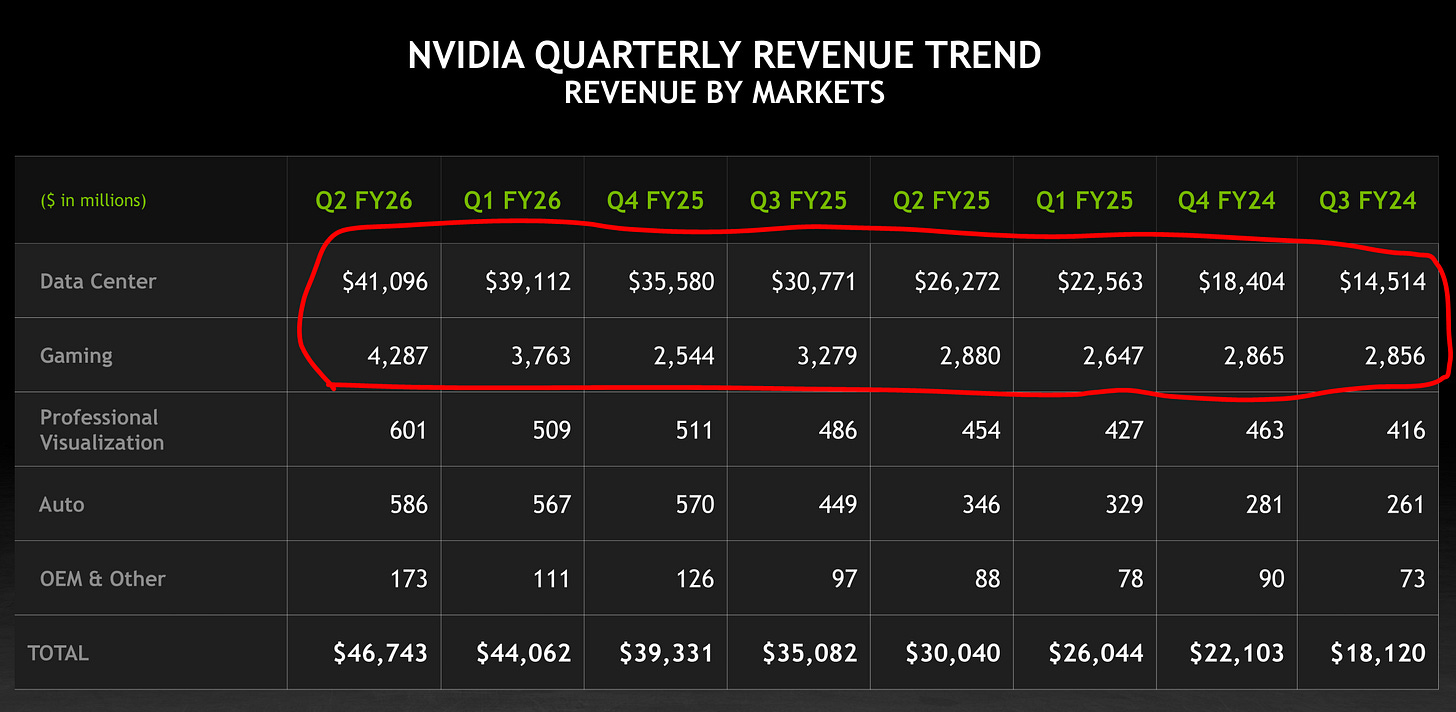

Finance friends, do any of you give a fuck about Nvidia gaming (legacy business) revenue given what has happened with datacenter?

I argue that Intel products group is just as important as Nvidia gaming group. (not important!)

Reminder on the name of the publication you are reading…

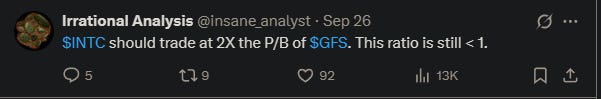

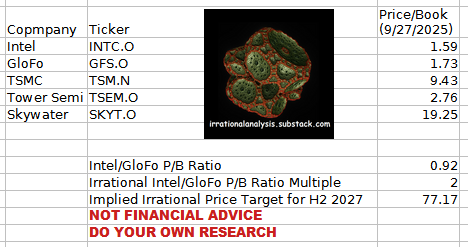

I believe that a leading-edge semiconductor fab network should be worth at least 2x GloFo. Valuing capex-intense businesses like semiconductor manufacturers on a price/book basis makes sense. Learned this from on particular finance friend.

GloFo is a collection of mediocre process nodes in non-critical process technologies. In other words, they suck.

The only reason Intel has a LOWER valuation than GloFo is because GloFo’s book is fine (stable) while Intel’s book is on fire.

Trump and his… unusual tactics… have placed a floor on Intel’s valuation. I personally do not believe Intel can go bellow 1.2x book going forward.

To be clear, the book is on fire so 1.2x book could be a much smaller number than you think.

Let’s take a look at the word “fiduciary” means in a financial context.

Google AI-mode, please take on any legal liability….

In short, “financial fiduciary duty” means a responsibility to behave in the interest of certain parties.

For example, institutional investors (hedge fund, mutual fund, family office) are legally required to act in what they believe to be the best interest of their limited partners.

(the people/entities whose money they manage)

Another example is c-suite executives and corporate board members. All of these people have a legal responsibility to do what they believe is best for the long-term interests of shareholders.

Recently, I spoke with a smart institutional investor and Intel was one of the topics. Not going to say more other than he was not convinced but we had an interesting healthy debate.

The point I am trying to make is… I can do whatever I want with my own money. Institutional investors have real legal risk and have an ethical duty to act in what they believe is in the best interest of the entities they have a fiduciary responsibility to.

So, the investor person I talked to recently has several reasons why in his judgement Intel should not be an investment for his fund/coverage/mandate.

That is totally fine. I cannot make any incremental arguments to investors other than what is written above.

I can make one additional argument to the board of directors of every single American chip design company.

It is in all of your best interest that Intel Foundry lives and acts as a viable counterbalance to TSMC pricing power.

You have a fiduciary duty to your shareholders to protect their long-term financial interests.

TSMC raising prices with impunity is a genuine risk and you have a fiduciary responsibility to mitigate this risk. Helping Intel Foundry in any way you can is one easy way of accomplishing this goal.

As a reminder, you can read this old post for technical information on PDKs. There is a reason why I am posting the link a second time.

A Background-Proof Guide on Process Development Kits

Irrational Analysis is heavily invested in the semiconductor industry.

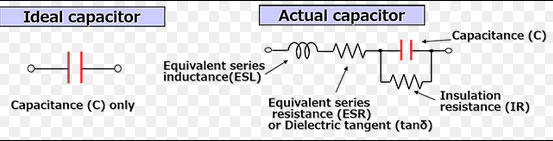

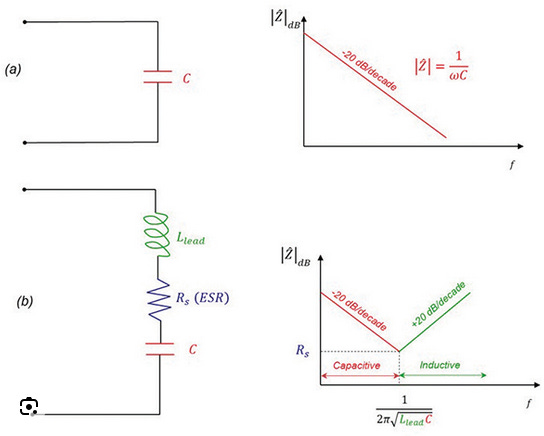

Suppose you have two arbitrary process nodes.

Process A is vanilla FinFet transistor based.

Process B uses the more complex and advanced gate-all-around transistor with an additional advanced feature called backside-power-delivery.

You don’t need to know what any of these terms mean.

Just need to know that Process B has two fancy features that should (logically) make it better than Process A.

Allow me to explain why this intuition can be completely wrong because of PDK quality.

Note: All numbers in this section are made up. Everything has been heavily obfuscated for obvious reasons. Nobody should take these numbers seriously and it is only to build a mental model and intuition. I am serious. Numbers are random from my ass.

Suppose you expect Process node B to deliver a 15% area reduction due to the advanced features.

In early parts of the porting effort, you seem to get these gains. But after simulating the ported design, you notice problems.

Some device models of certain basic PDK elements (transistor libraries, capacitor, resistor, inductor) are either missing or modeled as ideal.

Because the PDK does not provide sufficient (**BASIC**) information, you now must add a shit ton of extra devices to “margin” the circuit.

In other words, overbuild so much that the area gains are negated.

You can even run into (very sad) situations where Process B area is higher than Process A.

Even if the numbers are reported in the PDK, variation is so high that designers must significantly over-build circuits compared to the incumbent Process A, leading to severe power and area regressions.

Finally, certain transistor libraries could be missing from the Process B PDK.

This could result (HINT HINT WINK WINK) in dramatic power efficiency regressions.

I have consistently and aggressively attacked Intel 18A.

Maintain my opinion (for like the 10th time) that Intel 18A is completely unviable for 3rd party use.

Intel 18AP can be completely different. It can be good. They have an (OPINION) 70% chance of fixing the problems.

They needed more time.

They needed Tower Semi experience to help them with external PDK.

Experience is a function of time.

Despite the recent investments by Softbank and Nvidia, Intel still needs more help to survive until H2 2027.

They can make it.

Lip-Bu Tan can fix Intel. (**with Trump’s help**)

You can help.

THIS IS NOT FINANCIAL ADVICE.

ALWAYS DO YOUR OWN RESEARCH.

PLEASE DO NOT SUE ME. I AM JUST A HOBBYEST PLAYING WITH MY OWN MONEY AND EXERCISING RIGHT TO FREE SPEACH.

PLEASE REFER TO SECTION [7] FOR DETAILED FINANCIAL DISCOLSURES.

[3] Micron Re-Iteration

I re-iterate my recent coverage of Micron from two days ago.

Incrementally, several people have asked me if SK Hynix is better investment than Micron.

The answer is a confident “yes”.

If you (institution) have access to Korean equities, go for it. In my opinion, anyone who has access to SK Hynix equity should not own Micron stock. SK Hynix objectively better risk/reward and ESPECIALLY VALUATION BASED ON PRICE/BOOK RATIO.

I am retail and not willing to bother with the EU listed derivative thing. Got enough shit to deal with.

[3] Qualcomm Re-Iteration and “Snapdragon Summit” Event Coverage

I re-iterate my opinion on Qualcomm from 9 days ago.

Some brief incremental coverage of the recent “Snapdragon Summit” event.

8CC mmWave is stupid and almost impossible to achieve. Nobody wants a 5G modem in their laptop.

No.

That’s why you upload that data to the cloud.

Case-in-point. Upload to the cloud. No need for edge AI processing other than local background blur and other toy features.

Real AI of economic value happens in the cloud and does not need 5G, let alone 6G.

Text is easily compressible and can be serviced with 4G LTE just fine.

NO IT IS NOT.

Fun fact, I saw this ad at Times Square when I was traveling.

I also own an X elite laptop (bought it myself at launch) and use an Intel Meteor Lake laptop for work.

The Intel solution (Core Ultra 100-series) has…

Significantly better battery life than the X Elite.

I am serious.

10-11 hours vs 7-8 hours under very similar usage patterns.

Same apps, video playback intensity, rough brightness…

Significantly better CPU performance.

