Screaming Buy: $KEYS

Stable, high margin business, incredible technical moat, strong correlation with AI hardware R&D.

IMPORTANT:

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

I bought some KEYS 0.00%↑ shares after hours today because of their earnings. Intend to buy more shares in the near future and possible explore LEAP options.

Background:

Keysight primary business is electrical test equipment. There are other segments, and they don’t really matter.

Within their “commercial communications” segment there is:

Wireless

Wireline

Let’s go over some of their products, why they have significant engineering-driven moats, and how the revenue profile is so amazing.

Wireless Hardware:

The Keysight UXM is the industry-standard wireless testing platform. You can think of it as a highly configurable fake basestation.

There are add-on accessories to expand testing capability for mmWave.

Keysight has some competition in this “call box” segment from companies like Arnitsu and R&S. They suck.

On the other hand, spectrum analyzers from R&S and Tek are quite competitive.

Keysight channel emulators are pretty good but not industry leading.

Better channel emulators exist, such as those from Spirent… which is why Keysight is acquiring Spirent.

Managment is smart with M&A strategy.

Wireline Hardware:

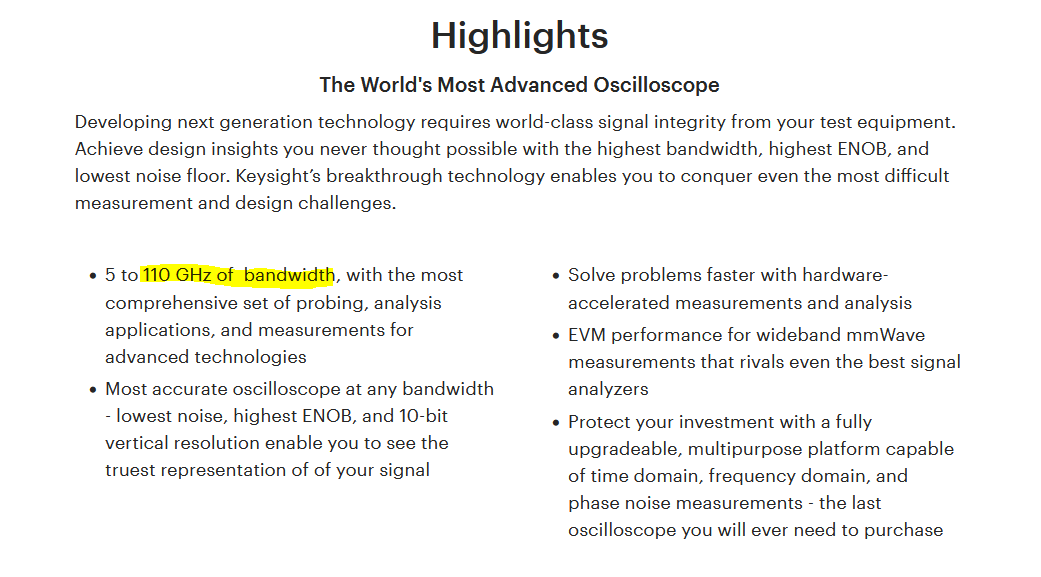

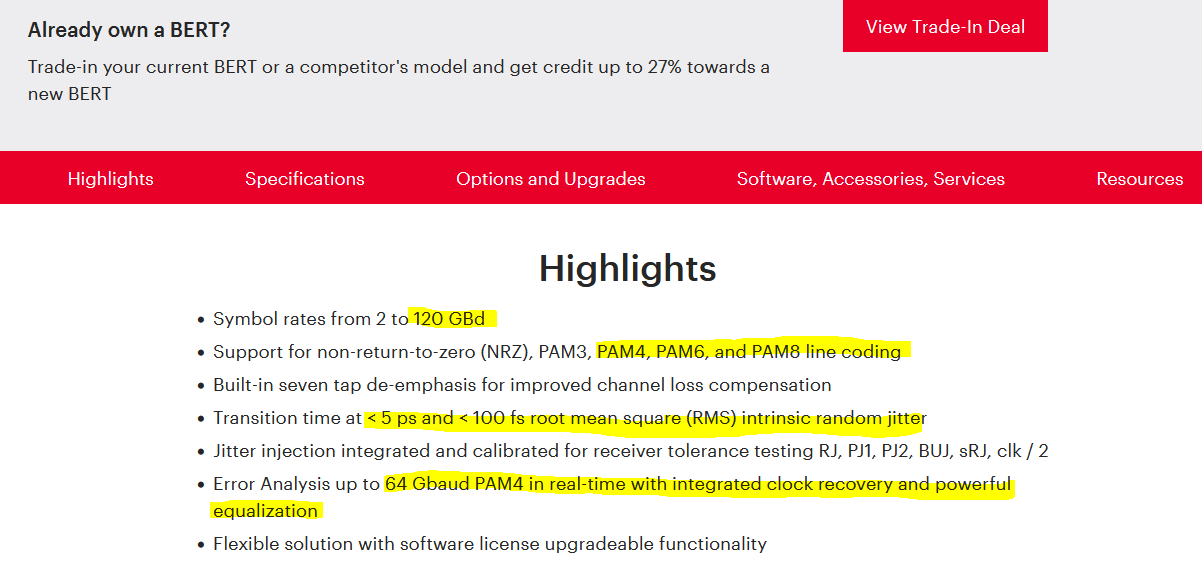

Keysight oscilloscopes and BERTs (bit-error rate testers) are industry leading by a massive margin. Every competing product is outright unusable for 224G SerDes R&D.

