IMPORTANT:

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

Intel:

INTC 0.00%↑ had a stellar quarter and the stock spiked 9% as a result.

Galaxy-Brain Gelsinger had some useful info in his prepared remarks.

A major customer committed to Intel 18A and Intel 3, which includes a meaningful prepayment that expedites and expands our capacity corridor for this customer. The customer is seeing particularly good power performance in area efficiency in their design. This opportunity is very significant and highlights our full-systems foundry capabilities and high-performance computing, big die designs, leadership performance in area-efficient transistors, advanced packaging, and systems expertise. In addition, we are extremely pleased to announce today that we have signed with two additional 18A customers.

This is great news! Rumor is that the mystery pre-paying 18A customer is Nvidia. They like to pre-pay for capacity and PowerVIA (BPD) likely is a huge benefit for HPC chips.

Very curious who the two additional 18A customers are.

In addition, in Q3, we made the decision to divest the pluggable module portion of our silicon photonics business, allowing us to focus on the higher-value component business and optical I/O solutions to enable AI infrastructure scaling.

Unfortunate for Intel’s networking group. Good news for Fabrinet, Nvidia, and Broadcom.

Ross Seymore -- Deutsche Bank -- Analyst

Hi, guys. Thanks for may I ask a question. I wanted to follow up on one of the topics you just mentioned about your partnership with ALM. The flip side of that is there's been reports recently of a number of people entering the CPU business for PCs using ARM architectures, similar to what we've seen over the last couple of years on the data center side of things.

Can you just talk about the competitive landscape of x86 versus ARM And potentially more importantly if, in fact, ARM was gaining traction, would you consider using that architecture and kind of broaden your technology internally?

Pat “Galaxy-Brain” Gelsinger -- Chief Executive Officer

Yeah, thank you, Ross, and you know, overall, I think what you're seeing is the industry is excited around the IPC And as I declared this generation of IPC at our innovation conference, you know, a couple of months ago, you know, we're seeing that materialize and you know Customers, competitors seeing excitement around that, you know, ARM and windows client alternatives, you know, generally they've been relegated to pretty insignificant roles in the PC business.

And we take all competition seriously, you know, but think history is our guide here. You know we don't see these as potentially being all that significant overall. You know our momentum is strong. You know we have a strong roadmap for Meteor Lake launching this IPC generation December 14th.

They are talking about Qualcomm’s recently announced “Snapdragon X Elite” with Nuvia (Oryon) cores. More on this later.

Aaron Rakers -- Wells Fargo Securities -- Analyst

Yeah, I do. Thanks, John, and thanks for the detail there. As a quick follow-up, just kind of thinking about the gross margin line, know, I'm curious, Dave, I know last quarter I think it was I want to say was 220 or so million factory under load impact and gross margin. It sounds like you had a reversal of inventory reserve and gross margin this quarter.

Are we done with the factory under load or what was that number And how are you thinking about that embedded in a gross margin guide?

Dave Zinsner -- Chief Financial Officer

Yeah, I mean it was a meaningful benefit, the under-load improvement in the quarter. That said, there was still a reasonable amount of under load charges in the quarter. That does improve a bit in the fourth quarter, but we'll be kind of dealing with this under-load hangover. I'd call it probably all through next year as we -- as we kind of progress largely in part because while we will improve the loadings and probably get beyond under load charges on -- on a quarterly basis, we'll still have all of that under load kind of tied up In the -- in the cost of the wafers in inventory.

And that still has to get flushed through before we're completely done. So, meaningful improvement, you know, I'd say we have -- we're largely out of the woods, but still, some wood to chop through next year to where we're completely clean of under load.

Interesting that they still have Fab underutilization charges despite client/CCG recovery.

Lattice:

LSCC 0.00%↑ got absolutely rekt. Normally don’t care about low-end FPGA but this is too crazy to not check.

Lattice sells small, low-power FPGAs and they have huge revenue exposer to Chinese industry. Do we have another victim of Xi deflation?

Tristan Gerra (Robert W. Baird $ Co.)