I blame the trash Microsoft emulator TBH.

Significantly better GPU performance.

Literally zero easy 3D games I tried (Railgrade, Frostpunk 1, Frostpunk 2, Against the Storm, function at a playable (> 20 FPS) framerate on Snapdragon X Elite.

It can only run 2D games at an acceptable framerate.

Got maybe two driver updates over the last year. Not much change.

Significantly better day-to-day light app performance.

Simple electron apps like Discord (x86, re-skin of chrome browser) lag so bad on Snapdragon X Elite that it feels like I am using my old 2018 Kaby Lake Intel laptop.

This is insulting to the 8-year-old Kaby Lake laptop.

I am not going to buy one of the X2 laptops. Will be buying an Intel Panther Lake laptop.

Looking forward to Qualcomm reaching that $1B revenue target for PC promised back in 2019.

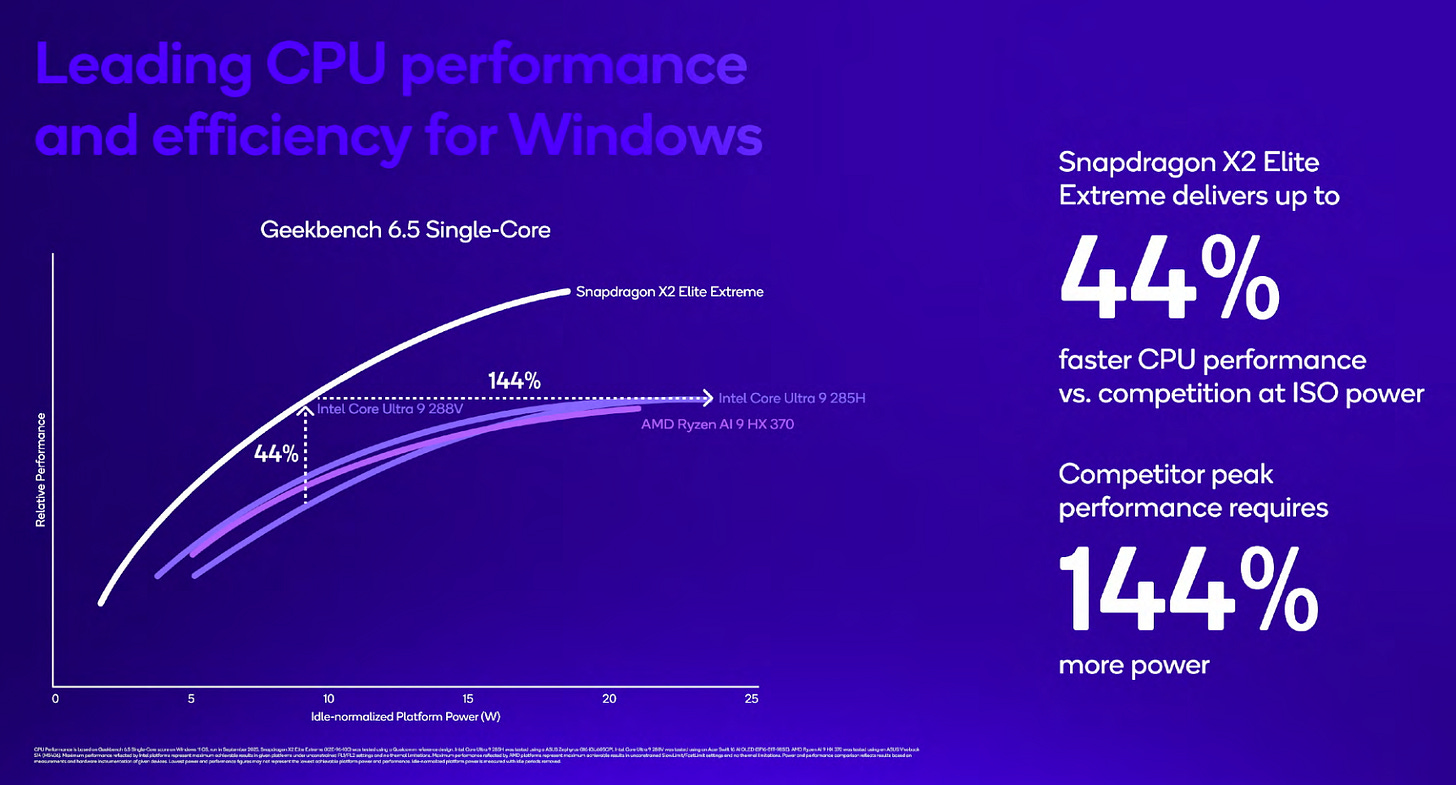

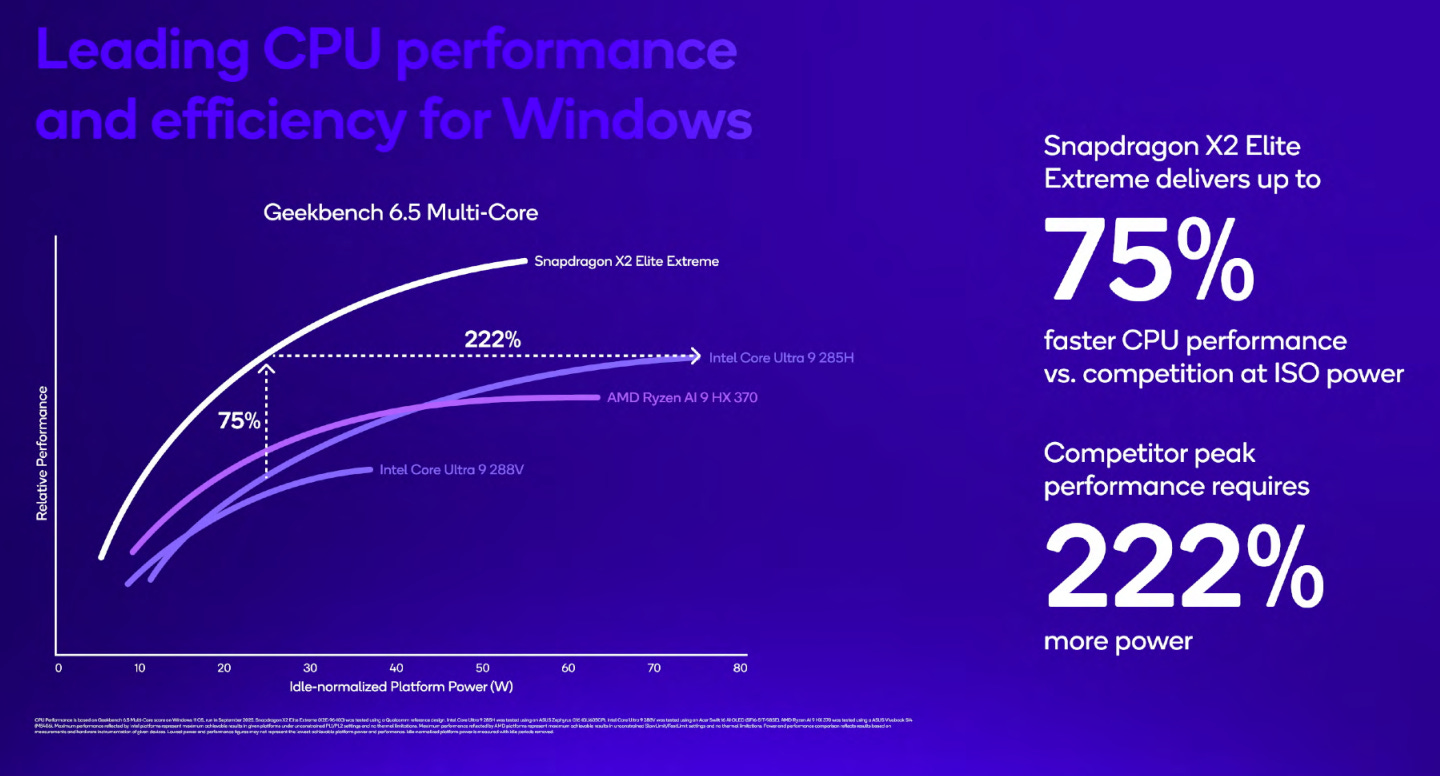

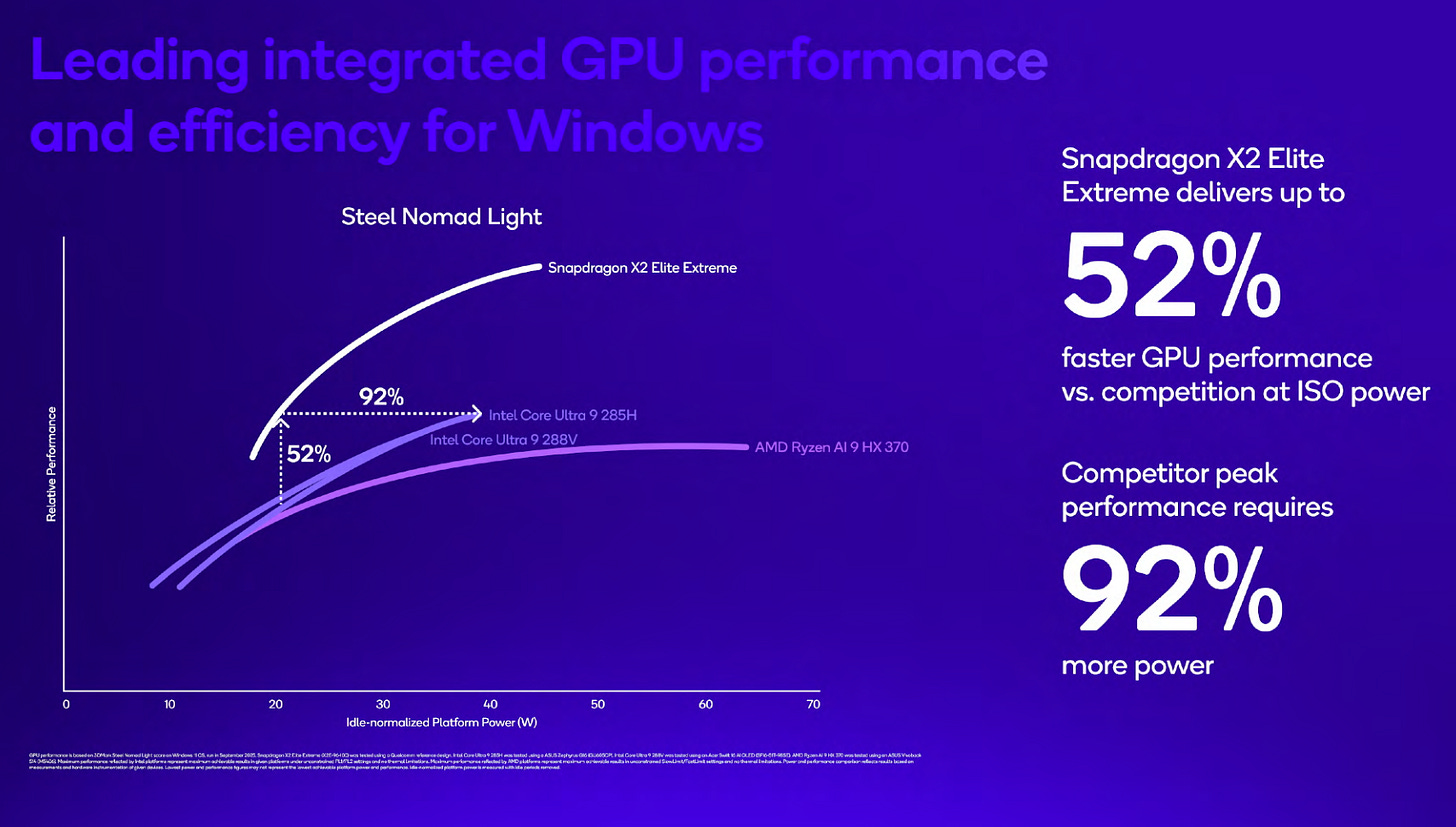

What the hell odes “idle normalized platform power” mean…?

