Optical Illusions: $FN $CIEN $SITM $LITE $TSEM $GFS $COHR $CSCO Ayar Labs

Finding an Optical Oasis in Shitco Sahara

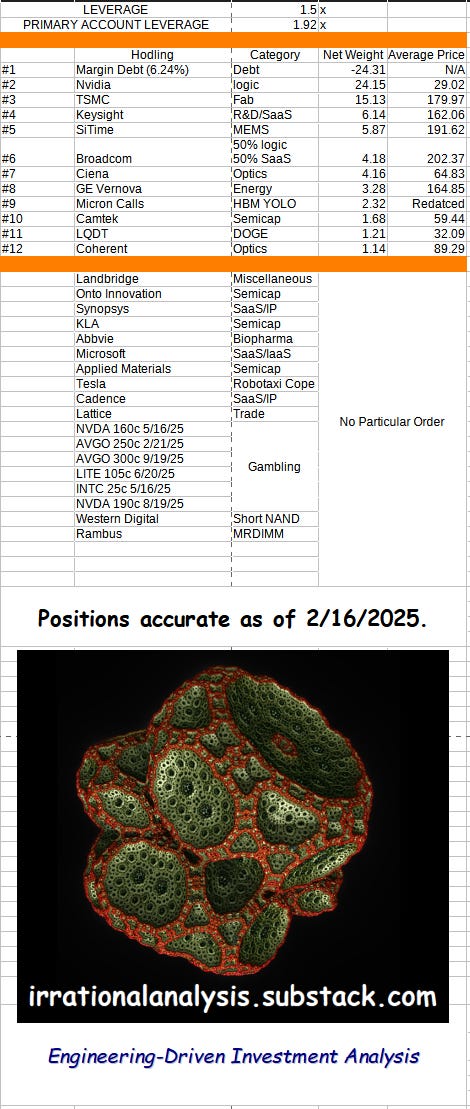

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Optics is a theme that I am hyper-bullish on. The problem is, there are a lot of… low quality companies in this space. Finding the right opportunities is like searching for an oasis in the Sahara Desert. Aimlessly wandering while delirious from dehydration.

Salvation and wealth await in semiconductor-shitco Sahara. Enter the search only if you understand the risks. As a wise CEO once said, plan B is to drink your own urine.

Contents:

Technical/Engineering Themes

Optical Circuit Switch (OCS)

Co-Packaged Optics (CPO)

Parts-Per-Million (PPM) Frequency Stability vs Jitter

Phase Noise // Coherence

Investment Vectors

Long-Haul: Ciena and Cisco

Degen Optics: Lumentum, Coherent, and Credo

Quality: Fabrinet and Ayar Labs

Photonic Fabs: Global Foundries and Tower Semiconductor

Ultra Degen: Applied Optoelectronics, Innolight, and Eoptolink

ITS HIGH TIME TO LOOK AT SITIME

Engineering Overview

AI/Datacenter Market Opportunity (TAM)

Ghetto Revenue Model

Guide for SiTime Application Engineers and Technical Marketing

Key Risks

[1] Technical/Engineering Themes

For a detailed guide on communications systems, please check out this old post.

A Background-Proof Guide on Communication Systems

Irrational Analysis is heavily invested in the semiconductor industry.

I will only cover the absolute minimum technical material today. This info is critical for understanding why certain investment ideas are worth your attention and further research.

[1.a] Optical Circuit Switch (OCS)

Optical switching has a history in the telco world. Converting optical signals into electrical and then into digital bits is a power-intensive and CapEx expensive.

https://en.wikipedia.org/wiki/Wavelength_selective_switching

Outside of telco, only Google has used OCS for datacom/AI applications.

Semianalysis has excellent coverage on OCS.

https://semianalysis.com/2023/03/17/google-apollo-the-3-billion-game/

A few snippets. (you should just read the entire piece)

This is niche tech that struggles to compete with regular switching tech as-is. CPO will add even more pressure.

Speaking of CPO…

[1.b] Co-Packaged Optics (CPO)

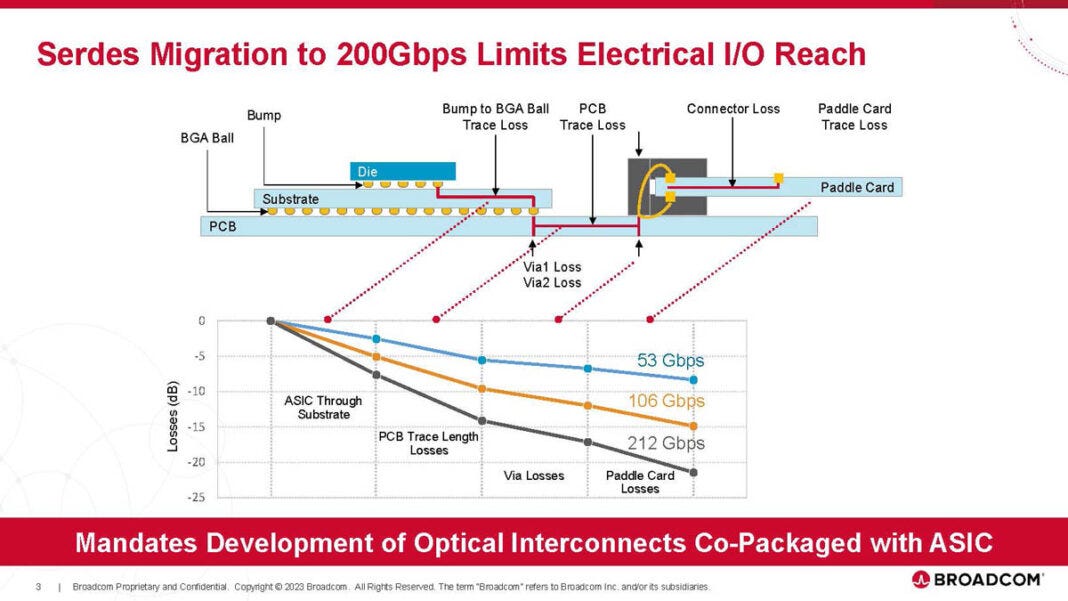

With 200G electrical SerDes, we have arrived at a limit in terms of reach. Many applications will need optics. A technology known as co-packaged optics is starting to make economic sense.

The main issue of CPO is reliability and serviceability. Nobody wants to throw away an entire switch just because one of the ports died.

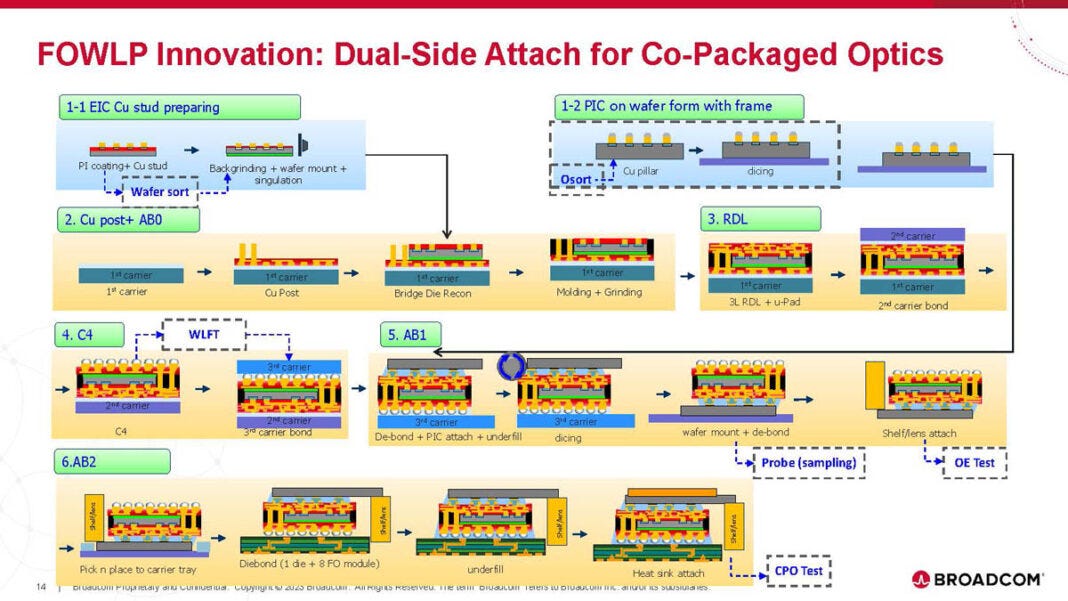

Broadcom believes their solution has solved the reliability issue. The most failure-prone device, laser sources, is pluggable and serviceable.

Intuitively, CPO involves using advanced packaging techniques to tightly integrate the photonics IC (PIC) with the electrical IC (EIC).

Both Broadcom and Nvidia are aggressively perusing CPO. Google is rumored to already be using CPO in some TPU flavors.

This trend is going to drive real revenue ramp for several companies within the next 12-18 months. More on this in section 2.

[1.c] Parts-Per-Million (PPM) Frequency Stability vs Jitter

Imagine you have an ideal square wave at X frequency.

