Intel's Terrifying Future

A tale of two IDMs...

IMPORTANT

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

DO NOT SHARE INSIDER INFORMATION OF ANY KIND IN THE COMMENTS SECTION. (Leaked info or rumors from **other** corners of the internet is ok)

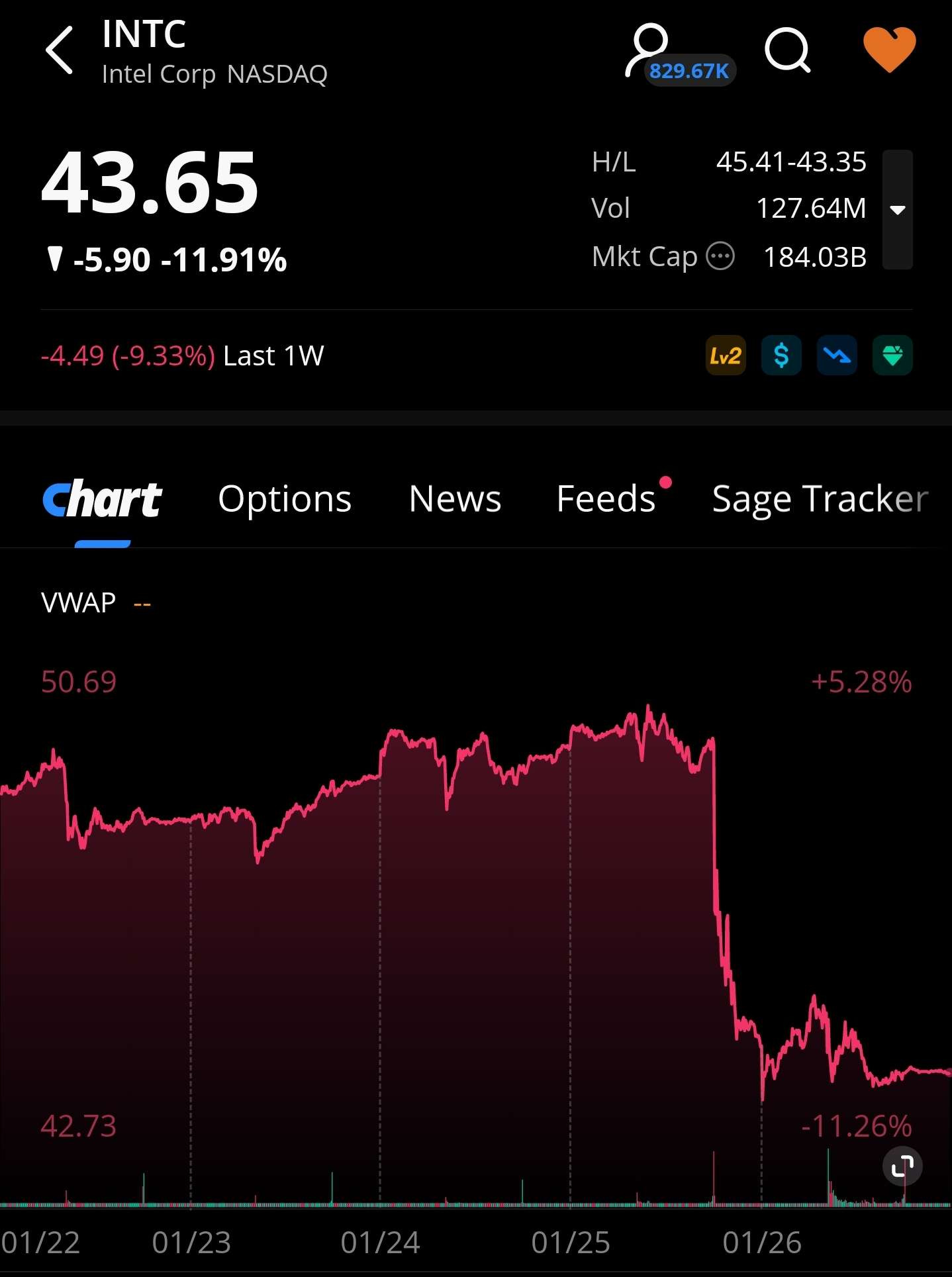

So… Intel had a bad week. Their earnings and guidance were really bad, and the stock dropped 12% in one day.

