[1QCY25] $INTC $AMD $QCOM $ARM $FN $COHR $SITM $QRVO $SWKS $ONTO

Reading in-between the lines.

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Quite a bit of volatility. Hope you find this earnings roundup useful.

Sidenote: I am very behind on responding to direct emails. Will clear up the backlog this weekend. Sorry.

INTC 0.00%↑ AMD 0.00%↑ QCOM 0.00%↑ ARM 0.00%↑ FN 0.00%↑ COHR 0.00%↑ SITM 0.00%↑ QRVO 0.00%↑ SWKS 0.00%↑ ONTO 0.00%↑

Intel:

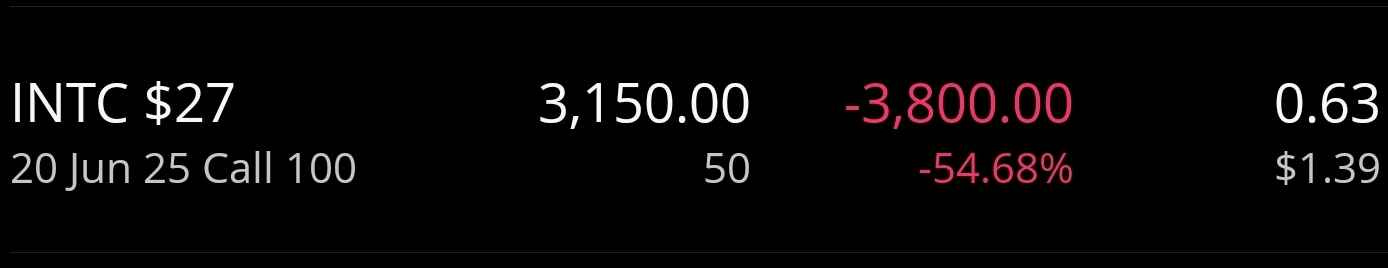

I had puts and calls going into earnings. Managed to lose money on both.

Still bagholding these calls on dismemberment opportunity. (will get to that)

The call was… not good. Zinsner sounded clinically depressed. Someone check up on him.

Gelsinger and Zinsner seemed to have gotten along very well. Feel bad for Zinsner. It’s like watching your best friend at work get murdered right in front of you and getting promoted to his job right after by the murderer (board).

But I digress. Let’s go over the call itself.

I can almost hear Jensen laughing in the background.

Falcon Shores is dead.

<Mr. Leather Jacket background laughter intensifies.>

Frankly, this decision is cope. The entire datacenter GPU team at Intel should probably be cut. AMD is struggling to compete against Nvidia (will get to them shortly) and more importantly, hyperscaler custom silicon with Broadcom/Marvell/MediaTek/Alchip.

This is a half measure. Intel should gut their GPU group down to the bone. Keep a skeleton crew for iGPU in laptop chips. Nothing more.

Bro who told you this?

What momentum? A small army of sell-side and boutique financial analysts are busy hunting down TSMC CoWoS leaks in Taiwan and re-packaging this information into supply-chain analysis.

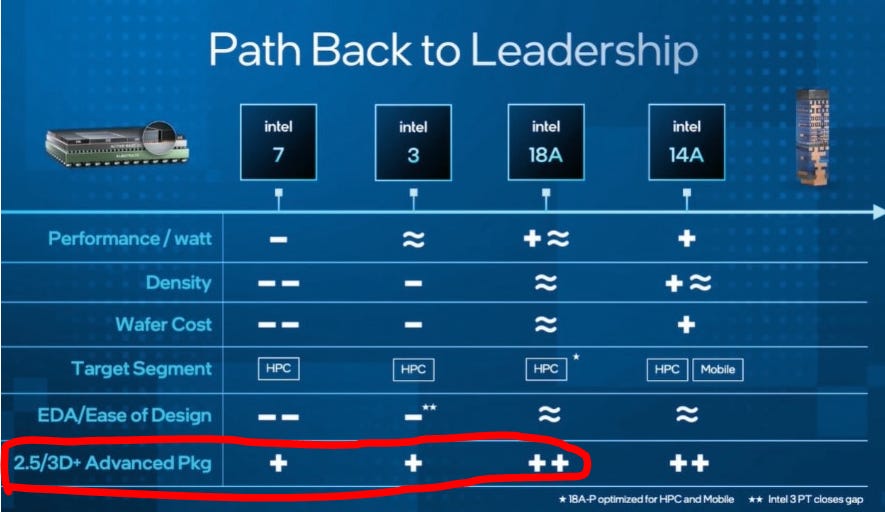

We are two years into the most severe advanced packaging shortage in the history of semiconductors and nobody gives a damn about IFS packaging.

