The Curious Case of NASDAQ:ARM's Low Float

Obviously overvalued... but by how much?

IMPORTANT:

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

DO NOT SHARE INSIDER INFORMATION OF ANY KIND IN THE COMMENTS SECTION. (Leaked info or rumors from **other** corners of the internet is ok)

Hello wonderful subscribers. Welcome to part #2.

Here is part #1, which focuses on historical and technical background:

For this post, I will be referring to three distinct concepts with the following definitions:

ARM (LTD)

A corporation publicly traded as NASDAQ:ARM —> ARM 0.00%↑

ARM (ISA)

A specification for a CPU architecture, commonly referred to as an “instruction set architecture”, ISA.

There are other CPU ISAs such as x86, RISC-V, POWER, MIPS, …

Human languages (English, Chinese, Spanish, Hindi, Arabic…) are a good intuitive reference. Please read part #1 if you want to learn more.

ARM (RTL)

Reference CPU microarchitectures (real-time logic) and other silicon IP that ARM (LTD) licenses/sells to customers.

The official branding is “Cortex”. (“Mali” for GPU IP)

These three concepts often get conflated, leading to confusion amongst the financial community and even portions of the technical/engineering community.

Everything is named “ARM”, so any confusion is understandable.

With that out of the way, let’s get started. :)

Contents:

Masayoshi Son

2016 Privatization of LSE:ARM

SoftBank Vision Fund(s)

NASDAQ IPO

Financial Analysis

Business Model Overview

TLA Example: Samsung Exynos 2200

ALA Example: Apple

ALA/TLA: Key Points

The Four Business Models

Failed Royalty Hike Attempts

Sell-Side Status

Qualcomm/Nuvia Lawsuit

Timeline

Possible Outcomes

Competitive/Market Landscape

Embedded/IoT

What this market needs.

Evidence of share losses.

The 2018 FUD campaign.

Smartphone

ISA Share

RTL Share Decay

The 🌶 Spiciest 🌶 (theoretical) Timeline

Laptop/PC

Datacenter

Data Processing Unit

Cloud Native CPU

HPC/Supercomputing

The False AI Narrative

Irrational Price Target

[1] Masayoshi Son

To understand what is going on with ARM (LTD), we must first take a detour into the life of Masayoshi Son.

The Financial Times has a great 15-minute documentary about Masa. Go watch it if you want to learn more about him.

Quick Highlights:

Masa founded SoftBank Group and is the majority shareholder at roughly 35%.

Technology focused investments.

Very high risk tolerance.

His greatest success was investing 20M USD into Alibaba in 2000.

It is difficult to estimate what his exit ended up being.

He could have sold at 200B (10,000x) but instead probably got out at ~50B.

SoftBank operates two venture capital funds called “Vision Fund 1 // 2”.

These Vision Funds have invested in high-profile, unmitigated disasters such as WeWork, Katerra, Greensill Capital, Wirecard, and Wag.

Even the ok investments, such as Uber, went badly because Masa bought it a high valuation and sold at a loss post-IPO.

Due to the corporate structure, Masa has (effectively) total control over SoftBank and both of the Vision Funds.

[1.a] 2016 Privatization of LSE:ARM

In July 2016, SoftBank announced that it would acquire ARM (LTD) for $32 billion. This was a 43% premium over the price ARM (LTD) was trading at on the London Stock Exchange.

Masa clearly overpaid, but the more important development happened a year later. In 2017, SoftBank sold a 25% stake of ARM (LTD) to Vision Fund 1 for $8 billion. This transaction was effectively an inter-company transfer at the 2016 privatization valuation.

[1.b] SoftBank Vision Fund(s)

Imagine a venture capital firm with nearly infinite money, an extreme appetite for risk, and no talent/competence/intelligence to speak of.

This VC firm exists as a subsidiary under SoftBank.

Vision Fund (now known as Vision Fund 1) was born on May 2017. An abomination of capitalism that proceeded to destroy value at unprecedented speed.

Crucially, the largest investor in Vision Fund 1 is the Saudi Sovreign Wealth Fund. This $45B investment comes with extra strings attached: a 7% annual coupon.

This means that each year, Masa is on the hook to pay 7% of $45B to the Saudi’s… in cash… regardless of the health or liquidity of Vision Fund 1.

That is over $3B in annual cash coupon (dividend) payments!

And this is where ARM (LTD) comes in… the 25% stake SoftBank sold to Vision Fund 1. Masa desperately needed liquidity to pay the Saudis their coupon.

[2] NASDAQ IPO

Originally, the financial press expected ARM (LTD) to IPO in a way that would allow both SoftBank and Vision Fund 1 to sell stakes. Vision Fund 1 was expected to sell their entire 25% stake over time while SoftBank would sell some but retain majority share of ARM (LTD).

What actually happened was SoftBank “bought” the 25% stake from Vision Fund 1 at a $64B implied valuation. This was a private transaction that occurred before the IPO. Only 9% of ARM (LTD) was sold to the public with a chunk bought by various strategic partners in pre-IPO agreements. The real free-float of NASDAQ:ARM is only ~8%!

~8% of ARM (LTD) was sold at IPO at $54.5B valuation when just weeks before, Vision Fund 1 privately sold 25% at $64B valuation.

The IPO valuation is questionable because it hinges on the “IPO roadshow claims”. ARM (LTD) management went to sell-side and told them a story of growth through raising royalty rates.