I will get to the actual report, earnings call analysis, and so on later.

.

.

.

IDM stands for “integrated device manufacturer”. In other words, a semiconductor company that designs and prints their own chips.

“Real men have fabs.” — Jerry Sanders (ex-AMD CEO)

In the old days, there were many companies that operated as IDMs. This operating model has several massive benefits.

Much higher gross margins due to vertical integration.

Higher operating margins with SG&A unification.

The ability to customize process technology for the singular (internal) design team.

As of 2024, there is only one IDM left: INTC 0.00%↑ .

To understand what is going on with Intel in the present, we must take a look at what happened to AMD.

AMD: The Other IDM

For most of its history, AMD operated as an IDM just like Intel. This operating model worked for a long time and allowed AMD to enjoy all of the aforementioned benefits, until it didn’t.

The IDM model has a major weakness: management complexity.

Chip design and chip manufacturing are very different from both business and engineering perspectives. As the complexity of these two fields continued to explode throughout the 1990s and early 2000s, it became untenable for companies to successfully execute and manage both of these functions for complex logic chips built on leading-edge nodes.

One by one, IDMs fell and executed breakups, deals, and divestitures. As of 2024, Intel is the only leading-edge logic IDM left. A handful of smaller companies still operate under the IDM model, but they all use lagging-edge specialty nodes for analog devices.

In 2008, AMD faced their reconning. They were already underperforming with mediocre products and losing market share to Intel. The global financial crisis added fuel to the dumpster fire that was 2008-AMD.

On October 7th, 2008, AMD announced what was once unthinkable. They were going fabless. Six months later, Global Foundries was born.

*Note: The great AMD/GloFo split is a fascinating topic that deserves much more depth, but I want to get back to Intel’s situation ASAP.

The great divorce of 2009 was caused by two major factors:

Household financial stress.

Underperformance of one partner. (AMD fabs in this case)

So… a typical divorce.

AMD’s process technology group, Hench forth referred to as GloFo, was consistently failing to keep up with Intel. AMD management had failed to get them in-line and hoped the scrutiny imposed on a now separate GloFo would help resolve this problem.

Obviously, both AMD and GloFo remained highly dependent on each other. And so, the infamous Wafer Supply Agreement (WSA) was born. This agreement was updated many times over the years but here are the high-level details.

AMD was required to purchase a large number of wafers per year from GloFo.

If AMD failed to buy enough, they would be hit with punitive financial penalties.

Due to demand for AMD products collapsing, there were several years where AMD had no choice but to (almost) single-source wafers from GloFo.

If GloFo ever suspended leading-edge process development, the WSA would be re-negotiated as much lower volume.

Unfortunately for AMD, GloFo continued to underperform after the spinoff. This led to a re-negotiation of the WSA where minimum yield targets must be met by GloFo. In other words, GloFo would be financially responsible for their own incompetence if yields continued to suck.

GloFo kept failing anyway. ATIC (Abu Dhabi investment fund, largest shareholder) fired the entire management team.

CEO, COO, and board chairman all fired in one day with no notice.

Over the coming years, both AMD and GloFo went through hell. In many ways, the WSA held AMD back and forced them to make bad design choices (Bulldozer uarch) out of necessity.

Thankfully, AMD was given an escape route. In 2018, GloFo announced they would be leaving the leading edge and winding down their 7nm-class node efforts.

AMD promptly re-negotiated the WSA and moved the vast majority of their volume to TSMC.

Today, both AMD and GloFo are healthy companies. Their journeys were turbulent and painful, but they survived. Arguably, AMD is thriving from the Zen and CDNA3 renaissance(s) under Dr. Lisa Su’s leadership.

But what if the breakup never happened? What if 2008 AMD management was able to get the fabs back in shape, retain their IDM status, and reap the synergistic benefits?

From a financial perspective, a unified (IDM) AMD would have resoundingly outperformed fabless AMD + GloFo… if management could get all groups accountable and performant.

They could not.

This brings us to modern Intel.

Intel’s Disastrous Guidance

On January 25th, 2024, Intel reported their Q4 FY2023 earnings. It was a disaster because of horrible guidance.

Guided revenue midpoint is 12.7B while sell-side estimate was 14.3B.

Let’s go through the earnings call transcript before I share my opinion on what is happening.

