Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

CES 2025, the Consumer Electronics Show, had some very important disclosures by INTC 0.00%↑, AMD 0.00%↑, and NVDA 0.00%↑.

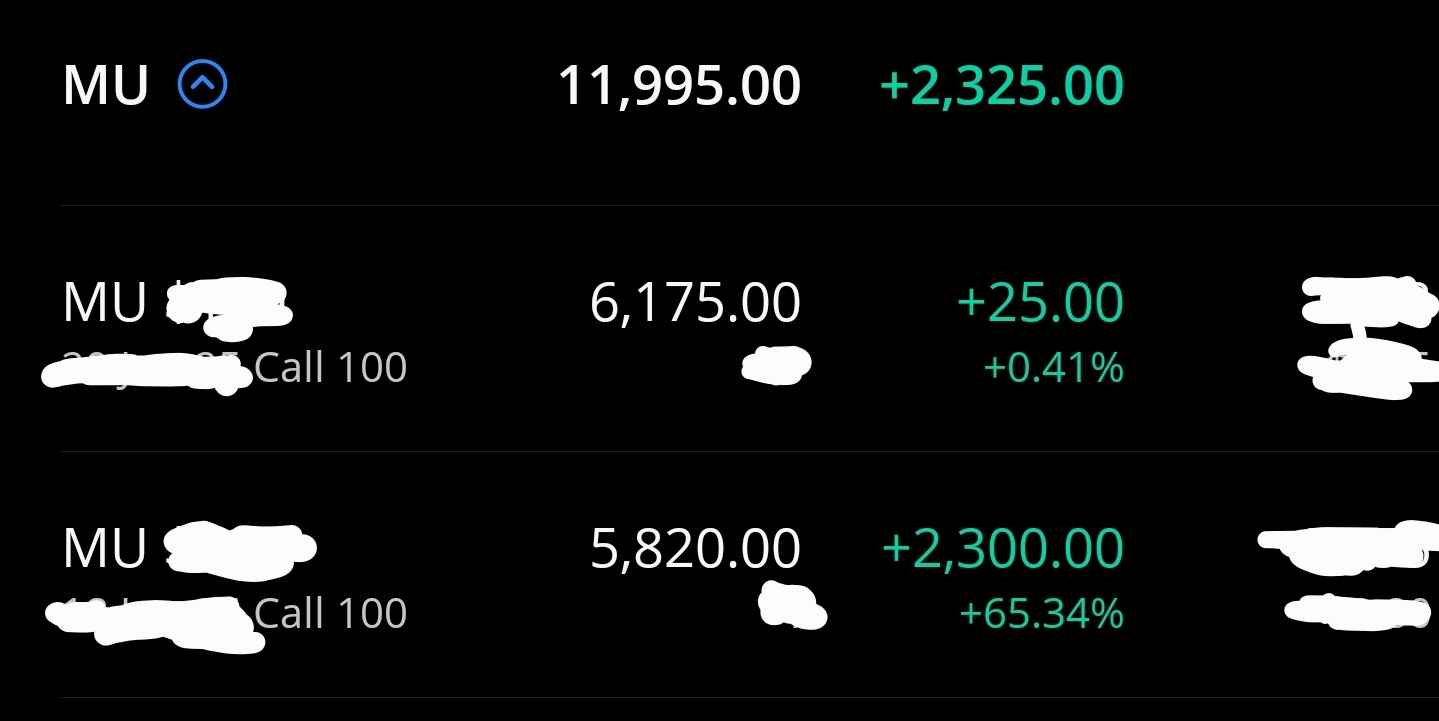

I have a variety of relevant options positions active at the time of writing.

Too lazy to update the spreadsheet.

Nvidia and AMD options are for datacenter reasons. Have something in drafts and will cover that thesis later. Also… the DOJ actions against CXMT and Jensen’s comments on Samsung HBM3e are amazing for SK Hynix and Micron. A lot of risk went away in the last 48 hours.

Currently have ~$12 worth of Micron options and intend to buy more at various strikes. Closed an earlier strike portion after the CXMT news to take profit and de-risk. Due to volume/liquidity concerns, I do not want to share which strikes and expirations. Ethically problematic.

The Intel puts are because of what was disclosed at CES.

Let’s get started.

Contents:

Pathetic Lunar Lake Ramp

Dell + AMD Partnership (reading between the lines)

Nvidia Digits (ARM) and Apple Silicon MacBook’s: The new development platform does not need x86!

Bloomberg Consensus, Charts, and a OTM Options YOLO

[1] Pathetic Lunar Lake Ramp

This is terrible. For context, lets estimate what percentage of Intel client shipments Lunar Lake represented.

Assumptions:

Q4 2024 client (desktop + laptop) shipments were ~= Q4 2023 given the sluggish PC market. Micron and Samsung have both said PC is weak.

All 1.5 million units of Lunar Lake were shipped in Q4 2024 given the timing of launch (September) and the holiday season.

