Seppuku Inside

Intel threatens to commit suicide in official SEC filing.

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Still on break.

Once again, one-hour time limit.

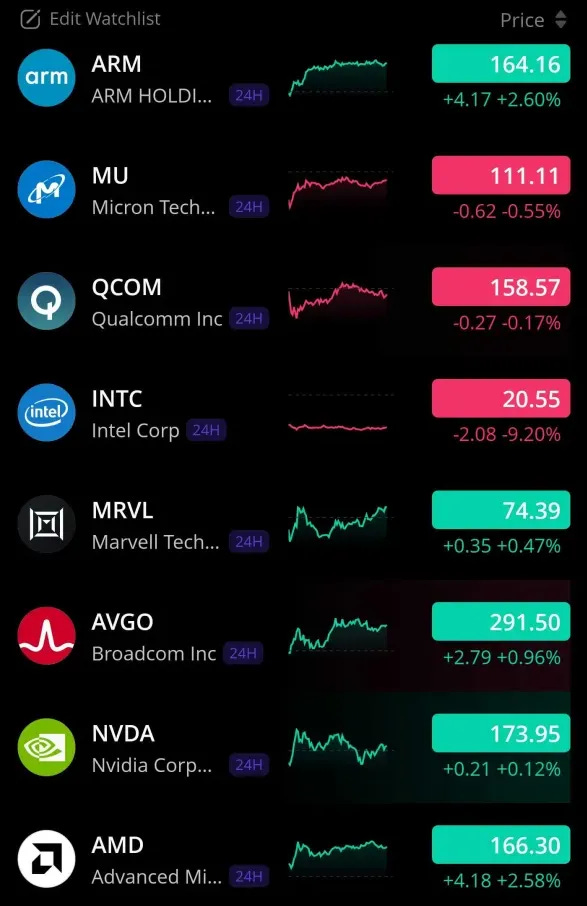

ARM and AMD are up 2.5%, Intel is down 9%, and every other name on my primary watchlist is flat-ish.

You know what that means… Intel reported earnings.

