Qualcomm is out of time.

Insufficient diversification progress, impending April 2027 EPS cliff.

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

AT THE TIME OF WRITING, I HOLD NO ECONOMIC POSITION IN QUALCOMM OR APPLE STOCK, OPTIONS, OR OTHER DERIVATIVES.

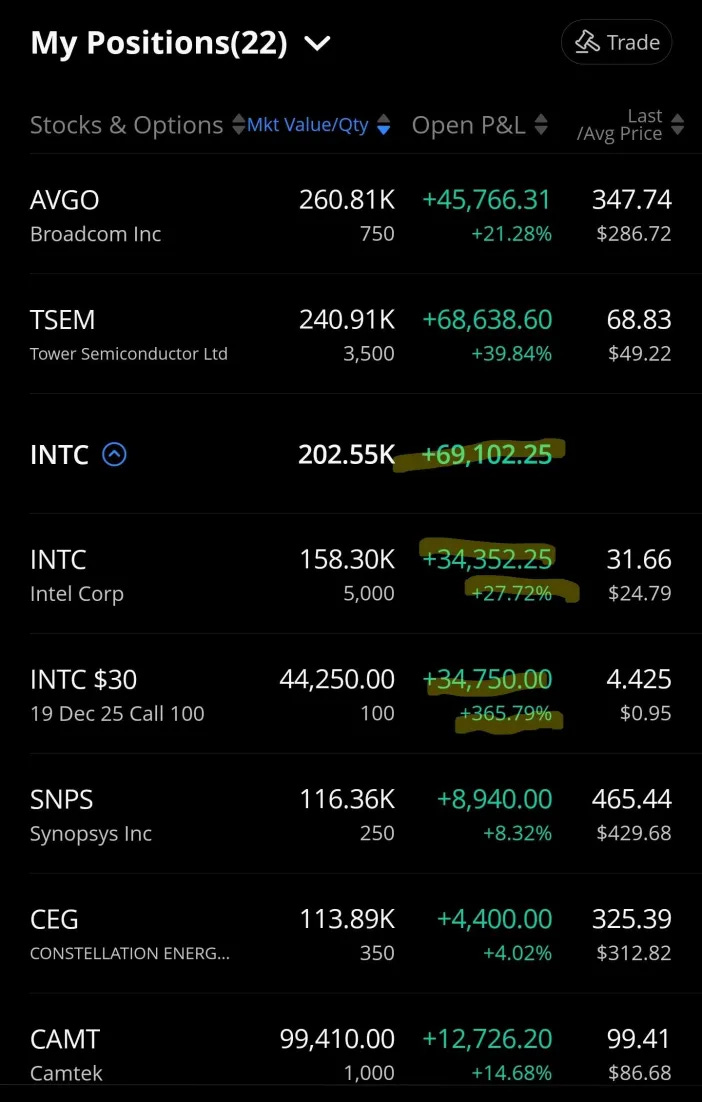

I am long SiTime in both the trading account and long-only accounts.

I am massively long Tower Semi and Broadcom for unrelated reasons.

Want to short GloFo for fun.

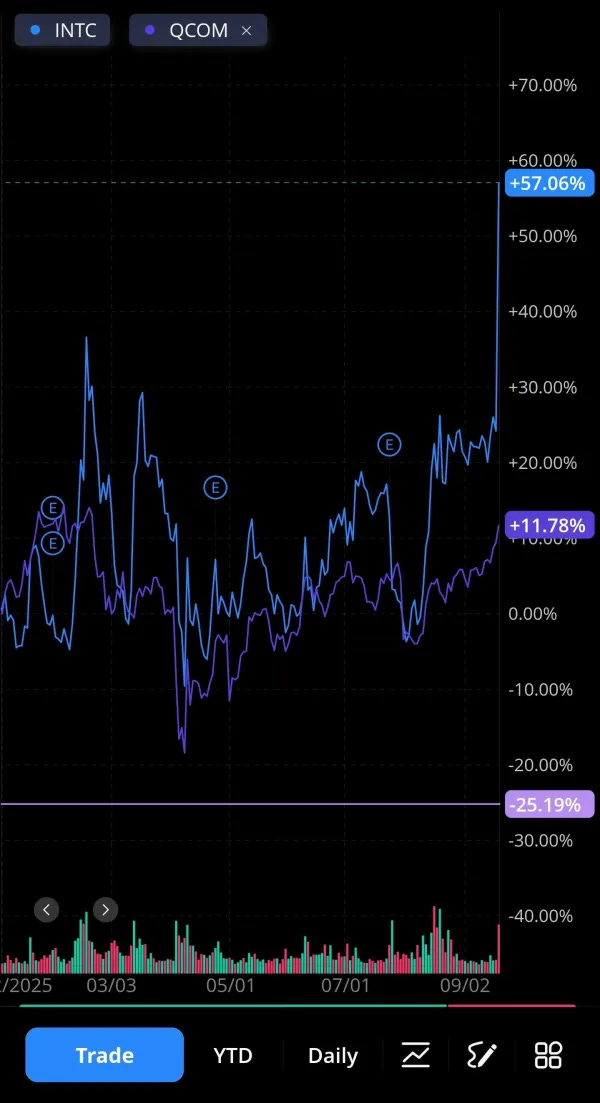

Qualcomm stock have meaningfully underperformed the semiconductor sector over the last 5 years.

Amusingly, Even INTC 0.00%↑ is out-performing QCOM 0.00%↑ YTD.

To understand how we got here and where things will go, we must take a trip back to January 2017.

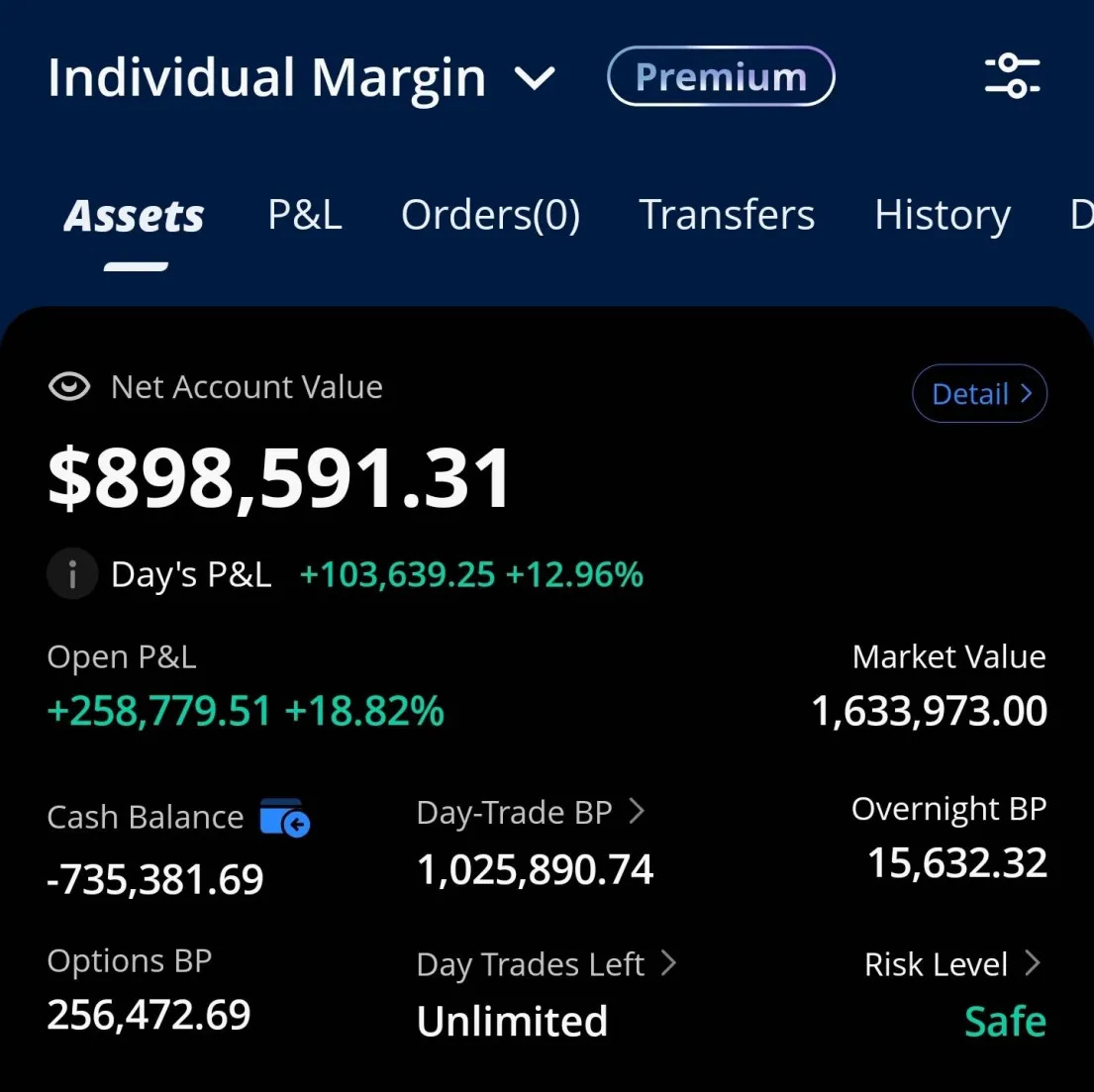

Quick snapshot of the trading account.

Still holding the INTC position I think. Think there is enough time for one more news event. Might trim the calls by half. Not sure.

Contents:

The Apple+FTC Lawsuits

Jan 2017: Legal Saga Begins

Dec 2018: Major Qualcomm Victorys

April 2019: Qualcomm Total Victory

May 2019: Judge Koh says NO

Aug 2020: 9th Circuit Reverses Judge Koh Decision

Oct 2022: Apple Loses Second Supreme Court Challange

April 2019 State of Play

Rules of the Race

Qualcomm Diversification Efforts

Failure #1: Cloud AI 100 (AI Inference)

Failure #2: Snapdragon X Elite (Laptop SoC)

Failure #3: RF Front End (as a diversification vector lol)

Failure #4: 5G O-RAN (entering saturated basestation market)

Failure #5: XR/AR/VR (lost Meta to MediaTek)

Failures #6 and #7: Datacenter CPU (**TWICE** THEY ACTUALLY BOTCHED THIS TWICE AND ARE TRYING FOR A THIRD TIME)

Success #1/1: Automotive

Qualcomm Segment Reporting: Nothing to See Here

September 2025 State of Play

Incoming Capsaicin Tsunami: April 2027

June 2025 Earning Call Transcript

Qualcomm is out of time.

[1] The Apple+FTC Lawsuits

Both the Apple vs. Qualcomm and FTC vs. Qualcomm lawsuits are thematically similar and occurred around the same time.

For simplicity’s sake, I will cover both as if it was one lawsuit but technically these are separate cases.

Additionally, I want to make it clear to any lawyer who happens to come across this post that I AM NOT COMMENTING ON WHO IS RIGHT OR WRONG IN A LEGAL, MORAL, ETHICAL, OR ANY SENSE.

Simply writing about historical events using public information. Any commentary on what might happen in the future is based on reasonable interpretations of past events AND DOES NOT IMPLY ANY POSSIBLE FUTURE EVENTS ARE RIGHT/WRONG IN A LEGAL/MORAL/ETHICAL SENSE.

Certain words such as “victory”, “defeat”, “win”, and “lose” will be used in this section to describe past events based on how favorable or unfavorable a particular court decision was towards a particular party. I AM NOT ENDORSING, AGREEING, OR DISAGREEING WITH ANY COURT STATEMENT OR OUTCOME.

Let’s see if more cease-and-desist letters are coming to my inbox.

[1.a] Jan 2017: Legal Saga Begins

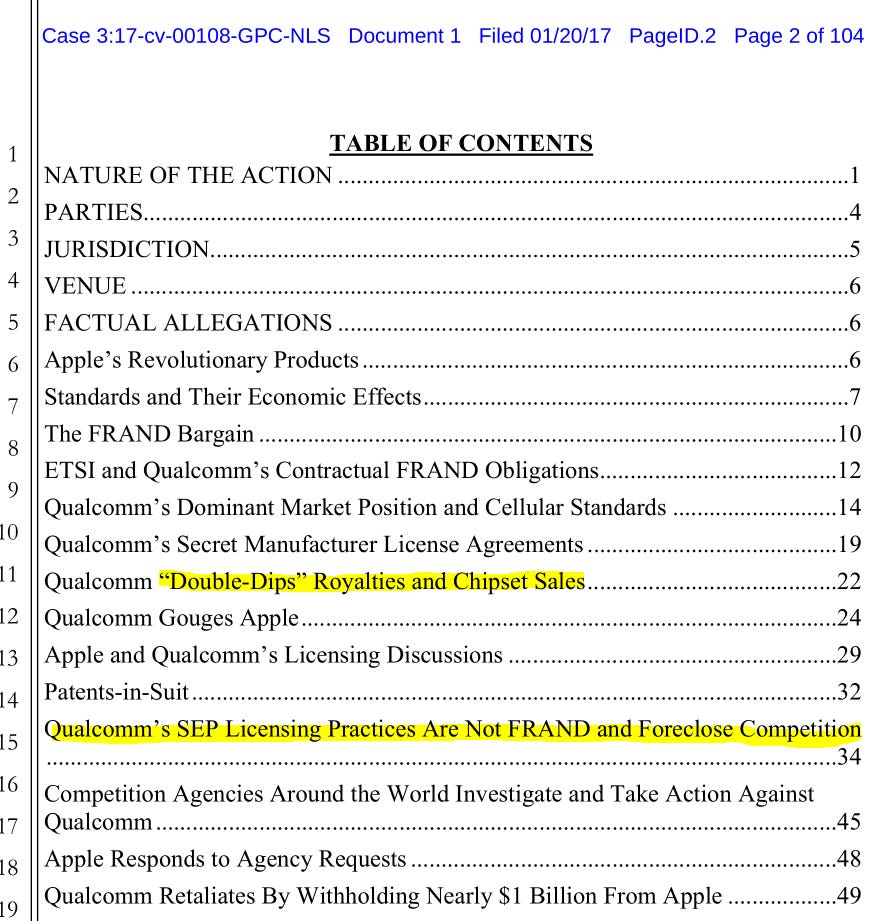

In January 2017, Apple filed a lawsuit against Qualcomm.

Google search is really bad at finding old documents…

Here is a nice website I found.

https://www.courtlistener.com/docket/4571826/apple-inc-v-qualcomm-incorporated/

Original complaint filed by Apple is here:

https://storage.courtlistener.com/recap/gov.uscourts.casd.522828.1.0.pdf

Three months later, Qualcomm filed a response to the Apple lawsuit.

You can find the PDF here:

Instead of boring you with commentary on hundreds of pages of legal documents, here are two screenshots from the table of contents.

Here is what Google AI mode says about how Qualcomm’s licensing business works.

And here is what the cap is according to Google AI mode.

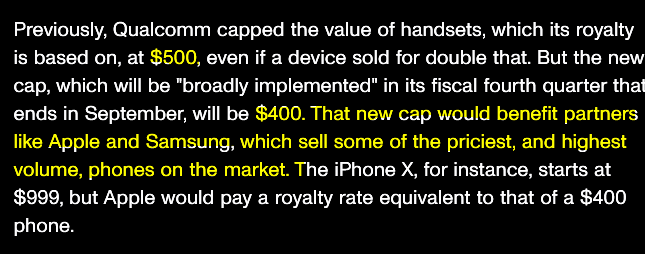

This cap apparently was $500 before Apple stopped paying and sued.