In a nutshell, this is what reference clocks are supposed to generate. Every chip needs a refclk which is typically generated by a quartz crystal.

The industry term for these devices is crystal oscillator, commonly abbreviated to XO.

All crystal oscillators have non-ideal behaviors. The two most important are PPM (parts-per-million frequency offset) and jitter.

PPM is a measure of what the actual frequency of the XO is relative to the desired frequency.

Oscillators are typically rated for a range. Operation within +/- some PPM value.

For example, if you were buying a 100 MHz XO (common frequency) rated for +/- 50 PPM (common rating) the actual frequency of the output could be anywhere between 99.995 MHz and 100.005 MHz.

The “natural” PPM of the oscillator varies due to manufacturing tolerances. Importantly, it also varies with temperature. A XO might be +25 PPM at room temperature but drift to -45 PPM at 80 Celsius.

Within a communication system, the PPM that a receiver “sees” depends on it’s local XO and the remote transmitters XO.

For example, if a receiver has an XO at -20 PPM but the remote transmitter has an XO at +30 PPM, then the receiver “sees” 50 PPM.

Thus, if both ends of a system have +/- 50 PPM rated XO, designers must have tolerance for +/-100 PPM at a minimum. Typically, +/-150 PPM tolerance is desired.

Remember, PPM will drift due to temperature and over time. Extremely expensive Rhubidium and Selenium XOs exist to guaranty ultra-low < 1 PPB (yes billion) stability over an entire year. These devices are used in laboratory environments and can cost over $10K per unit.

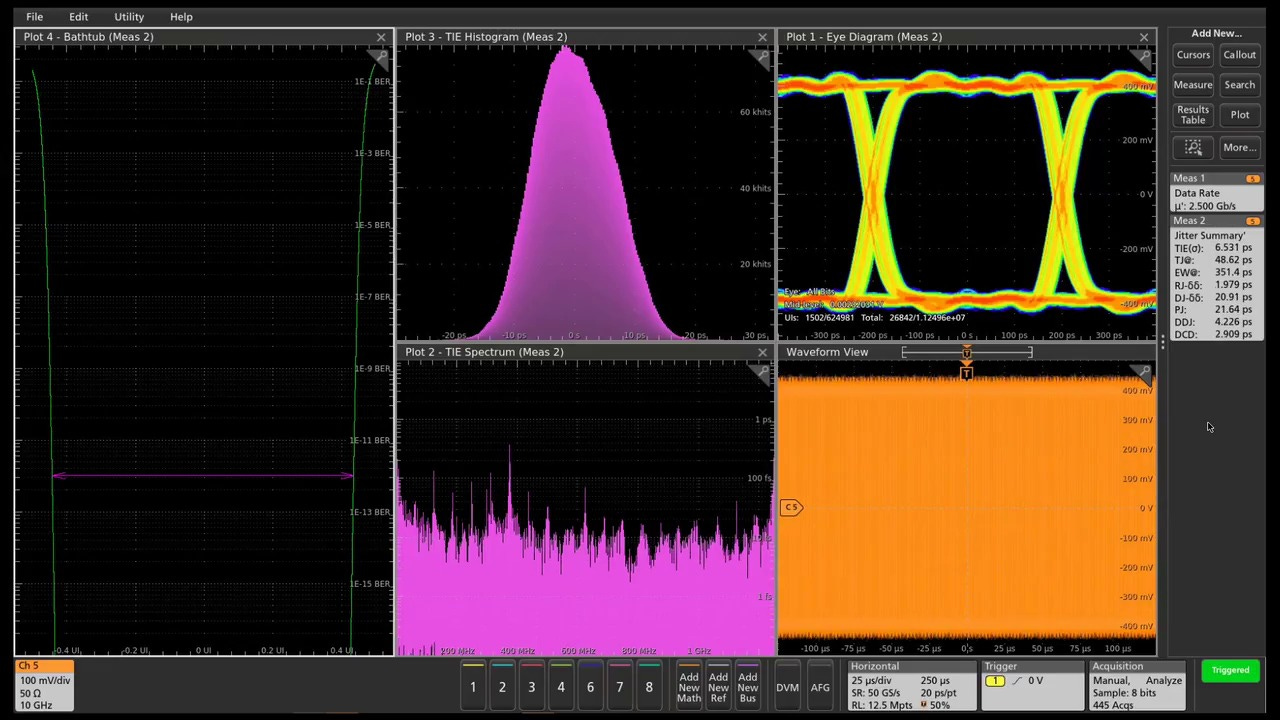

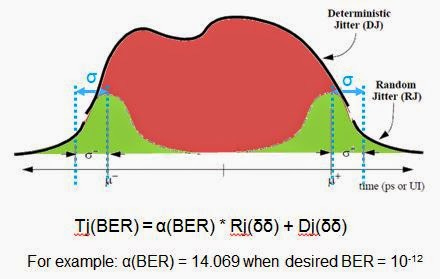

Jitter is simple to understand but has a lot of nuances I will avoid discussion of today.

Jitter is a measure of “how much the clock wiggles” in time domain.

There are many forms of jitter measurement, but most of the results end up looking like a Gaussian.

The source of this jitter is random/thermal noise.

Deterministic jitter (also known as sinusoidal jitter) typically comes from a source. Unwanted crosstalk from a poorly isolated circuit, power supply noise, or even electromagnetic coupling from a neighboring device on the same PCB.

If you see two Gaussians, something is fucked up.

Jitter is typically measured in femtoseconds. High-quality Quartz XO are rated for 50 femtoseconds integrated jitter.

The standard band to integrate when measuring a XO is from 12 KHz to 20 MHz.

[1.d] Phase Noise // Coherence

When looking into optics, you will quickly run into a word.

Coherence.

One optical company is literally named Coherent.

What does this mean?

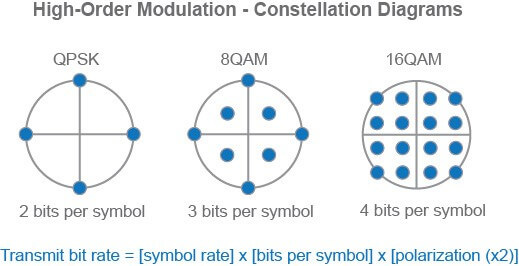

Phase-based modulation. (QAM)

Wireless standards (WiFi, 4G/LTE, 5G) use QAM regularly. It is not something special.

The optics industry makes a big deal about coherence vs non-coherence because of how difficult it is to use QAM at these extreme speeds.

Wireless has at most ~100 MHz of bandwidth, ~400 MHz for select 5G mmWave bands.

Optics uses literally 50-100 GHz of bandwidth. At these speeds, the phase noise of every component in the system becomes critical.

High phase noise turns your nice grid into a useless doughnut.

When you think “coherent optics” think “low phase noise”. That is the differentiation. You need much higher quality components and system design to achieve this.

Phase noise is directly related to jitter BTW.

https://www.keysight.com/us/en/assets/7018-01984/technical-overviews/5990-3108.pdf

[2] Investment Vectors

Now that the background information is finished, lets talk stonks.

[2.a] Long-Haul: Ciena and Cisco

Long-Haul optics are critical for multi-datacenter training runs.

