[Fab]ulous Failures

Incoming epic shortage in leading-edge logic.

Irrational Analysis is heavily invested in the semiconductor industry.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Welcome to an update on the logic foundry ecosystem.

Contents:

It’s time to spread the word: PANIC

Failure is Natural, and Often Obscured

Samsung Foundry has… recovered meaningfully.

The Tesla Deal

Special Relationship Between Samsung and Qualcomm

Recent Rumors

Intel Foundry: Lip-Bu Tan Queen Sacrifice Worked

Conclusion: S E M I C A P

[1] It’s time to spread the word: PANIC

I think a panic is brewing in leading-edge logic and most don’t realize how bad it is about to get. Memory and advanced packaging shortages have sucked all the oxygen out of the room.

Now, 5nm-class and below logic gona suck all the nitrogen out of the room too.

Prepare for total vacuum!

[2] Failure is Natural, and Often Obscured

Given how difficult leading-edge logic process technology is to develop, failure is natural. Because of the secretive nature of this industry, failure is often obscured until it can no longer be swept under the rug.

TSMC first attempt at 3nm-class was N3B. It did not go well. Credit to TSMC, they basically re-did their 3nm in the form of N3E followed by N3P (2% mask shrink, slightly better design libraries). What separates winners and losers in this business is who recognizes mistakes first and recovers the fastest.

Intel’s 10nm node (really 7nm-class) was an epic failure. Something like 7 years of delays. Rumor has it that simply saying “cobalt” in front of Dr. Ann Kelleher leads to a visible grimace.

The story of Intel 7nm-class (10nm later rebranded to Intel 7) is simple.

Retarded arrogance and a refusal to recognize mistakes.

I could go on and on about solid-cobalt interconnect, quad-pattern DUV, idiotic density targets, and legendary mis-management by one particular clown.

I have a conspiracy theory that Qualcomm intentionally sent Murthy to destroy Intel from the inside.

PUN INTENTED

Clown empire builder parasite corpo scum eventually took over Intel process technology in his political kingdom.

After a particularly disastrous earnings call where Bob “Clown” Swan announced yet another delay to Intel 10nm (7nm class), Murthy was fired.

Legit think Clown Swan was too stupid to see through Murthy’s bullshit and let the ship sink while bean counting.

Continuing with Intel, lets talk about 18A.

It’s shit.

I have been screaming this for the past 18 months and you can look at backlog to learn more. Below post from 12 months ago is technical but also a thinly veiled discussion on Intel 18A. Try and spot the sneaky bits.

It gives me great satisfaction to have been right on this when basically everyone else was wrong. Turns out, everyone lies in conference papers and parametric yield cannot be determined by vibes.

Amusingly, Intel Investor relations have been openly admitting to buy-side that 18A yield is still bad. My network of little birds tell me of funny conversations.

Oh so now 18A is internal only and you were never even targeting external customers. BULLSHIT.

Finally, we have Samsung Foundry.

I have direct knowledge and experience with 5LPE, 5LPP, 4LPE, 4LPP, 4LPX, 3GAE, 3GAA, SF3, SF3 v2 (SF2).

To put it mildly, Samsung Foundry has been a disaster for quite some time.

The “2nm” SF2 is actually not even close to that performance class. It is the 4th or 5th attempt (lost count…) of a 3nm-class node that is meaningfully worse than TSMC N3E in PPA of most designs.

Samsung literally renamed a new iteration of SF3 to SF2.

[3] Samsung Foundry has… recovered meaningfully.

Despite the many years of fail, things are looking up for Samsung Foundry. Partially because SF2 is half decent if you blow up area and accept meh parametric yields.

Partially because there is an epic shortage. TSMC has no capacity available. Intel also effectively has zero externally usable capacity until 2027 with 18AP ramp.

[3.a] The Tesla Deal

There were credible rumors last year that Samsung was considering writing-off their Taylor Texas logic fab due to poor (almost zero) customer traction. Only Groq and Tenstorrent were using tiny volumes of SF4X while SF3/SF2 capacity was idle.

Tesla threw them a lifeline. Some basic math and guesses behind the deal makes me think Samsung Foundry gets negative gross margins unless they meaningfully improve parametric yield.

Which is fine. They were about to write-off the fab lol. The amount of learning they get from this 8-year deal is worth losing money on every single wafer for the first 2-4 years.