So what was the royalty rate applied upon the $500 cap?

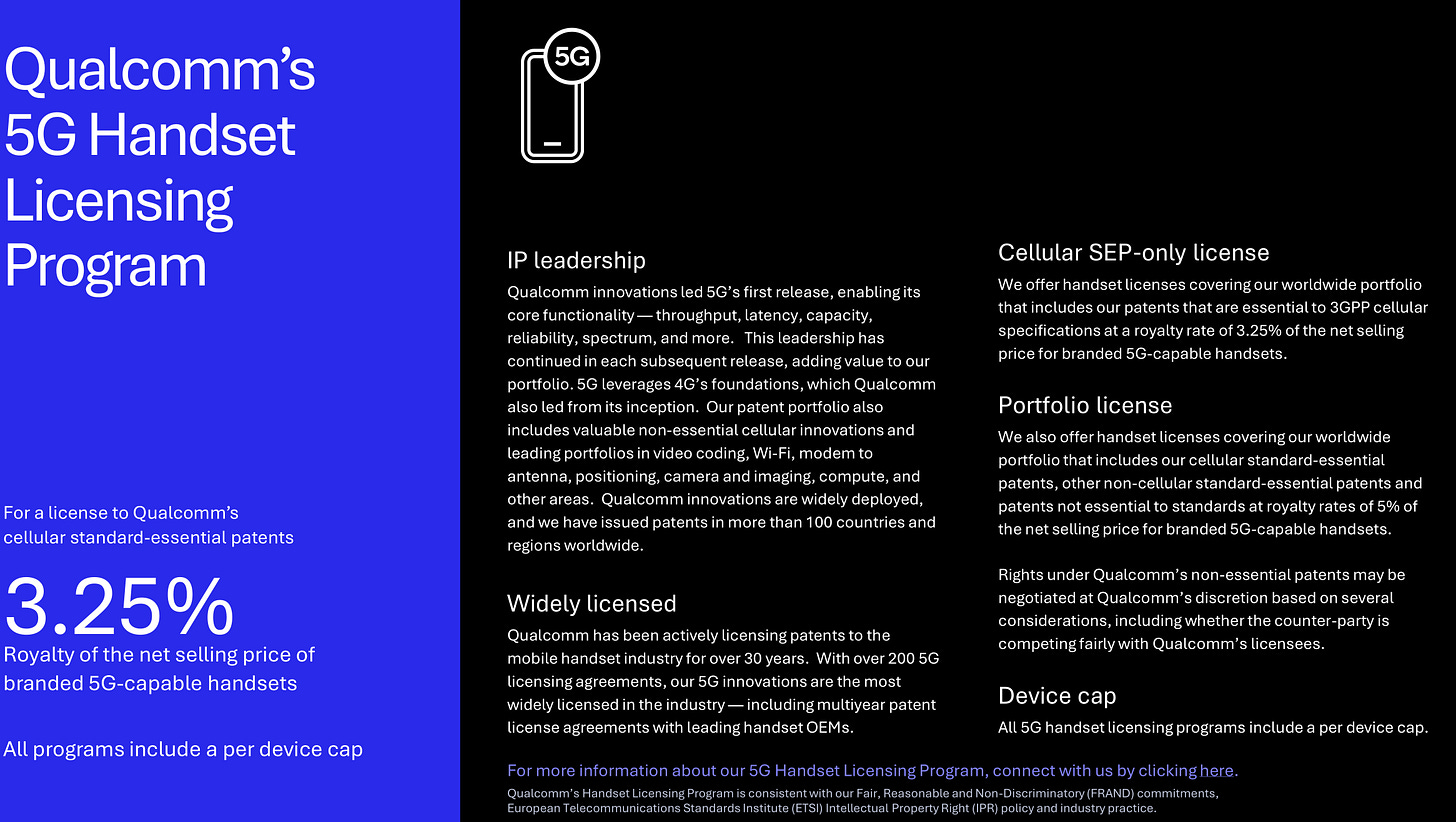

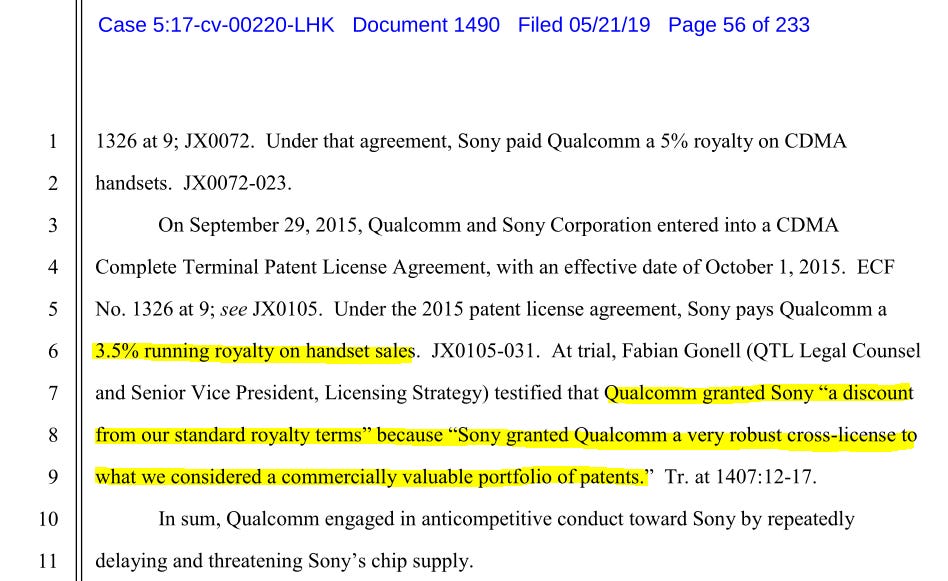

A later Qualcomm document says the rate is 3.25%.

Figuring out what the royalty rate was at the 2017 lawsuit is difficult. Will come back to this in section [1.e] as the Judge Koh decision has interesting unredacted numbers.

While both Apple and Qualcomm made many allegations against each other, the core of this dispute appears to have been over pricing.

Right around the same time, the FTC filed a similar lawsuit against Qualcomm.

https://www.ftc.gov/legal-library/browse/cases-proceedings/141-0199-qualcomm-inc

So… FTC files on January 17th, 2017 and Apple files on January 20th, 2017.

[1.b] Dec 2018: Major Qualcomm Victorys

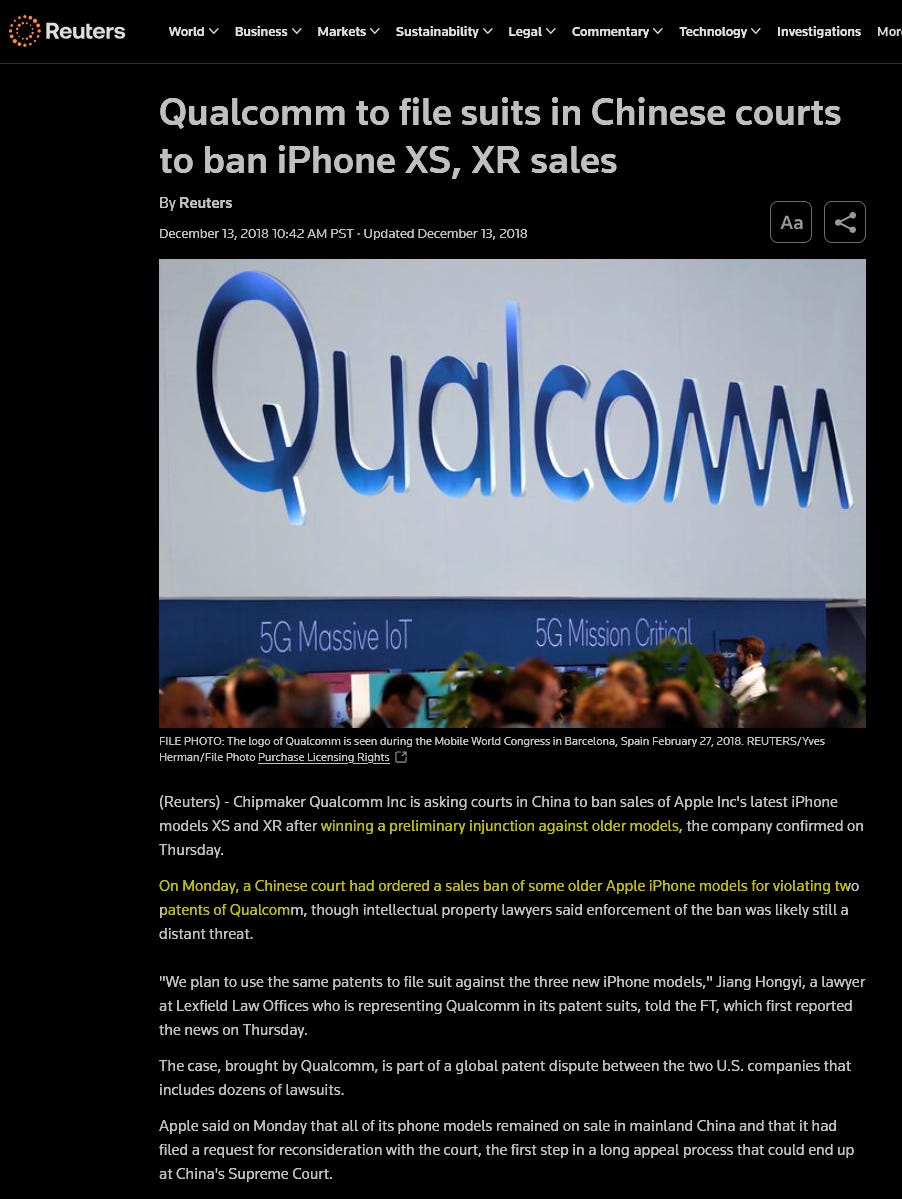

Qualcomm managed to get China and Germany to ban the sale of iPhones that use an Intel modem due to patent infringement.

This was a major victory that applied enormous pressure. With Intel-modem powered iPhones partially banned and supply of Qualcomm modems short, Apple was forced resolve this quickly.

[1.c] April 2019: Qualcomm Total Victory

Three months after Qualcomm’s major victories, it was all over. Apple and Qualcomm signed a settlement and dropped all litigation against each other.

Some sources say $4.5B while others say more. It’s a lot of money.

Also, the midpoint of the royalty per iPhone ($8.5) at a cap of $400 implies a 2.1% royalty rate.

The dates of the licensing agreement are very important.

(why did they pick April fools lmao)

Deal was until April 1, 2025 with an option to extend to April 1, 2027.

[1.d] May 2019: Judge Koh says NO

Remember the FTC case that is technically separate from the Apple lawsuit?

I shit you not this happened less than a month after the Apple settlement.

Now to be clear, THIS RULING BY JUDGE KOH WAS OVERTURNED 15 MONTHS LATER.

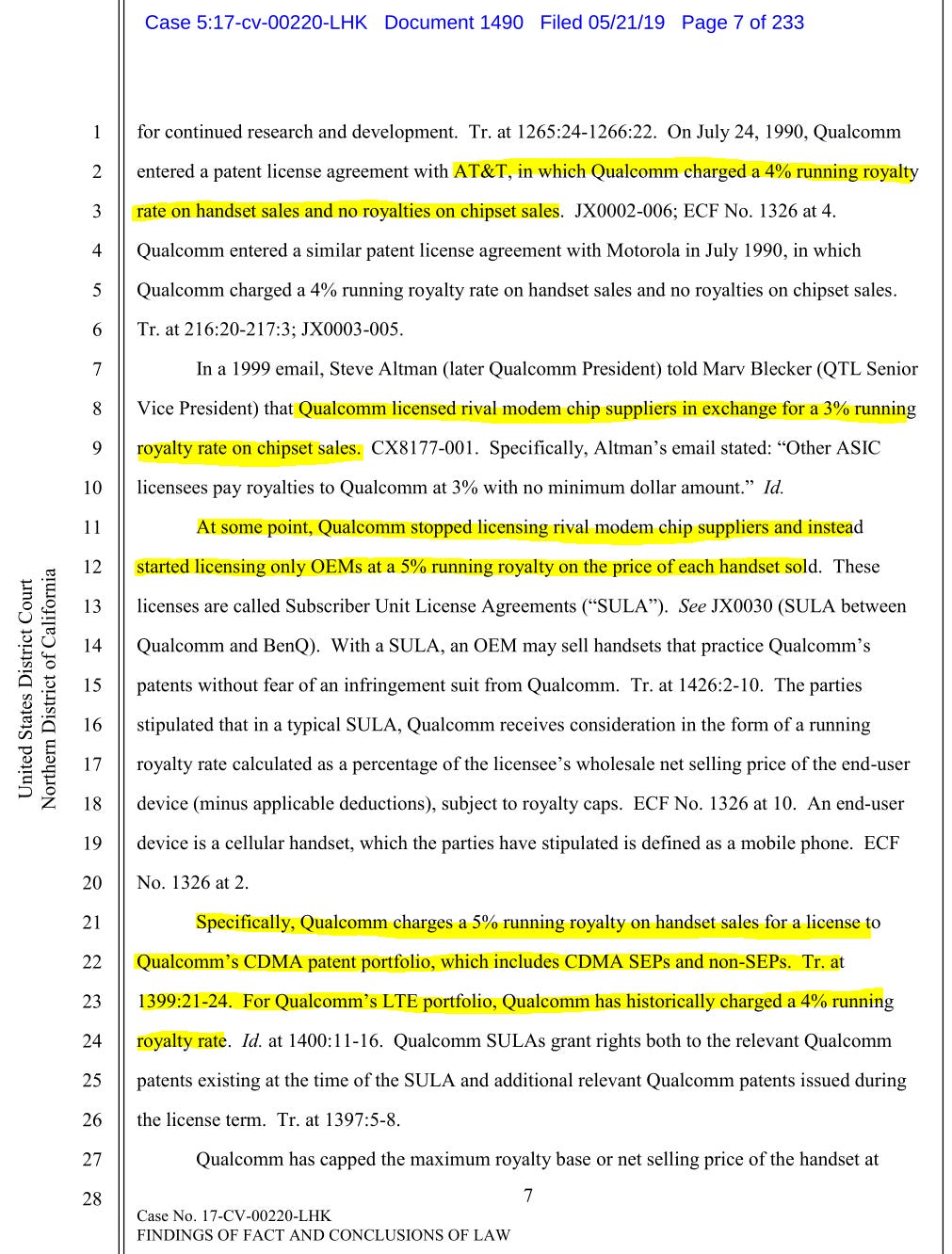

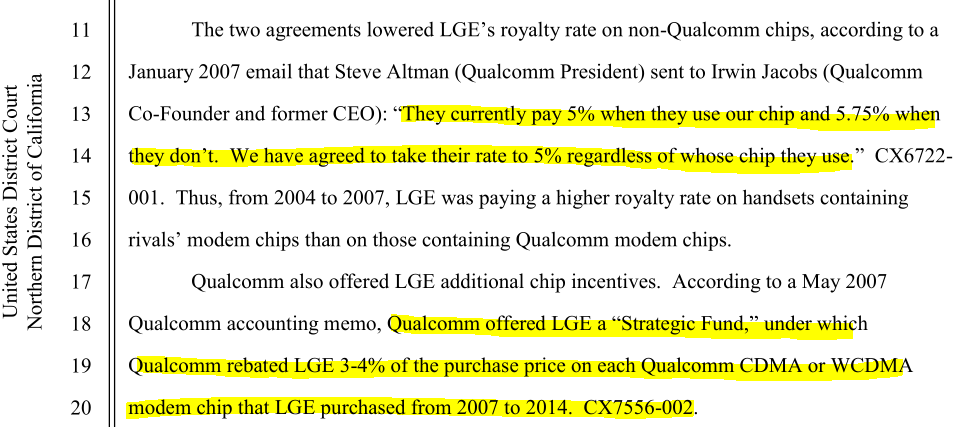

Even though the ruling was overturned, I will be snipping some interesting passages as it is one of the few coherent sources of information.