PSG Red Herring

Right at the beginning of prepared remarks, Intel’s CEO blamed PSG (FPGA/Altera) as one of the reasons guidance is low,

However, discrete headwinds, including Mobileye, PSG, and business exits, among others, are impacting overall revenue, leading to a lower Q1 guide.

CFO also throws PSG under the bus in his prepared remarks.

The server business delivered double-digit growth sequentially, partially offset by the FPGA inventory correction.

The sell-side analysts are having none of this. :)

Joseph Moore -- Morgan Stanley -- Analyst

Great. Thank you. I wonder if you could talk about the data center decline in Q1. How much of that is a function of the weakness in FPGA that you've talked to already? And then just any sense of what the cloud and server environment is like in the first quarter?

Pat Gelsinger -- Chief Executive Officer

Yeah. So, overall, when you act -- obviously, we've spoken separately about the FPGA business, so let's just move that to the side. Overall, I'll say it's fairly seasonal quarter to quarter and what we expect. That said, we're seeing strength from our server customers.

For instance, more of the OEM response is strong with regard to the momentum they're seeing in the enterprise server business. And obviously, our product line is improving there. We do expect year-on-year growth here. We see our market share stabilizing.

Obviously, as we're ramping Gen 4, Gen 5, Granite Rapids, Sierra Forest, the momentum is building for us overall. And as we indicated, hey, we think more of the AI surge is going to result in AI inferencing on-prem, which we're well positioned to be a beneficiary. I would just cite that here we are in year 20 of the public cloud, and you have 60% plus of compute in the cloud, but 80-plus percent of data remains on-prem, right? Customers want to realize the value of that on-prem data with AI, and that's an enterprise strength for Intel. So, we do see all of these trends giving us a very favorable outlook for the year.

And there's nothing surprising about the Q1 guide here, and we're going to be very focused on beating those numbers and building on the momentum of improving product line.

Intel’s datacenter segment is showing severe weakness as Nvidia and AMD rapidly grow. CPU TAM is getting crushed by GPU CapEx cannibalization from both Nvidia and AMD. Within CPUs themselves, AMD continues to aggressively gain market share at higher gross margins.

On-perm AI inferencing will be Nvidia and AMD GPUs, not Intel CPUs.

Morgan Stanley analyst is subtly calling out Intel management. He is politely implying that FPGA/PSG weakness cannot explain the numbers. There must be share losses in core CPU.

Intel CEO gives a classic deflective non-answer and claims that everything is fine, Seasonality, expected, no market share losses, … nothing to see here.

BoA analyst smells blood in the water from Morgan Stanley analyst’s question and moves in for the kill.

Vivek Arya -- Bank of America Merrill Lynch -- Analyst

Thanks for taking my question. Pat, I'm curious now that we are a year into the generative AI deployments, what's your view on how cloud customers are thinking about the capex between traditional and AI servers? Because when we look at the revenue growth across your GPU competitors, they seem to be capturing nearly all of the incremental capex and in some cases, ****even more than***, right, just the capex as the public cloud company. Does that really leave much room for your CPU business to grow, right, beyond just the seasonal variations? So just how are you looking at the AI market overall? And what part of that is Intel really able to capture when we just look at how much is being or needing to be dedicated to your GPU competitors?

Vivek Arya (BoA) has been consistently asking the sharpest questions. Here, he frontloads several blunt facts into the question to box Intel CEO in. I did not include Gelsinger’s response because it is a waste of time pile of corpo speak. He has no real answer because BoA analyst is spot on.

All the datacenter TAM growth is going to the competition.

Existing TAM is also bleeding to the competition. (“even more than” comment)

Funny Moments

Intel continues its mission to bring AI everywhere. We see the AI workload as a key driver of the $1 trillion semiconductor TAM by 2030. And given our foundry and product offerings, we're the only company able to participate in 100% of the TAM for AI silicon logic.

Here is a rough TAM breakdown of AI silicon logic:

90% TSMC+Nvidia+AMD

9.8% TSMC+Broadcom+Marvel+ALChip+Microsoft

0.1% TSMC+Habana/Intel

0.1% Samsung Foundry + Various Startups

Who is stupid enough to fall for this “100% TAM participation” comment? lol

Ross Seymore -- Deutsche Bank -- Analyst

Hi, guys. Thanks for letting me ask you a question. Have a near-term one and then for my follow-up, it will be a longer-term one. So, the near-term one is on the demand picture.