[3] Financial Analysis

ARM (LTD) does not make chips*. They sell intellectual property. It is very important to understand the four IP license styles and the history.

*This is changing soon. See section [5.d.i]

The most important page of their IPO prospectus (SEC F-1) is copied bellow.

Take a moment to read the F-1 snippets to hear their spin of the four business models.

[3.a] Business Model Overview

“Total Access” and “Flexible Access” are very new so let’s start with TLA and ALA.

Its best to go through two real-world examples before comparing the four business models described by ARM (LTD) in their official SEC filings.

[3.a.i] TLA Example: Samsung Exynos 2200

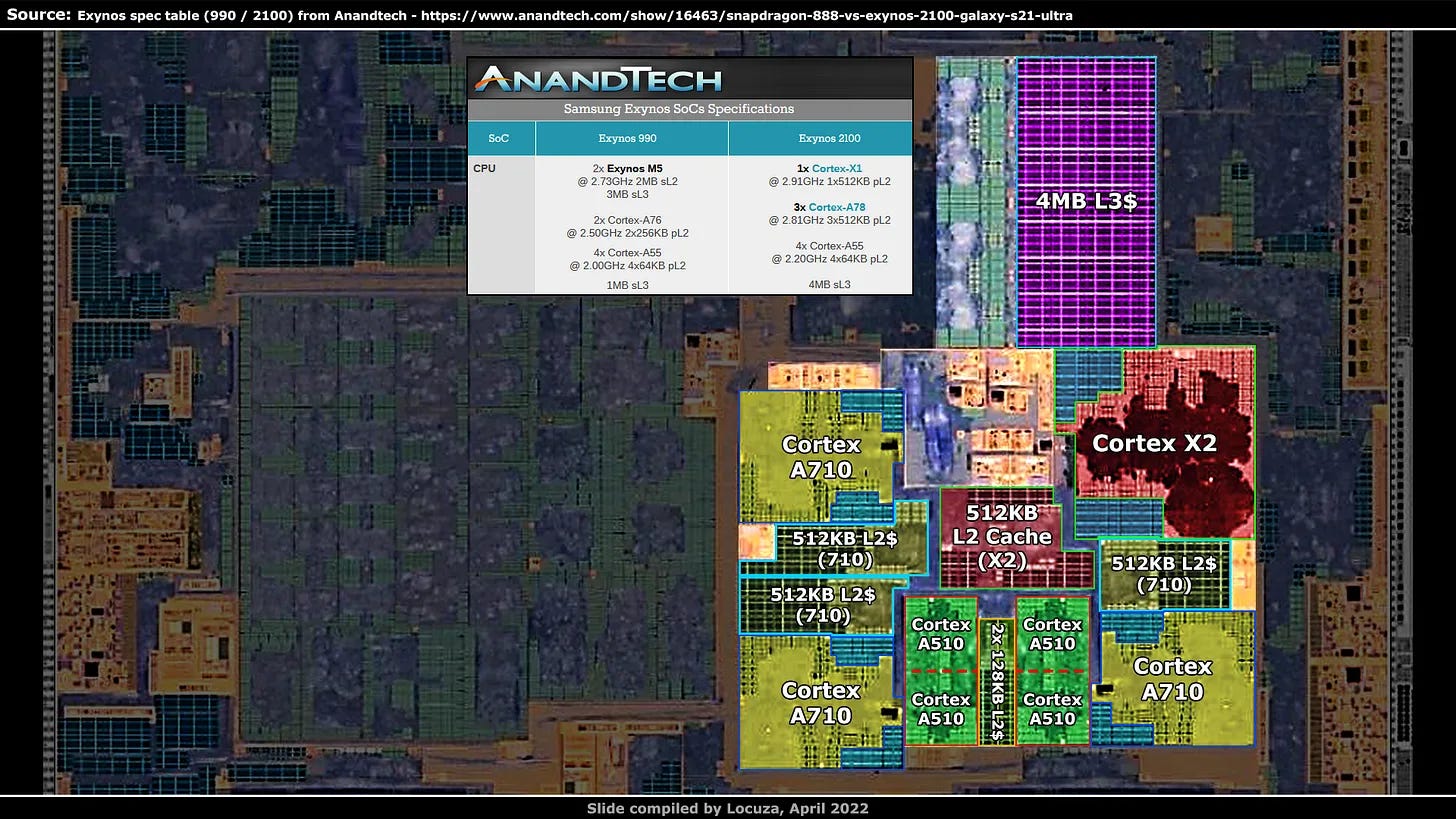

This is a labeled die shot of the Samsung Exynos 2200.

ARM (LTD) has sold three blocks of ARM (RTL) IP under a TLA.

Cortex A710 (mid CPU core)

Cortex A510 (little CPU core)

Cortex X2 (big CPU core)

ARM (LTD) also sells GPU IP under the brand of “Mali”, but Samsung decided to license GPU IP from AMD in this generation.

Samsung pays roughly 2-4% royalties to ARM (LTD). Assuming an ASP of $35-45 per chip we get royalty per chip range of 70-180 cents. The range is wide because I am making these numbers up based on sporadic, publicly available information.

