The Refurbished iPhone Apocalypse

+Huawei Revival; +Exynos Resurrection; +Google Tensor; +Zeku Investigation-u; +MediaTek Gainz

IMPORTANT:

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

Hello wonderful subscribers. Welcome to the first edition of “Trends”, a category of posts that cover industry/macro/market phenomena.

Today, we are covering the smartphone/handset market with a particular focus on mainland China, the largest and most competitive region.

Engineering-driven investment analysis… market intelligence?

Sidenote: My current/personal smartphone is a Samsung Galaxy S23 Ultra. I have never owned an iPhone and probably never will.

Contents:

Handset Market Overview

Global TAM Trends

Recap of China Smartphone/Handset Share Volatility

The Refurbished iPhone Apocalypse

What Apple is doing.

Severity of the situation.

Huawei Resurrection

How HiSilicon came back from the dead.

Opinions/predictions on China market share trends.

Exynos is back in a **big** way.

History of Samsung’s dual-sourcing strategy.

Process nodes, parametric yield, and Exynos 2200+2300.

Area budget…? What budget? (Exynos 2400 rumors)

Google’s Strategy

Tensor is a lightly modified Exynos. (for now)

Google’s long-game.

Zeku Investigation-u

An interesting post on LinkedIn.

Why did they pull the plug so late? Is China macro that bad…?

MediaTek Gainz

“Now I am become death…”

Recent Apple/Qualcomm History

A historical Analogy

[1] Handset Market Overview

Handset’s (aka Smartphones) represent a consumer electronics market that can be divided up in several ways:

By Tier (premium, mid, low)

By region [China, USA/NA, EU, APAC (excluding mainland China), …]

By Operating System (iOS, Android)

By connectivity technology [4G/LTE, 5G (sub-6 only), 5G (sub-6 + mmWave)]

This post will primarily cover #2 and #3, with a focus on mainland China.

[1.a] Global TAM Trends

“Total Addressable Market” TAM is measured in millions of units per year.

Here is a plot that shows the historical smartphone/handset global TAM.

In general, TAM is referring to **new** device shipments and excludes all used/refurbished devices. This is going to be important… #Forshadowing

Two firms, IDC and Counterpoint Research, tend to have the best market intelligence so I will be citing their data frequently.

What can we tell from the above historical plot at a high level?

Global smartphone TAM was increasing (in terms of units/year) from 2011 to 2017 but has since been in a steady decline.

2021 had higher unit shipments that 2020, likely due to COVID demand pull-forward.

Of course, average selling prices (ASP // price-per-unit) has also gone up over time and tends to follow connectivity technology transitions. For example, the 4G/LTE to 5G ramp that began in 2019 led to significant ASP increases despite unit shipment declines when compared to 2017/2018.

With any market, there is a growth stage and a terminal/ex-growth stage. COVID caused significant disruptions that clouded the forecast for consumer electronics.

When the plague hit, consumers shifted spending from services to goods. They also were forced to stay at home (bored) and realized their electronics needed an upgrade. This resulted in a “pull-forward” of demand. Many consumers who typically upgrade their devices every X years decided to upgrade a year or two early in 2020/2021.

Many semiconductor companies incorrectly believed this surge in demand was durable. Intel and AMD both guided laptop/PC TAM to be 350 million units/year or higher and got burned badly when reality re-asserted itself.

Note: I read somewhere within AMD official communications that they believed 2022 PC TAM would be 350 million units. Can’t find it now (maybe slide deleted lol) but that number was officially floated by AMD at some point late 2021 // early 2022.

There is a simple reason why many consumer electronics companies incorrectly believed COVID demand surge would be durable, overproduced, and were stuck with massive inventory write-downs.

Hope.

Hope that their market is not ex-growth.

Unfortunately, hope does not translate into financial performance.

Laptop/PC is a saturated, terminal, ex-growth market at ~270 million units per year.

Smartphone/handset is also ex-growth at ~1.25 billion units per year.

Note: Ex-growth does not mean 0%. Pitiful growth of 1-3% YoY also counts. Remember that USA treasuries (the risk-free rate) are at over 5%.

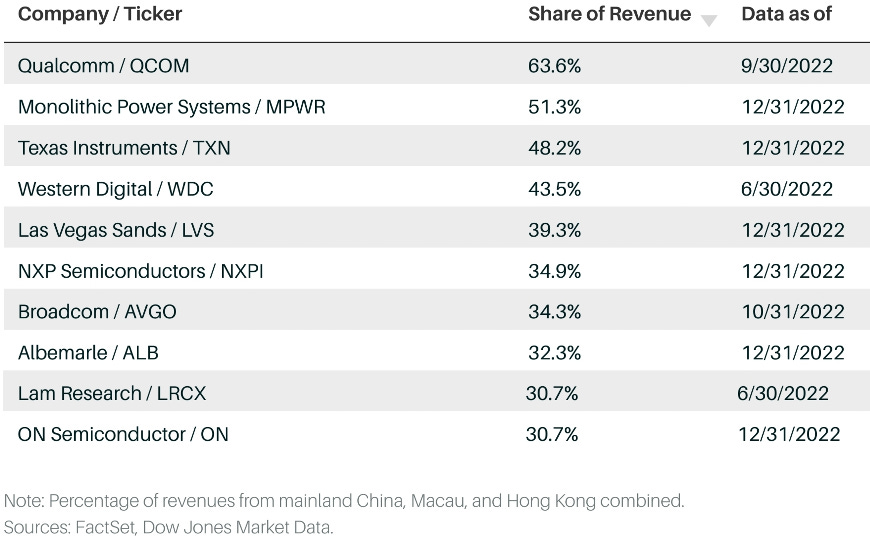

Intel, AMD, Apple, Qualcomm, MediaTek, Dell, HP, Samsung MX, Oppo/Vivio, Xiaomi, and all their investors would like to believe this is not so… but it is.