https://semianalysis.com/2024/09/04/multi-datacenter-training-openais/

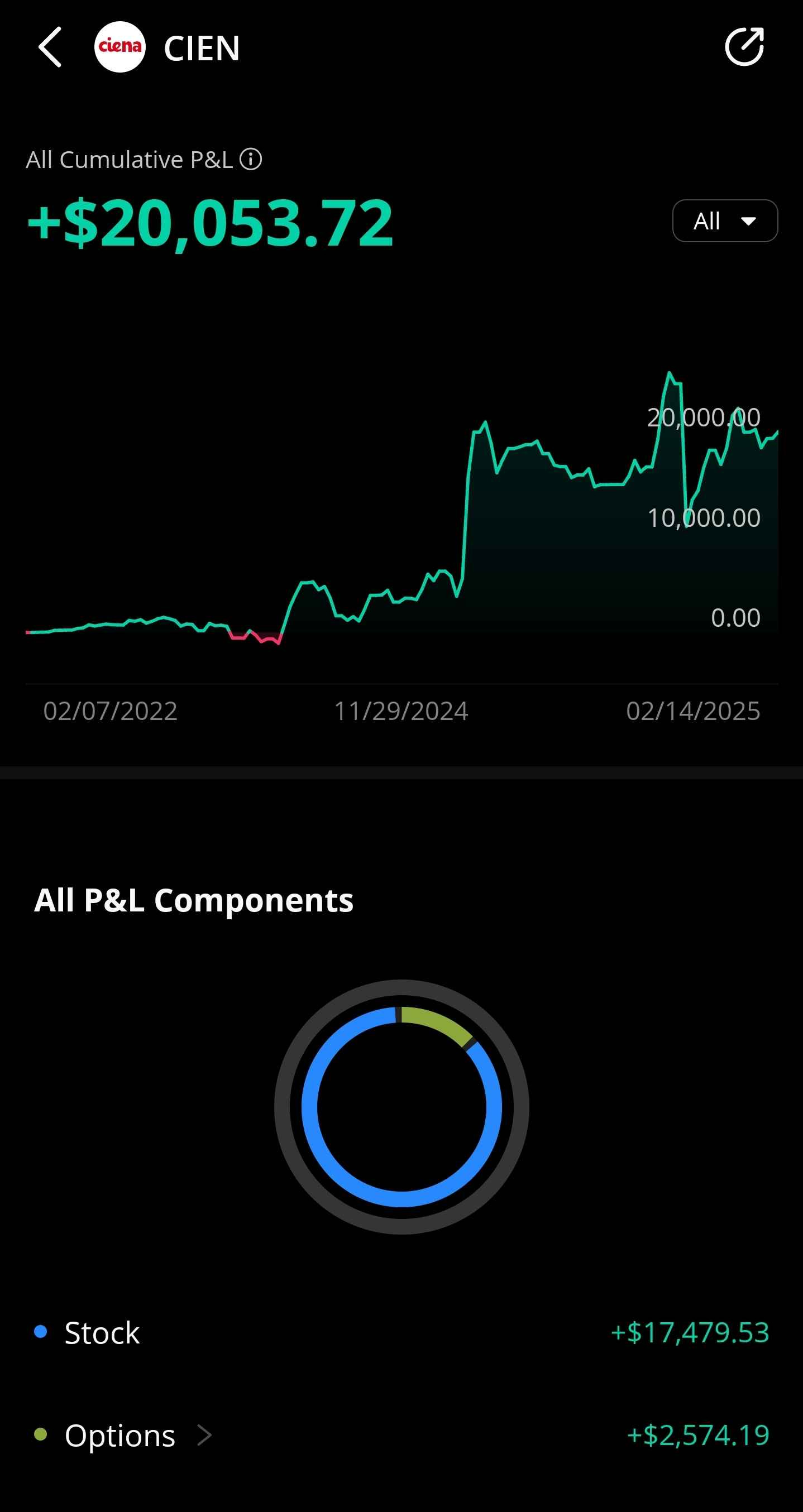

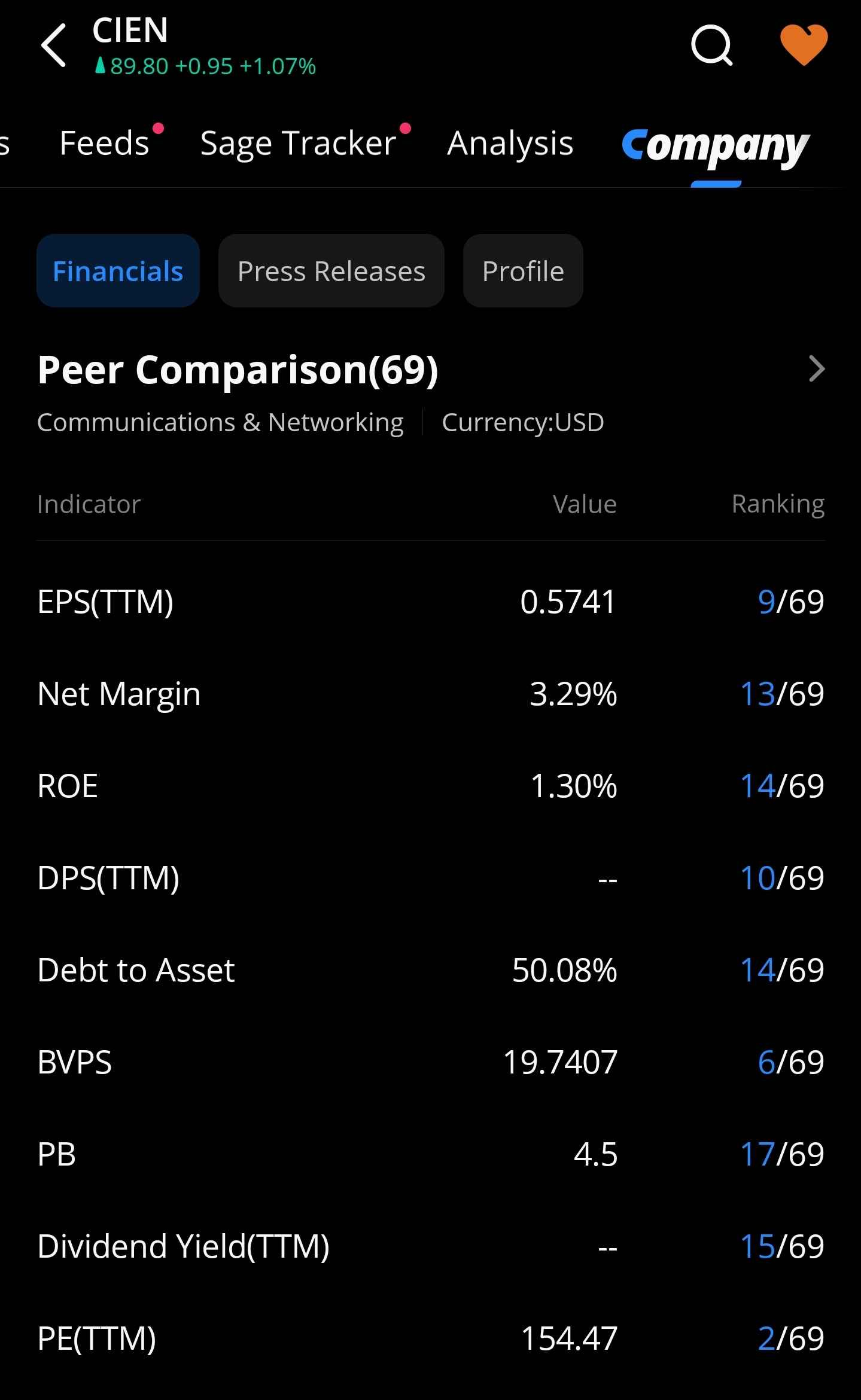

Ciena is a pure-play to this trend. I bought a bunch and am holding. It probably still is a good investment at these levels given the magnitude of what is happening. Recent Fabrinet earnings provided a good read-though/confirmation of the story.

The valuation is a bit stretched though.

If valuation matters to you, check out Cisco.

There is a mini-Ciena inside Cisco, surrounded by garbage.

I generally prefer pure-plays.

[2.b] Degen Optics: Lumentum, Coherent, and Credo

None of these stocks are safe investments.

Let’s start with Credo.

I have made some money on this stock and presently do not like the risk/reward. Showed my (truly degenerate) portfolio to a very smart hedge fund friend and asked him what the most dangerous position was.

Much to my surprise, he said Credo. The valuation is absurd according to him.

After comparing the book value of Credo, Lumentum, and Coherent, I agree.

From a forward P/E perspective, Lumentum is more expensive than Coherent.

