Intel's Agentic Dumpster-Fire

A truly shit earnings print and conference call.

Irrational Analysis is heavily invested in the semiconductor industry.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Let’s play a game.

Spot the outlier!

Do you see it? Congratulations, you have proven to be smarter than the average “The Information” employee. Will get to them soon.

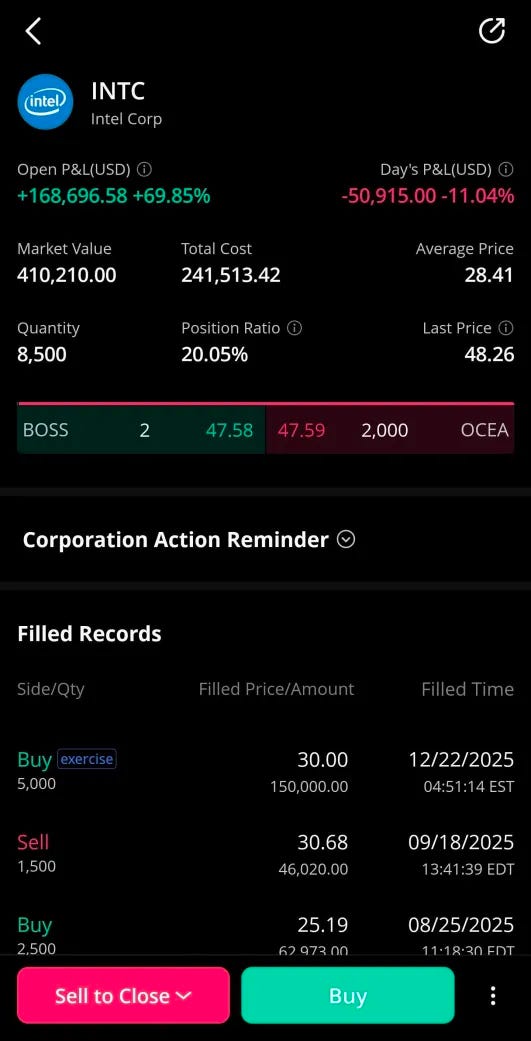

Oh interesting. A huge run-up right before earnings, followed by an implosion.

Ah yes, -12%, a sign that somebody fucked up.

This is my risk management department.

Its me, enjoying the breeze like rabid dog.

At some point, I will write up my unusual views on money.

Joke intro aside, lets deal with “The Information” before going after Intel.

I was subbed to “The Information” for two years and realized around month 14 that all of their writers are idiots with less intelligence than ChatGPT 3.5 running on AMD MI350X. Was waiting for them to get better at covering semis/hardware and realized they are just straight up incompetent.

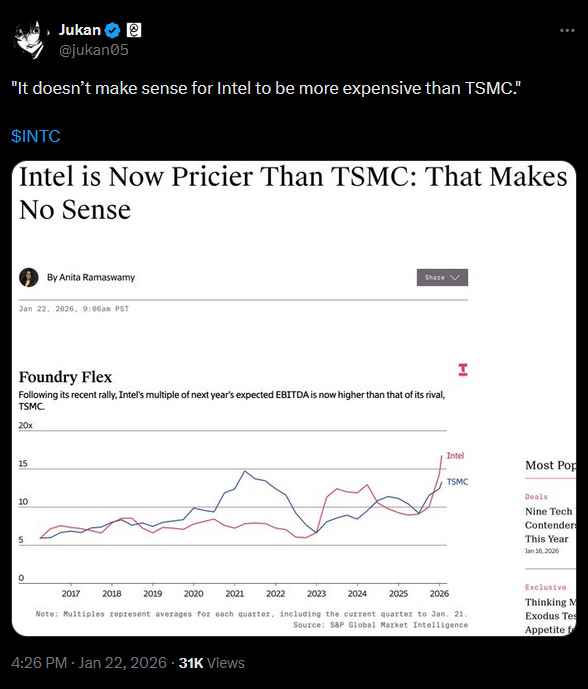

Semiconductor fabs are capital-intensive businesses. Depreciation is a huge factor! Why the fuck would you value based on EBITDA? The “D” in “EBITDA” stands for “[before] depreciation”. 🤡

