[3Q2024] ARM, Qualcomm, Astera Labs, Fabrinet, Wolfspeed, Supermicro

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Welcome to a wild week of earnings: 2024 Election Week Edition

ARM 0.00%↑ QCOM 0.00%↑ ALAB 0.00%↑ FN 0.00%↑ WOLF 0.00%↑ SMCI 0.00%↑

ARM:

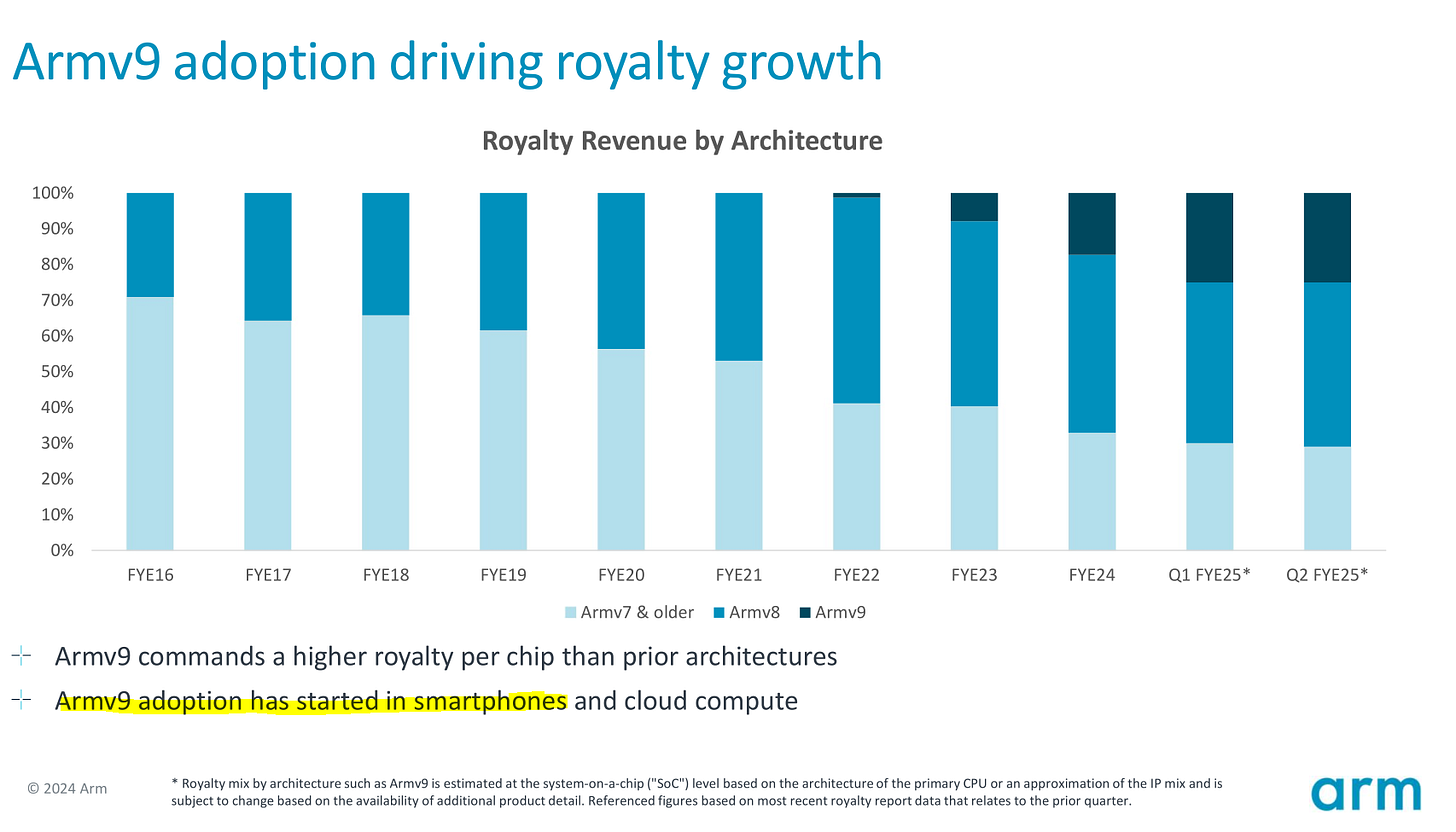

ARM v9 adoption is primarily in smartphones… (as expected)

… and 40% of royalty revenue is from smartphone application processors.

