IMPORTANT:

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

The “intel inside” marketing program is one of the greatest of all time. In honor of these annoying stickers, let’s talk about Intel’s most recent earnings report in-depth.

There is some obfuscation inside…

Something is not right. I have a conspiracy theory.

Let’s build a case.

Timothy Arcuri -- Analyst

Sure, thanks. Dave, can you again explain how June gross margin was so much worse than you thought just three months ago? I mean, revenue is basically in line. I know you talked about mix. But it seems like it was probably a pretty small part of it, mix was.

And it was really more the decisions arrived until 4 and 3. So, can you just explain again? I'm not sure I understand why that was such a big factor.

David A. Zinsner -- Executive Vice President, Chief Financial Officer

Yeah. OK. That was the biggest one. I'll just say that there were a couple other things that, you know, we had to do some write-offs related to legacy businesses that impacted us.

Our utilization was a bit lower. That did impact us. But the biggest one was the shift. We were originally planning to ramp Meteor Lake Intel 3 and even run production on Intel 4 -- or, sorry, Intel 4 and then run production on Intel 3 in Oregon, which is our TD fab, our process technology fab, kind of our development fab.

We made the decision to more quickly shift all of that over to Ireland. And it's a good move because it saves capital. We don't have to spend capital twice essentially. And it, you know, starts to mature the Intel 4 and 3 processes in Ireland more quickly.

The downside of that is the wafers are expensive right now. And so, you know, we get this kind of early ramp of the product at a much higher wafer cost that we're pushing through the system. And that puts pressure on the margins. That's going to carry into next quarter.

I mean, we will do better in next quarter, obviously, but we're going to do more volume. And the margins, you know, will be below the corporate average because of -- because while we're improving the wafer cost, it's still not to the point where it's above corporate average yet. And so, it will weigh down on margins for the third quarter as well. After that, you know, it gets more and more mature.

The cost structure gets better. And, you know, the situation on Meteor Lake will improve meaningfully.

Red flag.

Srini Pajjuri -- Analyst

Thank you. Couple of follow-ups. Dave, on the move from Oregon to Ireland fab, you talked about, you know, that being a gross margin headwind. Can you talk about how much -- can you clarify how much of a headwind that is right now? And also, when it's fully loaded on a like-for-like basis, how much of a headwind do you think that's going to be on an ongoing basis?

David A. Zinsner -- Executive Vice President, Chief Financial Officer

OK. All right. So, I think the best way to think about it is, you know, we were, I don't know, 400 basis points or so off on the gross margin, taking into account revenue was part of it. You know, it was a meaningful chunk of that 400 basis points.

There was -- the write-offs rate related to legacy businesses. And the, you know, mix and underutilization also affected it and it wasn't an insignificant amount. But that was a good portion of that 400 basis points, let's call it that. And that will be the case in the third quarter probably, given the, you know, increase, I think we're talking about a 50% increase in Meteor Lake quarter over quarter in the third quarter.

Beyond that, it's going to start to become less and less to the point where it's, you know, actually not going to be a headwind.

Patrick P. Gelsinger -- Chief Executive Officer

Yeah, it becomes tailwind.

David A. Zinsner -- Executive Vice President, Chief Financial Officer

Yeah, exactly.

Patrick P. Gelsinger -- Chief Executive Officer

Right? As the Ireland factory ramps, the production factory will have a lower cost per wafer start than a TD factory like Oregon.

David A. Zinsner -- Executive Vice President, Chief Financial Officer

Yeah.

Patrick P. Gelsinger -- Chief Executive Officer

So, it becomes a headwind as we go into next year.

David A. Zinsner -- Executive Vice President, Chief Financial Officer

Tailwind as we go into --

Patrick P. Gelsinger -- Chief Executive Officer

Tailwind.

David A. Zinsner -- Executive Vice President, Chief Financial Officer

Now, as we -- now the challenge for next year will be, we'll now be ramping Lunar Lake next year. Lunar Lake has the memory in the package. So, we're going to have to essentially buy that at a price and turn around and include that in our price at 0% margin. So, that puts some negative pressure on the margins.

And additionally, it's got more of the content sourced externally. And as you know, we're seeing some inflation. So that one then becomes more of the -- Meteor Lake starts to be helpful, but Lunar Lake starts to become a drag on the Intel products margins, which is why we're tempered in terms of our outlook for margins next year because we're going to have a lot of improvements on the Intel Foundry side. It's going to be tempered on the product side, and it's really going to be because of Lunar Lake.

John Pitzer -- Corporate Vice President, Investor Relations

Srini, do --

Patrick P. Gelsinger -- Chief Executive Officer

And I'm just going to add one thing. As we move the Intel 4, 3 capacity into Ireland, it also gives our TD team more focus on their capital on 18A, as well as then 14A and 10A. You know, we're taking, for instance, the second high-end A tool that is coming into our Oregon facility. So, we're well underway on 14A.

So, part of this was a capacity and cost decision for the long term. Part of it was an AI PC acceleration. But it was also a TD cadence decision in optimizing the use of our TD resources, you know, for the next-generation technologies which are already well underway and showing good early indicators.

These two exchanges on the earnings call are extremely suspicious.