Do I sound like someone who knows what is going on with IFS packaging at a technical level? Why has nobody second-sourced their CoWoS programs at IFS? Could it be that IFS packaging is incompetent and refuses to follow industry-standard methodology?

Clearwater Forest has been massively delayed. MJ is blaming packaging and says 18A is fine.

I call bullshit.

A Background-Proof Guide on Process Development Kits

Irrational Analysis is heavily invested in the semiconductor industry.

My PDK guide is a thinly veiled way of explaining to everyone that 18A D0 can be fine but the overall yield can simultaneously be horrific. Delaying Clearwater Forest is a massive red flag. Personally, I think 18A parametric yield is so bad, Intel literally does not have capacity to ramp Clearwater Forest on-time. All the wafers going towards Panther Lake.

MJ has publicly confirmed what many within industry circles already knew.

If Intel Products won’t use Intel Foundry, who the hell will?

The situation is quite dire. There are rumors of multiple Intel Products programs on TSMC N3 and even N2.

Intel is pretty much dead. The call-options I have are a volatility trade to try and make money as organ sales are announced.

Here are a collection of rumors…

Something is happening at GloFo. Maybe the CEO resigned in preparation of becoming IFS CEO. Maybe to become Intel (everything) CEO. Maybe GloFo is going to merge with IFS (the funniest outcome).

No idea. There is smoke but unclear what color the fire is.

Qualcomm is rumored to be interested in Mobileye in some capacity.

There was a meme rumor that Lattice would leveraged-buyout Altera but IDK. Seems too crazy to work out.

Maybe Cathie Wood should become the next Intel CEO and tax-loss harvest the company to greatness.

The patient is dead. It’s time to dismember.

AMD:

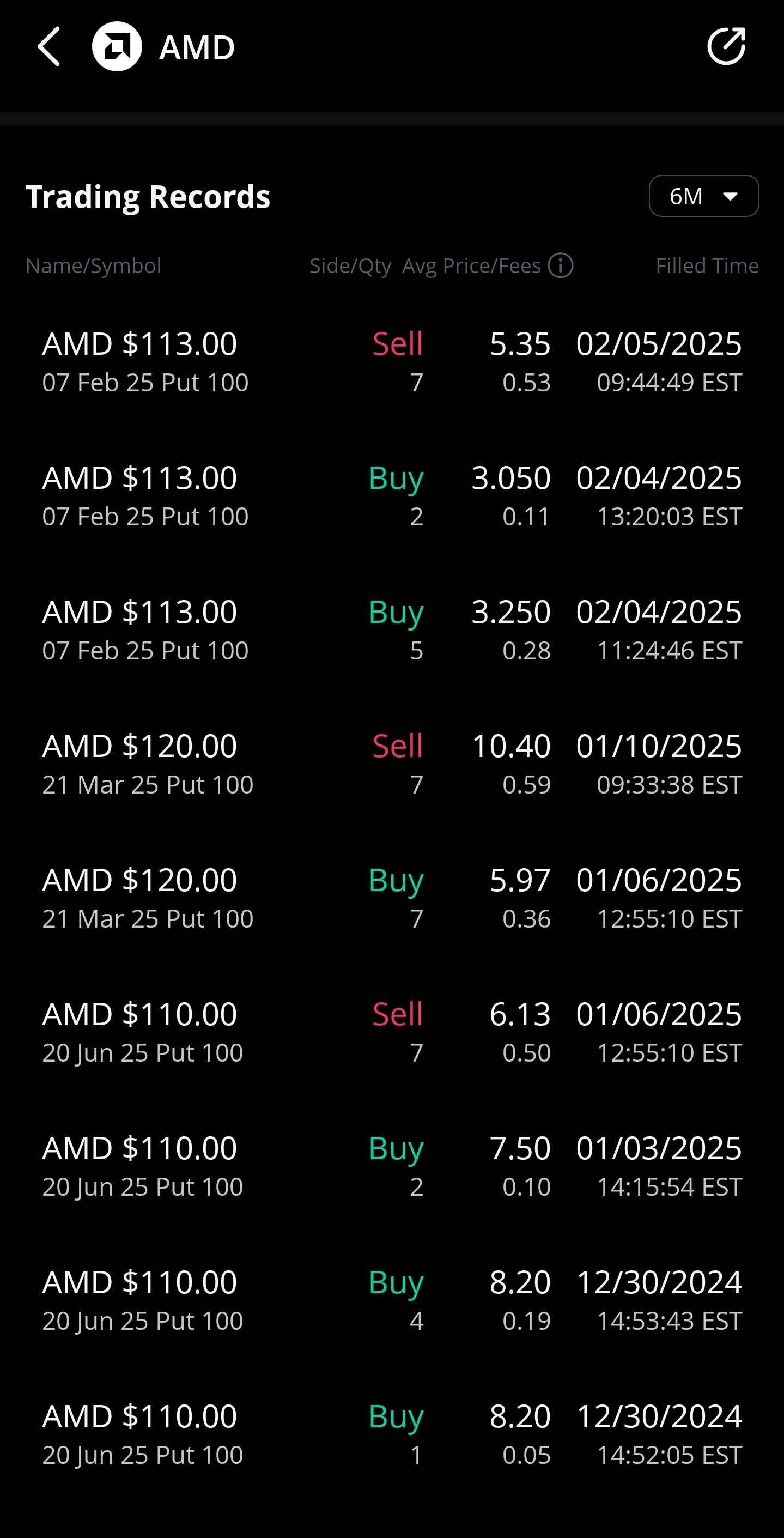

Made a little money off this. Was expecting DC GPU to disappoint and boy oh boy were the generalists not happy with what Su-Bae had to say.

AMD = [A]llways [M]issing [D]atacenter

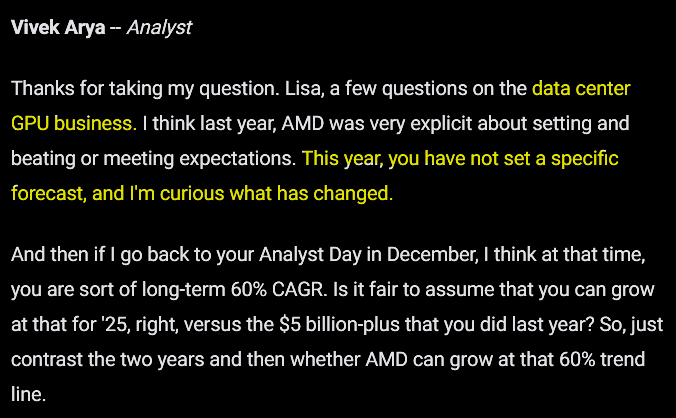

Cowards. Nvidia is wiping the floor with you in gaming and now you are hiding the numbers.

Datacenter down sequentially.

(because GB200 and GB300 are going to destroy AMD)

MI350 is competing with GB300. It’s going to be a bloodbath.

Harlan sounded like he was trolling here lol. AMD has no rack-level scale-up until UALink in like 2026 lmao. Probably 2027.

NVIDIA. THAT IS WHY.

I listened to the call live at work. It was a slow day. Su-bae was pissed by this question lmao. God bless Stacy “Body Bag” Rasgon. Keeping the professional-managerial class on their toes with the spiciest questions.

Many people have pinged me asking if it is “time to buy AMD”.

What compels you to own this stock? Is your man-crush for Su-Bae that strong?

Broadcom, TSMC, Nvidia, SK/Micron are all better investments.

If you absolutely must own AMD, wait another two quarters. Once the street realizes MI350 is dead on arrival the stock will bottom and become a compelling CPU story.