ENHANCE

Ok… well let me just put my face right in front of my monitor.

Ok so they ran some tests that had idle periods in-between and removed them.

Fine. That is honestly a reasonable thing to do.

YOU HAVE PLENTY OF ROOM ON THE SLIDE

MAKE FONT BIGGER

I tried the 6 crossed out games on my X Elite laptop and they either crashed or ran at < 10 FPS.

Not buying a X2 unit to be disappointed again.

If one of the hedge funds would like to buy me one of these laptops as a gift/donation when they launch in 6 months, I will test it and publish report for free.

Not burning my own money on this again.

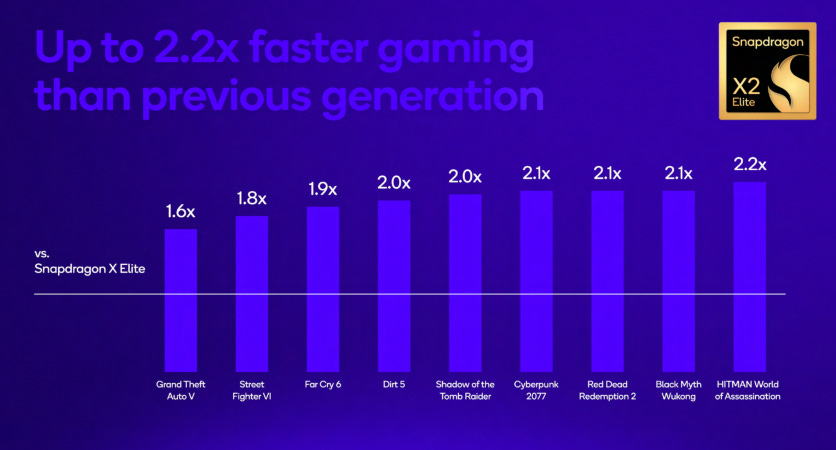

2.2x of 5-10 FPS is 10-20 FPS and is unplayable. Lowest settings. Very low resolution.

Good they have an Intel vPro answer. Needed that for enterprise.

While on-package memory has clear engineering advantages for laptop chips, it is really damn bad for buisness.

Intel tried this with Lunar Lake, realized it is a terrible business play, and are stopping it ASAP. Go ask Zinsner about this. LOL

Traditionally, laptop OEMs (HP, Dell, Asus, MSI, blah blah blah…) make significant margin upselling consumers on memory/DRAM capacity.

By integrating the memory on package, Qualcomm and Intel basically piss off all the partners by taking away a very important revenue stream on their already low-margin (~10-15%) OEM business.

If Qualcomm applies no margin upon the in-package DRAM, OEM is mad as they cannot charge a margin and upsell the consumer.

If Qualcomm does apply a margin on the in-package DRAM, OEM becomes VERY MAD.

Honestly, nobody wins in this scenario.

I do not understand why Qualcomm is making the same mistake Intel made over a year ago.

[4] EDA Majors

Both Synopsys and Cadence are solid long-term investments.

To be clear, I recently liquidated the (rather large) Synopsys position in my trading account to de-lever and book profit. Generally worried the market is over-heated and chose to aggressively de-lever.

Both of the EDA majors have rather…. rich valuations.

In the event of market volatility, the valuation of these two might become problematic.

Long-term, both are great. Just don’t hold these in a leveraged account.

[5] Obscure Semicap Corner

Teradyne is rumored to have gained share from Advantest for Nvidia Rubin ATE. This would be huge. At least four people from different organizations have told me about this rumor over the last three months so I consider this fair game.

Also, Citrini likes Teradyne a lot because robotics.

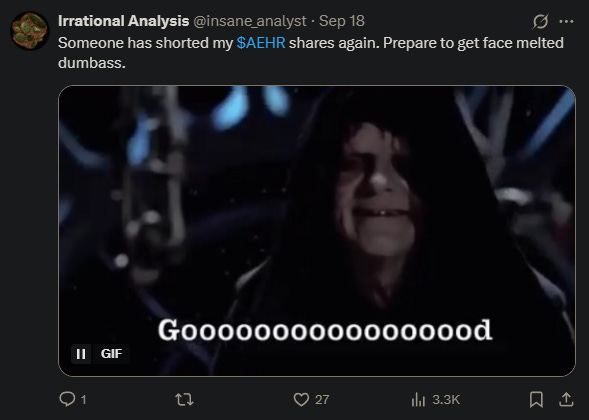

The other semicap stock I want to give a shoutout to is Aher Test Systems.

To be clear, this is a hilarious bubble stock like Astera Labs. Someday, both of these tickers will go down 50% in one day and it will be hilarious.

For now, roller coaster is super fun.

This stock is legit toxic to institutional investors. Almost none of them can justify going long. Some of them short it.

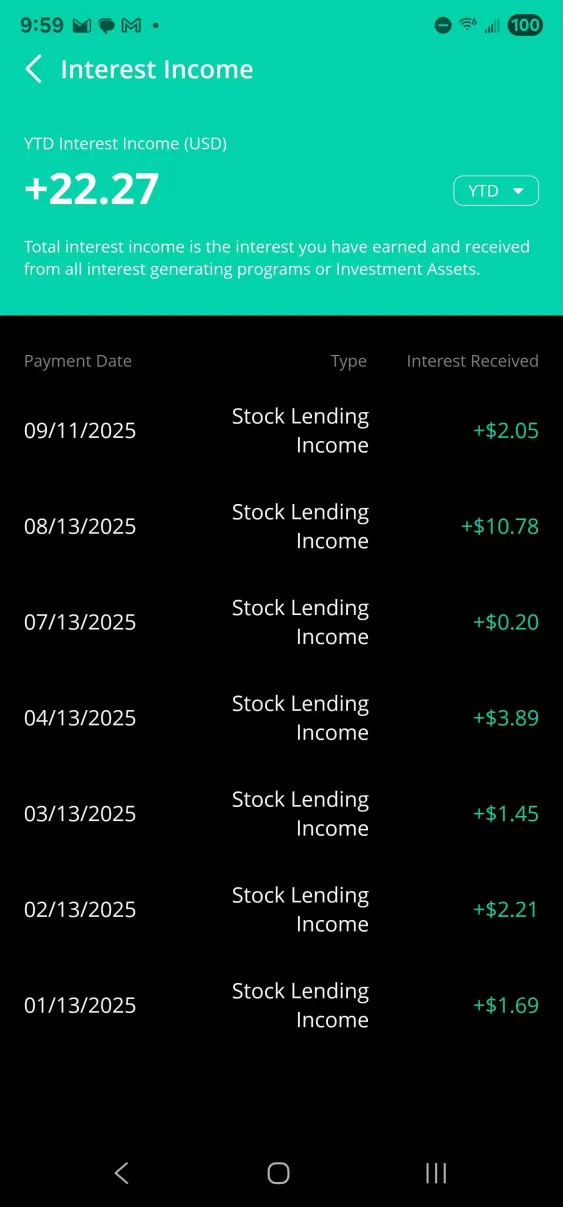

Webull tells me every time someone is shorting my shares.

So far, my Aehr shares have been shorted at least 4 times (to the best of my recollection).

Each time, whoever shorted my Aehr got vaporized by a +20-40% move. LOL

The interest rate Webull pays me is almost nothing but it is kinda cool to see my shares get borrowed by some dummy who does not understand what he getting himself into.

In conclusion, Aehr Test Systems is the “gamestop of semiconductors” but with actual substance and AI exposure.

https://en.wikipedia.org/wiki/Space_Shuttle_Challenger_disaster

You can’t go to the moon unless you accept the risk the rocket might blow up and take you with it to the bottom of the sea.

[6] Citrini-Style Basket: Apple Modem Acceleration

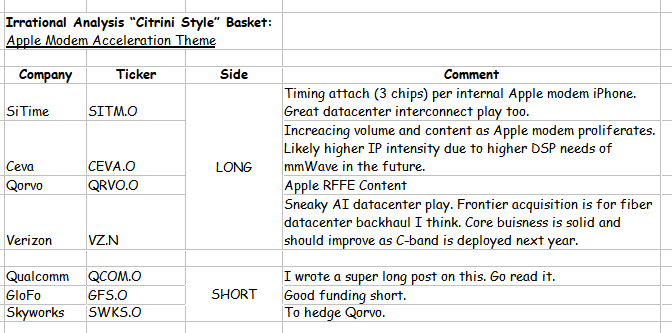

I have prepared a Citrini-style long/short basket for the “Apple Modem Acceleration” theme.

Hate Citrini’s investment style but his research is great and I am both a fan and paid sub on my real Substack account.

I am not participating in every part of this basket to be clear.

Just putting it out there because it is a fun idea.

Please see next section to understand what I actually own or am short at the time of writing.