So it sounds like the revenue shortfall relative to expectations for Q4 is all industrial and automotive related. So assuming that gives us about $95 million in Q4 for that segment, that's still above the run rate of '22. So the question, and I know you've mentioned weakness in China, how much further downside could there be in that segment that's been growing very meaningfully over the past 2 years?

Where do you think your true demand quality revenue run rate baseline is in that market? And what was the significant growth in the past few quarters, was it driven by inventory sales versus content gains? So just trying to see where we could land from a stable run rate, quarterly run rate in future quarters in that segment.

James Anderson (CEO):

Yep. At no point in the call did Lattice management utter the word “China”. They try to obfuscate their exposure by lumping China revenue into “Asia”. Analyst called them out by saying the forbidden word. :)

AMD:

I used to be hyper-bullish on AMD 0.00%↑ because of how much better Genoa/Genoa-X/Bergamo is over the trash Intel is stilling at 2000 bps lower gross-margins.

Unfortunately for team-red, Nvidia has turned the tables on them.

Datacenter/cloud CapEx has drastically shifted to Nvidia because of LLM/Generative AI.

Massive improvement in product portfolio and… flat revenue.

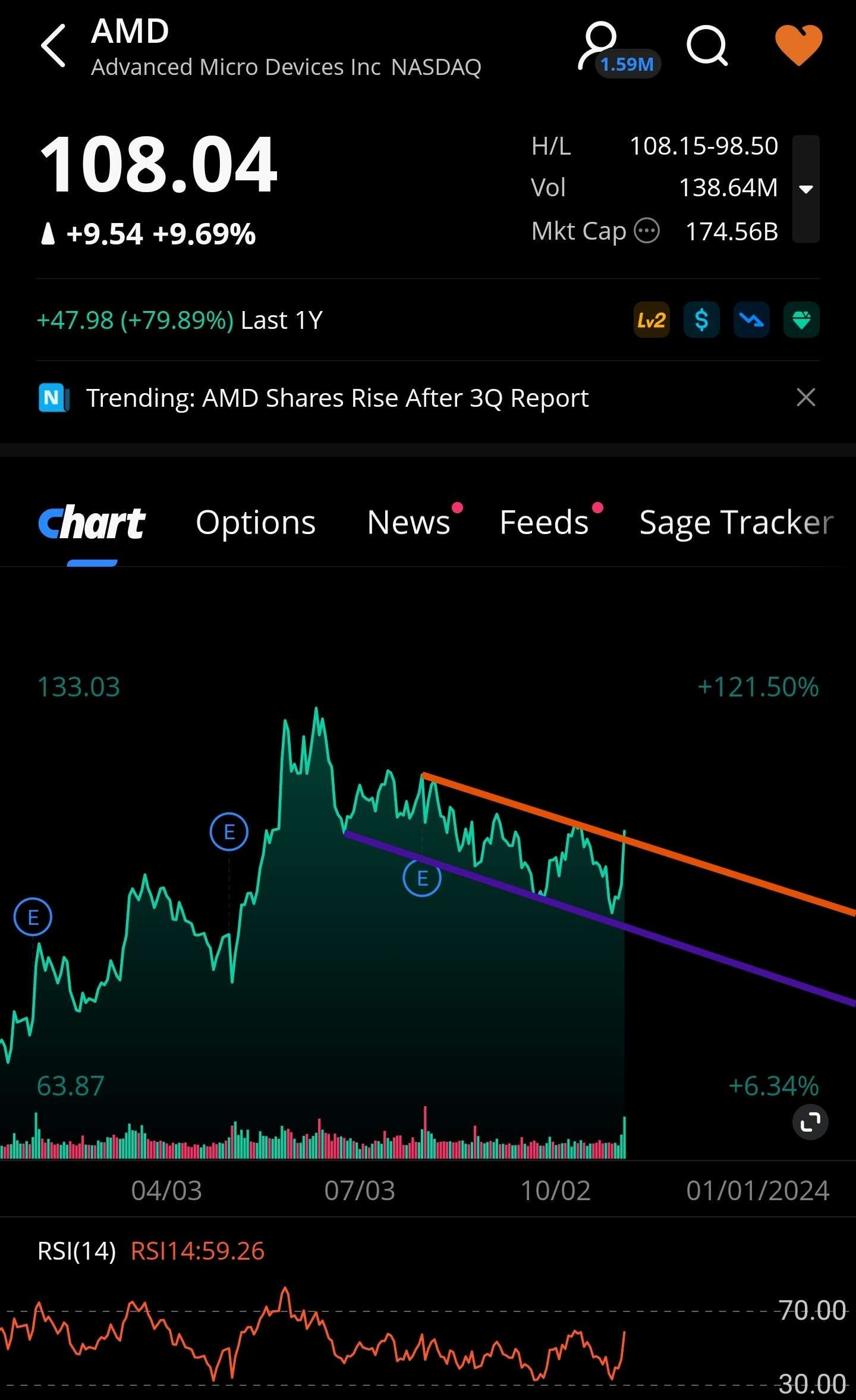

However, AMD had some interesting price movement…

Stock dropped due to weak guide, courtesy of Mr. Leather Jacket.

Dr. Lisa Su (praise be upon her) announced on the call that they expect $2B revenue from MI300X for AI inference. (speculated to be sandbagging)

The next day, whales jumped on the news. (surprised more of the price movement did not happen in after hours)

The main customer is Microsoft, and I was expecting this.

I was not expecting Microsoft to buy so aggressively in H1 2024. MI300X is going to get crushed by Nvidia B100 in Q4 2024 but AMD has a 3-quarter window so good for them.

More info from Semianalysis:

General takeaways:

Not concerned for my Nvidia shares. (largest position)

Microsoft Athena is unusable garbage.

I have made some money selling covered Nov 3 AMD calls and rolled out to Dec 15. Will probably add to the position. (buy shares at 108, write 110c)

Webull charges 9% margin interest.

AMD IV is great.

Look at this chart…

Qualcomm:

Before covering the earnings slides and call, let’s go over some recent marketing slides regarding their new Windows-on-ARM/Snapdragon chip, “Snapdragon X Elite”.

Qualcomm is going to sell these chips for **WINDOWS** laptops/PCs. Why are they sharing benchmarks with their chip running Linux and the competition running Windows/MacOS?

Simple answer.

They lose in Windows.

Perhaps the loss is due to Microsoft’s continued failures in x86 to ARM (ISA) emulation. Perhaps the loss is due to unfortunate delays due to multiple re-spins, un-core issues, and a spicy lawsuit. Regardless of the root cause, Qualcomm is clearly hiding some losses with these Linux benchmarks.

In summary:

Qualcomm used a mix of Linux and Windows benchmarks in their marketing.

All of the Linux benchmarks are invalid.

The Windows benchmarks have high-resolution slides available, but they buried the Linux benchmarks (which got the most press coverage) in a low-resolution livestream.

Microsoft Pluton will probably lock the bootloader so real customers won’t be able to run Linux on bare-metal…

Based on this questionable marketing, Qualcomm is probably already losing to existing competition (Intel Alder Lake, Apple M2) and will likely lose by a much wider margin once Oryon // Snapdragon X Elite launches.

Qualcomm is launching in mid-2024 because they had to run a last-minute re-spin according to SemiAccurate.

M3, Meteor Lake, and whatever AMD is working on (no public details) will all be out months before Snapdragon X Elite.

In Intel’s most recent earnings call, Galaxy-Brain Gelsinger outright dismissed Qualcomm. There are a lot of problems at Intel but they know how to read fine-print and realize when the competition is bluffing. Intel has strong relationships with the OEMs. They know what has been going on behind the scenes.

Sidenote: There is a weak rumor floating around that Nvidia has won the 2025 Microsoft Surface socket from Qualcomm.

With that said, Oryon is still very impressive given it is a first-generation clean-slate design from the Nuvia team. Qualcomm will finally have a viable product for laptop/PC in 2024, after spending 6-years catastrophically failing.

Hypothetically, if Meteor Lake ends up ~20% faster than X Elite but delivers worse battery-life, I would choose X Elite. Looking forward to performance tests from independent reviewers.