Qualcomm+ARM:

I want to cover these two as a pair because the stuff that actually matters involves both.

Qualcomm stock went down because this ticker is cursed.

Maybe Cristano desecrated an ancient alien temple as a child in Brazil.

Numbers were good and we learned nothing new lol. Who sold the news on this one?

Does this sell-sider not know about the $400/unit ASP royalty cap?

I own one of these laptops. The compatibility and stability are garbage. No large enterprise or small business is dumb enough to buy your half-baked product.

There is zero chance Huawei pays again. So QTL guide is flat even though Transsion is paying much more.

This means significant share losses to Huawei.

Sell-side is correctly pointing out that PC sales are trash. $100M/quarter is peanuts.

Qualcomm CFO refused to answer the question and dodged. That 10% share number is concocted nonsense. The consultant who came up with this bullshit statistic deserves a bonus.

The answer is no. It’s only downhill from here.

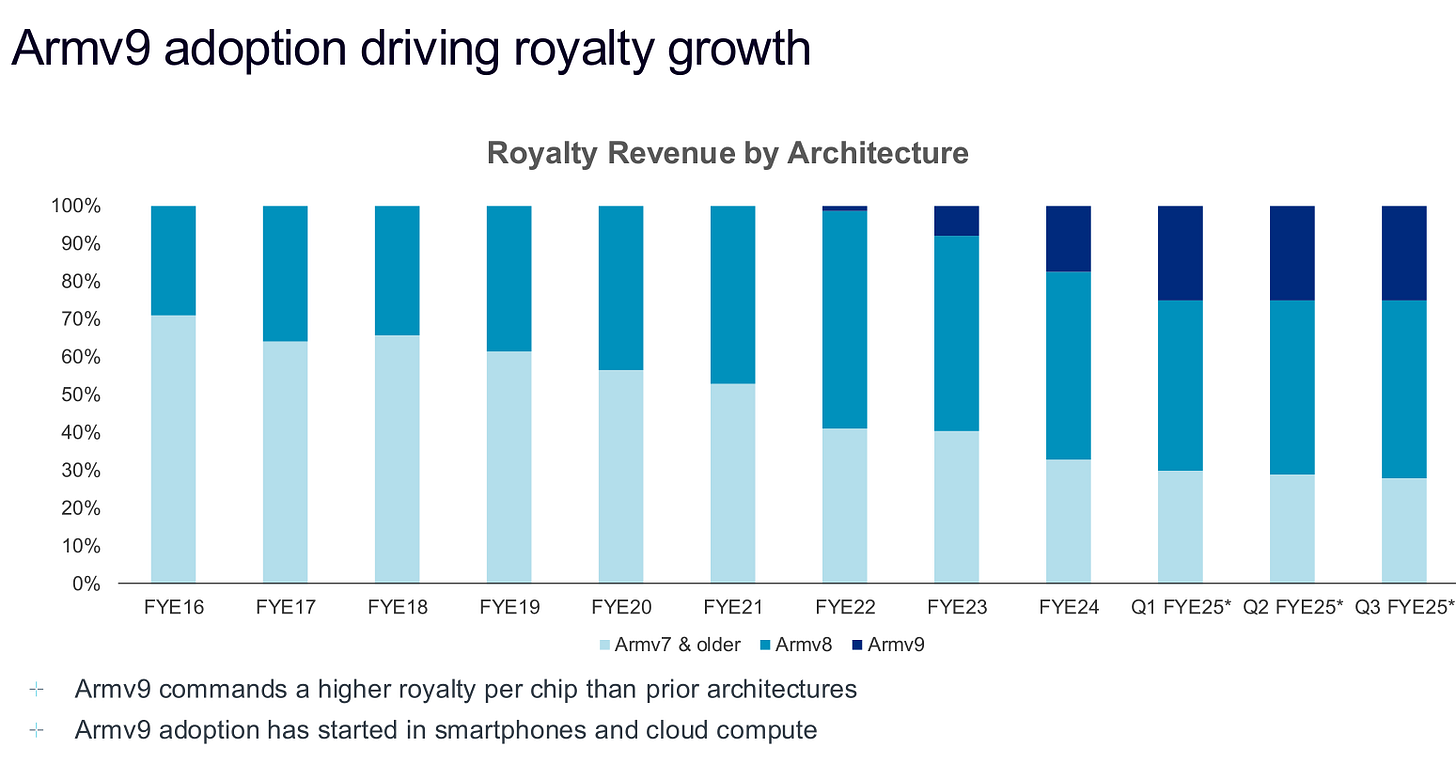

Let’s pivot to ARM.

hmmmmmmmmmmmmmmmmm. Lets zoom in.

