Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Today I want to discuss my short-term views on AMD 0.00%↑ and NVDA 0.00%↑.

At the time of writing:

I still have my largest position as Nvidia shares. (have not sold any).

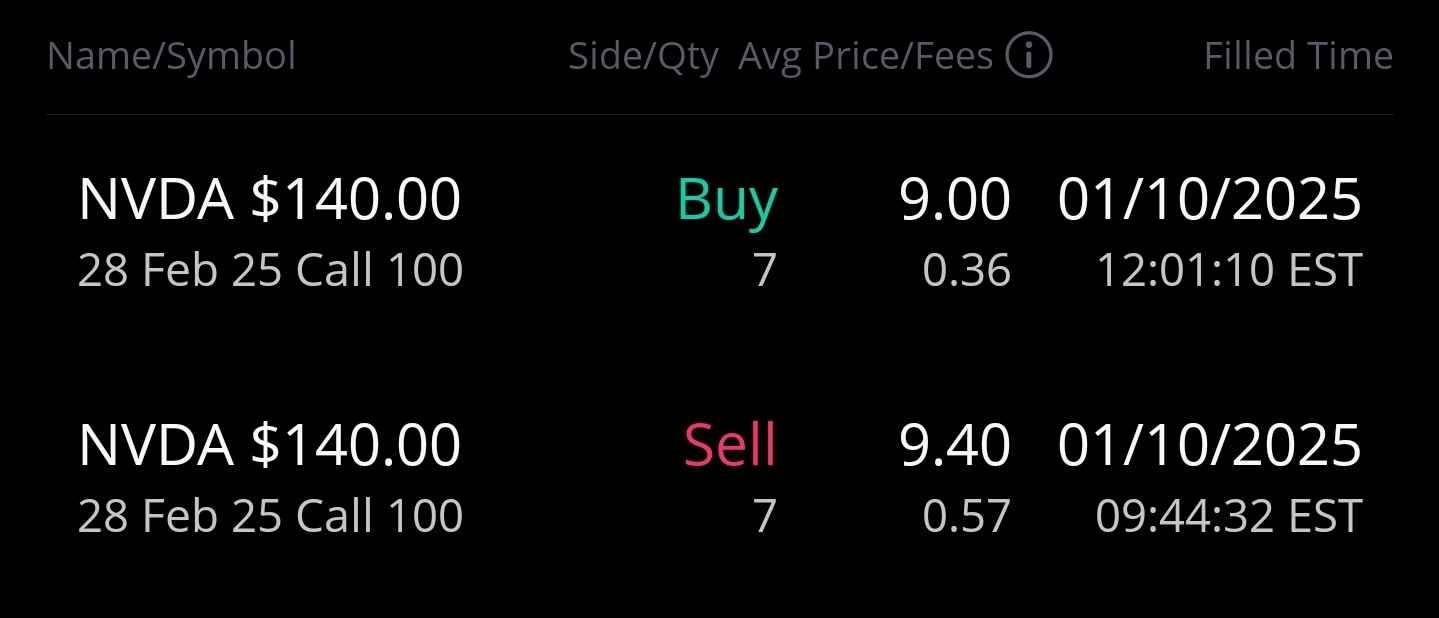

Currently hold no NVDA options position.

Hold no economic position in AMD (stocks, short, options).

Reminder that this Substack is free, and I share these screenshots/disclosures in an effort to eliminate ethical issues.

Let’s start with Nvidia as it is easy.

There is a lot of chatter about problems with GB200, especially NVL72. Multiple rumors call out Amphenol (cable/connector/backplane vendor) as a particular pain-point.

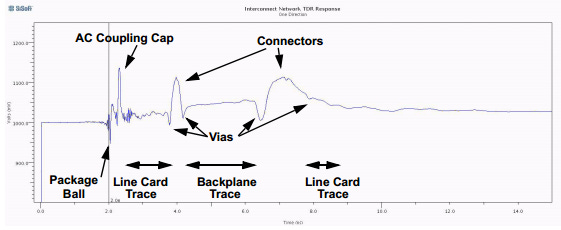

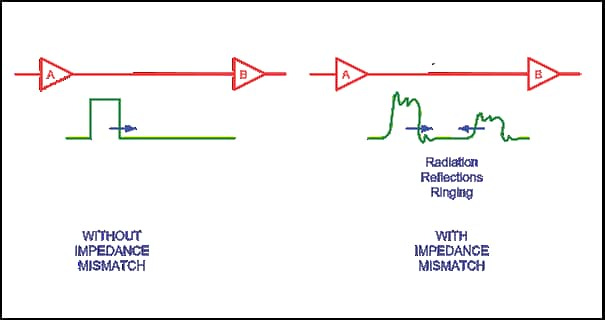

My guess is that the rumored manufacturing issues are largely associated impedance mismatch issues within NVLink. Because Nvidia went so aggressively on trying to be first to 200G speeds with purely passive copper cables, there is not much margin for error. If unexpected manufacturing issues are happening, that probably induces nasty reflections that cannot be corrected by the equalizer.

