[Q1 CY2024] Marvell and Broadcom

A tale of two custom AI silicon vendors...

IMPORTANT:

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

Two interesting companies had earnings today: Marvell and Broadcom.

Both got run up before earnings on hype for custom AI silicon projects for various hyperscalers.

Both got hit after-hours, but Marvell is down a lot more.

And Nvidia is up slightly in after hours because revenue that was penciled in for AVGO 0.00%↑ and MRVL 0.00%↑ has been re-allocated to NVDA 0.00%↑.

The root cause of this divergence between Marvell and Broadcom is 5G. Let me provide some brief background before going to the earnings calls.

5G Cope

5G is an economic hoax that is imploding right now. The entire telecommunications industry (carriers, basestation, standards/IP) has been shilling 5G as some magical technology that will enable new use cases (not smartphone) since 2018. Really 2015 if you consider 3GPP standards process.

We are now in 2024 and 5G is still just for smartphones… with one niche exception which I will get to.

The following 5G technologies all have one thing in common:

Millimeter Wave (mmWave)

Massive MIMO (M-MIMO)

Beamforming

They all exist to increase capacity so more devices can connect to the network. Unfortunately for telco, there is almost zero demand for this capacity they worked so hard to develop.

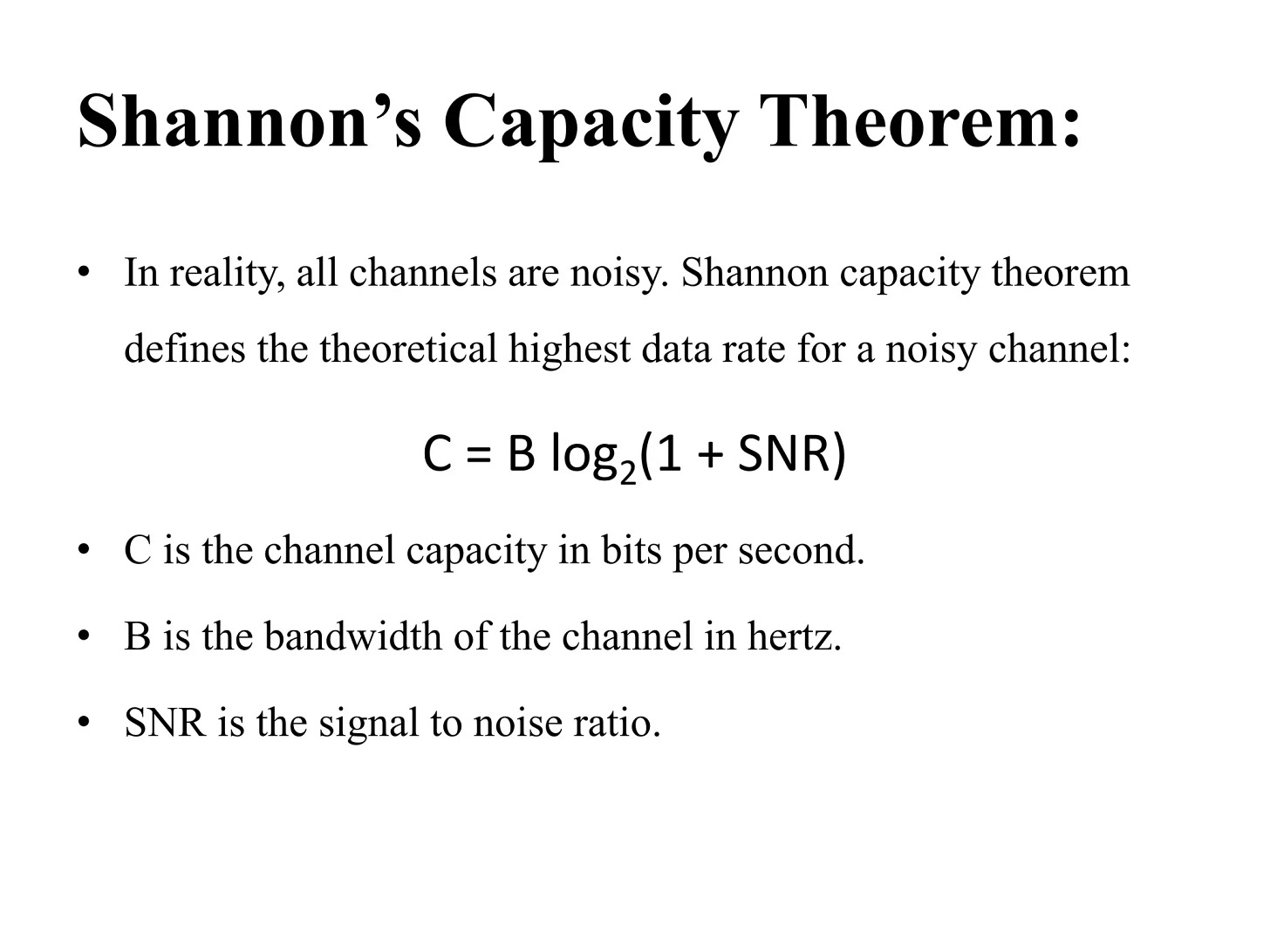

Shannon’s capacity theorem defines the theoretical maximum amount of information (C) that can be transmitted in a channel. Can be wireless or wired. Does not matter.

There are only two variables that effect this limit:

B - Bandwidth

Typically, 5-100 MHz in 4G/LTE and non-mmWave 5G.

Goes up to 400 MHz in mmWave 5G.

Wireline (Ethernet, PCIe,) have much higher bandwidth in the 10’s of GHz.

SNR - Signal to Noise Ratio

Now… a thought experiment:

If you could arbitrarily increase either bandwidth or SNR, which would you choose?

Capacity scales linearly with bandwidth.

Capacity scales logarithmically with SNR.

So boosting SNR leads to diminishing returns and a hard/asymptotic limit while boosting bandwidth keeps scaling indefinitely. In reality, bandwidth does have a limit because of losses at higher Nyquest frequencies but the point is bandwidth is very valuable.

