IMPORTANT:

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

Hello wonderful subscribers and happy Friday.

The agenda for today is as follows:

DELL 0.00%↑ shitshow (earnings leadup) and earnings coverage.

MRVL 0.00%↑ earnings coverage.

Updated thoughts on MU 0.00%↑ and HBM investing.

Dell:

There was a buyside driven mania led to a lot of stupid price action in the leadup to Dell earnings. When the actual results came out, stock collapsed after-hours and here we are.

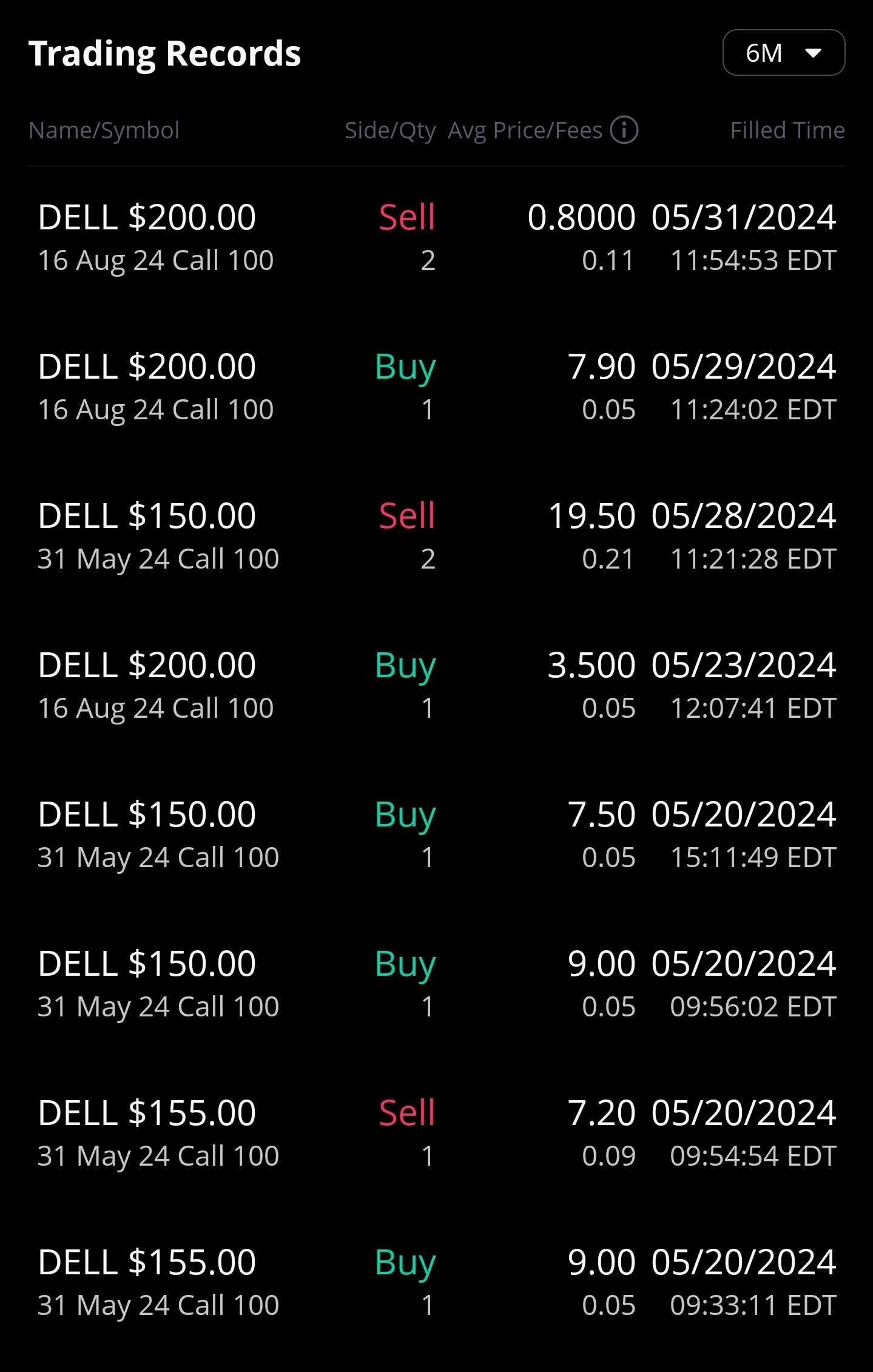

I participated in this stupidity for fun and somehow was lucky enough to get out with a decent profit. Could have been a lot more profit but I got greedy and held the August 200c into earnings.