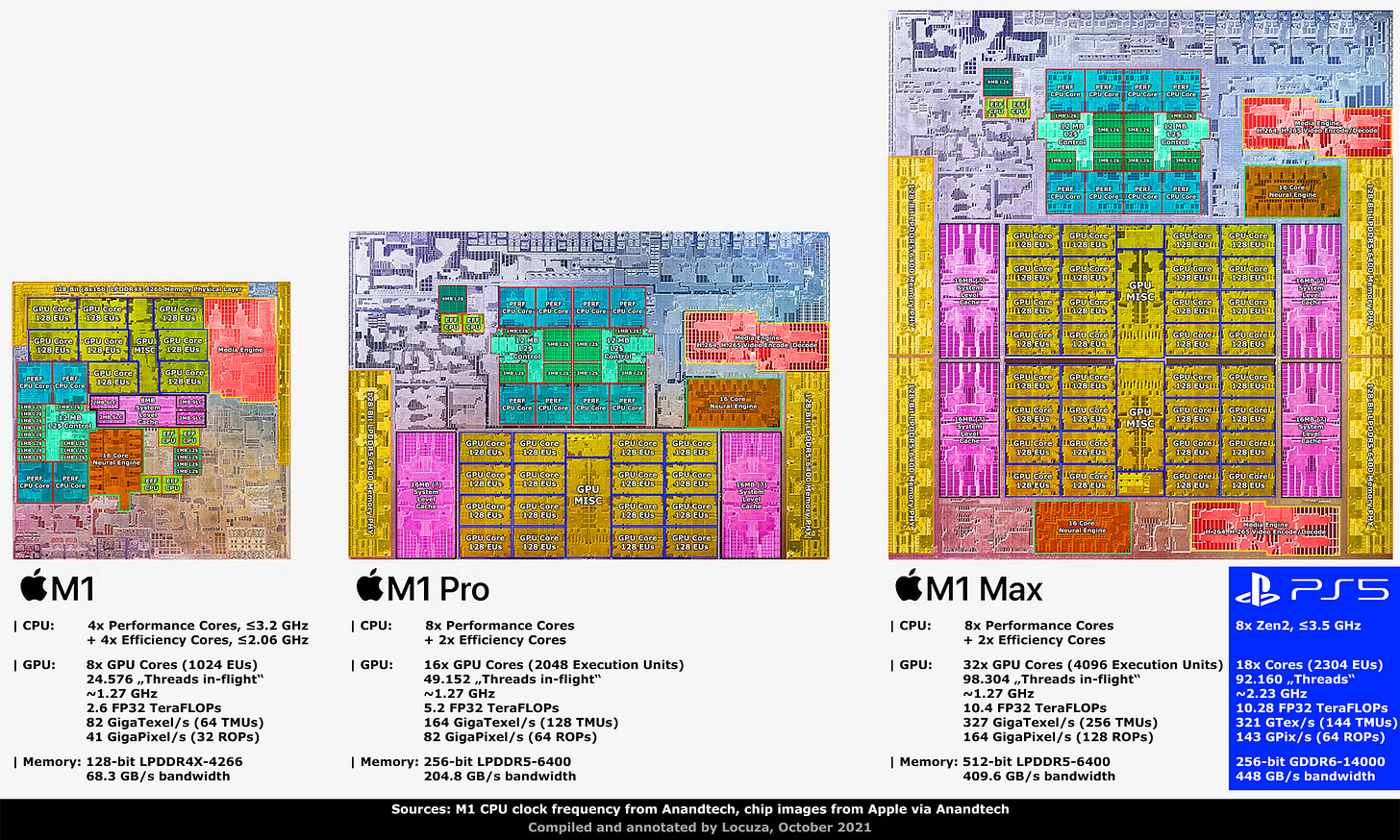

[3.a.ii] ALA Example: Apple

All of Apple’s chips use ALAs. They have not licensed RTL IP from ARM (LTD) since 2011. ALA users have been rumored to pay 0.5-1.5%. Again, the best info out there is an AnandTech article from 2013 and random tweets.

Assuming ASP of $40-60 per chip, we get a royalty per chip range of 20-90 cents.

Thankfully, The Information published Apples per chip royalty to ARM (LTD) as less than 30 cents per chip.

[3.a.iii] ALA/TLA: Key Points

TLAs carry significantly more economic value because designing CPU microarchitectures is very difficult.

Many companies have ALAs for ARM (ISA) but choose to not use them.

Nvidia had custom ARM (ISA) CPU designs (Denver 1/2, Carmel) but discontinued their program.

Samsung had custom Mongoose cores but fired the entire team in 2019.

Intel and AMD both have ALAs but choose to design x86 CPUs for self-preservation reasons. AMD is re-considering this policy.

As of 2023, there are only four companies that have the engineering capability to design high-performance CPU microarchitectures:

Intel

AMD

Apple

Qualcomm/Nuvia

(more on this in section [5])

Physical design is a huge effort, and this work typically falls on the chip company, not ARM (LTD).

*For more information on semiconductor development, please check out this post.

**For more information on ALA/TLA, see this AnandTech article.

[3.a.iv] The Four Business Models

In preparation for the IPO, ARM (LTD) created two new subscription business models: “Flexible Access” and “Total Access”. These are essentially TLA bundles that renew annually.

Here are all four business models in order of cost. (cheapest to most expensive)

ALA

License the ARM (ISA) instruction set.

Super cheap royalty rate.

Expensive up-front license.

Really hard to design a competitive CPU microarchitecture.

Might get sued.

TLA

License individual IP blocks that are timing-closed and ready for physical design by customers.

Very convenient.

Only buy the blocks you need.

