Qualcomm Investor Day; ARM Trial Preview; Cerebras Hoax Benchmarks

Tactical Idea: ARM Swing Trade

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Three small topics today. Next week, I hope to finish the big communication system // optics // AI networking piece.

Contents:

Qualcomm 2024 Investor Day

Irrational Recap of the Conference

Incoming Gross Margin Pressure

Extremely Underwhelming PC Guidance

MediaTek Objectively better Edge/AI/Connectivity Investment

ARM v QCOM Trial Speculation and Trade Idea

Cerebras Hoax Benchmarks

[1] Qualcomm 2024 Investor Day

The stock tanked 7% the next day so it obviously did not go well.

Let’s go in order before high-level commentary and conclusions.

[1.a] Irrational Recap of the Conference

lol no.

This BMW program has been rumored to be a dumpster fire.

BMW hates the Qualcomm/Arriver stack and wrote their own.

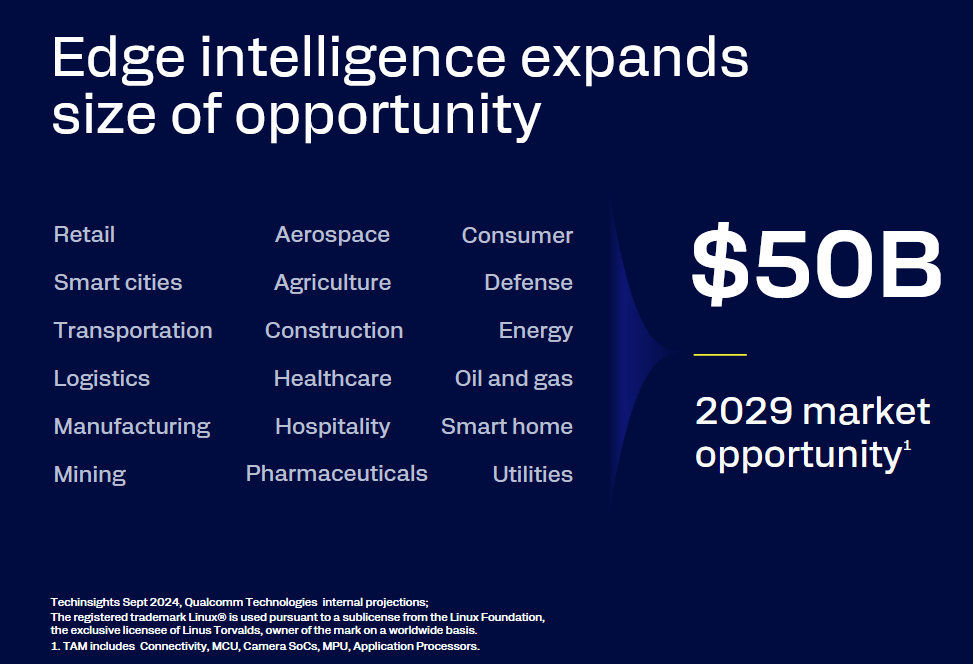

Industrial edge AI is nonsense in my opinion. Even if this becomes a real market, Qualcomm will not benefit. MediaTek and ARM take the gross profit dollars.

The entire “Industrial” slide deck looks like Qualcomm spammed random icons, logos, and abstract concepts to make the slides look full/busy.

IoT is down in 2024 relative to 2023. Every company with even tangential exposure to cloud/datacenter AI has outperformed Qualcomm this year.

Meta switched to MediaTek.

My X Elite laptop only gets 6-8 hours of battery life with web browsing.

Discord does not have a native ARM version. It runs slower than my old 2018 Intel laptop.

Every game I want to play (excluding Spelunky 2) does not run at more than slideshow speeds. League of Legends is still broken because of anti-cheat compatibility.

The GPU drivers have not been updated since launch!

My experience with the Qualcomm X Elite platform has been so mediocre that I will almost certainly be upgrading to Intel Panther Lake next year.

