Intel 4Q2024 Preview: The Piranha's Smell Blood

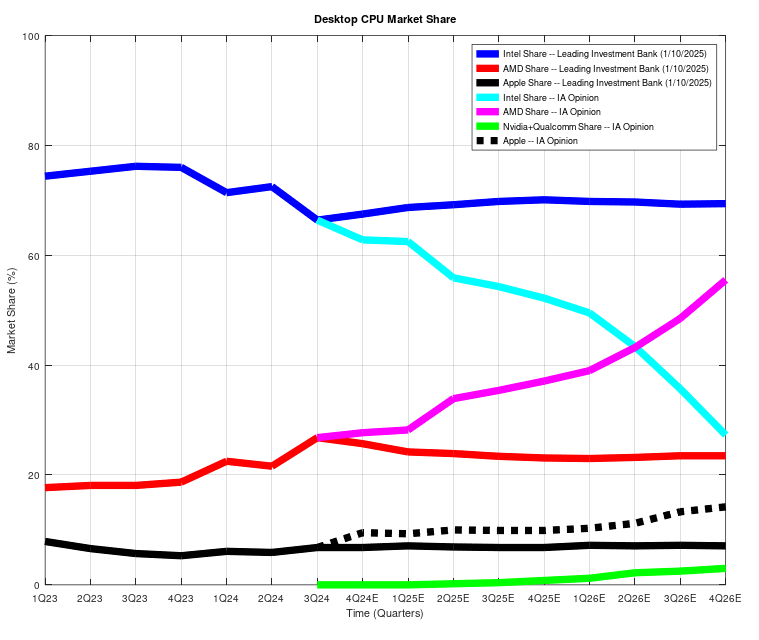

Opinions on the next two years of client/laptop/PC market share.

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Welcome to another low-effort weeknight shitpost.

There is a super exciting project I have started prep work for. It will take at least two more months.

For very large projects like the “Background-Proof” series, I typically spend 1-3 weeks just thinking about the structure and flow. In other words, editing the table of contents. 🤡

Then it takes 2-6 months to fill in the skeleton.

Today’s low-effort post is to roast Intel and investment bankers, two of my favorite hobbies.

Today’s content is brought to you (inadvertently) by a leading investment bank who’s model I have access to. This spreadsheet was updated on 1/10/2025 and has some super interesting stuff.

Let’s talk about Intel desktop, laptop, and datacenter CPU market share.

Desktop:

Problems I have with the leading investment bank model:

Having non-AMD + non-INTC market share as flat.

Historically, TAM - Intel - AMD = Apple.

Apple is going to grow…

Nvidia and Qualcomm both go from 0% to something.

Intel re-gains market share over the next two quarters then becomes stable?

Really guys?

From product quality alone, AMD is clearly going to gain meaningful share over the next two years.

There is no way Intel has stable market share in desktop. Where are these numbers coming from? Even if you have AMD as flat market share, Apple + Nvidia + Qualcomm are going to at least get 2-5% incremental market share by 4Q2026.

Laptop:

Problems I have with the leading investment bank model:

Intel share is again flat from 3q2024 through 4Q26E.

WHY?

In which reality does this assumption make sense based on product quality deltas? Not this one!

Qualcomm laptops are not that bad. They are going from 0.2% market share to mid-single digits. This is a pessimistic view. Good execution gets more share.

Apple is going to continue gaining share. If I was not dependent on Windows for engineering software and video games, I would have switched by now. Modern “Windows update” is malware. Literally have been forced to re-format OS drive more often because the clowns at Microsoft decided I would be a beta tester for their broken ass patches than actual viruses since Windows 10.

Nvidia is going from zero to some decent market share. Brand power and functional GPU drivers will lead to a much better ramp than Qualcomm X Elite.

Datacenter (CPU):

Problems I have with the leading investment bank model:

Intel share loss is not happening fast enough.

Other (dominated by hyperscaler ARM CSS chiplets) is growing way too slow.

If vertical solutions are excluding from the TAM assumption, then ok fine.

AMD deserves much more growth. Turin is so much better!

Nvidia counts as merchant silicon and will clearly gain mid-single digits market share over time.

You know who agrees with me?

The former Chief Architect of Intel Xeon! Yet another Intel lifer who has found a lifeboat and taken it.

What makes this hilarious is that he joined Qualcomm’s 3rd (yes really) datacenter CPU team.