It looks like v9 royalty revenues are not growing.

This is because Qualcomm has obliterated ARM in the lawsuit. Total victory.

I went into the trial thinking Qualcomm has a ~2.5% ALA rate that expires in 2028.

The trial revealed their rate is (hilariously) only 1.1% and expires in **2032**.

ARM is actually in deep shit lmao.

Qualcomm is going to start selling datacenter CPU chiplets, directly competing with ARM CSS.

They never going to migrate to v9.

Fabrinet:

Stock is down because of Nvidia supply-chain panic. Is Nvidia multi-sourcing transceivers? Blah blah blah.

Ciena strong.

Nvidia Hopper weak.

Maybe Nvidia multi-sourcing now. Don’t care enough to look into this.

I still think that in the long-term, Fabrinet will be a big winner of co-packaged optics due to complexity and IP protection requirements.

Problem is there are a bunch of supply-chain degen pod monkeys shoving volatility into this ticker. There are less stressful ways of making money.

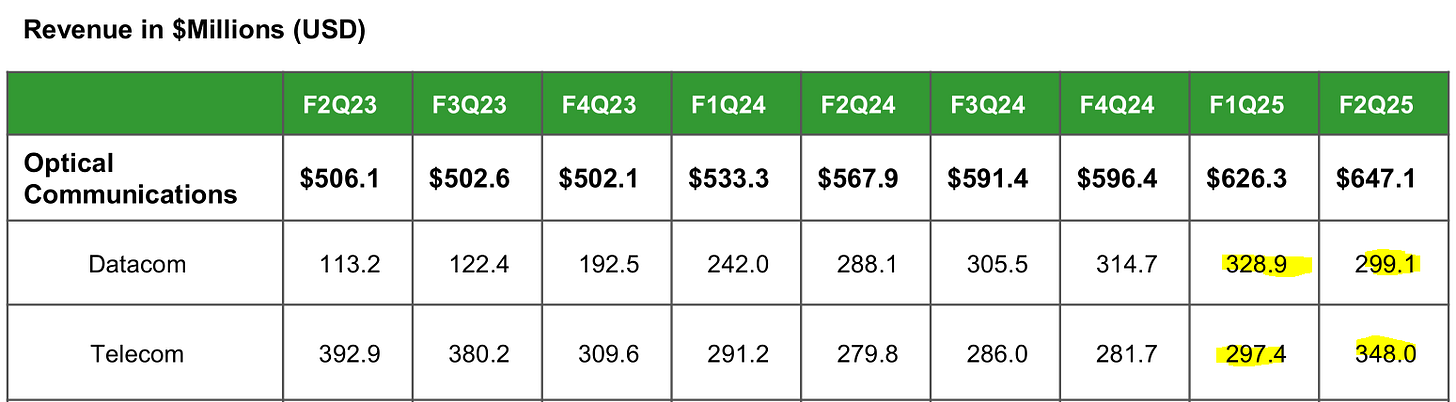

Coherent:

I have misplayed this one. Probably going into the 2025 year-end fail list.

Let’s look at the call.

Uh… huh.

Someone other than Google is buying optical circuit switches?

Hmmmm.

I had written off this part of Coherent as a meme call option.

I don’t know what to make of this.

You all have my email. Send me stuff.

This seems interesting. Worth a deeper investigation.

