Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

What a disaster lmao.

Reminder that I willingly own shares of the radioactive dumpster fire.

There is hope though.

I will cover the earnings call transcript followed by a memo written by the Napalm Dragon himself.

Earnings Call Transcript:

Lip-Bu is earns a crazy amount of money if INTC 0.00%↑ hits $70/share within the next few years. Paging

/.Notice how Lip-Bu Tan repeatedly brings up “yield reliability” in the earnings call. He is referring to the crap parametric yield of 18A. Everyone who has worked with this PDK knows what is going on. There is a lot of 18A activity from a test chip (R&D) perspective but not from commercialization side of things.

Everyone external is waiting for 18AP.

Intel Foundry is on their own (financially) for the next 12-18 months.

I am convinced (with zero evidence) that Clearwater Forest has been intentionally delayed because 18A parametric yield of Panther Lake is so bad, they need all capacity just to meet client market demands.

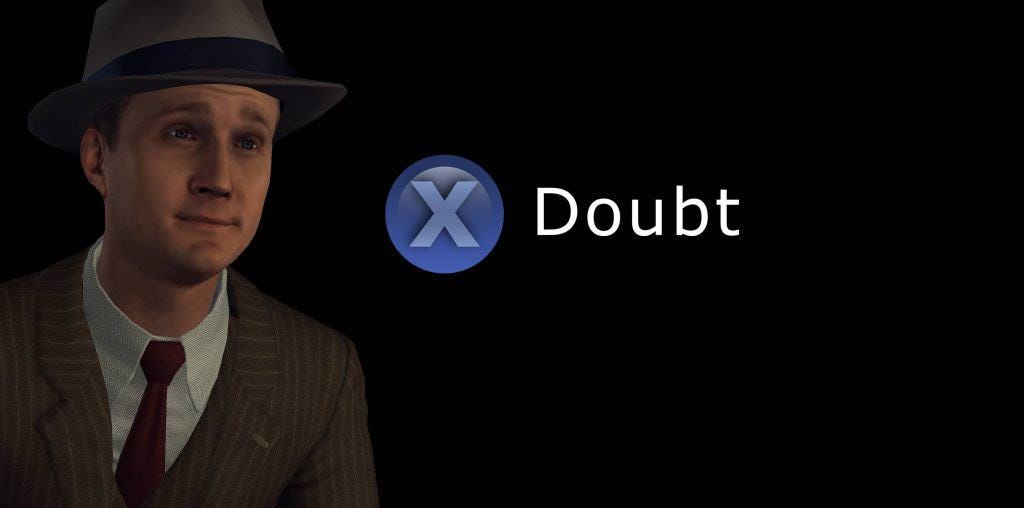

Hard doubt on this packaging excuse for Clearwater delay.