Here is a timeline from my perspective:

5/16

At dinner party with friends.

One of them says Dell is going to the moon because of rumored GPU allocations from Nvidia.

I push back and say that does not matter cause their [Dell] gross-margins are going to get annihilated by Supermicro, Foxconn, and several other sheet-metal box shitcos.

Friend counters and claims Dell makes 60% gross margins on storage servers.

Using public information, I roughly back-calculate Dell storage server gross margins on my phone and get mind blown… Dell is scalping their customers lamo.

5/17 - 5/19

More research into the storage servers Dell sells.

Eventually get a more confident estimate of 70-75% incremental gross-margin for Dell storage because AI clusters need high-performance NVMe arrays.

Thesis: Dell is gona upsell the crap out of their AI server customers and they will just buy overpriced storage servers for reliability and peace of mind.

The absolute $ amount of these storage servers is miniscule compared to AI/GPU servers.

Dell has a good track record with enterprise reliability.

Risking months of training progress or valuable datasets to cheapo/janky storage solution is not worth it. Save money elsewhere.

5/20

Begin degenerate gambling with borrowed money.

5/22

A different friend shares a sell-side model of Dell that confirms street-expectations of ~60% gross-margin for storage servers.

I still think the gross-margin will be 70-75% based on my BOM calculation for NVMe servers and public Dell configurator tool pricing (div/2 for volume customers).

5/27 - 5/30

Rumors around Dell spread more widely.

Buyside now has a $10B AI server backlog as a bogey.

Sell-side starts publishing updated notes.

5/30

Dell reports earnings and stock tanks after-hours.

Dell managed to disappoint everyone’s expectations. Gross margin on AI servers is terrible. Somehow, they manage to miss revenue for storage…

Toni Sacconaghi — Bernstein

Yes, thank you for the question. If I just look year over year at the ISG business, storage was perfectly flat. AI servers went from zero to 1.7 billion, which sort of suggests that traditional servers were flat. So really the only thing that changed was you added 1.7 billion in AI servers, and operating profit was flat. So does that suggest that operating margins for AI servers were effectively zero? And if that's not the case, how do you square the circle with what I just outlined? Thank you.

Yvonne McGill — Dell CFO

Okay, Toni, I'll take that one. So when I look at the overall ISG performance from an operating income standpoint, storage, I'll start with storage, right? So if the operating income was low in storage, you know that Q1 is seasonally our lowest revenue quarter from a storage perspective. When the revenue declines, the business descales, and so we saw that evidenced in the Q1 results. And while OpEx remained unchanged to the points you're making, the operating rates declined. In traditional servers, we saw strength in large enterprise and large bid mix, so a shift there a bit, which, as you know, that drives lower margin rates. And when I look into Q2 and FY'25, though, I tell you that we expect ISG Opinc rates to improve, as we talked about in the guide, over the year and really deliver against our long-term framework, that 11% to 14%. So, I think what we saw in the first quarter was multifaceted, but we do continue to expect recovery as the year goes on. And those AI-optimized servers, we've talked about being margin rate diluted, but margin dollar accretive. And so you'll continue to see that evidenced in the results also.

Translation:

Analyst: Your margins are shit.

Dell CFO: <word salad before admitting the margins are indeed shit>

Entire earnings call was basically the same show. Each sell-side analyst asked the same question on margins in a different way and got junk answers in return.

So how did the fiasco leading up to and through Dell earnings happen? Why did so many hedge funds, pods, institutions, and retail investors (me included) pump DELL 0.00%↑ to the moon only to watch it explode like a SpaceX test rocket?

The answer is group-think and human behavior.

Under normal circumstances, Dell is a stock I would never touch. Low-gross margin businesses that lack meaningful engineering-driven moats do not interest investor me.

