Masa's Rocket-Powered Merry-Go-Round and Intel Murder Synopsys

Oracle and Synopsys earnings unhinged note.

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Hot Chips 2025 post coming this Saturday or Sunday. Giving certain companies reasonable time to review the private draft link. Still need to re-write the d-Matrix section.

Quick note this morning. Oracle and Synopsys earnings super interesting. Gotta goto dayjob so this note is literally 15 min stream of consioousness.

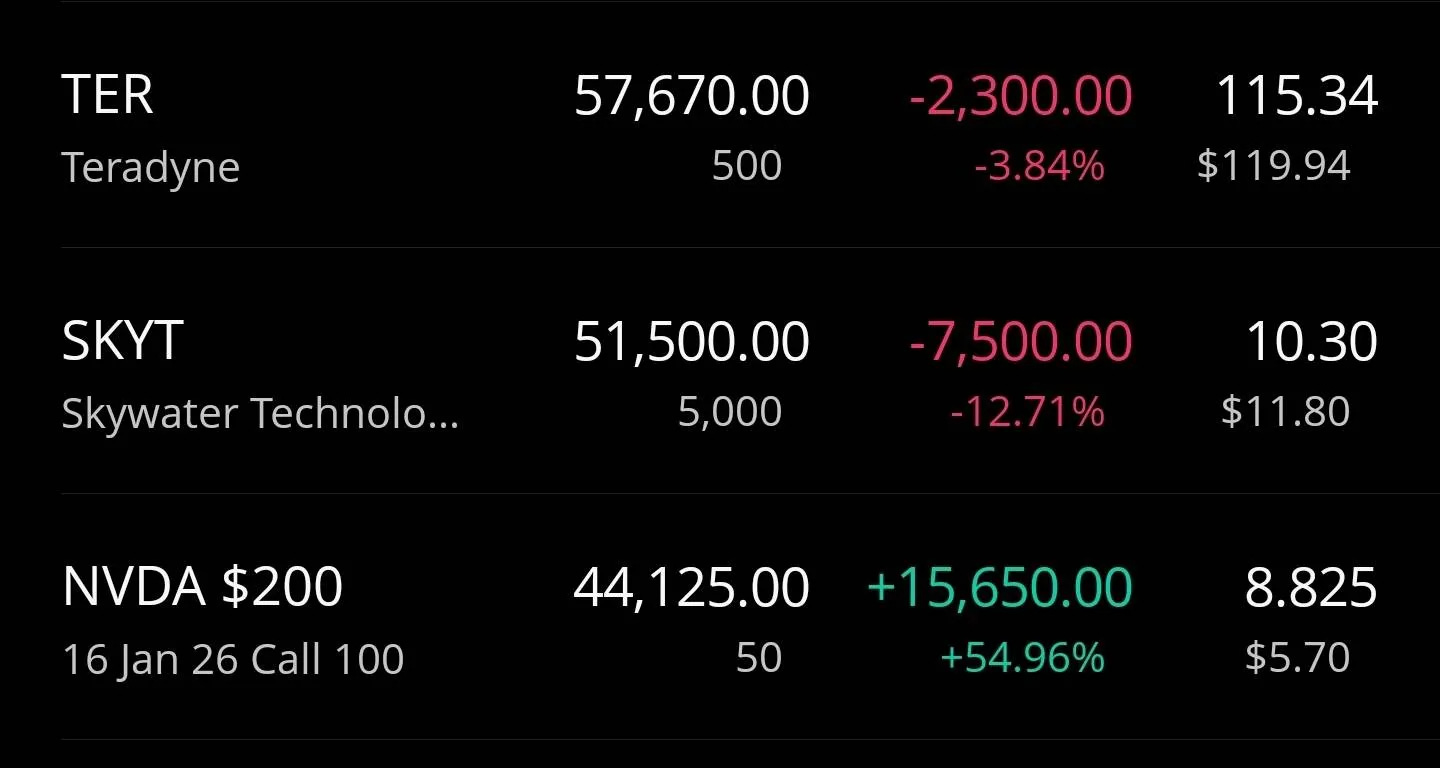

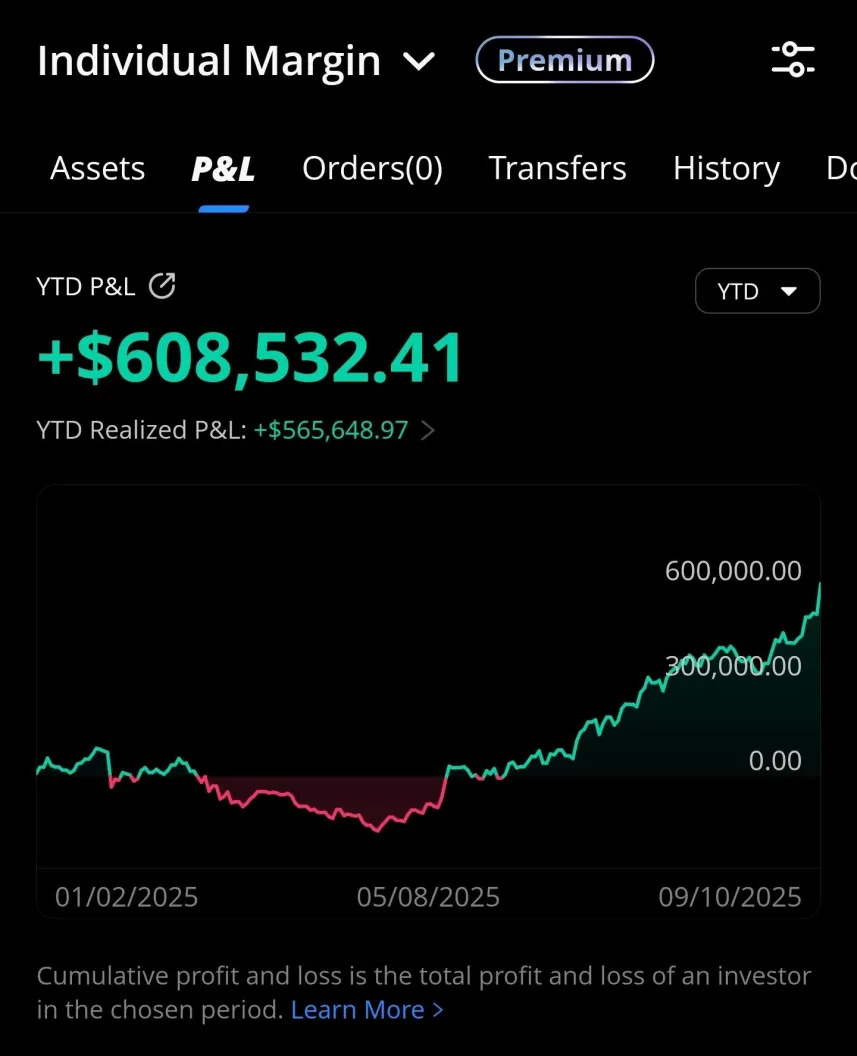

RAPID DISCLOSURE AND UPDATE ON TRADING ACCOUNT

Too lazy to make a funny thumbnail. Here is chart instead.

Oracle:

They smashed RPO (remaining performance obligations). This means Oracle has booked huge contracts and is now going to spend way more CapEx.

Bloom Energy, Broadcom, Nvidia, Vertiv, and a few other usual suspects benifit from Oracle massive spending raise.

But the sleeper is ARM.