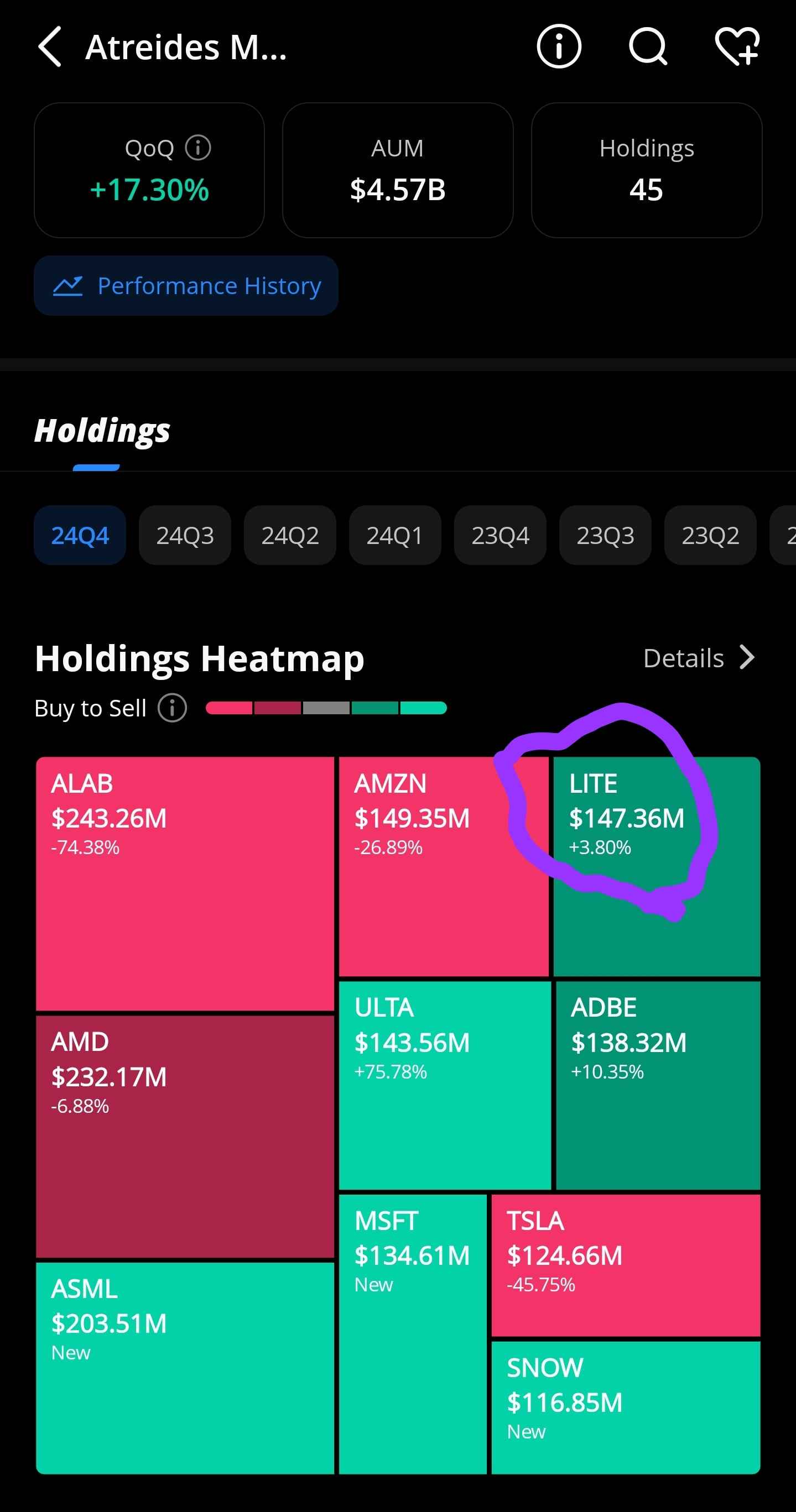

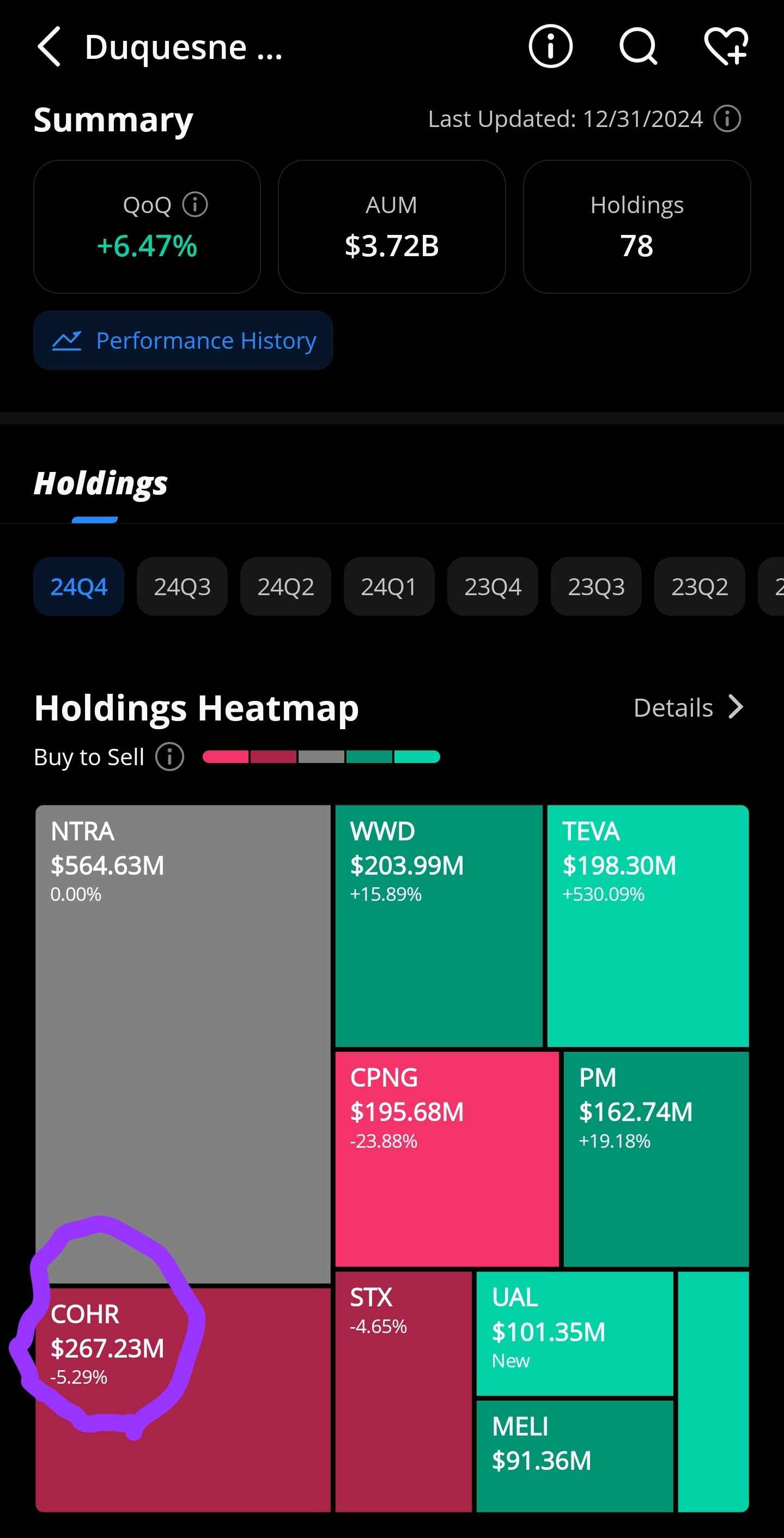

Gavin Baker is long Lumentum while Druckenmiller is long Coherent.

Lets go over Lumentum first as they are easier to understand.

They claim to have a unique advantage that is not at all unique. AAOI and Coherent both make similar claims. I struggle to find anyone using this alleged “conventional model”.

A common theme of this optics companies is that they have some kind of proprietary edge. I have no way of verifying any of these claims. They all say the same thing, so it is very difficult to form an opinion.

One thing to be aware of is that Lumentum has new leadership. There is some speculation that the new CEO is sandbagging to juice his stock grants. I have some call options for fun. Unwilling to size up given that Coherent appears to be better in relative terms.

Through a variety of friends, I have access to basically all sell-side research. After reading hundreds of pages of material about Coherent, I have arrived at a simple conclusion.

Coherent is very good at making low phase-noise lasers.

I still have no idea how they accomplish this. (lol)

Valuation is OK… relative to what else is out there.

Two important things you need to be aware of as a potential investor.

First, Coherent management is suspicious.

These are not the kind of letters you want to get from the Securities and Exchange Commission.

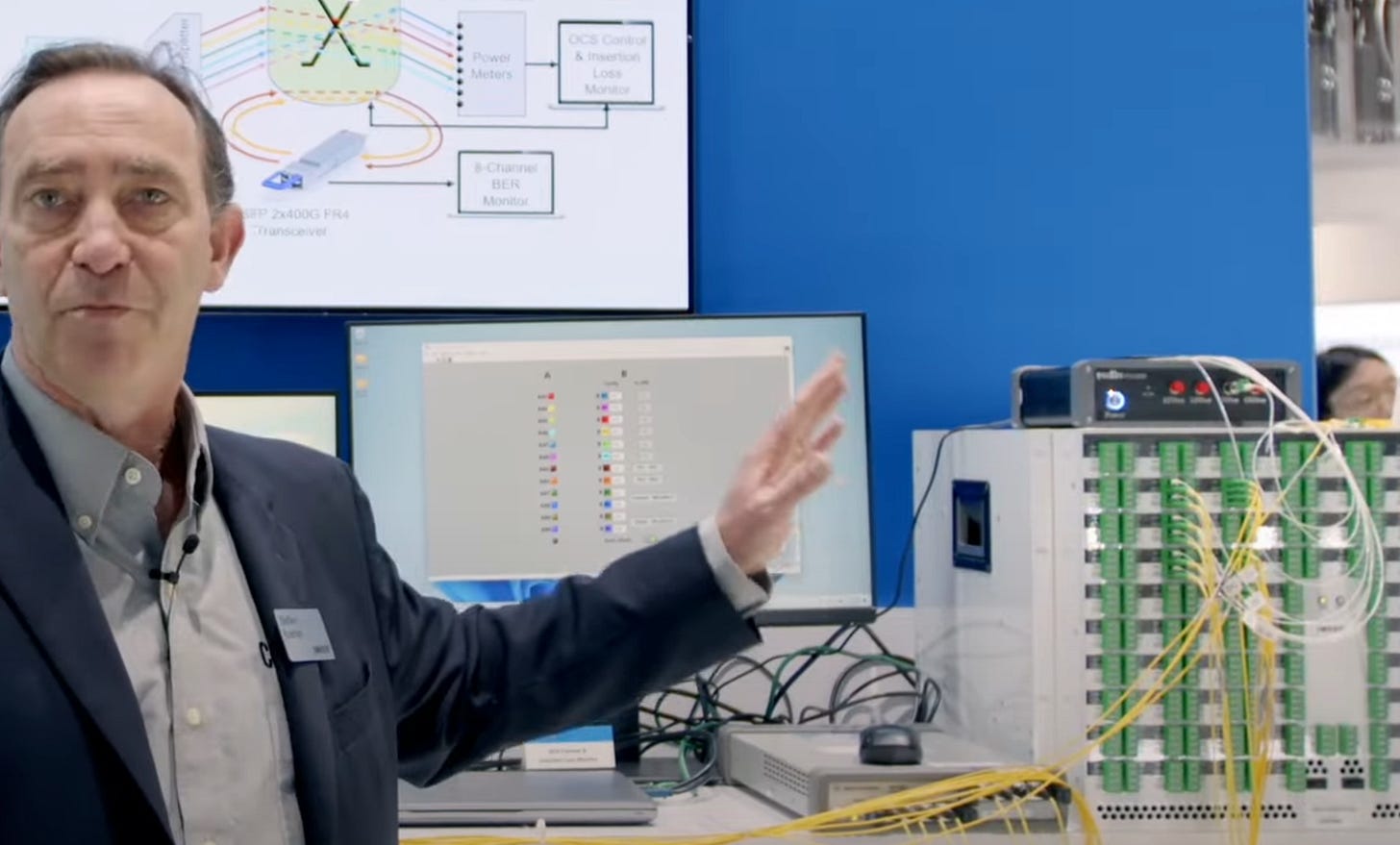

The second consideration is on OCS. Coherent CEO hyped this up in the latest earnings call.