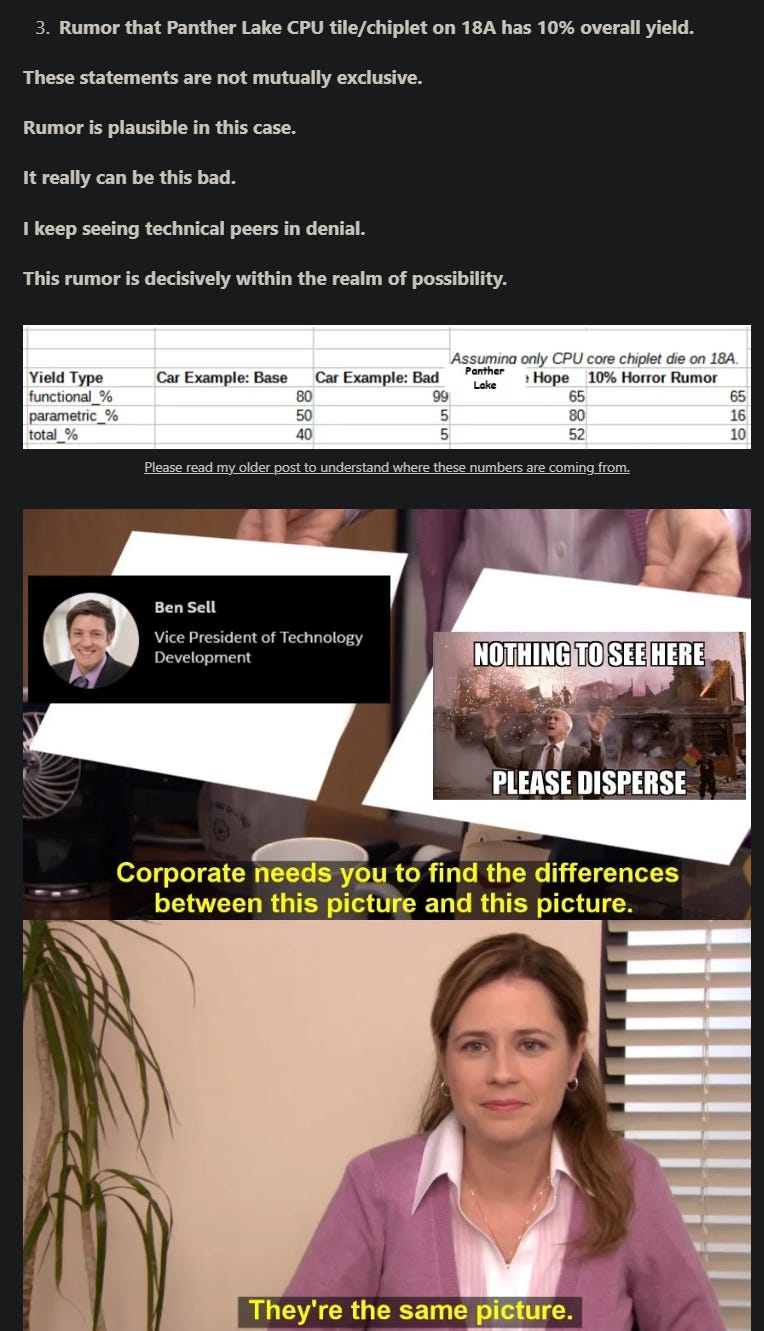

Could it be that comparing the price/book ratio of companies in a similar sub-sector is form of “value” investment?

Intel has a much lower “true” valuation that TSMC.

The valuation of a leading-edge fab (Intel) that can credibly challenge TSMC on PPA in 2028/2029 is the same as a lame fab (GloFo) primarily exposed to low-margin markets (RFFE, lagging-edge) and has no meaningful upside.

The reason for Intel’s low price/book ratio is their book is on fire due to a period of extreme self-inflicted stupidity that only recently started to turn around.

Which is a great segway into the next important topic before covering earnings and call transcript.

