IMPORTANT:

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

In the world of Dune, there is a substance called Spice.

Available only on planet Arrakis, Spice is the only substance that can enable interstellar travel. This makes it the most expensive and valuable commodity in the Dune universe.

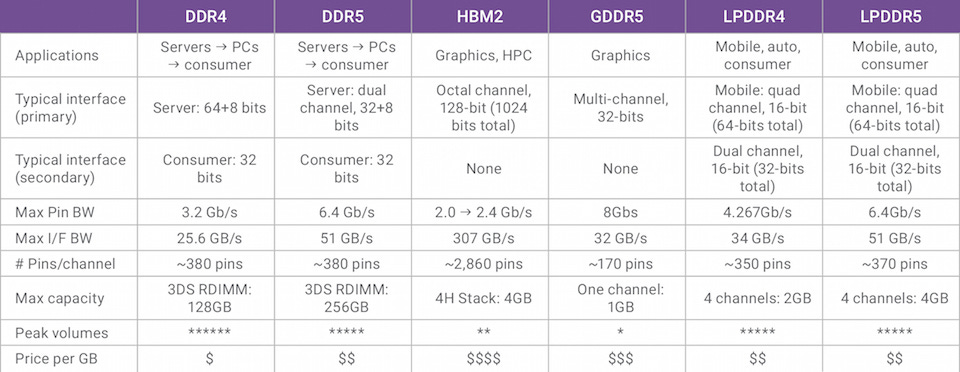

DRAM has been around for a long time. DDR, GDDR, and LPDDR have all existed to serve varius markets. The underlying structure of DRAM (aka volile memory) is the same. A vast grid of capacitors and transistors.

Each transistor acts as a gate to store the capacitors charge. A charged capacitor is a ‘1’ while a drained capacitor is a ‘0’. This is why DRAM is “volitile”, constantly needing power to refresh the capacitors and keep its data preserved. Additonaly, reading from a section of DRAM drains all capacitors, requirng the cells that were storing a ‘1’ to be refreshed.

For many years, all forms of DRAM have been volitile comodities, violently swinging in price. An unpleasent buissness not worth participating in for most investors. But recently, a new flavor of DRAM has rocketed in importance.

HBM. High Bandwidth Memory. The memory of AI.

Spice is Spice. DRAM is DRAM. But HBM is differnt kind of DRAM… and whoever controles it controls an empire.