The party is over and refurbished units are amplifying the hangover for some…

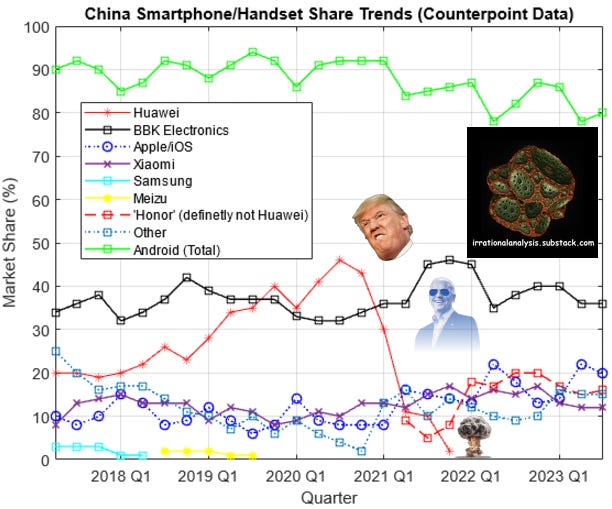

[1.b] Recap of China Smartphone/Handset Share Volatility

Before continuing, I would like to thank Counterpoint Research for publishing a lot of their high-level data for free online.

China Smartphone Market Share: By Quarter - Counterpoint Research

I have plotted their data to make the… recent volatility clearer.

Two obvious trends:

Apple/iOS has been gaining share against Android in China, doubling over the last five years. #Ecosystem

They are also gaining share globally.

iOS achieved majority share in USA market ~Q3 2022.

Something happened to Huawei…

Huawei is the target of a great deal of geo-political drama. This is an engineering and investment focused newsletter so let’s not go there.

Here is what you need to know:

Huawei is a large Chinese telecommunications company that makes infrastructure (base stations), smartphones/handsets, laptops/tablets, and holds many 5G/wireless standards patents.

The public branding for their smartphone SoCs is “HiSilicon”.

Intuitively, HiSilicon/Huawei and Exynos/Samsung are very similar as both utilize integrated, first-party 5G modems.

Before Q4 2020, Huawei sold handsets under several brand names such as ‘Mate’, ‘Honor’, and ‘Ascend’.

In 2020, the USA Government imposed a series of sanctions upon Huawei which led to the following high-level outcomes.

HiSilicon (the chip design group within Huawei) was cut off from TSMC.

Huawei was previously TSMC’s second-largest customer, only behind Apple.

TSMC was allowed to complete and deliver in-progress wafers but could not take any new orders from HiSilicon. (this is important)

USA Government granted a license to Qualcomm for selling 4G chips to Huawei. (old 4G-only chips and new chips with 5G disabled)

Huawei “spun off” their ‘Honor’ sub-brand as a separate company.

USA Government considered adding Honor (the spun-off company) to the same export/ban list as Huawei but has not done so as of August 2023.

So, when the dust settled, Huawei had the following predicament:

They have a finite supply of first-party (HiSilicon/Kiren/Balong) 5G-capable chips and can’t get any more from TSMC.

They can ration the HiSilicon… silicon… but will eventually run out.

The few supply options they still have are routinely rumored to be under threat by USA Government taking additional actions.

In early 2023, Reuters and the Financial Times both reported that USA Government stopped granting any new export licenses (in relation to Huawei), which does not bode well for possible future renewals of existing export licenses…

Honor (the spun-off company) has not seen its status change in 2023 (yet) but the specter additional restrictions remains.

As of September 2023, HiSilicon is back. Allegedly with 5G.

[2] The Refurbished iPhone Apocalypse

Apple has been up to something. The first sign of this mysterious, fruity endeavor showed up in Qualcomm’s Q2 2023 earnings call.

Brett Simpson -- Arete Research -- Analyst

Yeah, thanks very much. Cristiano, I wanted to ask about the state of the Android market. There seems to be a sort of consistent structural share loss here. And I guess, even going back pre COVID, Apple has been growing their business since COVID and Android just seems to keep losing share.

So, what do you think is going on? And how much of the structural decline in Android, do you think, is the secondhand iPhone market? And then I don't know whether you can size this, how big do you think the secondhand market is and how it's affecting Android? And what do you think the Android value chain is going to do to reboot their business? Thank you.

Cristiano Amon -- President and Chief Executive Officer

Yeah. No, it's a great question, and there are a number of things to unpack. So, first, I just want to go back a little bit in recent history. I think there was an addressable market for premium devices, and to some extent, premium and high-tier devices that became available as Huawei declined in share.