Flexible Access

TLA subscription to all IP blocks up to a certain generation.

Seems to exclude v9 ISA-compatible cores.

Paying for Mali when you probably won’t use it.

Total Access

TLA subscription for all IP blocks.

Paying for Mali when you probably won’t use it.

[3.b] Failed Royalty Hike Attempts

Let’s start with Apple.

It was widely known that Apple pays a tiny royalty rate to ARM (LTD) but The Information recently revealed some key details.

< 30 cents per chip.

Apple is less than 5% of ARM (LTD) annual revenue.

Masa tried to raise rates and got shut down by Tim Apple.

“At one point, Son called Apple CEO Tim Cook to tell him Arm would be raising prices for all its major smartphone and chip customers. Cook’s team reassured him that Arm couldn’t raise fees, because the companies’ contract at the time lasted through 2028. Son backed off. Since then, Apple and Arm have been through several rounds of negotiations that have kept the financial terms of Apple’s deal largely in place, people familiar with the matter said.”

The recently announced “beyond 2040” deal between ARM (LTD) and Apple has zero public details. I have a conspiracy theory in section [5.b.iii]…

On to Android. The Financial Times has some great reporting on this.

Summary:

ARM tried to change their business model from charging royalties as a % of the chip to a % of the smartphone/device.

Device makes such as Apple, Samsung, and (presumably) Huawei would be excluded from this change.

ARM would collect royalties from chipmakers (Qualcomm, MediaTek) and device OEMs (Xiaomi, Oppo, Vivo, …).

Chipmakers could only sell to “authorized” device OEMs.

Epic backlash.

Qualcomm called them out publicly in one of their legal responses.

It appears they have given up on this as the recent shareholder letter, earnings call transcript, and official SEC docs do not mention this at all.

Amusingly, ARM (LTD) seems to have copied this business model from Qualcomm. QCOM uses modem patents (CDMA in particular) to extract royalties on a %-of-device level. All the drama between Apple and Qualcomm is over the royalty rate pegged to device BOM.

In Qualcomm’s defense, they treat all their IP "customers” the same. ARM (LTD) was proposing a licensing scheme that would be very beneficial to Apple, Samsung and Huawei, while incredibly detrimental to Qualcomm, MediaTek, and basically every other Android OEM.

[3.c] Sell-Side Status

Most of sell-side has no idea what they are talking about. ARM (LTD) sold them some happy talk about royalty growth and AI. A lot of them bought it.

Arm Holdings is a buy, according to a Wells Fargo analyst, who said licensing deals should power the chip maker’s growth.

Wells Fargo analyst Gary Mobley initiated coverage of Arm (ticker: ARM) on Monday with an Overweight rating and $70 price target, which implies a 27% upside from the stock’s closing price on Friday.

“We view Arm as one of the best positioned companies within the $550 billion global semiconductor industry,” Mobley wrote in a research note.

For fiscal 2024, Mobley believes that Arm should generate about 13% top-line growth, and attributes this to future licensing deals.

Mobley also wrote in his research note that he expects revenue growth to accelerate in fiscal 2025, “mostly driven by a cyclical chip recovery as well as higher royalty rates.”

Bernstine is one of the few sell-siders who has a reasonable take. They have (well-founded) doubts that ARM (LTD) will be able to raise royalty rates according to guidance. Underperform rating with $45 price target.

I will give some engineering-driven justifications on why I am so bearish on the royalty rate growth story in section [5].

[4] Qualcomm/Nuvia Lawsuit

ARM (LTD) filed a lawsuit against Qualcomm in September 2022. Dylan Patel (SemiAnalysis.com) has some excellent coverage but I want to go over more detail now that the IPO is done.

I have read 300+ pages of legal documents so you don’t have to.

You can find all legal documents here.

[4.a] Timeline

Here is a timeline of key events constructed used public news reports and legal filings. I have added brief descriptions to certain events to explain their significance and provide context.

[4.b] Possible Outcomes

Unfortunately, predicting the outcome is very difficult. This case is a contract dispute. These ALA licenses are complicated legal documents that are likely hundreds of pages long. Both sides have quoted the ALA text but everything useful is redacted.

Only a small subset of ARM (LTD) and Qualcomm employees have access to this sensitive document. The trial (and discovery) will be super interesting.

Here are some possible outcomes with arbitrary probabilities assigned.

Out-of-court settlement where Qualcomm and ARM (LTD) sign an amended ALA with higher royalty rates and a one-time IP transfer fee.

Rate would probably be negotiated in between current ALA rate and the requested rate from 2021.

Probability: 80%

Jury rules in favor of Qualcomm.

ARM (LTD) revenue from Qualcomm goes down by 50-70% in 2026.

Qualcomm effectively gets the right to license CPU IP to 3rd parties using their (upheld) ALA, presenting existential risk for ARM (RTL) market share.

Probability: 19%

Jury rules in favor of ARM (LTD) who then immediately cancel Qualcomm’s ALA for material breach of contract.

This is a nuclear option that would shatter the confidence of every other ALA holder.

Kills the valuation of startups like Ampere Computing.

Inflicts irreparable harm to the ARM (ISA) brand, supercharging RISC-V.

Obliterates Qualcomm’s entire product roadmap.

Probability: 1%

[5] Competitive/Market Landscape

Let’s go sector-by-sector starting with lowest power/TDP first.

[5.a] Embedded/IoT

What do the following devices have in common with each other?

