Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Welcome to earnings roundup, Halloween 2024 edition.

Today’s coverage is of QRVO 0.00%↑ ONTO 0.00%↑ AMD 0.00%↑ INTC 0.00%↑

Qorvo:

Normally, I don’t care about meh RFFE companies like Qorvo.

But this chart is too funny to ignore.

Let’s explain the factors driving this disastrous guidance.

QCOM 0.00%↑ has 100% share in the Samsung Galaxy S25 series and has gained RFFE content via bundling with the modem.

Apple is ramping up their internal 5G modem and this will result in RFFE content gains for AVGO 0.00%↑. (Note: RFFE != WiFi baseband)

Smartphones are becoming bi-modal, with premium and cheapo tiers taking permanent share from midrange.

Cheap phones have become really good.

Either buy the lowest common denominator or go for flagship.

Do not buy the dip on this one. Qualcomm and Broadcom have Qorvo in a brutal pincer situation. Share losses on Android and iOS.

If you want to play smartphone, consider QCOM call options.

Onto:

I own Onto shares and would like to buy more opportunistically once buying power is back.

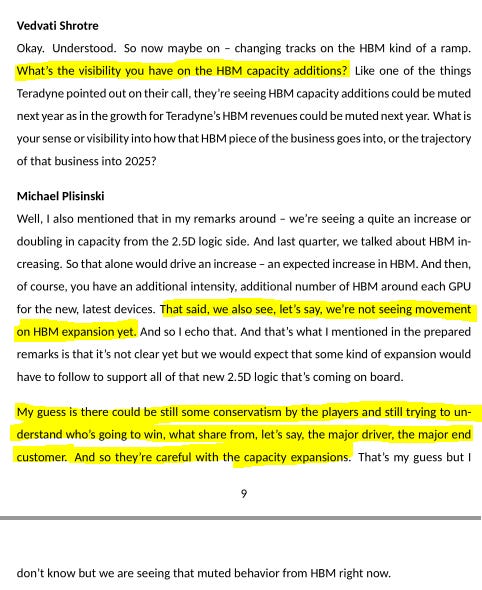

SK and Micron are being cautious with HBM-related WFE spend because they6 don’t know who will win Nvidia share.

This is scary for SK and Micron bulls lol.

Samsung may have fixed their HBM. I don’t believe what Samsung executives say on earnings calls because they have a history of making delusional statements…

…but SK and Micron are clearly scared. They view Samsung HBM3E ramp as potentially real.

The following message is for holders of SK and MU 0.00%↑ shares and/or call options:

You need to re-underwrite your investment thesis. Onto CEO has publicly stated that SK and Micron believe Samsung may have gotten it together on HBM3E.

Another confirmation that logic advanced packaging (Nvidia, Broadcom) is very healthy, but HBM packaging is unreasonably muted. SK and Micron really are playing a game of chicken with Samsung.

I am bearish/fearful of semicap majors because of high (40% or more) revenue exposure to China.

SemiAnalysis just publicly humiliated the entire US Commerce department.

There are only four possibilities:

The US Commerce department will continue to be extremely incompetent.

The US Commerce department cares more about the lobbyist money/pressure than doing their job and protecting USA national security interest.

The US Commerce department was incompetent but will now put in much stricter regulations because they got publicly roasted.

Secretary Raimondo is a CCP asset.

I think #3 is most likely. It is a bad time to buy shares of semicap companies with major China revenue exposure. So… all the majors.

Go ahead and invert me. Let’s find out next year who is right.

This Steelhead Securities analyst is either a complete idiot or he is trying to push Onto CEO into more explicitly stating what he already said twice.

SK and Micron are not ordering tools because they are afraid of Samsung HBM3E ramp being real. They do see massive strength in 2.5D logic packaging (Nvidia Blackwell) so there are two possibilities:

TSMC has over-ordered (extremely unlikely)

Samsung/Micron/SK Mexican standoff.

AMD:

AMD stock is driven by one thing: Datacenter GPU (MI300X/325X) revenue and gross margin guidance. All the other businesses practically don’t matter.

There exists a certain type of boomer portfolio manager who thinks AMD is gona be the Nvidia second source. These idiots keep bidding AMD stock up with truly moronic DC GPU bogies. Remember when buyside was saying AMD 2024 DC GPU revenue would be $8-9B?

It just got raised to $5B.

2025 numbers are gona get crushed as Blackwell ramps.

I will give you the investment opinion up front.

AMD is a very attractive short candidate. I bought some puts, doubled my money this week, then lit most of the profits on fire via INTC puts which… is a topic for the next section.

Presently, I have very little buying power even though my main account is < 1.9x leverage.