And the reality, Apple pick a significant amount of their share. We did as well, I think. So, our competition, I think everyone grew as the expense of the market. And I think that is resulting to a much larger -- you look at that Huawei Android as a net loss of Android, and that's for the areas that Apple gained share.

The market is smaller and those -- even the component of hand-me-down phones, it's accounted in our planning of a smaller market. I think that's where we are until we go to the next upgrade cycle, cyclical business. But our position in Android has improved, and I think if you look of our trajectory actually on the smaller Android market, we've been gaining share and focus on the value share of the market with concentration in the high and the middle tier.

Brett Simpson -- Arete Research -- Analyst

Do you think the secondhand market is growing structurally? I mean, just to understand the dynamics because some of the data we've seen, it would suggest that this is starting to have an impact on the Android volumes.

Akash Palkhiwala -- Chief Financial Officer & Executive Vice President

Yeah. Brett, it's Akash. So, I divide this into two parts. I think there's a second end market that has been around for a long period of time in emerging markets as a hand-me-down device, and so that obviously still exists.

There has been a little bit of a change at the top with the refurbished phone market, and so that's something that we're definitely closely watching and definitely contemplated in our numbers at this point.

Brett Simpson (Arete Research) explicitly asked Qualcomm CEO about **refurbished/secondhand** iPhones shrinking the **new** Android market. QCOM CEO proceeded to give a long answer that largely ignored what the analyst asked about, discussing share shifts in the **new** handset market as Huawei declined.

The analyst directly challenged QCOM CEO’s answer and QCOM CFO had to jump in to end the line of questioning.

Let’s go down the [refurbished] rabbit-hole…

[2.a] What Apple is doing.

Joanna Stern (Wall Street Journal) has an excellent article on Apples secret weapon.

I highly encourage readers who have a WSJ subscription to stop reading this and go read the WSJ piece before continuing here.

Summary for non-WSJ subscribers and lazy folks:

Carriers (particularly western ones) have started offering generous trade-in programs for iPhone users.

3rd-party electronics firms clean, data-wipe, and repair (if needed) vast quantities of used iPhones sold to them by the carriers.

Some of these refurbished iPhones go for sale online at Amazon or Back Market, but most are shipped overseas.

In a way, everyone participating in this program wins:

Western consumers get a nice upgrade that is perceived as “cheap”.

Carriers lock-in their subscribers into multi-year contracts/

Apple accelerates sales of new iPhones in high-margin regions.

Apple gains service revenues from the folks who buy these refurb units.

The 3rd-party electronics firm gets a steady, reliable business with decent margins and high-volume.

[2.b] Severity of the situation.

Joanna Stern’s article was written in March 2023. At the time, the full scope of Apple’s new program was unclear.

We found out how bad the situation is in Qualcomm’s Q3 2023 earnings call.

Tim Arcuri -- UBS -- Analyst

Got it. And then just last thing. So do you have any data on the refurbished market? It seems that it has gotten pretty large and maybe it's affecting the new Android market. Sort of what portion of the handset TAM this year do you think is used or refurb? Could it be -- I mean, we've seen numbers in the 350 million unit range, something like that.

So the market is flat to down, but the market for new phones is really actually down quite a bit. Can you actually talk to that?

Akash Palkhiwala -- Chief Financial Officer

Yes. So we have the same data as you do on the refurbished phones. It has grown over the last couple of years. when we give the market, the global handset unit information, we're not talking about the refurbished phones.

We are talking about new phones. And so it's already factored into the guidance we gave.

Remember, Apple started ramping this refurbishment program within the last 12 months (H2 2022). Tim Arcuri (UBS) appears to be saying that projected volume for Apple’s refurb operation in 2023 is 350 million units/year.

2023 is obviously not over but that does not stop professional analysts from attempting to project full-year volumes.