Industry Background

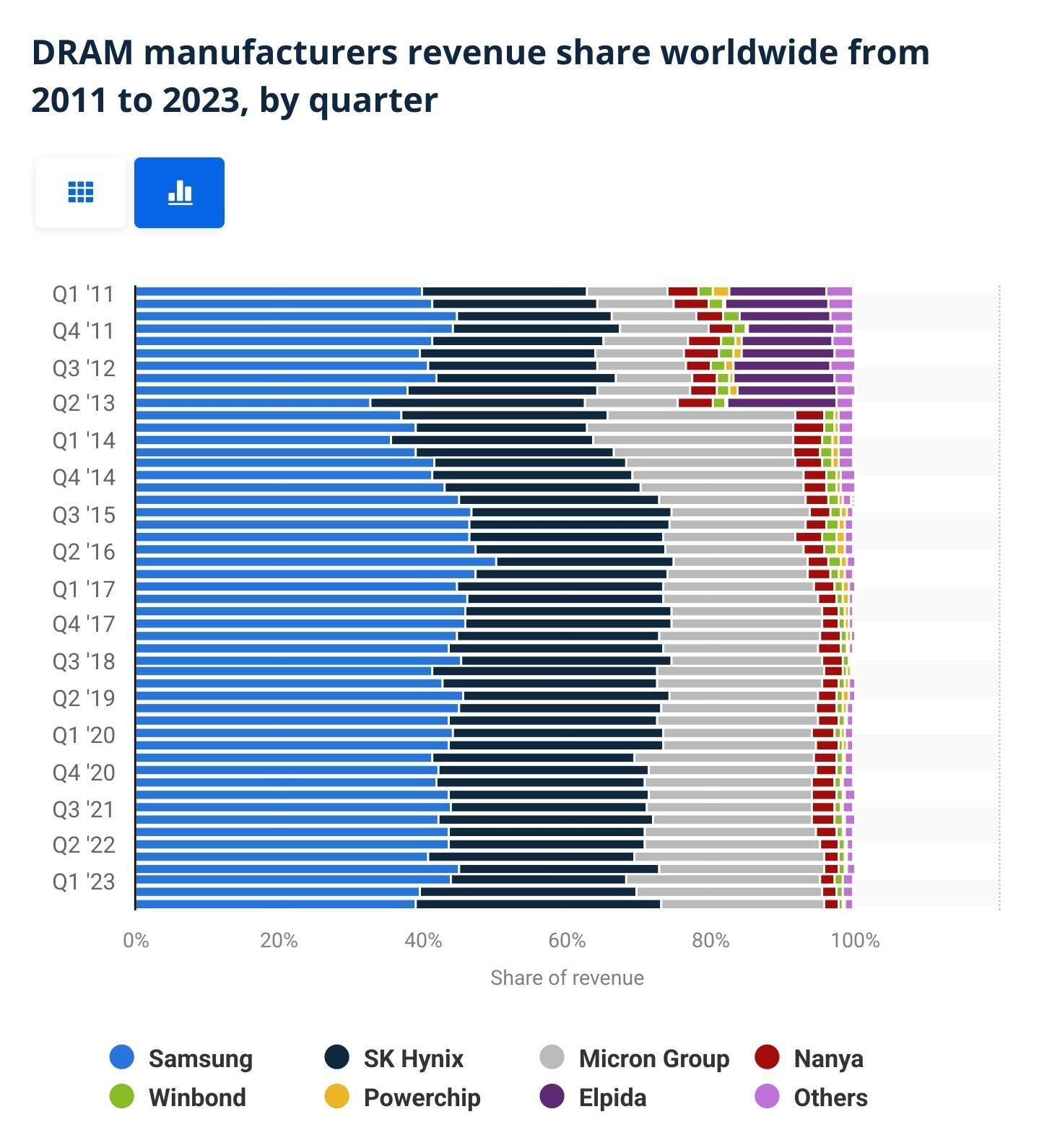

Over the last decade, DRAM has been an oligopaly with three members. Samsung is the leader with 50% share while SK Hynix and Micron trade blows for the remainder.

A long time ago, there were many companies that made DRAM. Most of them died or merged with each other due to brutal cylical pressures. What makes DRAM differnt from logic is the reliability requirments.

