Everything is (not) fine at Intel

Intel New Segment Reporting: Irrational Recap

IMPORTANT:

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

Today’s Intel event was… concerning.

Concerning.

This one word is how I feel today’s webinar should be framed. Keep it in mind.

To the event slides/transcript/VOD!

Webinar:

Timestamps are with respect to this link.

[12:40] Great Summary Slide

Very well-done, honest assessment. FWIW I agree with Intel’s framing, excluding the last row for advanced packaging. TSMC customer base and volume much higher.

[17:12] Bring the wafers home… ouch

[23:21] “Healthy” Product Gross+Operating Margins

It’s not healthy. They are kitchen sinking by artificially setting the internal wafer costs low. Margins are going to deteriorate much more as AMD and ARM gain share in datacenter. Client is going to be a feeding frenzy led by AMD with Qualcomm and Nvidia participating too.

[24:32] “Execution”

“We had execution challenges which impacted the competitiveness of our products. As we’ve improved our execution, we are introducing better products that can command higher margins.” - David Zinsner, CFO

Which products are those?

In client, AMD will crushed Intel with Strix. Qualcomm and Nvidia go from 0% share to at least 5% each in 2025.

Datacenter will be a gluttonous AMD + ARM party.

Margins of every Intel product is going down over the next two years minimum.

[26:05] Admission Lunar Lake is on TSMC

“Intel Foundry lost Intel products to external suppliers due to the process deficits we discussed.”

Client CPU, GPU, I/O, and SoC tiles of Lunar Lake are all non-Intel nodes.

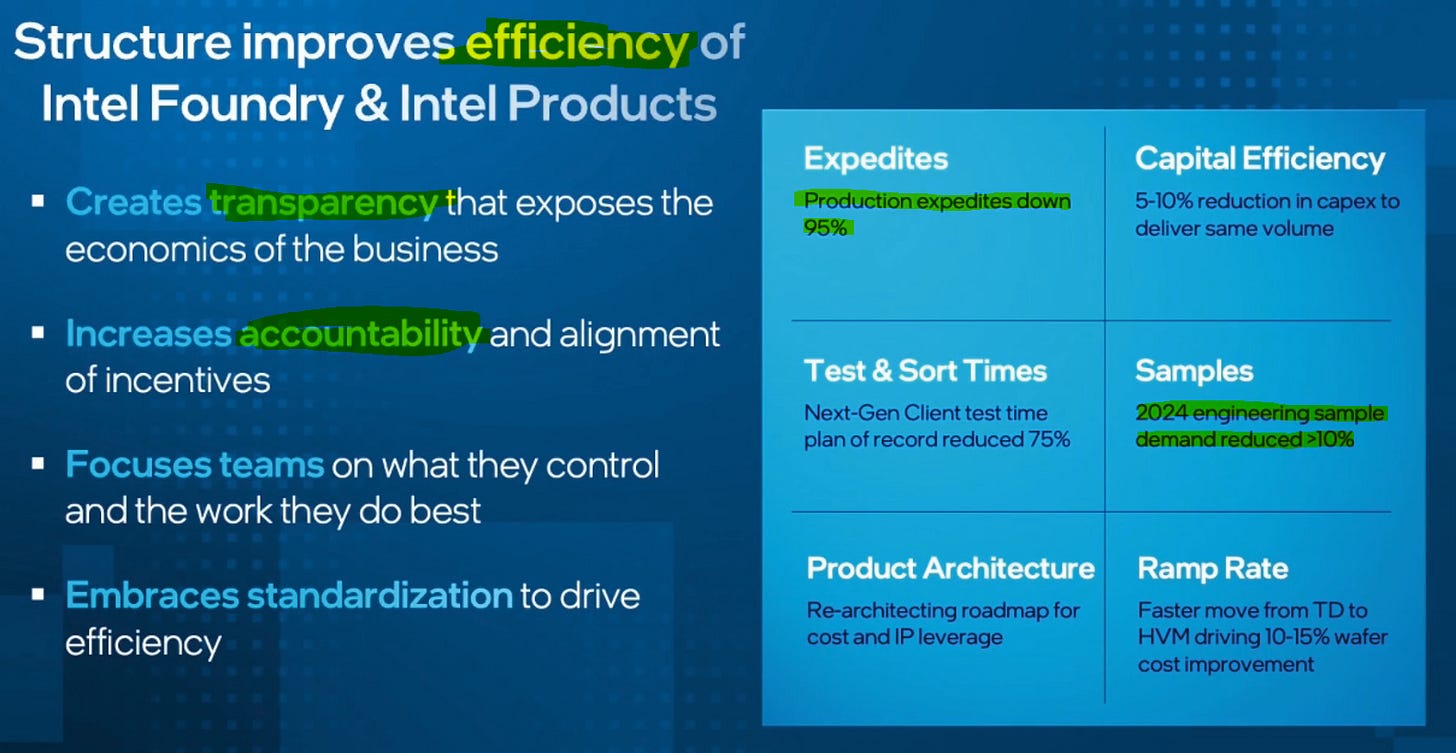

[29:32] Pinkey Promise

Translation: We will stop making expensive/dumb mistakes. If anyone continues to make expensive/dumb mistakes, they shall be found (transparency) and fired (accountability).

