Synopsys is probably a buy.

Context on the over-reaction from SaaS tourists.

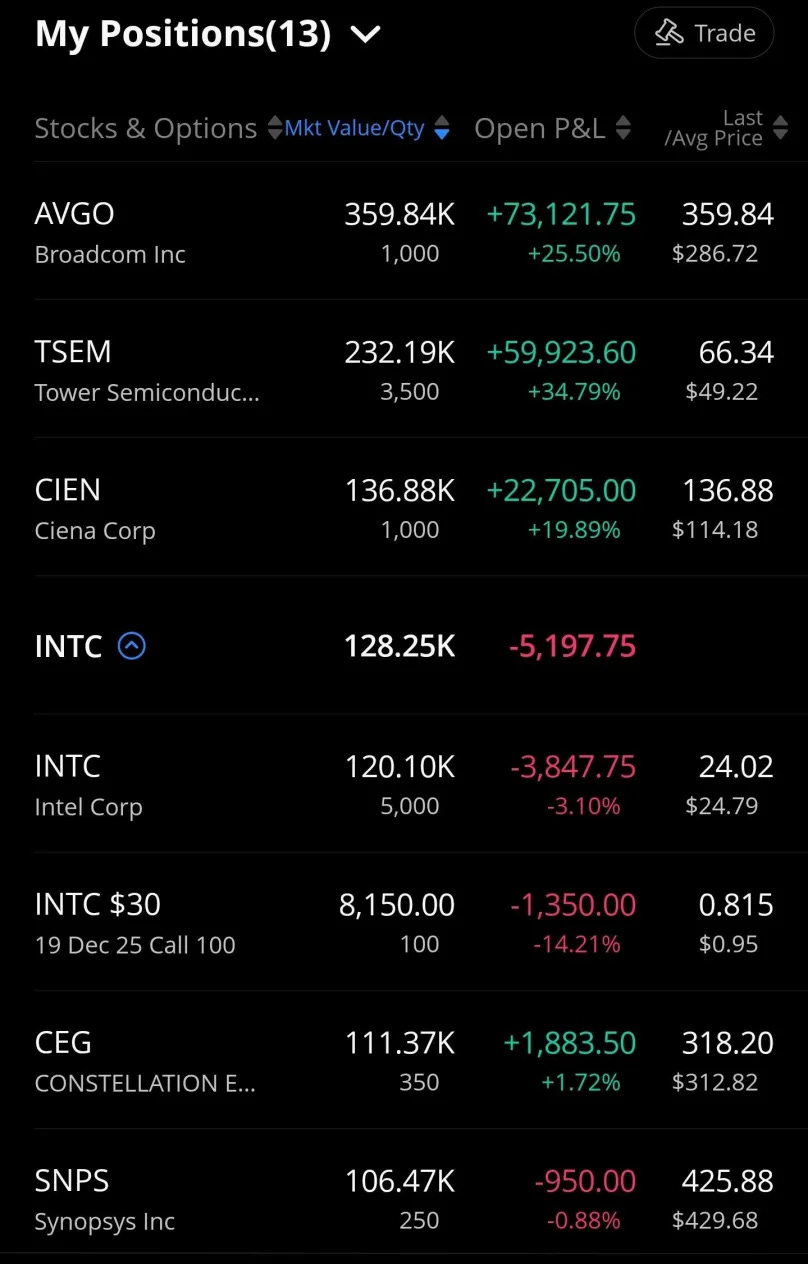

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Allright it’s time to properly cover the epic SNPS 0.00%↑ implosion.