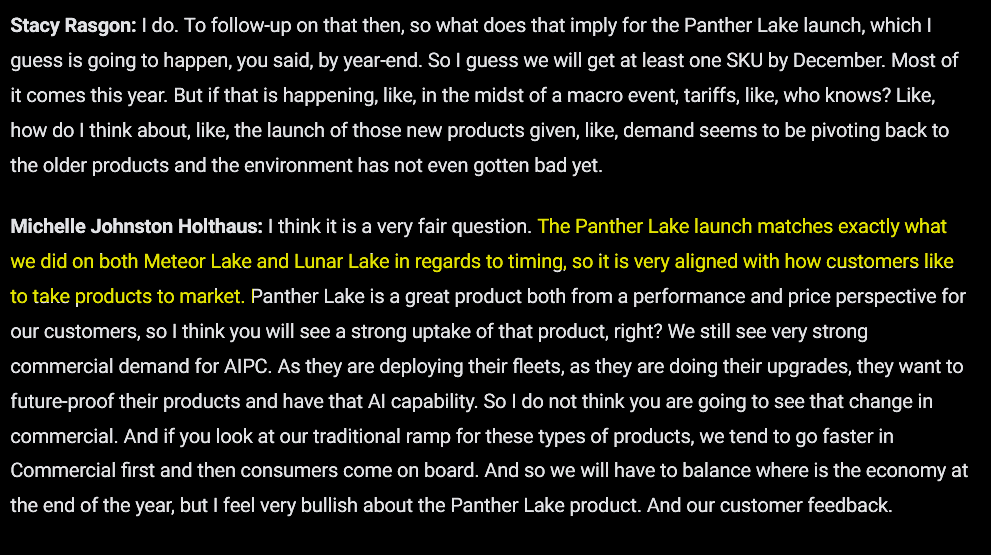

This is the most important moment of the earnings call.