[7] [PLEASE READ] Detailed Disclosures and Disclaimers

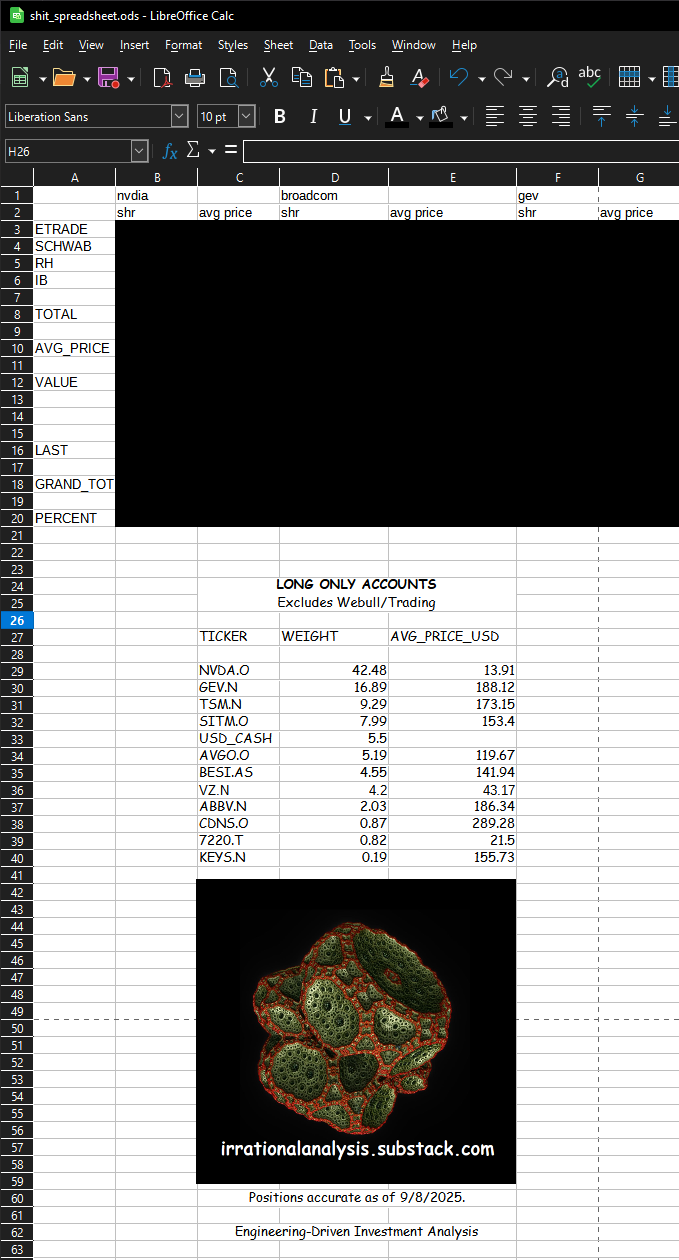

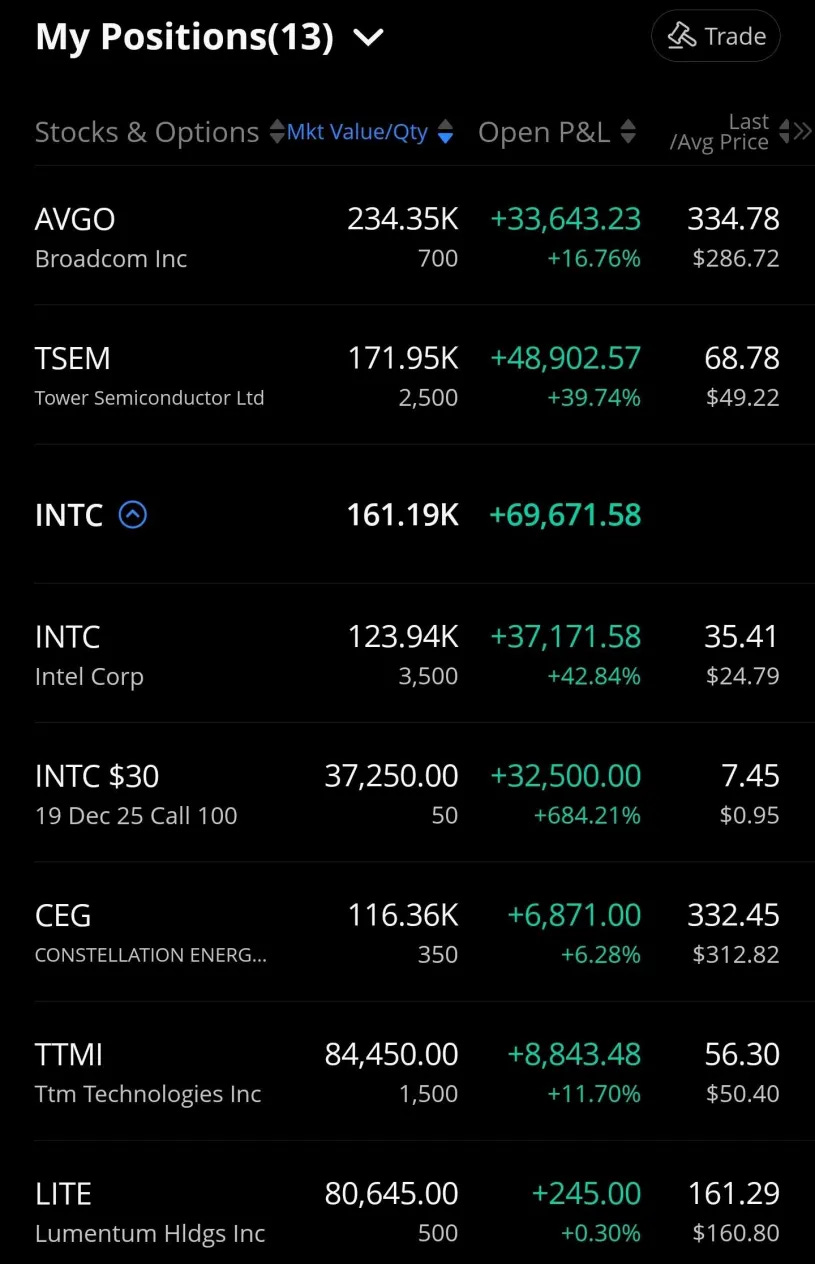

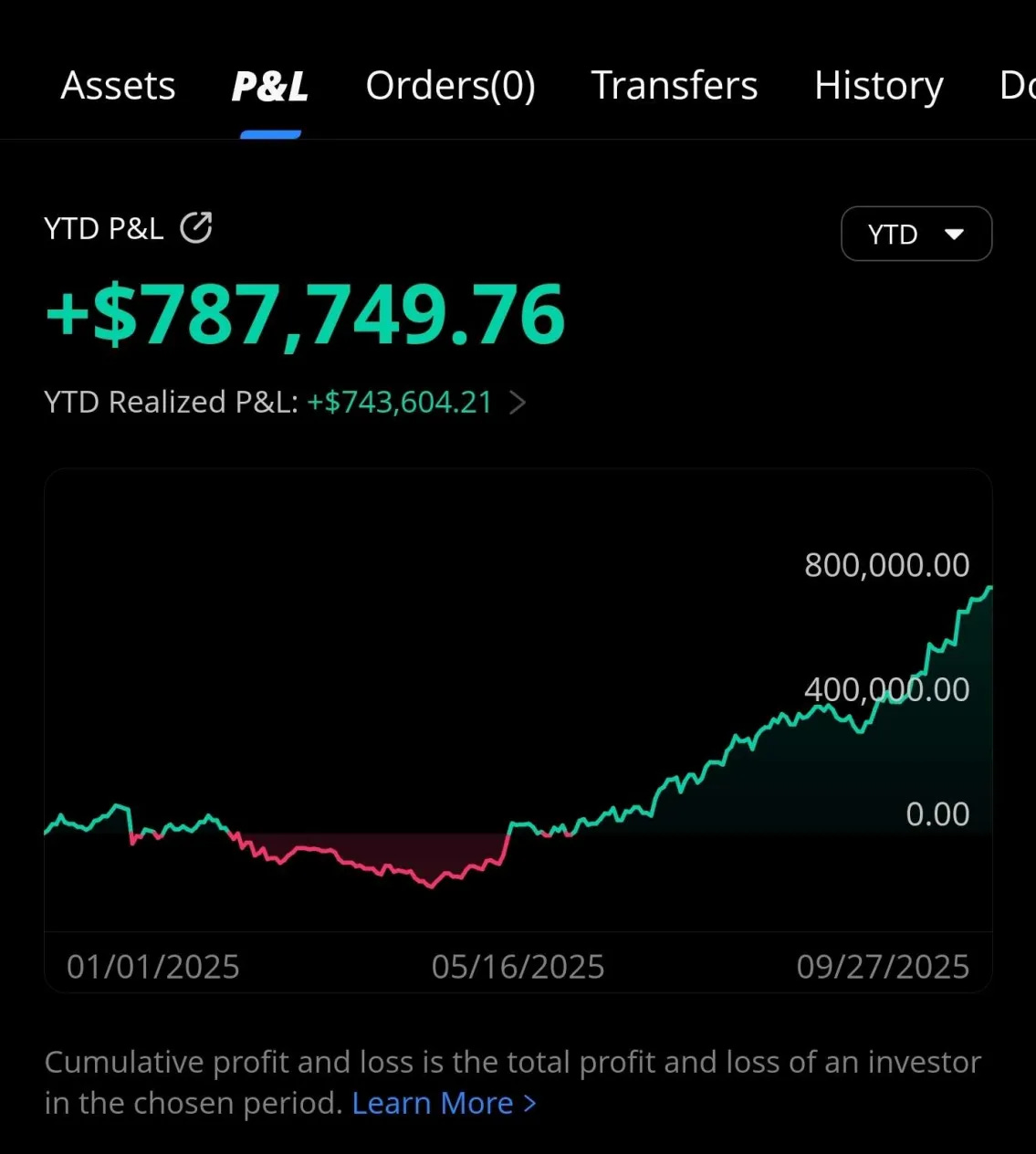

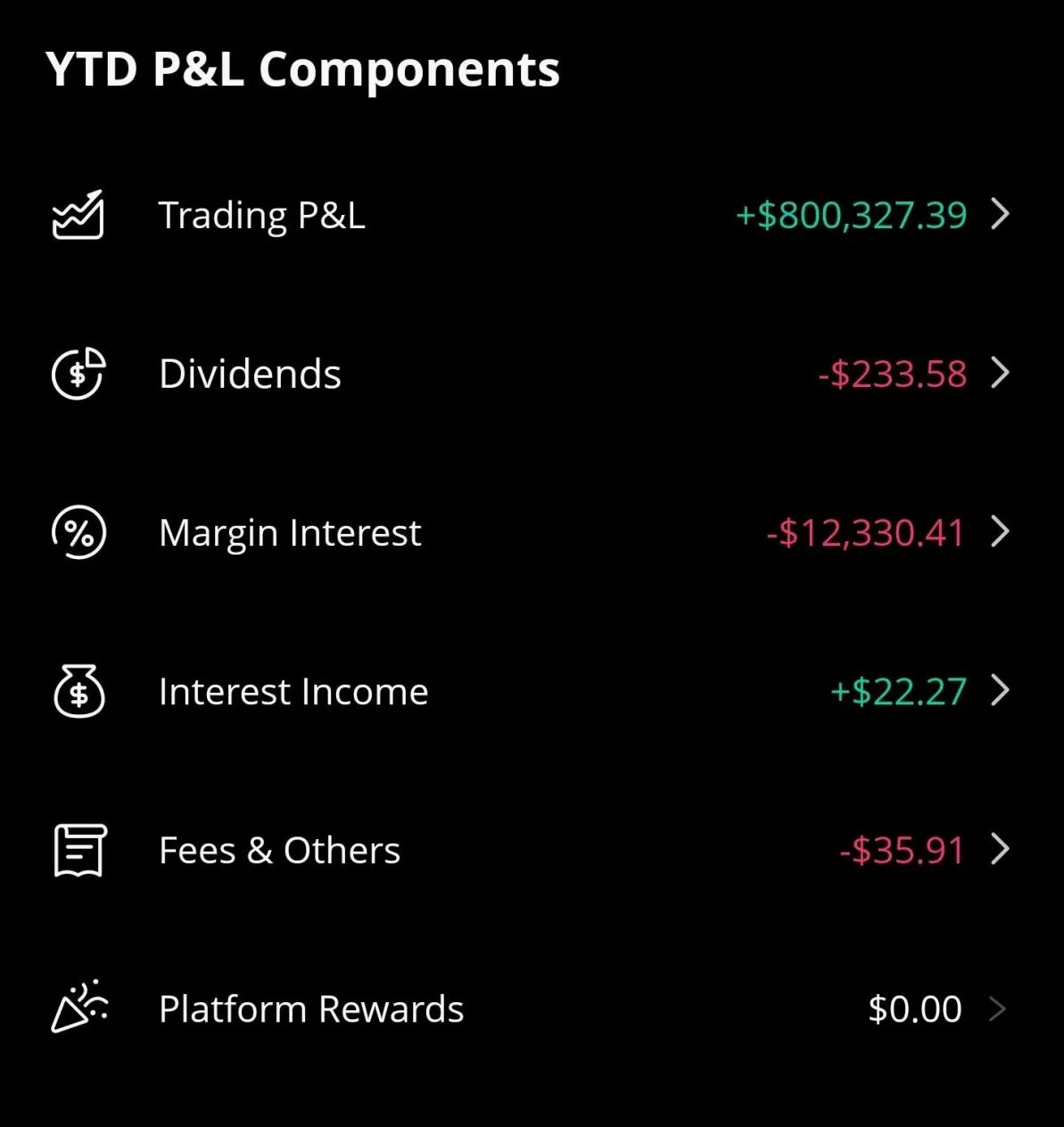

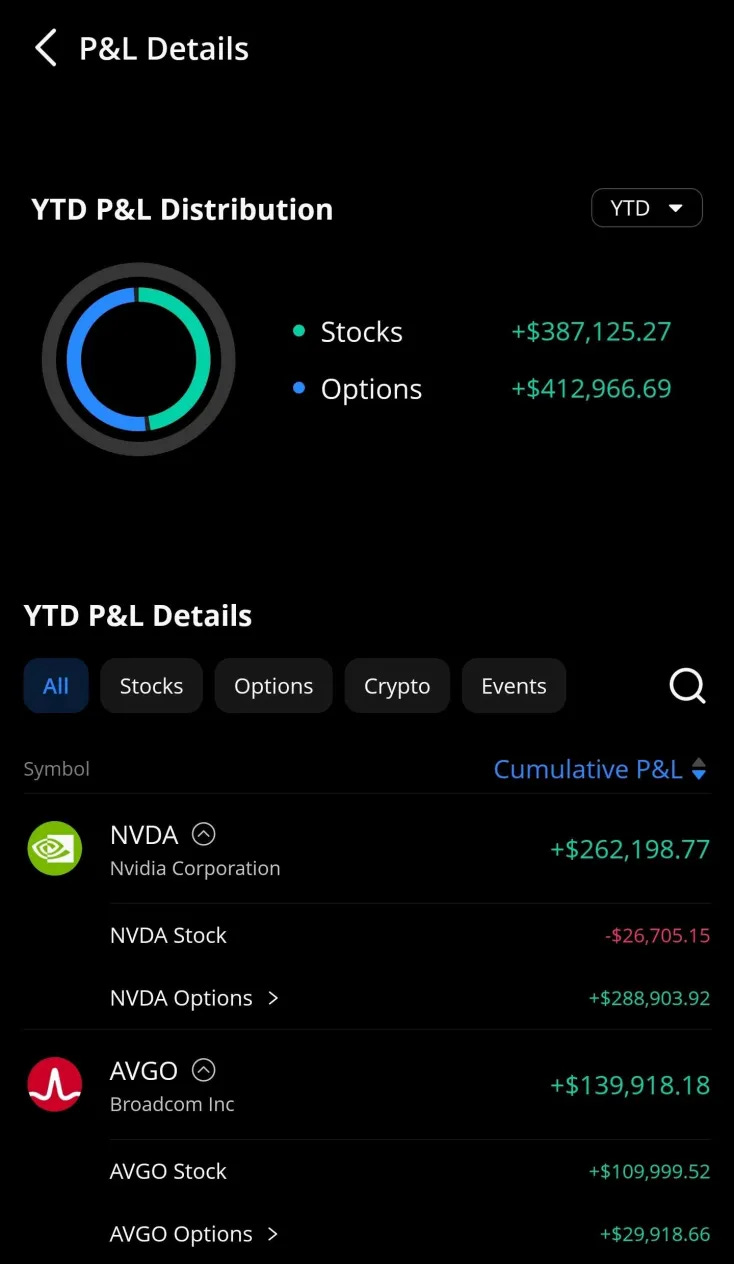

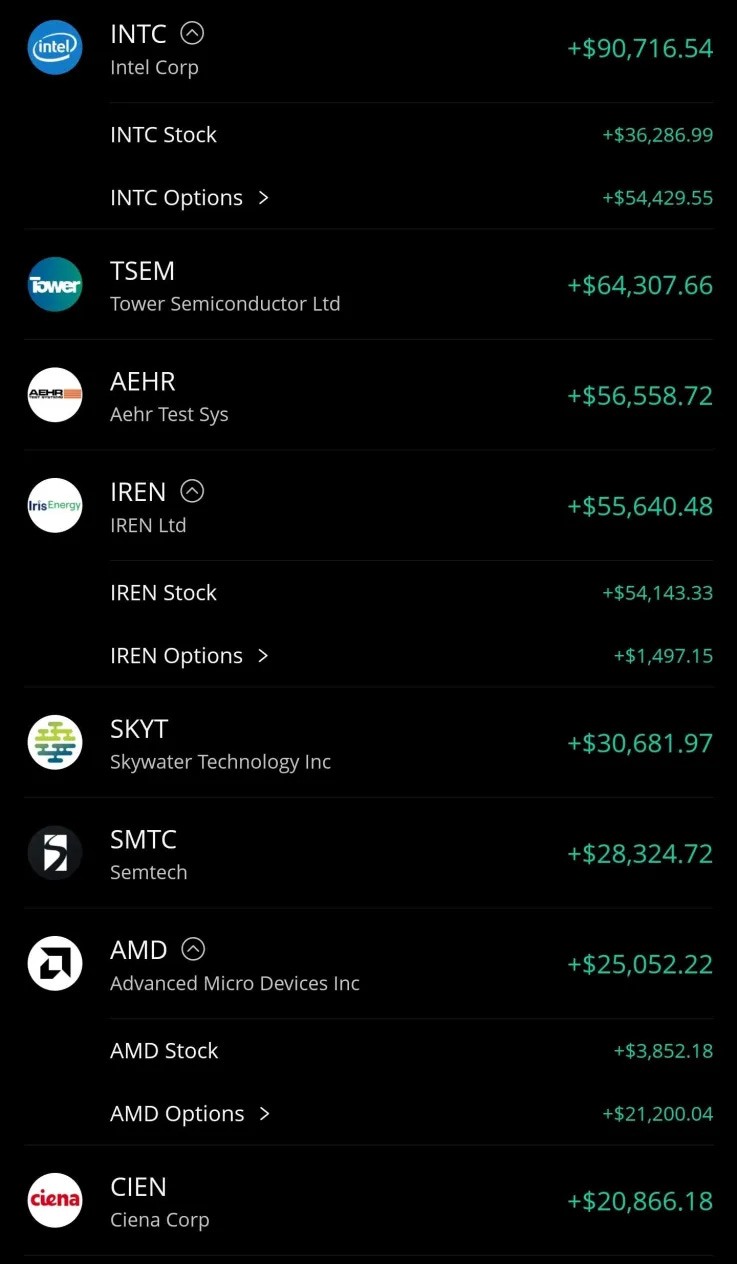

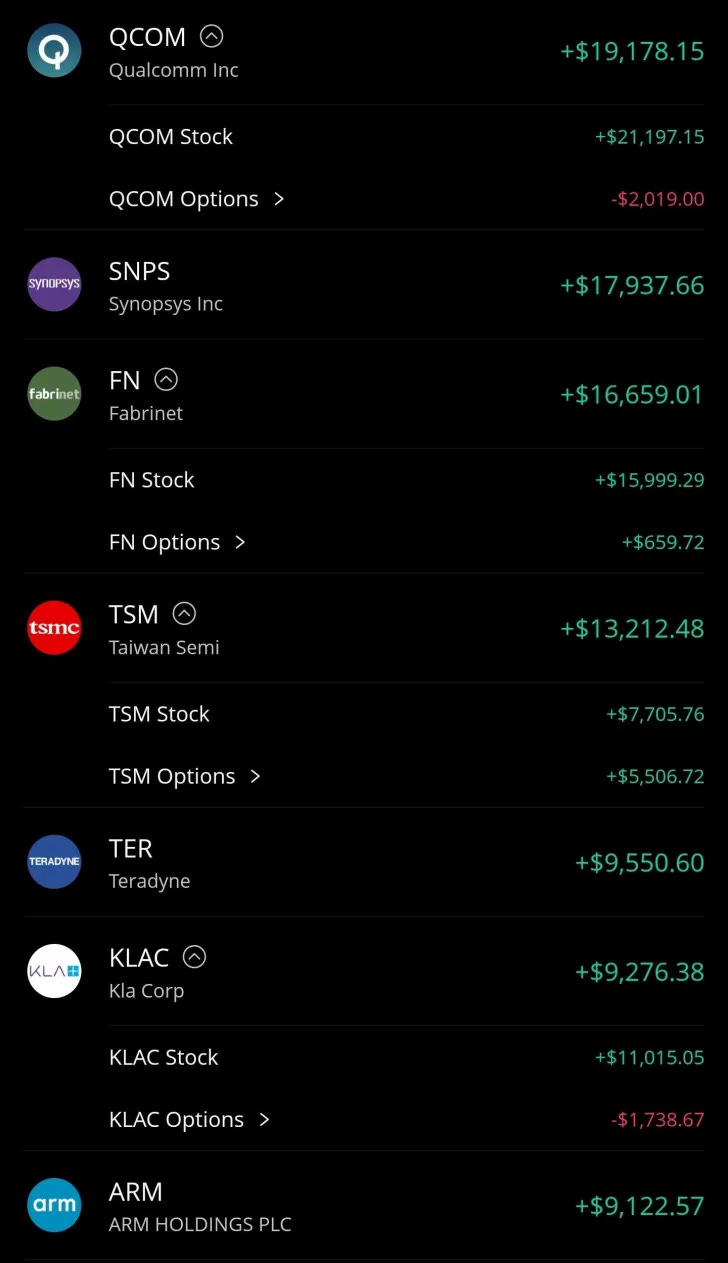

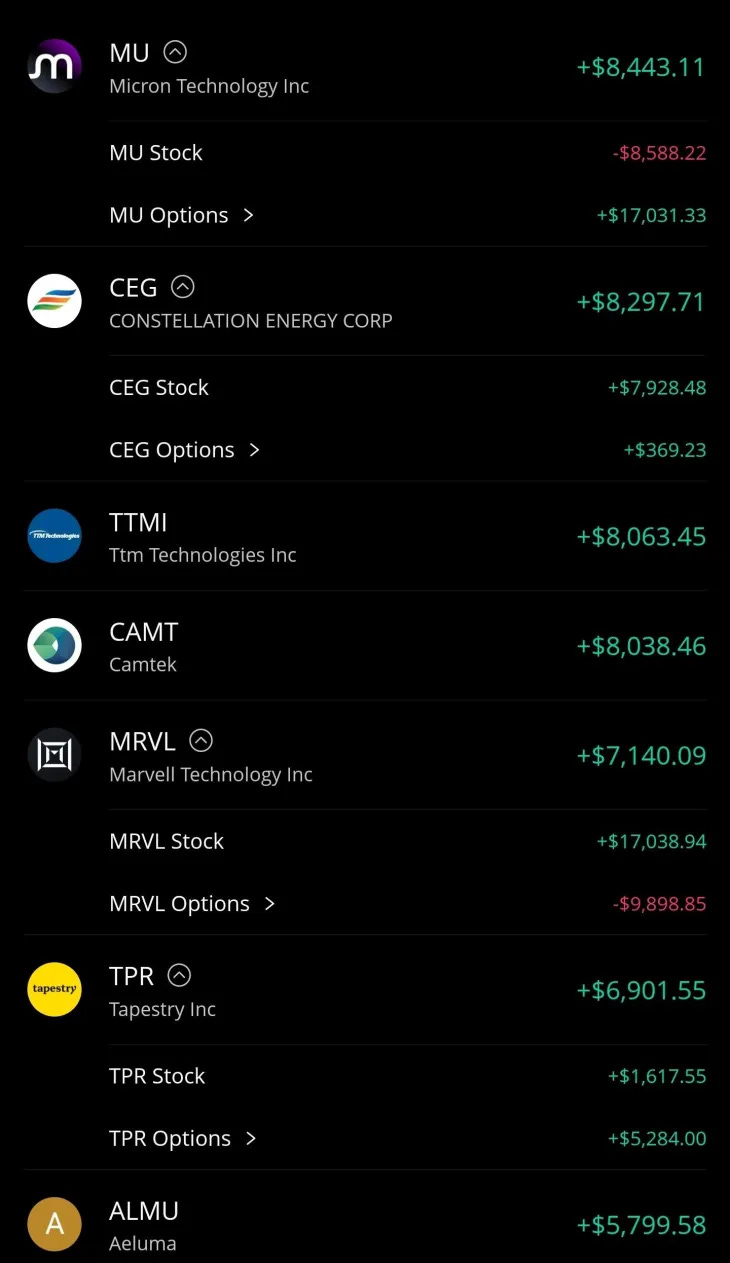

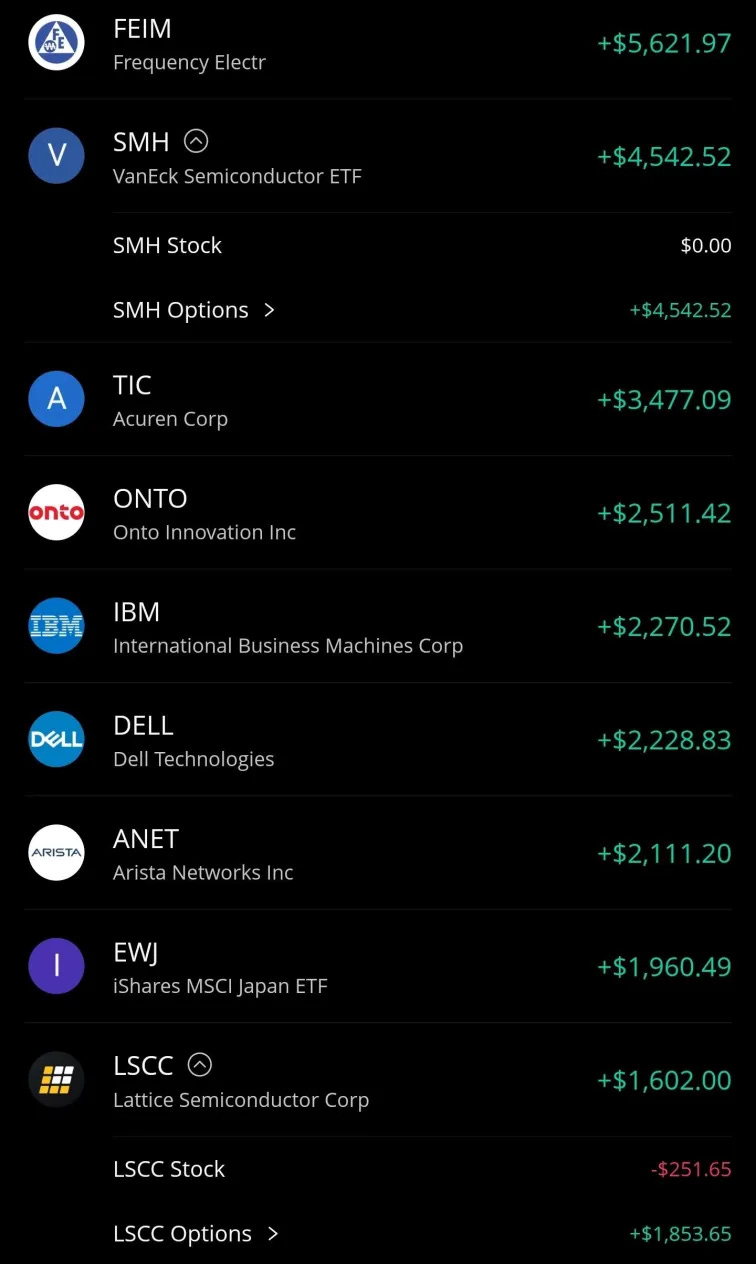

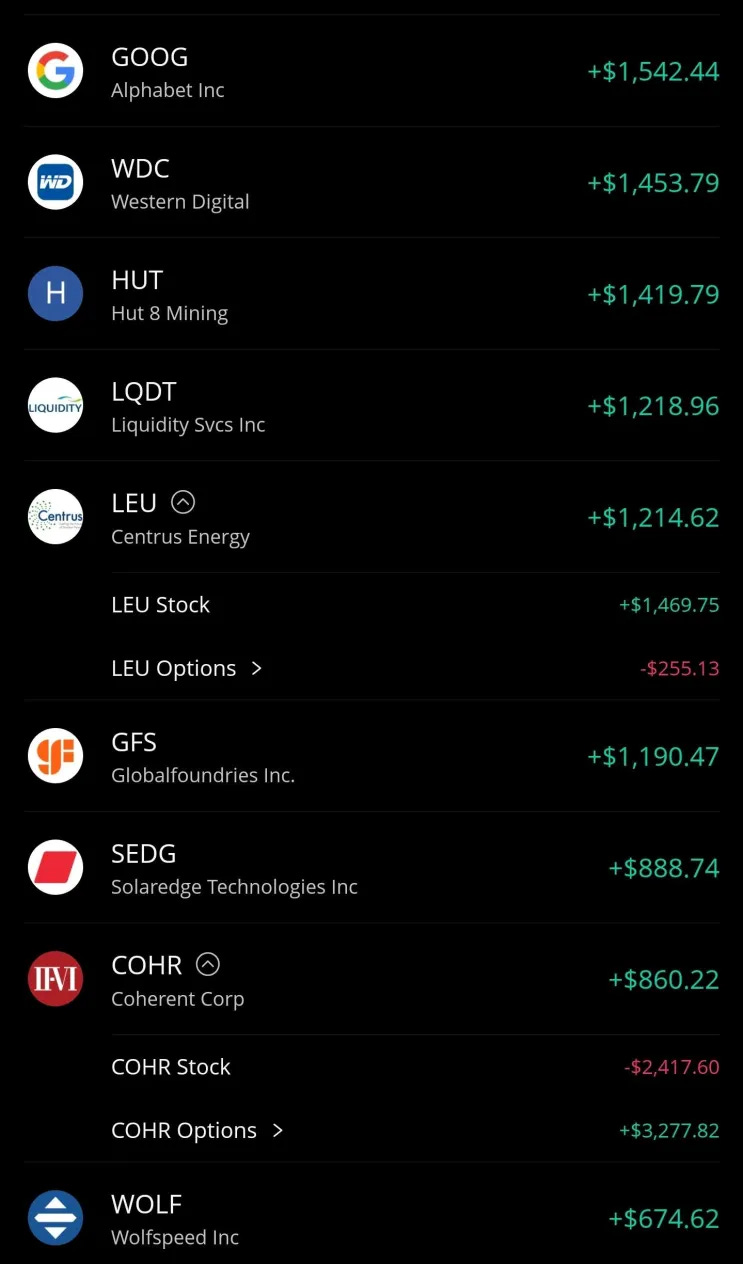

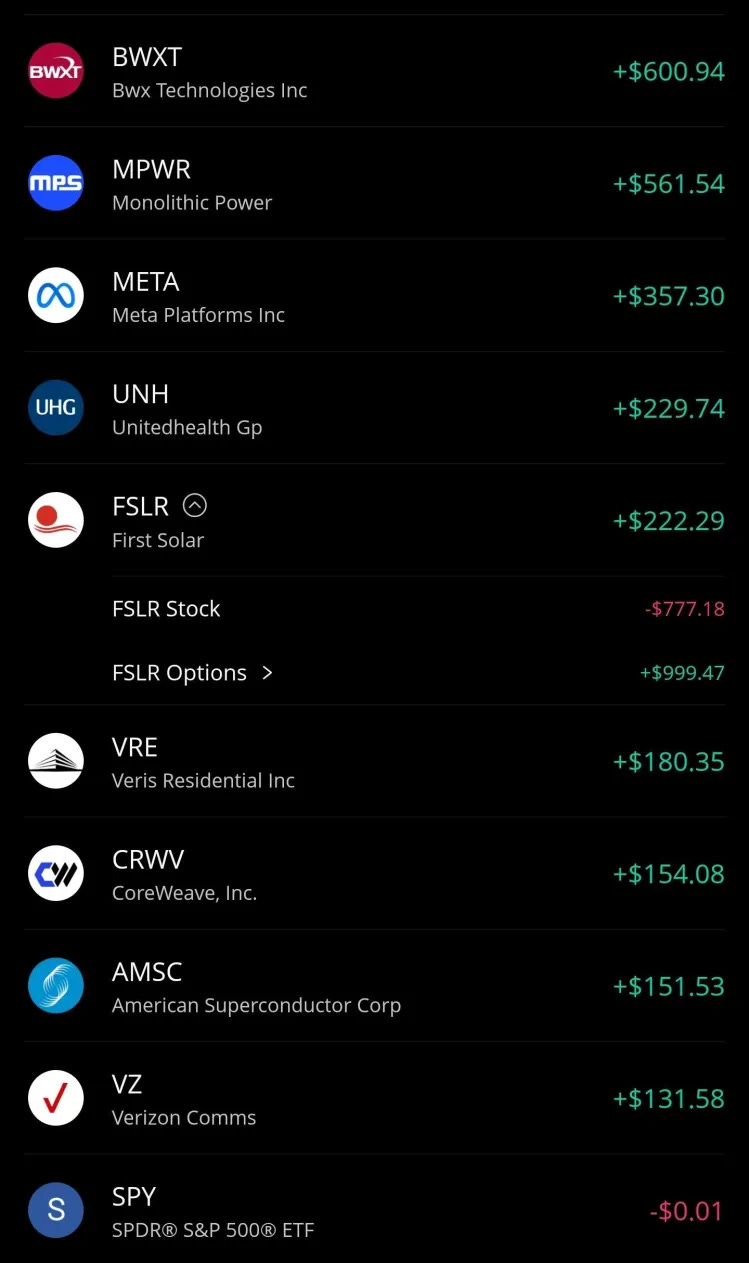

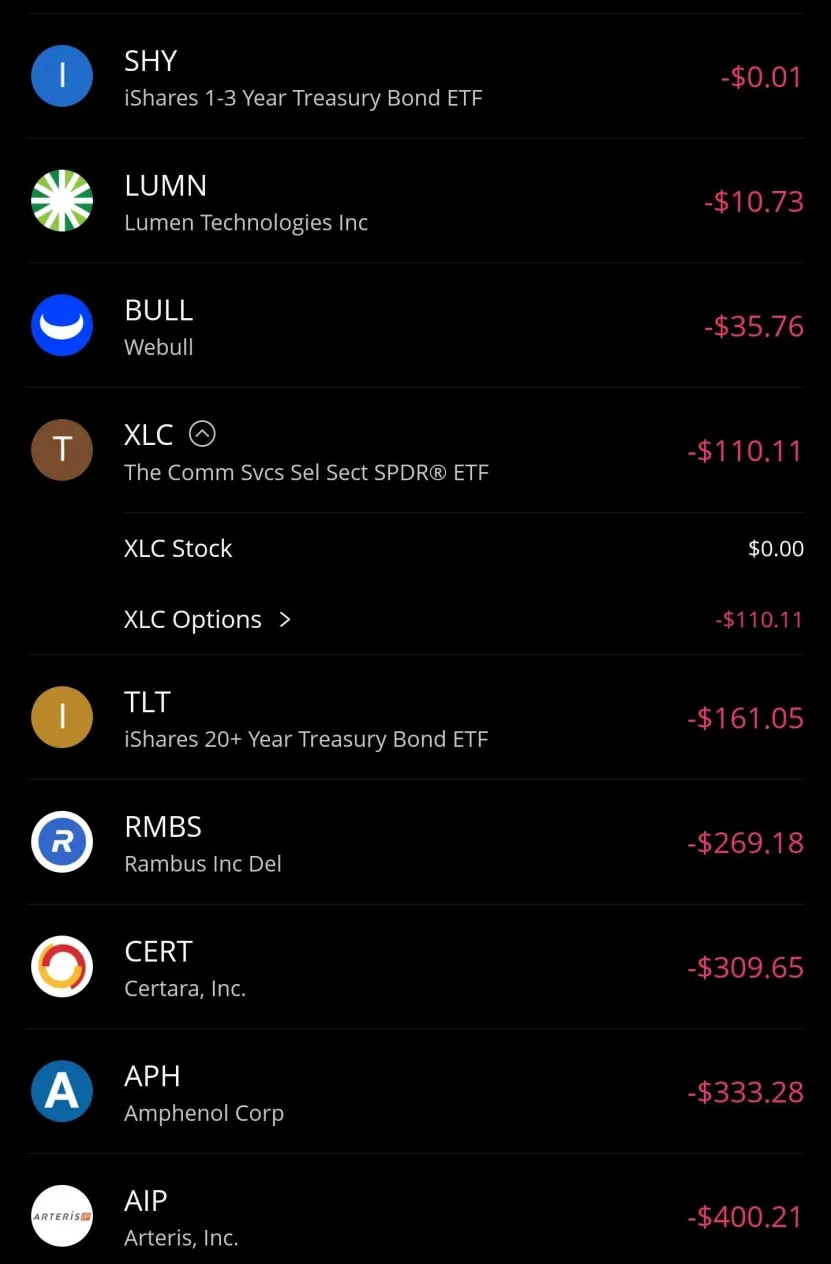

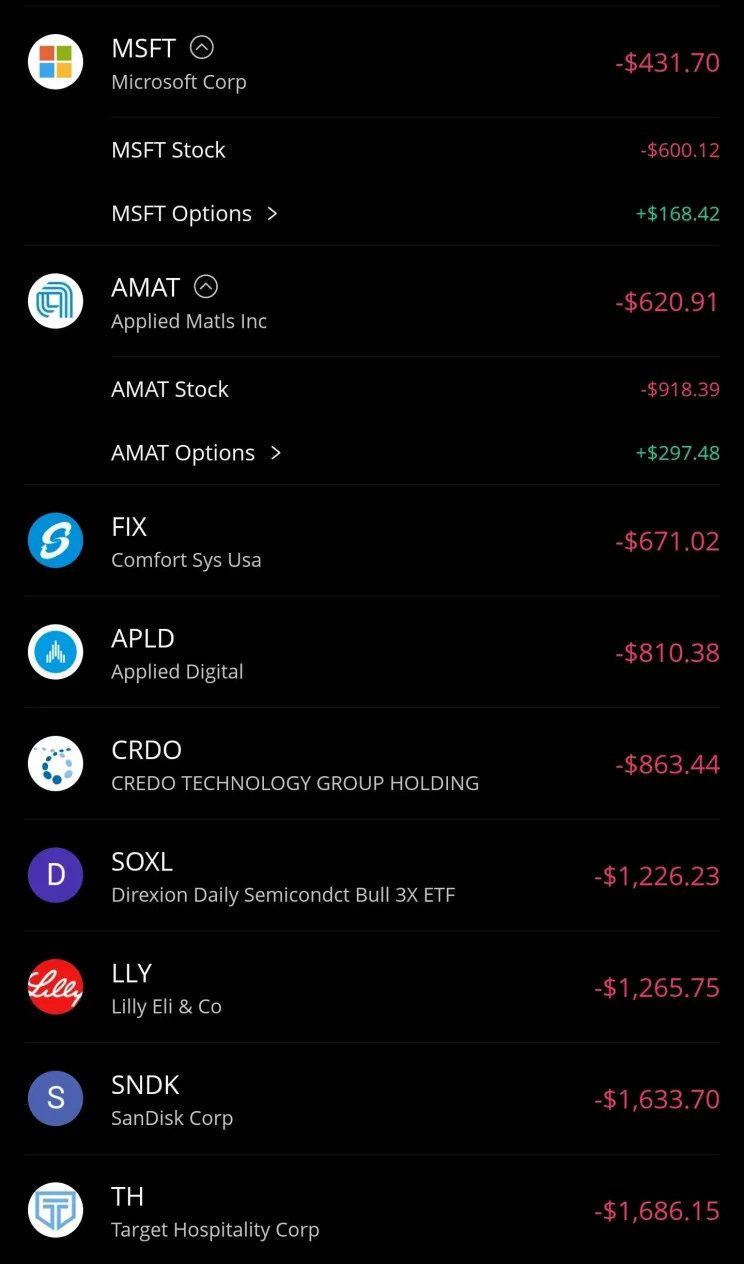

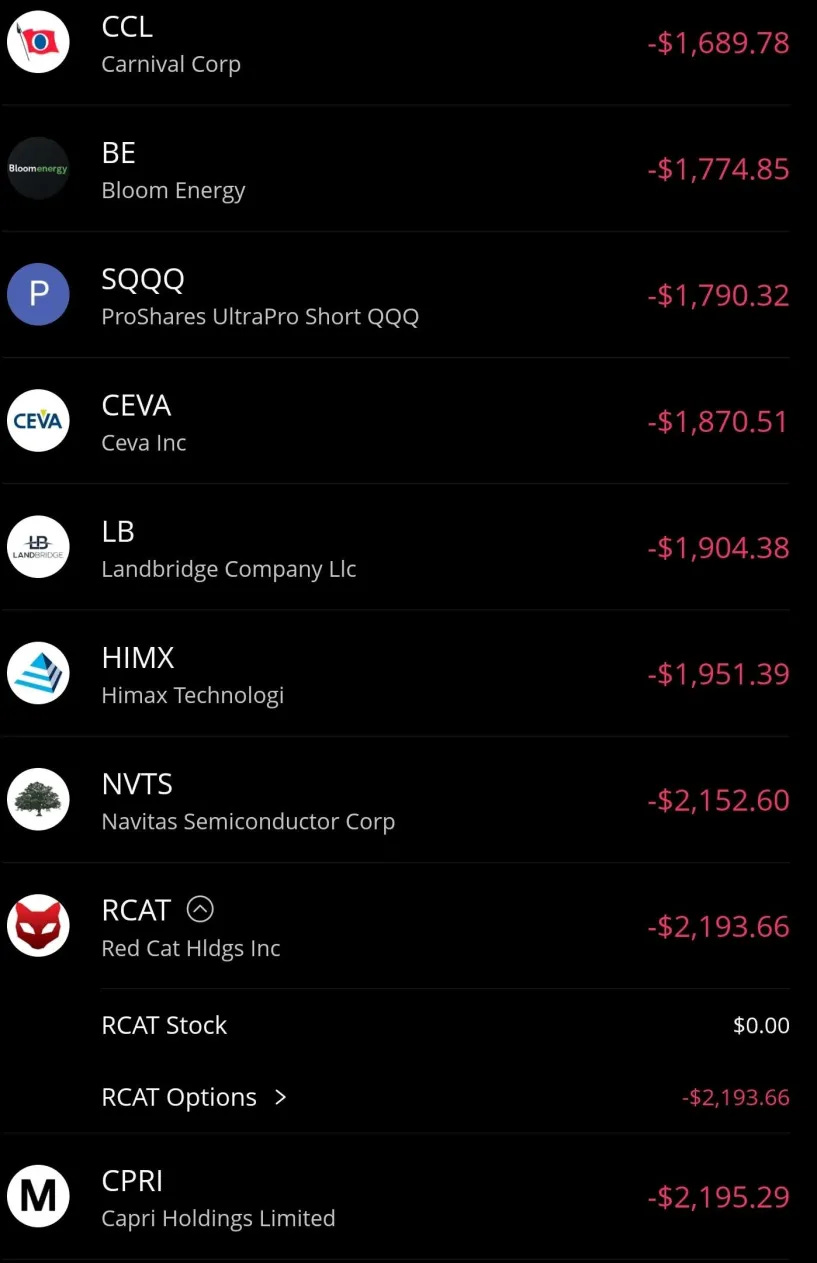

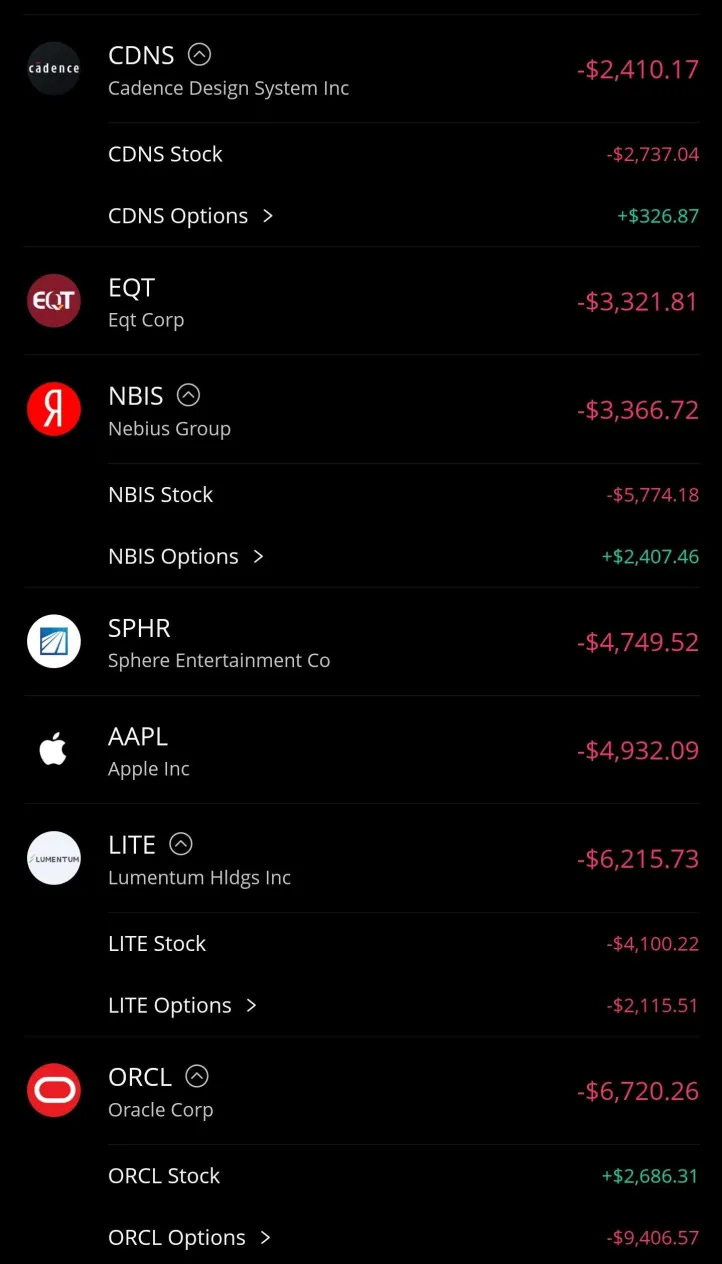

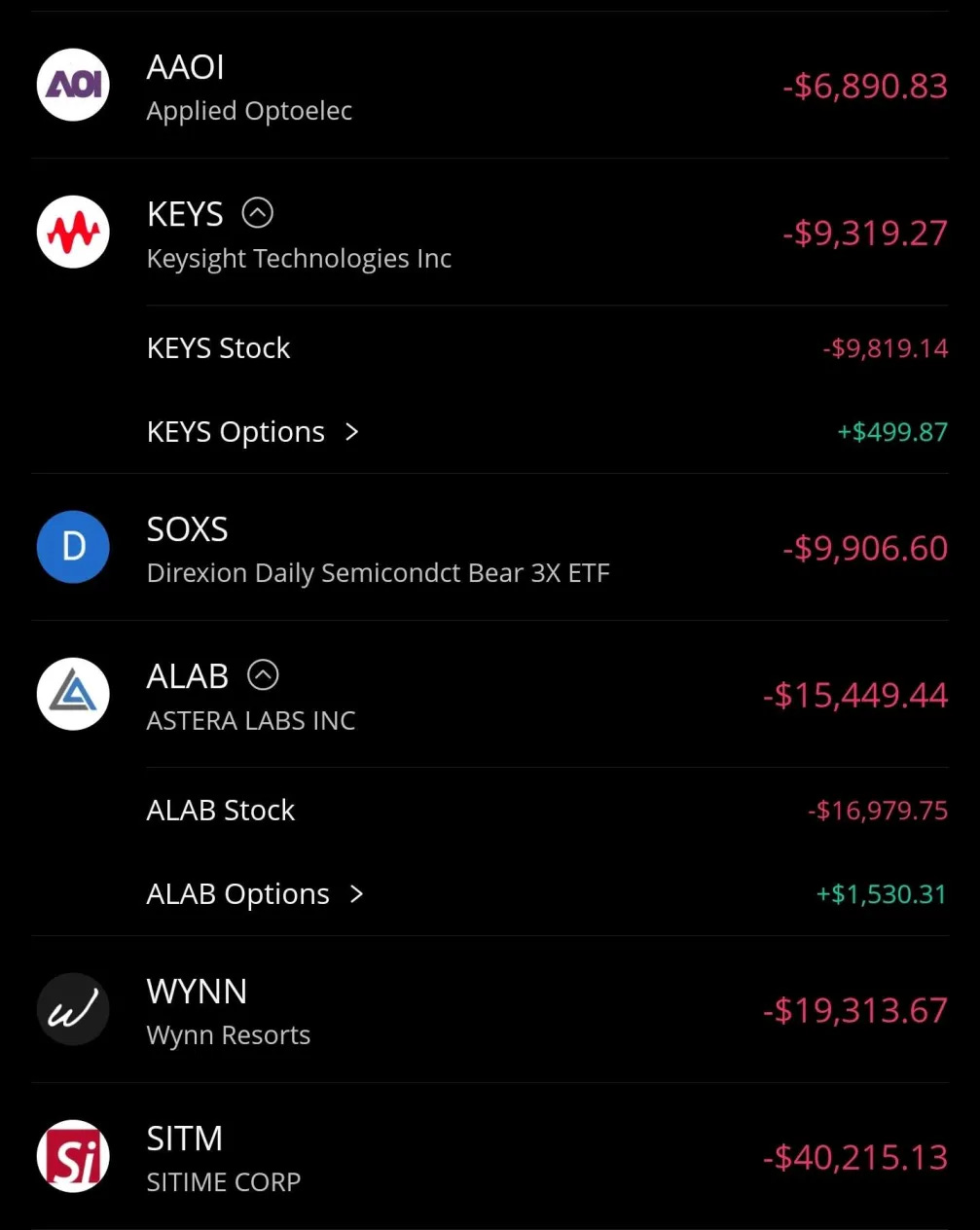

At the time of writing, I hold the following positions across my LONG ONLY (NOT TRADING) accounts.

