Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

I am rushing to write this note because of Doug and Zero Gravitas excellent piece.

The financial stuff is brilliantly covered. Have some engineering-driven commentary to help add to this idea.

I already have some CEVA 0.00%↑ shares but probably going to buy more.

Unfortunately, the options chain is revolting.

CEVA 0.00%↑ QCOM 0.00%↑ AVGO 0.00%↑ AAPL 0.00%↑ SWKS 0.00%↑ QRVO 0.00%↑

Contents:

Background on Apple C1 Modem

Background on Practical 5G

Implications for CEVA

Implications for Qualcomm

Implications for Broadcom

[1] Background on Apple C1 Modem

This modem has been in development since 2019.

6 years.

Apple had to settle with Qualcomm because Intel’s 5G modem was such garbage the carriers would never allow it on their networks.

In short, Apple lost the battle but vowed to continue fighting the war.

The terms of the settlement made it very obvious what the plan was.

Apple pays license fees and agrees to buy modems until 2025.

Apple has the right to unilaterally extend the agreement until March 2027.

Goal always was to become 100% self-sufficient in modems (all regions, sub-6 and mmWave, all iPhone SKUs) by 2025. Avoid the extension. Stop paying QTL royalties ASAP.

Problem is…. the Apple cellular modem program has been a radioactive dumpster fire.

Apple has spent an obscene amount of money to get this pile of garbage modem working. There are (educated guess) over 6K engineers working on this ONE MODEM for the past 6 (six) years… and it still is crap.

Part of the problem was where these engineers came from.

You have a team with…

Apple engineers

ex-Intel engineers (some of the dumbest in the industry)

Without a doubt the most incompetent group to have ever existed within Intel.

Bob “Clown” Swan must have been delighted to unload so much dead weight upon Tim Apple.

Intel was blessed to get $1B in payment.

These 🤡 engineers probably had negative net productivity.

ex-Qualcomm engineers

even a few ex-Broadcom engineers

These people HATE each other.

There are so many insane/funny stories I could tell you about this saga, but it requires obscure context and is probably a waste of time.

Just trust me that this program is the most epic failure within semiconductors within the last 20 years. So much worse than AMD Bulldozer.

After multiple catastrophic delays, this abomination of a modem is finally shipping. It has already shaken up RFFE. Just look at the chaos at Skyworks and Qorvo.

The iPhone 16e is going to use this internal modem globally but has no mmWave support.

This is very important, and I will explain why in the next section.

What matters for stocks is who gets content, who loses (its Qualcomm… no shit), and how the ramp is shaped.

I have access to Morgan Stanley and Goldman Sachs sell-side models.

I strongly believe the street is extremely wrong on how fast this internal modem is going to ramp.

[2] Background on Practical 5G

This section is condensed to the bare minimum.

First, there are two types of 5G.

sub-6

“normal” frequency bands

maximum of 100 MHz per band

mmWave

Mostly useless.

Required in USA market.

Increasingly important in mainland China.

Lots of extra engineering problems.

Maximum of 400 MHz per band.

Reliant on high carrier aggregation to function at all.

