Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Note #1: At the time of writing I hold no economic position in Marvel. (equity, options, other derivatives)

Note #2: For a variety of reasons, I am going on hiatus. For most of you, this is the last you will hear from me for a while. You can still try to contact me (email, text message, Discord DM, Substack chat, X/Twitter) but the probability I ignore you is very high so please do not be offended. In my head, there is a small list of people I will still respond to but for my own sanity I need a break from most of this. Before starting Irrational Analysis, I would spend 25-35 hours a week playing video games. Honestly, I have spent most of my life sitting behind a computer, using fake names, exploring fake worlds. The pandemic was perversely entertaining to me. It was fun to watch all the normal people lose their minds due to isolation. Turns out, normal people refer to my default lifestyle as “quarantine”. To an extent, spending 25-35 hours a week writing unhinged semiconductor trash talk has been healthier (more real-life interactions, more social, more grounded in reality) but it’s time to go on a social media detox.

Not all hobbies are healthy.

Marvell management has basically accused me of “making up nonsense”.

I was going to just take a break and let this slide but here we are.

Word of advice to the corpo scum who read my shit:

Never accuse me of lying or making things up. I take ethics very seriously. Lots of stuff does not get published because the evidence is too week. When I make a high-confidence call, it is because of an engineering-driven thesis and/or real data.

I will end your parasitic worthless joke of a career.

Contents:

Re-Iteration of Circumstantial Evidence

The Irrefutable Proof

Engineering-Driven Explanation

Practical Explanation

Guide for Financial Analysts Attending Marvell 2025 Custom AI Investor Event

Miscellaneous Topics

Coherent (the corporation) CPO Obvious Bullshit

MediaTek SerDes Apparent Failure

Semtech Interesting Setup

[I Don’t Care About] AMD

Qualcomm Acquires Alphawave

BE Semiconductor (BESI)

Micron

[1] Re-Iteration of Circumstantial Evidence

Here is an updated list of circumstantial evidence:

3+ sources tell me Trainium 2/2.5 stability is poor.

Anthropic and Amazon are both unhappy.

Network stability was repeatedly highlighted as an issue.

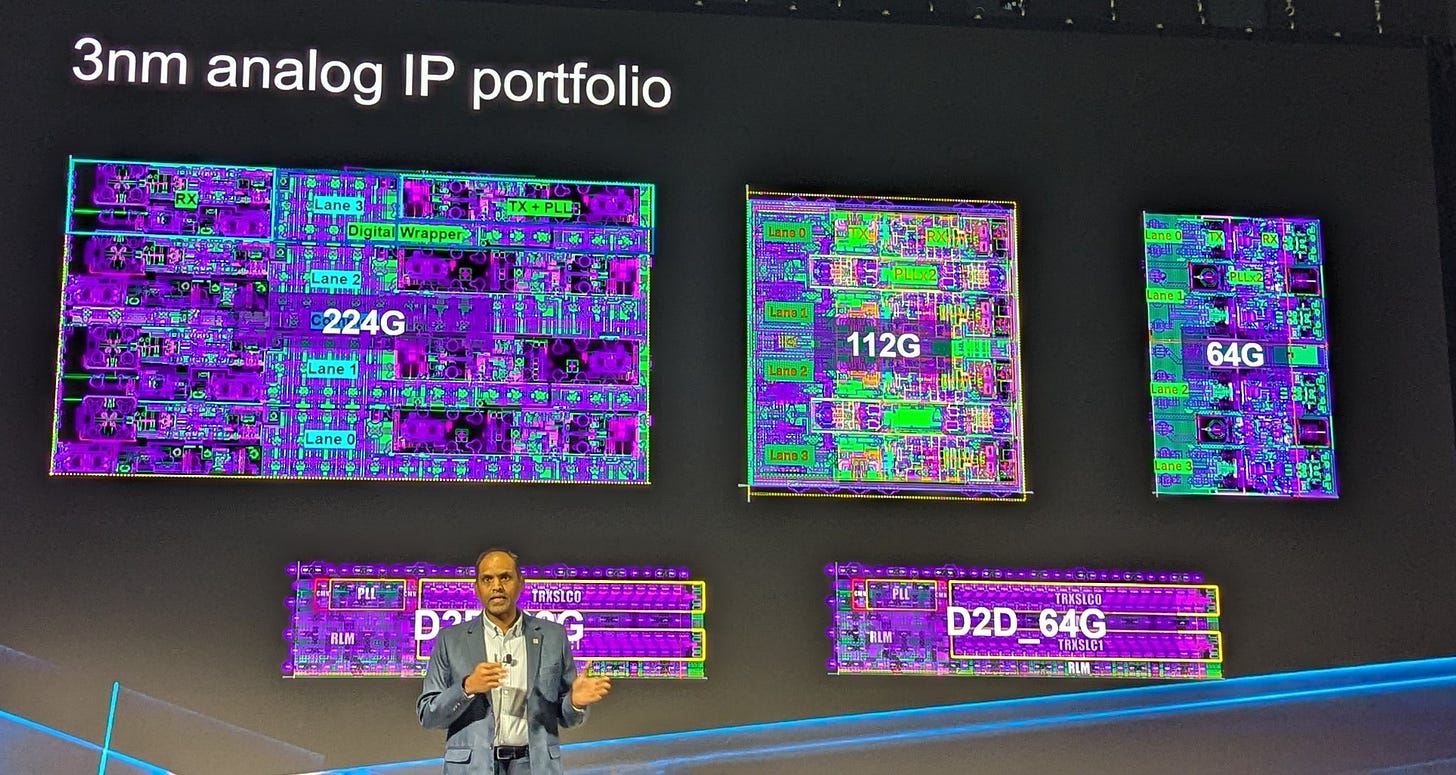

Public demos of Marvell’s 3nm 224G showed poor performance.

I have seen DesignCon and OFC demos.

