Micron Q4 FY2024 Earnings, Intel Meme Buyout Offers

Memory market provides market insights. ARM joins Qualcomm in trolling Intel publicly.

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Before covering today’s topics, some housekeeping.

I have liquidated my non-trivial MU 0.00%↑ options position at a nice profit.

All of that money went into adding to KEYS 0.00%↑ and FN 0.00%↑ in that order.

Will give opinions on Micron stock later but just want all of you to know I no longer have a position and no intention to re-enter at the time of writing.

Also, I have finished an important deliverable for my dayjob, which means the high-quality content in my drafts can resume.

Let’s talk about Micron and memory in general,

Micron Q4 FY2024 Earnings:

Micron has a strange fiscal calendar because of potatoes. Yes really. Look it up.

They smashed sell-side expectations because historical framings are all wrong. This is important. I will explain this at the bottom of this section.

Slides:

Micron dragged their feet (intentionally) on implementing EUV for DRAM to save costs. It worked. Samsung rushed to EUV and destroyed their yields and thus costs per wafer.

This is true. Micron does have some custom burn-in testing machines and methodology.

Traditional servers (CPU) are growing! Socket consolidation wave is just starting.

Datacenter revenue mix is going to spike even harder.

HBM yields are good, which is important to profitability and revenue as all HBM supply has already been contracted out. Sells instantly at pre-agreed prices.

The previous HBM TAM for 2025 was $20B.

Some of the TAM expansion is from yield improvements.

But a lot is from AI accelerator TAM going even higher!

Presumably, they are comparing against Samsung’s 8-high HBM3E. There has to be some truth to the 20% lower power claim because Micron is getting sued by shareholders for materially false statements if it is a lie. Most likely, there is some optimistic fudging with favorable test scenarios so lets call be pessimistic and say only 10% lower power. Still a huge competitive advantage.

Thermal limits are hard limits. If the HBM/memory draws 10% lower power, then the logic dies can use that power budget to clock higher. It matters. Real advantage.

Data center SSD is going very well. They might be gaining share from Samsung in this market which is surprising. Samsung SSDs have custom logic controllers that are industry leading. Micron SSDs use 3rd party controllers from Phison and Silicon Motion. Is Micron NAND so much better than Samsung NAND that they can win on performance and power with inferior SSD controllers…?

Smartphone and laptop/PC are stable. One worry I had with my options YOLO position was these markets self-immolating. The read through is… not great, not terrible.

In honor of Mira Murati’s recent resignation from OpenAI, here is my NAND conspiracy theory post linked above. NAND was unusually strong this quarter for Micron.

Auto declined QoQ which suggests more pain for that end market.

Earnings Call Transcript:

Hyping HBM quality delta vs Samsung. SK Hynix is the leader of HBM with over 80% market share for HBM3/E. All comparisons Micron makes are against Samsung.

Also, HBM TAM greater than $25B lol. Think Sanjay went off script in his excitement.

Vivek from BoA once again asks the best question.

“What if Samsung gets it’s shit together?”

Sanjay had a great answer that is incredibly bullish and should alleviate any fears investors have for now.

We [Micron] expect Samsung to get it together hand have a viable HBM3E product.

It does not matter. Supply very tight.

It does not matter. Our HBM is has a lower cost base.

It does not matter. Our HBM has a huge power consumption (quality) advantage.

On HBM vs DRAM share, Micron is still fine no matter what happens.

Micron server-grade DDR and LPDDR is better than the competition.

Supply is tight on HBM and regular DRAM due to 3:1 wafer intensity ratio.

Historical Framing:

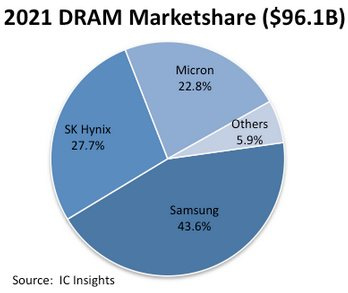

Historically, there have been three major DRAM vendors. Samsung has been and continues to be the largest by revenue… by a wide margin.

Yes, SK Hynix has historically had slightly larger revenue share than Micron…

Ignore the percentages. What matters is that Samsung has been MUCH larger (in terms of overall DRAM revenue) than SK and MU for a long time.

This cycle is different.

We have a new type of DRAM, HBM, that has three critical features:

HBM uses the same wafers as regular DRAM (DDR, LPDDR, GDDR) but at a much higher (3x) intensity.

HBM is a “more refined” version of commodity DRAM that requires additional processing (advanced packaging, stacking) to be sold.

HBM has way waaaaay higher gross margins and insatiable demand.

Here is a framing. Let’s ignore the computer jargon and just talk about a theoretical commodity market.

Imagine that for the last 20 years, there have been only three vendors for some fake metal called Mythril.

All of a sudden, there is a new, massive, insatiable demand for a higher purity of Mythril called “High Conductivity Mythril”, HCM for short.

To produce HCM, it takes 3x the raw Mythril ore and requires special equipment ( CAMT 0.00%↑ ONTO 0.00%↑ ) and extra skill to refine to the required specifications.

Vendor A, the historical revenue leader, is incompetent and repeatedly self-immolates. They cannot produce HCM in high volume at the required quality metrics. Even after repeated attempts to produce the latest version of HCM… HCM3e, they fail. Vendor A gets a pity HCM3 design win for old product lines that are low-priority and will go out of production soon, likely at much lower ASP for the defective, low-quality HCM3.

Even when Vendor A finally gets their HCM3e to a high enough purity, the amount of raw Mythril ore it will take to produce each ingot of HCM3e will be comically high. Thier refinery has horrific yield.

As a result, Vendor B and Vendor C party to the moon even though Mythril (in all it’s forms) is a commodity metal.

I remain bullish on MU 0.00%↑ but it is too dangerous for my taste. If you want to deal with the stress of memory investing, go have fun and good luck to you.

As a US-based investor, it is difficult to get access to SK Hynix equity. Similar opinion for those to do have access.

Micron and SK Hynix are partying at Samsung’s expense. This party will probably continue for at least another year.

Another Intel Meme Buyout Offer:

I wrote a long post arguing the Qualcomm offer was a joke.

ARM 0.00%↑ management saw QCOM 0.00%↑’s Cristiano Amon’s trolling of INTC 0.00%↑ and decided to join in on the fun.

At the time of writing, roughly 20% of Intel’s market capitalization is from meme buyout offers. Public trolling is literally 1/5th of Intel’s valuation.

Do you think Intel will be able to deliver 18A on time for external customer? Panther Lake and Clearwater forest cpus are planned for mass production using 18A. If 18A fails, can't imagine what will happen with Intel?

When hbm 4 arrives, u think samsung using 1c node while other remain on 1b can address the yield issue? Still a surprise samsung yield is so bad even both micron and samsung are on tc ncf