****350 million units/year is insane!****

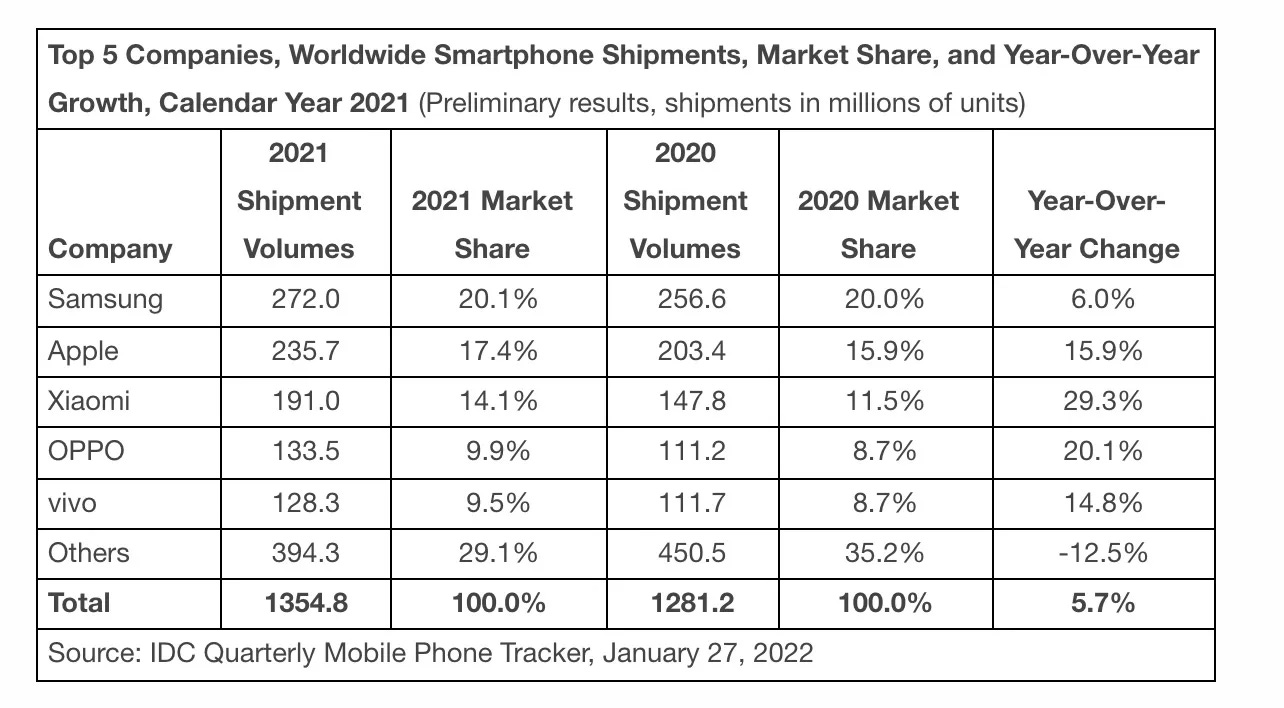

To illustrate how crazy this ramp is, let’s take a look at smartphone/handset shipment share during 2021 when COVID demand surge inflated everyone’s volume.

Samsung shipped 272 million **new** units in 2021 and is #1.

Apple shipped 236 million **new** units in 2021.

Apple is currently projected to ship 350 million **refurbished** units in 2023.

Think about what Apple has done. Within 12-18 months, they have created a refurbishment program that is not only projected to out-ship their own new units, but vastly out-ship the #1 vendor’s new units by ~30%!

[3] Huawei Resurrection

Huawei is back. They surprised a lot of the technical press in late August 2023 but there were signs this was coming months ago.

So… how did they accomplish this?

[3.a] How HiSilicon came back from the dead.

For many years, HiSilicon (Huawei’s internal chip design division) has relied on TSMC as their sole-sourced manufacturer. Given the complexities of modern process nodes, one cannot simply port a design willy-nilly.

With the TSMC ban, HiSilicon’s only option was to use SMIC for manufacturing. At the time, SMIC did not have a competitive process node. To make things worse, USA Government convinced the Dutch Government to ban EUV machine sales to SMIC.

EUV is a fascinating topic that I hope to cover some other time.

<>

For now, all you need to know is EUV is essential for process/technology nodes that are “7nm-class” or smaller.

At least, that is what the conventional wisdom was.

Research firm TechInsights was first to confirm that SMIC has managed to create a legit “7nm-class” process node without EUV by analyzing a cryptocurrency mining ASIC using electron microscopes.

When Huawei surprise announced the Mate 60 in August 2023, TechInsights was again first to confirm that HiSilicon is indeed back from the dead, courtesy of SMIC 7nm++. Credit to TechInsights for getting this done within 24 hours.

So how did SMIC pull this off without EUV machines?

Turns out, they are not the first company that tried to make a “7nm-class” process node without EUV. Intel tried that from 2014-2021 and it did not go well. Intel’s 10nm process node (roughly equivalent in specs to TSMC N7 and thus “7nm-class”) was repeatedly delayed and marred by yield issues.

Note: Yield is what % of chips printed are sellable. (will cover this in dedicated post)

<>

SMIC probably does not have great yields on their non-EUV “7nm-class” node.

Apparently, Huawei/HiSilicon does not care.

They are determined to become self-sufficient, and the yields must be “good enough”. Perhaps China’s Central Government is helping with subsidies to SMIC. (baseless speculation…)

[3.b] Opinions/predictions on China market share trends.

So those export controls Trump and Biden imposed worked… until they didn’t…

Huawei is going to re-gain lost share. Maybe they will buy out one of their independent competitors in order to scale up HiSilicon volumes. Maybe they will sell HiSilicon chips to other Chinese handset OEMs.

The chart is gona continue to be volatile.

[4] Exynos is back in a **big** way.

Now that we are done with covering Huawei/HiSilicon, let’s move on to their Korean brother: Samsung/S.LSI/Exynos.

Before analyzing what happened in 2023 or making predictions as to what will happen in 2024, we must go back and check out some history.

[4.a] History of Samsung’s dual-sourcing strategy

Samsung has a history of dual-sourcing smartphone SoCs. To understand this, you need to first realize that Samsung is a mega-conglomerate that has multiple pseudo-separate entities within it.

“SET Division” aka Samsung MX: The division that makes phones such as Galaxy devices, TVs, and other consumer electronics.

“Device Solutions”:

Samsung Foundry: The division that prints chips.

Samsung LSI aka S.LSI: The division that designs chips such as Exynos.

<many other sub-divisions that are not relevant for this post>

It is very important to understand that in 2021, Samsung re-organized itself such that the foundry and design groups report the same person (Kyehyun Kyung), are part of the same organization (Device Solutions) and thus presumably share profit and loss (P&L) responsibilities.