Post-FEC results are quite underwhelming given the favorable channel and aggressive active cooling of the demo setups. (unrealistic)

Multiple hedge-fund contacts have told me that Marvell stuffed the channel with oDSP.

Multiple contacts have told me that Marvell oDSP customers are unhappy with performance.

Multiple contacts have told me that major optical transceiver customers will be moving significant share away from Marvell and replacing the volume with Broadcom oDSP.

There is a sense amongst semiconductor buy-side that Credo’s (somewhat unexpected) continued success is because Marvell Alaska (AEC optimized DSP chip) is dogshit. Copper cable companies cannot use it and are trying to switch to Broadcom, delaying their ramp.

[2] The Irrefutable Proof

I received the following image from a sell-side contact. This information contains test results of Marvell 3nm and 5nm optical DSP chips by a major optical transceiver manufacturer. In other words, one of Marvell’s customers generated this data.

The information was shared at a sell-side conference held by the Marvell customer. Because many sell-side analysts were present at this conference, I am willing to classify the info as “effectively” public information.

Orange dots are 5nm. Blue dots are 3nm.

As you can see, performance has gotten worse.

[2.a] Engineering-Driven Explanation

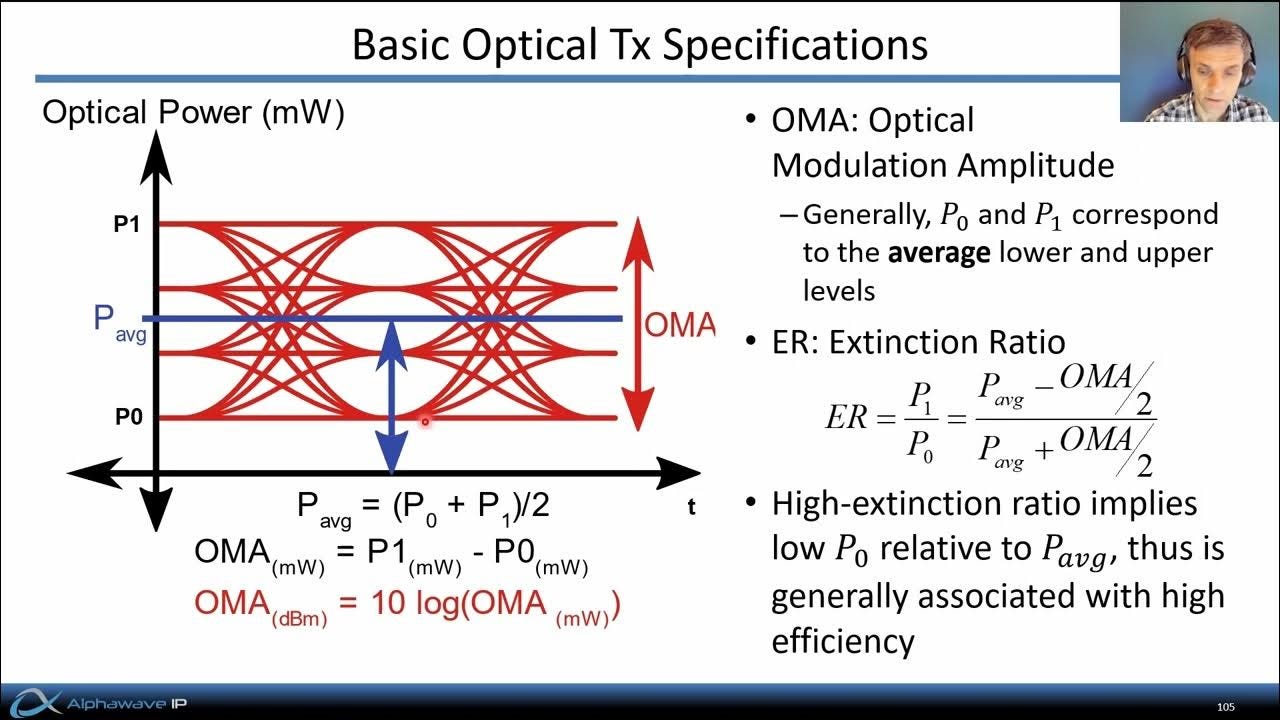

Let’s define both axis of the plot.

The Y-axis, is OMA, optical modulation amplitude.

Alphawave (will get to them later lol) has excellent content on YouTube. Thanks!

OMA is basically the difference between the highest and lowest optical power level. Larger difference between “high” and “low” is desirable.

The electrical SerDes driving the optical bits (direct or EML) effects OMA via electrical swing and rise time. Stronger electrical driver means higher (better) OMA.

Eyeballing the scatterplot, it looks like Marvell 3nm DSP has ~0.5 dB less OMA than the 5nm DSP.

TDECQ is somewhat complicated.