I read 233 pages of legal document so you don’t have to.

BINGO

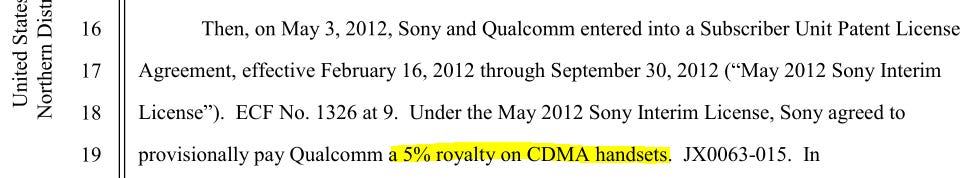

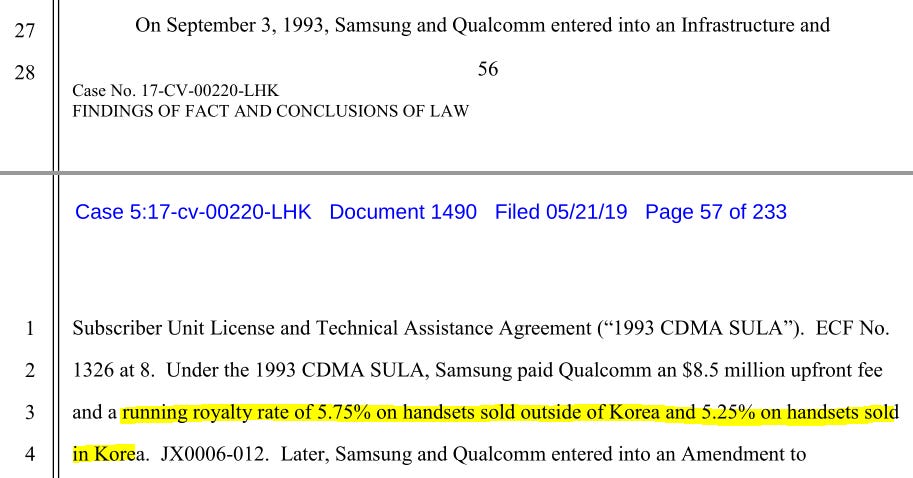

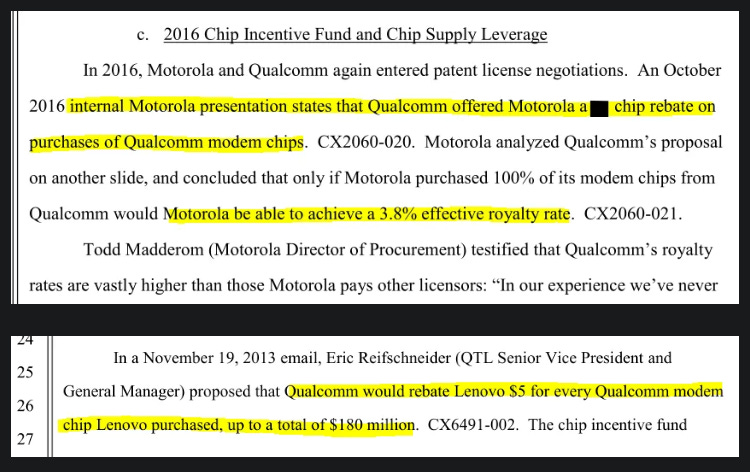

Various other players have royalty rates ranging from 4% to 5.75% with a variety of incentives and rebates but now we have numbers on Apple.

5% per phone, converting to $7.5 per phone after marketing incentives (rebates) applied.

Effective royalty rate would go from $7.5 to ~$16.5 per phone as the old agreement was expiring and new agreement in 2013 was under negotiation.

Ok… now I am confused. Previous parts of the document said $7.5 per iPhone but this paragraph just said “lowered to” $10.

Remember the huge victory Qualcomm had in China and Germany court on December 2018?

This is why it was so important. iPhones with Intel modems (all the 2018 models) got banned in two important markets.

Very sad these numbers are redacted.

Well at least they were aware this might happen. LOL

[1.e] Aug 2020: 9th Circuit Reverses Judge Koh Decision

Qualcomm got a partial “stay” on the Judge Koh ruling from the Ninth Circuit court in August 2019.

This means that Judge Koh’s ruling was only in effect for ~3 months.

“Stay” is legal term for “lets not enforce this while we let the defendant appeal the decision”.

In August 2020, one year after the stay and 15 months after Judge Koh’s original decision, it was all thrown out.

[1.f] Oct 2022: Apple Loses Second Supreme Court Challange

Of course, Apple also appealed legal things. All the way to the Supreme Court apparently. Twice.

Supreme Court basically said “not worth our time”.

And so it was finally over… until either April 2025 or April 2027.

[2] April 2019 State of Play

Let’s play some theoretical strategy mind games.

Pretend you are Apple.

Then pretend you are Qualcomm.

Apple’s primary objective is to get their own internal modem working by 2025 so that they don’t have to extend the licensing agreement. (they failed and thus had to exercise the extension option)

Qualcomm’s primary objective is to diversify as fast as possible because they know Apple will try to re-negotiate the royalty rate once they have modem self-sufficiency.

[3] Rules of the Race

Both Apple and Qualcomm are now racing.

Qualcomm has no rules. They are free to try and diversify in whatever way they can.

Apple does have to follow some rules.

Let’s talk about the carriers.

I will focus on Verizon and mmWave as an example, but similar logic applies to every carrier in every region.

Imagine you are a wireless carrier.

What are your primary expenses?

Spectrum licenses purchased from the government.

CapEx for cell towers, fiber backhaul lines, and small regional datacenters.

For example, in March 2021, Verizon spent $52.9B on new spectrum licenses from the FCC.

Given the very high fixed costs of being a wireless carrier, your objective is very simple in principal yet quite difficult to implement.

Maximize the number of subscribers on your network without people noticing slowness, coverage issues, latency, or any other negative effects.

Keep as many people happy as possible with the least amount of CapEx. Lord knows you blew a shit ton of money on spectrum licenses already.

Verizon is… special…

Out of all the carriers in the world, Verizon was the MOST AGRESSIVE ADOPTER OF MMWAVE.

These dipshits actually went all-in on a technology with less range than a small child playing minigolf.

AT&T also over-indexed into mmWave.

T-mobile was not retarded and bought Sprint. The combined T-mobile+Sprint network had plenty of mid-band capacity and did not need to degen into mmWave so aggressively.

I am bringing this up because the Apple C1 and C1X modems do not support mmWave.

In 2025, only the iPhone 16e and iPhone Air use the internal Apple modems globally. There appears to be no region split.

Let’s say that these two models of iPhone represent ~25% of sales.

What would happen if 100% of 2025 iPhones used Apple’s internal modem?

Verizon’s network would very likely crash outright.

AT&T’s network would experience moderate to severe instability, disruptions, and might crash too.

Designing a cellular network is very complicated. If a wave of devices with different capabilities hits your network all at once, its gona be a bad time.

mmWave is a very easy feature to explain and pick on.

It’s a clean example.

Verizon over-invested in mmWave.

Verizon is biggest carrier in USA.

Apple C1/C1X modem does not support mmWave.

Verizon has existential incentive to reduce Apple internal modem share within iPhone volume until….

… Verizon fully deploys their C-band spectrum….

… or Apple future (C2?) modem supports mmWave.

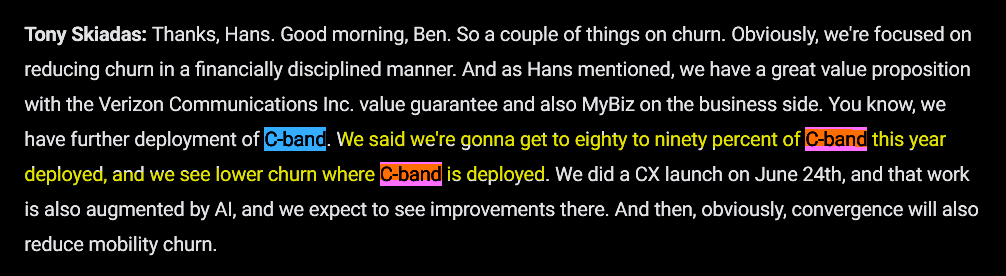

For what it’s worth, Verizon claims to be far along in their C-band deployment.

Verizon explicitly says they see lower churn (subscriber loss) in places where C-band is deployed.

SO THAT MEANS MMWAVE IS DOGSHIT. AM I INTERPRETING THIS RIGHT?

80-90% C-band deployment by the end of this year.

So… maybe in 2026 (iPhone 18 series), Verizon would be OK with 100% Apple modem share.

Sidenote: I kinda like Verizon stock because weird reasons. Don’t own any but considering buying some in my long-only accounts.

Verizon + mmWave is a clean and easy to understand example but there are many more situations like this.

Apple wants to shift as much volume as possible as quickly as possible for obvious reasons.

The carriers across different regions have varying levels of resistance based on how their networks are set up and what feature set the Apple internal modem has.

Let me be clear on one thing.

The consumers opinion is not anyone’s priority here. Apple internal modem volumes is entirely determined by corps negotiating with other corps primarily due to network capacity and stability.

Technically, there is also decode performance…

The vast majority of cellular plans use one of the two following structures:

“Unlimited” data but you get kicked to slower 4G/3G or even 2G networks after a certain data cap.

Pay per GB of data.

Both types of plans track a user’s data consumption.

Carriers only “count” data that actually makes it to your phone.

If a basestation has to re-transmit the same packet 9 times, the carrier only books that packet to a users account once the 10th attempt makes it through.

Subscribers with bad modems (bad decode performance, drop lots of packets) directly harm the profitability of carrier networks.

I do not believe this is an issue for Apple. It appears that Apple C1 modem has excellent decode performance.

Geekerwan did a surprisingly good job of testing the modem given they are amateurs who lack the proper equipment or training.

Apple’s C1 modem is excellent. Missing a bunch of features… but decode performance and power are as good as Qualcomm or even slightly better sometimes.

(uplink carrier aggregation is a big missing feature so vloggers who upload HD videos from their phone without WiFi are out of luck…)

Some features missing from Apple C1 matter. Some do not.

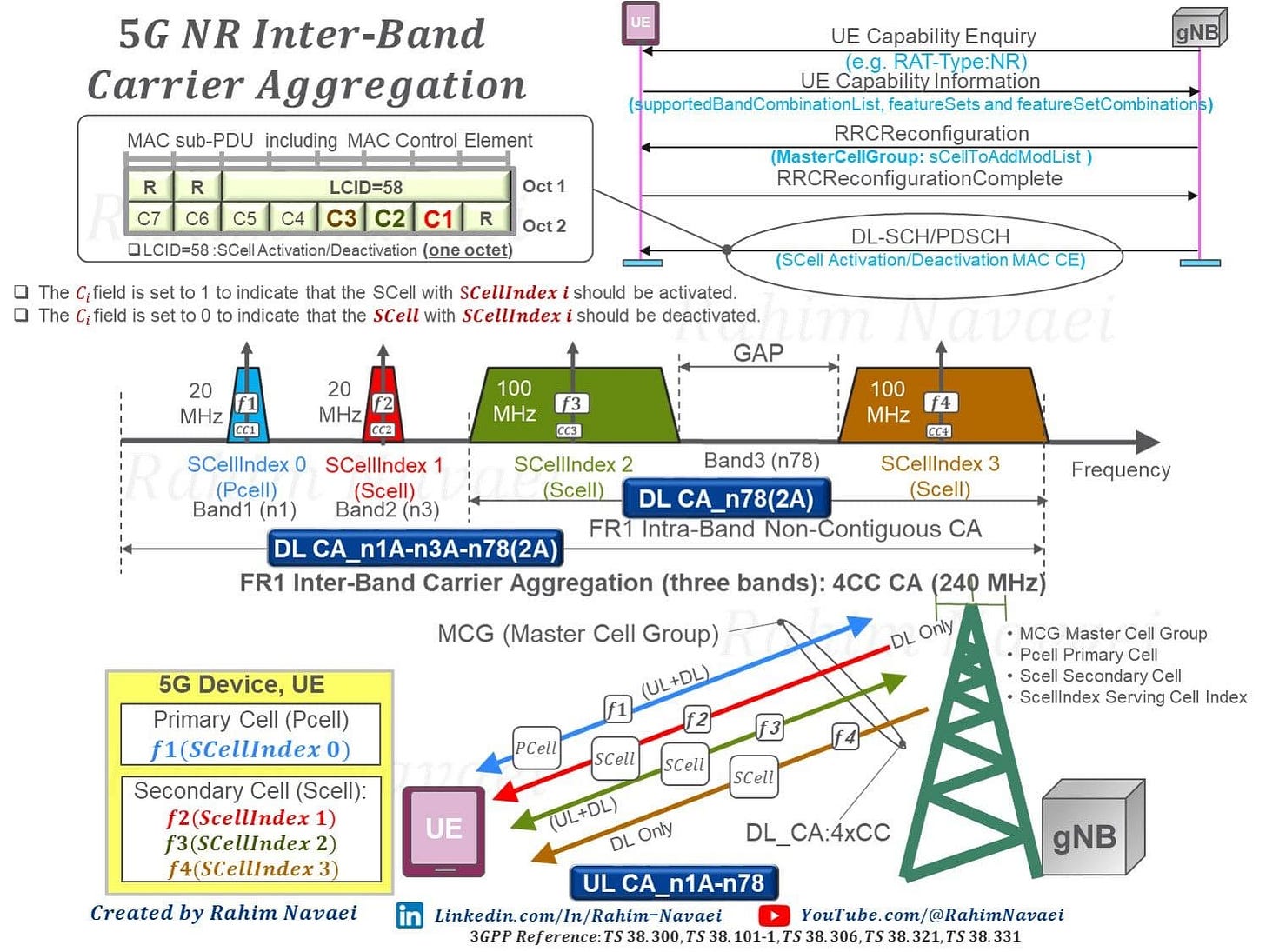

For example, let’s re-visit mmWave, this time from the view of carrier aggregation.