https://en.wikipedia.org/wiki/5G_NR_frequency_bands

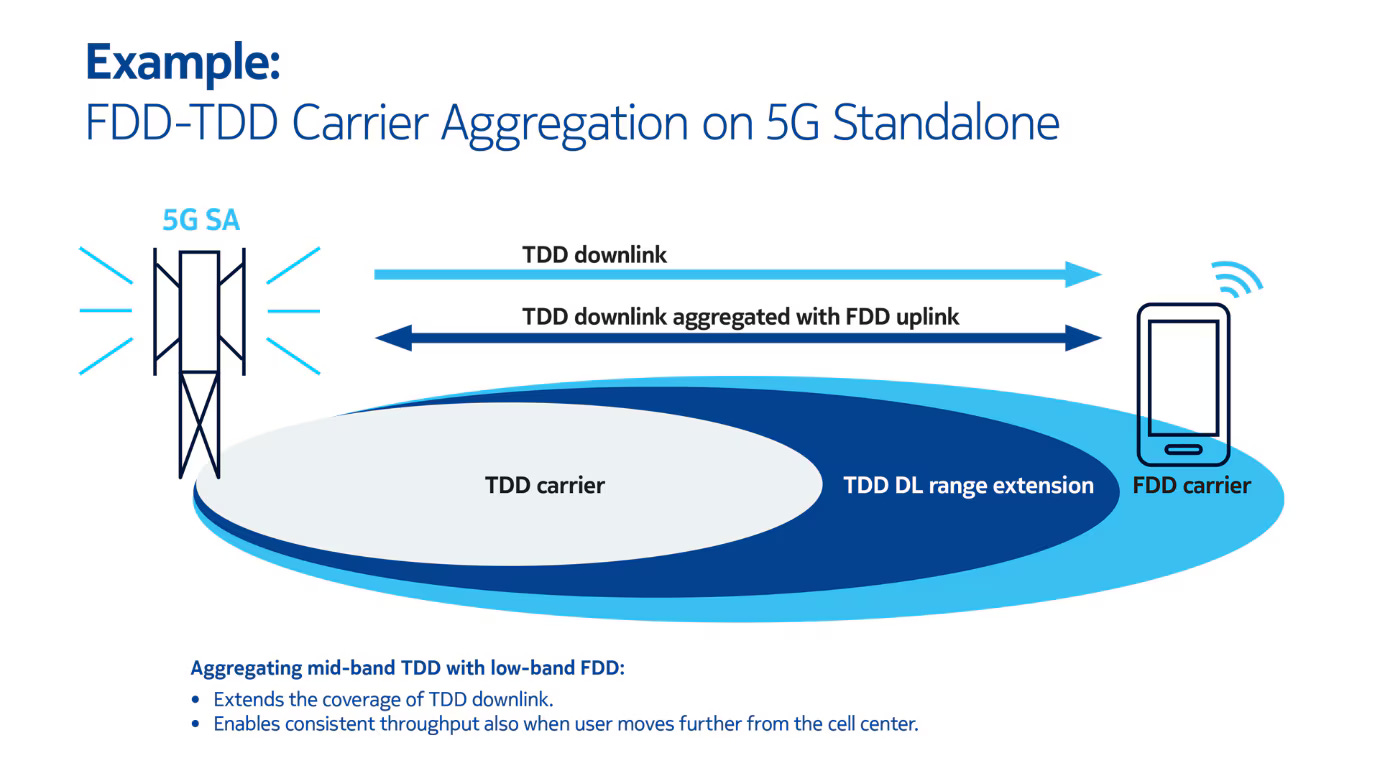

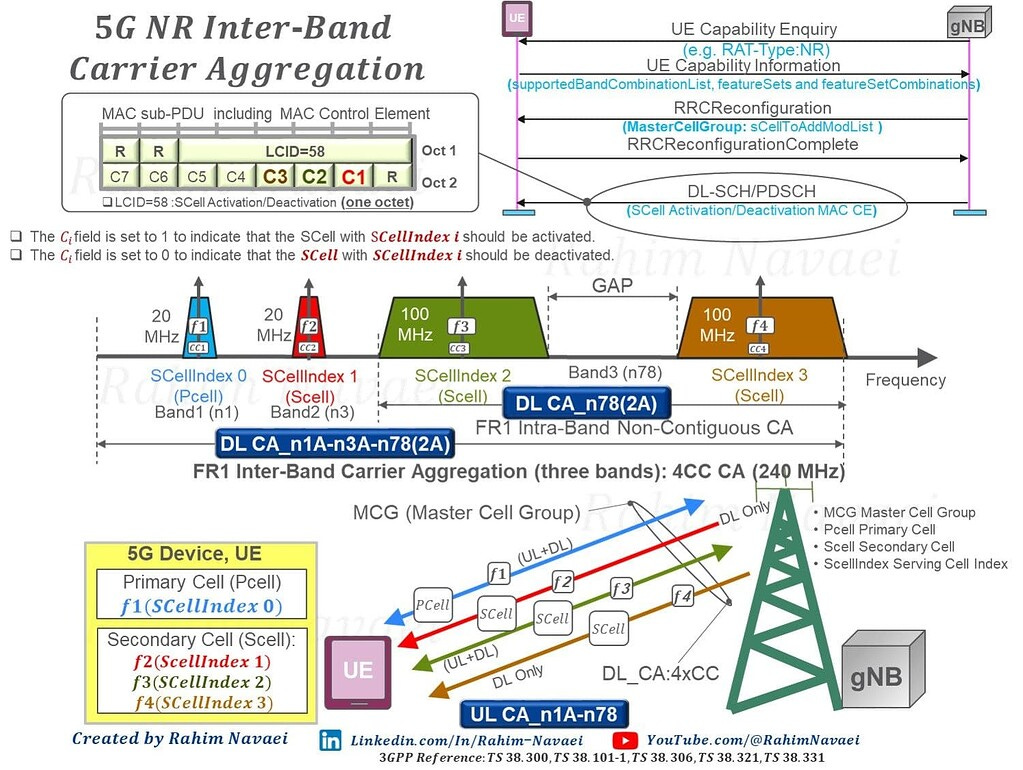

Carrier Aggregation is the term for having a device connect to multiple frequency bands at the same time. The lingo is “CC” which stands for “component carrier”.