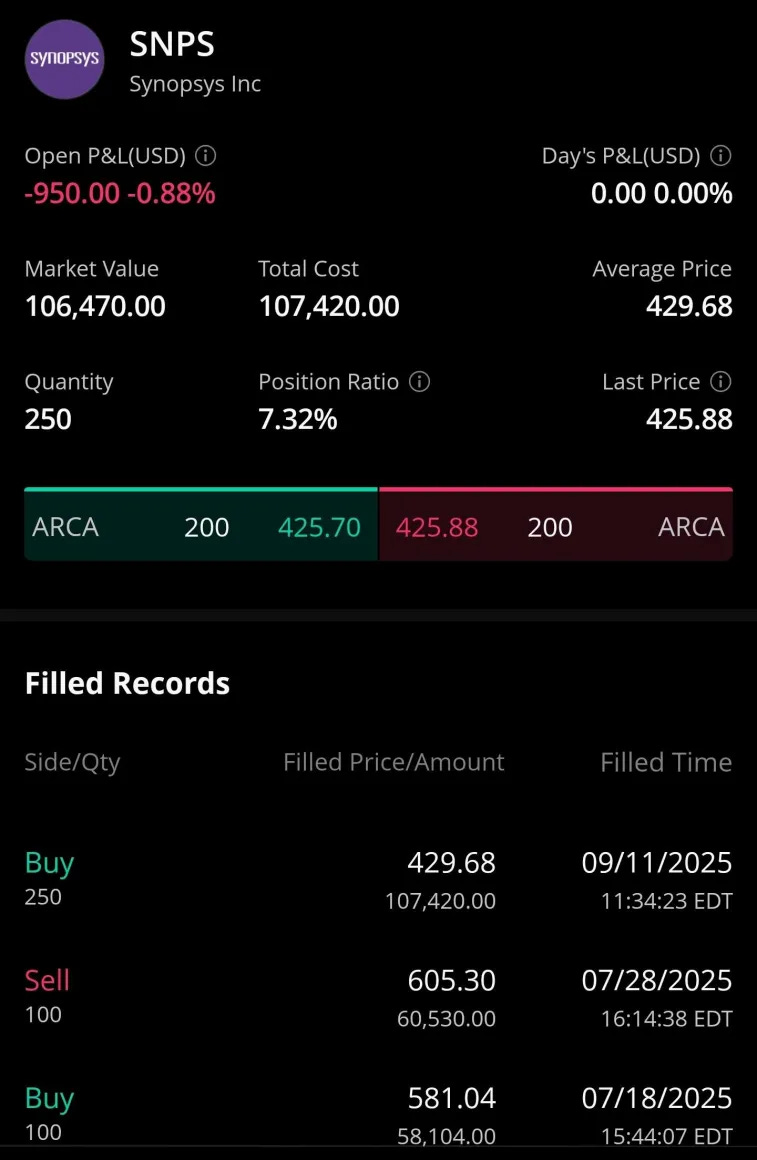

I have a position. Friendly reminder that YOU ARE RESPONSIBLE FOR YOUR OWN FINANCIAL DECISIONS.