For some reason, Webull only allows 1x leverage on ALAB 0.00%↑ shorts but is fine with a hilariously dangerous 2.86x leverage on AMD short positions.

Once I have buying power again, I will be shorting AMD in size.

You can see the dummies bidding up the stock right before earnings.

The guidance relative to an average of sell-side estimates is just a tiny bit light. Stock reaction is because buyside had much higher expectations. Like an extra $1B revenue minimum and 200+bps of gross margin.

Most AMD shareholders are in pure hope mode right now. A small blip took the stock down 10% in a day. I think we have a much bigger disaster coming next quarter.

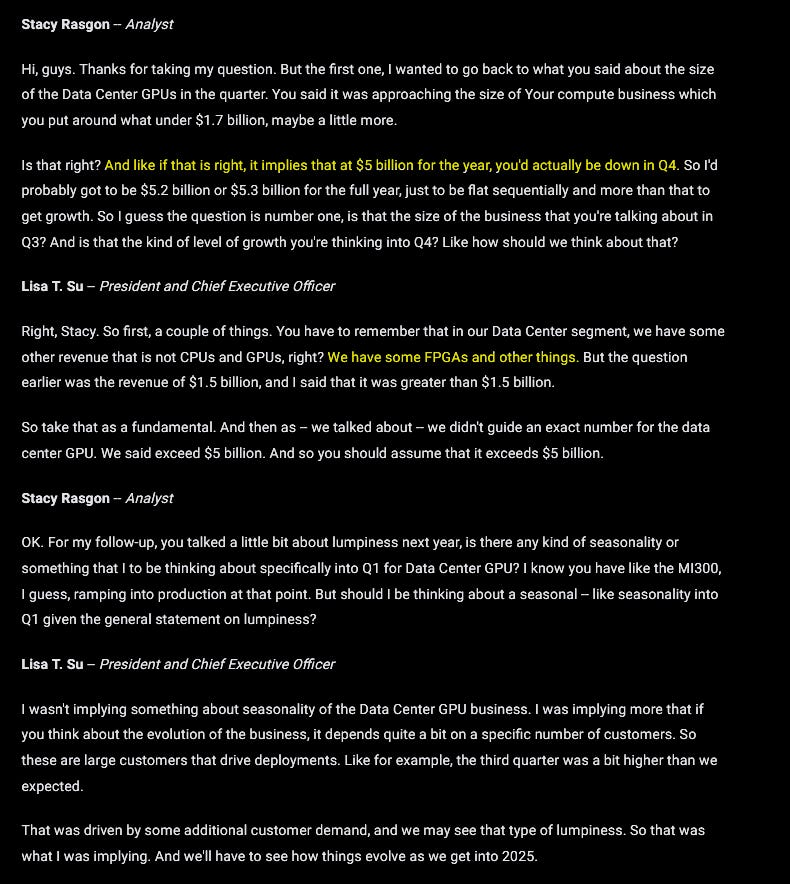

Stacy Rasgon sort of caught AMD in between a rock and a hard place. Figured out that Q4 guided DC GPU may be sequential decline.

AMD CEO tried to cover this up by claiming FPGA sales into datacenter muddle the numbers a bit. Technically this is true. However, most of FPGA revenue goes to embedded, telco, and industrial markets. Some to datacenter… but it’s probably a rounding error.

Who here thinks AMD DC GPU gross margin improves in the next three months as Blackwell ramps?

The competitive positioning is going to get much worse in 2025. AMD is already capped on ASP because MI300/325X exists for one market:

single-node inference for a small subset of models

Intel:

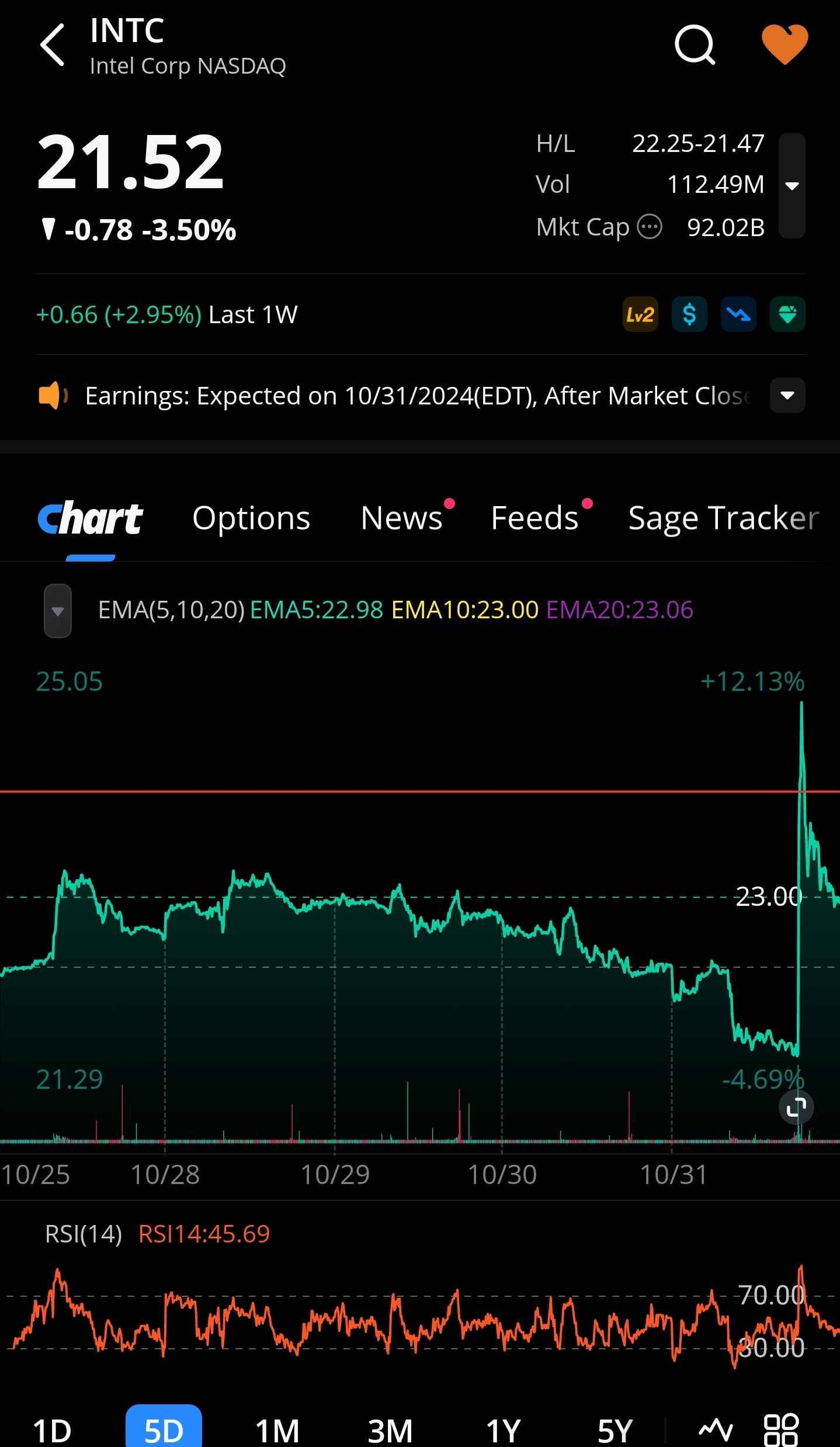

A lot of good news. I have puts that are going to zero tomorrow morning and not even mad. Genuinely happy for Intel. They really needed this.

Message to Intel employee subscribers: Hope this lines up with ESPP.

The selling into earnings was because of Microsoft’s crap guidance for their PC segment.

They wrote off a ton of tools on the Intel 7 process node production lines. It makes sense. Intel 7 is indeed worthless.

Backing out Intel 7 write-down hit to margins, we get 41%.

Thats much better than I was expecting. Puts were bought because I thought they were going 33-37% GM because of Lunar Lake ramp.

What happened Microsoft? Are people buying Linux-based Lunar Lake laptops…?

(this is a joke to be clear)

IDK how to make sense of Intel, AMD, and Microsoft’s PC numbers. Must be missing something here.

I don’t understand how they are keeping gross margins up. Good for them but way against my expectations.

Maybe I need to re-visit my COGS estimate. (frankly, I am super busy with more interesting things so prob won’t bother)

It was obvious six months ago that Gaudi 3 is garbage and will fade into nothing.

This is huge news. Extremely positive. Congratulations to every Intel engineer who worked hard to secure these important 18A wins.

I am 90% confident one of the new secret 18A customers is IBM. All their latest products are currently on Samsung Foundry 5nm-class (SF5) which has worse PPA performance than TSMC N7. Given that SF2 (4th attempt at 3nm-class node with worse PPA than TSMC N5) is on fire, it makes sense that IBM needs an exit.

Based on process of elimination, I believe with 30% confidence that the other secret 18A customer may be Nvidia.

Intel is first to backside power delivery with 18A which has incredible benefits for HPC (aka compute-centric) designs. This eliminates every mobile design house (Qualcomm, Apple, MediaTek). AMD is a mortal enemy and has picked up capacity on Samsung Foundry SF4X (extremely cheap wafers worse than TSMC N5 in PPA). Every other company needs 3rd party IP to make a chip and thus cannot be one of the two new secret 18A customers.