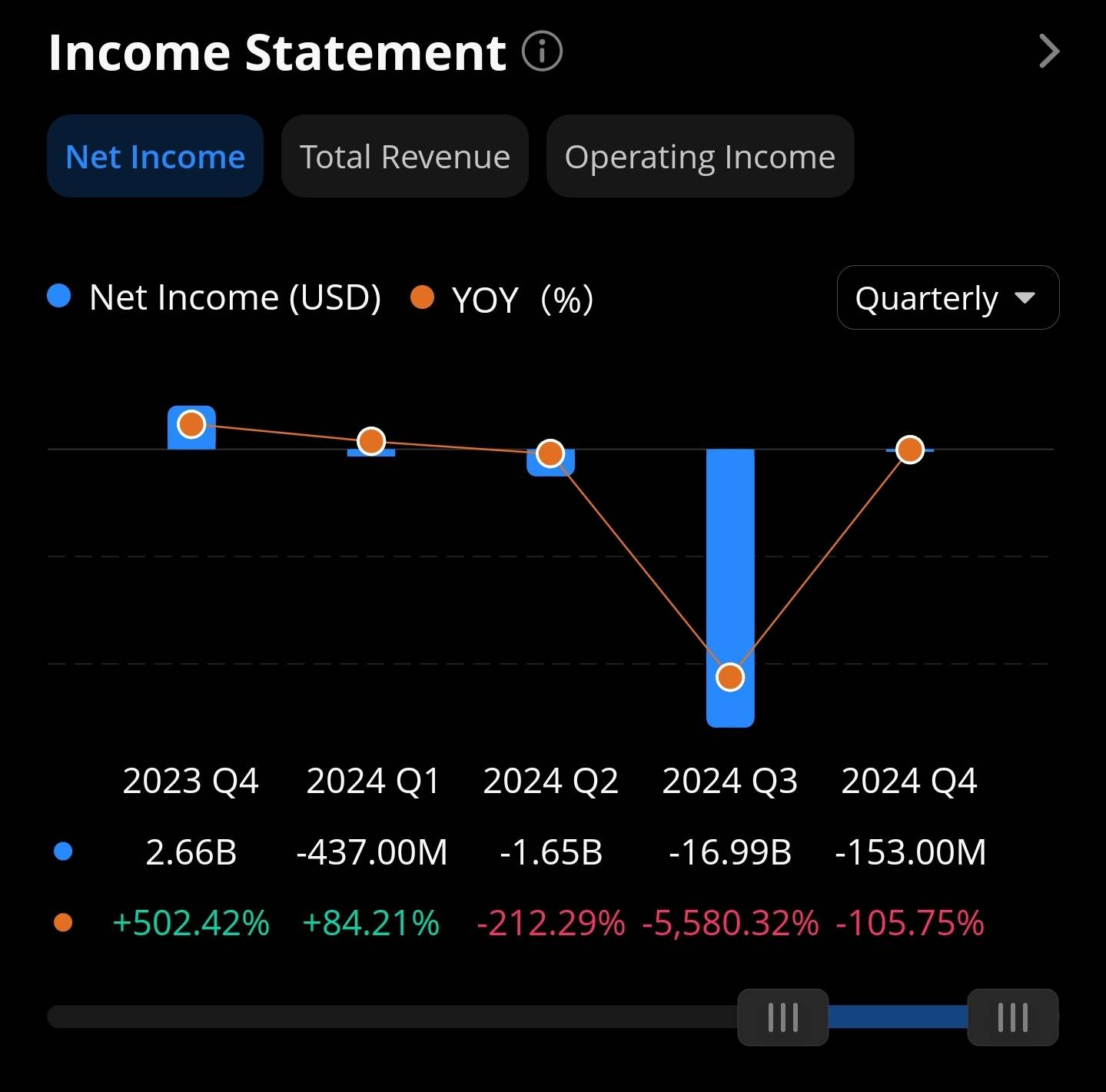

It is very strange that Intel 7 (aka Intel 10nm attempt #5… lol) is now capacity constrained. Recall that just TWO QUARTERS AGO, Intel wrote off most of the Intel 7 equipment in a massive charge.

A large portion of this “17 billion dollar” loss booked 6 months ago was mostly writing off the Intel 7 equipment. CFO David Zinsner told investors this Intel 7 factory capacity is junk and marked the assets as zero.

How can junk factories turn into a capacity constraint in under 6 months?

Something is not right. I can’t put my finger on it yet but this is a massive fishy red flag.

A deeper issue lurks. Still trying to figure this out.

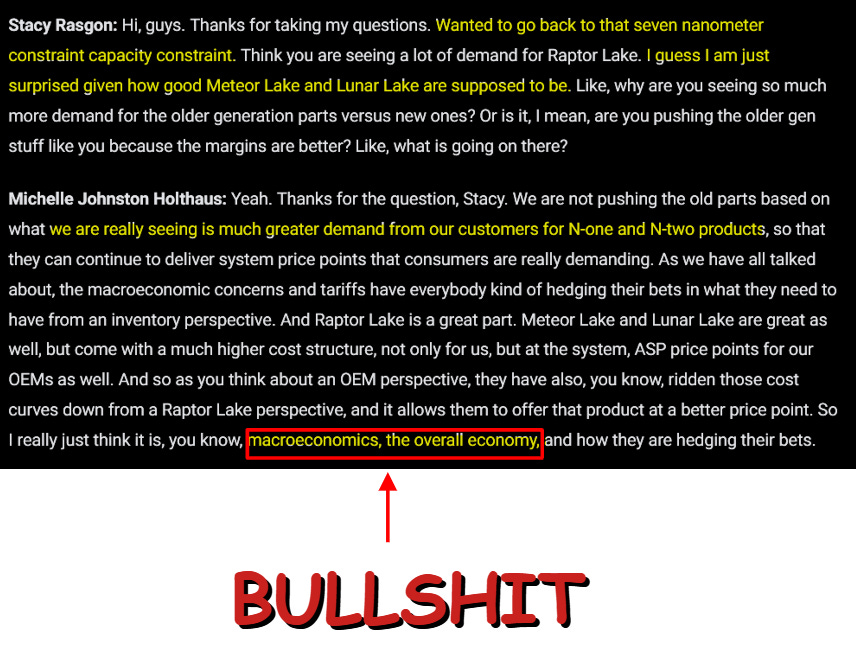

Stacy Rasgon, my favorite sell-side analyst, asked the best question on the earnings call. This question was so good, Intel management might ban him again.

It does not make sense that the much older products are outselling so well.

Again, I don’t have enough info to make a call but here are some possibilities.

Competitive pressure from AMD has brought Intel to the point where they cannot lower ASP of Lunar/Meteor further without destroy margins completely?

Massive share losses in the premium segment to AMD?

Massive share losses in enterprise segment to AMD who recently launched a vPro competitor?

TSMC price hikes making Lunar Lake economically unviable?

MediaTek/Nvidia has gained significant market share and these units will start shipping in the second half?

I don’t think customers enjoyed the random late December launch of Meteor Lake but ok whatever lol.

Vivek Arya (Bank of America) has been hammering this question for like three years now.

The problem with Intel Foundry is the financials cannot be good unless there is meaningful 3rd party revenue to offset Intel Products market share decline and migration to TSMC.