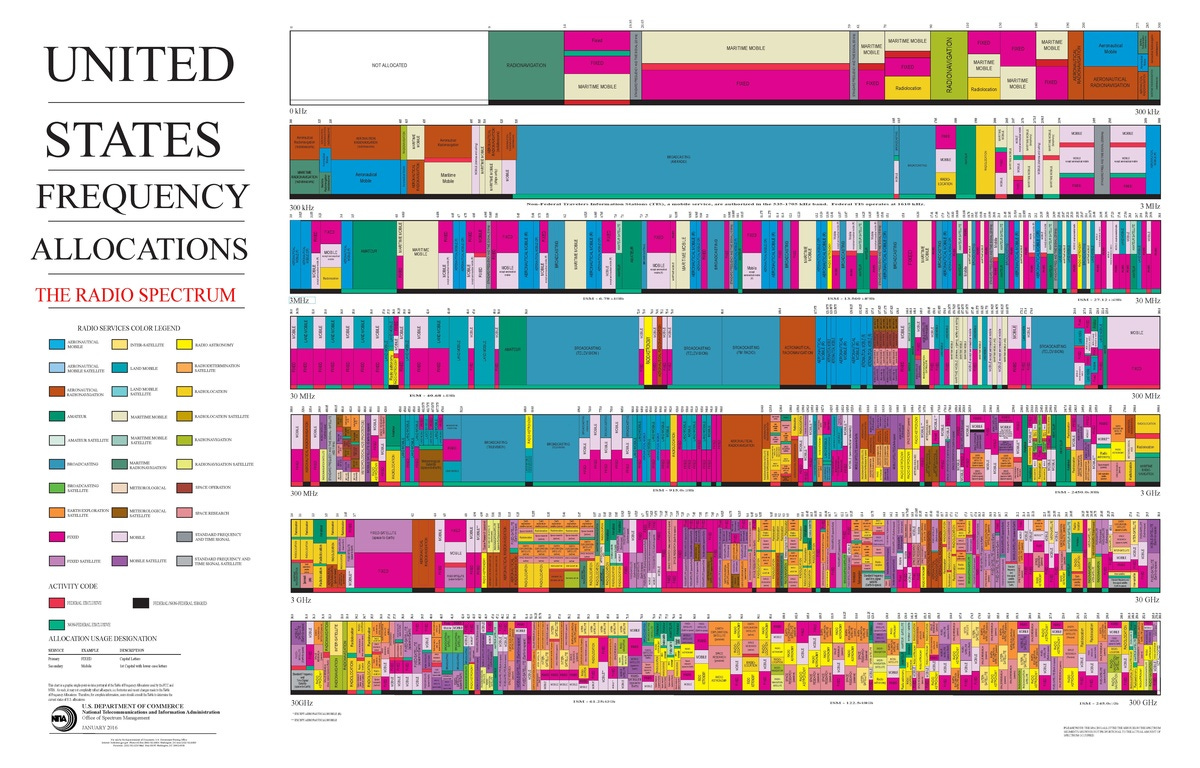

Unfortunately for the telco industry, they cannot simply use more bandwidth at will like wireline. Wireless spectrum is licensed, creating fierce competition amongst industry groups, governments, and militaries.

The above chard is a simplified version of the United States spectrum (bandwidth) allocation. Other countries/regions have their own allocations.

The wonderful new promises and use-cases of 5G could not be realized with existing spectrum which is why mmWave was created.

Yes… a piece of paper can block mmWave signals.

Yes… carriers need to deploy a huge number of basestations to get any sort of meaningful coverage.

Yes… the RFFE on both basestation and device/UE sides is super expensive and burns a lot of power, harming carrier OpEx and user battery life.

But the industry had no choice. They wanted more low and mid band but could not get it. And so, 5G-land took some crap spectrum nobody was using (for good reason) and developed some complicated, over-engineered technologies to try and boost SNR and make it viable.