[3.b] Special Relationship Between Samsung and Qualcomm

Qualcomm and Samsung have a special relationship that most don’t properly understand. Examination of this relationship can tell you a lot about how Samsung Foundry is doing.

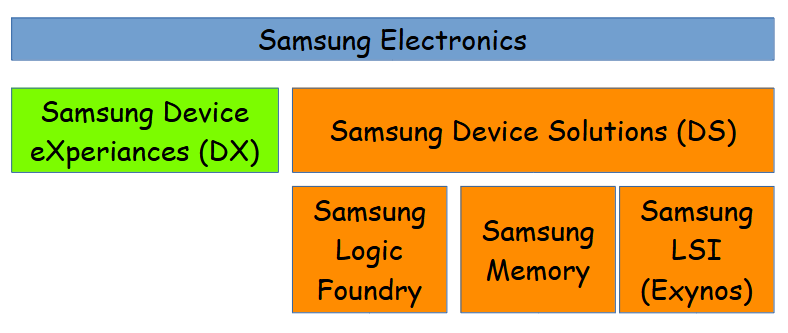

Samsung Electronics as the above corporate structure.

DX makes smartphones, tablets, earbuds, laptops, and so on.

DS three sub-divisions. Logic foundry, memory, and design. The design group is commonly referred to as S.LSI and the most important product they design is the Exynos smartphone application processors. S.LSI also makes the industry-leading SSD and NVMe controllers for Samsung first-party storage devices.

What you need to understand is DX and DS have sperate P&L responsibilities.

This means that DX can buy Qualcomm application processors or Micron LPDDR if they determine it is best for their P&L.

Historically, Samsung DX flagship smartphones (Galaxy S Series) have been 60% internal/Exynos, 40% external/Qualcomm.

For 2024 and 2025, DX chose 100% external/Qualcomm because Samsung Foundry SF3 was so bad, DS could not deliver viable chips (meet power target) at viable volume. Smartphones are region-based. If the yield is so low that a single region (typically EU) cannot be supplied, there is no point.

Samsung DX, Samsung DS, and Qualcomm are all aware of the economic game being played here.

DS has (in theory) an intrinsic cost advantage as they are a vertically-integrated IDM while Qualcomm typically uses TSMC.

Every year, DX pits DS and Qualcomm against each other. This places a VERY STRONG pressure for Qualcomm to use Samsung Logic Foundry instead of TSMC.

Qualcomm has a very good internal process tech team. Possibly the best in the industry when it comes to fabless companies. Every year, this department has to figure out how bad is Samsung Foundry and does Qualcomm need to play ball or play chicken.

For 2024 and 2025 generation chips, Qualcomm chose to play chicken… and they won decisively. They correctly assessed Samsung Foundry was unviable at the time and went 100% TSMC. Samsung DX had no choice but to single-source external smartphone AP.

In the 2026 Galaxy S Series, Exynos (Samsung DS) is back. 20-30% share. Now rumors are going around that Qualcomm is considering SF2 for the 2027 launch Snapdragon Chips. At least a derivative for Samsung DX. Rest of Qualcomm customers prob get TSMC version.

[3.c] Recent Rumors

A variety of rumors have been floating on Twitter and amongst the people who talk to me. They indicate… more panic.

Intel is looking to make PCH (motherboard chipsets) on Samsung 7LPP.

AMD is looking at SF2 for CPUs, possibly datacenter?

Google is looking at SF2 for TPUs.

Friends, I know Samsung Foundry well. They have meaningfully improved over the last year or so but not by this much.

There.

Is.

A.

P A N I C

[4] Intel Foundry: Lip-Bu Tan Queen Sacrifice Worked

Previously, I thought Lip-Bu Tan’s gambit/threat that Intel may abandon the leading edge was crazy and dangerous.

Turns out, LBT is a goddamn genius. The suicide threat worked.

18AP has a lot of positive rumors going around.

It can easily be a “fixed” version of 18A.

Have always believed that Intel needed more time (or for the Tower deal to go thru) in order to deliver a viable PDK for 18A.

18AP == more time

They can do this. Apple is interested. Others are slowly getting warmed up to 18AP in 2027.

Also, Intel advanced packaging group has been whipped into shape by LBT. No more idiotic self-owns. Meaningful traction on this. Advanced packaging revenue can come in much faster than 18AP revenue.