I know a lot of you might find this corporate structure stuff quite dry, but it is critical to understanding what his about to happen in 2024.

Historically, Samsung MX has granted design wins to S.LSI and Qualcomm on a regional basis. Some regions, such as Europe, use Exynos while others, such as USA/NA use Snapdragon. Over the years, the ratio has shifted, and it is rare for Samsung MX to give 100% allocation to one chip/vendor for any generation.

Exceptions:

[4.b] Process nodes, parametric yield, and Exynos 2200+2300.

Ok so this part is a little sensitive so I will try to write it as neutrally as possible.

With every process node and chip design, there is a concept called “yield”, the percentage of chips printed that are sellable.

Yield can go down for two reasons:

Catastrophic Defects: This means the chip has some functional flaw rendering it broken and unsellable.

Parametric Yield: This means the chip works but is either too slow or runs too hot, usually a combination of both.

When the Foundry (TSMC, Samsung Foundry, GloFo, …) shares the PDK with chip design companies, they include detailed statistical models designed to help designers predict their yield.

Design teams have a set of targets that determine their area and power budgets:

Target yield for commercial production: (70%, 50% …).

Target clock frequency: (1 GHz, 2GHz, …)

Target power budget:

In voltage: (1V, 0.8V, …)

and/or…

In watts: (2W, 20W, 200W, …)

Parametric yield can be measured with something called a Shmoo plot:

In this plot, one axis is frequency/speed and the other is voltage.

Chips on the same wafer routinely have different performance characteristics. When the initial batch of test chips come back, the design team has to figure out what percentage of the chips will meet the simulated/expected specifications.

Ultimately, it is up to management and product teams to decide on the final operating voltage, base clock, and boost clocks based on economic analysis.

In a nutshell, what happened to Samsung Foundry in their “4nm and 3nm-class” process nodes (4LPX, 4LPE, 3GAE) is the parametric yields were lower than expected.

For reference, TSMC's 4nm process node --- which is used by Qualcomm to manufacture the Snapdragon 8 Gen1 Plus --- is said to have a yield rate of over 70%.

According to the industry, it is known that the yield of Qualcomm 4-nano AP [Snapdragon 8 Gen1] produced by Samsung Foundry is only about 35%. This means that out of 100, 65 are defective. The yield of Exynos 2200 produced on the same line is understood to be lower than this.

Source: TheElec (with Google Translate)

Low parametric yields lead to two problems:

Supply might be constrained as not enough chips pass specification to meet customer demand.

The chip might not meet performance targets and thus undergo competitive pressure.

Qualcomm has been repeatedly reminding their investors that they are supplying Samsung Galaxy (aka Samsung MX aka SET Division) globally in 2023.

This will not last. It is temporary.

[4.c] Area budget…? What budget? (Exynos 2400 rumors)

Based on Samsung’s past product launches the Exynos 2400 is probably going to launch in early Q1 2024 with the premium Galaxy S24-series.

GSMArena has reported on leaked specs for this chip.

iGPU:

12-cores vs the 6-cores found in the previous generation Exynos 2200.

The IP is licensed from AMD and each “GPU core” is a RDNA2 compute unit.

CPU Cluster:

1x X-Series (Big)

2x high-clocked A7xx-series (mid)

3x low-clocked A7xx-series (mid)

4x A5xx-series (small)

A new chip with new IPs on a new process node will obviously have many differences so a 1-to-1 area comparison is not reasonable. Still, we can get a ballpark idea of how much bigger this Exynos 2400 is compared to the 2200.

It. Is. MASSIVE!

See those yellow Cortex A710s each with 1 MB of L3$ cache? Exynos 2200 has three but the new Exynos 2400 will have 5.

See the big square of stuff on the left? That is the RDNA2 GPU IP licensed from AMD. S.LSI is **doubling** it for the Exynos 2400.

See the 8MB of System Level Cache and associated blocks above the CPU cluster. The pink and purple stuff. That is probably going to be 50% larger to feed all those extra GPU and CPU cores. Might even be doubled.

This is going to be a massive gen-on-gen area boost!

Design teams usually have strict area budgets to keep costs down… which begs the question…

Why is S.LSI making such a huge chip for the mobile market?

The answer is simple: Fab Utilization

Semiconductor factories have very high fixed operating costs and need to be at high utilization (relative to theoretical maximum factory output) in order to be profitable. Samsung foundry has lost several large customers (Nvidia, Qualcomm, Cisco) and likely has very low utilization at leading-edge (7nm-class and lower // 7LPE, 5LPE, 4LPP, 4LPX, 3GAE) process nodes.

The only high-volume customer left is S.LSI. (the Exynos team)

At an organizational level, the economically rational choice for “Samsung Device Solutions” is to print a giant Exynos 2400, regardless of yields or cost.

They must print something, so it might as well be giant Exynos-es… Exynos-i?

A similar situation happened with Intel when their Fab utilization plummeted. They flooded the market with laptop chips even though demand was low, gaining share from AMD is a destructive manner.

Under normal circumstances, Samsung MX would judge the upcoming Exynos 2400 against the upcoming Snapdragon 8 Gen3 based on performance and cost.