[56:00] Insource/Outsource Ratio

We're peaking external use today, but we expect the smart capital to use external over time but at a lesser scale. Those foundry relationships are super important, but will be less critical for P&L. Peaking in 2024/2025, but moderating over time. We use external for some specific nodes we don't have, for capacity balance, or just because they've got features we don't have. These are important relationships for Intel. It's built into the model.

30% of wafers today are from external foundry. We'll be insourcing a couple of fab modules, and will pivot that number down to 20% over the period. It helps us in cost, consolidation, and also extend the life of our nodes. Also supply demands, supply control is a benefit.

Peak will be much higher than 30% and likely occur in 2026/2027.

8-K:

Intel foundry profitability (or lack thereof) depends on Intel Product revenue. This situation is going to get much worse before it gets better in 2027/2028.

Conclusions:

This whole situation is quite sad. The engineering (process tech) has been turned around by Dr. Ann Kelleher’s leadership and the hard work of thousands of engineers. Pat “Galaxy Brain” Gelsinger and David Zinsner are trying their best to avert catastrophe.

The problem is they are too late. The next 3-4 years will be hell for Intel.

As a wise, failed presidential candidate once said…

According to the 2010 Citizens United supreme court ruling.

I quite like this framing for investment analysis.

Imagin, you have a person… Mr. Intel… who is very sick.

Mr. Intel has spent years getting antibiotics prescribed but never finishes the pills. Each time, Mr. Intel only partially solves the problem, leaving the strongest bacteria alive. Over years and years, the bacteria grows stronger, becoming resistant to antibiotics and performance reviews.

Doctor Gelsinger is trying to save Mr. Intel but it’s not looking too good. A series of super-drugs need to be developed to save this patient.

Backside Power Delivery

Gate-all-around Transistors

Efficient use of EUV via pattern shaping.

High NA

Advanced Packaging System Foundry

Mr. Intel has great (federal) insurance so he will live. The journey to full recovery will take 4-6 years. Painful, highly medicated years with some amputations along the way.

Applied Materials is the sole-source of many of the medications Mr. Intel needs.

Do you want to invest in the patient or the drug company?

First, I love your substack and writing style, having just discovered it! While I more or less agree with you about Intel in the short term, IMO this does not quite account for valuations.

If the "drug company" has already run up it could take a bigger beating in a future cyclical downturn (whatever the reason for it). But if Intel has been beaten down so much that it's down to rock-bottom valuations, then it could do better longer term in a turnaround. Unlike a sick human, sick companies can re-incarnate in many different ways.

So, the question really is what would be the rock-bottom price for Intel? Intel's book value is about 110B. Most of it is fab PPE which is valuable and can easily be sold. Let's say Intel Foundry is a complete failure. I could see its valuable equipment and real estate being sold to TSMC's US operations (which they are ramping) or Samsung which already has long standing US operations. Heck Micron could bid for some things like the fab shells etc. Even the worst fabs have a greater than 1.0 Price/Book valuation. But let's apply a minor discount and say one might realize 100B of that book value.

That leaves the question of how to value the products group. What's the worst case we can imagine for them? Let's say they lose the complete datacenter/NEX business. In reality they will have some percent of on premises x86 server business that will not die but let's be harsh. The client is unlikely to die completely because even with superior products AMD and Apple haven't quite managed more than 25-30% market share. There seems to be some combination of brand value, inertia and/or application/driver compatibility worries at work. Let's say they shrink to a third of their current client CPU revenues. That gives about 10.3B in sales per year. Add about 4.2B in sales per year for MobileEye/Altera and that gives about ~15B in sales per year. The most beaten down value segment of small value gets about a 1.0 price to sales multiple. Large value is typically a higher multiple but again let's be conservative. That gives about 115B in value. Intel is not far away today at 135B market cap. One could do a more detailed analysis by looking at each asset in the balance sheet (perhaps I should do a substack post) but you get the rough idea.

The downside doesn't seem that much. Let's also not forget that the US and western governments have a vested interest in keeping Intel alive as way more strategically important than the car mfrs like GM etc. were ever in the GFC. It's also good for consumers and society to have a viable second leading edge semi foundry. If Intel turns around it will be worth way more. The risk/reward to me looks good if we see the green shoots of a turnaround.

Intel even acknowledging and coming terms to how screwed up they were is a big deal, so points to Pat Gelsinger for that even if the fruits are yet to be seen. Don't underestimate what the right kind of technically competent CEO/management can do to turn around a company. Just see Satya and Microsoft. Of course, it takes a whole lot longer to turn around a huge tanker like a Semiconductor mfr., so I'm willing to give it more time. Let's see ...

P.S. Full disclosure: I own INTC, and none of this is investing advice so readers should do their own due diligence.