But someone told me about this and degenerate gambler-me could not help sit out. With Nvidia’s recent historic results, all of finance-land wants to find some downstream or upstream supplier to gamble on. Mr. Leather Jacket (praise be upon him) has been shilling Dell since GTC. Rumors that some customers don’t like SMCI 0.00%↑ have been brewing. Rumors of Dell getting favorable Nvidia GPU allocation.

Rumors lead to irrational market behavior which lead to FOMO which lead to more irrational behavior.

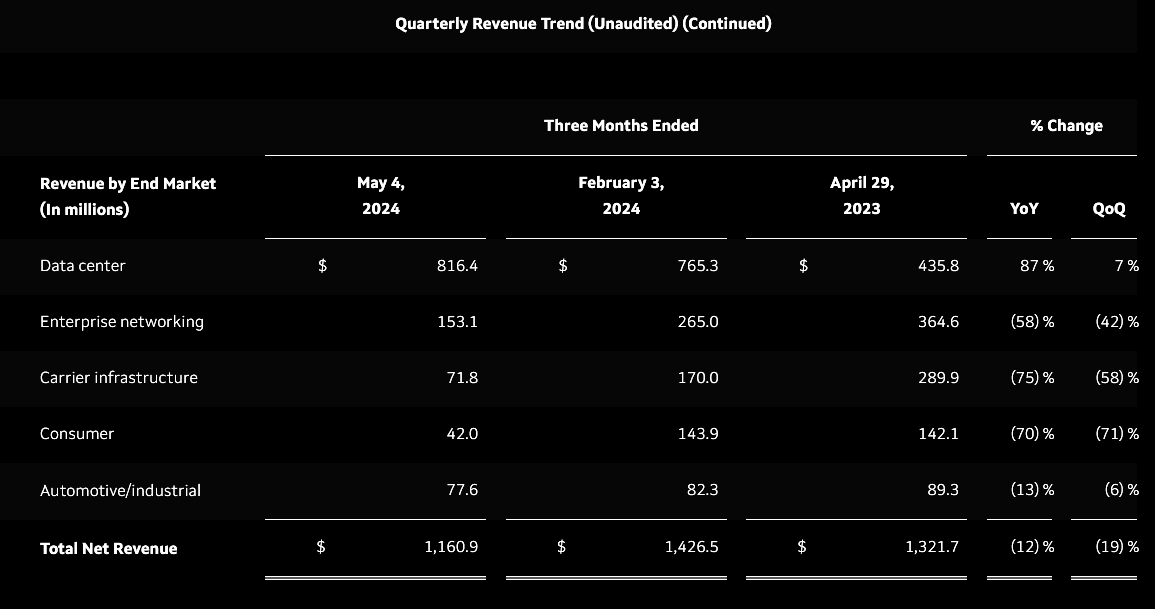

Marvell:

Datacenter is going well but everything else has imploded so cancels each other out.

This entire business is a dumpster fire except for two product lines:

Amazon custom AI ASIC (Trainium + Inferentia)

DSP/Optics Re-timers

Broadcom is hungry for more share in #2 and will be getting it shortly. Thus, the only hope for Marvell fans is for Amazon to order a truly stupid quantity of low-quality AI chips.

I strongly believe Trainium+Inferentia are doomed to fail eventually, crushed by the benevolence of Nvidia Blackwell, followed by Rubin. But I also think Amazon, driven by the cult-like corporate culture and “leadership principals”, will light a ton of capital on fire.

Doug from Fabricated Knowledge is bullish Marvell for a bunch of reasons I don’t agree with, but you should read his take as he is much smarter and more experienced than me.

The one part of Doug’s thesis I do agree with is the stock grants Marvell management gave themselves. Encourages sandbagging of the Amazon capital bonfire opportunity.

I have a very small position (call options) for fun. This is gambling. Still think Marvell is a terrible long-term investment idea.

Micron/HBM

I previously wrote about HBM and Micron here. You should go read that post first.

At the time, I concluded that Micron might be a viable investment for some but not me. Since then, a lot of information regarding Samsung as come out so it is time to admit I was wrong and change position.