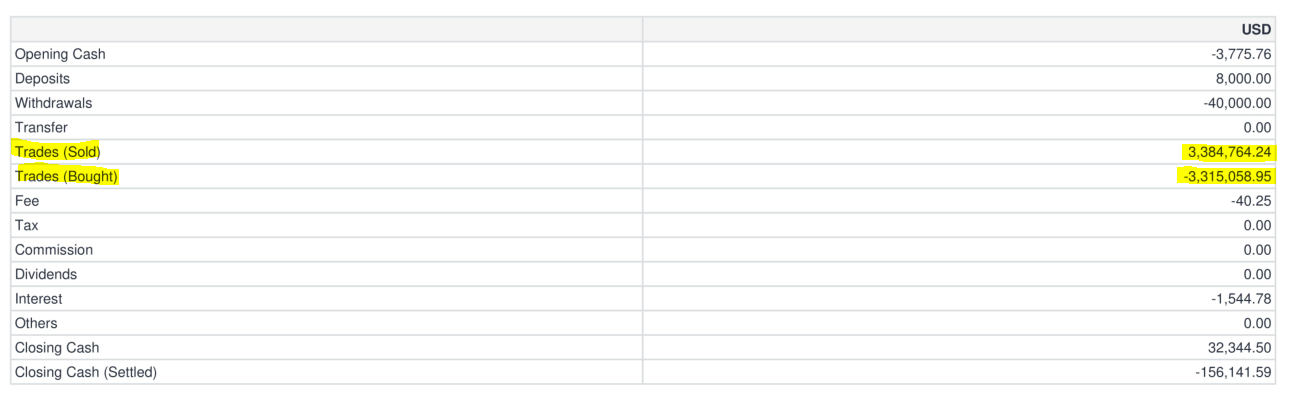

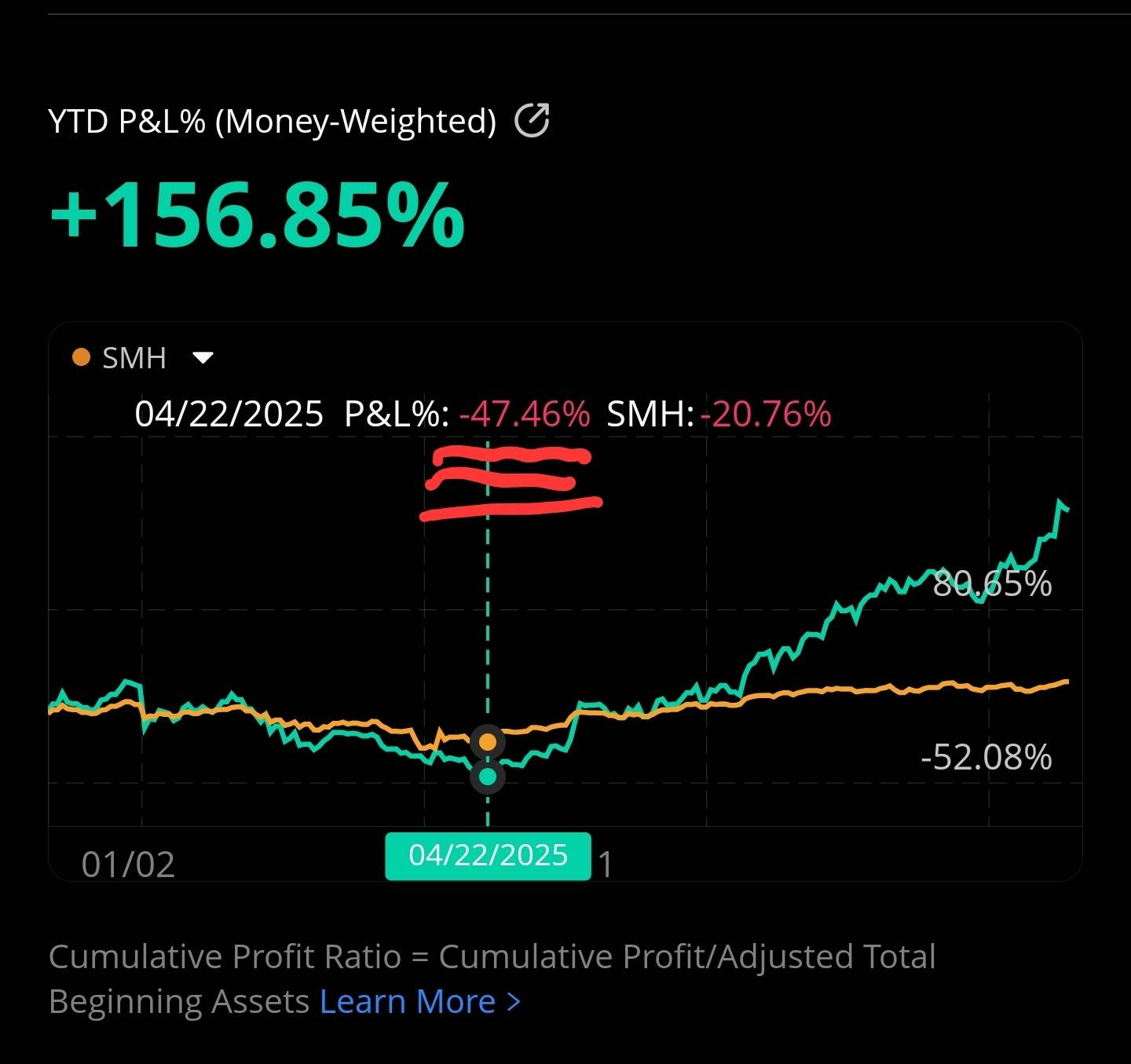

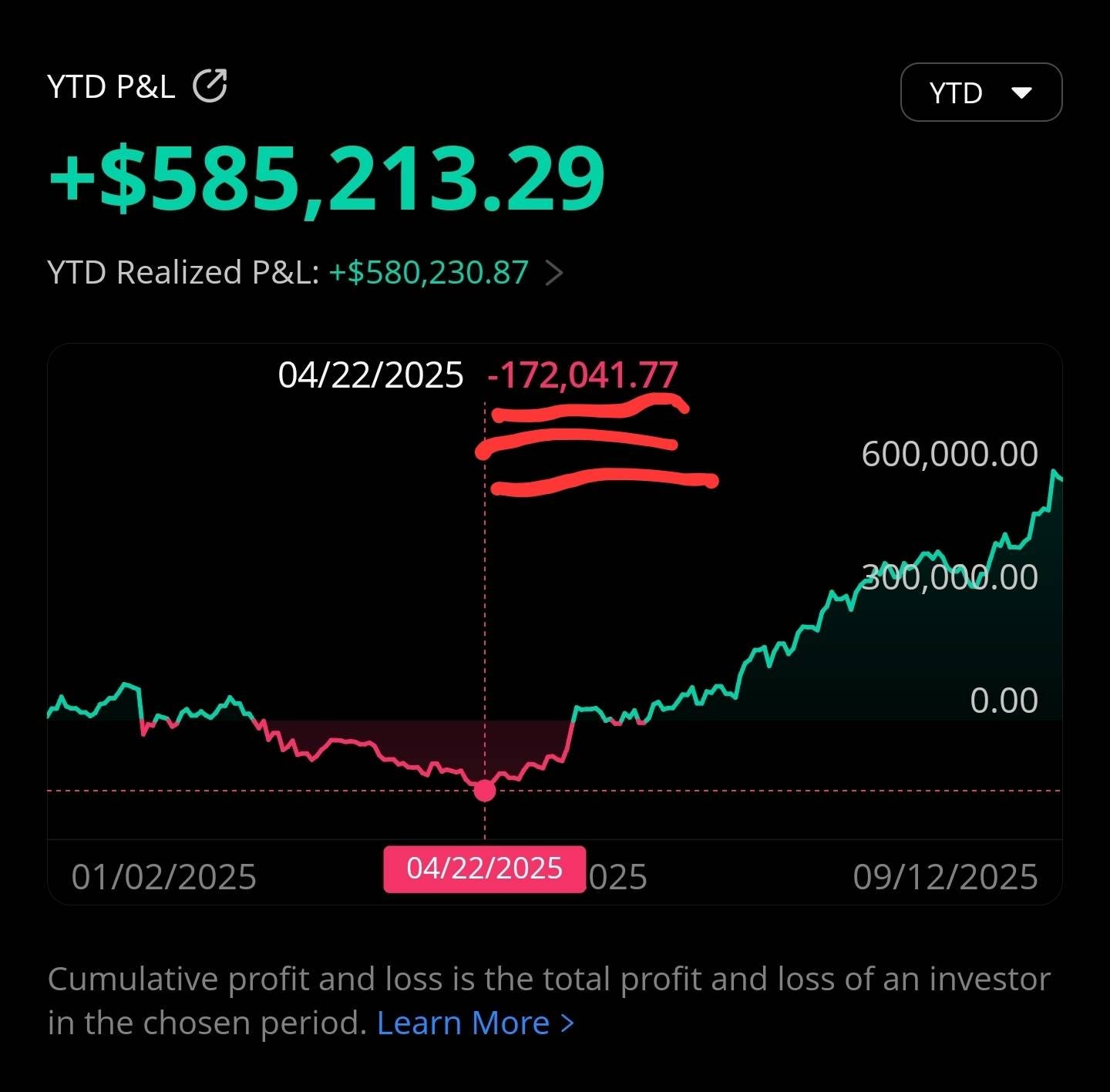

Take a look at my last month account statement.

Apparently, I had over $6.6M in transaction volume last month with a NAV of ~$600K.