For the long-term, this does not concern me. Not selling my shares.

But those June 2025 180c options don’t look like a good idea anymore. There will likely be some mild panic and dumb takes from sell-side about how Nvidia is having trouble executing.

GB300 should be fine in the second half of 2025. Nvidia likely improved the SerDes. Perhaps more floating FFE taps or a stronger CTLE.

They have had enough time to take corrective actions now that they have ample data on real-world manufactured channels.

What Nvidia is trying to do with NVL72 is extraordinarily ambitious. Ongoing manufacturing issues related to networking (signal integrity) and heat are fine.

If the stock tanks, I will probably aggressively build a call-option position. Very excited for NVL72 enabling superior performance on reasoning models.

AMD is much more difficult to figure out.

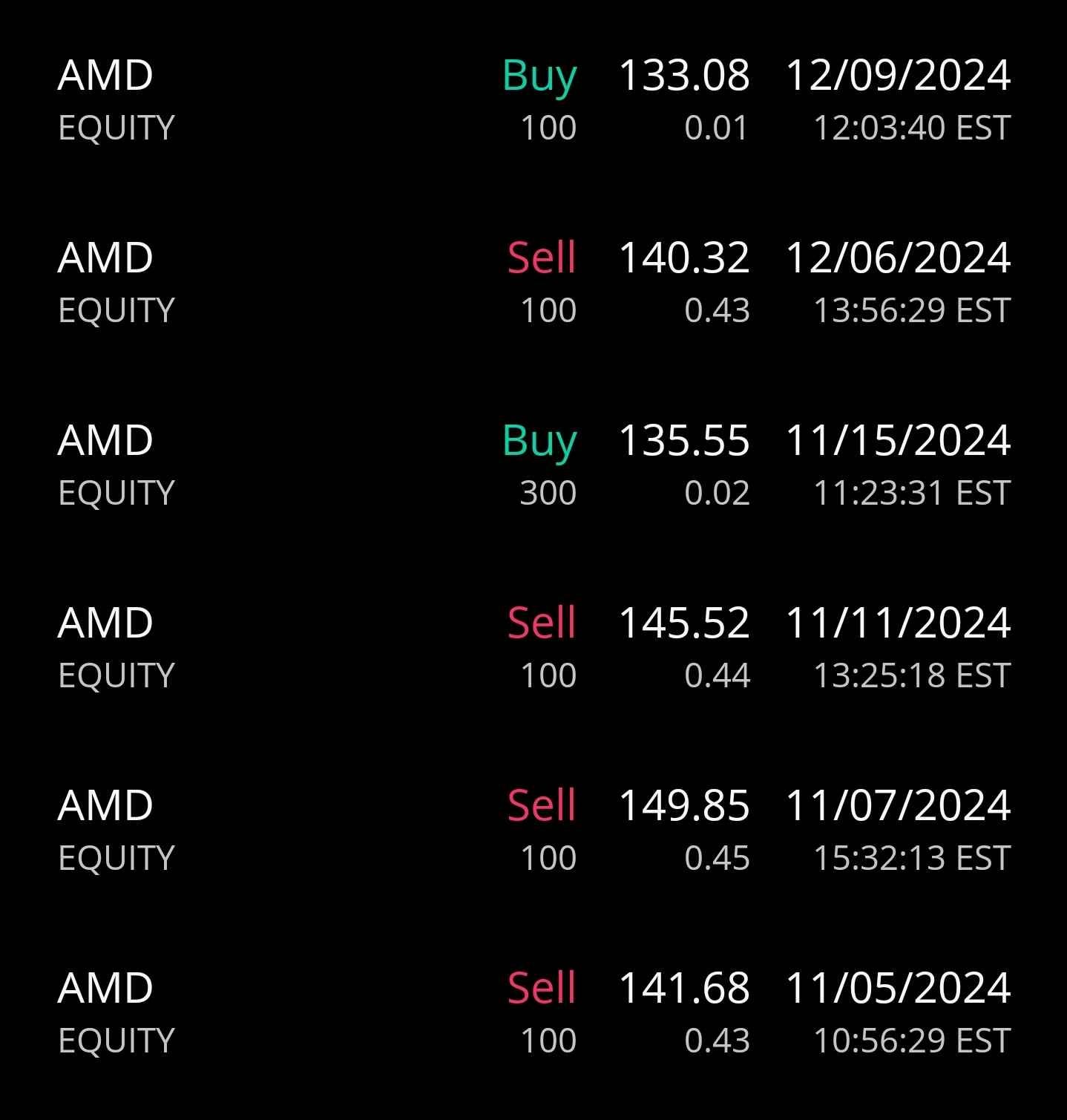

The stock is already down quite a bit. Made some good money on puts recently and decided to take profit for now.

