NASDAQ:ARM is Comically Undervalued

Sell-side has completely missed Nvidia Grace royalty mega ramp.

IMPORTANT:

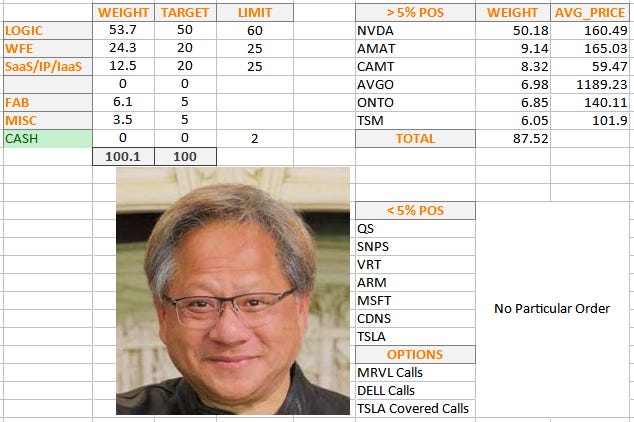

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

ARM 0.00%↑ is on its way to the moon. Not our moon. Maybe one of Jupiter’s moons.

Background here as today’s update is an extension of this thesis:

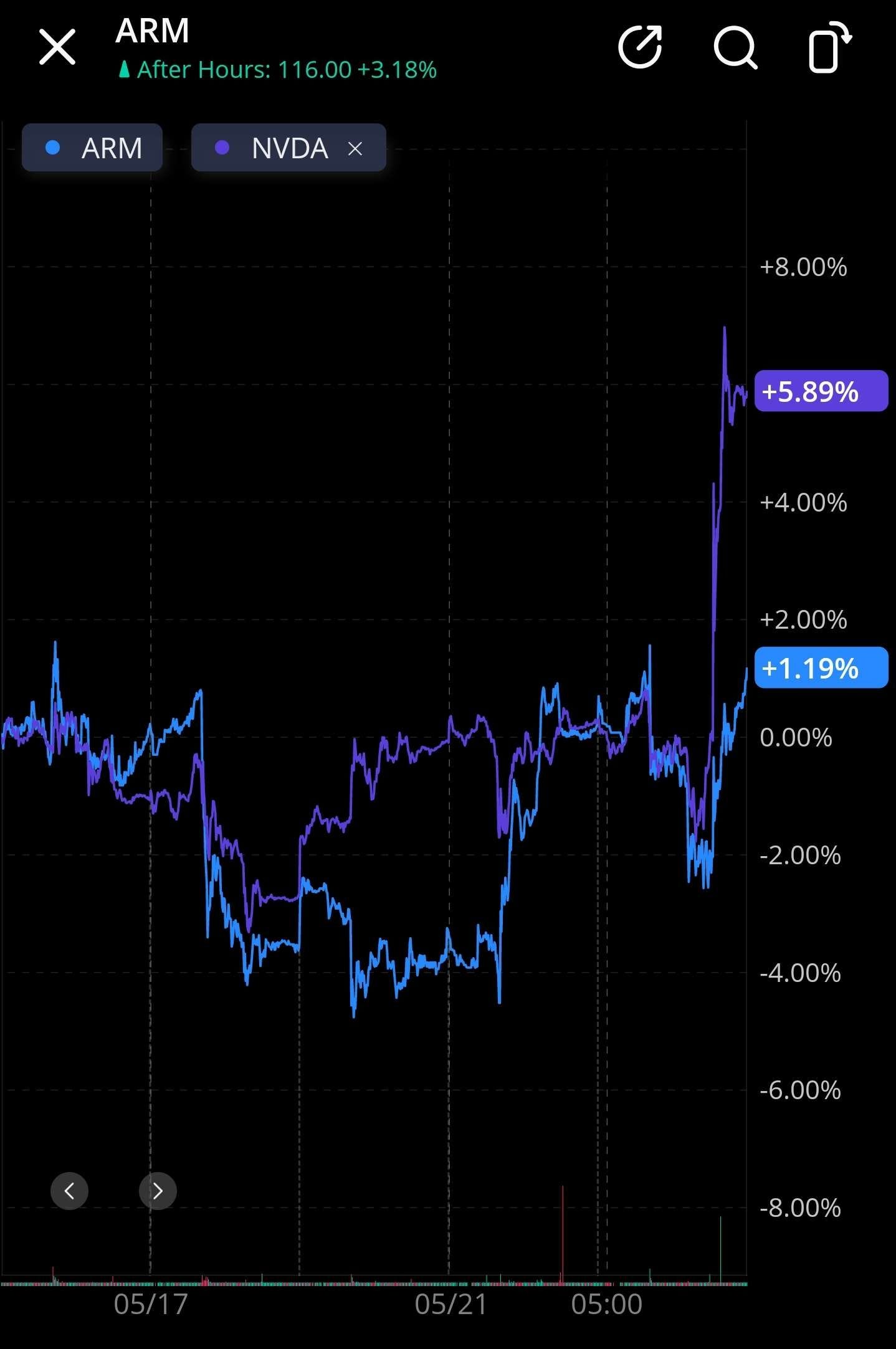

Nvidia reported today and spiked.

ARM (LTD), along with several other stocks, also moved after hours, riding the leather jacket party.