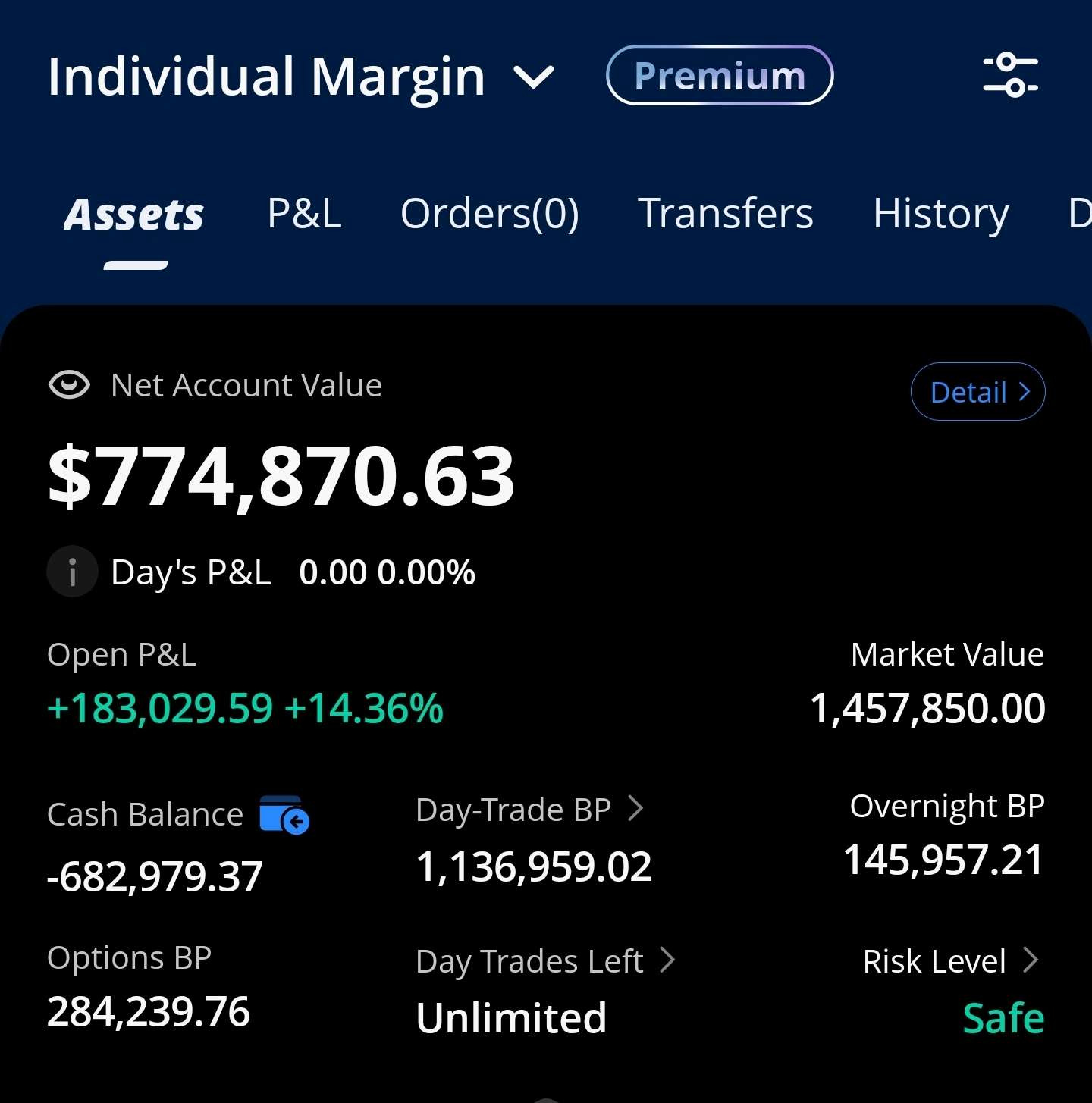

New snapshot of the trading account.

I am here to fucking gamble with MY own money and abdicate all responsibility for anything subscribers may or may not do with THEIR money.

What happened to Synopsys is actually quite simple.

Those within industry (and even a good chunk of the finance crowd) knew what was going on. What nobody expected was Lip-Bu Tan to unilaterally cancel a massive contract.

The poor Synopsys CEO was trying so hard to say “Intel fucking backstabbed us” in the most corpo neutral bullshit manner possible.

Will give some background first and then show how the Synopsys earnings call clearly confirms what happened.

Contents:

Background

Synopsys Earnings Call

Reasonable Conclusions

[1] Background

Note: Everything in this section is effectively public information. Thousands within the engineering community know this stuff. A surprising number of finance people also know this information.