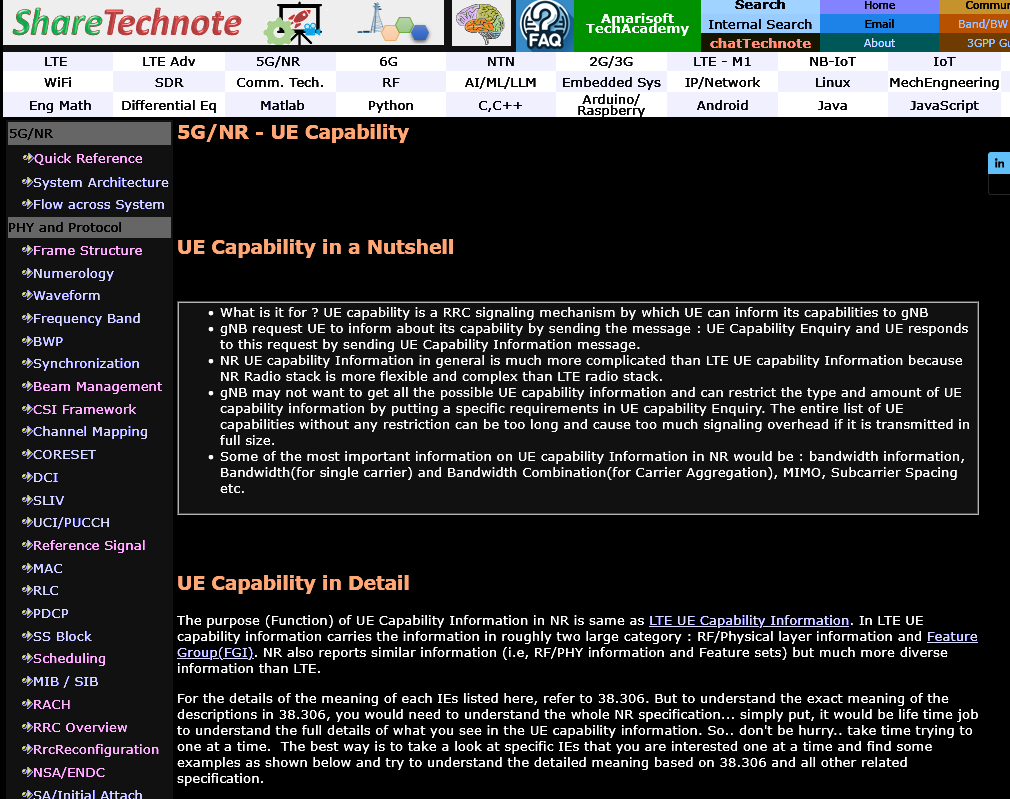

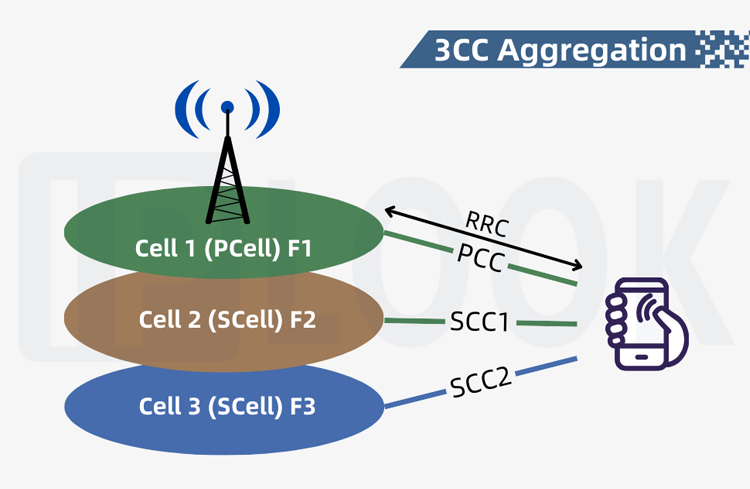

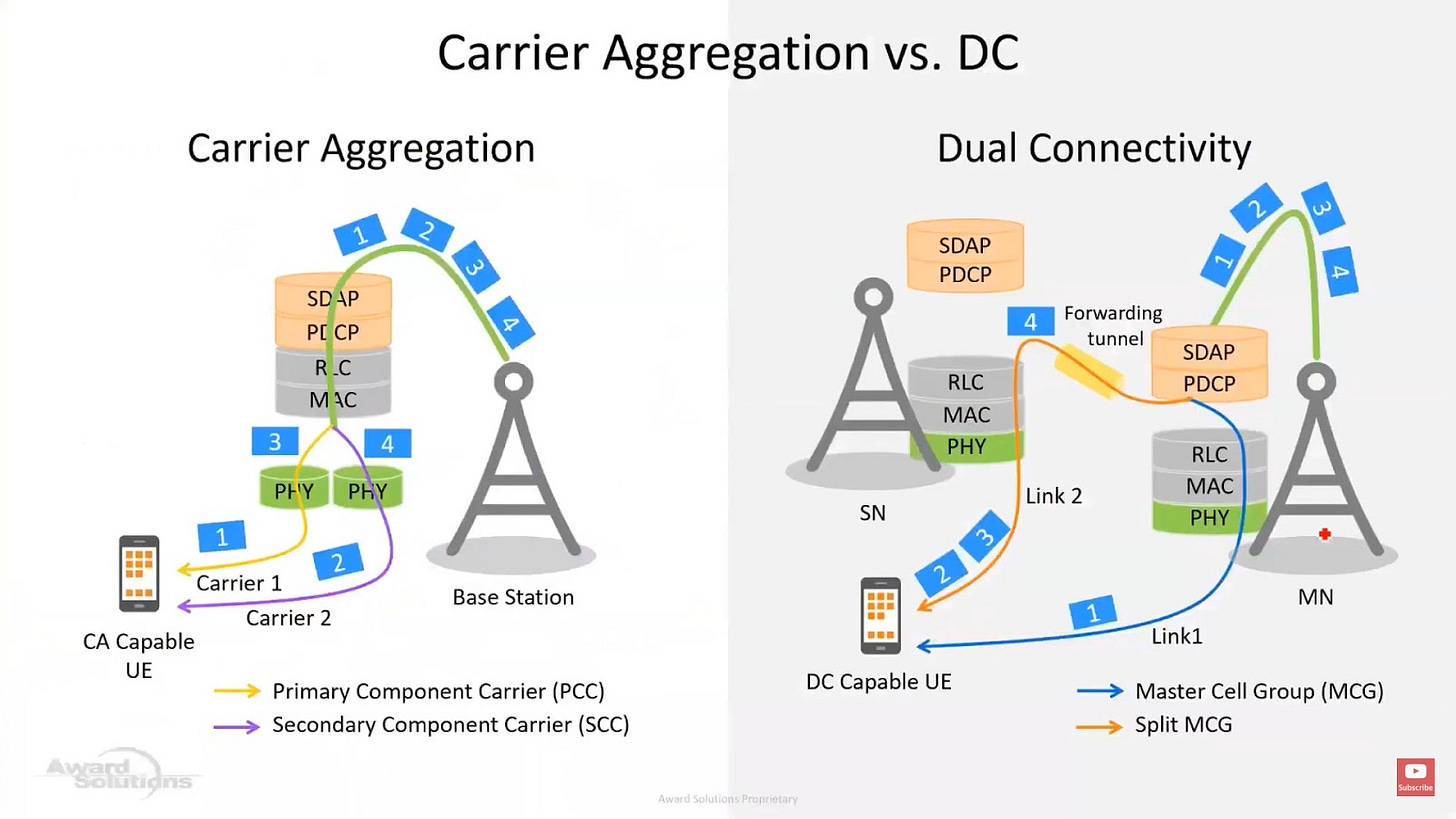

Carrier aggregation (CA) is a process that has one phone connect to “multiple basestations”.

Technically, CA is using multiple PHY (remote radio heads, RRH) while dual connectivity is really “connect to two basestations”.

This image is one basestation with many RRH.

Each rectangle is an RRH.

Circles are wireless backhaul because carriers don’t like to set up expensive fiber backhaul for every cell site.

The invisible structures are what the deep state used to disperse COVID. 🤡

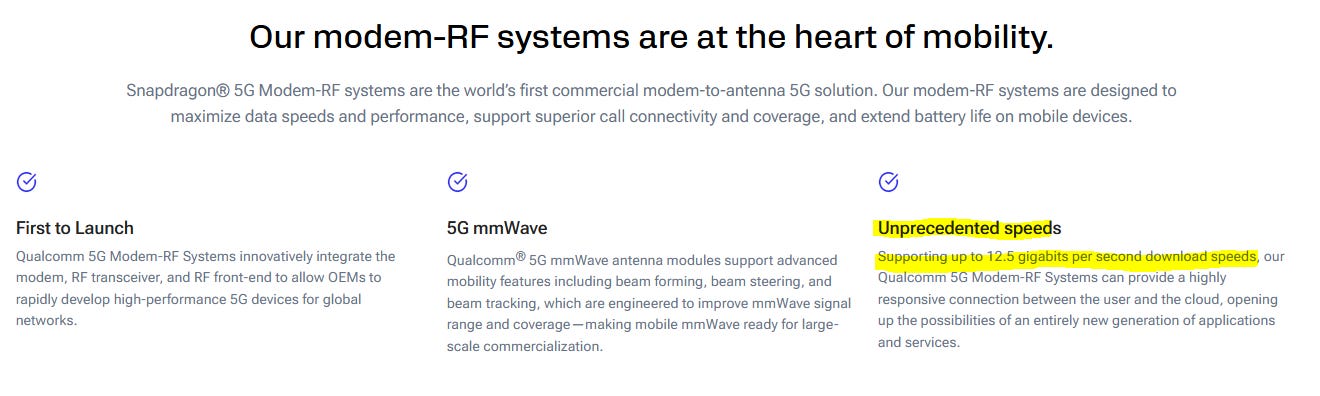

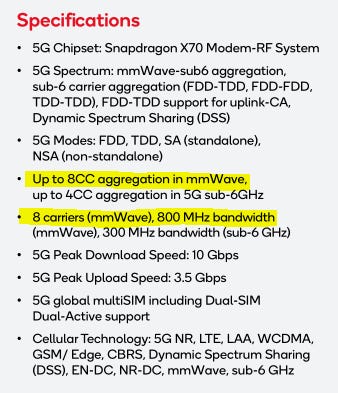

Qualcomm loves to advertise peak download rates on mmWave.

One obvious question is how likely is a user to actually experience these 12.5 Gbit download speeds?

Let’s check the datasheet.

8CC. Users need 8 mmWave RRH to all send traffic at the same time.

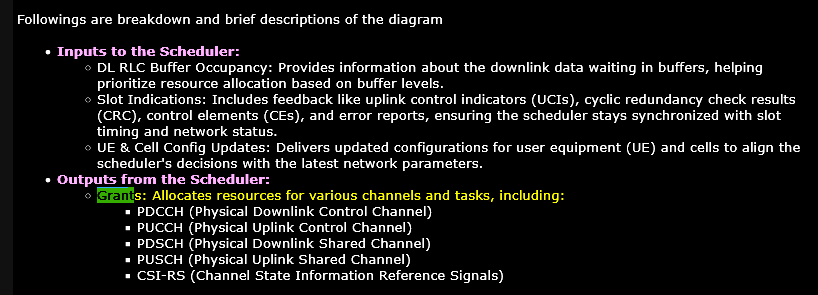

Now is a good time to talk about grants…

Cellular networks are very much like Infiniband or UEC or UALink. They function using credit-based flow control.

In telco lingo, people say grant instead of credit.

A good chunk of the readership here frequently travels to conferences using business class.

Presumably these people also expense the more costly “business cellular plans” to their fund because:

They can. 2 and 20.

They actually need the highest quality cellular service to do their jobs more effectively.

There are also a bunch of college students in the readership who are probably broke and use cheapo “virtual network providers”.

The difference between cheapo sub-brand, normal plan, and business plan is the same.

Grant priority.

Say you are in a crowded area. Network resources are low.

If you are a cheapo sub-brand customer, the network discriminates against you and provides fewer grants.

If you are a premium business customer, the network puts you in front of the line for grants.

Now that you understand what grants are and how they work, lets go back to 8CC mmWave 12.5 Gbit claim Qualcomm makes.

No real network is going to actually give a single user enough grants to achieve this datarate.

The following conditions all have to be simultaneously true to even have a chance of getting the stars to align for 8CC mmWave peak throughput.

You are in a city center with lots of infrastructure.

It’s 4 AM on a weeknight so most people are asleep and not using the network.

You are an ultra-premium business subscriber.

Your phone has line-of-sight to 8 mmWave basestations simultaneously.

Somehow you run a workload that actually requests 12.5 Gbit datarate.

My home DOCSIS-based internet is 350 Mbit.

Consider myself to be a heavy internet user.

Never have issues with this limit.

If all five of these conditions are met, MAYBE the Verizon scheduler will give you the grants.

Some 5G modem features matter. The vast majority do not.

Apple probably needs to support at least 2CC mmWave for coverage reasons.

8CC… lol its useless.

[4] Qualcomm Diversification Efforts

It’s mostly failure to be honest.

[4.a] Cloud AI 100 (AI Inference)

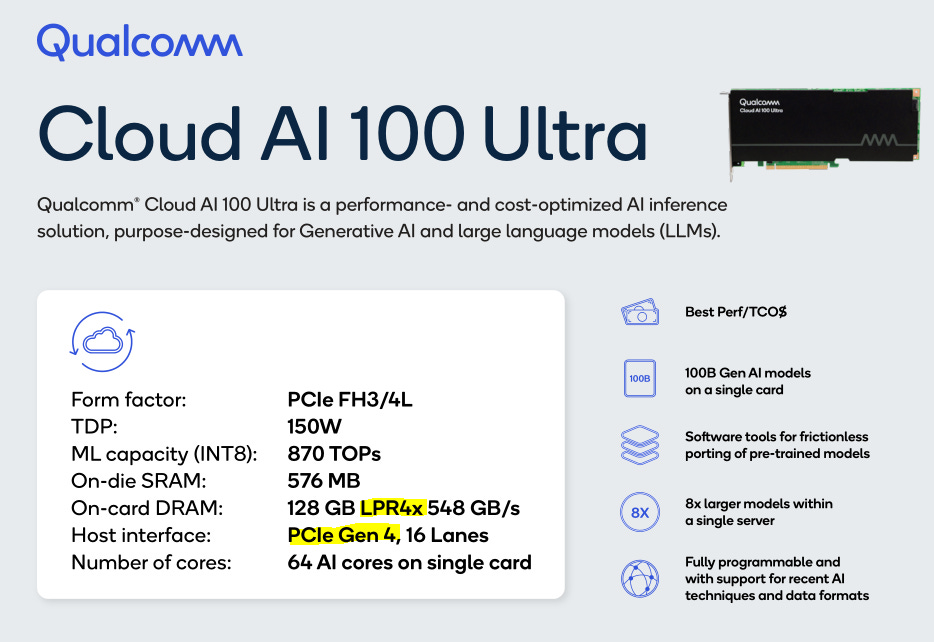

Qualcomm launched the Cloud AI 100 in 2019. This is a 7nm chip that uses LPDDR4x.

Four years later (2023) Qualcomm launched the Cloud AI 100 Ultra. This appears to be four of the 2019 chip on a single PCIe card and apparently uses a PCIe switch internally.