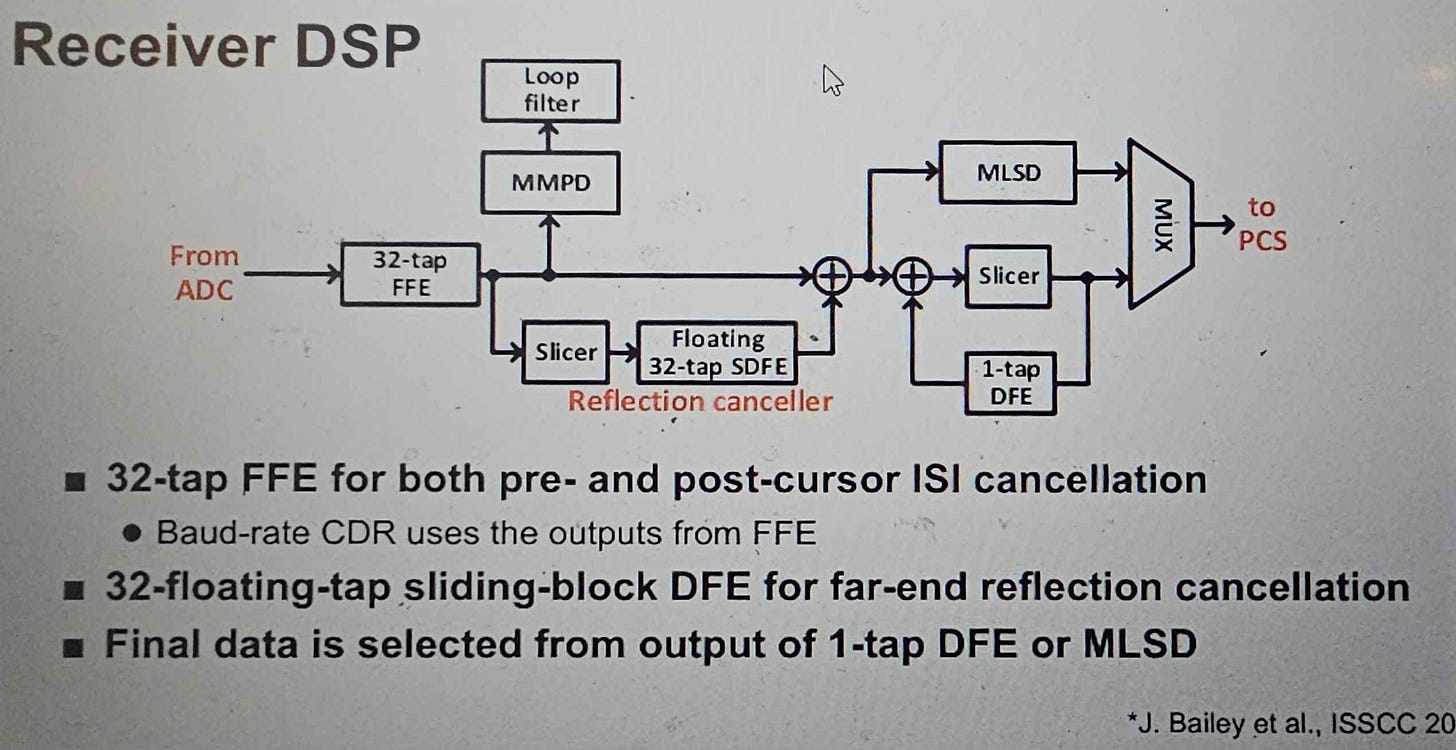

Imagine you have a reference receiver with a 5-tap FIR filter and basic analog CDR. How much more effort does your [non-ideal] transmitter need to make to achieve the same target error rate?

A TDECQ of 0 dB means your transmitter is perfect. This is not possible.

In reality, a high-quality system will have a TDECQ of < 1.5 dB.

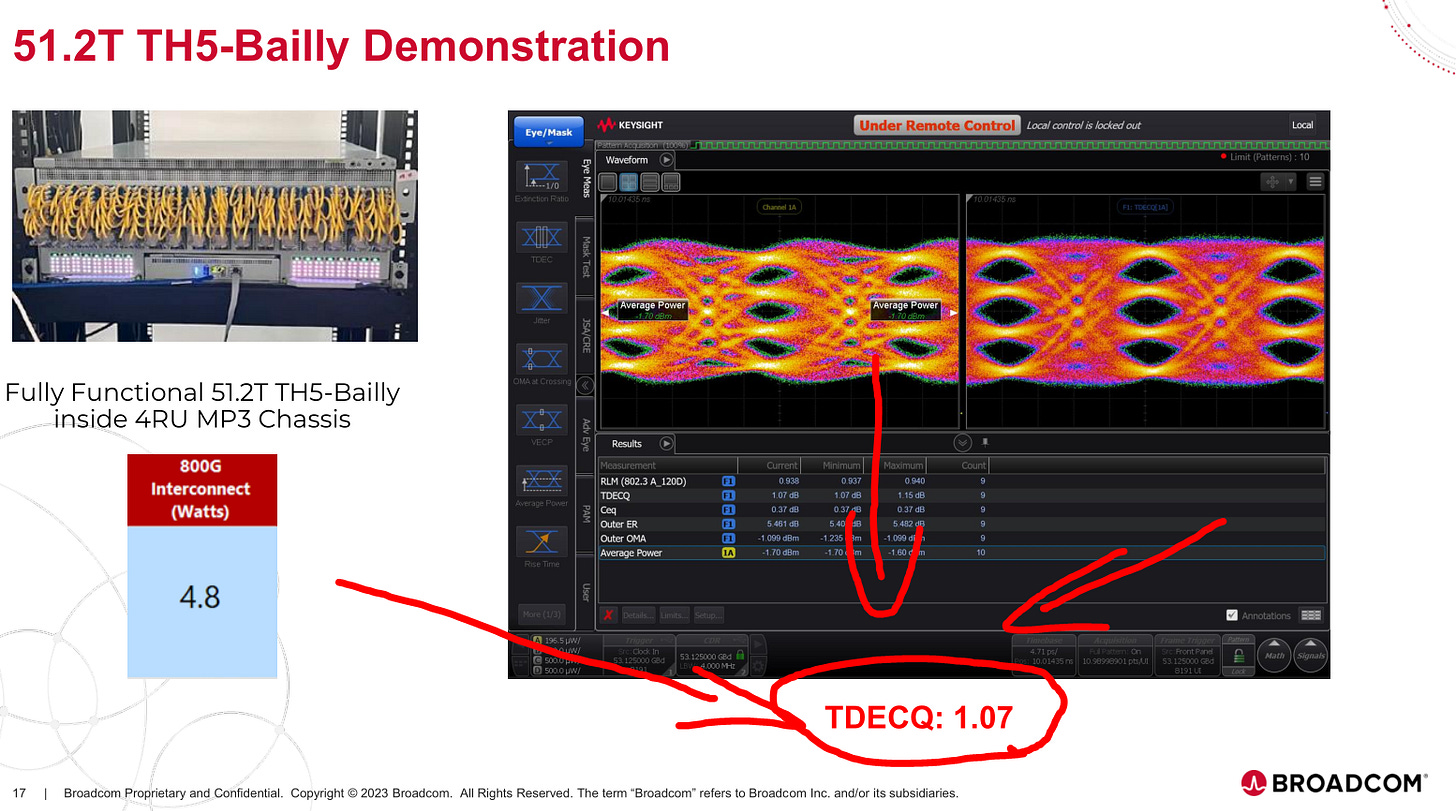

Broadcom achieved TDECQ of ~1.1 dB on their 5nm CPO system. This is what real engineering looks like.