For example, a 4 CC configuration means four bands aggregated.

The point of carrier aggregation is to blend coverage. Give users a balance of capacity and range.

Each carrier across the world has their own frequency bands and preferred network configuration.

A global modem needs to be compatible with every carrier in every region, for every combination of equipment (E///, Nokia, Samsung Infra, Huawei, ZTE, …) and every band combination used by the carriers.

This is a nightmare.

This is why MediaTek cannot supply Apple for the iPhone, only small things like Apple watch. Their 5G modem is very good but it does not work for many regions and high complexity CC configs.

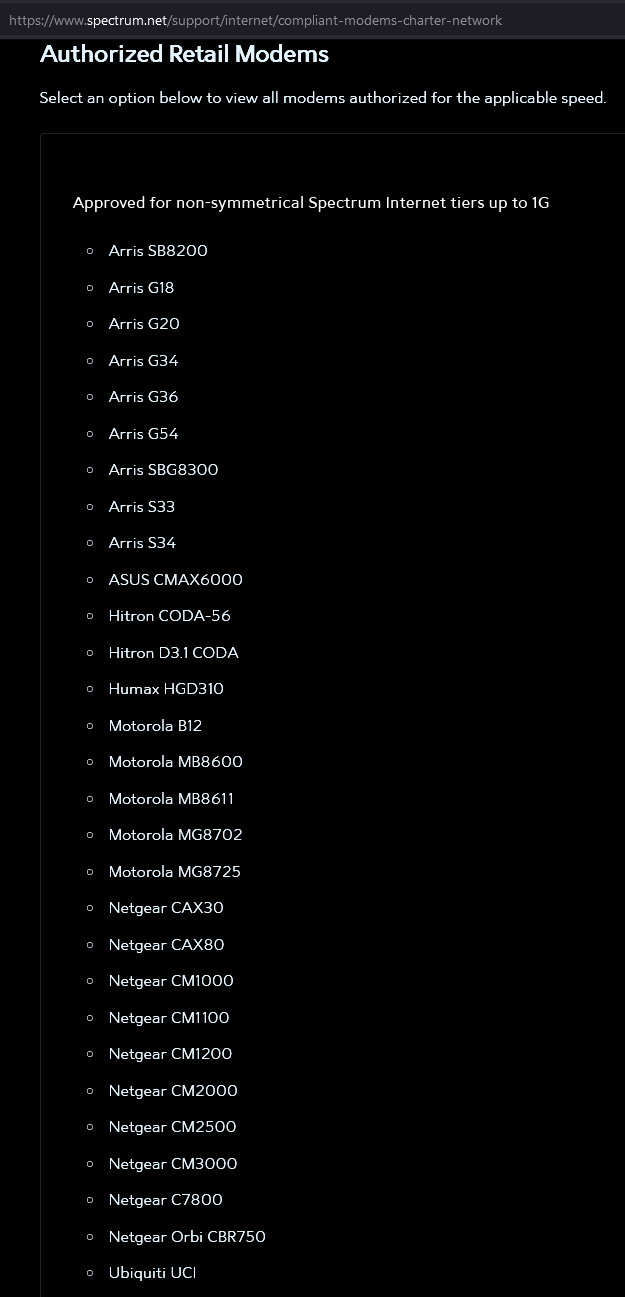

Wireless carriers are the gatekeepers. A bad modem can turn every phone/UE/device using it into a jammer.

Wired (DOCSIS) cable networks also only allow approved modems on their networks.

Real engineering reasons justify this kind of aggressive gatekeeping by the carriers.

Apple **aggressively lobbied** the carriers to let their internal modem on the networks back in 2023 and 2024. The carriers refused. Think about how powerful Apple is.

The fact that this Apple C1 modem is now shipping globally is a huge accomplishment.

It will be very interesting to see what band combos are supported as the iPhone 16e launches over the coming weeks.

Cellular networks are intuitively similar to InfiniBand “credit based” flow control.

A phone (UE) can only transmit data if it has an uplink grant. It can only get downlink data if it has a downlink grant.

Carriers regularly discriminate against devices.