QCOM 0.00%↑ numbers were great, which goes against all of the high-level trends I was anticipating.

Lots of interesting moments in the call…

Akash Palkhiwala -- Chief Financial Officer

Notably, QCT handset forecast includes sequential revenue growth of greater than 35% from Chinese OEMs.

At first, this sounds amazing but think about it. All the Chinese OEMs launch new phones in Jan/Feb for the lunar new year. Of course, there is going to be sequential revenue growth given the sell-in timing of SD8G3.

Samik Chatterjee -- JPMorgan Chase and Company -- Analyst

OK. OK. Got it. And for my follow-up, I guess, you're sounding a lot more positive around the recovery in the Android OEMs to the smartphone market.

I think investors at the same time are grappling with the potential sort of puts and takes, particularly when it comes to your primary or large Android customer Samsung using more in-house solutions going forward. So when we think about sort of seasonality beyond the December quarter, particularly around the launch period, how should we think about your market share with Samsung progressing? And what impact does that have on -- relative to your typical seasonality from December to March? Thank you.

Cristiano Amon -- President and Chief Executive Officer

Very good question. Let me unpack that question. Let's divide the conversation in two. I think the first part of the conversation, as we said in the prepared remarks, we're happy that the inventory dynamics that we have seen within the Android business are largely behind us right now.

And 1 data point that we provided in a cautious, I think, remarks is sequentially from Q4 fiscal to our guide, we're seeing a total growth of revenue from Chinese OEMs, both in China and outside China of 35%. And I think that shows that our customers are in a great position, I think, even facing new entrants in the market. And it's also a strength of our road map in the stabilization of the market. The second question is about Samsung.

Look, we -- we're happy with our partnership with Samsung. There's the upcoming launch of the GS 24. We expect to have the majority share. Our product is really great.

I think as -- as I said, we probably have one of the best product road maps in the history of the company, especially in the Gen AI processing capabilities. And the product is getting better. We were happy to talk about what we have done in PC with our new Orion CPU. That CPU is coming to mobile.

especially in '25, and we expect even more, I think, evolution of Gen AI. So the road map gets better over time. Overall, we're positive about our relationship with Samsung.

This is very interesting. Historically, Samsung goes 40% Snapdragon and 60% Exynos. The big fear was that Samsung was determined to go well past the mean, possibly 20% Snapdragon (USA/mmWave only) and 80% Exynos.

QCOM CEO is implying 60% share which would be surprising given the economic incentives S.LSI has right now due to massive Fab under-utilization.

The most likely explanation:

S.LSI (Exynos Group) has probably catastrophically failed in some way.

Possibly a last-minute re-spin that kneecapped supply due to hot orders. Rumors on the internet suggest Samsung Foundry has improved yields of 3GAE. We will find out in February what happened.

Cristiano Amon -- President and Chief Executive Officer

I think we had a significant progress made across consumer in commercial applications. You continue to see announcements in Windows 11 can also run every x86, 32, and 64 bit to the Microsoft emulation.

If Microsoft’s emulation is so good, why did you feel the need to share Linux CPU benchmarks with critical information buried in fine-print? :)

Mike Walkley -- Canaccord Genuity -- Analyst

Great. Thanks. A quick question for Akash. You have strong cost execution come in ahead of plan for exiting the fiscal '23 and flattish into the start to Q1, how should we think about opex levels planned for the year? Is there more areas to cut? Or do you think you'll remain kind of flattish for the year from a good start?

Akash Palkhiwala -- Chief Financial Officer

Given the great results Qualcomm just posted, I am confused as to why the street is asking for more heads/blood. QCOM CFO rightfully dodged this question. Employee moral must be terrible right now.

Stacy Rasgon -- AllianceBernstein -- Analyst

That's helpful. For my second question, I want to ask about the new Apple agreement. So you put that out a little while ago, you're modeling 20% share are now in the phone that launches in '26. So that will be primarily a fiscal '27 issue.