Intel has 80% in x86 versus the 20% share of AMD.

All ARM-based shipments are Apple because Qualcomm is still a rounding error.

This 1.5mU number is horrendous. Why did Intel choose to share this?

Intel has invertedly confirmed Semianalysis reporting!

Remember when Intel reported horrendous gross margins and blamed the “AI PC accelerated ramp”? That was Lunar Lake. A pathetic quantity of Lunar Lake.

Really Zinsner? How the hell is 3% of your client volume IN THE LAUNCH QUARTER “all-in”? Have you ever played poker before?

Intel 10nm (rebranded to Intel 7) is on par with TSMC N7, an obsolete node that nobody is using for power-sensitive applications.

INTEL IS ALREADY IN ULTRA DESPERATION MODE.

ITS GOING TO GET SO MUCH WORSE.

AMD GAIN SIGNIFICANT SHARE.

APPLE GAIN MORE SHARE.

QUALCOMM GO FROM ROUNDING ERROR TO MEANINGFULL MID-SINGLE DIGIT SHARE.

NVIDIA/MEDIATEK GO FROM ZERO TO SIGNIFICANT (5-15%) SHARE IN 2025.

[2] Dell + AMD Partnership (reading between the lines)

Dell, a historical Intel-only shop has partnered with AMD in a big way… on enterprise laptops.

This is incredibly important. Professional industry analysts have called this out first.

Intel has disproportionate market share in enterprise laptops because of vPRO.

This vPRO feature is essentially a set of software tools built on top of Intel Managment Engine (ME).

ME is essentially a hardware rootkit. vPRO is a set of software tools that let corporate IT departments managed large fleets of machines.

Remote wipe lost/stolen laptops.

Deploy mandatory OS and software patches.

Check if an employee decided to copy restricted files to a USB stick.

… much more

AMD has not had a comparable solution. Now they do. Dell is helping them sell it too which is huge.

Why would Dell do this?

An easy explanation is the recent Intel 13th and 14th gen (Raptor Lake) epic failures. Intel botched reliability testing and these chips started failing at alarming rates in the field.

OEMs like Dell sell millions of laptops per quarter. They have a lot of historical failure data. Here are some examples from the Dell mega leak.

Dell modeled how many extra support calls they expected for the Qualcomm version of their product.

Dell found that a mistake in touchpad engineering/integration led to a 0.8% failure rate of the previous model (Meteor Lake XPS) within one year of shipments.

Intel tried to cover up the Raptor Lake epic failures claiming the problem is not that bad and be fixed by microcode. OEMs like Dell are not falling for this. They know how to root cause field failures.

From ~2007-2017, every CPU AMD made was e-waste on launch. It took years for AMD to rebuild their reputation. Intel is now the incompetent x86/CPU partner. Dell is partnering with AMD because they no longer trust Intel.

[3] Nvidia Digits (ARM) and Apple Silicon MacBook’s: The new development platform does not need x86!

Nvidia Digits is an incredible developer platform.

If I was running an AI/software startup, ever developer would get one of these machines and an (ARM) MacBook as standard issue IT equipment.

The x86 moat is dead. Almost every programmer I know uses an ARM-based MacBook. Nvidia Digits is the final nail in Intel’s coffin.

[4] Bloomberg Consensus, Charts, and a OTM Options YOLO

The rows that matter are gross margin % and revenue. I think both are wrong given the disastrous Lunar Lake volumes and rumored 10% yield on Panther Lake CPU chiplets due to horrific parametric yield.

Inte’s upcoming earnings call will probably be a circus. Two non-technical co-CEOs leading a dying company with utterly uncompetitive products. A company hemorrhaging share to AMD, Apple, Nvidia/MediaTek, and Qualcomm.

When Intel management say that margins will improve as Panther Lake ramps on internal (18A) wafers… why should you believe them? If the yield is shit, the margins can easily be worse than external TSMC N3 wafer based products.

Why is Intel preparing more 10nm (Intel 7) products? Maybe that 0.4 D0 number is a bullshit distraction. Maybe parametric yield is a disaster?

Intel is a going concern. Wall Street just does not realize it yet.

You’re truly a bold person. I could never even think of shorting Intel.

What if, by any chance, 18A succeeds? What if someone like Liang Mong Song suddenly appears at Intel and revives their process? That kind of uncertainty keeps me from going long or short on Intel.

But one thing is certain: Intel’s long-term outlook doesn’t look good. They’re selling off the companies that Krzanich acquired, and the x86 moat is undeniably crumbling, as you pointed out.

Do you think Intel has any way to recover?

I am very excited about DIGITS. Maybe I could get a second-hand unit in few years for personal play :-)

This could move copilot-level LLMs out of datacenters and into private server rooms of businesses. Improved security and response time, opportunity for new hw/sw providers of customer-adapted solutions.

In my (rather pessimistic) opinion, the various copilots are the only AI tech which might be profitable & makes sense.