Qualcomm’s 1st datacenter CPU design team was called Centriq and they were all fired in 2018. Cristiano Amon, the current CEO, was President at the time and was directly involved in this decision.

Qualcomm’s 2nd datacenter CPU design team is from the Nuvia acquisition in 2021. The people working on the server chip were fired or quit in 2022-2023. Cristiano Amon, the current CEO, was directly involved in this decision.

This dude is like….

yes

Qualcomm datacenter CPU team #3

💀 job security 💀

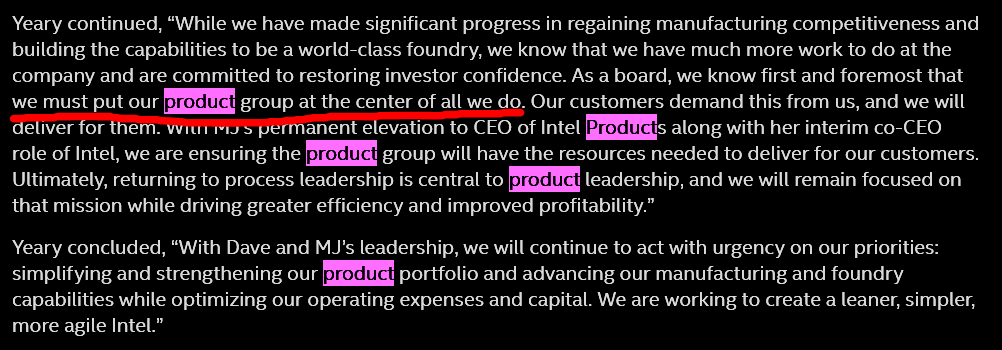

The engineers are leaving! Intel should not be a product-first company! The products are doomed! Fabs are the only thing of value and must be saved!

Why does this idiot still have a job? Why is he still chairman of the board?!

Bring Gelsinger back! Make him chairman of the board and pick someone else as a CEO. Gelsinger is viewed by the investment-class as a failed CEO. Ok fine I won’t argue this today. But he tried his best and is uniquely qualified. Infinitely more qualified than this Yeary idiot. Make Gelsinger chairman of the board and pick a new CEO with better execution. The strategy was right! It’s the only way Intel will live.

DISCLOSURE: I am an Intel shareholder now and have had AMD and Intel stock before. I am NOT A FINANCIAL ADVISOR, I only studied CompSci.

Qualcomm hiring someone who refused to move to chiplets while the house was on fire, doesn't really bode well for a 3rd attempt. That Sapphire Rapids he has in hand wasn't exactly a star product either (maybe second worst to Ice Lake SP).

I would say that both yours and the bankers are extreme scenarios. AMD is starting to push premium markets and negleting mainstream chips. That is not how they will grab significant marketshare, but they are pushed to do so because the share price commends so much premium.

What I have recently been wondering about this, is that AMD is putting a lot of cutting edge chips on Chinese junk brand mini-PCs. The latest one won't even be out for a while. This is not common, they were usually stuck with 2y+ old products.

To me this is a pretty clear indication that both datacenter and laptop demand is quite low compared to other years, that AMD doesn't know what to do with pre-ordered wafers.

Maybe it is just an internal miscalculation thing, but market share gain doesn't seem to be going accross the board.

I was actually very surprised by the latest Intel earnings and missed on the bump post-earnings - as I was not expecting good things for the sector, generally. DRAM demand was bad and continues to be.

But yet, despite positive reactions, prices have again dropped to last year's lows. It is a very volatile stock and anyone touching it needs to keep that in mind.

The laptop marketshare seems a bit too aggressive, intel for whatever reasons have very good relations with laptop makers, and AMD has failed again and again to supply that market with enough chips. Also if you follow the CES coverage once again intel dominates the laptops, its almost exclusively arrow lake for high performance gaming laptops, even the x3d chip which is most likely going to be the best gaming chip by a mile isn't going into 5090 laptops and is stuck at a 5070ti laptop. On the server side they are the most competitive they have been in ages so they may retain share better than expected and they are still the default for head nodes in AI servers. But how much faith can anyone have in their server roadmap really, pat getting fired just like that is not a good sign.

That we are focusing on products thing is soo stupid as well, as if intel didn't have the resources to focus on both products and IDM, as if they didn't have much more resources than their competitors. what does that even mean we will focus on products, someone is going to come into the boardroom and say what if our products weren't shit, and everyone goes wow we never thought of that.