Cerebras S-1 Initial Analysis

Hilarious related party revenue ratio. The Lucid Motors of semiconductor?

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Welcome to the first post of many that will cover Cerebras Systems, soon to be listed as $CBRS.

Before covering the S-1 filing that was just published, I want to give my quick opinion on the IPO.

I believe this IPO will pop due to low float, hype, and an army of dumb people who don’t understand basic computer architecture. Cerebras has great marketing materials that are perfect for duping gullible oil money, boomer PMs, semiconductor tourists, and degen retail gamblers.

I intend to get allocation for the IPO, ride this garbage up, then short aggressively. A detailed short report should be ready between their first earnings call and the IPO lockup. (4-5 months after IPO date)

For now, here are my quick thoughts on the S-1 in order.

https://www.sec.gov/Archives/edgar/data/2021728/000162828024041596/cerebras-sx1.htm

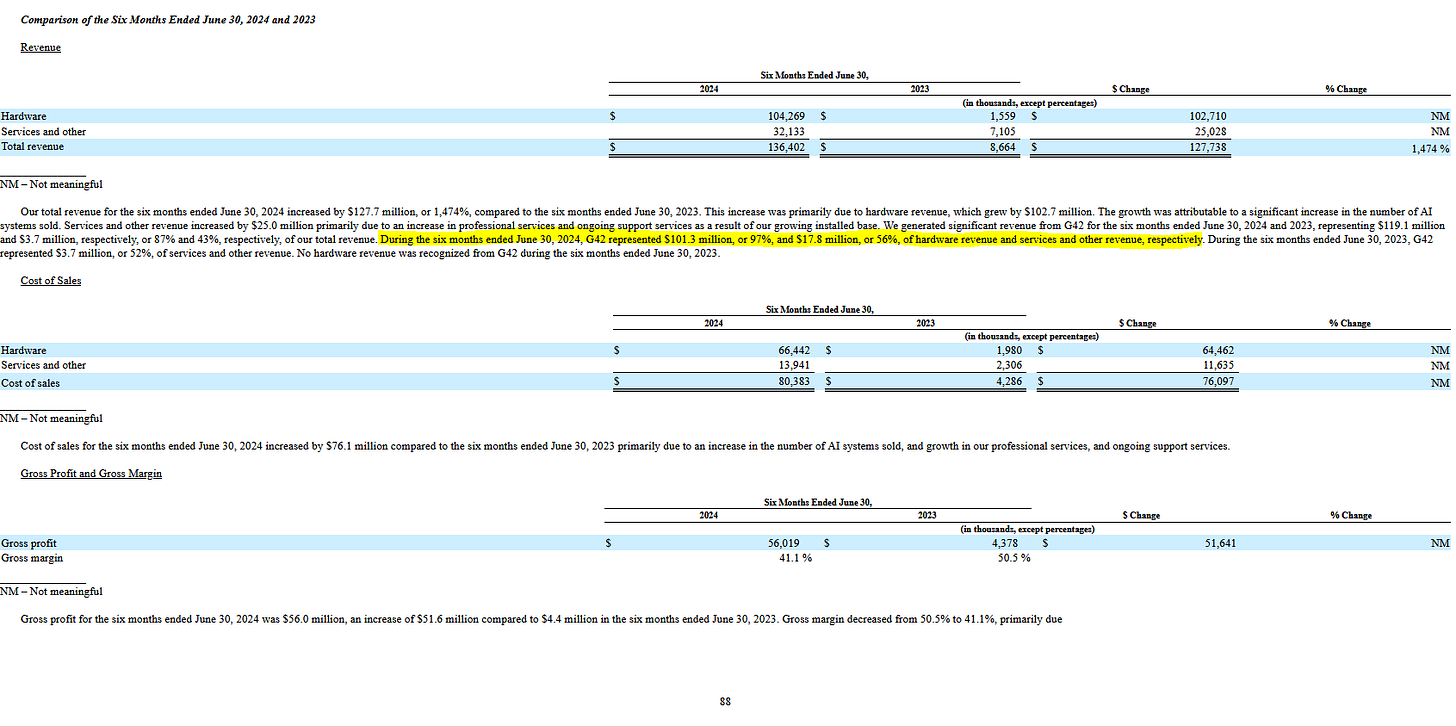

Hardware gross margins are only 36%. That is frankly mediocre compared to Nvidia’s hardware cross margin of ~75-80% and AMD’s hardware gross margin of 45-55%.

Sub 40% gross margin in semiconductor is not good. This is commodity level GM like high-tier smartphone and laptop chips.

I am ignoring the services revenue margins because that is from the micky-mouse “cloud” they operate on behalf of G42.

Cerebras is a front for G42, a state-owned oil money incineration company.

G42 is a major investor. This is related party revenue! I was expecting the related party revenue to be high but this is crazy.

87% of Cerebras revenue (hardware + services) this year is from a related party!

Looking forward to it.

An existing contract for $1.4B worth of hardware and services with G42. If they spend another $500M, G42 gets a special stock option. Interesting that this option is only exercised if a single order hits the $500M threshold.

Presumably, G42 and Cerebras coordinated this ahead of time. They will likely announce a supercomputer order that hits the $500M threshold (1024 CS-3 cluster?) to pump the stock even though massive dilution is coming.

Massive pre-payments from G42. Their option is priced super low at $14.66 per share. Very curious what the actual % holding is once the prospectus is updated.

97% OF HARDWARE REVENUE THIS YEAR WAS FROM G42!

They neglected to mention that the memory-IO style proprietary interface for getting data on and off the wafer is very slow and a massive bottleneck for both training and inference.

CS-3 competes with GB200 NVL36/72, not H100.

The cost of this inference is likely terrible. They have five CS-3 systems chained together. That is something like $3-5M in CapEx drawing ~120-140KW of electricity.

A single GB200 NVL36 rack costs less than $2M and draws only (lol) 65KW and likely crushes Cerebras CS-3 inference TCO.

AMD too. The upcoming MI325X has huge HBM capacity and low gross margins because AMD wants to undercut Nvidia. A rack of MI325X should also handily beat Cerebras in this niche demo. Notice how they support Llama 3.1 8B and 70B but still no sign of 405B support. It’s because their SRAM meme inference is choking on wafer I/O limits and latency. They have FPGAs that sit between the optical 400/800G Ethernet and their proprietary memory-IO interface on the wafer.

And scaling to multiple WSE is a nightmare. NUMA latency hell on training. Bandwidth bottlenecks and latency issues on inference.

Institutional investors on my list… go ask them why Llama 405B is still not supported. Cerebras claims their “CSoft Compiler” delivers easy-to-use performance.

If your compiler is so amazing, why not demo Llama 3.1 405B? Models are only getting bigger. Surely your SRAM meme inference strategy is not inherently limited by IO weaknesses?

Much more to come. I will be following this ticker closely. Huge trading opportunity.

Increasingly I'm thinking that the more a company touts a compiler as a competitive advantage, the weaker their tech is...

lots stupid money out there but you'd think people with a hare brain would see through to the flagrant amount of related transaction + stock option trigger - classic insider pump? They should hire better investment bankers to pretend they actually tried to legitimatize this. Lawyers may be more clever with this.