Eyeballing the scatterplot, it looks like Marvell 3nm DSP has ~1 dB higher TDECQ than the 5nm DSP. The average TDECQ of the 3nm DSP appears to be a whopping 2.6 dB.

[2.b] Practical Explanation

This is an epic engineering failure. Porting a SerDes design from TSMC N5 to TSMC N3P should result in “free” performance gains.

Faster transistors

Lower power devices

More area to use for isolation

Lower intrinsic (thermal) noise of devices

Better linearity of devices

…

Seeing such a massive regression in Marvell’s 3nm DSP is incredible. I am absolutely certain they fucked up, but have no idea what the underling cause of this disaster is.

Here are some theories. I need a die shot of the 5nm SerDes core or more detailed test results to figure out the root cause. The outcome is certain though. Scatterplot is irrefutable hard data. They fucked up.

Massive inductive coupling between something and Tx PLL because Marvell fucked up layout when porting to 3nm.

Change in the transmitter driver that backfired.

Changed T-coils for some reason and it backfired.

Clocking bug.

Both OMA and TDECQ have degraded. Let’s add some context on what these numbers mean.

Let’s give Marvell a pass on OMA and ignore the ~0.5 dB degradation. Let us only focus on the ~1 dB degradation in TDECQ.

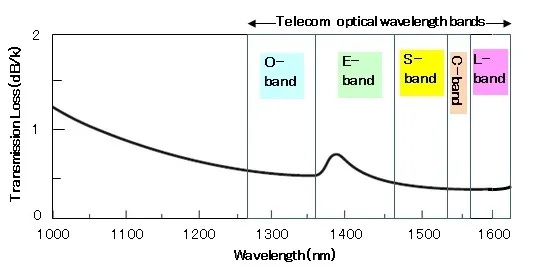

This is what the loss of an optical fiber is in dB/kilometer.

The popular wavelengths for most lasers are 850 nm, 1310 nm, and 1550 nm due to a variety of reasons such as laser construction. I will cover this in detail some other time.

Marvell’s 3nm DSP has ~1 dB lower TDECQ than the previous 5nm DSP and thus transceivers built with this shit silicon will have (on average) 0.5-2 KILLOMETERS lower reach depending on the source laser.

[3] Guide for Financial Analysts Attending Marvell 2025 Custom AI Investor Event

Marvell is having an investor day soon. They are very excited.

I am excited too.

I would like to coach a small army of financial analysts on how to make this Marvell event a true circus.

NVLink Fusion chiplet is literally a SerDes retimer. Chip with SerDes on both ends.

NVLINK FUSION IS ABSOLUTLY A REPLACEMENT FOR YOUR SHIT SERDES MARVEL RETARDS.

Broadcom has their own SerDes and will build their own ecosystem. AMD is off in the corner eating shit because they don’t have anything. (more on them later)

NVLink Fusion: Jensen Murders UALink with Galaxy-Brain Strategy

Irrational Analysis is heavily invested in the semiconductor industry.

Financial analysts do not let Marvell bullshit you on this.

Marvell joining NVLink Fusion is an outright admission their internal SerDes is shit. It absolutely is a direct replacement. Susquehanna what the fuck are you doing you idiots. These callback notes read as if both sides are completely devoid of functioning brain cells.

Key Points (do not give an inch):

Marvell joining NVLink Fusion is extremely bearish for Marvell internal SerDes. Read the post I linked above. Do not let these idiots play word games with you.

Marvell 3nm DSP/SerDes is meaningfully worse than the 5nm version. This has massive ramifications for their market share in optical transceivers and AEC. You can with a straight face ask them “why reach 500 meter lower?” and that question is technically sound and has hard data backing it.

What is Marvell’s differentiation if Alchip and MediaTek will do the same job for much cheaper using NVLink Fusion?

If you find engineers willing to talk, ask about electromagnetic/inductive coupling. Go fishing and if you catch something send it my way. 🙂