TV

Smart Fridge

Solid-State Drive (SSD)

Wi-Fi Router

Smart Thermostat

Digital Alarm Clock

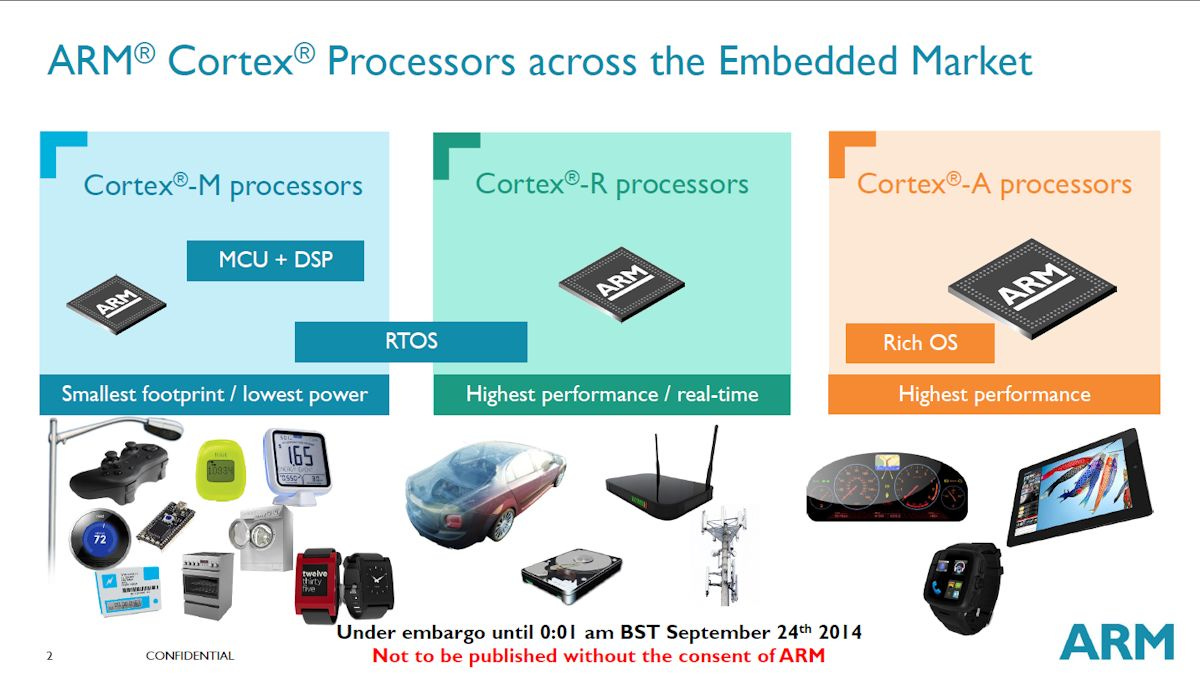

They all probably have at least one chip with ARM (ISA) compliant CPUs on them. The vast majority use ARM (RTL) IP under the “Cortex-M” and “Cortex-R” brands via TLA licensing.

The engineering term for the embedded/IoT market is MCU, microcontroller unit.

Sites such as DigiKey (encourage you to brows the 13K+ results) have many MCU models for sale from a wide variety of manufactures such as NXP, Infineon, Microchip, Renesas, Texas Instruments, STM, and Analog Devices.

The volume for these tiny chips is huge, but ASP is very low. This is why ARM (LTD)’s average royalty is ~6 cents/chip.

ARM (LTD) is most famous for their presence in smartphone and increasing presence in laptop/PC and datacenter… but the real volume is MCU.

[5.a.i] What this market needs.

Here is a first-party slide from ARM (LTD).

The comparison between ARM (ISA) and x86 is fair. But there are problems with the narrative ARM (LTD) is trying to sell regarding RISC-V.

The embedded market does not need “compute performance”. There are plenty of RISC-V cores (horizontally sold and internal designs) that performance that is more than enough for embedded. Low-end embedded is… low-end. The tiny, low-power CPU that powers your alarm clock or your smart thermostat does not need to do much. Most likely running some cut-down flavor of Linux or some custom firmware.

Often, the code that runs on these MCUs is written by the chip vendor and does not interact with user space. For example, a NVMe flash memory controller will be running some proprietary firmware that does not care about ISA standardization. In fact, there might be a desire to create some extra non-standard instructions to speed up niche workloads. This significantly lessens the value of standardization and software ecosystem.

Let’s look at some evidence.

[5.a.ii] Evidence of share losses.

Soldi-State Drives (SATA, NVMe) typically have three components:

NAND flash memory.

DRAM (RAM) cache.

A controller.

Traditionally, this controller is a MCU that has a few ARM (Cortex-M/R) cores. Some companies, such as Phison and Silicon Motion, sell these controllers as merchant silicon. Other companies, such as Samsung and Western Digital, make their own controllers, NAND flash, and even DRAM in-house.

Western Digital migrated from ARM (RTL) IP under a TLA to their own RISC-V core called SweRV.

Will anyone ever run arbitrary, user-space code on this custom SSD controller?

Does Western Digital care about high-performance in this optimized, embedded, ultra-low-power use-case?

Will anyone care that there is no software ecosystem for this chip that is only ever going to run proprietary firmware written by WD?

NO! NO! NO!