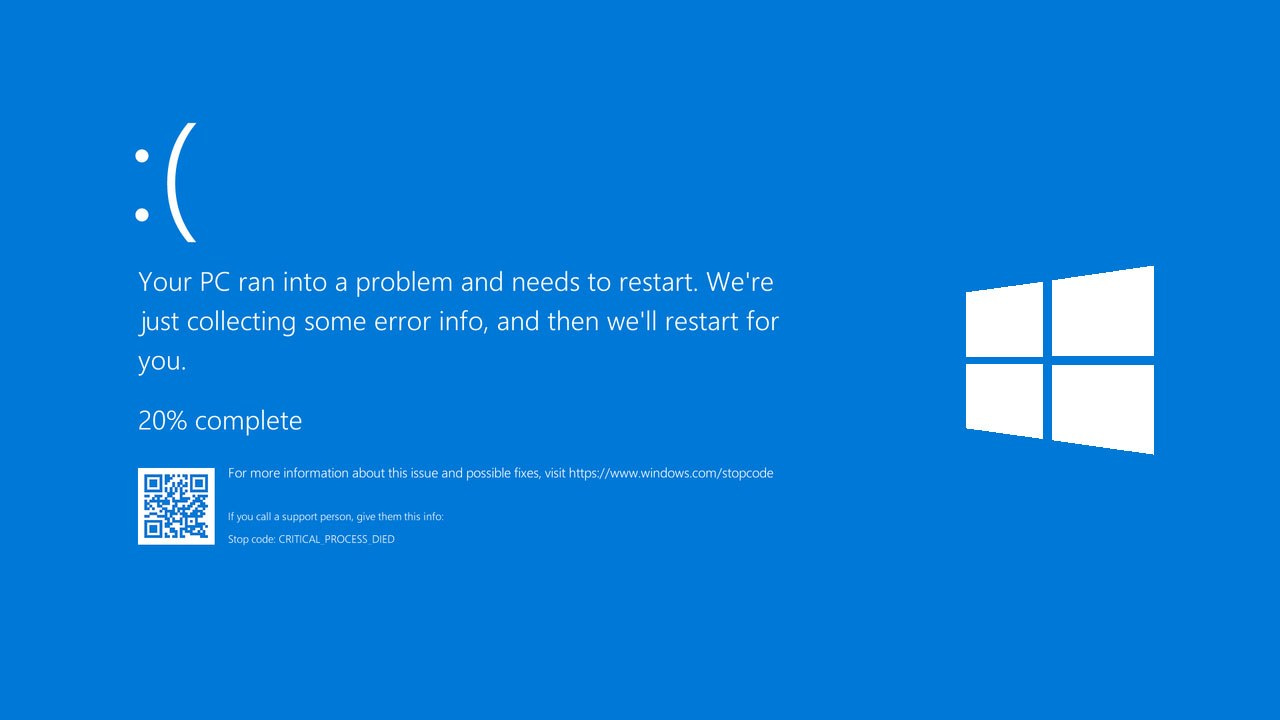

Software is designed with expectation that data written to memory can be retreived, unharmed. Defective memory cells lead to really bad problems. Programs crashing. Kernal panics. Incorrect database updates. No bueno.

This is why every memory chip (DRAM and NAND flash) undergoes a proceess called “burn in”. Each chip is repeatedly written with data patterns inside literal ovens. All 1. All 0. 101010…. and so on. Weak chips die early and are discarded. Any chip that survives moves on for packaging and sale.

Because of the burn-in process, DRAM takes much longer to manufacture when compared to logic. In-progress inventory stays on the books… longer than the manufacturers might like. Production can not be cut quickly, leading to brutal oversupply situations where everyone is forced to sell at negative gross margins.

It takes ~9 months for a DRAM wafer to go from start to sold/finished goods.

Recent Micron History

MU 0.00%↑ is having a good time right now (early 2024) but lets take a quick look back.