Too early to discuss 14A. Don’t waste time on it. Plenty of other things to think about.

[5] Conclusion: S E M I C A P

The conclusion is very simple.

Embrace your inner primate.

It is time to ape into semicap/WFE.

Which ones?

All of them.

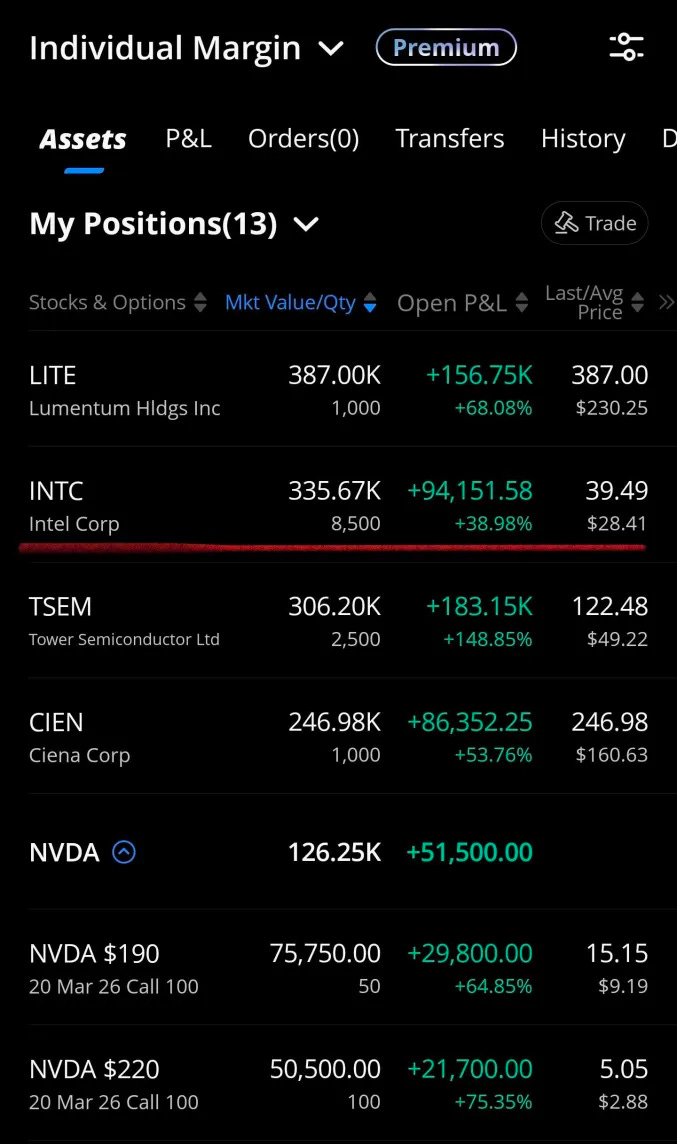

My holdings at the time of writing are biased towards advanced packaging, memory, and metrology. Frankly, I think it doesn’t matter.

The vibe I am getting is people don’t understand how fucked logic is going to get very soon.

Messa think everyone too distracted by memory shortage to realize logic is about to get slammed harder than those idiots in that amateur-engineering carbon-fiber sub.

Once again a post where I had to laugh hysterically. I’m a bit puzzled. I was a super semicap bull in late 2024/ early 2025 and was rather surprised by the lack of traction given the very apparent surge in demand into last year.

Something postponed is not something abandoned and thus have significantly increased my semicap exposure since October. Iirc asml basically said during their investor’s day that they were sitting on news and waiting for the new year for further announcements. Should make for a very good read on the whole situation.

I’m very interested if we’ll see a race to high-NA now. Intel has that EUV trauma from Intel 10nm++++++++++, which, as far as I understand, is at least partially to blame on them being late to EUV besides that whole cobalt drama fueled by infinite arrogance.

Intel and Samsung have got their test machines, don’t see tsmc delaying much further considering the traction Samsung and Intel are apparently regaining.

One thing I’m very curious about is given the incredible state of the memory sector while the Chinese have now been gaining ground, what crazy manufacturing and product technologies will now be investigated by the big three on the off-chance they work? if there ever was a time for experiments, it is now.

18A-P 1.0PDK… Do you smell that? What’s that smell? “Opportunity”. What? No. M-O-N-E-Y. I smell money!