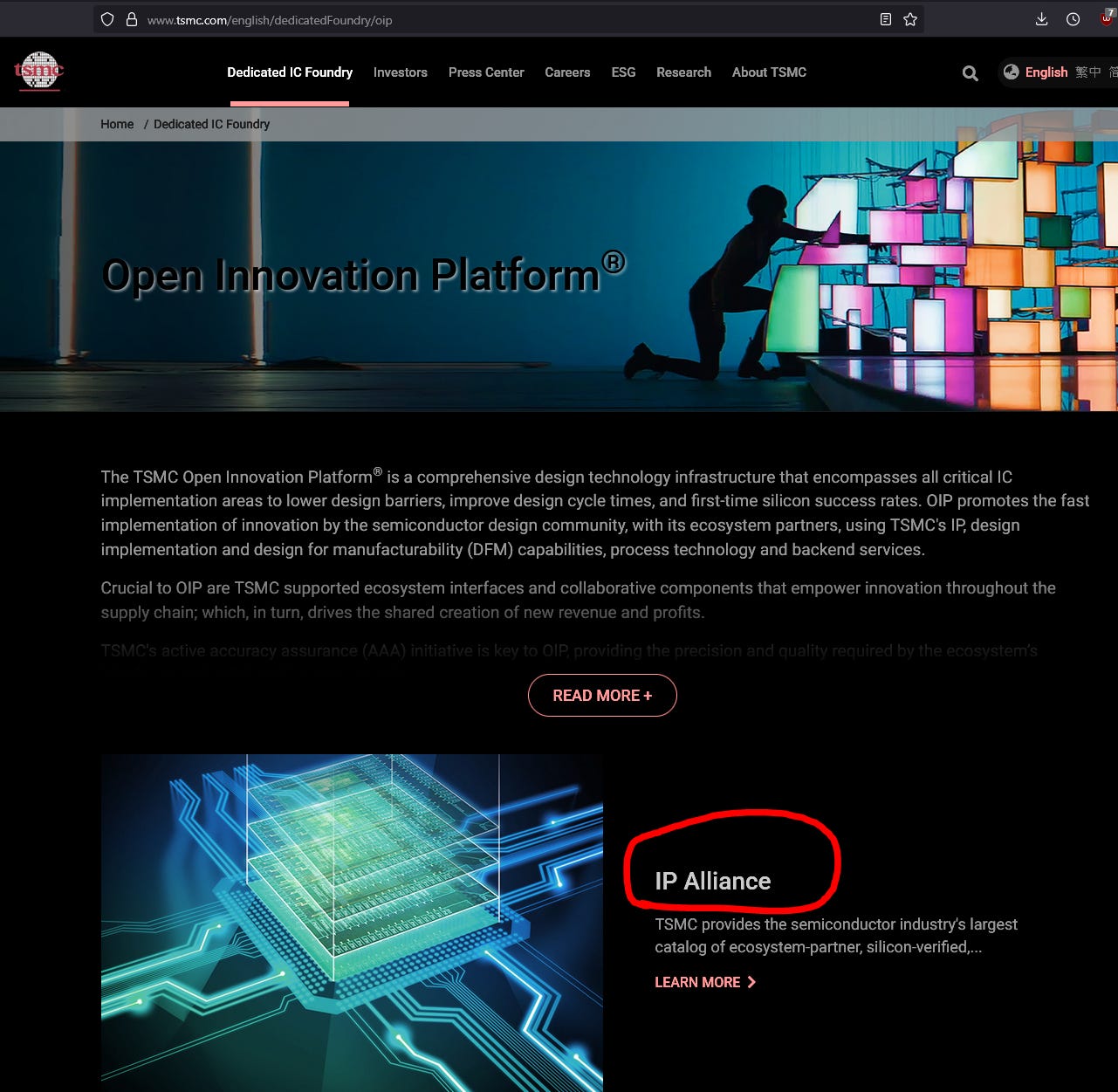

TSMC has a symbiotic relationship with IP vendors (Synopsys, Cadence, Alphawave, Rambus, ARM, …).