Here are my biases, updated based on after-hours prices:

ARM is now my highest conviction long-term investment idea. I plan to aggressively buy more and might even use margin to buy some LEAP calls.

THIS IS NOT INVESTMENT ADVICE. THIS IS HOW I PLAN TO SPEND MY* OWN MONEY (*borrowed or otherwise…). DO YOUR OWN RESEARCH.

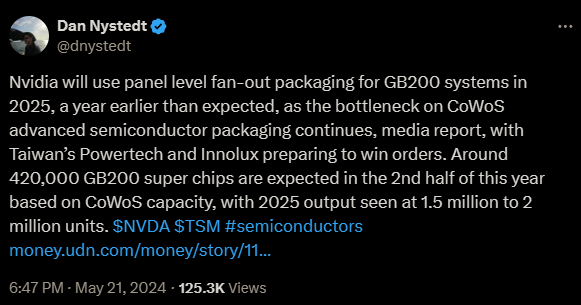

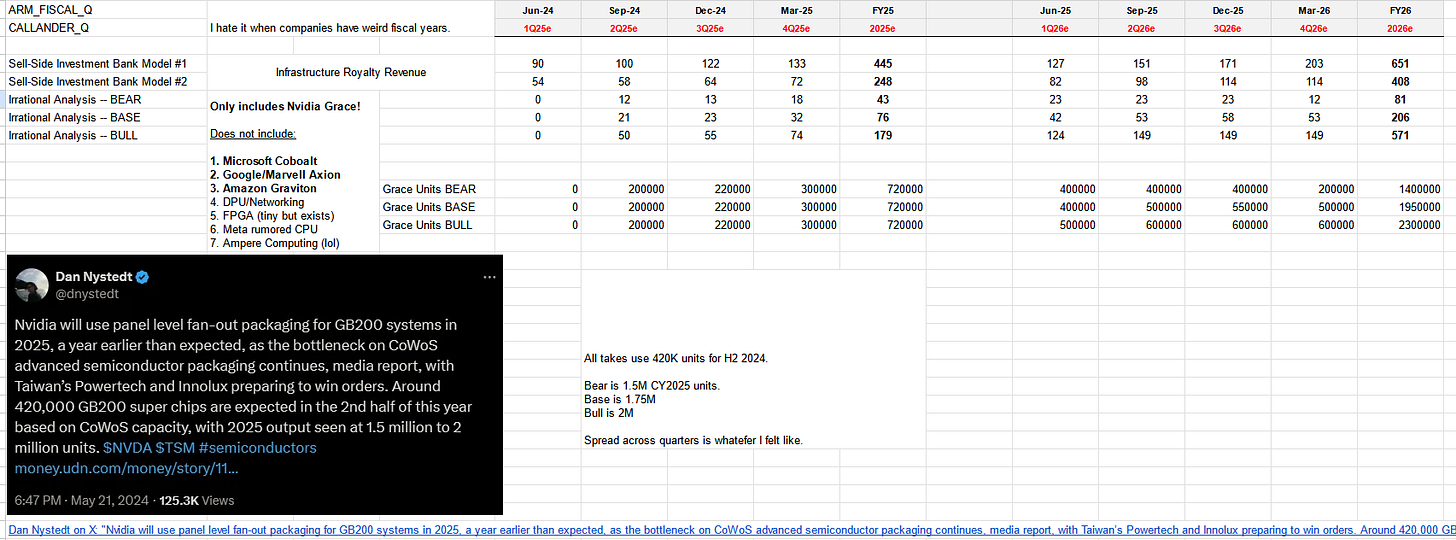

There are two very important pieces of information in this Tweet.