All to enable those new (non-smartphone) use cases.

It is 2024. 5G has been deployed. Those non-smartphone use cases have all whiffed. Amusingly, mmWave has been re-packaged and salvaged in a desperate attempt to re-coupe wasted R&D.

Because mmWave is so unreliable, no region outside of USA (mid-band starved by FCC) has meaningfully deployed it.

For years, companies who sunk resources into mmWave (Qualcomm in particular) have tried and failed to push this technology. A solution looking for a problem.

Recently, that problem has finally manifested itself, India home internet.

As a rapidly developing, population dense country with scattered infrastructure, India ISPs did not want to lay fiber to expand coverage for home internet.

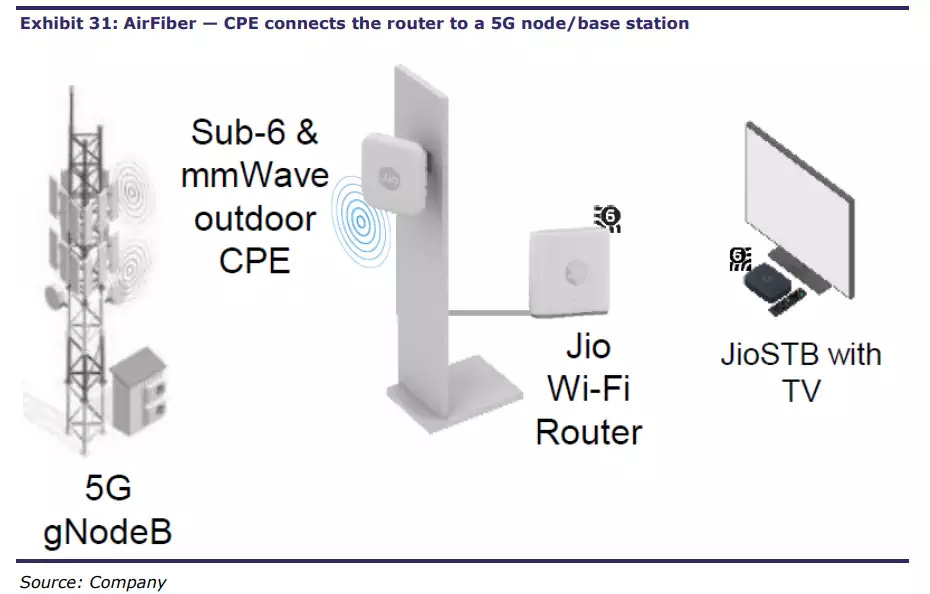

Enter the 5G mmWave CPE: a stationary box with souped up RFFE and a higher EIRP (power radiation limit) that will use 5G for last-mile home internet infrastructure. No need for DOCSIS/fiber.