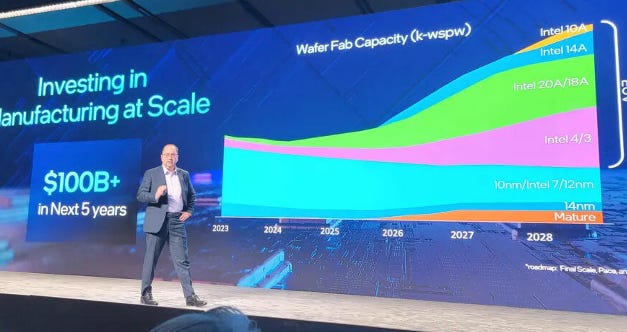

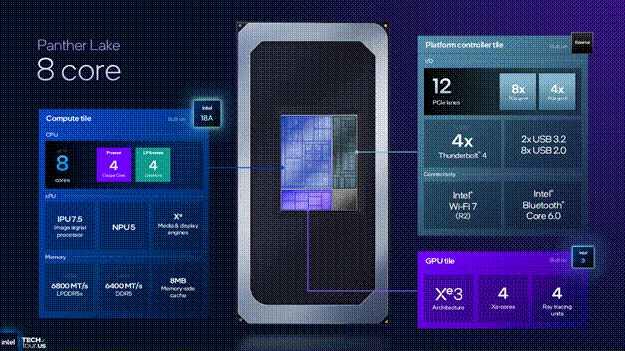

This picture is old.

You can tell because it still has 20A. That was canceled because 18A was going so well!

Oh wait.

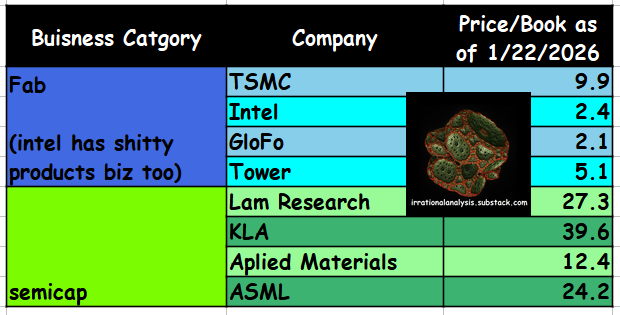

That was the bullshit message a year ago.

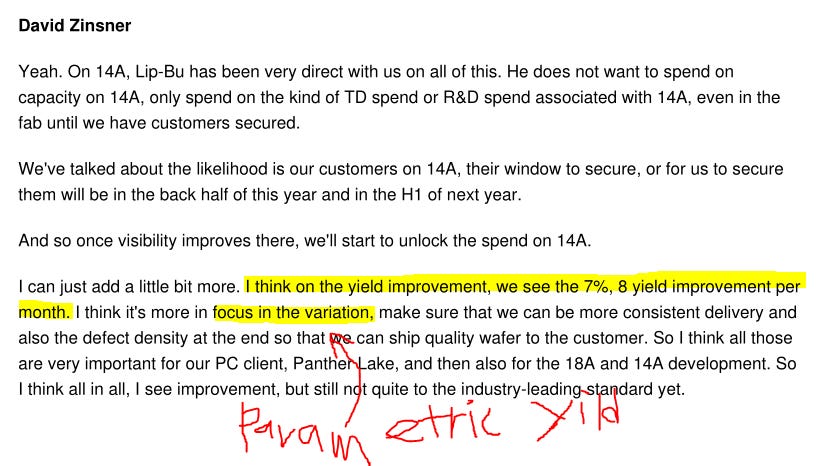

Now, Intel investor relations and executives are openly admitting that 18A yield is not where it needs to be. (shit)

But but tHe DEfEcTtt denSItY is < 0.4 🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡🤡

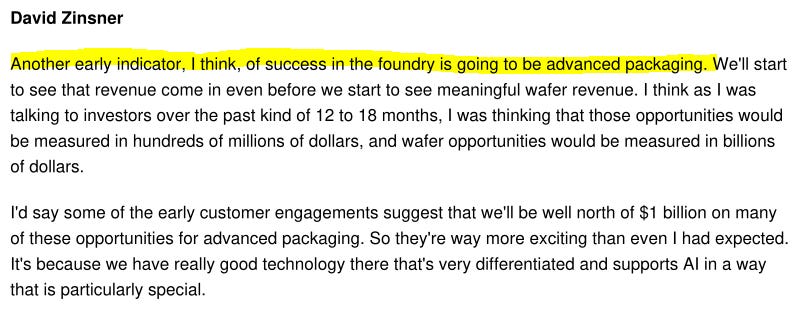

You now have sufficient background to understand the earnings call transcript. Sell-side did a decent job torching Intel management for very obvious fuck-ups.