Nvidia is re-doing the packaging for GB200 in order to meet demand, despite TSMC massively expanding CoWoS capacity.

Crazy expected shipment numbers for Grace CPUs due to very high GB200 mix within the Blackwell product family.

In isolation, the unit numbers don’t mean anything. Could be just another made-up number from the rumor-mill.

However, Nvidia going through the enormous effort to re-do all signal integrity and power integrity on a new packaging technology **mid generation** gives enormous credibility to the numbers and has massive implications for ARM (LTD).

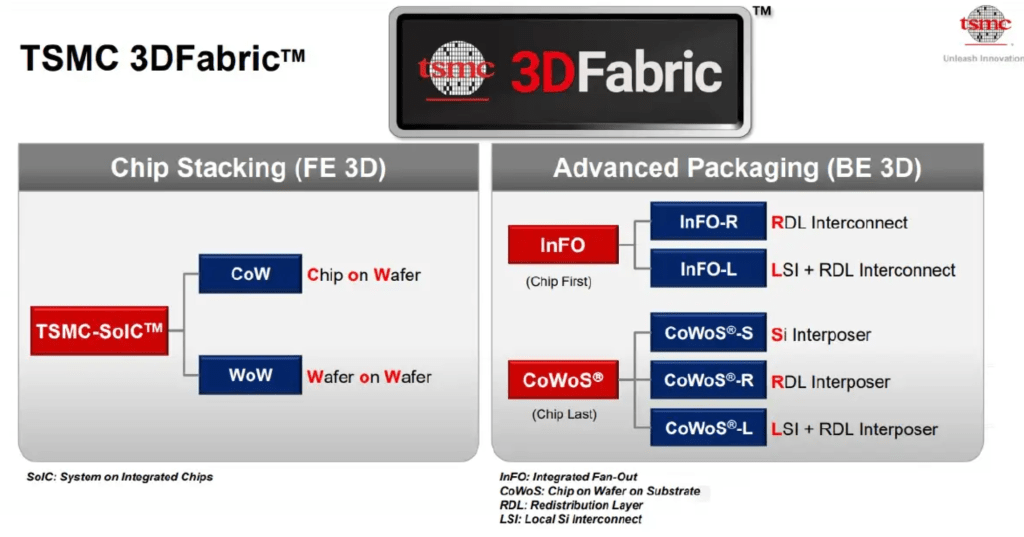

Part 1: Packaging Speedrun

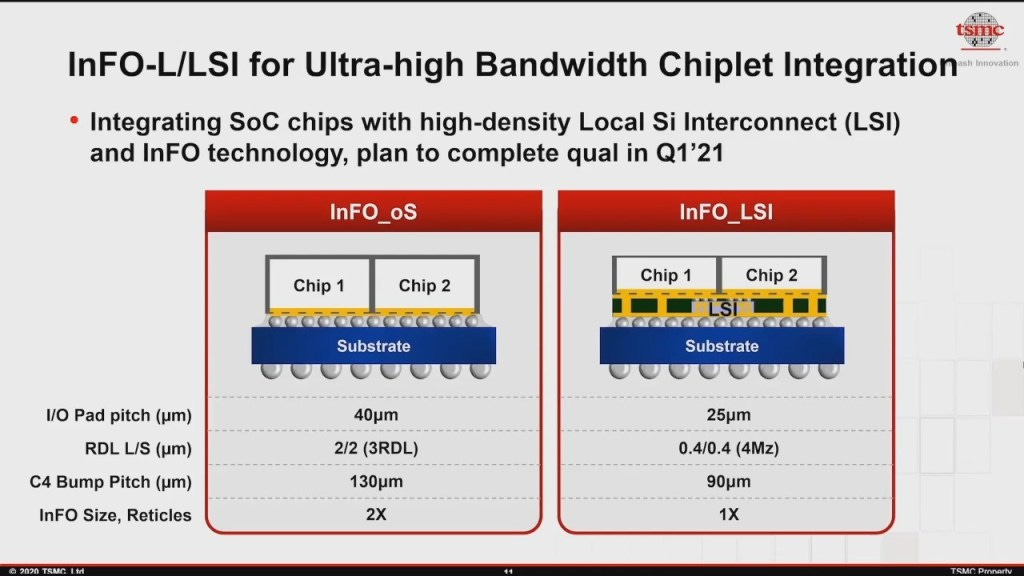

Packaging is very complicated. I want to hammer home this point. Nvidia is not fast-tracking a fan-out (InFo) derivative of GB200 (CoWoS) for fun. The engineers working on this effort are in omega crunch mode right now.