This is the kind of shit that terrifies me. Sell-side clearly has no idea what the hell OCS is. They taking the bait. Hook, line, and sinker.

Coherent had a demo of this product at OFC. They were kind enough to provide a public video of this demo.

It’s not good.

Notice how they are only using ports that are right next to each other.

If you connect the far end ports of a switch together, the insertion loss will be higher. These guys picked one of the lowest insertion loss paths for their demo.

Despite this, they still have several lanes/bands marginally passing. The limit is 3 dB. This is a very favorable scenario, and it barely works.

If Coherent stock spikes because of OCS, I am liquidating on the news. This is not a viable technology for AI, especially when CPO switches are right around the corner and objectively better in every way.

[2.c] Quality: Fabrinet and Ayar Labs

Fabrinet is a rather volatile stock.

The volatility comes from pod monkeys using massive leverage to gamble on supply chain rumors.

I still believe that FN 0.00%↑ is a long-term optical winner.

Co-Packaged optics is a huge jump in complexity. Fabrinet has the experience and skillset to handle this. Vast majority of competitors do not.

CPO also requires strict IP protection.

Fabrinet is basically a competent company surrounded by clowns.

This is a quality investment in the long-term, but dangerous in the short-term.

Tread lightly.

Ayar Labs is a private company specializing in CPO. I usually try to avoid covering private companies because there is not much information disclosure or accountability. Public companies have to show up and answer questions once every three months. Regulations around materially false statements force the corpos of publics to behave for the most part.

Somone on X/Twitter asked me to add this one. There is some old (2019) technical information so let’s go over it.

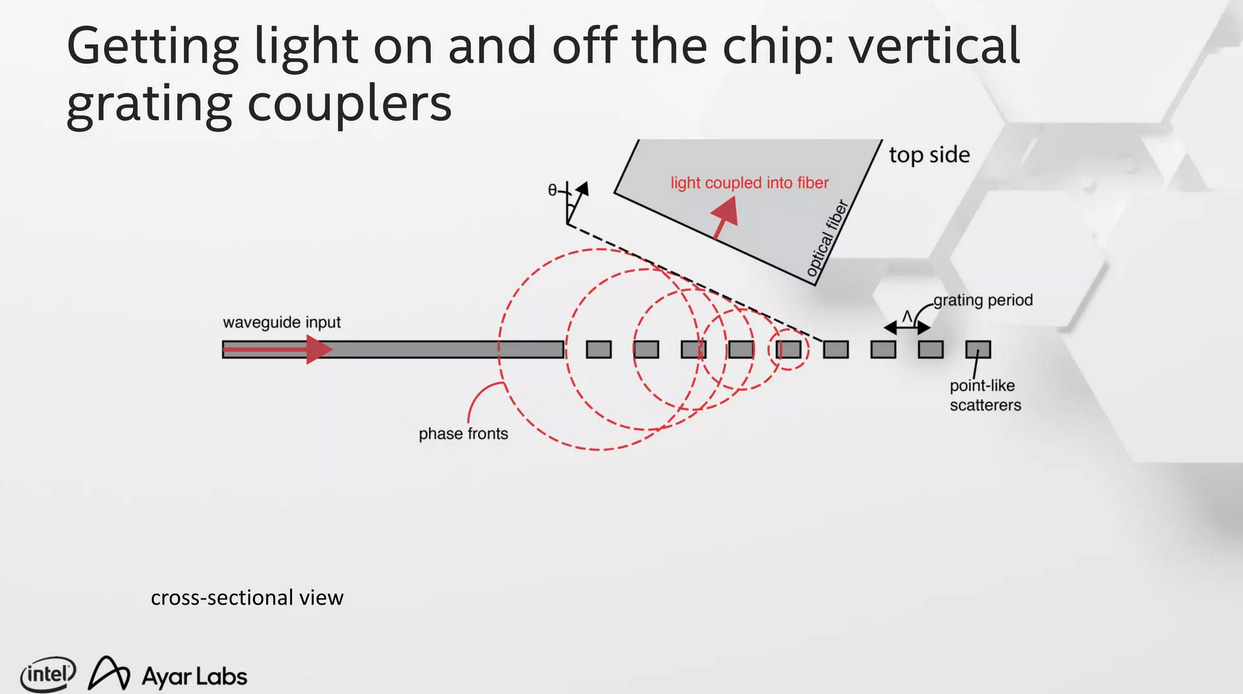

They are using lithographically printed scattering elements in a phased array configuration.

I know a lot about phased arrays from a previous life. Basically, every phased array in existence has some form of steering.

Sometimes digital, sometimes analog, sometimes both (hybrid).

Ayar Labs technology appears to rely on un-steerable phased arrays. This shit must be an engineering nightmare. Insane manufacturing tolerances.

If someone showed me these slides back in 2019, I would have said this would never work.

We are in 2025 now though. Ayar Labs just raised a new round.

This tech appears to be real. There are a lot of rumors about Nvidia actually using it in 2026/2027.

I am still too poor to invest in private companies. If I was rich, I would probably buy some shares on the secondary market.

[2.d] Photonic Fabs: Global Foundries and Tower Semiconductor

Photonics ICs (PIC) need a special process node. TSMC has one but it sucks.

Tower Semi and GloFo are the only two quality photonics-capable Fabs.

The problem is, neither are pure plays. Both have significant exposure to RFFE which is radioactive to me.

Let’s compare the stock chart of these two against TSMC.

Ouch. Pour one out for Mubadala, the bagholders of GloFo.

Neither GloFo nor Tower Semi are optical pure-plays. This is why I don’t like them personally as an investment.

8.5% of Glofo revenue is what I am interested in. ~Half (smartphone) is radioactive garbage.

Tower has a better mix but still not what I am looking for.

If I was a professional analyst and had to give an opinion to a portfolio manager, I would pitch Tower Semi. They have a reputation of treating customers well (not stuffing them) and seem more competent than GloFo.

Recent poor results are due to smartphone RFFE trends.

I have a theory that Apple modem and Qualcomm premium tier is shifting RFFE content such that GloFo is gaining share from Tower. It’s not that GloFo is better, just that customers who tend to use GloFo are gaining share for orthogonal reasons.