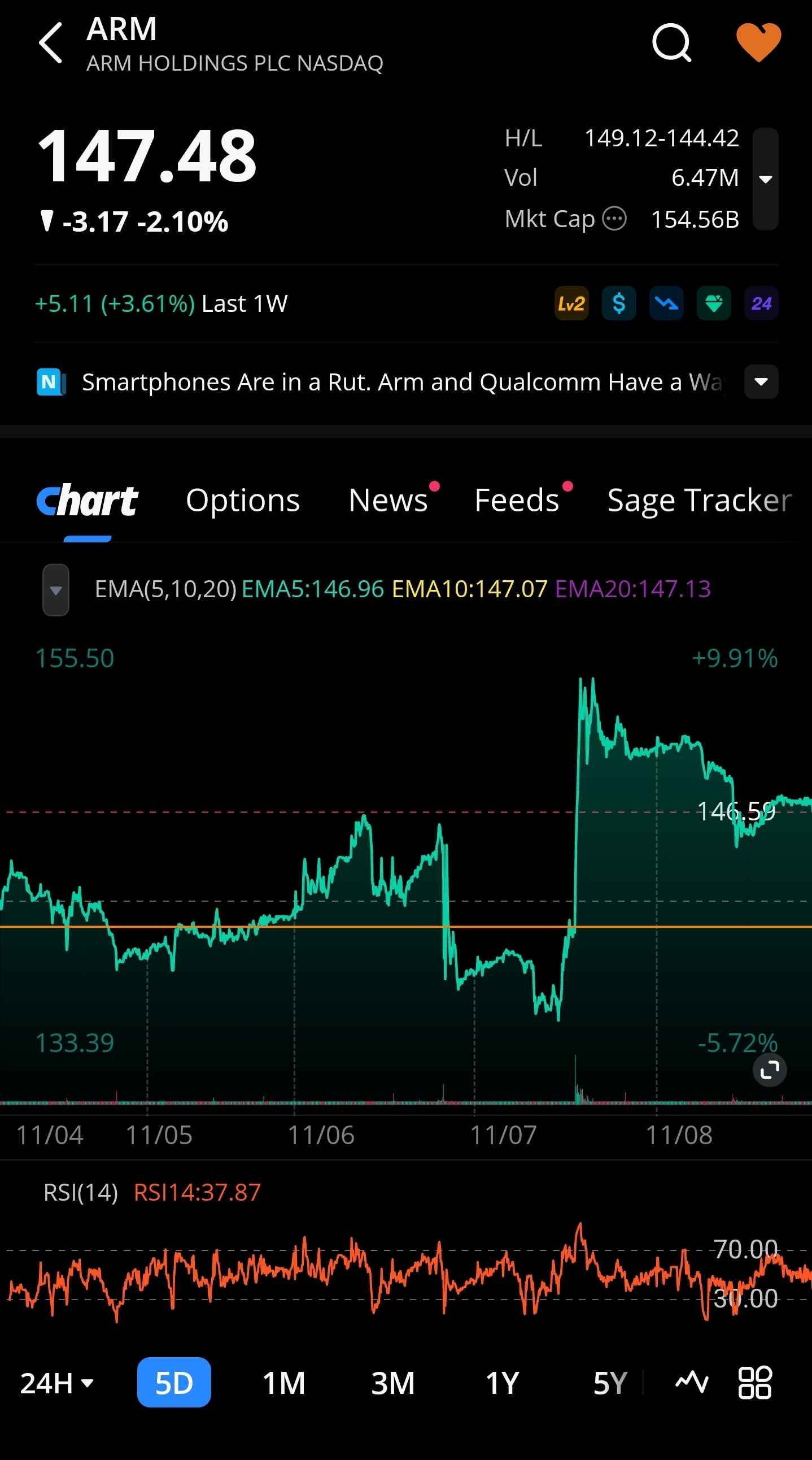

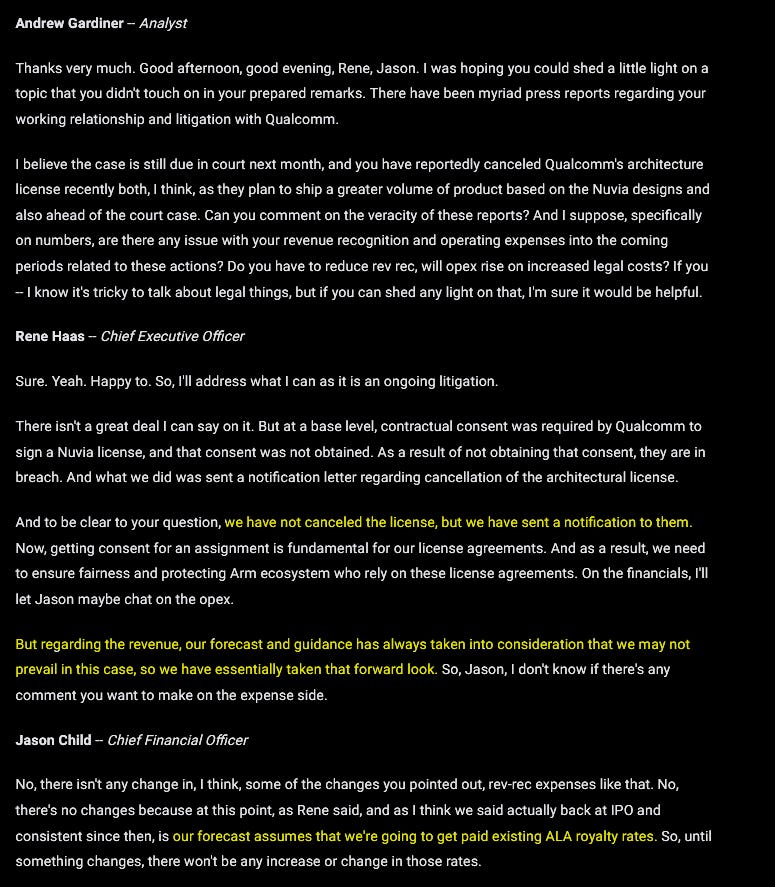

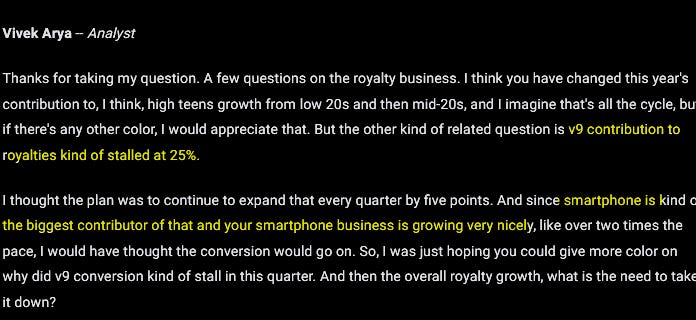

Qualcomm moved from v9 TLA to v8 ALA recently and that his having a massive hit to near-term numbers. Sell-side did not model this headwind correctly, leading to an initial sell-off of the stock.

Very interesting that MTK is using CSS now. It makes a lot of sense as they use all of ARM IP (CPU, GPU, NoC) and only design their own modem and NPU/DSP+ISP.

They neglected to mention Qualcomm regressing from v9 to v8.

Very bullish.

I strongly believe ARM is going to win the lawsuit and force Qualcomm into a much higher royalty rate for v9 ALA. The numbers are assuming v8 ALA. Suspected this but they directly confirmed.

As a long-term investment, I have some doubts. Sending an ALA cancelation notice to Qualcomm was incredibly short-sighted.

But short term… this stock could be a nutty 2-3x in 12-18 months.

CSS and v9 have incredible earnings power torque.

The answer to this question is Qualcomm regressing from v9 TLA to v8 ALA royalty rate. ARM CEO refused to say this. Instead, he gave a long/rambling answer that was mostly useless. Only interesting bit is he appears to have implied that the rate for minor versions (v9.2, v9.3, v9.4, …) are getting hiked now instead of flat rate for all minor revisions in same major revision.