Jitter means time-domain noise. All test equipment has intrinsic noise. Keysight gear is the best (lowest) by a massive lead.

Software and Services:

Keysight test equipment has a ton of add-on software that is sold under annual contracts. This company is a sleeper SaaS business. Many of these software licenses cost over $100K annualized per box. So expensive that it is common for companies to only buy a few licenses and bounce them around stations as needed.

It gets better though. Each of these boxes needs annual calibration. Even if you don’t want to pay for the add-on software, you have to calibrate with Keysight. Guaranteed annualized revenue at high gross margin that scales with the install base and cannot be moved to 3rd party providers.

Do I have your attention hedge fund and investment bank subscribers?

Recent history and why the bottom is (apparently) in:

After hours move:

5-Year chart enhanced by orange crayons:

The pain Keysight has been dealing with has been almost entirely driven by the wireless test equipment segment. The UXM callboxes and associated mmWave upgrades. Managment gave several signals that this business has finally stabilized into a steady state. Given Apple’s recent progress on their modem, it seems likely.

I have been watching Keysight for over a year, waiting for signals that wireline finally takes over wireless revenue. This is it.

Earnings Slides and Call Analysis:

Large companies such as QCOM 0.00%↑ are “geoshifting” from Americas to India. This is why Keysight sees CC growth in Asia Pacific. This trend is bad for them as the gross margins on equipment, software, and calibration services is much worse.

Signaling a stable bottom in the wireless business.

Wireline has nearly surpassed wireless revenue. A couple quarters ago wireline was only 30% of commercial communications revenue.

Cloud hyperscalers are starting to meaningfully ramp their spend on wireline electrical test equipment. This is extra bullish because I believe the software attach-rate will be much higher than traditional Keysight customers.

Here is an example that is directionally correct:

Keysight sells some add-on tool/app that costs $150K/year/box.

A competent test engineer can replicate 70% of the core functionality with 2,000 lines of Python code.

Thus, the entire lab only needs a small number of boxes to have the license.

The cloud hyperscalers are exactly the type of customer who are willing to pay Keysight for the SaaS add-on:

Lots of budget to spend because Nvidia has lit a fire underneath their butts.

Inexperienced middle management who are easy targets for Keysight sales reps.

Wireless has stabilized. Another bottom-signal. There will be no bounce. The rest of this opening statement by management is copium.

Which is fine. I expect wireless to stabilize and basically never grow again. Geoshifting gross margin headwind will easily counter any R&D up-cycle from 6G/FR3/NTN.

Conclusion:

KEYS 0.00%↑ is a screaming buy.

Correlated to AI hardware R&D spend.

Massive competitive moat in wireline test equipment.

This moat is patrolled by sharks, piranhas, alligators, and mutant

Strong software and calibration services business.

Can’t get out of annual calibration.

A true hidden gem.

Poor coverage from sell-side.

A lot of dumb questions on earnings calls.

It is clear the street does not understand this company.

Under covered in general.

Possible future dividend as wireline install-base (and thus service revenue) scales.

This stock is not going to the moon, but it is a very stable, high-quality investment in my opinion.

In terms of long/short, I recommend ALAB 0.00%↑ for the short leg. Can’t participate myself for ethical reasons but the sheer alpha from this trading pair is worth serious research.

Hedge fund subscribers, you should look into this. Astera Labs is comically overvalued and the only hope they have is to win PCIe switch content from AVGO 0.00%↑ for upcoming Nvidia Blackwell platforms.

ALAB management is full of bovine excrement. The probability that their PCIe switches fail qualification for GB200 platforms is very high. Re-timer content is imploding now that B100 and B200 are effectively canceled. The current valuation depends on securing PCIe switch content in GB200 and GB200A platforms.

Certain semiconductor tourists are relying on incorrect information feeding their own confirmation biases. How does one “estimate” the ASP of a product that has not even been announced yet?

Signal integrity of a PAM4 PCIe switch is very difficult. Broadcom SerDes is significantly better than the IP Astera has licensed and integrated, providing greater margin for board designers.

ALAB 0.00%↑ has significant downside risk that has not been covered correctly by sell-side and certain boutique models. KEYS 0.00%↑ has significant upside from strong engineering-driven moats, incredible high-margin guaranteed service revenue, an expanding customer base willing to pay for SaaS add-ons, and alpha opportunity from low quality sell-side coverage.