You tell me if a LPDDR4x 7nm chip originally launched in 2019 that uses an outdated smartphone VLIW DSP core is competitive in 2025.

Instead of meticulously tearing apart this chip, I will simply refer to official Qualcomm SEC 10-K filings.

https://investor.qualcomm.com/financial-info-sec-filings/sec-filings/default.aspx

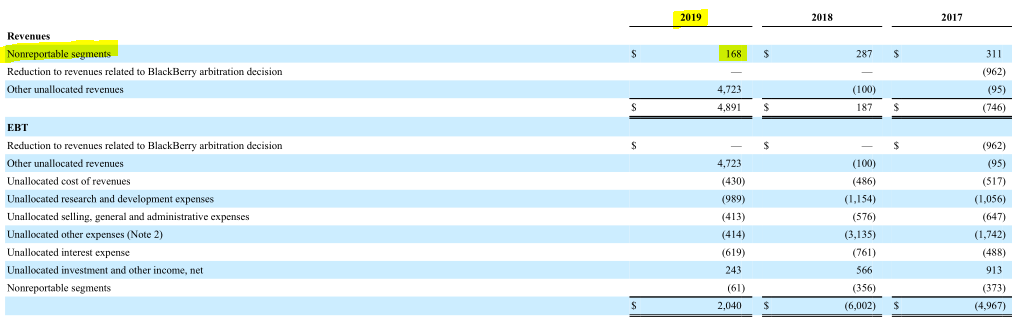

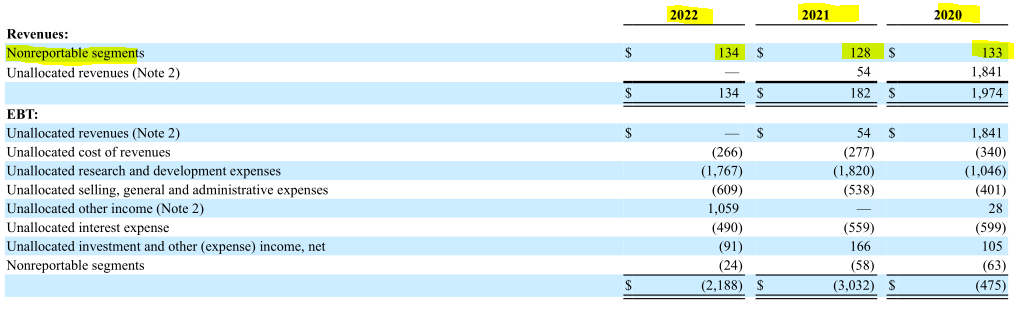

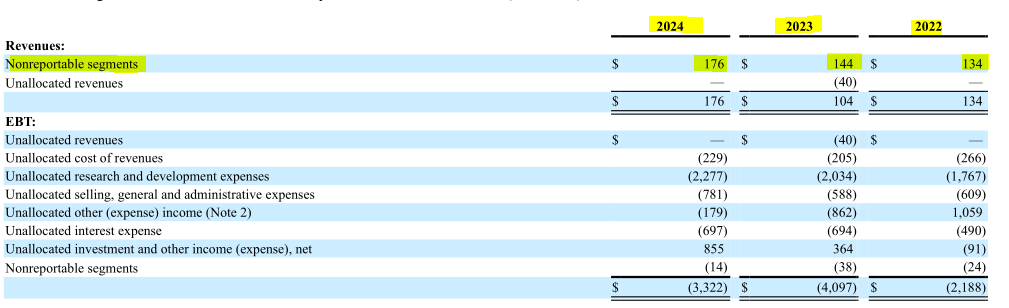

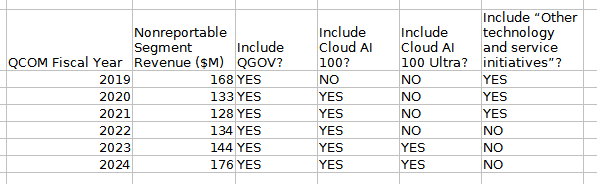

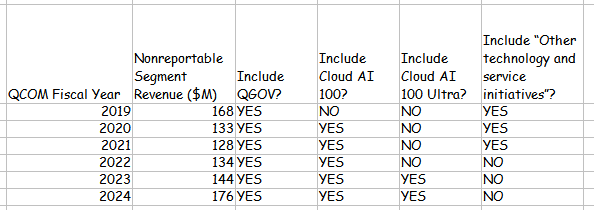

In the 10-K filing in November 2019, Qualcomm defined its non-reportable segments as follows.

“We also have nonreportable segments, including Qualcomm Government Technolgies or QGOV (formerly Qualcomm Cyber Security Solutions), as well as other wireless technology and service initiatives.”

- QCOM 2019 Form 10-K

We can see that this non-reportable segment (mostly government contracts) generated $168M of revenue in 2019.

The 2020, 2021, and 2022 10-K has a new definition for non-reportable segments. In general, the wording is very similar, but I have included direct quotes from each SEC filing for completeness.

“We also have nonreportable segments, including Qualcomm Government Technologies or QGOV, our cloud AI inference processing initiative and other technology and service initiatives.”

- QCOM 2020 Form 10-K

“We also have nonreportable segments, including QGOV (Qualcomm Government Technologies) and our cloud AI inference processing initiative and other technology and service initiatives.”

- QCOM 2021 Form 10-K

“We also have nonreportable segments, including QGOV (Qualcomm Government Technologies) and our cloud AI inference processing initiative.”

- QCOM 2022 Form 10-K

Finally, let’s look at 2023 and 2024.

“We also have nonreportable segments, including QGOV (Qualcomm Government Technologies) and our cloud computing processing initiative (formerly referred to as our cloud AI inference processing initiative).”

- QCOM 2023 Form 10-K

“We also have nonreportable segments, including QGOV (Qualcomm Government Technologies) and our cloud computing processing initiative.”

- QCOM 2024 Form 10-K

Given the explosive growth of datacenter/cloud AI computing shown by Nvidia, Broadcom, and AMD, it would make sense for investors to want direct visibility into Qualcomm’s comparable program.

Unfortunately, QGOV is lumped into nonreportable segments alongside Cloud AI 100/Ultra. It is reasonable to assume that government contracts are lumpy, so the true growth of Qualcomm’s datacenter/cloud AI business is difficult to gauge.

I am excited to see what nonreportable datacenter/cloud AI number will be shown in two months when Qualcomm files it’s 2025 10-K with the SEC.

Those of you finance pros out there with Bloomberg terminals should try plotting Nvidia/Broadcom/AMD AI datacenter yearly revenue from 2019 through 2024 against Qualcomm. Maybe you can see something I don’t. 🧐

[4.b] Failure #2: Snapdragon X Elite (Laptop SoC)

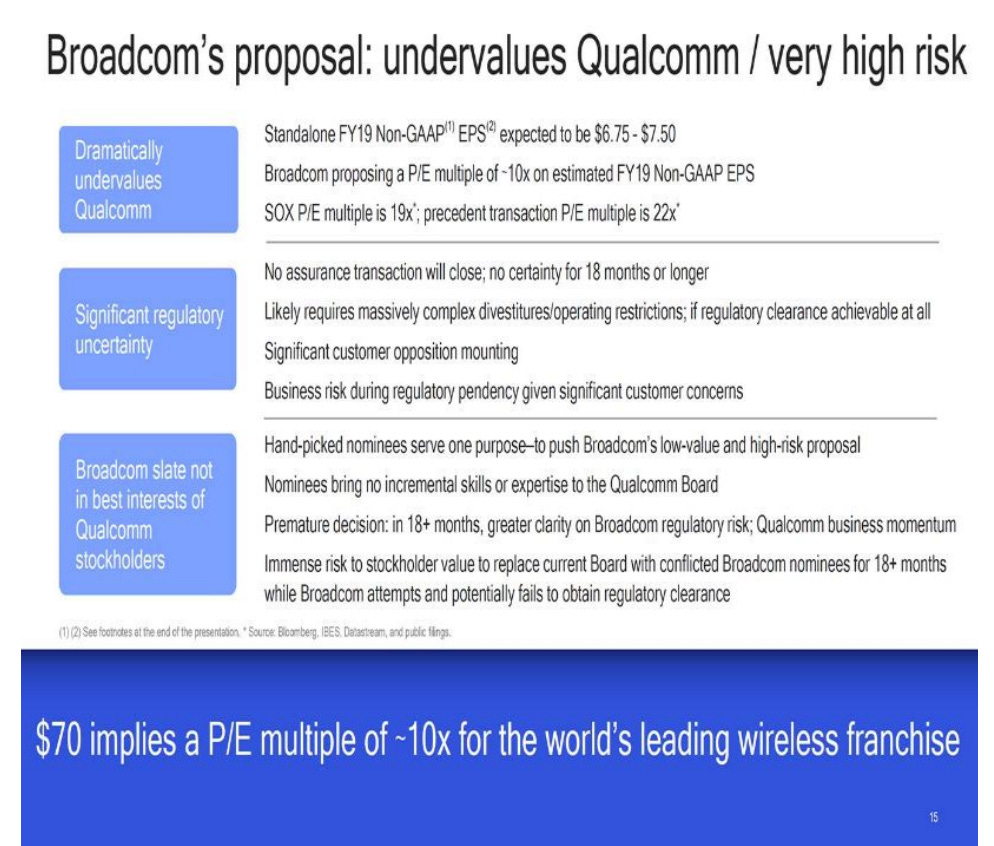

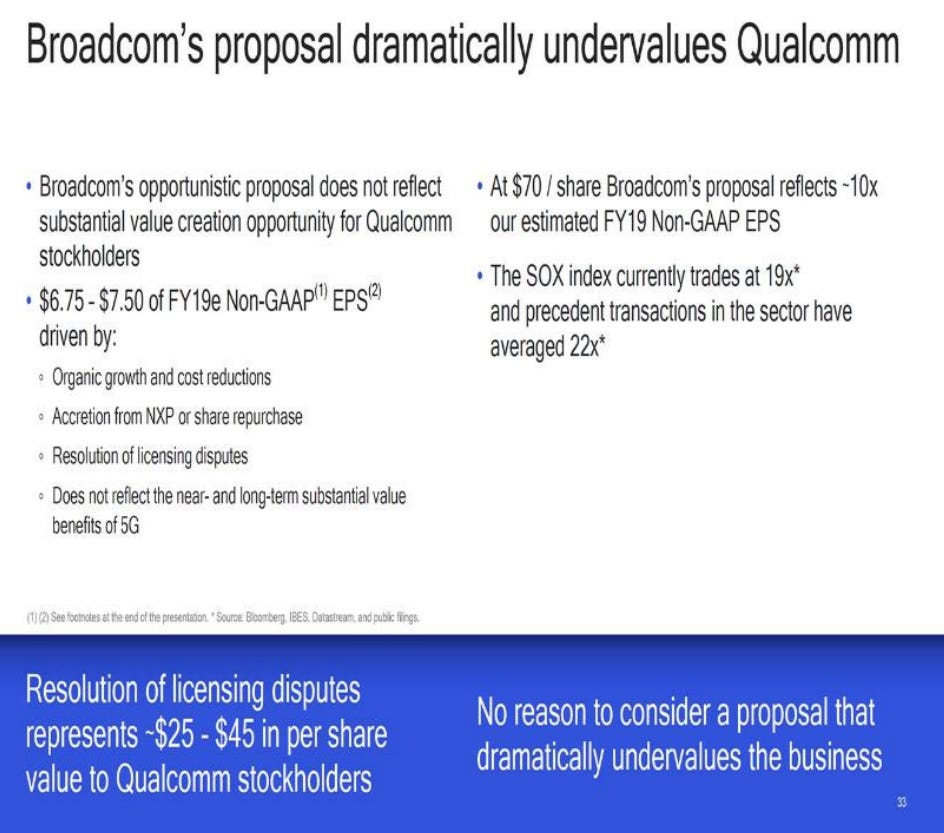

I think the best way to start is to go all the way back to January 16th, 2018.

On that day, Qualcomm filed an official document with the SEC that was related to the Broadcom hostile takeover.

In short, arguments on why Qualcomm shareholders should not allow evil Hock Tan to take over.

Here is a direct link to the PDF. Go read it for yourself.

https://d18rn0p25nwr6d.cloudfront.net/CIK-0000804328/2214514b-e497-4e95-97d5-0379ca4172f8.pdf

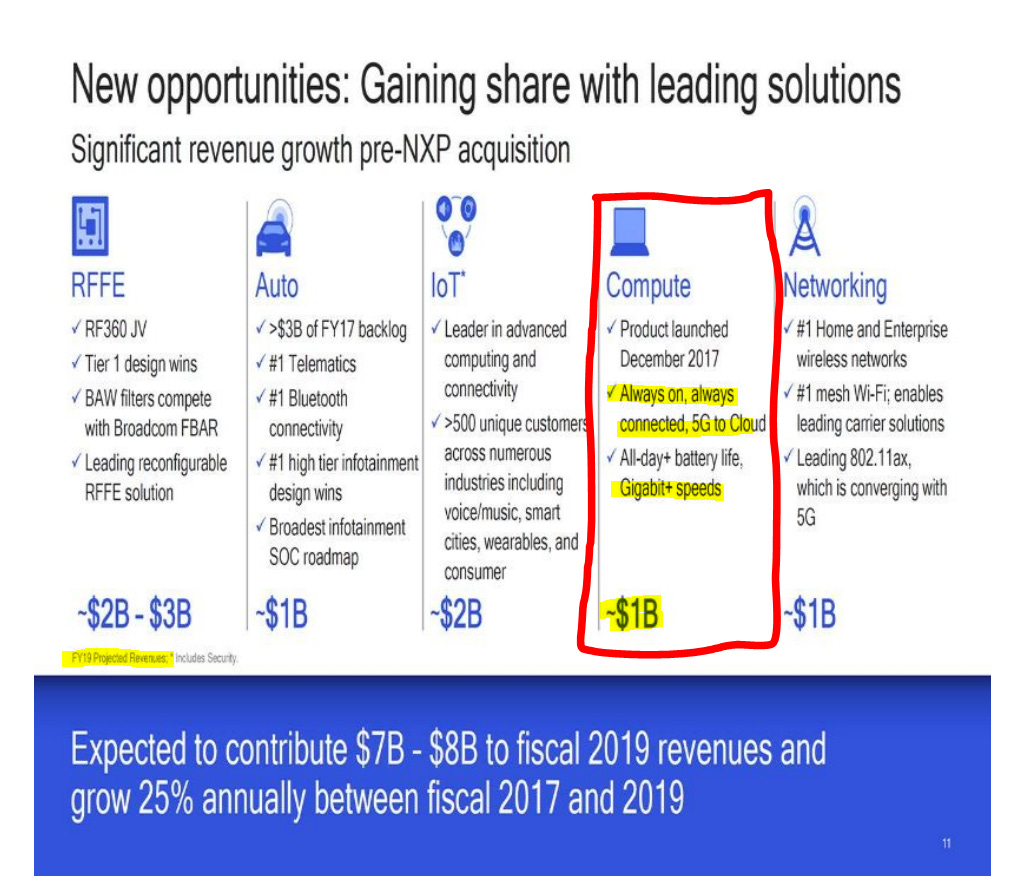

The reason I spent half an hour digging though old SEC filings is to show all of you this.