18AP in 2027 is when things turn around, hopefully. In the meantime, it’s time to curl up into a fetal position and survive.

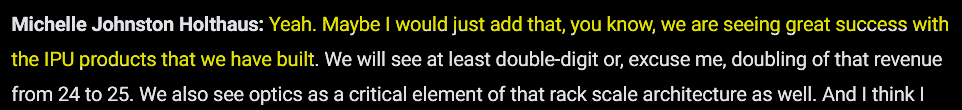

Really? I hear that Mount Evans was a disaster due to upper management incompetence and Google was not happy with the C5 revision clown fiesta that was finally dragged across the finish line.

Napalm Dragon Letter:

https://www.intc.com/news-events/press-releases/detail/1738/lip-bu-tan-our-path-forward

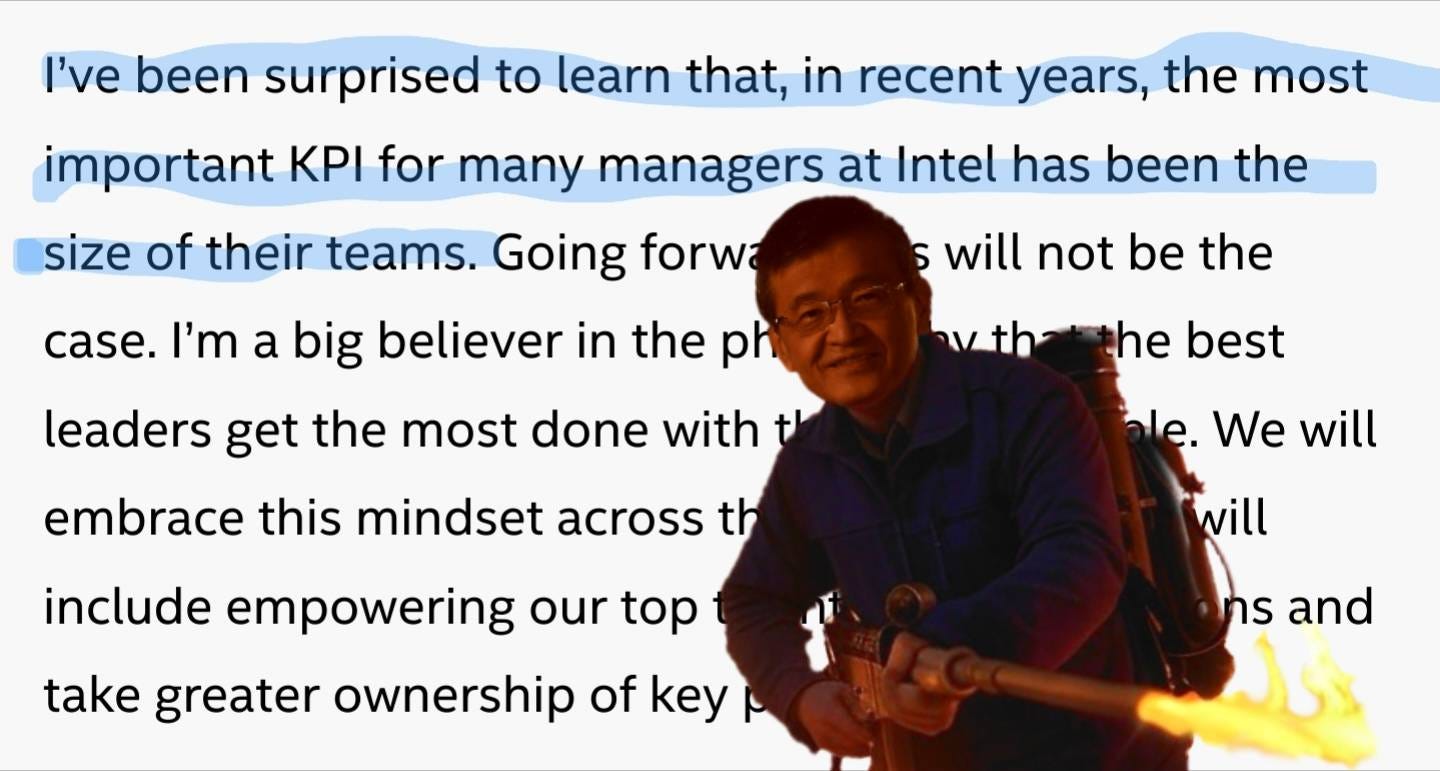

This line makes me so happy, I almost went into a serotonin coma. For those of you who have not worked in the semiconductor industry, we have a problem with a class of people I like to call “the empire builders”.