[4] Miscellaneous Topics

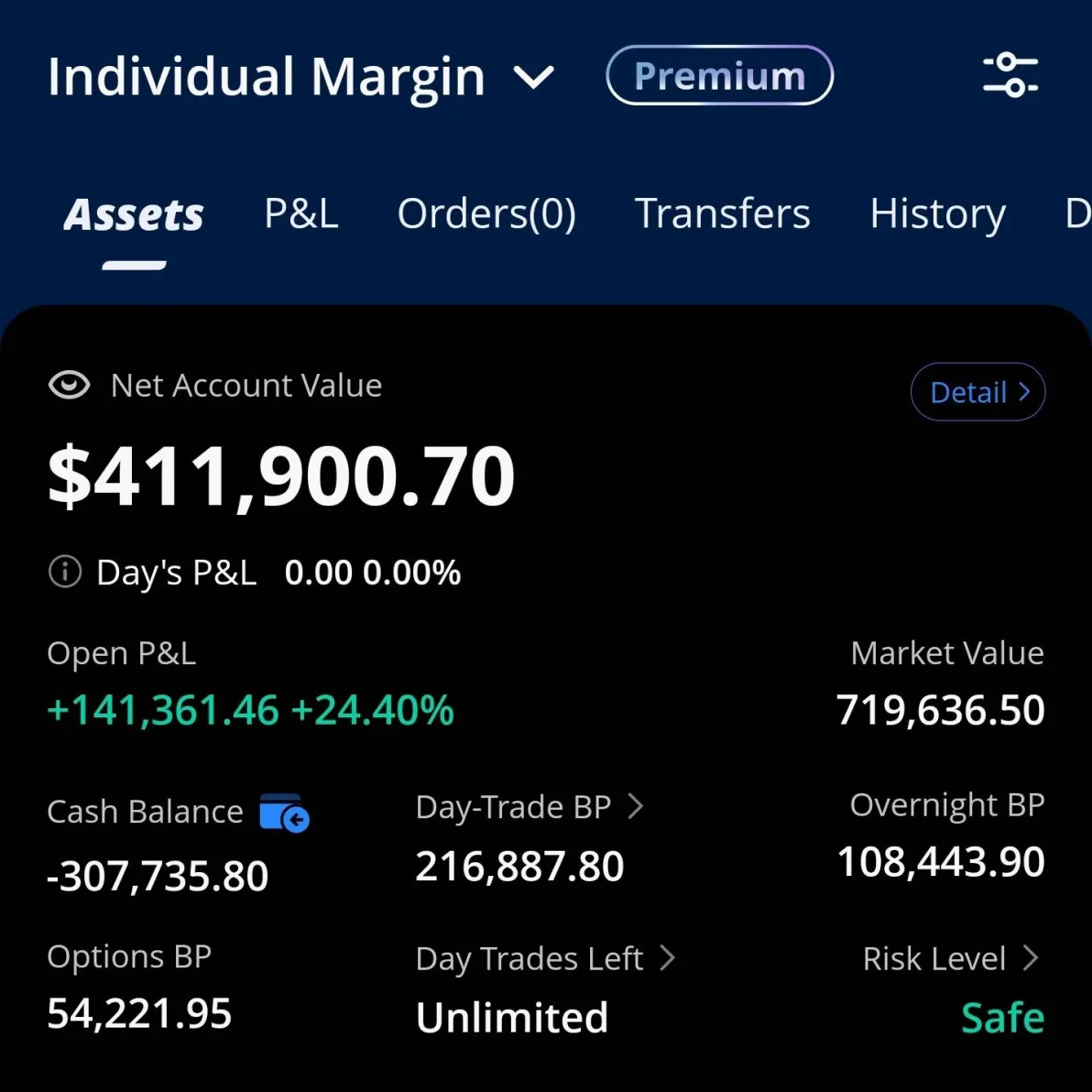

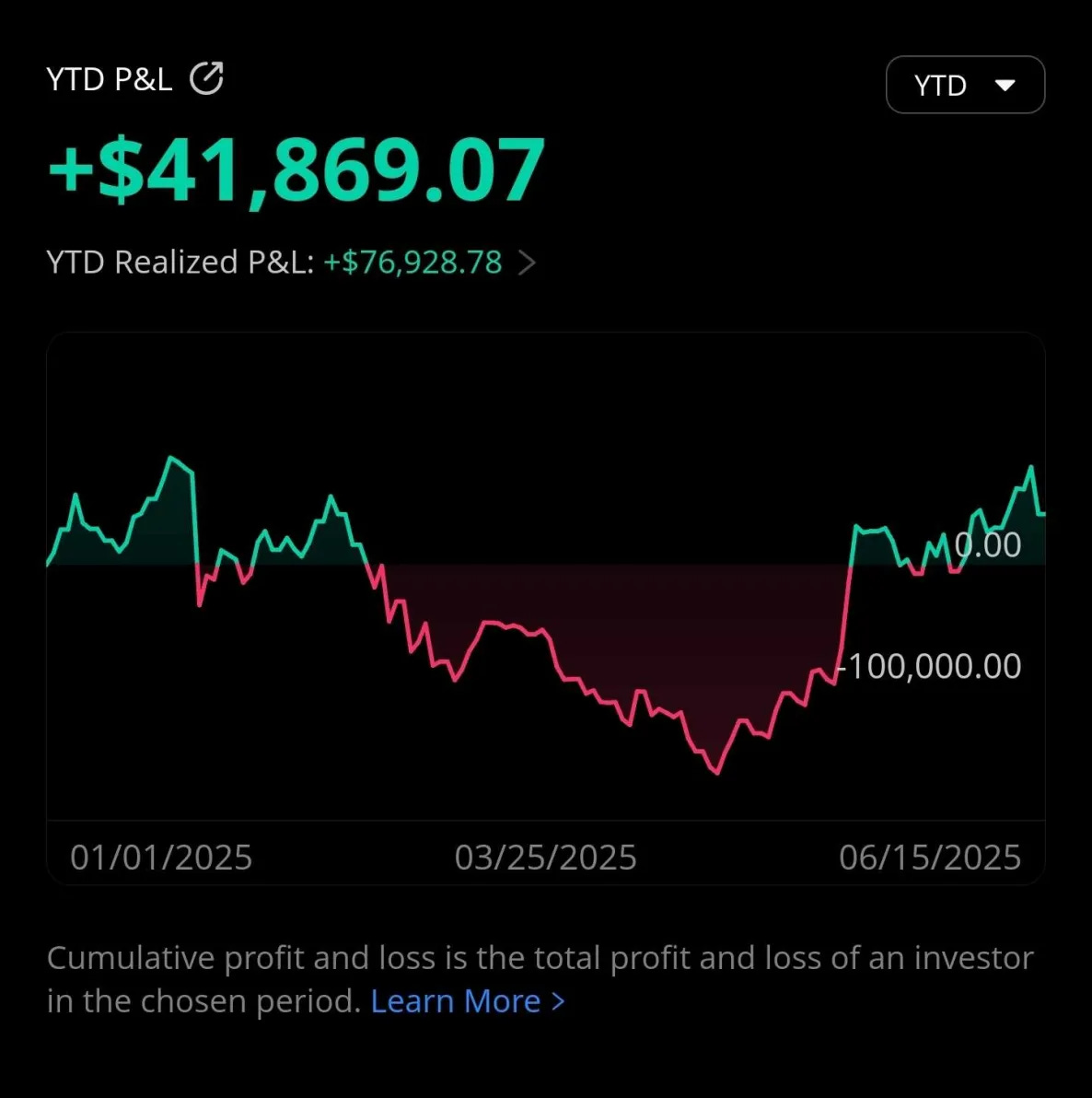

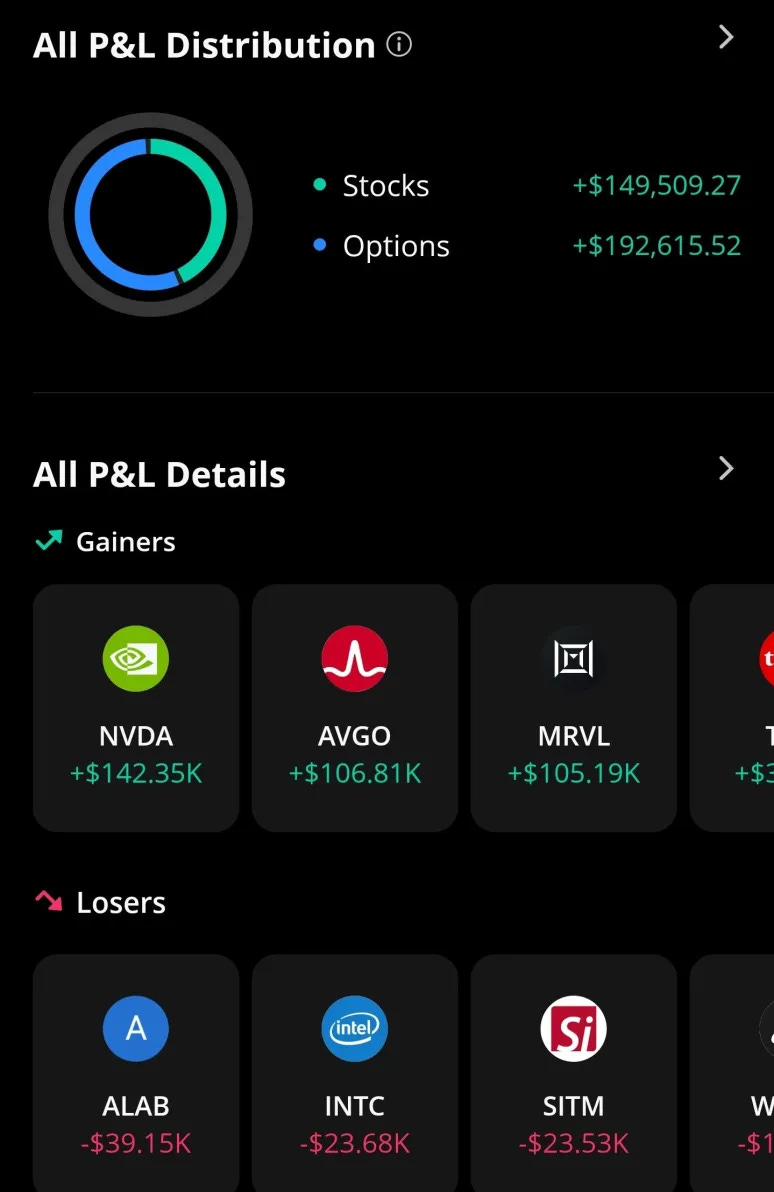

I will be away for a while so here are screenshots for the trading account. Will still be trading aggressively in this account FYI. Israel/Iran shit forced me to de-lever from 2x to 1.5x. Want to buy back into KLA but need a nice margin equity buffer to navigate the geopolitics crap.