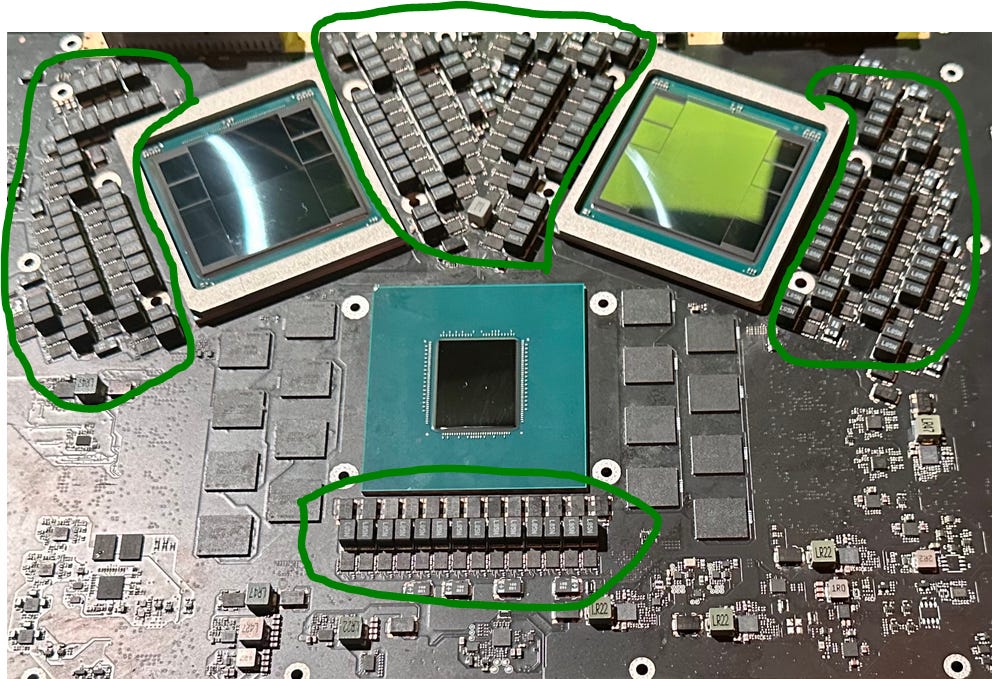

Here is a picture of the CoWoS GB200 board. All of the stuff in the green circles represent power delivery components. The blocky things are inductors, commonly referred to as “chokes”. Flat rectangles are power-stages. Modern-high-end power stages are typically rated for 70-90 amps. Nvidia runs Vcore at ~1 volt +/- 100 mV. At first glance, it appears that each Blackwell (700W TDP) only needs ~15 power stages to have sufficient margin.