There are more examples but this one is the best in my opinion. Encapsulates all the factors and (hopefully) builds intuition. Feel free to share your favorite examples of ARM (RTL) to cheap RISC-V IP migration in the comments.

In August 2023, Qualcomm put out a press release describing the formation of a new RISC-V alliance.

This makes sense as Qualcomm is getting sued. But… take a look at who joined as founding members.

Bosch

Infineon

NXP

Nordic

It’s a bunch of big MCU companies. Low-end embedded, a massive market for ARM (LTD) is looking to drop ARM (ISA).

ARM (LTD) already had a RISC-V problem and their lawsuit against Qualcomm has made it much worse.

If you combine global smartphone/handset shipment data (IDC, Counterpoint) with the above slide, it becomes clear that ARM (LTD) has an IoT/embedded/MCU problem. 300-400M units gone YoY. What percentage of this decline is macro and what percentage is RISC-V? Don’t know. Maybe half?

[5.a.iii] The 2018 FUD campaign.

In 2018, ARM (LTD) created a website called “rsicv-basics.com”.

This site existed to spread FUD (fear, uncertainty, doubt) about RISC-V. Unfortunately, The Internet Archive does not have it and there are almost no good screenshots floating about on the internet.

Underhanded move in poor taste. Pissed off open-source/libertarian corners of the internet and gave RISC-V a solid boost.

ARM (LTD) took the website down and released a "uhhhh… not our intention" non-apology.

"Arm’s negative campaign against RISC-V can only backfire," said GNOME and Xamarin cofounder Miguel de Icaza on Twitter. "Also, their points are kind of weak. This was attempted before against open source, and all it achieved was eggs on people’s faces."

Arm told us it had hoped its anti-RISC-V site would kickstart a discussion around architectures, rather than come off as a smear attack. In any case, on Tuesday, it took the site offline by killing its DNS.

“Our intention in creating a webpage to offer key considerations around commercial RISC-V based products was to inform a lively industry debate," an Arm spokesperson told The Register.

"Regretfully, the result was something different, a page that wasn’t in line with Arm’s collaborative culture, so we’ve taken it down. Indeed, many of our own people also told us they didn’t like it.”

"One thing to clear up immediately is we absolutely did not want to give the impression we were attacking open source as we are highly committed supporters of open source communities in many different areas. Our intention is to cultivate a healthy discussion around architectural choices as it is one of many subjects critical to our industry’s future.”

Source: The Register

This fiasco is important because it shows ARM (LTD) management were aware of the existential threat RISC-V represented for their most important market.

They have not made the product better.

RISC-V adoption has greatly accelerated over the last five years.

There appears to be no plan.

[5.b] Smartphone

Very good slide. Let’s break it down.

[5.b.i] ISA Share

CPU cores in smartphones and laptops interact with user-space (Operatic System, apps) which means software ecosystem is extremely important.

There is zero risk of ARM (ISA) losing share to RISC-V in mobile market for the next 15 years. Google is making some noise that they want Android to have “tier-1” support for RISC-V and place it on equal footing with ARM (ISA).

ISA-inertia is huge. See how much trouble Microsoft has been having getting Windows ported to ARM (ISA) with reasonable emulation performance. ARM (LTD) themselves have experienced inertial problems. Chinese app stores (huge market) dragged their feet on migrating from 32-bit ARM (ISA) code to 60-bit ARM (ISA) code.

Someone at Google is using Android on RISC-V to get their promo. The moment this thing becomes technically functional (but still unusable), they will get the promo and abandon this project. It is the Google way.

Investors should not be concerned about ARM (ISA) losing share in mobile market.

[5.b.ii] RTL Share Decay

ARM (RTL) share losses are a real problem though.

iOS/Apple has been gaining share against Android.

New and refurbished units.

None of Apple’s products use ARM (RTL) IP.

Vast majority competing products (losing share) use ARM (RTL) IP under TLAs with much higher royalty rates.

Huawei/HiSilicon is back and gaining share from a base of effectively zero.

Custom ARM (ISA) compliant CPU cores, built under ALA through ARM China.

Because ARM (LTD) has extremely limited auditing capabilities over ARM China, we don’t know if Huawei/HiSilicon chip volume is accurately counted.

Geopolitics gives ARM China and Huawei/HiSilicon strong incentives to lowball volume and ASP.

Qualcomm is replacing ARM (RTL) CPU cores with the Nuvia designs in their smartphone chips soon. (2025/2026)

Samsung is rumored to be designing their own custom CPU cores under ALA for the Galaxy S27.

The reasons why ARM (RTL) IP is losing so much market share to custom cores built under ALA are simple.

Product quality has been getting worse over time.

Power-efficiency regressions. (A510 is quite bad)

Underwhelming performance of big (X-series) cores.

A decade of repeated obliteration by Apple’s CPU design team.

What happens when a company raises prices on products that customers are already unsatisfied with?

They go vertical.

[5.b.iii] The 🌶 Spiciest 🌶 (theoretical) Timeline

This is a bit of a conspiracy theory but stay with me…

Whenever you hear ARM (LTD) management say “total compute solution”, think chiplet. They have had some success with datacenter CPU chiplets (more on this in section [5.d.ii]) but their ambition for a smartphone compute chiplet is very interesting. This slide apparently confirms something I have been suspecting for months.

Follow me on a journey to capsaicin station….

ARM (LTD) has been hiring a lot of engineers, primarily in physical design. They also signed a deal with Intel foundry services. Analysts have pointed out that ARM (LTD) does not have access to baseband (modem) IP and they are correct.