India bought a bunch of basestations (mostly from Ericson), built out their network, and… it’s over. Look at E/// earnings. India revenue collapsed and it’s not coming back.

Sidenote: China is ramping mmWave soon but only Huawei will benefit.

So let’s go back to Broadcom and Marvell. Both have exposure to 5G but Marvell’s exposure is much worse.

Broadcom is an Apple supplier for WiFi+Bluetooth baseband and cellular RF. The baseband buissness will be gone in 2027 once Apple has their own combo cellular+WiFi+BT modem integrated into the main SoC but that is fine. RF is also safe-ish because of Broadcom’s leading filter portfolio.

Marvell is super exposed because of their carrier/basestation products.

The guidance for next quarter implies carrier infrastructure continues to implode to sub-100M in revenue with more weakness on enterprise networking.

Marvell and Broadcom are the two big players for custom AI silicon. I own Broadcom shares precisely because of the toxic carrier/telco/5G expose Marvell has. Today’s earnings and price actions support the anti-5G thesis.

And now, the earnings calls ordered by entertainment value…

Marvell

Matt Murphy -- President and Chief Executive Officer

Now, let me turn to Marvell's carrier and enterprise end markets together. As we have been communicating, these end markets have been dealing with a period of soft industry demand.

As a result, both were down sequentially in the fourth quarter, and we expect them to decline again in the first quarter. On a sequential basis, we expect revenue in the first quarter from carrier to decline by approximately 50% and enterprise networking to decline by approximately 40%. Looking ahead, we expect revenue declines in these end markets to be behind us after the first quarter and forecast a recovery in the second half of the fiscal year. Longer term, these are large and enduring end markets, which are critical to the global economy.

As a result, we expect both of these end markets to eventually return to contributing over $1 billion each in revenue on an annual basis once demand normalizes, and we begin to realize the benefits of upcoming Marvell-specific product cycles.

Carrier is not coming back. Enterprise weakness probably indicates some share losses to Broadcom. Marvell Ethernet switches are kinda mediocre.

Ross Seymore -- Deutsche Bank -- Analyst

Hi, guys, thanks for asking question. Clearly, it's kind of a tale of two cities, the data center and AI side is going to be really strong, the rest of it not so much. So, why don't we just get the bad news out of the way first? The magnitude of the drops ex your data center are kind of shocking. Can you just walk us through how much of that is something that is not going to come back, you know, some of the stuff in 5G, etc., versus what do you view as just taking the cyclical medicine and then a snapback should it ensue soon thereafter?

Matt Murphy -- President and Chief Executive Officer

Yeah, hey, great. Thanks, Ross. Yeah, definitely a tale of two cities. On the carrier enterprise and consumer side, the way to think about it is, sure, the drops are pretty steep in Q4 and Q1.

We're definitely going through a cyclical downturn in the industry, you've been doing this a long time, so have I, we've seen that happen, and that's what we're going through. The way to think about both of those businesses is at their peak, together, they were about $2.5 billion in revenue, and this would sort of be during the pandemic and some of the supply chain issues that went on. You can now see we're shipping well below that. And so, I said in my prepared remarks, both of these are very solid businesses, Ross, for Marvell.

Both will recover to greater than $1 billion in revenue. over time, the question is when. And remember as well, within these businesses, these are very long product life cycles, typically like seven years in production. So, these are designs.