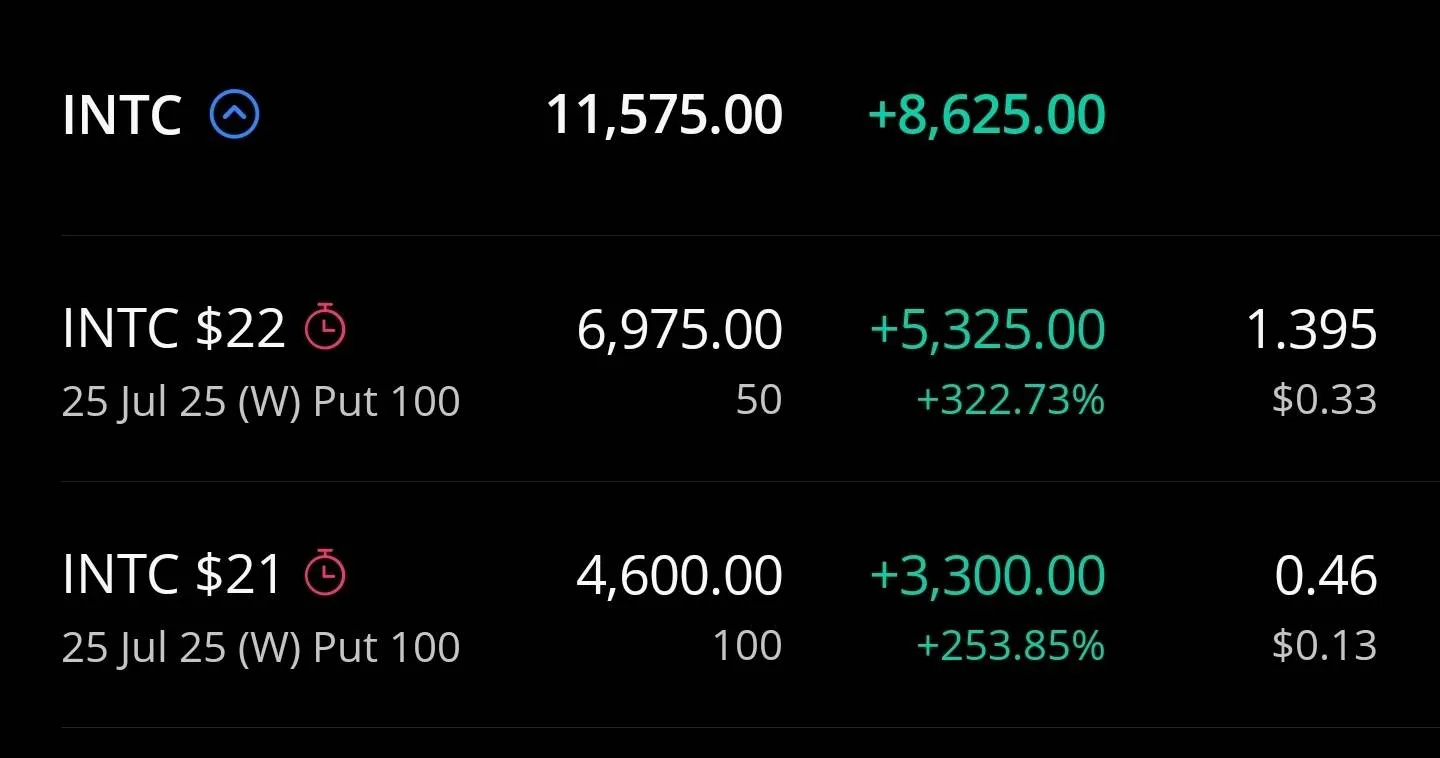

Made some blood money off this.

Feels immoral but whatever. The other side of this trade was probably some Citadal or Jane Street robot.

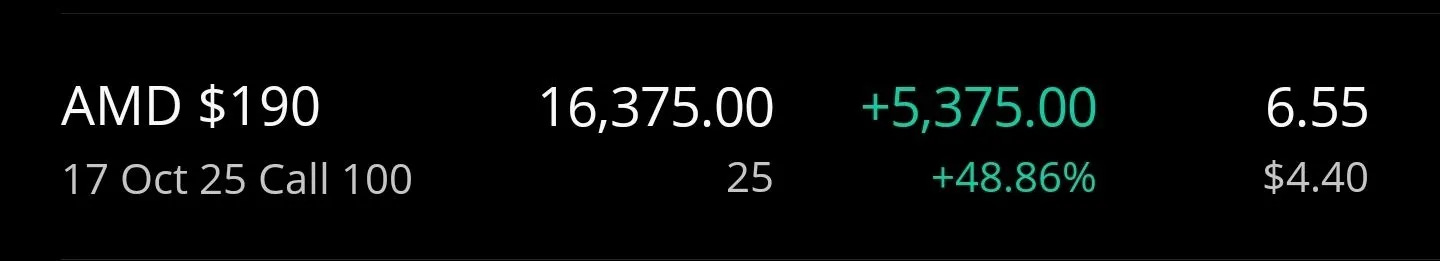

Also, I have been trading in and out of AMD call options for GPU meme trade but now it looks like CPU will be a meaningful tailwind. CPU revenue and gross margin expansion could offset margin dilution of MI350 fire sale.

Prob gona hold this into AMD earnings in first week of August.

Finally, a few people have pinged me about Aehr. Honestly, my thesis as not even played out. The Sonoma order announcement is for packaged AI ASIC burn-in. My whole thesis focused on wafer-level burn-in of AI logic designs. This has not happened yet lol.

Still holding all my shares. My portfolio has sufficient available margin equity to take on this risk. I am also retarded.

What you do with your own money is not my problem. Please stop asking “when is it time to sell AEHR”. You figure it out. I just tell you my engineering thoughts and gamble with my own money.

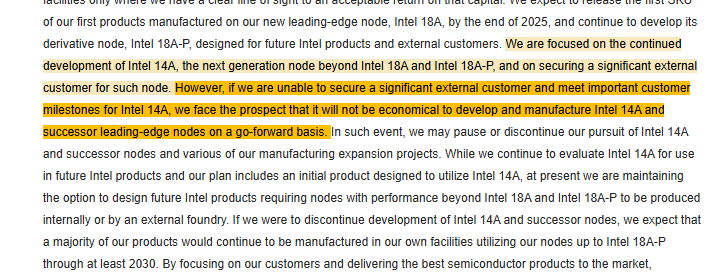

Ok let’s talk about Intel. The most important takeaway is the official 10-Q (SEC filing) contained a suicide note.