“With no baseband IP and less multimedia-related IP, ARM is unlikely to compete with existing smartphone customers (such as Apple, Qualcomm, etc.). However, if ARM’s own chips ship smoothly, this shipment record will still benefit Intel’s foundry business and attract orders from other customers, especially for HPC/computing applications.”

— Ming-Chi Kuo, TF International Securities

But what if they did get a modem somehow? What if they really were planning on directly competing with Qualcomm?

If you browse the leadership team website, there is one guy at the end who is really interesting.

Kevork Kechichian is head of the recently formed and rapidly expanding chiplet group at ARM (LTD). Physical design guy. His LinkedIn is interesting. His longest stretch of employment was 12 years at Qualcomm.

Browsing LinkedIn reveals some interesting, correlated migration.

Remember the deal Apple and ARM (LTD) signed that “goes beyond 2040”?

Think about how these negotiations might have gone. Several years ago, Masa tried to raise royalty rates on Apple and failed. Apple has no incentive to give up this rate, which was already locked-in until 2028.

ARM (LTD) still wanted to raise Apple’s royalty rates in the leadup to the IPO but knew they had no leverage. Instead, they settled for signing a long contract extension and publishing that as news to generate confidence amongst investors.

But what if the negotiations included a secret sweetener….

What if Apple agreed to sell their discrete (thin) modem to ARM (LTD) in 2026/2027? By then, the smartphone compute chiplet ARM (LTD) is working on (staffed by ex-Qualcomm) would be production ready on Intel 18A. Normally, discrete modems have a significant power penalty compared to integration on-die. But… Intel has some great advanced packaging offerings that could mitigate this problem. All of the existing IFS revenue is Foveros chiplet packaging of Amazon Graviton CPUs.

Imagine a world where Qualcomm’s core business gets eviscerated by the unholy union of an ARM (RTL) compute chiplet and an Apple modem chiplet… packaged by Intel.

That would be the 🌶 spiciest 🌶 timeline.

[5.c] Laptop/PC

This section will be brief because I am working on a big, dedicated piece on this topic.

Target release date of H2 2024.

Quick Summary:

ARM (RTL) CPU microarchitectures are utterly uncompetitive for this market and catastrophically lose to:

Intel (Alder Lake, Redwood Cove, Gracemont, …)

AMD (Zen 3/4)

Apple (Firestorm, Icestorm, …)

Emulation is very challenging. Apple put it the work and Microsoft has dragged their feet for years.

Apple Rosetta 2 has 40-80% emulation efficiency which is incredible.

Windows on ARM was missing x86-64 emulation for most of its existence and was therefore unusable. (terrible performance too)

[5.d] Datacenter

Datacenter is an interesting opportunity for ARM (LTD) with a lot of nuances.

[5.d.i] Data Processing Unit

In the old days, network cards were simple, offloading most of the compute needed to the host CPU. With the rapid growth of cloud computing, a new kind of network card was born: the DPU.

ServeTheHome has a great video on this topic so go watch it if you want to learn the details.

This DPU trend is great for ARM (LTD) and is often underlooked.

Higher ASP

New, rapidly growing market.

High ARM (RTL) IP attach rate.

[5.d.ii] Cloud Native CPU

“Cloud Native” is a marketing term for CPUs that are optimized for density and consistent performance. Many cloud providers want to maximize the number of CPU cores per rack and virtualize (divide up) these cores to customers. They also want all the CPU cores to have the same, consistent performance, regardless of the load.

Suppose you have a CPU with 64 physical cores virtualized into 4-core instances. If customer VM1 runs a heavy floating-point workload that slows down customer VM2, that is a problem.

ARM (ISA) had an opportunity to gain significant share from x86 but the development was too slow. AMD has already launched their answer (Bergamo) and Intel will be launching their solution (Sierra Forrest) in Q2 2024.