How should we think about the shape of that in '24 and the launches that happened in '24 and '25. Do we assume that you've got close to 100% of the majority of the units there and then it drops down for modeling purposes to 20% on the '26 launch? Or like what does that look like?

Akash Palkhiwala -- Chief Financial Officer

Everybody knows the following information:

100% share in 2024 because Apple’s modem has catastrophically failed, according to WSJ.

20% share in 2026 for USA market (mmWave) because Apple has poached half of Qualcomm’s modem team and they are determined to ditch QCOM out of spite.

“Apple isn’t going to give up,” said Edward Snyder, a managing director of Charter Equity Research and a wireless industry expert. “They hate Qualcomm’s living guts.”

The question is how much share Qualcomm gets in 2025. Good question from Stacy Rasgon but no luck. QCOM CFO refused to answer. My guess is 20% but who knows.

Apple + ex-Intel + ex-QCOM = poor teamwork

Brett Simpson -- Arete Research -- Analyst

Yeah. Thanks very much. My question was really on fiscal '24 Android smartphone outlook. And I guess there's a lot of moving parts here with Huawei building up their own chipset.

And we've all seen the volumes they're talking about for next year. And you've also got a fairly high share in flagship segments with Samsung. So just looking at fiscal '24, can you perhaps just provide us a framework for whether or not Qualcomm can grow Android handset sales in fiscal '24?

Akash Palkhiwala -- Chief Financial Officer

Brett, we're not guiding the full year at this point. We gave you the guidance for first quarter, and I gave you an outline as well of how we expect the shape of the year to play out for the overall company. And I think those pointers should give you a sense of our view into the year.

Brett Simpson -- Arete Research -- Analyst

OK. And maybe just a follow-up, Akash, in terms of your opex plan for fiscal '24, I mean, we've seen your sales in fiscal '23 decline and operating profit down pretty significantly in fiscal '23. How are you thinking about the opex for fiscal '24? And I guess, and specifically, when I look at Qualcomm's headcount, you have over 50,000 people in the business and a lot of your large fabless peers have about half that headcount. How do we think about the sort of spending plan for next year, just given the puts and takes here?

Akash Palkhiwala -- Chief Financial Officer

Yeah. So Brett, as you are aware, through calendar -- through fiscal '23, we took action on cost reductions a couple of times. And as I also mentioned this quarter, we've taken additional actions. So the idea is how do we maintain operating discipline while continuing to invest in the diversification initiatives that are so important for the company going forward.

And what you're seeing in our forecast is the representation of those factors.

That first question from Brett Simpson really pissed off QCOM CFO. (listen to the call to hear what I am talking about)

The second question is another head/blood seeking one. Strange that this topic came up again. We just got a beat and a raise. Why are the Analysts nudging management for another blood sacrifice? Give the surviving employees a break!

QCOM CFO rightly dodged this OpEx (layoff) question for the second time.

Tal Liani -- Bank of America Merrill Lynch -- Analyst

Hey. Thank you so much. I want to ask about market share. Next year, MediaTek is saying that they are doing great and they're gaining share.

Huawei published now their target for 100 million units versus 60 million that they had before. And the question is, how do you feel about your market share for handsets sourced within China? What are the areas maybe that you are strong at? What are the areas that you think you'll see more competition? Thanks.

Cristiano Amon -- President and Chief Executive Officer

Akash, I will start and maybe you'll add some quantitative comments. Tal, I think I will say, if you -- just to recap, in fiscal '23 that just ended, we had a share increase both globally and in China of sell-through.

I find the "share gains via sell-through comment extremely suspicious.

Overall, there seems to be some missing information. A lot of the existing datapoints directly conflict. Brett Simpson tried to point this out in his first question but instead pissed off QCOM management. Curious if he still gets to ask a question next quarter.

In theory, the following could all be simultaneously true:

S.LSI messed up badly and Exynos will only be 20% (EU).

MTK continues to gain share.

Huawei/HiSilicon continues to gain share.

Refurbished iPhones continue to obliterate new Android.

35% sequential China growth comment means nothing because QCOM always has good sequential growth in China due to lunar new year launches.