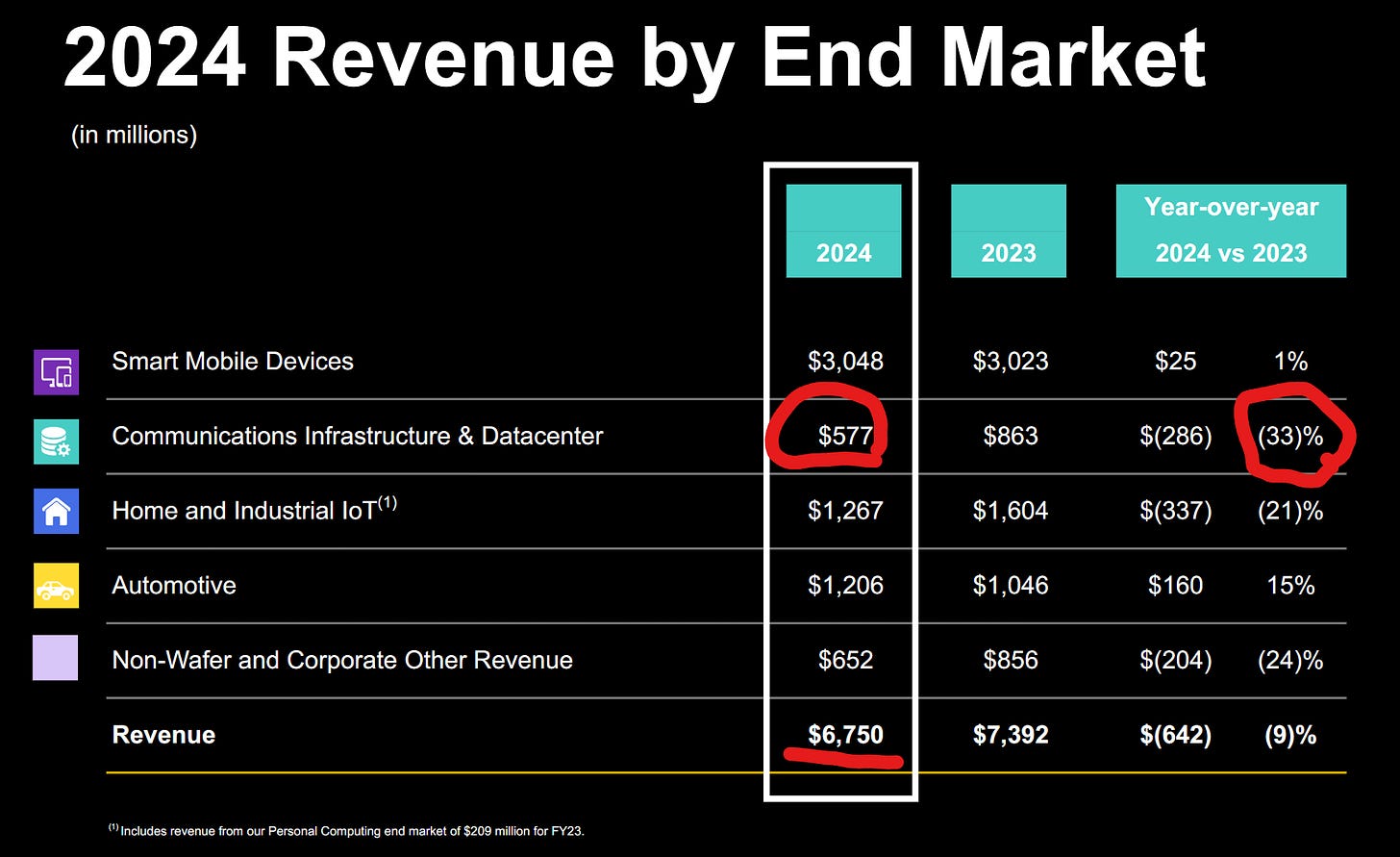

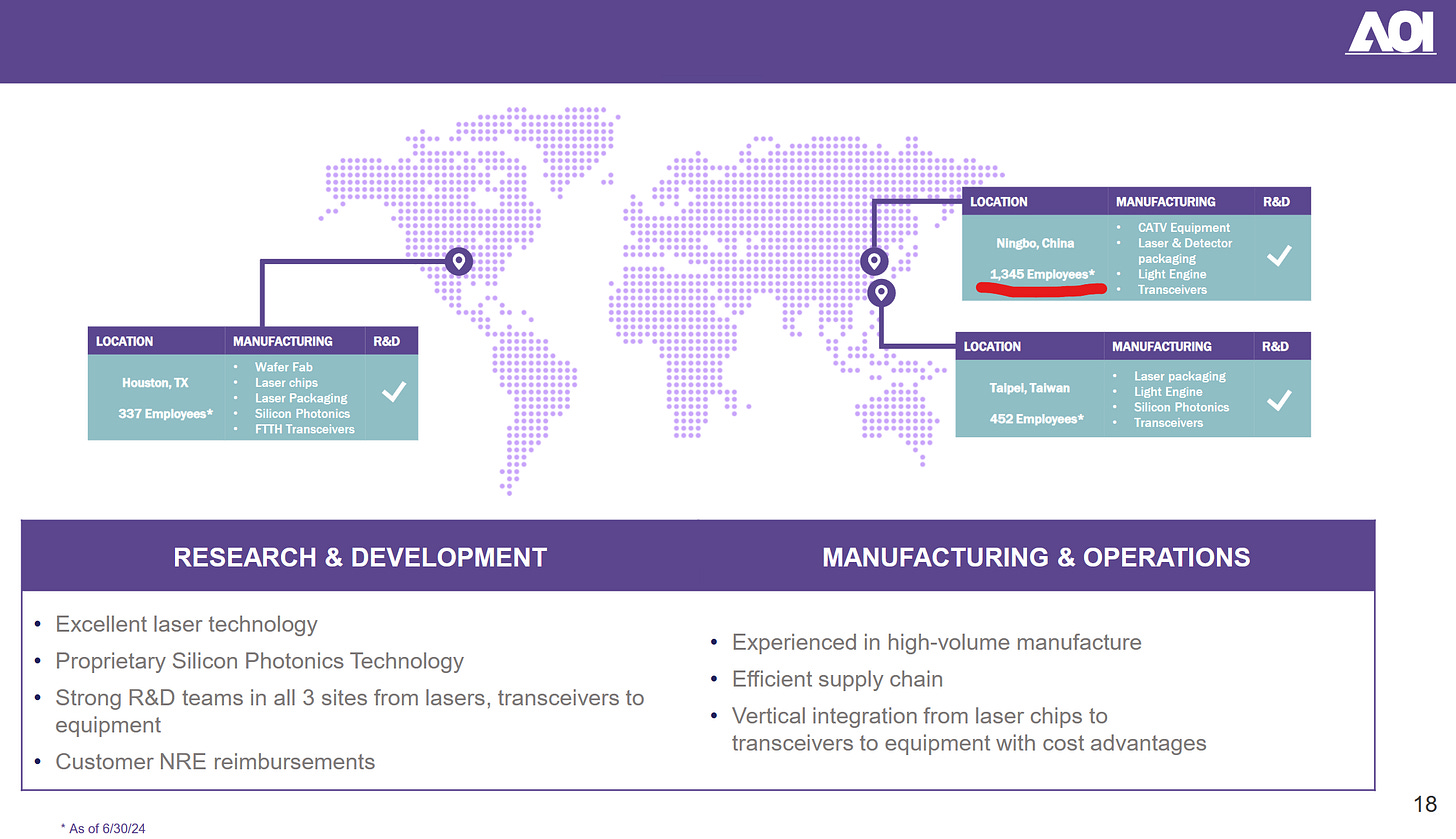

[2.e] Ultra Degen: Applied Optoelectronics, Innolight, and Eoptolink

All three of these companies are exposed to tariff man.

63% of AAOI employees are in PRC.

I wonder how Eoptolink allegedly stole IP. /s

There is a short report on AAOI too. The summary is this:

AAOI is run by morons.

[2.f] ITS HIGH TIME TO LOOK AT SITIME

This sub-heading has been stolen from my all-time favorite Fabricated Knowledge piece.

There are a few contenders for second place but this one will always be first in my mind. Highly recommend all of you to read Doug’s post right now if you have not already read it.

[2.f.i] Engineering Overview

SiTime makes silicon based refclks. Unlike the 40-ish companies who are slicing Quartz crystals like cavemen, SiTime uses the power of semiconductor processes. Lithography and mass production → scalability → high gross margins → operating leverage.

Another huge benefit of SiTime refclks is programmability. Have a PPM problem? Just shift the frequency using an I2C command.

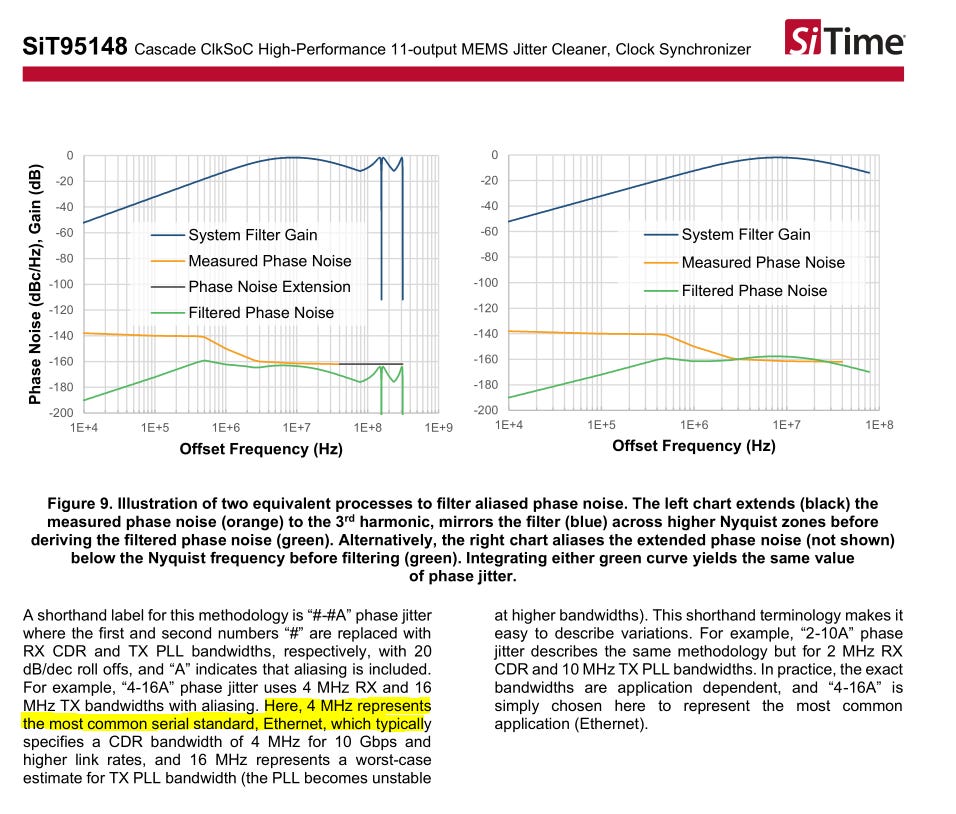

There is one problem though, SiTime’s jitter is dogshit. It’s so bad that they resort gaslighting within datasheets.