MediaTek is rapidly gaining share in premium-tier. They got the Samsung Galaxy S25 FE socket.

Automotive connectivity TAM includes ridiculous RFFE content growth assumptions.

This $4B revenue guidance is hilariously bad. Stasy Rasgon (Bernstein Research) was livid in the Q&A section, for good reason.

Will explain why this is bad in section [1.c] later.

Even this terrible 2029 revenue target might be missed. Back in 2018 during the Broadcom hostile takeover attempt, Qualcomm claimed in a proxy presentation that they would hit $1B PC revenue in 2019.

META SWITCHED TO MEDIATEK. STOP CLAIMING YOU ARE THE PARTNER OF CHOICE. THE MOST IMPORTANT XR PARTNER CHOSE TO LEAVE.

Cheap power-over-Ethernet switches invalidate most of this hopium TAM.

Diversification revenue is going to be at 30-45% gross margins. The Apple modem sales are at over 65% gross margins. Nobody is falling for this.

This 50/50 revenue split by 2030 is believable, given the handset revenue losses due to Apple, MediaTek, Google, Huawei, and Xiaomi.

This does not look like continuation. Messa see big big gapy gap here.

Also, why the fuck would anyone want to run a model locally (obliterating battery life) when they can use the industry-leading Qualcomm modem+RF technology to just talk to the cloud at a fraction of the battery cost.

Users will not accept half the battery life and turning their phone into a hand-warmer in exchange for minor cost reduction. Just pay the $20/month subscription for much higher quality results without obliterating battery life!

[1.b] Incoming Gross Margin Pressure

The core issue with Qualcomm’s guidance is that all this new diversification revenue is at dilutive (trash) gross margins.

I have previously modeled the Snapdragon X Elite gross margin profile.

For this post, I modeled the Snapdragon 8 Elite (8 Gen 4) to see how much the incoming royalty rate hike is going to harm Qualcomm.

The core issue is that margins on Apple modem revenue is way higher than literally every other product Qualcomm sells. The hole Apple is about to punch into Qualcomm’s income statement is going to be devastating.

New diversification revenue is at crap margins. See this exchange from the Q&A section.

PC gross margins are already below corporate average. They have not even launched the lower tier products yet!

“Several parts of automotive” have strong gross margins? So… 10% of auto revenue has good margins and the other 90% are trash?

Deutsche Bank Analyst is essentially calling Qualcomm management out here.

Growth is in doubt. Margins are terrible.

[1.c] Extremely Underwhelming PC Guidance

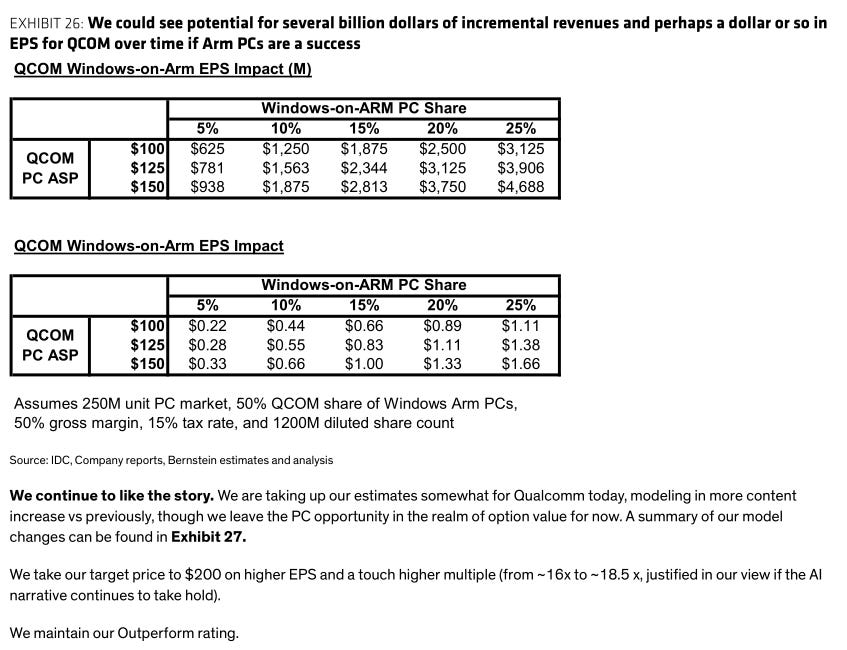

You know who agrees with me?