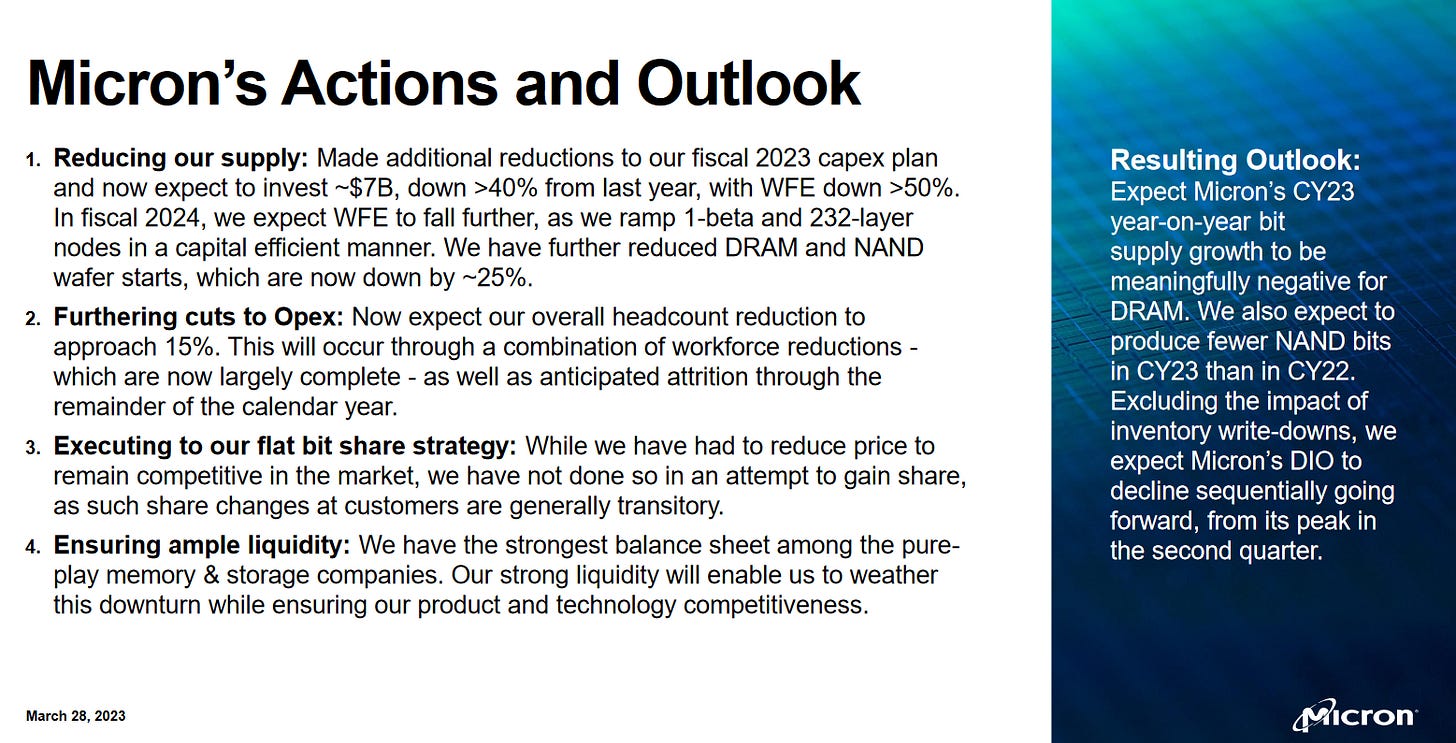

December, 2022: 20% wafer start reduction. A drastic move.

March, 2023: OpEx will reduce because of attrition (lol) and balance sheet is strong. Allways a good sign when a company feels the need to remind investors the balance sheet is strong.

Sanjay Mehrotra

So I think with respect to the industry environment, you have to look at that over the course of last 3 years, the world faced once-in-100-years kind of pandemic, once-in-multiple-decades kind of Russia-Ukraine war and its impact on the economy, 40-year-high inflation and its impact on the macro. And all of these really resulted in an environment that created a material dislocation in terms of the demand, the surge in demand, and then the inventory adjustments that took place and resulted in a material dislocation in the customer behavior as well.

And now you are seeing the process of recovery that is starting, the process of recovery with respect to the supply growth reductions actions that are being implemented. We talked about ours today. And so this will ultimately lead to the industry to recover to healthier levels. The profitability levels in the industry today are simply not sustainable. So the demand and supply environment has to improve in the industry. And keep in mind that before this period of last 2 to 3 years with all these events that I just mentioned, the industry for 10 years plus has been disciplined particularly in DRAM.

Micron CEO is publicly begging Samsung for mercy. Very entertaining.

June, 2023: Background of the slide is now red (LAMO). Slashed wafer starts again!

Old Micron earnings call transcripts are quite entertaining.

March, 2024 Earnings Transcript Analysis

Ok so what the hell happened? A massive beat and raise. Numbers good blah blah blah…

Let’s go over the transcripts.

30% lower power is a bold claim. Unfortunate that performance claims for memory cannot be independently verified easily.

Sold out for basically the next 21-24 months. Wow.

3x wafers needed for HBM compared to DDR.

Due to die size from larger memory structures. (larger bit gate transistors for faster switching frequency?)

Yield loss from die stacking.

Confidence HBM demand canibalizes supply and boosts DDR/LPDDR prices.

Base process tech is mature with high yield.

Conclusions

I would like to know what Rosenblatt analyst is smokeing. The kind of rhetoric is comically dangerous. Biggest upcycle in history will lead into biggest downcycle in history at some point.

Here is my framing. There are three DRAM (and thus HBM) companies. One of them is in the lead for HBM (SK Hynix), another is making great gains (Micron), and the third (Samsung) is catestrophically failing. Samsung has the most to lose (~50% rev share) and they are loseing fast.

There have been rumors cirulating for months but for self-preservation/legal reasons, I have avoided repeating them. Thankfully, Reuters confirmed everything last week so can speak freely now.

Samsung's HBM3 chip production yields stand at about 10-20%, lagging SK Hynix that has secured about 60-70% yield rates for its HBM3 production, according to several analysts.

Samsung’s HBM yeilds are garbage.

AMD MI300X ramp has been kneecapped by Samsung.

Memory is an extraordinary dangerous market to play in. If you want to ride the HBM train sand worm via SK Hynix or Micron (not Samsung lol), be very careful. Samsung could get their act together and unilaterally shatter HBM gross margins by flooding the market to gain bit share.

Chaebol psychoanalysis does not interest me.

Violently volitile commodity markets with a history of alleged price-fixing do not interest me.

Tread lightly, or the sand worms might eat you.