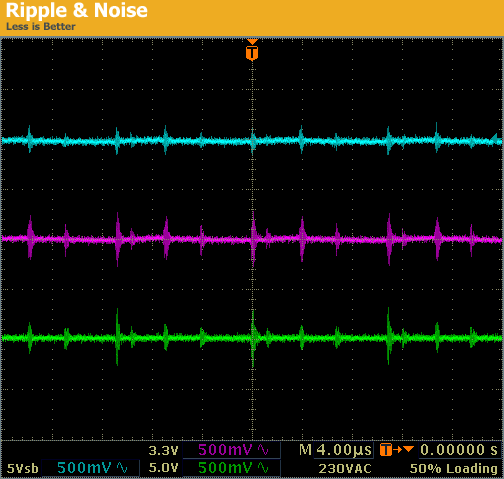

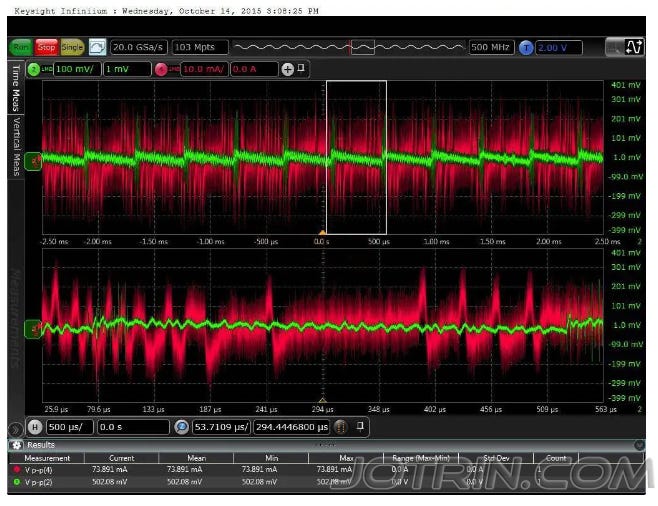

We have a lot more than 15 power stages. It is very common to run many power stages out of phase at much lower current to get better VRM (voltage regulator module) efficiency and cleaner ripple.

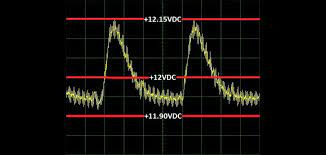

The stability of digital logic (the GPU itself) depends on how clean the input DC supply rails are. Enormous effort is needed to get this right.

All of the following need detailed power integrity (PI) design, simulation, and analysis:

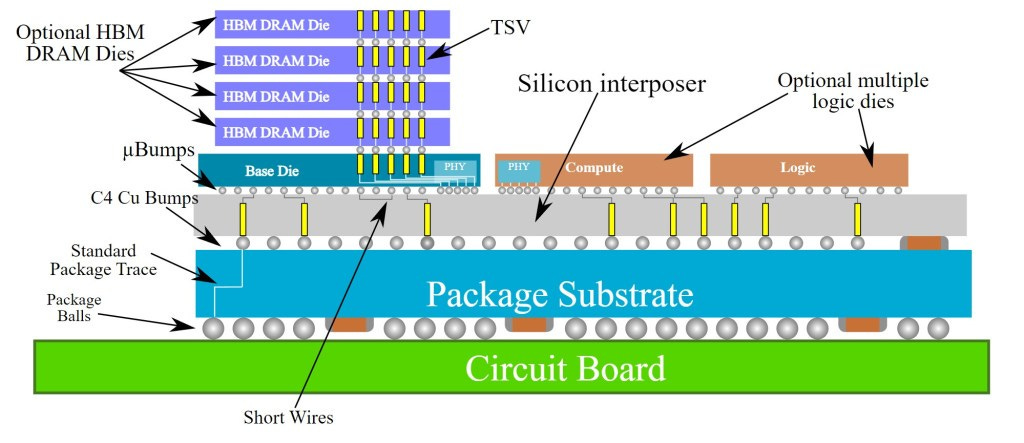

PCB

Substrate (organic)

RDL (organic)

Interposer (silicon)

Then you have to deal with signal integrity (SI) of three separate high-speed, densely packed I/O… ON ALL PREVIOUSLY MENTIONED ITEMS.

NVlink C2C (Blackwell package to Grace)

NVlink D2D (Blackwell die to Blackwell die)

NVlink (200G Ethernet-style SerDes)

Re-doing all of this work for Blackwell as a mid-generation derivative only makes sense if Nvidia expects massive demand that cannot and will not be met by CoWoS capacity.

Nvidia’s incredible packaging speedrun is a gigantic blaring signal that GB200 NVL36/72 integrated mainframe share within Blackwell generation will be incredible.