In some cases, we won three or four, five years ago, some of them we just won a year or two ago. So, we feel good about these businesses, but they are going through some demand softness and some inventory correction, but we expect to see that behind us. And to be very specific, none of this is due to any business that's not "coming back or share loss." And in fact, when things recover back to a normalized run rate, we do have Marvell product growth drivers in both of those segments, carrier, and enterprise to drive growth going forward. So, we're just managing through it in the short term.

Enterprise is 100% share loss.

Carrier is not coming back. 5G CapEx party is over.

Marvell CEO is delusional.

Broadcom

Based Hock

Before I give you an overall assessment of this segment, let me provide more color by end markets.

Q1 networking revenue of $3.3 billion grew 46% year on year, representing 45% of our semiconductor revenue. This was largely driven by strong demand for our custom AI accelerators at our two hyperscale customers. This strength extends beyond AI accelerators. Our latest-generation Tomahawk 5 800G switches saw through Ethernet NICs retirements, DSPs, and optical components are experiencing strong demand at hyperscale customers as well as large-scale enterprises deploying AI data centers.

The two hyperscale customers are Google (TPU) and Meta.

And in fiscal 2024, helped by content increases, we reiterate our previous guidance for wireless revenue to be flat year on year.

Apple business stable despite unit losses in China due to Huawei. Due to RFFE content gains.

Harsh Kumar -- Piper Sandler -- Analyst

Yeah. Hey, thank you. Hock, once again, tremendous results and tremendous activity that you guys are benefiting from in AI. But my question was on software.

I think if I heard you correctly, Hock, you mentioned that your software bookings will rise quite dramatically to $3 billion in 2Q. I was hoping that you could explain to us why it would rise almost 100% up, if my math is correct, in 2Q over 1Q. Is it something simple? Or is it something that you guys are doing from a strategy angle that's making this happen?

Hock Tan -- President and Chief Executive Officer

As I indicated, with the acquisition of VMware -- we're very focused on selling, upselling, and helping customers, not just buy but deploy this private cloud what we call virtual private cloud solution or platform on their on-prem data centers. It has been very successful so far. And I agree it's early innings still at this point. We just have closed on the deal -- well, we closed on the deal late November, and we are now March, early March.

Good. VMWare finally making money now that the bloat has been eviscerated.

Chris Danely -- Citi -- Analyst

Hey, thanks again for letting me ask a question. Just a question on the AI upside in terms of a customer perspective. How much of the upside is coming from new versus existing customers? And then how do you see the customer base going forward? I think it's going to broaden. And we know how you like to price.

So, if you do get a bunch of new customers for these products, could there be some better pricing and better margins as well? Hopefully, they're not listening to the call.

Hock Tan -- President and Chief Executive Officer

Chris, thanks for this question. Love it. because perhaps let me try to perhaps give you a sense how we think of the AI market, the new generative AI market, so to speak, using it very loosely and generically as well. It's really -- we see it as two broad segments.

One segment is hyperscalers, especially very large hyperscalers with huge, huge consumer subscriber base. You probably can guess who these few people, are very large subscriber base and very -- an almost infinite amount of data. And their model is getting subscribers to keep using this platform they have. And through that, be able to generate a better experience for not only the subscribers, but a better advertising opportunity for their advertising clients.

The money for generative AI is the cloud, not the edge.

Toshiya Hari -- Goldman Sachs -- Analyst

Hi. Thank you for taking the question. Hock, I think we all appreciate the capabilities you have in terms of custom compute I asked the question last quarter on the group call back. But there is one competitor based in Asia, who continues to be pretty vocal and adamant that one of the future designs at your largest customer, they may have some share and we're picking up conflicting evidence, and we're getting a bunch of investor questions.

I was hoping you could address that and your confidence level in sort of maintaining, if not extending your position there. Thank you.

Hock Tan -- President and Chief Executive Officer

I can't stop somebody from trash-talking, OK? It's the best way to describe it. Let the numbers speak for themselves, please, and leave it that way. And I add to it like most things we do in terms of large critical technology products. We tend to always have, as we do here, a very deep strategic and multiyear relationship with our customer.

They are talking about MediaTek taking some share (chiplet) in a future TPU.