Frankly, I do not think Intel can survive on products alone, given the massive (and accelerating) share gains by AMD and ARM in the CPU market.

There are quite a few Intel employees who are subscribed to Irrational Analysis via their work emails. Not sure how many of them still have jobs given that 20% were just fired and another 15% are about to be fired.

Friends, I understand that many of you have probably never read an official SEC filing and have no idea what 10-Q or 10-K means.

Basically, every publicly traded company must publish a quarterly report containing detailed commentary.

Usually, the 10-Q is boring and mostly contains repetitive legal stuff.

The suicide note is on page 28.

It’s really fucking bad that this shit is in an official SEC filing. Allow me to explain in the most inappropriate way possible.

I strongly suggest every (remaining) Intel employee to read the SEC filing.

Here is the link. Saved you a couple clicks.

For those of you who want to understand process development kits and practical chip design, check out this old post.

(conference papers are bullshit and can easily lead to completely wrong conclusions)

Let’s go over the earnings call transcript.

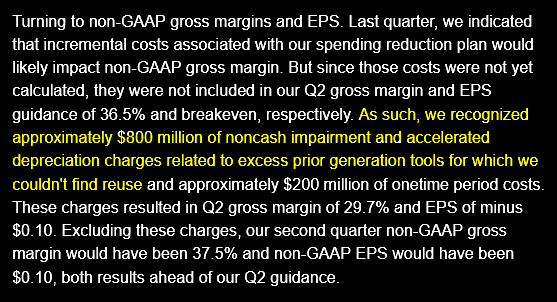

Intel is back to trading at 1x book value. The book value of fab equipment is bullshit. They are already writing off equipment in an accelerated manner because of demand issues. (more on this later)

Probably should trade at less than 1x book value to account for future (very likely) write-offs of expensive semicap machines.

HMMMMMMMMM

(this is not a good thing… more on this later)

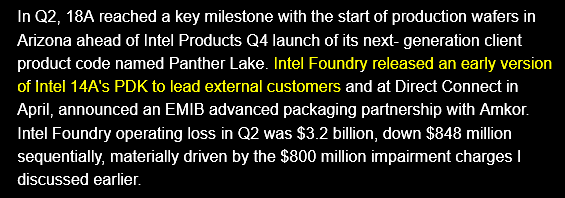

I had a call with some buyside contacts about the timeline for 14A. It was clear from the kind of questions they asked that Intel IR told them completely unreasonable (delusionally optimistic) things.

Will tell all of you what I told them over the phone.

If 14A 1.0 (full featured) PDK is released by end of this year, it will take 12-18 months of engineering work by 3rd party foundry customers to reach the “we would like to ramp into high-volume production” phase.

12-18 months is very optimistic estimate by me FWIW.

When the money hits Intel’s P&L is for finance friends to figure out.

Maybe Intel gets pre-payments. Maybe they get a partial payment at wafer start. Maybe they get paid after the wafers are finished 6 months after order.

IDK not my problem.

Also, reminder to all the finance friends that I don’t charge money for “expert calls”. If you are interesting, happy to chat for free.

Allways nice to learn from the pros. A lot of trading is about understanding what the market is thinking. Managed to figure out a lot just by the phrasing and tone of the questions from this particular group of buysiders.

Instead of charging $1K for the 1-hour phone call, I made $8.6K profit trading off the vibes expressed by people on the call. 😎

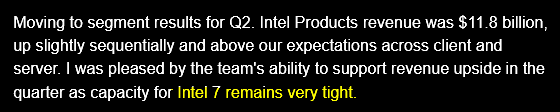

Again, capacity constraints on Intel 7 is not a good thing. It means the newer products (Meteor+Lunar Lake) are dogshit and have suppressed demand due to horrific margins.

Also, Intel advanced packaging group fucked up yet again. I hate this group more than I hate Marvell C-suite. Legendary levels of self-owning incompetence.

I could call IFS packaging group retarded but that would be insulting to the mentally retarded. IFS packaging group stupidity is so much worse.