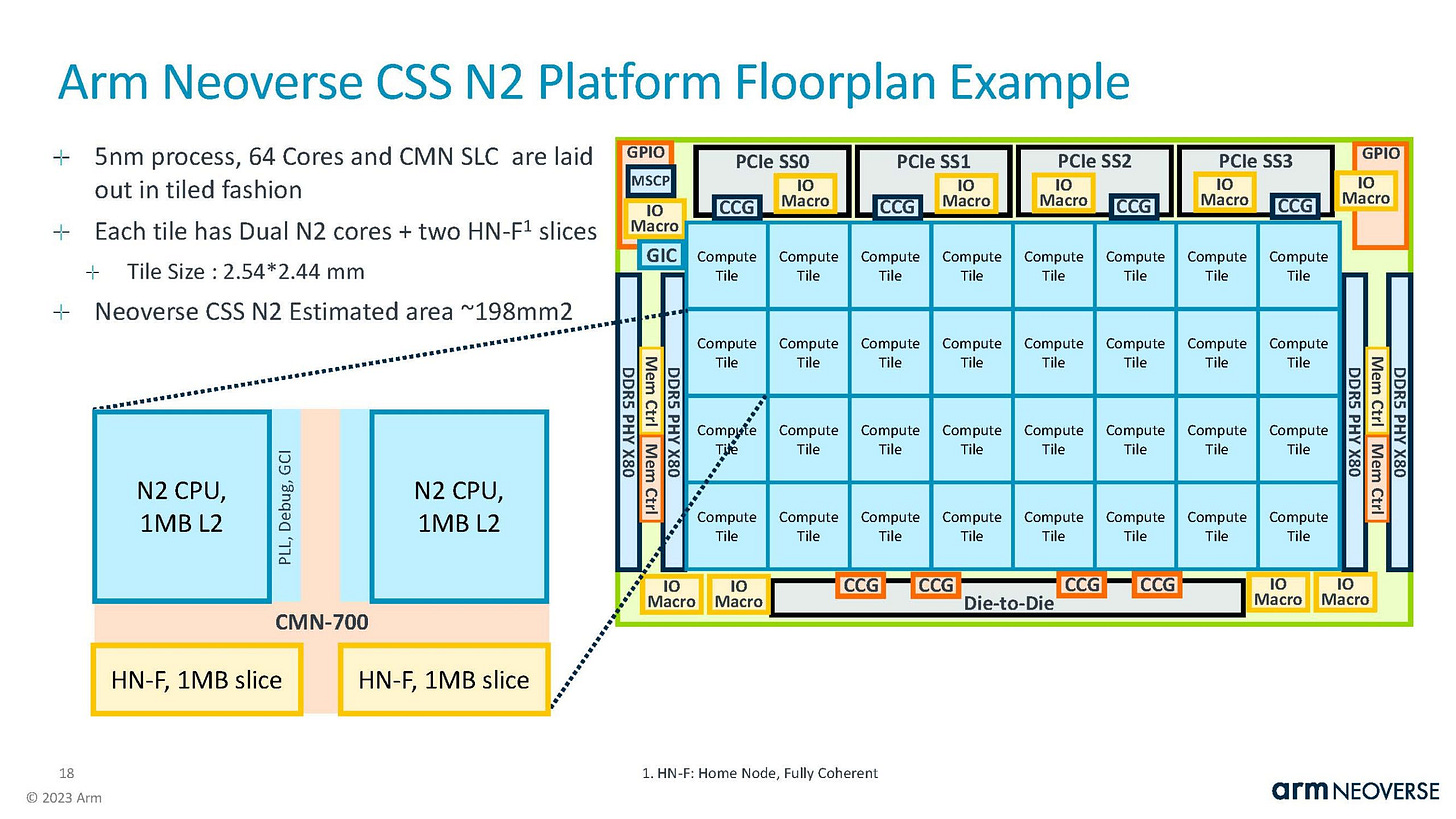

Still, the cloud providers want to create customized products and ARM (LTD) has a great solution.

CSS N2 is a datacenter CPU chiplet. It has Microsoft and Google as customers.

Sidenote 1: Microsoft was working on a custom CPU microarchitecture under ALA but fired the entire team.

Sidenote 2: There is a startup called Ampere Computing that is also targeting the cloud-native CPU space. They appear to be doomed. All their customers are going vertical (with the help of CSS chiplets) or buying AMD Bergamo // Intel Sierra Forrest.

This is a great initiative and credit to the ARM (LTD) employees who presented this at Hot Chips 2023. I believe this datacenter CPU chiplet initiative is the best program they have. Moving up the value chain, getting higher margins, volume participation, … great stuff.

[5.d.iii] HPC/Supercomputing

ARM (RTL) IP cannot compete in this market. There is one ARM (ISA) supercomputer made by Fujitsu under ALA. Not much going on here.

[6] The False AI Narrative

“… Nvidia announcing one of their newest products… Grace-Hopper that is based on ARM… so ARM is everywhere relative to AI.”

“You can’t run AI without ARM”

— Rene Haas, ARM (LTD) CEO

This is a false narrative. AI GPU spend is obliterating CPU TAM. All the CapEx is going to Nvidia. CPUs are being relegated to a commodity product. A basic BOM analysis of Grace-Hopper directly refutes this narrative.

Nvidia has an industry-leading software-defined scheduler that runs on CPU cores. Grace CPU exists to run the scheduler.

Grace CPU uses ARM (RTL) V2 microarchitecture IP but does not use the Cortex mesh interconnect (network-on-chip) IP. Nvidia makes their own NOC because the ARM (RTL) NOC is bad.

AI is a megatrend against the entire datacenter CPU market. This hurts ARM (LTD), Intel Xeon, and AMD EPYC.

[7] Irrational Price Target

I have a very poor understanding of traditional finance, multiples, and valuation methodologies. My strategy is to use engineering-driven analysis to pick good companies.

Shorted at $64 (<5% of NAV) and covered at $58. Somehow, it is currently trading near the Wells Fargo Clown’s price target.

There are two people who are much smarter than me who I largely agree with.

Sara Russo, Bernstein Research VP and Senior Analyst

She used to work at ARM (LTD).

Her commentary on AI and royalty hikes is spot on.

Chamath Palihapitiya, Billionaire Technology Investor

100% agree with RISC-V/embedded commentary.

100% agree with datacenter CapEx migrating from CPU to GPU because of AI.

“I think this is a very tough valuation to get right and trying to stretch to a 60 or 70 billion dollar print [valuation] is really tough. This is a… honestly… 15-20 billion dollar company.” — Chamath Palihapitiya, All-In Podcast E143

Bernstine price target is $46.

Social Capital price target is [implied] $14 to $19.

DPUs and datacenter CPU chiplets represent a decent opportunity so I feel Chamath is a little too bearish.

ARM 0.00%↑ Irrational Price Target: $30 to $40