Dave, you were helpful in breaking up the kind of the noncore impacts in the first quarter versus the core, but the low end of seasonality is a little bit of a surprise, given that cyclical pressures seem to have been abating and some of the market share trends should have been in your favor, at least also not worsening. So, can you just talk a little bit about why you're at the low end of seasonality in the first quarter for your core businesses? And what gives you confidence in super seasonality thereafter?

The very first question is hilarious. Sell-side analysts are generally good at forecasting macro trends. Consumer electronics (especially laptop/PC) has been recovering quite nicely. Deutsche Bank analyst is overtly challenging the “seasonality” excuse that Intel management is trying to push.

The numbers scream share losses.

Intel management is denying this.

Nobody believes them.

A Tale of Two IDMs

For the first time in its 56-year history, Intel is separating out P%L of it’s design and fabrication units. This is what “internal foundry model” means.

Intel CFO brought this up on the call.

We're excited to mark the first month fully operating under our new internal foundry reporting structure with improved accountability, transparency around cost and value drivers, and increased focus on driving higher rates of return for our owner's capital.

We intend to provide you with the recast historical financials this quarter in the form of an 8-K. We will unpack the details at that time, but you will see not only the first view of our manufacturing P&L but a view of our products group more in line with external peers.

I am super excited for this 8-K filing. Have big plans on covering this topic, Meteor Lake, and Pat Gelsinger’s tenure as CEO.

“Gelsinger’s Odyssey”

Modern Intel is facing the same problem AMD classic faced 15-20 years ago.

The IDM model brings great rewards and greater managerial challenges. It is extremely difficult to manage the performance and technical roadmap of chip design and chip fabrication under one unified company.

Why is Intel breaking out separate P%L? Accountability.

For many years, the factions within Intel have been blaming each other. Delayed products, expensive re-spins, excessive hot lots, and almost zero accountability or improvement.

Since Gelsinger became CEO in early 2021, he has fired a lot of higher-ups and worked hard to enforce accountability. Process tech (manufacturing) group has really turned things around under Dr. Ann Kelleher’s leadership. On of Gelsinger’s first acts was to promote and empower Dr. Ann Kelleher to lead all of manufacturing. Previously, she led the production fabrication group which was separate from the research division. TMG (research, mostly Oregon) had bad leaders who behaved in an arrogant, stubborn manner. The 10nm fiasco was largely due to leadership, not engineering.

Competent, accountable leadership makes all the difference. Intel’s manufacturing division is executing at the highest level.

The turnaround is real… but is it too late?

AMD tried to get their manufacturing division accountable by spinning them out into a separate company, GloFo.

Intel is trying to get their design division accountable by separating out P%L. This is a great idea, but this quarters horrible guide suggests it might be too little too late.

Datacenter revenue is imploding due to CPU TAM obliteration ****AND**** ongoing share losses against AMD. None of the rumors for next-gen datacenter CPUs inspire confidence in Intel’s chances of retaining market share or gross margins.

Laptop/PC/client revenue accounts for most of the guidance miss.

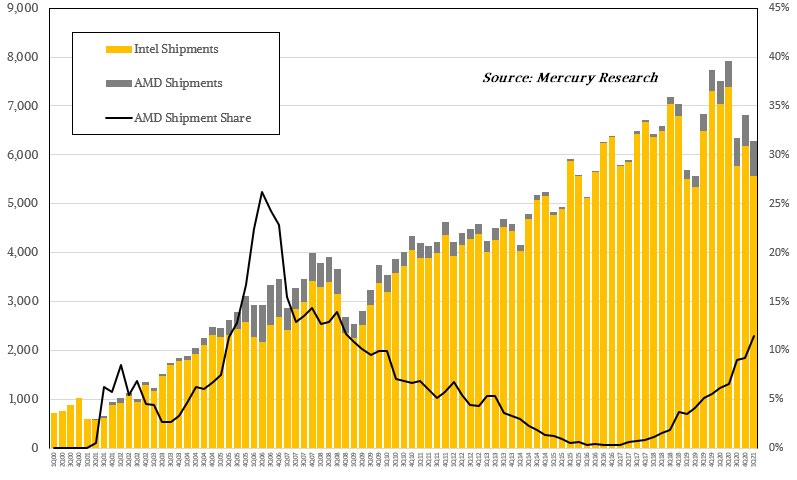

This market used to be 99% Intel, 1% AMD.