Grace (Nvidia, ARM V2 Cores) is great for all these tasks. Vivek Arya (BoA) asked a very sharp question and Gelsinger said a bunchy of filler stuff that is not believable.

Raymond James analyst asks a good question.

Here is the answer:

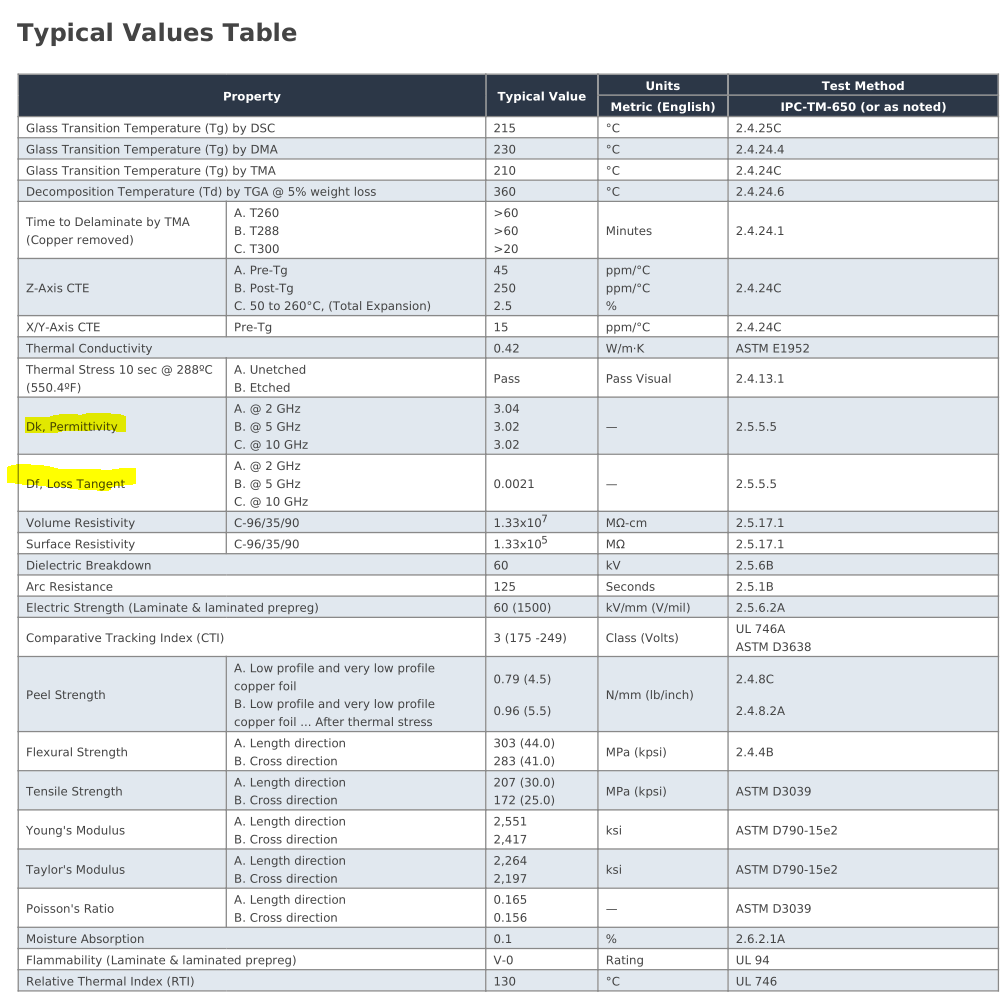

Intel has very poor traction on advanced packaging because…

Going to be careful about how I phrase this.

Dielectric cores of packages have standard thicknesses, EM propagation coefficients, and design rules.

There is a massive packaging industry built around standard practices.

EDA tool flows.

Core and Pre-Preg suppliers

Simulation databases of materials at various standard thicknesses.

Packaging/Substrate Manufactures

Packaging Houses (the company that puts chip onto package)

If a new, up-and-coming Fab had an extremely non-standard packaging flow, then their packaging revenue would suck.

IBM as the secret customer for Intel's 18 A node makes a lot of sense. In addition to your point about IBM getting sick of Samsung's EUV nodes not delivering the promised performance, there is also this: Intel got a chunk of money from the Feds specifically to serve as a "Secure Enclave". From what I understand, it's a further step from what used to be called "Trusted Foundry". IBM's Telums for its mainframes and Power CPUs for servers and workstations are heavily used by various governmental agencies and departments, not least the DoD. And even though South Korea is a close ally, it's still a lot easier to have a close eye on labs and fabs that are located stateside, never mind developing sensitive tech for the military.

Legacy fab can buy equipment that the advanced fab can not? I don't think you need to be an expert on loopholes to see that this was going to be exploited one way or another.