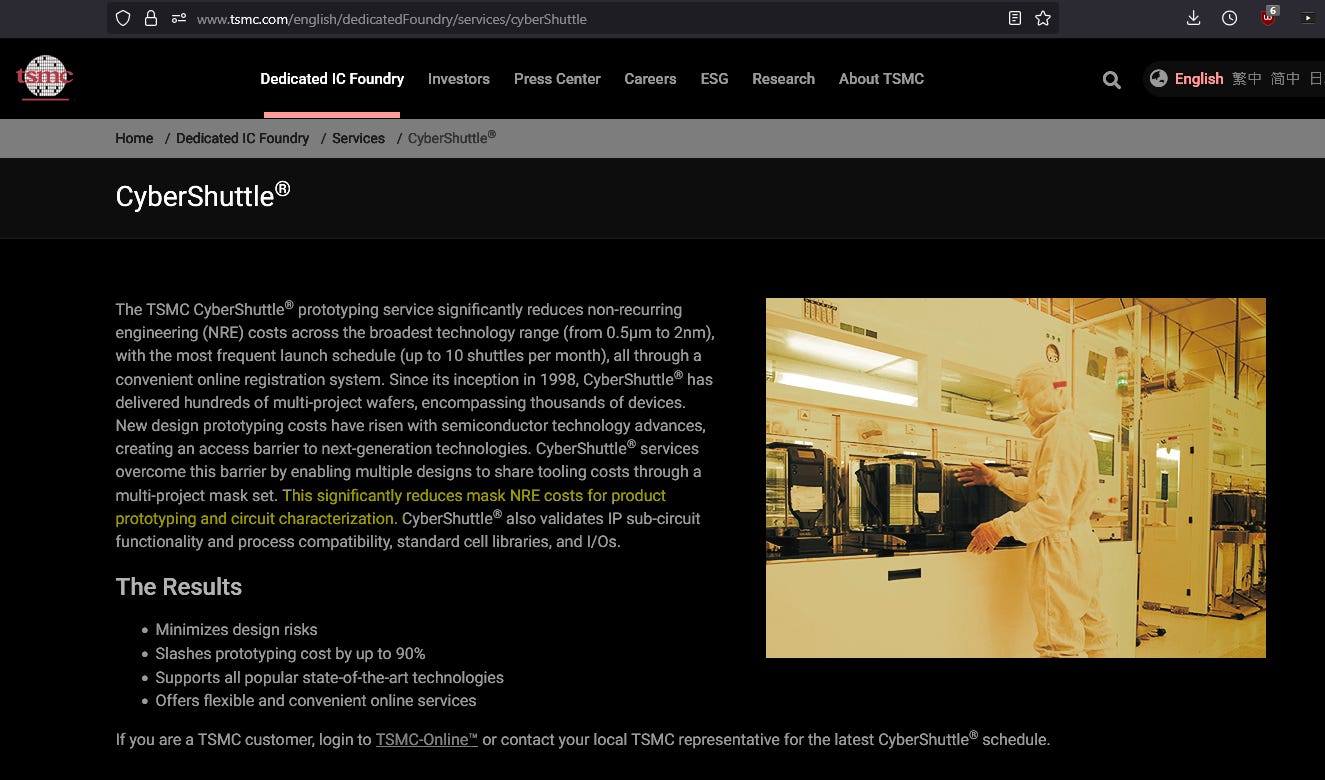

There exists a regular “IP” multi-project wafer (MPW) shuttle that is complimentary to all IP ecosystem partners. Effectively a “free” tapeout for IP companies every ~6 months.

In return, TSMC gets to advertise a large catalog of silicon-proven IP to all its customers.

Given that there is a huge customer base, IP companies are delighted to develop on TSMC process nodes. They know ROI will happen eventually.

Samsung Foundry and Intel Foundry are different. A distinct lack of customers means the IP companies cannot justify the risk of porting.

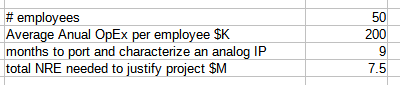

The math is relatively simple.

With some reasonable assumptions, it takes over $7M of OpEx to port ONE analog IP from TSMC to Samsung/Intel Foundry.

Nobody is dumb enough to light this kind of money on fire given the epic disaster that is Samsung Foundry 4LPE/4LPX/SF3/SF2 and Intel Foundry 18A.

So… obviously both of these foundries paid IP vendors large NRE contracts.

Let’s take a look at Synopsys IP catalog.

https://www.synopsys.com/dw/doc.php/ds/o/product_overview.pdf

Annoyingly, they only show which TSMC nodes they support in the public document. Cadence has a similar catalog PDF that actually shows which IP is available on which Foundry node.

So to recap…

Synopsys has a huge IP catalog.

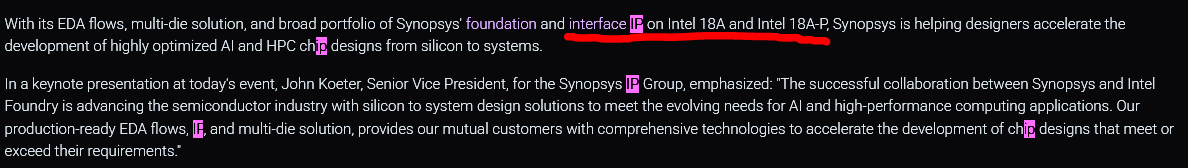

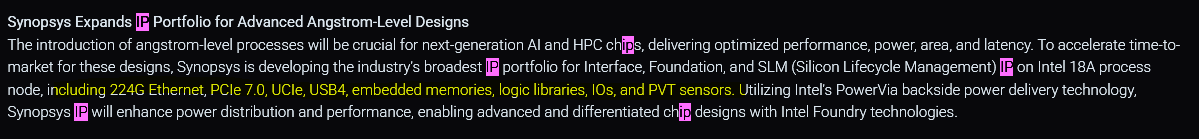

Synopsys publicly committed to porting all or the vast majority of their catalog to Intel Foundry 18A and 18AP.