When Apple went vertical and AMD began its recovery, market shifted to 70% Intel, 25% Apple, and 5% AMD roughly.

Clearly, AMD has gained much more share in 2024 now that they are taking their laptop chip lineup seriously. Qualcomm is entering the market with their first competitive product in H2 2024. Nvidia, Samsung, and MediaTek are strongly rumored to be entering the PC market in 2025 once the (alleged) stupid exclusivity WoA agreement between Qualcomm and Microsoft expires this year.

There is no way Intel CCG defends their existing market share and gross margins over the next two years.

Even worse is the mediocre performance and power efficiency of the latest generation, Intel Core Ultra aka “Meteor Lake”. I am still digging into this, but it appears that various factions within Intel design lied to each other and upper management.

Perf/watt is underwhelming.

Raptor Lake refresh (last-gen) appears to outperform Meteor Lake in some scenarios. (IPC regression?)

The launch was delayed to the second half of December 2023, with no real availability.

Ring bus is underclocked.

Multiple firmware bugs.

AMD’s upcoming product line (Strix) and maybe even Qualcomm’s X Elite (Hamoa) look like they will resoundingly outperform Meteor Lake in absolute performance and battery life.

As investors start to digest the separate P%L numbers for Intel design and Intel manufacturing, they might start to notice a trend.

One group (design) consistently underperforms but generates cashflow while the other group (manufacturing) is rapidly growing revenue while improving margins.

This is the kind of situation where activist investors come in to force a breakup and loot the remains of a once great company.

Activist investors are vultures. They want to eat their pound of flesh and move on to the next wounded animal/company.

Pat Gelsinger is aware of this. He knows what is coming. Vivek Arya (BoA) has overtly asked why a breakup has not happened already.

Intel management’s defense can be summarized as the “pipe cleaning” synergy. When a semiconductor foundry/factory has a new process node, they need a design partner to be the lead customer for “yield learning”. In other words, a high-volume customer who is willing to accept lower yields and help improve the process node. Intel argues that design and manufacturing must remained unified to keep this large internal “customer” for yield learning.

The problem with this argument is Apple has been TSMC’s lead customer for many years. Their “pipe cleaning” relationship works very well.

If Apple (design) and TSMC (manufacturing) can work together **as separate companies** on yield learning, then why does Intel (design) and Intel (manufacturing) need to be unified as one corporation?

As Intel’s core business (pun intended) continues to decline, it’s going to get harder and harder to defend against the inevitable activist/breakup pressure.

In 2008, AMD spun out their manufacturing group into a separate company, GloFo. Managing a unified IDM was deemed impossible. After many years of turbulence and several near-death experiences, both companies survived and are functioning/healthy.

In 2024, Intel is trying to convince themselves and investors that managing a unified IDM is still possible.

What if they are wrong?

Can Intel design survive as a standalone company? I don’t think so.

Intel has a terrifying future.

IDM will fail even if management is competent. Underlying causes are lack of scale for fabs with just one customer, too much variability with just one customer, too little diversity in learning future processes with just one customer, and an immense mismatch in the financial structure of the two different businesses which attract different investors and practices. Increasingly disparate staff skills and career paths. It is just one big "why?" after another. The best part of your AMD warm-up was highlighting the crucial role of the WSA.

Intel's plan was made wobbly by the damage caused by 5 years of mishandling the 10/7nm disaster, in a way which weakened the design side too. But they were recovering and arguably would have had enough to divide up with AMD this year .. except for AI and Nvidia train running through the middle and sucking up all the customer investment and engineering talent focus, putting the traditional CPU business in the doldrums. Hey, sucks to be building any DC CPU when AI is the hotness.

AMD of course seems to be responding to the AI challenge better, despite Intel having done some of the right things on packaging and chiplets. And then AMD in the CPU doldrums can still feel good about growing from 5% to 25% of a yawn, while Intel sees only down.

I sure hope IFS can stand on its own before the vultures start ripping. If so, then both halves will probably emerge standing, just different.

So when do the activists get involved and break up the company? Is the sum of the parts greater than the whole?