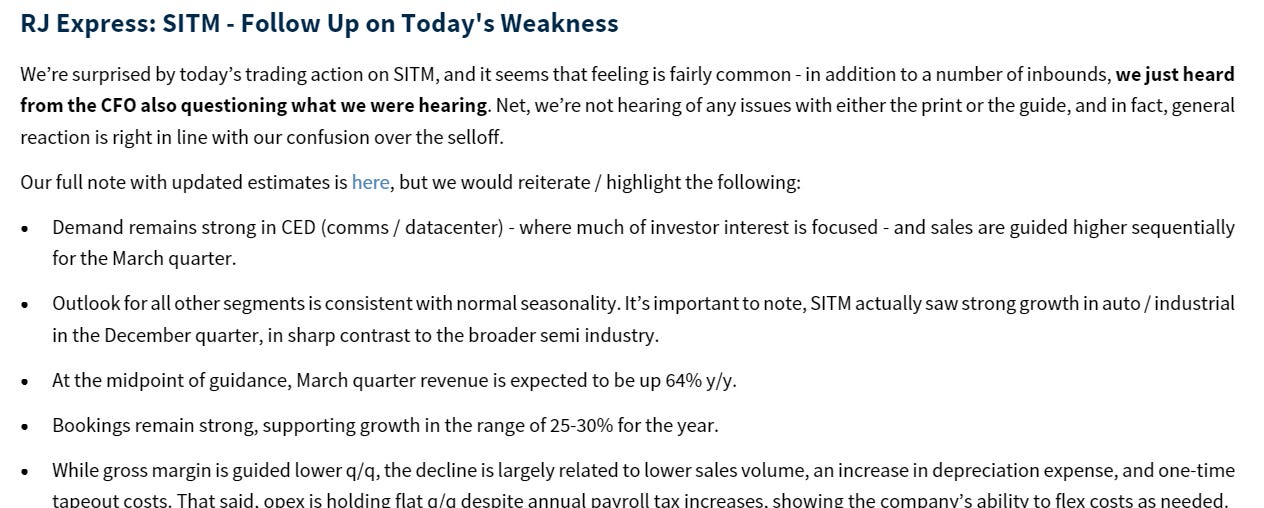

SiTime:

A Background-Proof Guide on Communication Systems

Irrational Analysis is heavily invested in the semiconductor industry.

SiTime looks good. Check out my previous coverage.

The call was incredibly boring. No new info.

And yet, the stock took a massive shit today. I bought the dip but the dip dipped.

Nobody knows why this stock got killed today. Even the damn CFO is lost.

Some pod monkey must have over-thinked iPhone SE launch pull-forward by one month and decided to panic sell.

I will take the other side of this. Depositing money tomorrow just to buy the dip even more.

Qorvo+Skyworks:

These two are linked and will be covered together.

Qorvo had a hilarious after-hours chart. It spiked then tanked.

Pour one out for the idiot who top ticked QRVO at $103.9/share lol.

Low and mid-tier Android is dead.

Qorvo content with Apple will not grow.

Now let’s look at Skyworks…

They lost share with Apple. Clearly this share did not go to Qorvo or Qualcomm so it must have gone to Broadcom.

RFFE is radioactive to me.

As an aside, I had a private theory for over a year that Apple would use superior Broadcom filters to compensate for their shit modem decode performance.

Skyworks claiming they only lost content due to “competitors catching up” seems like cope bullshit. OEMs do not design RFFE boards with multi-sourcing for the same device/region. Modem and RF need tight integration these days. I think Apple chose to pay the Broadcom premium to compensate for baseband deficiencies.

Onto Innovation:

I own ONTO 0.00%↑ in multiple accounts but usually do not write about them. The investment case is self-explanatory.

They get a section in today’s post because of the interesting info regarding HBM ramp trends.

(I have a shit ton of Micron call options)

It looks like SK and/or Micron finally grew a pair and realized Samsung was not going to get it together.

Lamo. NAND CapEx up. Layers race alive. Western Digital’s declaration of the end of the layers race once again refuted.

Long MRDIMM, Short NAND Flash

Irrational Analysis is heavily invested in the semiconductor industry.

I thought I was buying the dip for SiTime in the deep seek bloodbath. Then I thought I was buying the dip dip this morning. Tomorrow I will buy the dip dip dip.

keep up the excellent work sir 'keet