This is bullshit. Apple, Qualcomm, and Huawei will never adopt CSS. Google Pixel is a clown show that is doomed to low single-digit market share due to their own internal issues. Google is also desperately trying to save money on their financial failure of a smartphone program by using garbage Imagination GPU IP.

The customer list for CSS in smartphone is as follows:

MediaTek (confirmed)

Xiaomi (suspected)

Thats it. Calling bullshit on this 50% future CSS smartphone market share claim.

Translation: ARM expects to force Qualcomm to move to v9 ALA at a much higher rate a year from now.

Qualcomm:

This is one of the funniest charts I have seen all year. It is a rare technical pattern I like to call "the Wall Street Middle Finger”.

Had a small 175 strike 08/11 call position that was up 80% and sold all but one contract to take profits. Glad I did lamo. That last contract expired worthless.

Qualcomm smashed numbers but something clearly happened on the earnings call?

The next day, Qualcomm gave up all gains from after-hours and ARM+Intel both went up….

PRC stimulus saved Qualcomm.

Rather unsatisfying answer. ON the other hand, 100-150 bps gross margin degradation seems like noise so this can’t be why the stock tanked in regular trading.

This might be the smoking gun. Finance-land is very suspicious of the timing of all this PRC revenue. Qualcomm CFO clearly stated the timing pull-forward is not because of tariff mindgames… but he did not dispute a pull-forward by Xiaomi/Oppo/Vivo.