This cycle will not be normal.

The cost structure is distorted this time, allowing for a massive area boost. Performance will be way up because of all that extra area.

S.LSI/Exynos had 0% share in 2023. They will be getting a share much larger than 0% in 2024. It will be interesting to find out how high this number goes.

[5] Google’s Strategy

Obviously, Google has a lot of service revenue to lose if Apple continues to gain share using new **and** refurbished units. Let’s talk about Google’s response, how it’s going, and where it will likely end up.

[5.a] Tensor is a lightly modified Exynos. (for now)

First, you need to understand what Tensor is: a lightly modified Exynos.

Additional Citations:

https://wccftech.com/google-tensor-g3-a-modified-exynos-2300/

https://www.theinformation.com/articles/inside-googles-efforts-to-develop-custom-chip-for-pixel

Those of you who have subscriptions to The Information: it is definitely worth a read.

Google has developed two custom IP blocks:

Google edgeTPU, an inference engine made in-house that likely is a smaller version of their cloud TPU.

RISC-V/VLIW scalar core with smaller matrix engine and systolic array.

Replaces Exynos NPU.

Competes against Qualcomm Hexagon and Apple Neural Engine.

ISP (Image Signal Processor)

This block pre-processes raw camera sensor data before handing it off the NPU/NSP/TPU and/or GPU.

I vaguely remember reading somewhere that Tensor G2 uses a fully custom Google ISP but can’t find a source.

This is what google has been up to.

Tensor G1, G2, and upcoming G3 are all either confirmed to be or believed to be modified Exynos chips.

[5.b] Google’s long-game.

The Information piece by Wayne Ma has a lot of great info. Taking a small quote. Go buy a subscription. (it is worth it)

The search giant has delayed by at least one year the release of its first fully customized chip, which would act as the brains for its Pixel line of smartphones, according to two people with direct knowledge of the situation. Google had originally planned to release the chip, internally code-named Redondo, next year, replacing the semicustom chips it currently designs with Samsung. Instead, it will stick with Samsung for another year and wait until 2025 to introduce a fully custom design, internally code-named Laguna, the people said.

Source: The Information (Wayne Ma)

According to Nikkei Asia, Google requested suppliers to produce 8 million Pixel 7 devices back in October 2022. That does not include old generation sales and might be inaccurate but let’s have a thought experiment.

Let’s assume Google Pixel (7, 7 Pro, 7A, 6A, 6, 6 Pro) reaches total 2023 sales of 15 million units. This is a somewhat generous estimate.

As of August 30th, 2023, IDC is projecting global smartphone shipments of 1.15 billion units for 2023.

15 million / 1.15 billion = 1.3% market share (optimistically)

Google is making progress, but they have a long way to go.

That alleged fully custom 2025 chip (Tensor G5? // Pixel 10?) will be interesting to watch. Overall, I like Google’s strategy, but they have not had enough time to prove the financial merits. Excited for 2025.

Google’s Anti-iPhone Strategy:

Go vertical and copy Apple’s business model:

Build a tight ecosystem around customized (mostly-stock) Android, Google first-party apps, and exclusive AI+camera features.

Try to ramp service revenue.

Try to bundle high margin accessories such as Pixel Buds.

Aggressive Marketing:

NBA player sponsorships.

Huge TV ad buys.

Differentiation:

Camera and AI features.

Very noticeable (high impact) and easy to demo/highlight.

Note: If there are any Google (Pixel Division) employees reading this, please add an integrated stylus to your roadmap. I want to buy a Pixel, but the s-pen is just too useful.

[6] Zeku Investigation-u

Oppo, a Chinese smartphone OEM and subsidiary of BBK Electronics, has been trying to become silicon self-sufficient and go vertical. They created a subsidiary called ‘Zeku’ for precisely this purpose.

Zeku died an abrupt death in May 2023.

On May 12, Oppo suddenly announced its decision to disband Zeku. The decision came as Ga surprise for many employees of the company, which had just renewed the lease for its Shanghai headquarters and posted new job ads in late April looking for specific talent in system architecture, digital design, software algorithms and chip verification.

Source: Nikkei Asia

It’s time for a Zeku investigation-u!