4 MHz Rx CDR BW is a bullshit assumption. This needs to be 1 MHz.

This is trash.

A decent Quartz XO destroys SiTime in typical jitter without cheating. Even if we compare the (fake/deceptive) SiTime spec against decent Quartz, they still lose badly.

25 dBc/Hz difference is massive.

Several months ago, a trusted contact told me a rumor SiTime had apparently won the GB200 socket with Nvidia. A week later, multiple other contacts confirmed this, and the news started circulating publicly.

Multiple people had the (wrong) take that this design win was because of saving PCB space. I knew this could not be the case. Saving a little bit of space in exchange for killing jitter performance is obviously a stupid idea.

It took a few weeks of thinking to figure it out… but I became convinced last year on why Nvidia has done this.

PPM sync. Guaranteed 0 PPM for every link.

In the months since, I have become more and more obsessed. This looks like a crazy alpha opportunity that nobody else has noticed.

To understand why this is so important, let’s look at some official standards documents.

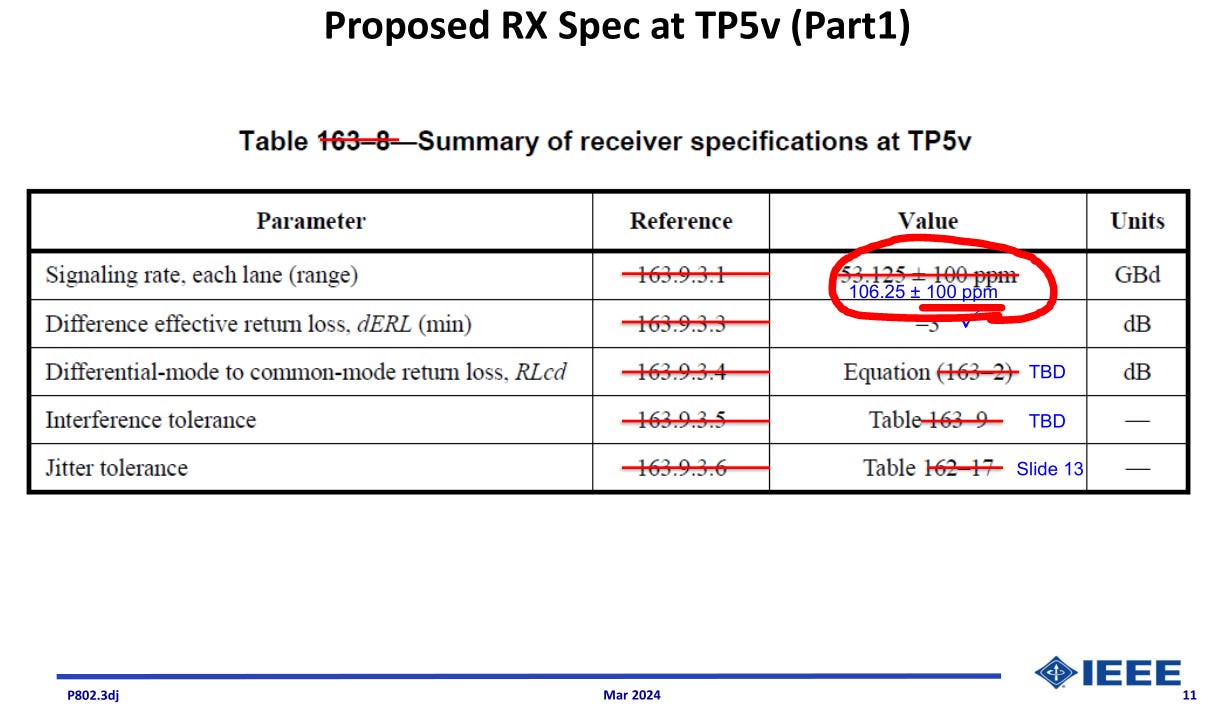

The latest electrical Ethernet specification requires +/- 100 ppm tolerance.

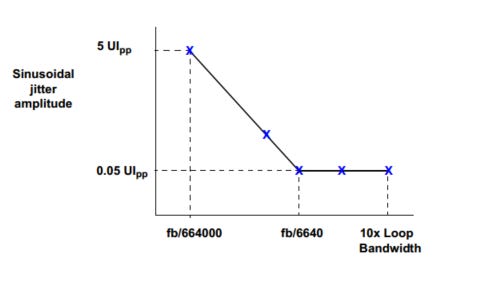

There is also a table of sinusoidal jitter tolerance requirements.

Now lets look at an optical specification. 400G OpenZR+

Only +/- 20 ppm is acceptable. Why is optical spec so strict with respect to PPM?

The answer is that phase noise can be corrected with heavier digital forward error correction typically present in optical systems. (O-FEC is hilariously heavy.) PPM-derived error cannot be corrected digitally with the same ease.

A Clock-Data-Recovery (CDR) circuit is responsible for recovering embedded clocks and using that information to also recover the data.

What you need to understand is this is a control system.

https://en.wikipedia.org/wiki/Proportional%E2%80%93integral%E2%80%93derivative_controller

PPM and jitter place different types of stress on this control system.

As datarates have gotten faster, PPM has become much more difficult to mitigate.

IF YOU ARE BUILDING A PRODUCT (OPTICAL CABLE, ACTIVE ELECTRICAL CABLE, CO-PACKAGED OPTICS SWITCH, NIC, SCALE-OUT ACCELERATOR SYSTEM) AND HAVE THE OPTION TO GUARANTEE 0 PPM AT THE COST OF JITTER YOU TAKE THIS TRADE EVERY TIME.

Only SiTime is positioned to capitalize on this transformative opportunity. They just need to up their sales game.

A phase-locked loop (PLL) is a circuit that generates a phase-aligned output.

There are two types of PLL:

Integer

Fractional (aka Frac aka FracN)

Integer PLLs are easy to understand and build. Suppose you have a 10 MHz input. A simple integer PLL would be able to output any frequency between say 10 MHz and 200 MHz in 10 MHz steps. (10, 20, 30 MHz, …)

In many scenarios, it is desirable to have a PLL that can output an arbitrary frequency. Say outputting 25.26812 MHz even though the input is 10 MHz. In general, it is much more difficult to design a fractional PLL. The noise performance (jitter) tends to be worse.

Every fractional PLL has configuration registers to run in integer mode too. This is a user-configurable register in most cases.

A modern chip (smartphone SoC, AI ASIC, GPU, CPU, …) has dozens of PLLs on die. The performance of individual sub-circuits depends on the jitter/noise of the external source refclk (quartz, SiTime) and the on-board clocking tree.

As you can see from this SiTime datasheet, this particular product has four independent integrated fractional PLLs. This is where the programmability comes from.

Remember that the outputs of this SiTime chip go into the customer chip which has it’s own PLL. Customer chip might have integer or fracN PLL.

So there are three realistic scenarios for system design:

Quartz refclk (low jitter) + integer host PLL (low jitter)

SiTime refclk (high jitter) + integer host PLL (low jitter)

Quartz refclk (low jitter) + fracN host PLL (high jitter)

Option #1 offers the best jitter performance but has no programmability. Can’t correct PPM.

Option #2 has medium jitter (at system level) but can correct PPM. Synchronous link operation!

Option #3 also has medium jitter but requires the host fracN PLL to support complex clock-forwarding. Getting this kind of setup to work involves a lot of effort. Dropping in a SiTime chip into the PCB design is much easier and cheaper!

Check-out this Texas Instruments part. It is clearly designed for optical applications given the PPM stability.

As you can see from the block diagram, there are no digital inputs. Unlike SiTime products, this TI part cannot be programed by the user.

An integrated temperature sensor drives the integrated fractional PLL to maintain PPM stability. In other words, there will be some intrinsic PPM but this PPM will not drift over temperature or time (10 years!).

SiTime crushes this product. It is objectively better in every way. They even win on jitter!

[2.f.ii] AI/Datacenter Market Opportunity (TAM)

First, a list of acronyms and definitions:

Direct Attached Copper (DAC)

Boring cable that is basically a copper wire.

Active Electronic Cable (AEC)

A re-timed electrical cable.

Contains a DSP chip on each end that converts the analog signal back into digital, cleans it up, then coverts back to analog.

Active Copper Cable (ACC)

A middle ground between DAC and AEC.

Has analog amplifiers for more reach.

Does not explode power consumption and BOM cost like AEC.

RIP SMTC 0.00%↑ lol.

Active Optical Cable (AOC)

Optical cable where a DSP chip converts between electrical (normal) SerDes and a special SerDes that can drive sensitive optical components.

Linear Pluggable Optics (LPO)

Optical cable where there is no DSP chip.

The host SerDes directly drives optical components.