YOU IDIOTS HAD A PERFECT SETUP TO GENERATE MEANINGFUL FOUNDRY REVENUE WITH ADVANCED PACKAGING AND BOTCHED IT DUE TO SELF-INFLICTED STUPIDITY.

YOUR DESIGN RULES ARE DOGSHIT. THIS IS ENTIERLY YOUR OWN FAULT.

A buyside contact told me that two hyperscalers were apparently evaluating IFS advanced packaging. Apparently, they botched the opportunity.

At least the IFS 18A process team made a valiant, good-faith effort. I really cannot emphasize this enough. IFS advanced packaging group failures are unforgivable.

Buddy, Nvidia and AMD buy HBM and apply their margins to the entire BOM. Why is Intel the only semiconductor company who buys memory, advanced packages it, and fails to add a margin to that portion of the BOM?

Maybe it’s because the product is shit value compared to AMD CPUs.

Can someone please challenge Zinsner on this? Every time he makes this chicken-shit comment, my blood pressure goes up.

Timothy Arcuri is right. There was already a prevailing sense of panic and “why the fuck are we wasting our time with Intel Foundry” within the ecosystem. Placing a suicide note in official SEC filings is not going to help.

Porting IP blocks is a common practice. Porting from say TSMC N5 to TSMC N3 is not a huge deal as both are FinFet and structurally similar.

Porting from TSMC N3 to Intel 18A is a much more work. Say 3x the engineering hours. This is because major structural differences (BSPD, GAA contact points) necessitate a full physical de-design. Can only re-use the schematic at best.

Many companies have already ported some of their internal IP blocks from TSMC N3/N5 to Intel 18A. Publicly threatening to kill 14A is a very dangerous gambit by Lip-Bu Tan. It strongly incentivizes ecosystem paralysis. Nobody will want to finish porting their IP portfolios with this continuity risk now in play.

Lip-Bu Tan is a smart guy with lots of experience, particularly in EDA as the former Cadence CEO. He is playing a very dangerous game. Analogy would be a queen sacrifice.

Thank you Mr. Tim Arcuri for directly challenging Lip-Bu Tan. Allways nice to see a sell-sider who is not an invertebrate.

AMD pioneered chiplets as a cost-saving strategy.

Intel implemented chiplets in the dumbest way possible, destroying their margins and driving demand for products that are two generations old. 🤡

What a disaster lmao.

The answer to the highlighted question from Stacy Rasgon is “yes”. Both Intel execs refused to address that which is telling.

Ok so here are some fun facts about SMT (usually called simultaneous multi-threading…)

The “good” way to implement SMT was invented by IBM and licensed by AMD.

Intel does not have the right IP/patents so they tried to make SMT in their own, “hacky” way, calling it “hyperthreading”.

This is old CPU history stuff. All these years later, the speculative execution security vulnerabilities hit all CPU designers (Intel, AMD, and ARM) but Intel was by far the hardest hit.

Intel Hyperthreading is a form of SMT. A buggy, inelegant form of SMT that is “worse” compared to IBM/AMD SMT. ARM designs generally do not have SMT and opt to just spam more physical cores.

Intel designers removed SMT/Hyperthreading because an endless parade of specter vulnerabilities forced them to constantly add microcode patches, negating the performance gains.

https://en.wikipedia.org/wiki/Spectre_(security_vulnerability)

You know a security vulnerability is bad when it gets it’s own fucking logo.

Also, there are hundreds of derivative specter-like vulnerabilities that continue to make the lives of CPU designers miserable.

I think Lip-Bu Tan is wrong on this and his insistence that SMT/Hyperthreading be added back will backfire.

INTC's Lunar Lake -- not being able to charge a margin on their embedded DRAM. Only NVDA has the ability to charge a margins on their HBM. AMD, AVGO only pass-thru their HBM whcih is why their GM on their GPU/ASICs are low- to mid-50s vs 75-85% GM for NVDA.

First of all. Love your substack. Second, I agree with your AEHR analysis. The core thesis hasn't even played out and yet the stock has popped on a different story.

Why not add to AEHR here? When the core thesis plays out. This pop will look like a small bump when we zoom out in a year. Just curious about your thoughts. It's great to have your insight btw since you've worked with incal tech before. Talk about having the perfect knowledge at the perfect time lolol