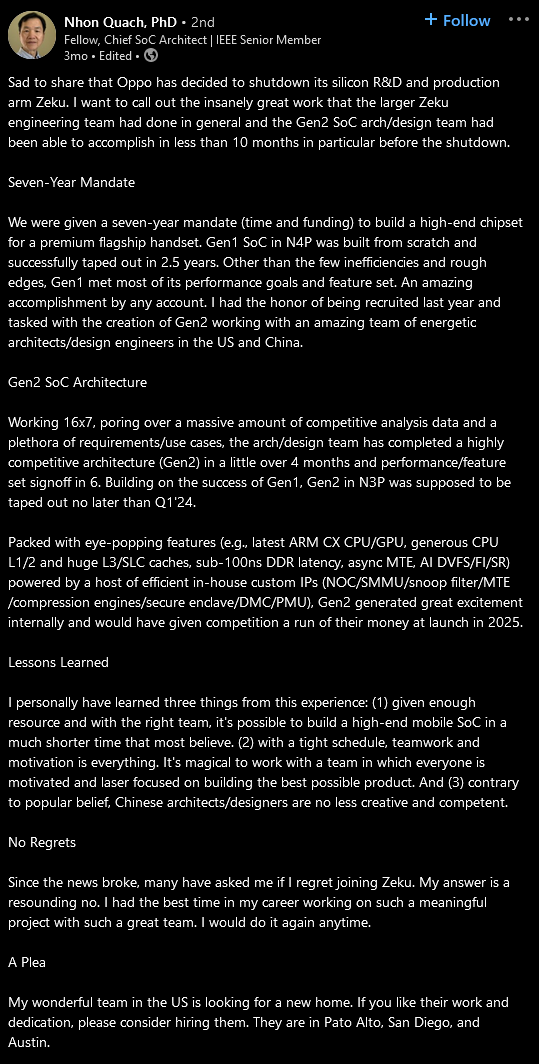

[6.a] An interesting post on LinkedIn.

Luckily for the investigation-u team, the (former…) head of Zeku posted some very valuable information/evidence on LinkedIn. (thank you Dr. Nhon Quach)

Key points:

Oppo had planned this as a 7-year program.

This makes sense given how long it takes to create a chip from start to finish.

Original plan was to create two generations then evaluate program P&L.

Their first gen SoC was taped-out on TSMC N4P, which is big news.

Prior to Dr. Quach’s post, there was zero public information about the existence of this chip or which process node it was on.

2.5 years from design start to tape-out is genuinely impressive.

Their second gen SoC was planned for tape-out on N3P in Q1 2024.

This implies a planned Q1 2025 commercial launch.

Big launches in China market happen around the Lunar New Year.

Based on this information, it is safe to say that Zeku’s second gen SoC was probably simulating on FPGA platforms as the physical design team was ramping up.

[6.b] Why did they pull the plug so late? Is China macro that bad…?

I was shocked when this news broke. Oppo had already sunk in hundreds of millions of dollars. Why pull the plug now?

Shutting the Zeku program down at the stage they did is effectively the worst of both worlds.

They burned a huge amount of money on design, tape-out, bringup, and post-silicon validation of gen 1 SoC, which was planned as a non-commercial test chip anyway.

They had a digital design-complete second generation with a planned commercial release but stopped development before the physical design team could get started.

Very abrupt cancelation that clearly had nothing to do with engineering.

Has the macro situation in China degraded this quickly and severely?

During the all-hands meeting where the decision was announced, Zeku CEO Liu Jun blamed the shutdown on "the grim situation surrounding the global economy and smartphone industry" and Oppo's inability to meet its revenue expectations, which he said made it difficult for the company to continue investing in chip development.

Liu, who is also Oppo's chief technology officer, stressed that the decision had nothing to do with the quality of work by the Zeku team.

Source: Nikkei Asia

Apparently yes.

Yikes.

[7] MediaTek Gainz

Qualcomm guided flat revenue from Q3FY23 to Q4FY23. This is unusual as their recent history showed sequential revenue gains from Q3 to Q4.

Three analysts attempted to dig deeper on the earnings call but QCOM CFO dodged their questions each time.

Matt Ramsey (TD Cowen)

Samik Chatterjee (JPMorgan Chase)

Ross Seymore (Deutsche Bank)

As these three analysts were repeatedly asking the same question regarding Q4/December revenue guide, a fourth analyst was forming a galaxy-brain question.

Brett Simpson -- Arete Research -- Analyst

Yeah. Thanks very much. Akash, I had a near-term question on smartphones. I mean some of your smartphone peers are reporting better fundamentals near term.

I think MediaTek's -- in the June quarter, they were up 6% in smartphones, and they're talking about mid-teens growth sequentially in September quarter. And I think Qorvo has also talked about quite a significant uplift in September. And I know you said there's weakness elsewhere in QCT, but can you just maybe home in on the smartphone business? And can you reconcile with some of the peers and what they're guiding and what you're guiding? Is it just really Apple and Huawei is going through a volatile patch for orders? Or is there something more structural you think it work?

Akash Palkhiwala -- Chief Financial Officer

Yes, Brett. So I'll start with your first question. If you -- let me break it down into Android and Apple in two parts. Within Android, two comments to keep in mind.

First is we don't think there has been any significant shift in share between the players over the last few months. However, what has happened is when you look at our total share of ****sell-through**** for '23 relative to '22, as I mentioned earlier, we've actually gained share within Android. So we continue to have a very strong position and the kind of the seasonality across the quarters for Android is really a reflection of when devices are launched and which tiers we play in, which is the premium and high tier, which they center around the holiday season versus midway through the year. So that's how I would think about the Android market.

The way Brett Simpson structured his question was brilliant. In my opinion, this was the most important moment in Qualcomm’s Q3FY23 earnings call because it confirmed material share losses to MediaTek+Qorvo.

Arete Research analyst cited MediaTek and Qorvo numbers, boxing QCOM CFO in. The keyword in his answer is “sell-through”.

When a chip design company sells chips to device OEMs (device manufacturers), this is called “sell-in”.

Examples:

AMD sells a Ryzen R7 CPU to HP.

Intel sells a Core i7 laptop SoC to dell.

MediaTek sells a Dimensity smartphone SoC to Oppo (BBK Electronics).