Qualcomm explicitly promised ~$1B of REVENUE from compute (laptop/PC) in FY2019.

This is not TAM, SAM, or some other debatable number that depends on underlying assumptions.

REVENUE.

2019.

Given how evasive Qualcomm management is in recent earnings calls on how much revenue compute (Snapdragon X Series) is generating, it’s safe to say the numbers are still not good.

If they had $1B in compute revenue they would have broken out X Elite into it’s own reportable BU and proudly declared this.

6 years late so far with no clear path to achieving the 2019 target…

I estimate Qualcomm’s annualized compute revenue to be between $200M and $700M. Wide range because there is no quality information.

I own one of these laptops. It sucks.

My Intel Meteor Lake laptop is objectively better in every way.

Somehow, the battery life is better too! 2-6 hours depending on what programs I use.

Additionally, I want to call out some of the phrases Qualcomm loves to use.

“always connected PC”

“5G to cloud”

“Gigabit+ speeds”

EVERYONE HAS A 5G WIFI HOTSPOT IN THEIR POCKET.

99.999% OF PEOPLE WILL USE THAT INSTAED OF PAYING FOR A MORE EXPENSIVE LAPTOP AND A SECOND CELLULAR SUBSCRIPTION.

Qualcomm’s mentality is driven by a pervasive desire to shove cellular technology and QTL patent portfolio into markets that have no need for it.

Instead of trying to make a good laptop chip, Qualcomm spend 2017-2021 trying to make a “good enough” laptop chip with an integrated 5G modem so they can try to replicate QTL royalty model on laptop sales.

Then when they realized that strategy was going nowhere, they bought Nuvia but somehow delayed the project so long that Intel had a chance to recover.

Truely legendary execution failures.

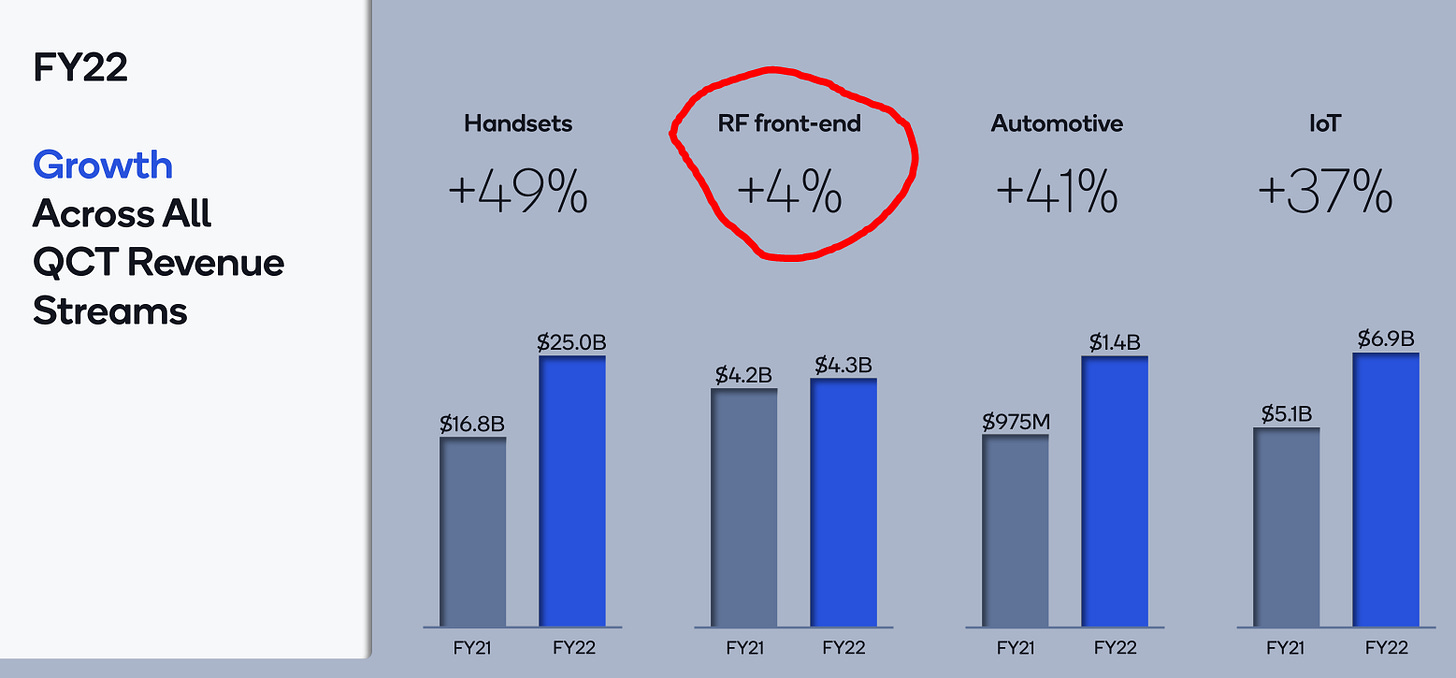

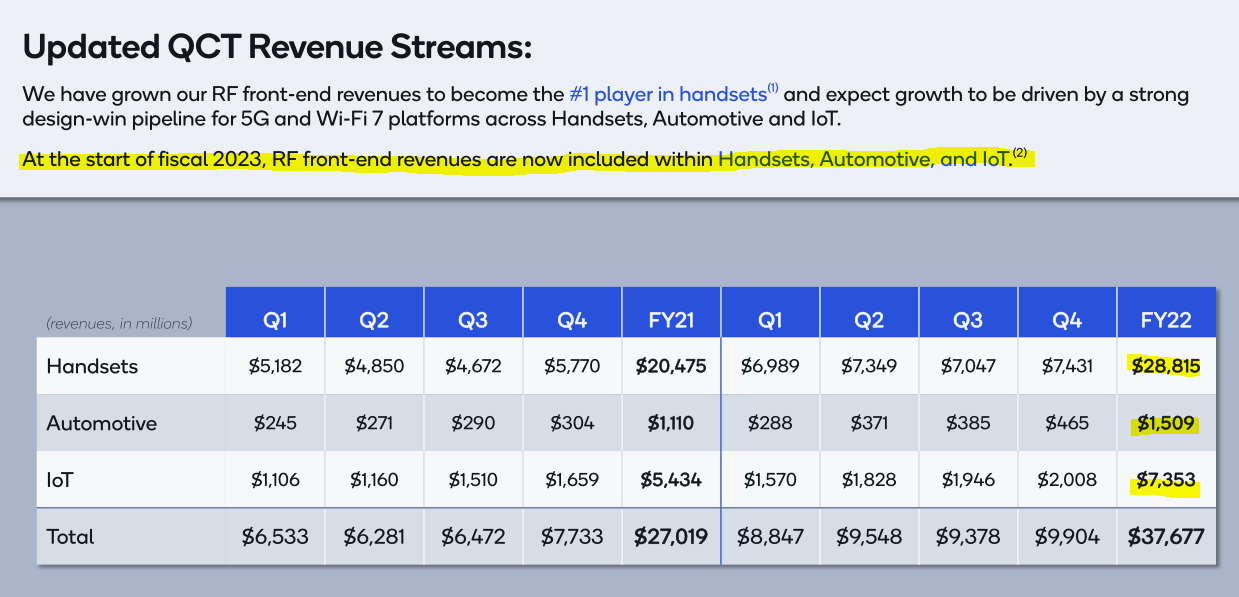

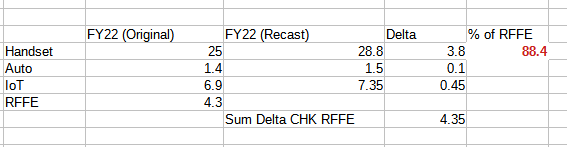

[4.c] Failure #3: RF Front End (as a diversification vector lol)

Previously, Qualcomm would report four segments.

The message to investors was:

Diversification == non-handset == RFFE + auto + IoT

Wow look at all that diversification revenue. We totally safe.

Investors correctly pointed out that the vast majority of RFFE revenue was going to handset market. Thus, RFFE is not really diversification, it is more leverage to handsets LOL.

Starting in FY23, Qualcomm deleted RFFE as a business unit and spread the revenue across the other three.

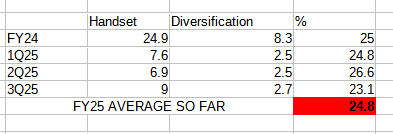

Let’s do some basic math.

Oh would you look at that. The investors were right!

Over 88% of “definitely diversification” RFFE revenue was going into handsets.

[4.d] Failure #4: 5G O-RAN (entering saturated basestation market)

Given how much shit Ericsson and Nokia have eaten over the last 5 years, you have to wonder what compelled Qualcomm to invest in 5G O-RAN (modular basestation ecosystem) given that they are already hyper-levered towards 5G/wireless.

Marvell’s carrier business has disintegrated so badly that they removed reporting for that BU with an obfuscation reporting consolidation.

Technically, this is diversification from handsets.

Still… it feels like this is Qualcomm entering a saturated market with very poor economics.

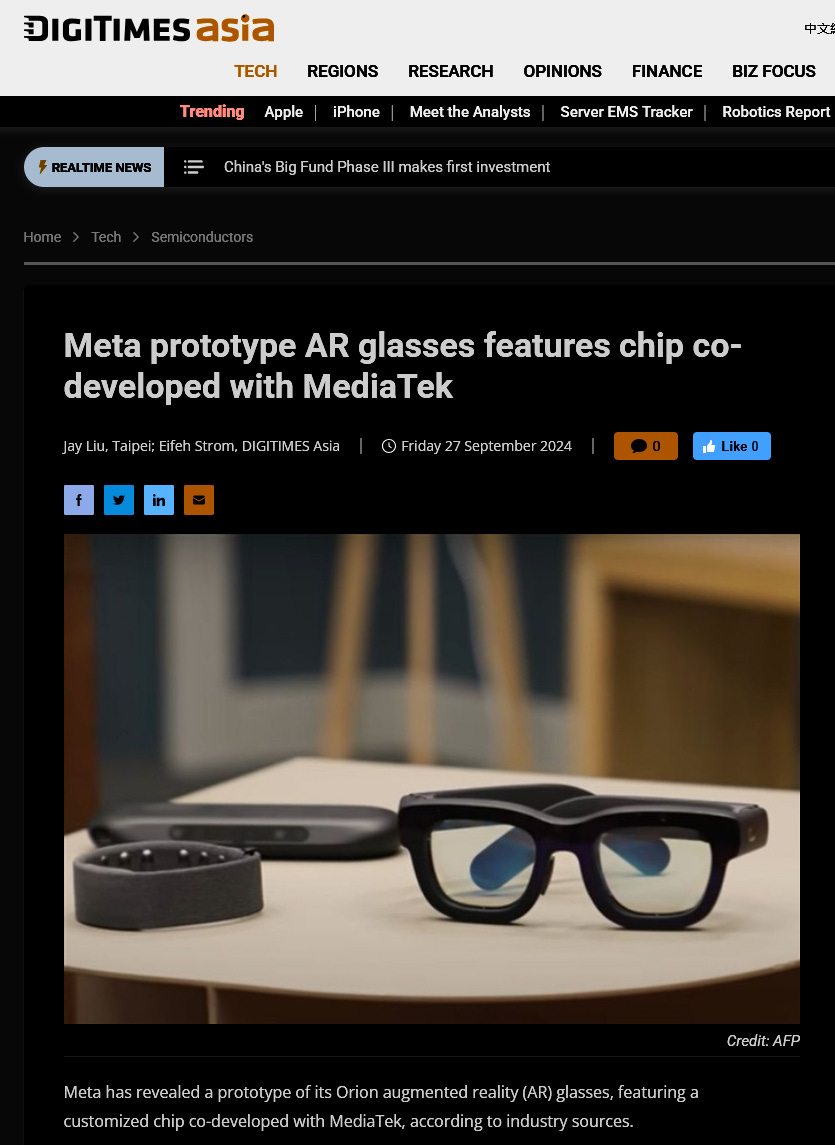

[4.e] Failure #5: XR/AR/VR (lost Meta to MediaTek)

Imagine performing so poorly that Meta (the company that renamed itself for the metaverse shit) decided to move premium sockets to MediaTek.

The market for XR is in its early stages and Qualcomm is already losing.

[4.f] Failures #6 and #7: Datacenter CPU (**TWICE** THEY ACTUALLY BOTCHED THIS TWICE AND ARE TRYING FOR A THIRD TIME)

Qualcomm’s first attempt (2017) at a datacenter CPU was called Centriq.

Five months after launch, rumors of Centriq getting killed were already circulating.

Because the VP of that group (Anand Chandrasekher) left. Methinks he saw the budget and headcount reduction plan and had no interest in implementing it.

At the time, Cristiano Amon was President of Qualcomm’s chip division, QCT.

He was directly involved in the decision to kill Centriq and “prioritize 5G”.

Four years later in 2021, Qualcomm bought Nuvia, a startup that was trying to commercialize a high-performance ARM-based datacenter CPU.

They had an in-progress design. At some point (2022?), Cristiano Amon, now CEO of Qualcomm, decided to axe the Nuvia server CPU and make what was left of the team focus on laptop chips.

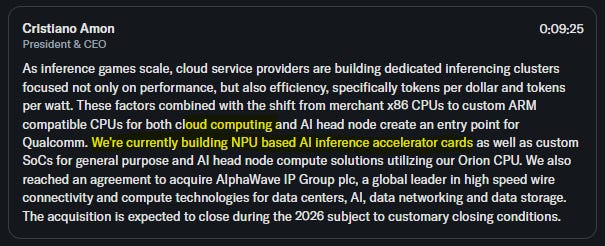

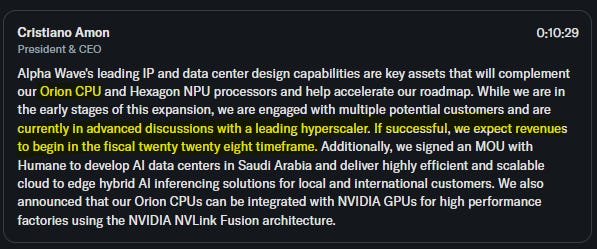

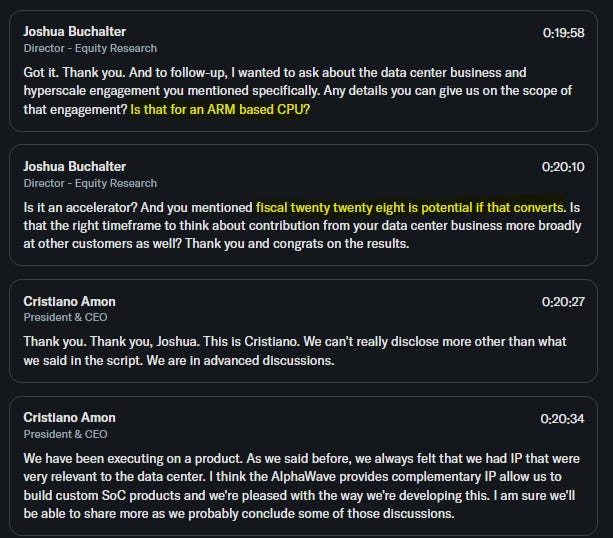

Now in 2025, ATTEMPT NUMBER THREE at datacenter CPU is kicking off.