Key observations:

Intel management was careful to hedge what they said and avoid allocating the gross margin miss across factors.

One excuse repeatedly brought up was moving Meteor Lake production from Oregon to Ireland.

This fiasco was spun as an “acceleration” of AI PC production.

Why is moving the production from the technology development fab (Oregon research) to a production fab in Ireland as surprise hit on margins? Logically, wouldn’t this always be the plan?

An event that was going to happen anyway and should happen from a commonsense perspective was repeatedly used to shield questions on gross margin. The other excuse brought up was “mix”.

I have read enough earnings call transcripts to spot suspicious excuses like this. Temporarily elevated costs and unfavorable mix are often used to hide a much scarier factor.

ASP decline. Loss of pricing power.

We know from the Dell leak that QCOM 0.00%↑ is charging half price when compared to the INTC 0.00%↑ chip. Despite the 50% lower price, Qualcomm is making ~52% gross margin, accretive to the corporate average.

I bought one of these Qualcomm laptops and reviewed it.

It’s not bad. A little disappointing but overall, a good machine with a good chip.

People do not buy laptop chips. They OEM picks a laptop chip, designs their device around it, and then you get to buy the finished device.

Is Meteor Lake a better chip than Snapdragon X Elite? Yes.

Probably 20-30% better in terms of overall quality.

Would I pay double for a chip that is only 20-30% better than an already good baseline? No.

OEMs are not happy with Intel. The Raptor Lake disaster has shattered what little trust they had left. Multiple competitors are attacking Intel from all sides.

Qualcomm

AMD

MediaTek + Nvidia colab

I am convinced the Dell leak happened to pressure Intel publicly on pricing.

I am also convinced that Intel is rapidly losing pricing power in negotiations with OEMs.

Stacy Rasgon has an interesting argument in his note. He thinks that Intel will be OK because of $40B worth of “effective” cash that enters the balance sheet over the next 18 months.

I don’t think the $10B gross capex cut Intel guided is realistic but whatever, let’s take that at face value.

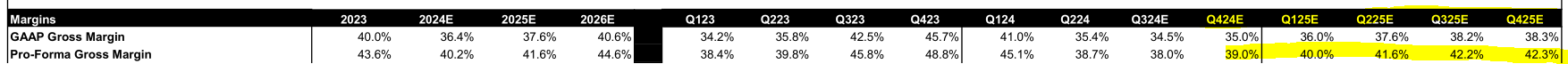

This argument only works if Intel’s gross margins do not deteriorate further. At 30-35% gross margin, Intell will hemorrhage way this $40B incremental cash safety net easily.

One way of looking at the gross margin miss is elevated COGS. Almost excuse Intel management gave on the call relates to COGS. Only “unfavorable mix” is associated with ASP.

What if Intel’s pricing power is collapsing and management wanted a big excuse to obfuscate this fact? What if the Oregon to Ireland production move excuse was contrived to hide material ASP declines?

I have no idea why Stacy is modeling gross margin as going UP starting next quarter. It should be going down!

Vivek Arya of BoA is also wrong. The red crayon line is the Irrational Analysis gut feeling estimate.

I strongly believe that Intel’s internal financial model and sell-side models are based on incorrect and wildly optimistic assumptions.

ASP is going down.

Zinsner and Gelsinger fed this nonsensical excuse on Oregon vs Ireland and everyone seems to have just taken it at face value without thinking.

It always makes sense to move high-volume production from the research fab to a production fab.

Meteor Lake paper launched in Q4 2023 and has been widely available since late Q1 2024. Why would the volume ramp profile change when AMD is clearly gaining share in a market with only modest recovery in terms of units?

If the production was not moved to Ireland, that fab would be idle so they would have to take underutilization charges, hurting gross margin anyway!

I refuse to believe that depreciation technicalities can account for such a large gross margin miss.

Bookkeeping rules resulting in a temporary headwind is a wonderful excuse to feed to sell-side.

Do not let that smile fool you. This dude is a shark. Very clever. Not an ordinary bean-counter like Clown Swan.

Gross margins are going to get worse. 30-35% is absolutely plausible in 2025. Zinsner and Gelsinger engaged in a brilliant cover up with this Oregon to Ireland production shift excuse. Everyone seems to have bought it. We find out in the next couple of quarters if I am right or this entire post is conspiratorial nonsense.

![[1/3] Dell XPS (TributoQC) 13 Review](https://substackcdn.com/image/fetch/$s_!xPDW!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fb4ecb4fc-5e71-46b2-995b-66adecffbac0_842x614.png)

You have heard the advice "when you must report bad news, ensure all the other bad news is arranged to be included"? Clear the decks so next quarter is better.

30% better CPU sure can be worth double. Intel has used the force multiplier ("the whole PC is 30% better because of the CPU") to claim value, since .. well pretty much always. Will the OEMs start pushing back on after 40 years? Popcorn required.

Dude spot on the ASP decline. Love your analysis. One minor nit: “I am convinced the Dell leak happened to pressure Intel publicly on pricing.” Large public companies do not do this on purpose. All their efforts are spent on trying to look at least like they are moderately exciting. They don’t have time and certainly the stomach for mind games