Stacy is so triggered, he made a mistake.

He assumed Qualcomm would address 100% of the 2029 SAM. In reality, competent companies such as Nvidia and MediaTek will be addressing most of the ARM AI notebook segment.

The following assumptions have been proven wrong:

Qualcomm would take 50% of the Windows on ARM PC market.

Gross margins would be 50%. (will be much lower as they dump product to hit the revenue targets lol)

ASP would be above $100.

Qualcomm would grow revenue to over $45.5B next year due to a great AI PC ramp. (it has fizzled out)

[1.d] MediaTek Objectively better Edge/AI/Connectivity Investment

Several buy-side friends have pinged me about QCOM 0.00%↑, asking if there is any price in which I would invest. The answer is no.

Garbage is cheap because it is garbage.

I do have a good idea though. If you want to play smartphone content growth, edge AI, and even a little datacenter AI on the side, MediaTek (2454.TW) is a great option.

In fact, I would argue that MediaTek is an objectively better version of Qualcomm, outperforming in every way.

[2] ARM v QCOM Trial Speculation and Trade Idea

This quick spreadsheet analysis was due to an interesting discussion with Ravi_711.

He claimed that royalty hikes would not really affect QCOM 0.00%↑ much but would be huge for ARM 0.00%↑ financials.

After a quick check, it turns out he is right.

I have a small ARM call option and QCOM put option trade active at the moment.

The trial is set to start in mid December. Ravi_711 thinks they will settle on the day the trial should start, just like the old Apple lawsuit. Good swing-trade opportunity.

[3] Cerebras Hoax Benchmarks

Cerebras finally released Llama 3.1 405B inference benchmarks but there is a catch.

James Wang never answered my question. 💔

If anyone has info on how many wafer-scale engines Cerebras is using to create these meme benchmarks, please email me.

irrational_analysis@proton.me

I want to calculate how negative their gross margins are.

Im not sure why you think Meta switched to Mediatek. Meta is only using Mediatek to codesign their experimental Orion glasses. They’re not even planning on selling Orion.

A Few things.

1) Qualcomm provided an updated Graphics driver on the 19th: https://www.qualcomm.com/developer/blog/2024/11/upgrade-latest-graphics-driver-for-snapdragon-x-elite-devices

2) "My X Elite laptop only gets 6-8 hours of battery life with web browsing." There are numerous videos and articles claiming better battery life. If we can be honest this is an issue on your power configuration. I have an x-elite and I get ~11 hours, but I run it in power efficiency mode. I don't need the cores clocked to the max to browse the internet.

2) Like Anmol mentions Nvidia's ARM cores were never anything special, what has changed that they can now compete with Qualcomm's custom cores? If the argument is that they can integrate their superior graphics then that's one bonus for them, but I don't see them competing with QC with stock TLA cores. You also mention "in reality, competent companies such as Nvidia and MediaTek will be addressing most of the ARM AI notebook segment." Then provide no further analysis of why this is the case.

3) your comment surrounding "In fact, I would argue that MediaTek is an objectively better version of Qualcomm, outperforming in every way."

Then you provide no evidence other than a relatively childish table with no sources. How are Mediatek cores better at decode and power draw? I spent the last 15 minutes looking for any blogs or tear downs, scientific publications that measured this and I could not find one. Will you post your source?

4) Meta working with Mediatek on AR glasses. As the others have pointed out you cherry-picked an old article while ignoring the new news.