[4.a] Coherent (the corporation) CPO Obvious Bullshit

Coherent is the only company with 6-inch Indium-Phosphide wafer production. This is a huge advantage and why I am long the stock.

https://www.coherent.com/news/blog/indium-phosphide-wafer-fab

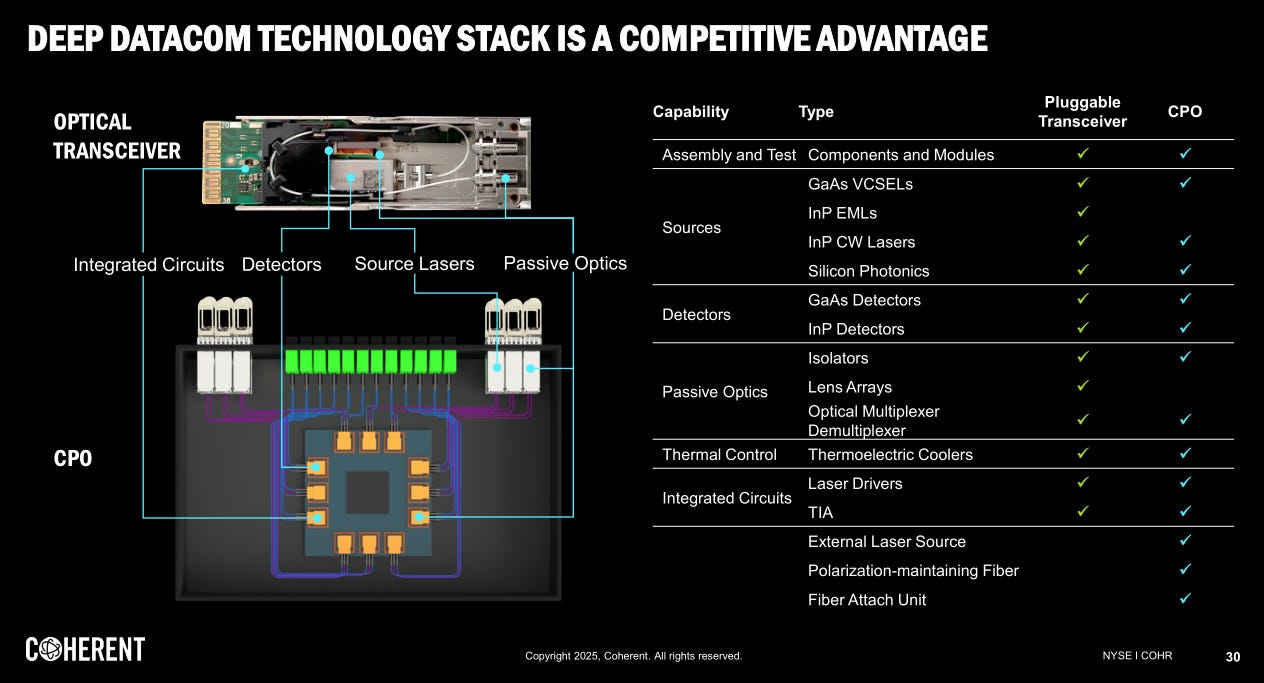

While performing standard due-diligence activities, I found these appalling slides.