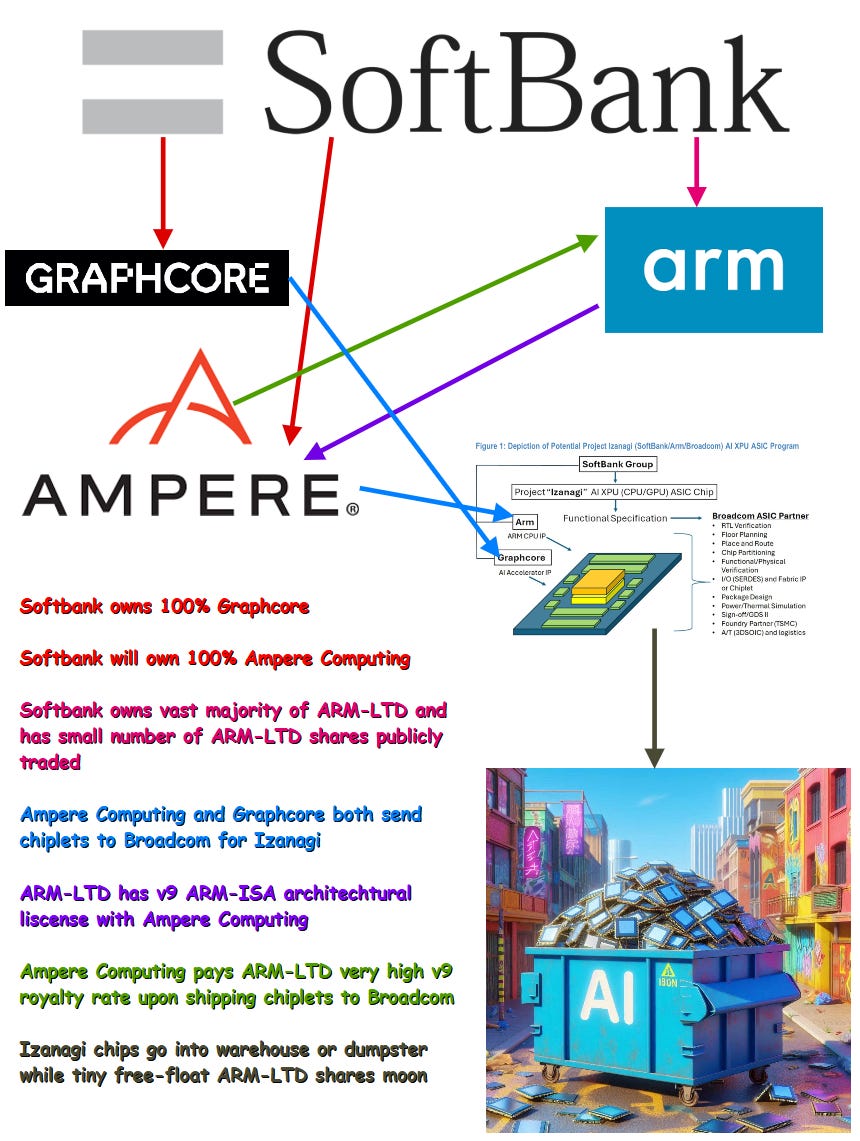

Several professional investors (hedge fund, large long-only) have repeatedly asked me about ARM/Softbank/Izanagi effect on Broadcom. My response up until now was “don’t care… Maza can make whatever unhinged garbage he wants with Ampere Computing and Graphchore (LOL) IP”.

These guys manage portfolios that have billions of dollars worth of AVGO 0.00%↑ so I just dismissed this inbound as hopium.

Now that Oracle is going crazy, it is time to take Izanagi and whatever related-party monstrosoty Masa is cooking seriously.

Softbank is a major investor in Stargate and thus has influence on where those CapEx dollars go.

Oracle and (aparently) Larry Ellison were massive shareholders of Ampere Computing and they were in deep shit before Masa/Softbank bailed them out.

ARM has extreamly low float and Masa refuses to sell any of his stake. This man almost certainly has massive loans colatoralized against the ARM shares.

Softbank (NOT ARM) is aquiring Ampere Computing.

Ampere Computing pays ARM very high v9 royalty rate.

Masayoshi Son is like Gavin Baker. Simultainiously a genius and an idiot. Bi-modal intelligence.

Hop on Masa’s rocket-powered related-party merry-go-round. Someday, the bubble will pop and ARM will drop 50% in one day. For now, enjoy the ride and don’t worry about all those creaking noises. I hear the merry-go-round was built by Adam Neumann using scrap wood from demolished WeWork buildings.

Synopsys:

Synopsys tanked 20% after hours. A friend of mine pinged me asking for my opinion because he wanted to buy the dip.

Told him there might be another near-term 20% hit. Friend said he wants to invest long term (set and forget 5 years) so I said sure go for it.

Literally hours after this conversation Synopsys down another 10% so… sorry to my friend. Hope he waited until market open lol.

The hit is because of Intel Foundry.

It is widely known within the engineering and finance communities that both Intel Foundry and Samsung Foundry paid massive NRE contracts to Synopsys and Cadence, hencheforth refered to by me as “EDA majors”.

18A 3rd party activity is basically dead. All interest is now 18AP. Analog IP (SerDes, memory PHY) taped out on 18A cannot be used on 18AP customer designs if they materalize.

So even though I am massivly long Intel with both shares and degen options, that does not make me a bull for the EDA majors IP departments.

My assumption was that the contract between Intel Foundry and Synopsys was set in stone. Based on the commentary on the Synopsys earnings call, it looks like the IP contract got cancled or scaled back in some major way.

I guess Lip-Bu Tan told Synopsys something along the lines of….

we going bankrupt and not paying you to port IP to a node nobody gona use anymore. also we your biggest EDA customer. Sue us.

Addendum re Softbank and their purchase of Ampere: I think this was also to take Ampere's custom core design out of circulation. Softbank owns a large number of ARM shares, the last thing they would have wanted was another large ARM license customer (e.g. Mediatek) getting ideas about pulling a Nuvia/Qualcomm-type move by buying Ampere on the cheap and then using Ampere's custom core design in their SoCs. That would have reduced the value of ARM shares quite a lot, which would have really hurt Softbank.

Congrats on all your success once again this year. Truly incredible!