Empire Builders are a subset of middle management (Director thru VP) who derive their self-worth by how many people roll up to them. They don’t contribute anything of value to the company from an engineering or managerial perspective. All they do is play politics and induce NEGATIVE productivity.

Every large semiconductor company has these parasites. Good companies (Nvidia, Broadcom, TSMC) keep the Empire Builders in check. Bad companies (Intel, Qualcomm, Samsung Electronics) let the Empire Builders multiply like maggots feasting upon an open wound.

The best way to kill any parasite is with fire.

OKR stands for “objectives and key results”. You would think that goal planning would be a good thing but the epidemic of Empire Builders has distorted the process into pointless bullshit. What the fuck are the “Key Results” this dumpster fire of a business has achieved in the last 5 years?

18A is in an unacceptably poor state due to critical issues with the PDK and parametric yield.

Massive market share losses in client and datacenter.

Completely missing AI despite multiple attempts.

Epic failure with Raptor Lake reliability.

Epic failure with Saphire Rapids E5 re-spin.

Missing advanced packaging ramp because of retarded self-owns.

Meteor Lake underclocked ring bus for some inexplicable reason.

Mount Evans C5 re-spin.

Losing gaming consol contracts on 18A because of price disputes.

Multiple networking product releases riddled with bugs.

The good news is that Lip-Bu Tan’s righteous flamethrower is just getting warmed up.

Garbage is garbage.

Maggots are maggots.

Parasites are parasites.

But burning all this shit can generate useful heat.

Lets go.

I think Intel HR department is a unique source of awfulness at Intel.

Their practices are idiotic and hurt the company a lot.

To name a few:

1) Freeze and glut of Hiring: Things are bad, hire no one! Things are good, hire everybody!

This "Feast or Famine" Lead to overall worse employees (missing good hires at Freeze, hiring bad at Gluts), increase Churn (Because you over-hire at the Glut) and hurt Morale (Since you fire and hire not-so-good employees).

2) Optional Firings: This means giving the Employee a choice: Get fired with a separation package, or stay. If you stay, you might get fired later, hint-hint, but might not. This basically makes the good people who can find work elsewhere to take the money and quit.

3) Algorithmic firings. The 2016 big firing at Intel (a Decade ago, I know) were basically done by a few metrics. Everyone who didn't get Successful last year or was a long time at the company got an optional separation package. Managers begged their Employees not to take them.

I have known one guy who got a really big separation package, took it, but was needed so he came back to work as a consultant (for higher cost). Another guy didn't take a separation package, and we joked he is now working for free.

Which leads me to:

4) Over-generous separation packages. I mean, It is nice, but 2 years of pay (when not in the contract) for a separation package is a bit excessive, especially when it is optional, and the root cause for the firings is to try to save money.

5) No Trust in managers: Managers have very low flexibility with their personal budget. They can't promote someone, and give someone else higher stocks. They are extremely limited by the system. Why? Also, there are changes all the time (so it might be out of date).

6) Hard to fire: The process to fire someone for a manager is quite onerous and long. Some managers prefer to try to push the employee to another team, or just find a place for him where he can do no damage or at least benefit a little.

So the HR practices of Intel make it a less dynamic workplace with worse people. The first thing that I would torch is the HR department.

In the

One reassuring thing is that the effort to transform Intel is at least *visible* and out in the open.

Samsung, on the other hand, isn’t even showing signs of that kind of movement.