Business customers get grant priority.

Budget customers (Mint, Boost Mobile, Cricket, …) with “unlimited data” are de-prioritized. Back of the line.

Devices from other regions (people traveling internationally), unlocked devices, and imported devices (say an American importing a China-only Xiaomi phone) are aggressively limited in terms of grants and allowed CC configs.

I strongly suspect the carriers have aggressively limited what band combos iPhone 16e can have. They also probably made some changes to their schedulers to mitigate the blast radius.

mmWave is a hard requirement for 20-30% of the market in 2025, primarily driven by USA with some pressure in mainland China.

It is ok for Apple’s internal modem to not have mmWave support right now. But if a large portion of devices (59% of USA devices lol) don’t have mmWave, the carriers are gona have congestion problems.

It is reasonable for Apple to get mmWave working in limited configurations (2-4 CC) by 2027. Most of the difficult work has been finished.

[3] Implications for CEVA

Doug’s approach is great. I prefer a different way of estimating.

Reasonable Assumptions:

Ceva royalty is 0.5% to 1% per chip.

Apple modem theoretical ASP (for the purposes of assigning royalty payments) is ~$20 per 5G modem and ~$4 per Wi-Fi+Bluetooth modem.

100% of 2025 iPhones use Apple internal Wi-Fi+Bluetooth

Apple internal cellular modem ramp (2025/2026/2027) is as follows:

Bear: 15%/40%/80%

Base: 25%/70%/100%

Bull: 60%/80%/100%

Annual iPhone units are between 220M and 250M units per year.

IDC and Counterpoint have great historical data.

Smartphone is flat/mature market these days.

Modeling friends… have fun.

[4] Implications for Qualcomm

Not good.

Sell-side is in la-la land on this modem ramp.

Certain investors delusionally think that Apple is going to keep paying QTL royalties after March 2027.

Apple will not pay Qualcomm a single dollar for modems or patent royalties after March 2027.

In fact, they could cease QTL payments much earlier.

The moment they have modem self-sufficiency, they break contract and demand to re-negotiate the rate.

Qualcomm overturned this ruling in court.

I frankly do not care who is right in a legal or moral sense.

For the purpose of stocks and investing, all that matters is what is most likely to happen.

Apple’s goal last time (2017-2019) was to force price discovery on the royalty rate.

They are going to do the exact same thing, but with complete modem independence.

Qualcomm will not have any leverage this time.

[5] Implications for Broadcom

Broadcom is losing the low gross-margin Wi-Fi baseband business, but they gain RFFE content. My gut feeling is this is a long-term win (2026 H2 and beyond) but a short-term headwind.

Is anyone investing in Broadcom going to sell because of a wireless miss in H2 2025? It seems stupid but I have seen the pod monkeys do dumber things.

Be careful out there folks! I have some experience with this as you can see in my twitter response to IrrationalAnalysis. A few things I'd like to point out -

1. As IrrationalAnalysis says, modem development is incredibly hard. Few are aware that even nVidia tried, failed and gave up. They bought Icera in Bristol UK in 2011 for use with Tegra but gave up and sold it in 4 years. Some of the same folks were involved in Graphcore, another failure that got bought by Softbank eventually, but I digress. At least nVidia was smart enough to realize not too late.

2. The last big instance of Apple needing to license core IP was for GPUs. They used the viable third guy out there - Imagination Technologies (AMD had sold mobile GPU IP to Qualcomm, Apple hated nVidia due to bumpgate). But guess what happened once they developed enough experience? They developed their own in-house GPU. Apple has enough money and time to replace anything important. If they can do something fundamental as developing their own CPU and switching the ISA for their software, they can do anything especially things that are kind of internal.

3. Even assuming they don't do this, it's not all roses as an Apple supplier. Look up what Murata says about what Apple allows them to earn. There are plenty of areas Apple doesn't want to bother to enter, but don't forget who has the upper hand in negotiations.

4. Assuming the numbers here are correct (seems reasonable to me), we are looking at about $40 million incremental revenue in the next few years and then flat (as smartphones aren't really growing). From around a $100 million current revenue level, is it really that exciting? This isn't a long-term hold quality name IMO.

Good luck out there.

P.S. Who's the smallest dinosaur in that picture?

It's certainly delusional that Apple just could stop paying for patents that it uses. It is called stealing.

Other option is that Qualcomm patents are not under FRAND requirements because 5G can be implemented without and in the future Qualcomm can charge other companies whatever it wants.

Either way Qualcomm gets the money.