Samsung failed to pass HBM3E qualification testing with Nvidia.

Samsung

firedre-assigned the head of DS (memory + logic foundry + S.LSI/Exynos).

SEOUL/SINGAPORE, May 24 (Reuters) - Samsung Electronics' (005930.KS) latest high bandwidth memory (HBM) chips have yet to pass Nvidia's (NVDA.O) tests for use in the U.S. firm's AI processors due to heat and power consumption problems, three people briefed on the issues said.

I knew they were failing parametric yield but it is apparently much worse than I thought.

New MU 0.00%↑ Thesis:

I generally do not invest in something unless I believe it is worth holding for at least 3 years. Preferably 5-7 years.

Invest = buy shares

Options = fun gambling

The following reasons are why I hate memory:

Triopoly where two members are large conglomerates controlled by families that may or may not behave rationally. Chaebol psychoanalysis is not a factor I want to deal with.

Poor visibility into product quality*. With logic, I have the skillset and resources to figure out which product is better.

Wide variety of end markets** that make it difficult to decide entry points.

Past history of alleged price-fixing.

Very long manufacturing process that makes cyclical downturns much worse. Even with leading-edge logic, fabless can cut wafer orders much faster. Memory triopoly often gets into situations where all three have no choice but to dump inventory at negative gross-margins.

This time is different though

*We have very good visibility into product quality this time. Remember that parametric yield is decided by the manufacturer. Samsung chose to limit themselves to < 30% and still failed Nvidia qualification. Think about how much incentive Nvidia has to qualify SS HBM. Majority of DC GPU BOM cost is HBM. There is a critical shortage. SK and MU are 100% rapidly raising prices. Jensen did his "approved GTC signature stunt" for good reason. Samsung HBM power draw must be significantly higher than SK and MU. One member of the triopoly (the largest one!) is out for the next 12-18 months minimum.

**HBM is special because it has much higher area intensity. Ramping HBM for the AI market is obliterating remaining supply for all the non-HBM products. Everything is going to the moon. Don't need to give a shit about end-markets this cycle.

All members of the triopoly planned their existing capacity cuts and future capacity build to navigate last cycle (driven by laptop/PC and smartphone). HBM incredible ramp and area intensity has thrown in a wrench to all three. It is as if SK, SS, MU all destroyed 30% of their capacity simultaneously.

Literally nothing will compel me to purchase shares in Micron or any other memory-exposed company, such as Lam Research. However, there is a historic opportunity in HBM/memory right now and I can’t just stay out. Degenerate gambler-me shall break the anti-memory rule temporarily.

I have a modest call option position on Micron and opportunistically adding more.

This is going to be the most violent memory cycle in history.

I want to participate in the violence. 😈

![[Q1 CY24] Micron's HBM Party](https://substackcdn.com/image/fetch/$s_!9Jb_!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fef2114e3-e307-4dbc-91d8-508be7d9fdb2_808x427.png)

Roughly 15bn 2GB DRAM chips shipped in 2023, and on track for 16bn this year.

HBM chips are 1.2 cm2 or a bit less than 2x the size of DDR or LPDDR chips (typically .65 to .7 cm2).

Let's say the shipments of H100-equivalent this year come to 4M, each with 128GB average HBM and 512GB average ancillary DRAM. Around 256M HBM and 1024M commodity DRAM chips. If we reckon the average yield loss of HBM in assembly (the loss at wafer level will be very low) at 30% then we come to under1.9 billion LPDDR-equivalents of manufacturing needed at the wafer level for the AI market. About 14% of production capacity this year, of which 6% is the actual HBM and the rest will be LPDDR and DDR with the LPDDR share rising sharply later this year.

There may have been a compensating fall in other markets, servers and mobile have both been flat to down IIRC. There seems no basis for saying there is a 30% capacity shock to the DRAM market. There has been a severe shortage in HBM, but that is due mostly to downstream assembly capacity needs.

Any thoughts on WDC or other memory companies? Seeing a lot of reports of pricing leverage on the NAND side too. Not the type of company I’m looking to invest in, but I’m mildly curious as a fellow MU call holder