These chips sit in the OEMs inventory until they build the actual final product for consumers. (smartphone, laptop, pre-built desktop, tablet, …)

When the completed devices are sold by OEMs to retail stores, direct-to-consumer, or to corporate customers, this is called “sell-through”.

Here is how to interpret the above exchange from the earnings call:

Qualcomm gave an unusual, flat sequential revenue guide. (Q3FY23 —> Q4FY2023)

Brett Simpson (Arete Research) cited recent MediaTek and Qorvo revenue numbers indicating share gains.

MediaTek and Qorvo are direct competitors to Qualcomm.

They have significant revenue concentration in China market.

Qualcomm CFO claimed that they “gained” share in Android if you compare FY22 sell-through against FY23.

The only logical conclusion is the device OEMs (Qualcomm/MediaTek/Qorvo’s customers) are depleting QCOM components and re-stocking with MediaTek+Qorvo parts. Share losses… not share gains…

[8] “Now I am become death…”

I have spent a lot of time trying to figure out the answer to one question…

Why has Apple unleashed this weapon of mass [handset market] destruction in 2023?

Two thoughts:

They could have started this program years ago.

Apple has been running an industry-leading 5-year OS update program for many generations.

Build-quality has been consistently good since the iPhone 7 (lol bend-gate), making it relatively easy to secure a supply of refurbish-able devices.

Refurbished iPhones are going to cannibalize Apple’s new device sales to some degree.

Why buy an iPhone SE when you can get a refurbished non-SE iPhone with way more features?

Future service revenue from refurb iPhone uses probably won’t offset near-term hardware losses for another several years.

Why now? Why 2023?

History time! (with tinfoil hat)

[8.a] Recent Apple/Qualcomm History

From 2017 to 2019, Apple and Qualcomm were engaged in a… heated legal dispute over handset royalty rates based on Qualcomm’s patent portfolio. This newsletter is focused on engineering/investments, so I want to avoid covering legal topics.

What you need to know about Apple v. Qualcomm:

CNET reports that Apple was paying Qualcomm $7.50 per device in royalties. Apple initially wanted to pay just $1.50 per device, which it thought was a fair rate based on the value of the modems it was buying from Qualcomm. But Qualcomm charges royalty rates based on the value of the entire device, not just that component.

Apple previously noted that it has tried to negotiate a direct license with Qualcomm for nearly a decade, but Qualcomm refused to offer it a license. Instead, Qualcomm licenses its intellectual property (IP) to contract manufacturers, who in turn get reimbursed by Apple. But those manufacturing partners do not negotiate, and simply accept terms that Apple has previously described as "exorbitant." Before Apple instructed them to stop paying, contract manufacturers were paying Qualcomm 5% for every iPhone, translating into $12 to $20 per device.

In exchange for exclusivity and other marketing concessions, Qualcomm used to give Apple rebates that effectively reduced its royalty burden. Those rebates brought the per-device royalty down to $7.50.

Source: The Motley Fool

Qualcomm has two business segments that are reported in their financials.

QCT: Chip division, best known for their Snapdragon processors.

QTL: The patent licensing division that charges a %-based royalty fee per **new** smartphone/handset.

The huge legal fight between Apple and Qualcomm was because Apple believed the fee charged by QTL was too high.

Apple lost this case and settled in April 2019, signing a multi-year agreement that expires in 2025 but has a two-year extension option.

In 2022, Apple pushed another case to the USA supreme court and lost again.

Apple’s in-house modem was expected to be ready in 2023 but got delayed.

In its filings through the appeal and challenging process, Apple argued that its “royalty payments and risk of being sued again justified hearing the case on the merits.” Apple took this argument all the way to the US Supreme Court.

Apple told the Supreme Court that it still faced the risk of litigation after the agreement expires in 2025, or in 2027 if the settlement term is extended. Qualcomm already sued once, has “not disclaimed its intention to do so again,” and has a “history of aggressively enforcing its patents,” Apple said.

With all conventional options exhausted, Apple seems to have conjured an ingenious, 5Head strategy: eviscerating Qualcomm’s licensing revenue with a tsunami of refurbished iPhones.

To the best of my knowledge, Qualcomm has never charged QTL royalties on used, re-furbished, or second-hand handsets. (no public evidence of this on the internet)

[8.b] A historical Analogy

On July 16, 1945, the first nuclear test (codenamed “Trinity”) was conducted in Los Alamos, New Mexio, United States. The effort to build the world’s first nuclear weapon was led and managed by Robert Oppenheimer.

20 years later, Oppenheimer gave a famous interview on NBC, reflecting on that day.

We knew the world would not be the same. A few people laughed; a few people cried. Most people were silent. I remembered the line from the Hindu scripture, the Bhagavad Gita; Vishnu is trying to persuade the prince that he should do his duty, and to impress him, takes on his multiarmed form and says, “Now I am become Death, the destroyer of worlds.”

I suppose we all thought that one way or another.

Robert Oppenheimer, 1965

“Now I am become death, the destroyer of QTL revenues.” - Tim Apple

It seems that Apple is ok with a little self-inflicted iRadiation, as long as Qualcomm’s licensing revenue gets vaporized in thermonuclear hellfire.

The refurbished iPhone apocalypse is here…

…and it’s helping Apple achieve their ESG goals.