This is a terrible manually updated spreadsheet. I hate updating this shit.

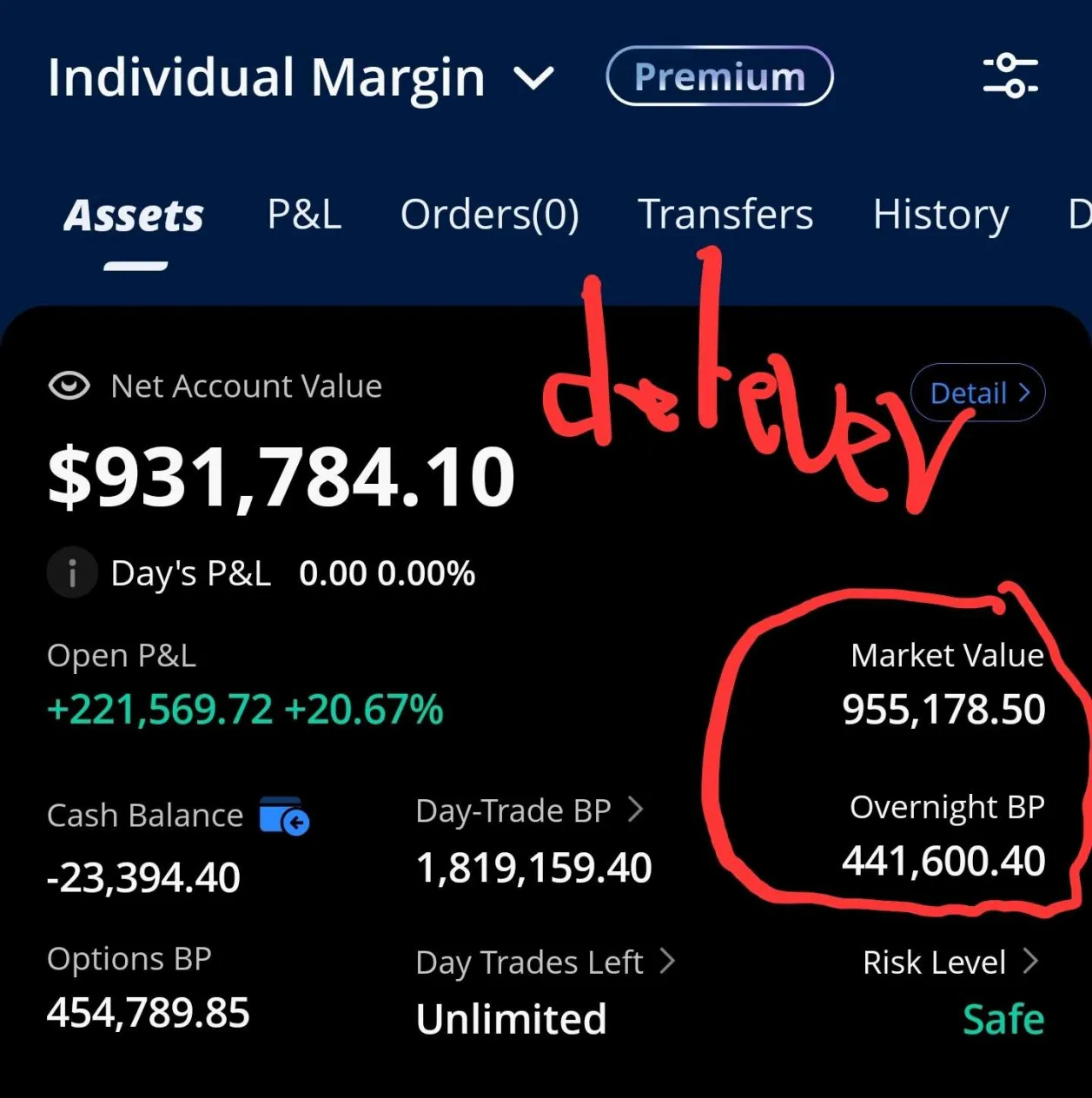

My trading account has more disclosure because I am far more aggressive and it is just easier to screenshot it. Webull generates lots of nice graphs automatically.

To be clear, the trading account is sperate from the long-only accounts.

Nvidia shares is my largest position even though you see zero Nvidia shares in the trading account.

I want to make it clear that the enthusiastic/bullish/positive commentary on Intel is due to a wide variety of biases, some financial and some… weird biases.

Obviously, I have made a nice amount of profit trading Inte and currently hold a large position via shares and call options.