Part 2: ARM’s Rocket Ship

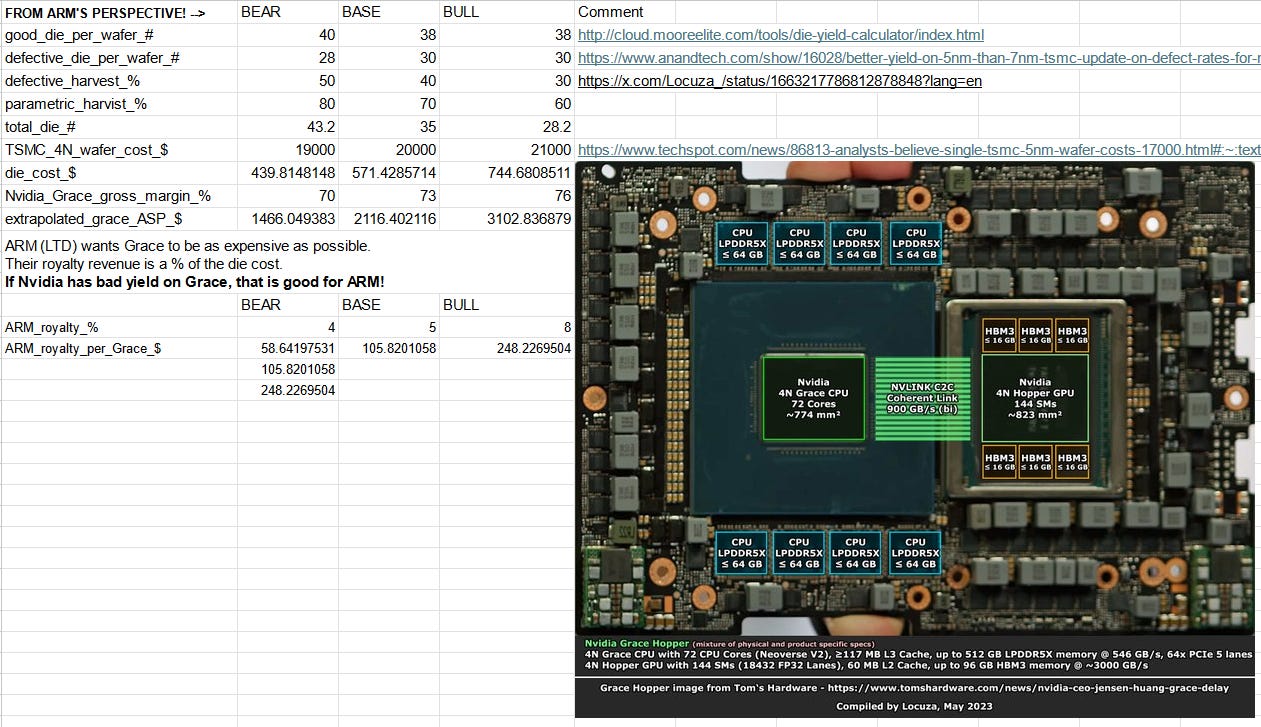

Here is my COGS model for Grace.

For base/bear/bull it is important to recognize that ARM (LTD) wants Nvidia Grace to have bad yields.

Bad yield —> Higher COGS —> Higher ASP because Nvidia has fixed target gross-margins.

Here is the infrastructure revenue ARM (LTD) could see JUST FROM GRACE!

There are plenty of other ARM-based CPU and DPU product lines ramping in datacenter right now.

Nvidia Grace could single-handedly shatter sell-side expectations for ARM (LTD)!

Feel free to download and play with the ghetto spreadsheet using your own assumptions. :)

![[GB200 NVL72] The Mainframe of Doom](https://substackcdn.com/image/fetch/$s_!_hFr!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9b4c8e16-a994-40a1-a08d-07d4a9448536_647x846.png)

Thanks for the interesting take when most seem to think that ARM is overvalued.

I'm curious to see what you and others think about why someone didn't buy Nuvia for their actual ARM server CPU design and instead Qualcomm snagged them who had infamously scrapped their server CPU efforts a while ago.

Why would any of the hyperscalers not want a world class design team actually designing an ARM server CPU? I know a server CPU is a lot more than just the main CPU core, but all of them have internal efforts anyway. Maybe not Amazon since they bought Annapurna a while ago, but it could have been a good fit for the others.

Were they afraid of Apple and the Apple lawsuit? They just want to focus on power efficient ARM CPUs and expect AMD to be good enough at the high end? They expected ARMs own designs to catch up? Only the legal team at Qualcomm had the chops to stand up to Apple?

Thanks very interesting. Though the calculation of royalty/Grace CPU seems high. Royalty/core is 50c-$1 in infrastructure segment and ARM said Cobalt 100 gets to the top end of $1 because it's a subsystem with 2x royalty so Nvidia will be towards the bottom end. Suggests possibly $37 of royalty content/Grace CPU (74 cores x $0.5 per core). Makes material upside near-term difficult even with a lot of units. And if you think that kind of upside is possible you should probably stick to Nvidia because that's way ahead of consensus! Any pushback?