This is intentionally mis-leading. Shame on the corpo scum who made these slides.

CPO is all about integrating all of these components into a single hybrid-bonded COUPE (TSMC) chip that sits on the TSMC-packaged system.

TSMC is eating almost all of this content.

All transceiver companies (Coherent included) are massive CPO content **losers**.

Go look at the ASP and BOM cost of an external laser source compared to traditional transceivers. That is where Coherent’s content/TAM is going within the next 5 years.

[4.b] MediaTek SerDes Apparent Failure

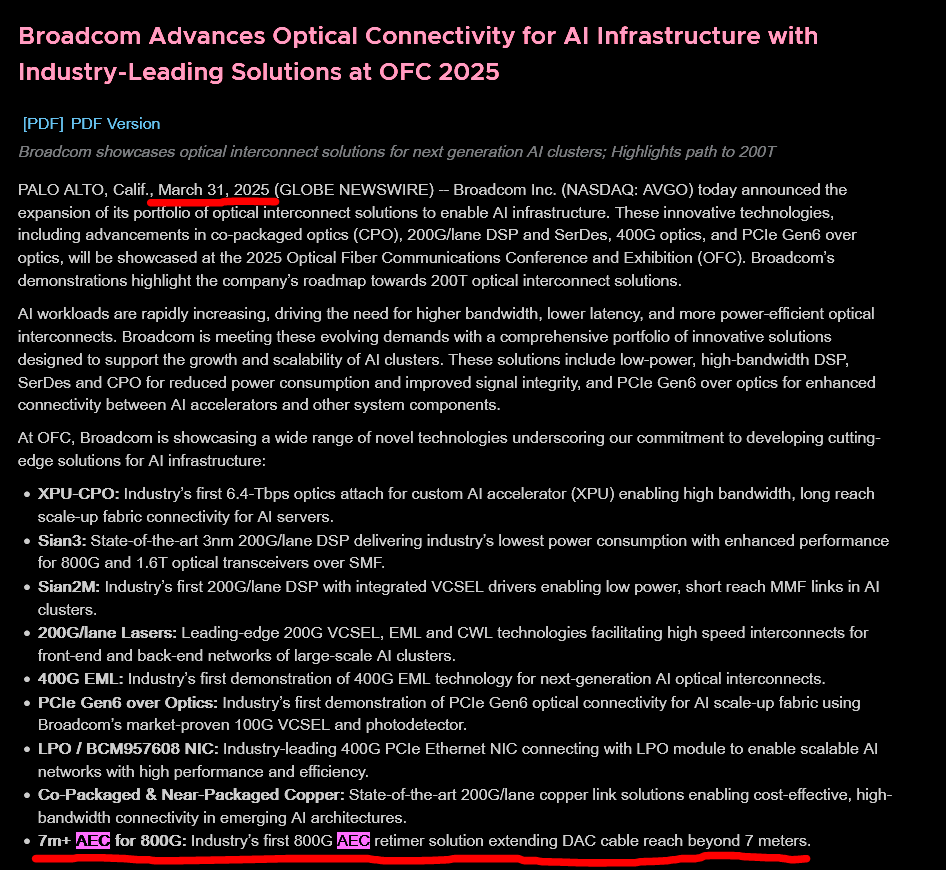

Broadcom stock had a small spike this week because yet another Taiwan sell-side/broker admitted the Mediatek/Google TPU project has been delayed again.

Too lazy to find the copeium note but it claimed delay is because of Google compute die, not MediaTek SerDes.

I know Taiwan sell-side reads my shit. Friends, if MediaTek SerDes is so good then why did they join NVLink Fusuion? It’s not looking good lol.

To be clear and transparent, I have flip flopped on this issue several times this year.