Zinsner is my favorite CFO.

Dude actually understands semis. He is great and none of this is his fault.

LBT is also great.

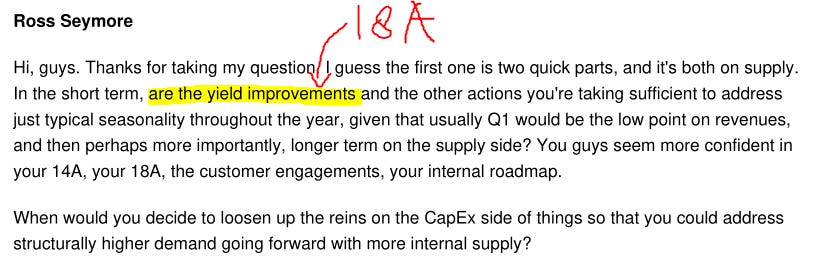

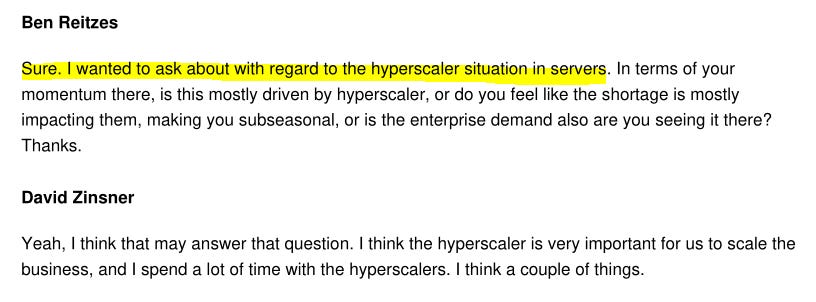

This is the first challenge to an interesting line of questioning.

You can see that Zinsner saw the subtext and did his best so say a word salad of bullshit that does nothing to answer the question.

Second attempt.

Why are your gross margins still shit? There is a shortage of datacenter products. Look at the memory guys. Micron literally deleted their consumer brand (Crucial).

RELEASE THE STACY “BODYBAG” RASGON

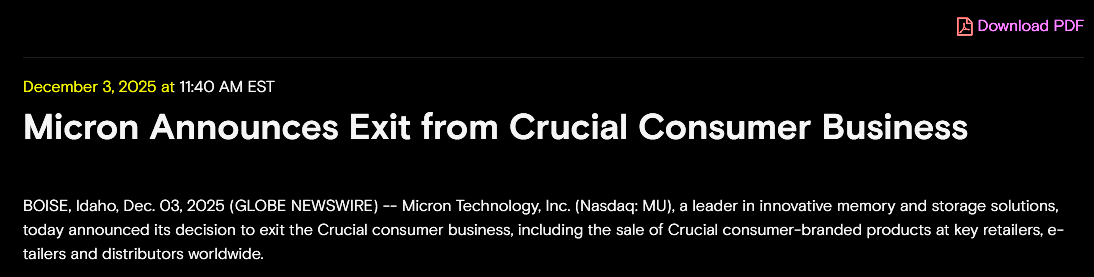

Here is what most are missing. Not sure why nobody else has mentioned it yet.