AMD is my favorite stock to trade. Still think there is an opportunity primarily because of some delusional sell-side models and research notes I have access to.

My bearish thesis for AMD is as follows:

Sell side is delusional. (everyone… not just GS and MS.)

These spreadsheets are nonsensical and detached from reality.

Stock price is a weighted average of opinions.

Anyone who believes AMD gross margin goes up as DC GPU ramps is extremely wrong.

The problem is, there are multiple Goldman Sachs and Morgan Stanley employees subscribed here. Need to obfuscate the numbers to reduce the probability that they sue me.

Goldman Sachs has AMD gross margins going up, even as datacenter GPU (MI300X MI325X) ramp and become a much larger portion of AMD overall revenue.

This makes no sense. AMD is going to have to discount aggressively to compete with HGX Blackwell (regular 8-GPU per server version).

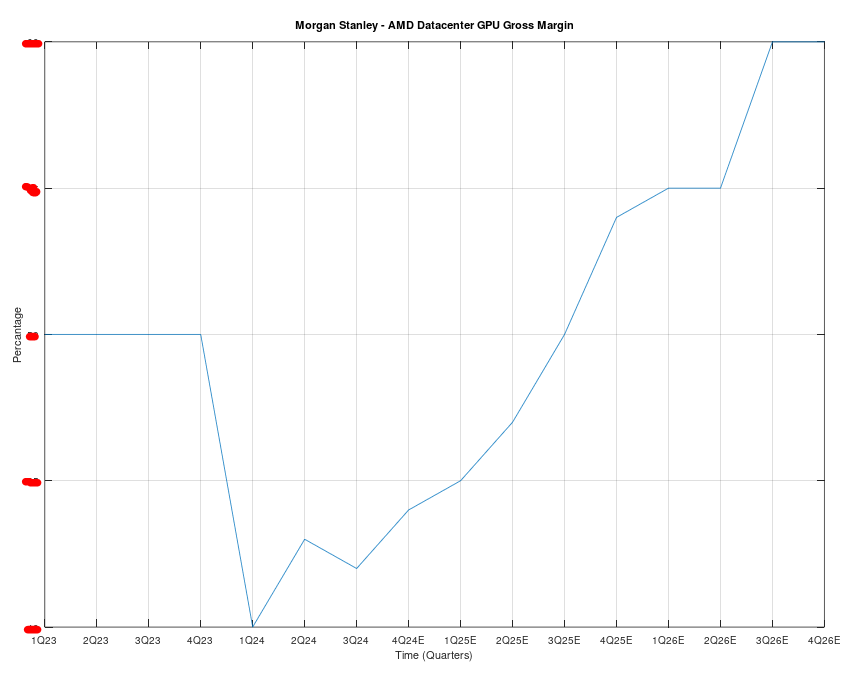

Morgan Stanely also has AMD DC GPU gross margin going up…

Two months ago, AMD announced a 4% layoff.

The excuse was that they needed to fire so people to “focus more on AI opportunity”. My gut feeling is that they realized DG GPU revenue would not grow enough to meet targets without steep discounts. Cutting some OpEx is their way of meeting upcoming EPS guidance.

I believe multiple factors are driving AMD DC GPU gross margins down, primarily from an ASP side.

Nvidia vanilla (no fancy NVLink topology) HGX Blackwell invalidates AMD TCO advantage due to a significant performance bump.

Nvidia GB200 NVL72 DGX Blackwell obliterates AMD in every way.

Terrible software experience on AMD limits use to niche internal hyperscaler workloads.

Meta (largest customer) and Microsoft are negotiating massive discounts because they have leverage. That Llama 405B inferencing exclusivity deal between Meta and AMD does not mean much. Epic discounts in the volume purchase agreement kill the bull case for AMD.

For what it’s worth, I think the DC GPU revenue modeling is also extremely wrong. Think there will be a massive air-gap in Q2/Q3. Blackwell issues could give AMD one more quarter of runway but that is it. A cliff is coming.

Even Q4 AMD DC GPU revenue could be horrible if MI400X does not launch on-time and in a good state.

I think you mean MI355x at the end there?

AMD DC GPU is only going to get interesting again in 26H2. MI400 and Rubin launch windows should be closer together (Both tied to HBM4 ramp). Although i'm guessing AMD will still be 1-2 quarters behind as tradition. Chiplet strategy only gets to be more superior as CoWoS goes to 5.5x reticle. ZT aquisition closed by then with rack scale solution ready. First uarch that is designed from the ground up with low precision / GEMM performance in mind. (if there is one thing AMD is alright at, it's uarch design). 1.5 more years to fix their shit software. UALink and their own inhouse AI optimized NICs should be ready by then.

MI355x is too little too late but I think MI400 is gonna give rubin a better fight than everyone currently expects..

2025 revenue & margins are currently severely overestimated by analysts but at the same time 2026 severely underestimated lol..

I agree with you on amd problem for shorting it from here is that dc cpu and client seem to be doing really well again