As a member of the semiconductor industry, I genuinely believe that a healthy Intel Foundry is vital for the long-term future and prosperity of semiconductors.

As someone who has in-depth engineering background on process development kits, parametric yield, and semiconductors in general, I strongly believe that Intel ran out of time with the 18A PDK and this is super sad.

They can make 18AP good. (70% probability of success IMO… baseless number from ass)

There is hope. Lip-Bu Tan can fix this with Trump’s help.

While I generally disagree with most of Trump’s policies and political views, his strategy regarding Intel is brilliant. Credit where credit is due.

Everything I have said about Intel in this post is because of biases #2 and #3.

Fuck the money. This is more important. American semiconductor corporations with healthy cashflow, please contribute to saving Intel.

I am serious. Have a board meeting and discuss fiduciary responsibility. TSMC having zero competition is a clear risk to your shareholders.

Please move low-priority products to 18AP if Intel delivers an acceptable PDK in 2026.

What the hell odes “idle normalized platform power” mean…?

It means they measured board power draw from the battery sensor, and deducted how much the device uses at idle.

This is basically gold standard testing that gets used in phones but not in laptops. Most laptop reviewers just blindly trust inaccurate package power figures.

Qualcomm massive hardware superiority is both real and expected. Qualcomm is competitive with Apple on the phone side. There is nothing x86 that is competitive with M series. So it’s self evident that a qualcomm SoC with their modern IP is not something x86 can handle.

You just have a very old (IP Wise) qualcomm chip. The reason you’re getting 10fps is that your iGPU is worse than a Qualcomm S25 Ultra iGPU while it’s thermally throttling.

Look up 8 Gen 2, that + OC is what you have in your laptop for iGPU. The 8 Gen 2 iGPU is a traditional phone iGPU designed for simple shaders and that struggles with deferred rendering. Adreno 830 is much more compatible with how games on windows render.

Qualcomm back is to the wall, Just like Intel. But X2 Elite and 8 Elite 5 show that Qualcomm are capable of great engineering that can rival Apple silicon.

If they keep it up, they will succeed. If they don’t, they will crumble. Live or die.

at this point samsung foundry seems much attractive than intel