Going to explain this extra simple…

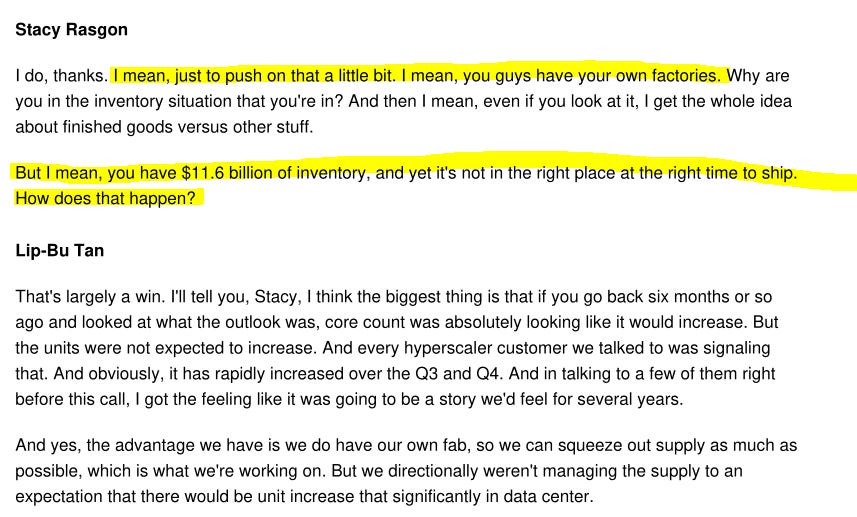

This is what an AMD consumer CPU looks like.

Red box is CPU chiplets.

Other chip is an I/O die.

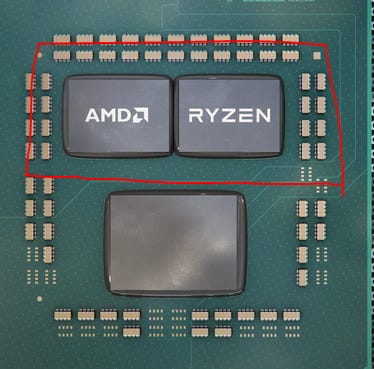

This is what an AMD server CPU looks like.

Again, CPU chiplets in red boxes. Last remianing chip is a (differnt) I/O die.

As you can see, a lot of the leadinge-edge die area is fungable across markets.

(this is over-simplification, speed binning forces some CPU chiplets to lower-tier SKU or specific makret)

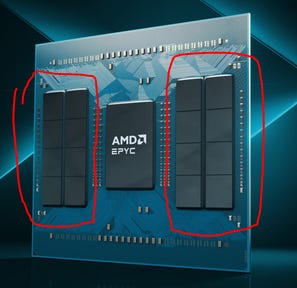

Here is the latest consumer CPU form Intel, Panther Lake.

None of these chiplets can be re-used in datacenter products.

SA has a great post on more Intel datacenter fails. (tour of incompetence)

The truth is, Intel fucked up not just because of bad planning.

It’s also bad engineering.

For YEARS 7+ (since 2nd gen EPYC in 2018?) AMD has been executing chiplets in the correct way.

**MAXIMIZE DIE RE-USE AND FUNGIBILITY**

Intel Products has been engaging in intentionally stupid behavior for probably political reasons.

Intel has been notoriously bloated for over a decade. Only with Lip-Bu has Intel become not-comically-bloated. (still bloated)

And frankly, I think LBP has been too kind.

These chiplet design choices scream “MAXIMIZE DESIGN WORK” instead of prioritizing yield fungibility. Losers trying to defend their own job at the expense of common-sense strategy is quite common across industry.

It’s not that Intel is stupid and has missed the agentic-related high-end datacenter CPU demand surge.

THE DEISGNS ARE BAD.

AMD SMART.

INTEL PRODUCTS 🤡

Congratulations dumbasses. You were gifted a demand surge from the heavens and fucked it up.

At this rate, AMD porting their IP to Samsung Foundry SF2 will happen before Intel can begin defending datacenter market share.

I think AMD might be a nice trade.

For some reason everything semis is red after-hours.

The ass-whooping AMD is about to unleash on datacenter CPU side is gona be hilarious.

I have a hard time believing it is a slam dunk for AMD. AMD already has considerable share in datacenter, while on the client side their volumes are not large. Not sure from where will they will be able to meet the excess demand if they haven’t reserved capacity at TSMC in advance. If what LBT says is true about CPU demand exploding being a recent phenomena, i don’t see how Lisa would have asked for meaningfully higher CPU volume from TSMC.

Hey Irrational, great post. Just wondering how you’re thinking about semicap after INTCs results?