Basic logic tells you that Intel and Synopsys must have signed some kind of deal to de-risk Synopsys spending ~$100M+ worth of OpEx porting all their shit to a node that might have zero external customers.

We all know that Intel 18A has ZERO external customers. Intel themselves have publicly admitted this. Intel Investor relations is straight up telling investors that they are focusing on 18AP and 14A for external customers.

The fun part is this…

Porting from 18A to 18AP requires new tape-out and meaningful design changes. It is the same amount of work as porting an IP from TSMC N5 to N5P or N4 or N4P. Minimum 3 months additional OpEx.

Thousands of engineers and several hundred finance people know when the 18A IP shuttle went out and when the 18A IP would theoretically be available to 3rd party foundry customers.

Between the 18A IP shuttle going out and test chips coming back, Pat “Semiconductor Jesus” Gelsinger was fired and replaced by Lip-Bu Tan.

Whatever contract Pat Gelsinger signed with Synopsys was probably lit on fire by Lip-Bu Tan.

Lip-Bu Tan has incredible leverage.

Intel Design is Synopsys largest EDA customer with nearly 100% wallet share.

Most companies split their EDA spend between Synopsys and Cadence.

Intel is an unusual example of “all-in” on one EDA vendor.

Lip-Bu Tan is the former CEO of Cadence and can credibly threaten Synopsys with EDA share loss to his old friends.

Intel is fucking going bankrupt. It is in Synopsys interest for Intel to live.

Trump owns 10% of Intel. You want to fucking sue Trump indirectly end get your EDA tools banned in China again? LOL

It is reasonable to conclude that Lip-Bu Tan went to Synopsys and said something along the lines of …. “Sue me bitch.”

[2] Synopsys Earnings Call

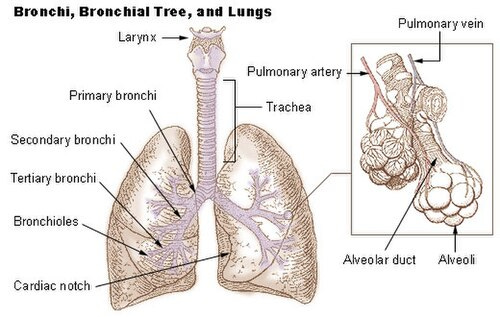

It is a common misconception that lungs are hollow air sacks.

Lungs are in-fact quite solid. Just full of tiny pours air sack things called Alveoli.

I bring this up because the Synopsys CEO was trying his hardest to say “Intel backstabbed us so many times our lungs are extra pours now” while remaining professional.

Allow me to play the role of “anger management translator” for the Synopsys CEO.

I imagine the Synopsys IP team working on nodes that ACTUALLY HAVE CUSTOMERS would yield higher growth.

The value of 18A IP is zero.

Translation: Intel signed a multi-stage huge contract to port the entire portfolio and they backed out partway through because 18A is dogshit and has no customers.

We developed for 18A and nobody is going to fucking pay us for it. Not even Intel WHO SIGNED A CONTRACT.

We are doubling down on interface IP for Foundries that either have customers (TSMC) or will honor contracts and pay us (Samsung).

Lip-Bu Tan might move upcoming EDA contracts to Cadence too. WE KNOW WE ARE NOT DIVERSIFIED.

Most of the hit is from Intel Foundry and already baked into guidance update. China bullshit of minimal impact.

We port whatever customer pays for. If customer backs out of contract halfway through the process…

[3] Reasonable Conclusions

Someone might have gotten blown up by Oracle and Synopsys 6-sigma moves in opposite directions.

A general panic amongst dumb people including SaaS tourists who don’t know shit about semis probably pushed the stock down even more.

This is a one-off hit due to Intel 18A completely failing. Nobody expected Lip-Bu tan to unilaterally break contract but what the fuck is Synopsys going to do about it? lol

Best time to buy is when there is blood in the streets and… yea lot of blood here.

The actual quote is -

“The time to buy is when there's blood in the streets, even if the blood is your own.” ― Baron Rothschild.

Perhaps it will come to that 😛

It did when it comes to $INTC for me a while ago. I quoted exactly that on my twitter feed. Too bad no time to update it now.

I think you forgot to talk about the $14B loan synopsys took on to buy ANSYS. This is also pulling down the EPS.