Not laying off the people responsible for attempts #1 and #2 and having some continuity in the technology roadmap would have been beneficial.

What is even more crazy is Qualcomm has indicated revenue from attempt #3 will only happen in FY2028.

WHY IS IT GOING TO TAKE THIS LONG????????????

YOU HAVE A WELL-INTEGRATED CPU UARCH TEAM SINCE 2021.

YOU HAVE EXCELLENT NOC IP.

YOU HAVE ONE OF THE BEST PHYSICAL DESIGN TEAMS IN THE INDUSTRY.

YOU DON’T NEED WAIT FOR ALPHAWAVE DEAL TO CLOSE. SIGN AN IP LISCENSEING DEAL IN THE INTERM JUST LIKE HOW NVIDIA AND ARM SIGNED A DEAL TO DEVELOP GRACE AS LEAD CUSTOMER OF V2 CORE IP.

THERE IS NO EXCUSE FOR THE TIMELINE OF ATTEMPT #3 TO BE THIS SLOW.

THIS IS A GREAT OPPERTUNITY AND YOU CANNOT AFFORD TO BOTCH THIS AGAIN.

One of my hedge fund friends thinks “Alphawave is a zero” and that “Qualcomm spent $2.4B to have a story.”

Zero is a bit too harsh IMO.

Licensing all the relevant Synopsys interface IP for the next 5 years would probably cost $200-500M in total contract value.

So Alphawave is worth at least that value + book value.

Synopsys UCIe and 224G IP is way better than Alphawave FYI.

Regardless of pricing and valuation, Alphwawave is a great buy for Qualcomm.

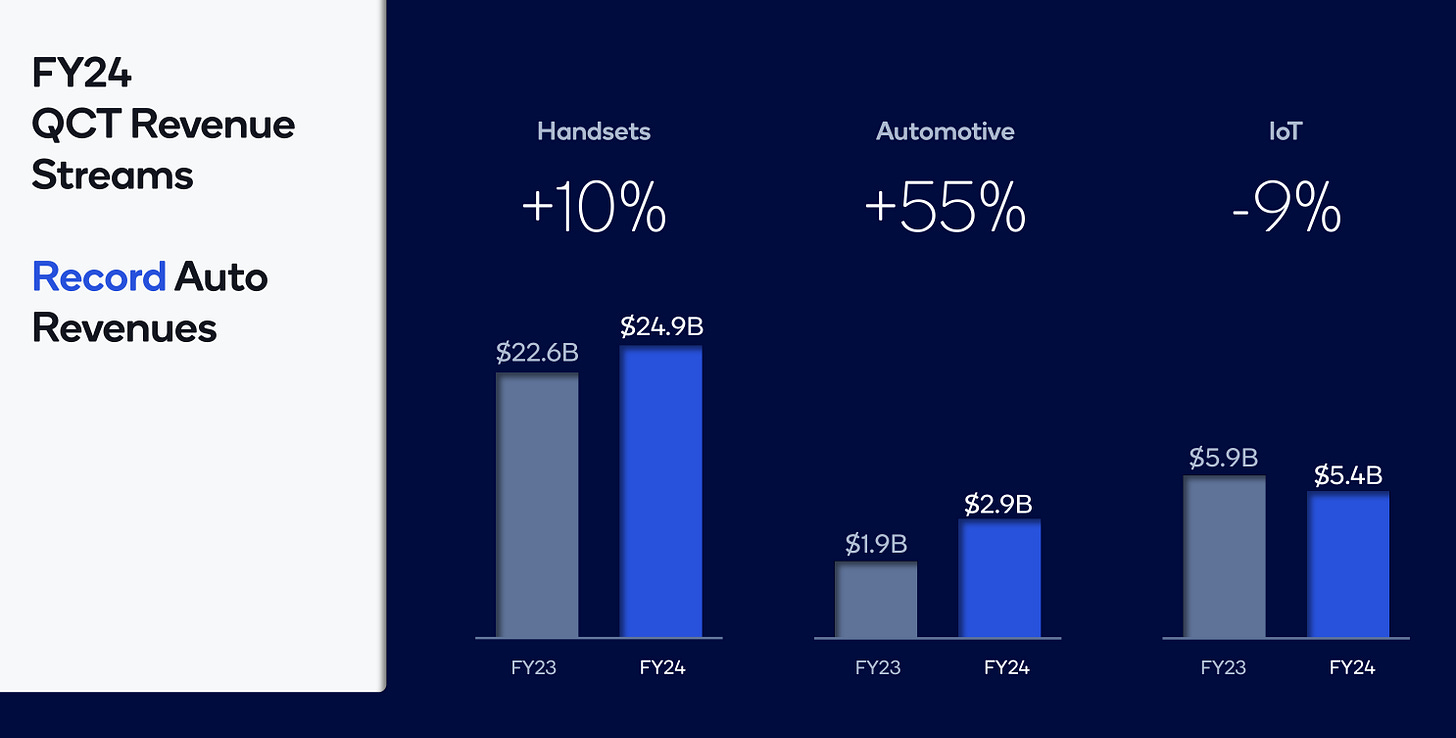

[4.g] Success #1/1: Automotive

Many people I talk to have criticisms of Qualcomm’s automotive business.

Very high revenue concentration to China region.

Low gross margins.

Mostly infotainment with little traction in higher value ADAS.

Comps will be difficult next year.

Revenue growth partially because Mobileye is incompetent.

Yes, all of the above statements are true.

But the auto business is Qualcomm’s greatest diversification success.

They went from zero to surpassing Nvidia in quarterly auto revenue very quickly.

This is a win.

Legit success. Credit where credit is due.

[5] Qualcomm Segment Reporting: Nothing to See Here

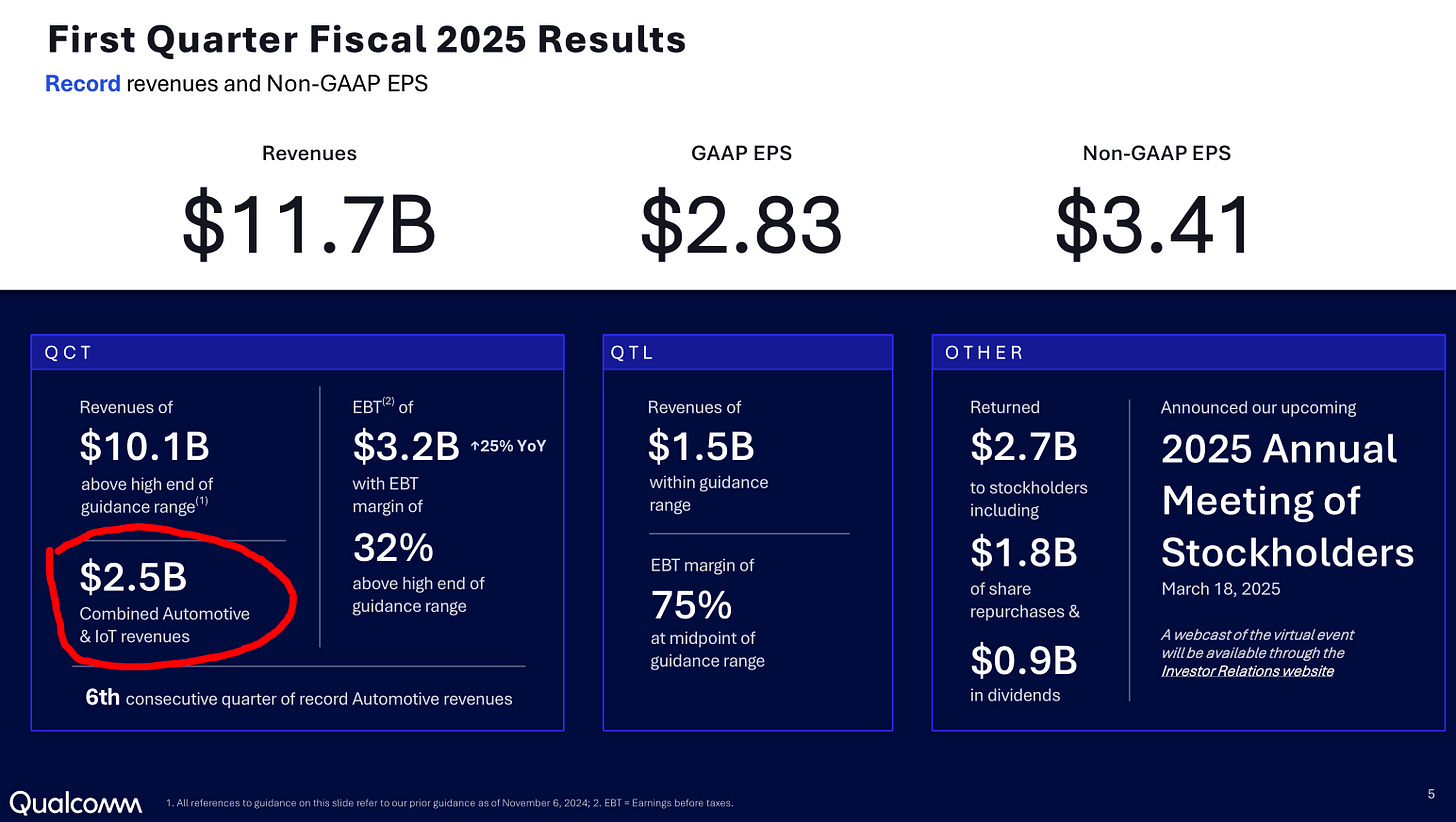

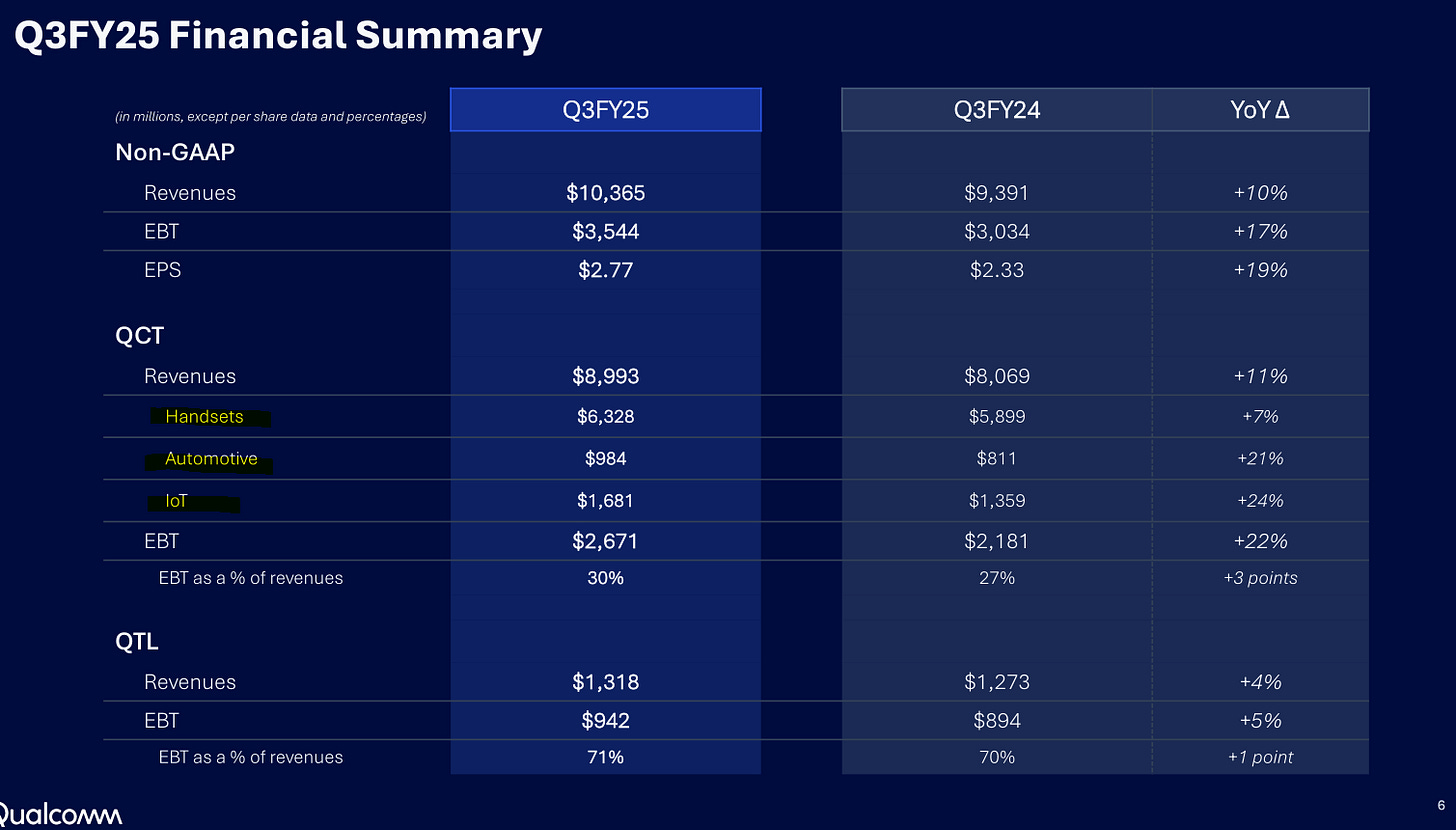

Before 2025, Qualcomm would show bar charts of chip revenues via three segments.

Now they use boring table. I liked the bar charts. :(

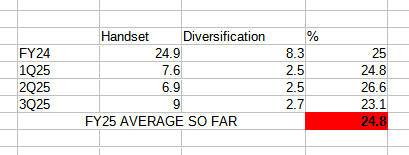

Let’s break this down into handset vs diversification (not handset) as %.

As you can see, it appears that diversification as a percentage of revenue has stalled.

This brings me to the “IoT” segment. What is in this thing?

Well… it’s all the half-baked businesses that Qualcomm refuses to break out because the finance people will immediately start making QoQ and YoY comps.