This tech is also commonly referred to as linear drive or direct linear drive.

Linear Receive Optics (LRO)

Half-measure between LPO and AOC.

Only the transmit side is re-timed.

Credo seems to be the only serious player.

Co-Packaged Optics (CPO)

Previously discussed in section 1.b (scroll up)

SiTime’s datacenter TAM can be broken up into several categories:

Switches (Ethernet, PCIe, Infiniband, UALink)

Network Cards // Smart NICs

Every single AI accelerator.

Each chip needs a refclk too!

All cables that contain retiming in some form.

AEC

AOC

LRO

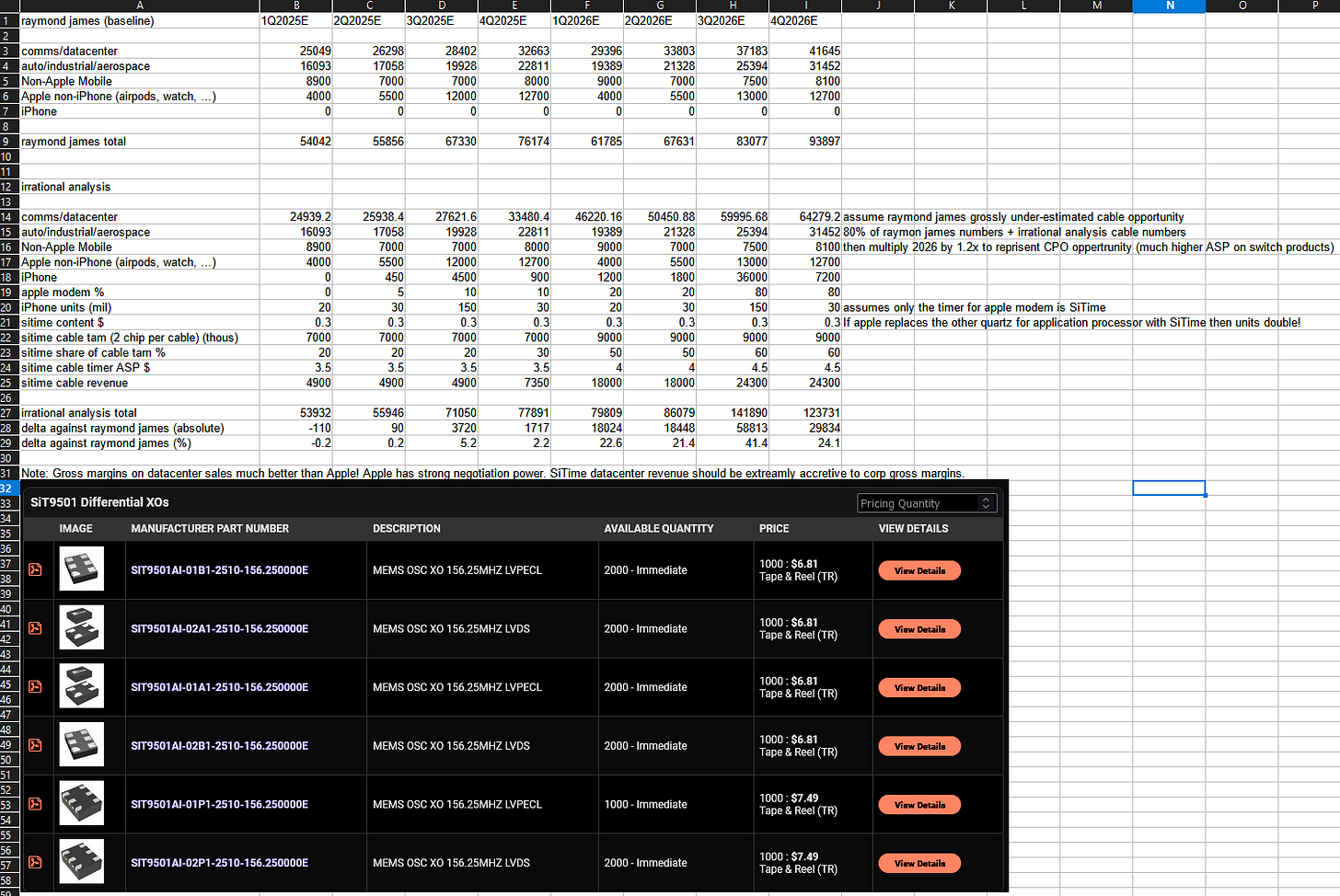

[2.f.iii] Ghetto Revenue Model

I am an electrical engineer by training. All my education and work experience is EE.

In other words, my spreadsheet/modeling skills are non-existent.

I have created this ghetto spreadsheet based on the following resources:

A Raymond James sell-side model on SiTime revenue by segment.

A wonderful report by Lightcounting.

My friend explicitly told me not to screenshot the Lightcounting report.

Unit numbers for various cables (relevant to SiTime) are eyeballed from the bar charts and modified by my crude assumptions.

Public DigiKey pricing of relevant SiTime and quartz products.

Obviously, 1K unit pricing is bullshit.

I have applied a deep discount assumption for true volume pricing.

[2.f.iv] Guide for SiTime Application Engineers and Technical Marketing

I have written this section for SiTime applications engineers and technical marketing employees.

At the time of writing, I am unsure if I have any SiTime employees subscribed. Only ~20-30% of subs are from work emails.

Yes, I really have read every autogenerated “new subscriber” email. It’s fun collecting the work emails of semiconductor companies and financial institutions.

Someone send my shit to SiTime employees. I want stock to go up.

Hello SiTime employees! I follow your company on LinkedIn.

Yes, MEMS is cool.

Sure, your products have neat benefits in size (save PCB space) and power.

Stop wasting your time with this crap.

Do you want your RSUs to triple over the next year? Listen up!

Your singular priority is to hit every single datacenter device maker with the following three questions:

What is the performance degradation of your device/system under low-frequency (40-400 KHz) sinusoidal jitter? (JTOL)

What is the performance degradation of your device/system under 50-100 PPM relative to synchronous (0 PPM) operation?

We know that your system will perform better under synchronous operation with slightly more jitter if you use our solution. Are you willing to pay $2-5 in extra BOM cost relative to quartz timers to achieve this performance gain?

Friends, I mean no disrespect but it appears you have no idea what you have or how to sell it.

Smart-NIC

Active Electrical Cables

Switches

Accelerators

Optical Modules

Your TAM is incredible. You have a huge performance advantage if you teach customers to use the PPM sync trick Nvidia has used in GB200.

Stop gaslighting customers on how to measure jitter and embrace 0 PPM operation that only you can enable.

YOU WIN IN SYSTEM PERFORMANCE IF CUSTOMERS SET UP THE SYSTEM RIGHT.

YOU WIN AT A SYSTEM LEVEL EVEN THOUGH YOU LOSE ON JITTER.

[2.f.v] Key Risks

The largest shareholder of SiTime is a Japanese company called MegaChips.

This is due to historical reasons.

Recent selloff is because these guys sold a lot of shares all at once into an illiquid market.

They still own ~15% of the company.

What you need to know is that Megachips is basically worthless. Their stake in SiTime is effectively their entire valuation.

The other major risk to SiTime is the upcoming iPhone SE with Apple’s internal modem. Many have speculated that Apple will bring SiTime back into the iPhone to support their mediocre modem. 5G has a reference signal called TRS which is used for frequency tracking, amongst other things. SiTime can enable frequency sync in wireless links too.

If Apple does not launch their modem, or the iPhone SE volumes are low, then SiTime stock will get hit hard. Probably another 10-20% drawdown.

Investments always have risk.

I like the risk/reward on this one.

I have a lot of thoughts on what is going on with Intel and TSMC. Waiting for more information to come out before writing up my (very strong) opinions.

You can find my preliminary low-quality opinions on X/Twitter as I scream into the abyss.

Thanks for the great write-up! I am a bit confused on why SiTime's programmability is unique. Seems like they just packaged fraction-N PLLs and their MEMS oscillator together. In principle, TI could package their BAW resonator with PLL and achieve the same programmability. Sure, fractional-N PLL is hard to set up and work with compared to integer-N PLL, but it is a very mature technology. It seems like SiTime's edge is still PCB space (?).

Also from the picture, the photonic grating coupler used by Ayar labs is not really a phased array. It is a pretty standard periodic structure for any photonic testing with fiber. The grating area is small (~10 um^2) and the distance between the fiber and grating coupler is also quite small (<10 um), as such the coupling efficiency depends on the near-field distribution of the optics. Small fabrication disorder doesn't really matter.

Thanks for the write up. Alphawave Semi has invested heavily in Coherent-lite to compete with Marvell/Ciena in networking campuses and increasingly within the datacentres themselves. I wonder how others see this coherent-lite adoption playing out especially at shorter distances. You also get custom silicon, chiplets and a full portfolio of PHY, controller and subsystem IP (which Siemens EDA is now throwing their weight behind). I think they are a much better prospect than the likes of Credo not least because, just as with ARM previously, the London market has no idea how to value them you get it for 1/10th of the price. I'm surprised they haven't had a mention in any of your articles so far, very interested to hear anyone's opinion on them.