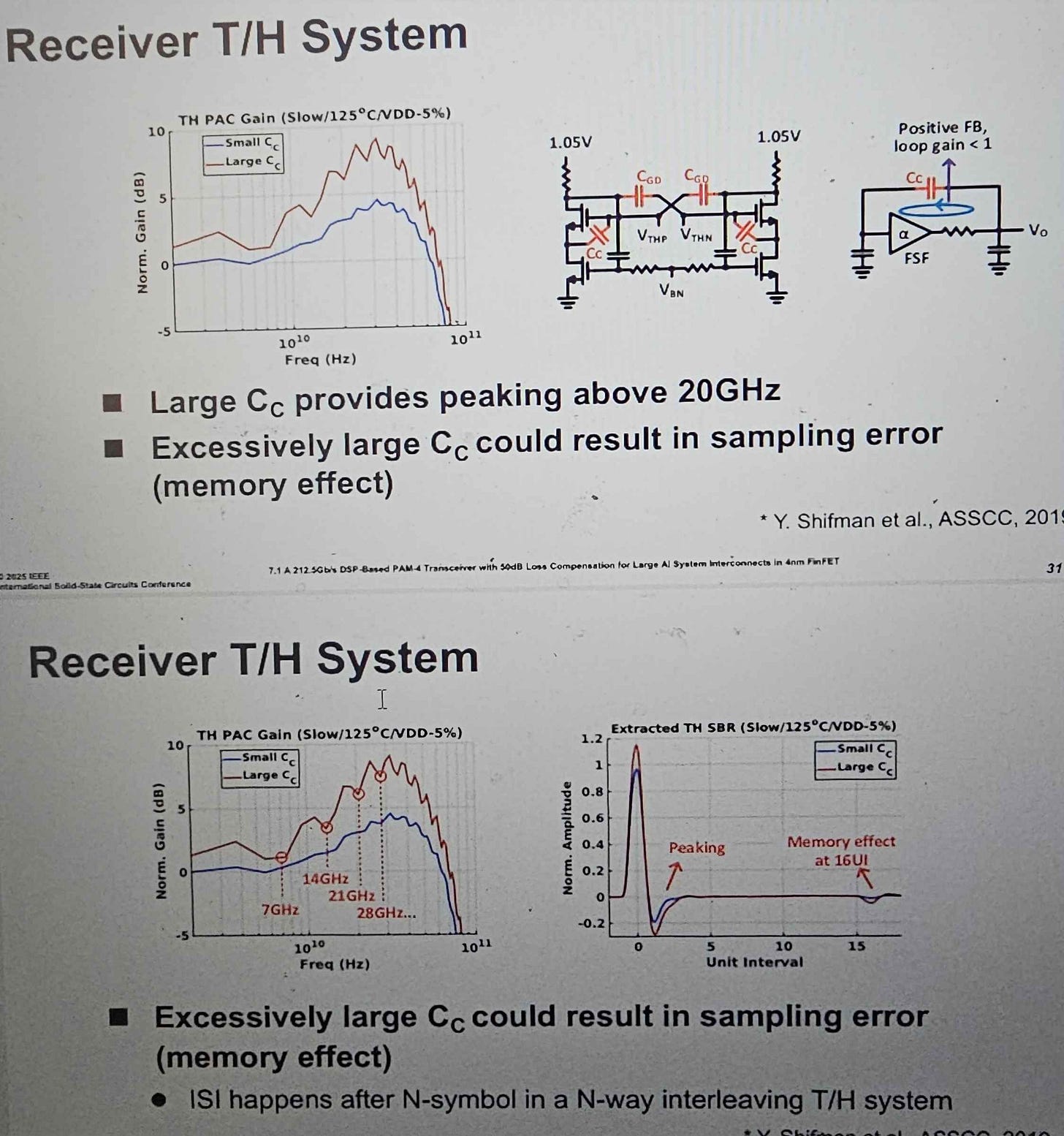

ISSCC 2025: Ultra High-Speed SerDes

Irrational Analysis is heavily invested in the semiconductor industry.

Initially thought MediaTek had no chance.

Then saw pretty decent ISSCC presentation. (Flipped to 70% chance MTK succeeds)

Then steady stream of negative rumors, including heavy attrition of MediaTek SerDes team to Nvidia. (30% chance MTK succeeds)

MediaTek joins NVLink Fusion. (its fucking over LOL)

The first MediaTek 224G SerDes that failed was on TSMC N4P and had some exotic design choices that clearly backfired. They put gain in the ADC interleaves and tried to correct horrific ISI with double DFE slicers. I assumed that if they removed this they could get the N3P version working. Apparently not.

[4.c] Semtech Interesting Setup

This ticker needs some backstory.

Semtech is a company that sells a variety of low gross-margin garbage. They tried to move up and make analog components for 224G ACC with Nvidia NVL36x2 as the lead customer. The CEO went around telling all the finance people about the huge revenue and gross margin increase and… Nvidia canceled NVL36x2.

Multiple hedge fund contacts have told me about an idiot at Whale Rock Capital Managment lost a truly hilarious amount of money off this.

The point is, Semtech CEO has pissed off almost all of the finance people. Practically none of them believe a word of what he says.

There is a setup that I am still digging into where this stock is an easy double. This is a dangerous swing trade where I see downside at $30/share and upside of $60-100/share. Still working on it.

[4.d] [I Don’t Care About] AMD

Many people ask me what I think of AMD or what I think of what Semianalysis thinks of AMD.

It’s actually quite simple.

AMD’s recent event was a complete nothingburger. They don’t have the SerDes. Don’t let the alphabet soup of UEC, UALINK, and other digital dressing distract you from the fact AMD is missing key technology.

One of the very smart buyside people I talk to suggested that AMD could fix all their problems by… joining NVLink Fusion. It’s kind of unthinkable and I was a little speechless on the phone, but he is right. It would help… but also be strategic suicide.

[4.e] Qualcomm Acquires Alphawave

Congratulations on Qualcomm for putting Alphawave out of their misery.

Allow me to take a moment and directly speak with any Alphwawave friends who might be reading this.

Your new management is great. Nothing to be worried about. Cristiano definetly did not buy you guys just for the UCIe and PCIe IP. The Alphawave 224G SerDes group is totally safe even though Qualcomm has joined NVLink Fusion. Tony definitely did not sell out the 224G team to save his own bags. Qualcomm has a long history of success in datacenter CPUs and you have a bright future joining them. Cristiano definitely will not paper-hand this latest ARM-based datacenter CPU opportunity.

YOU ARE SAFU. (づ。◕‿‿◕。)づ

S A F U

A

F

U

https://www.theregister.com/2018/12/10/qualcomm_layoffs/

[4.f] BE Semiconductor (BESI)

I don’t care about the revised guidance or HBM or logic.

I care about COUPE.

This is what actually matters. COUPE is really incredible. Will be much bigger than anyone expects. Hybrid bonding has found its true calling.

A Background-Proof Guide on Co-Packaged Optics

Irrational Analysis is heavily invested in the semiconductor industry.

[4.g] Micron

Apparently, Samsung is completely retarded. Even I thought for a moment that they would get it together. Briefly shorted Micron, lost money, and now have degenerate calls.

We are gonna miss you! Best free semiconductor content!!

How long of a hiatus? We will miss you!