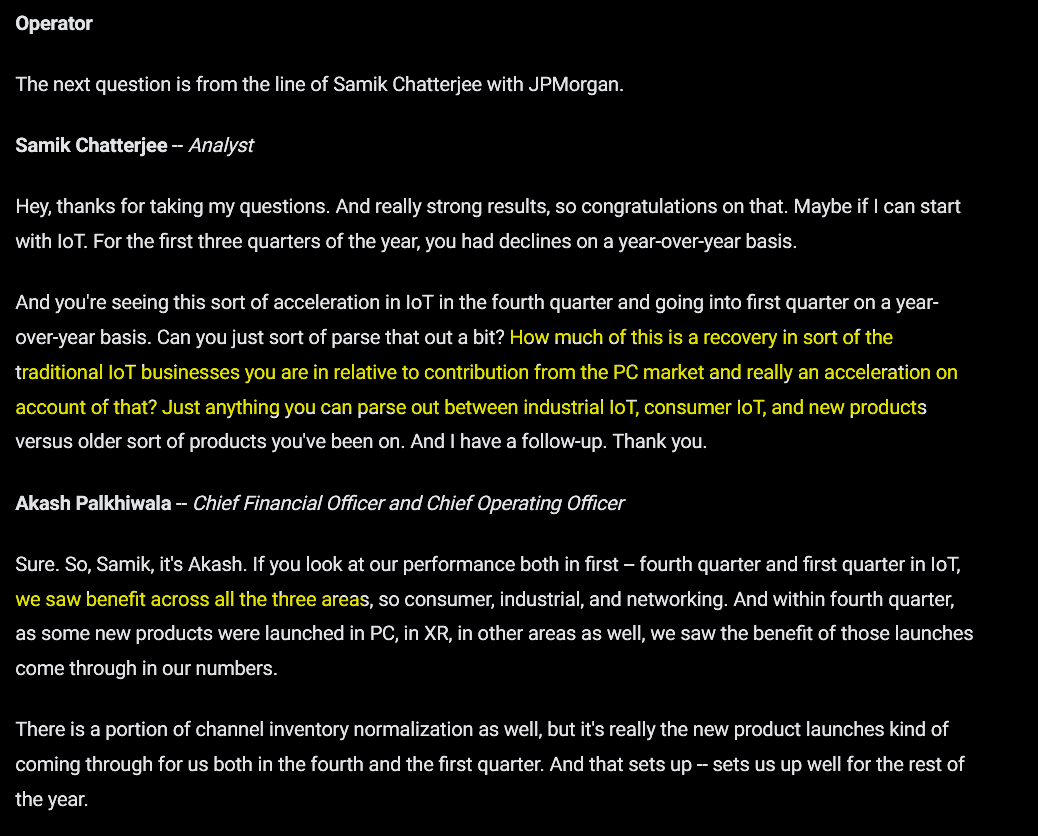

Every earnings call, the sell-siders ask for “color” on IoT. Breakdown of industrial vs consumer vs networking.

Here is an example of a sell-side analyst trying to figure out if the laptop chips are selling or not. (the answer is no)

The easy way would be for Qualcomm to just report laptop/consumer/PC as a separate segment or tell people the number verbally on the call.

Broadcom likes to say the granular numbers on the call. Whatever. Format does not matter. SHARE THE NUMBERS.

They have this PC number. They have the number for XR, and basestation/infra, and so on…

Transparency on revenue streams is always a good thing.

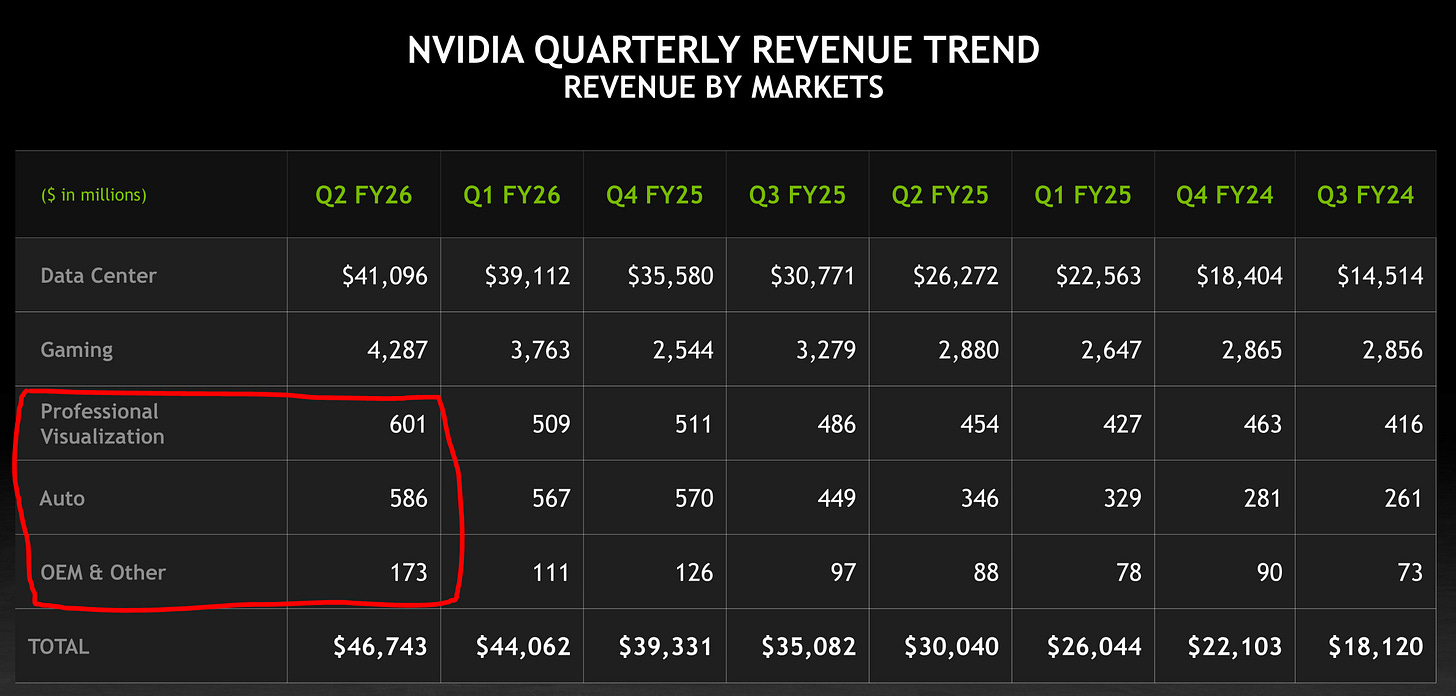

Look at what Nvidia does.

Nvidia could lump three segments into one but they don’t. More information is always a good thing.

I have called out AMD and Marvell for intentionally lumping together business units to obfuscate negative trends and I am repeating this comment towards Qualcomm.

[6] September 2025 State of Play

Apple has launched their modem in the iPhone 16e and iPhone Air.

The rollout has been surprisingly good. I was expecting some people to complain about coverage or stability from one or two carriers but no… it appears to have been a clean **global** launch where nobody noticed or complained…

but but…. making a gLObAl 5G mODEm is sO HArd. bY thE tImE AppLE gEts tHEre qUAlComM wiLL bE On 6G!!!!!!!!!!!!

Verizon is the main blocker of further volume increases. If Verizon completes their C-band rollout by Summer 2026, Apple will likely be able to go 100% internal modem for the September 2026 iPhone 18 launches.

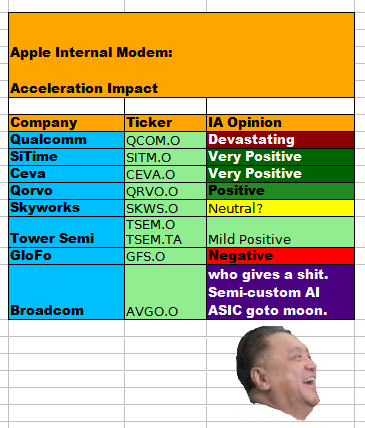

This would be devastating for Qualcomm, very positive SiTime and Ceva, moderately positive Qorvo.

Full list of affected tickers here.

While Qualcomm’s modem chipset sales to Apple would go to zero faster than sell-side expects, theoretically the licensing revenue would continue until April 1st, 2027.

Apple probably will wait the 6-months for the deal to expire. Some of my hedge fund friends speculate that Apple backs out of the deal early but that seems unnecessary and foolish. Just wait out the contract…

[7] Incoming Capsaicin Tsunami: April 2027

There are three possibilities for what happens when the existing patent licensing contract runs out.

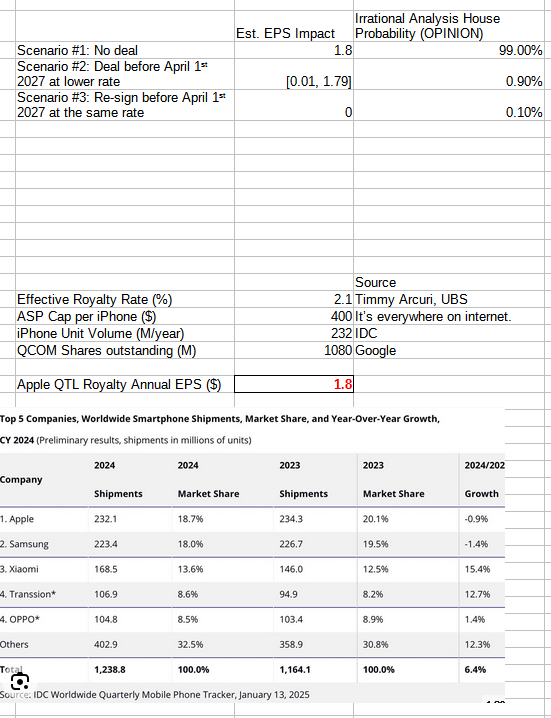

Here is a table with my personal opinion probabilities and rough EPS impact.

Last time Apple tried to negotiate on pricing, there was a brutal legal battle that lasted over 2 years.

Last time, Qualcomm had incredible leverage. Successfully winning bans in China and Germany for Intel-modem powered iPhones was critical to Qualcomm’s eventual victory.

Next time will be very different.

[8] June 2025 Earning Call Transcript

Let’s look at the most recent earnings call to get a sense of where things are.

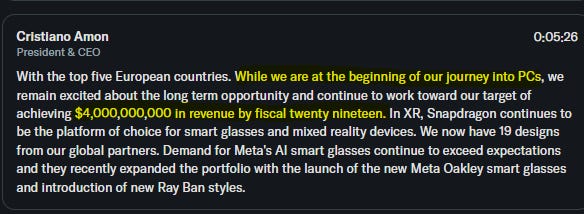

On January 16th, 2018, Qualcomm promised $1B of PC/compute revenue for FY2019.

It’s been 6 years and Qualcomm still cannot claim $1B of revenue in FY 2025.

Why should anyone believe your $4B FY2029 PC revenue target?

SEC filings say you have been building AI inference accelerator cards for the cloud computing market since 2020. How’s it going? Care to share any revenue numbers?

To me, it looks like non-reportable segment revenue is dominated by QGOV.

Cloud AI 100/Ultra could literally be lower than $50M of revenue annualized and this is a with generous assumptions.

2028 is too late. By then, Vera CPU will have been on the market for what… at least 18 months?

I am baffled this third attempt at datacenter CPU is going to take so long.

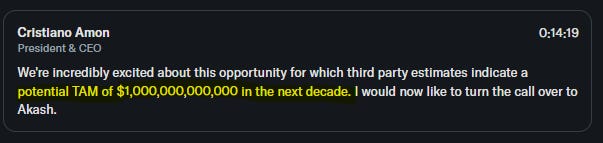

Looks like this TAM is going to Nvidia, Broadcom, AMD, and MediaTek.

Almost certain it’s a NVLink fusion CPU. Maybe Amazon.

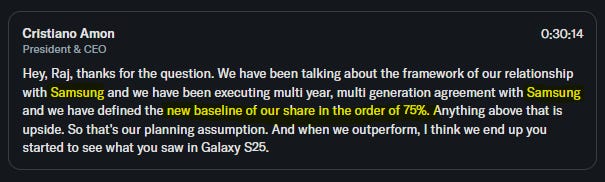

Going from 100% to 75% next year. Serious risk of Qualcomm hitting 20-40% share if Samsung Foundry fixes yield issues. It’s only going to get worse from here.

There is some background on the Xiaomi situation.

Xiaomi announced they have developed their own smartphone chip and even a 4G modem.

They publicly announced huge investment plans.

Obviously this is really bad for Qualcomm.

Literally one day after this bad news came out (May 19 2025 to May 20 2025) Qualcomm announces this deal.

Think for a moment.

Qualcomm is saying “volume increasing every year”.

Volume != Revenue

Given the many documented instances of Qualcomm signing deals with customers that have volume-based marketing/rebate incentives from Judge Koh’s findings, what you think happened here with Xiaomi?

Is revenue from Xiaomi going up, down, or flat each year over the term of this multi-year agreement?

Maybe this multi-year agreement is just delaying the inevitable by a few years.

Margins in smartphones are under extreme pressure. Even MediaTek is too expensive.

Going vertical seems to be where the handset OEMs are going.

[9] Qualcomm is out of time.

Remarkably, Qualcomm has managed to miss every major technology trend of economic value over the last decade. From the historic AI boom to ARM datacenter CPU, Qualcomm has made sure avoid the profitable stuff and relegate themselves to diversification via low margin businesses like automotive and edge IoT.

The driving force behind Qualcomm’s “bad bets” is the pervasive desire to shove wireless technology (and more importantly… QTL patent portfolio) into new end markets.

The “Connected Intelligent Edge” strategy can be re-phrased as “shove 5G modems into end markets that neither need nor want 5G modems”.

Windows on ARM PC

“Allways connected” sales strategy via integrated 5G modem failed.

People want a good laptop with a useable CPU.

Everyone has a 5G mobile hotspot in their pocket… their smartphone.

Pivot to addressing CPU deficiency was 6 years late, allowing Intel to retain market share they frankly did not deserve to keep.

Edge AI via wirelessly connected IoT devices is stupid.

Look at the growth of datacenter compute and datacenter connectivity, from copper to optical.

If low-power edge AI has economic value, there would have been revenue growth by now given the severe compute and datacenter infrastructure (power, cooling) bottlenecks.

Automotive diversification vector continues with this unhealthy obsession over legacy technology.

Qualcomm’s CFO has repeatedly brought up revenue expectations for “premium RF in premium connected vehicles” and “QTL royalty revenue per vehicle”.

The idea that autonomous (L4/L5) vehicles need 5G V2X technology is ridiculous.

Cristiano Amon’s strategy is not working.

Seriously let me re-paste the ratio.

The 2024 Investor Day was held on November 11th, 2024 to be precise.

First 9 months of fiscal 2025 clearly show the same diversification revenue ratio as Fiscal 2024.

24.8% ~= 25%

Maybe as handset revenue from Apple goes to zero in 2026 the diversification ratio go up.

The vast majority of engineers and investors would argue that wired/copper and wired/optical connected computing have been the driving force behind the AI infrastructure boom.

Nvidia and Broadcom are connected computing leaders with their high-power AI hardware and wired networking switches.

Niche wired connectivity and optical companies such as Credo, Astera Labs (sigh), Lumentum, Ciena, and Fabrinet have all experienced historic growth as Qualcomm struggles to find new markets for its existing wireless technology portfolio.

There is an insatiable demand for connected computing right now…

…just not the kind that Qualcomm can offer.

The last 8 years of diversification effort has not yielded enough revenue to mitigate the impending hole Apple will likely punch into Qualcomm’s income statement in April 2027. A cliff is coming in 17 months.

The world has moved on, and Qualcomm is out of time.

Sidenote: I have a separate deep-dive into the great 5G economic hoax, inspired by a great Business Insider YouTube video.

"The driving force behind Qualcomm’s “bad bets” is the pervasive desire to shove wireless technology (and more importantly… QTL patent portfolio) into new end markets."

This reminds me of peak Intel banging on opportunities with an x86 hammer and wondering why things weren't working (congrats on the Intel trade!)

1. Great write-up!

2. mmWave 5G has one major area that is its natural habitat - autonomous vehicles. Really fast communication between vehicles and to traffic management systems will be key for level 4 self-driving cars, trucks, buses etc. But, that's still in the distance for now.

3. The pachyderm that just entered the room is today's announcement of the deal between Nvidia and Intel. Will take a little while to show up, but Intel's position in mobile computing can only be strengthend because of this, which will in turn weaken Qualcomm's outlook here.