Astera Labs:

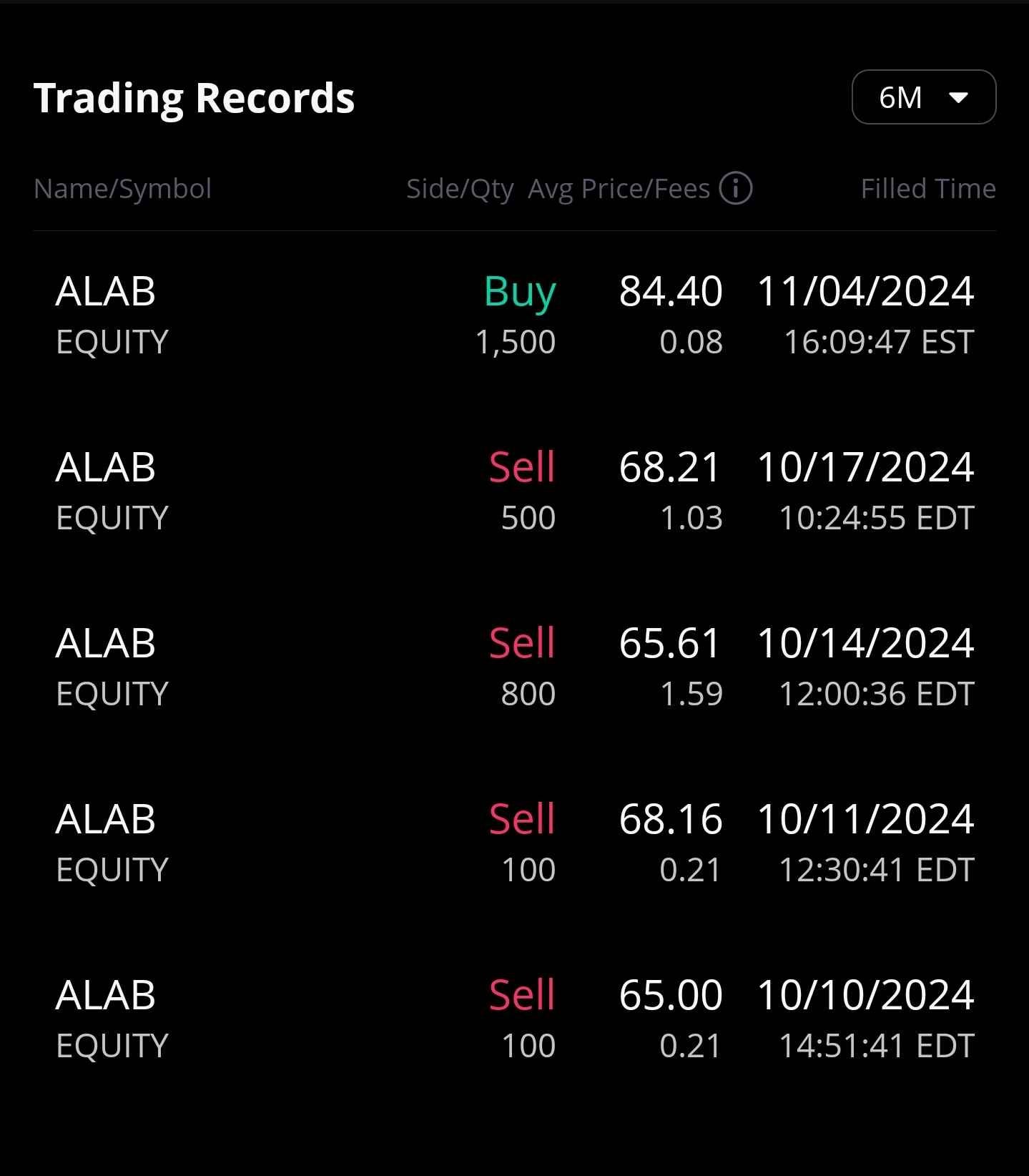

I had a massive short position going into earnings and got rekt.

Here are the full trading records so you can see the stupidity in real time.

Learning from mistakes is important. Here are the two mistakes to my ALAB 0.00%↑ short thesis:

I was not expecting Amazon Trainium 2 ramp (needs PCIe switches and every connection re-timed…) to be this large.

I strongly believed that local storage in AI servers was a waste of money which implies that PCIe switch content in every non-Amazon non-Trainium server would be zero.

Apparently, local PCIe storage is quite popular for ML/AI workloads.

kV cache offload, FSDP-NVMe offload, model weight swapping for inference…

There are several thousand of you here. Mildly annoyed nobody warned me that PCIe switches are quite popular for local server storage.

Still hate the stock. Astera Labs is the Rivian of semiconductors. Fake gross margins from related party revenue via Amazon warrants.

This is a moronic bubble stock. Problem is that the market can stay retarded longer than I can stay solvent.

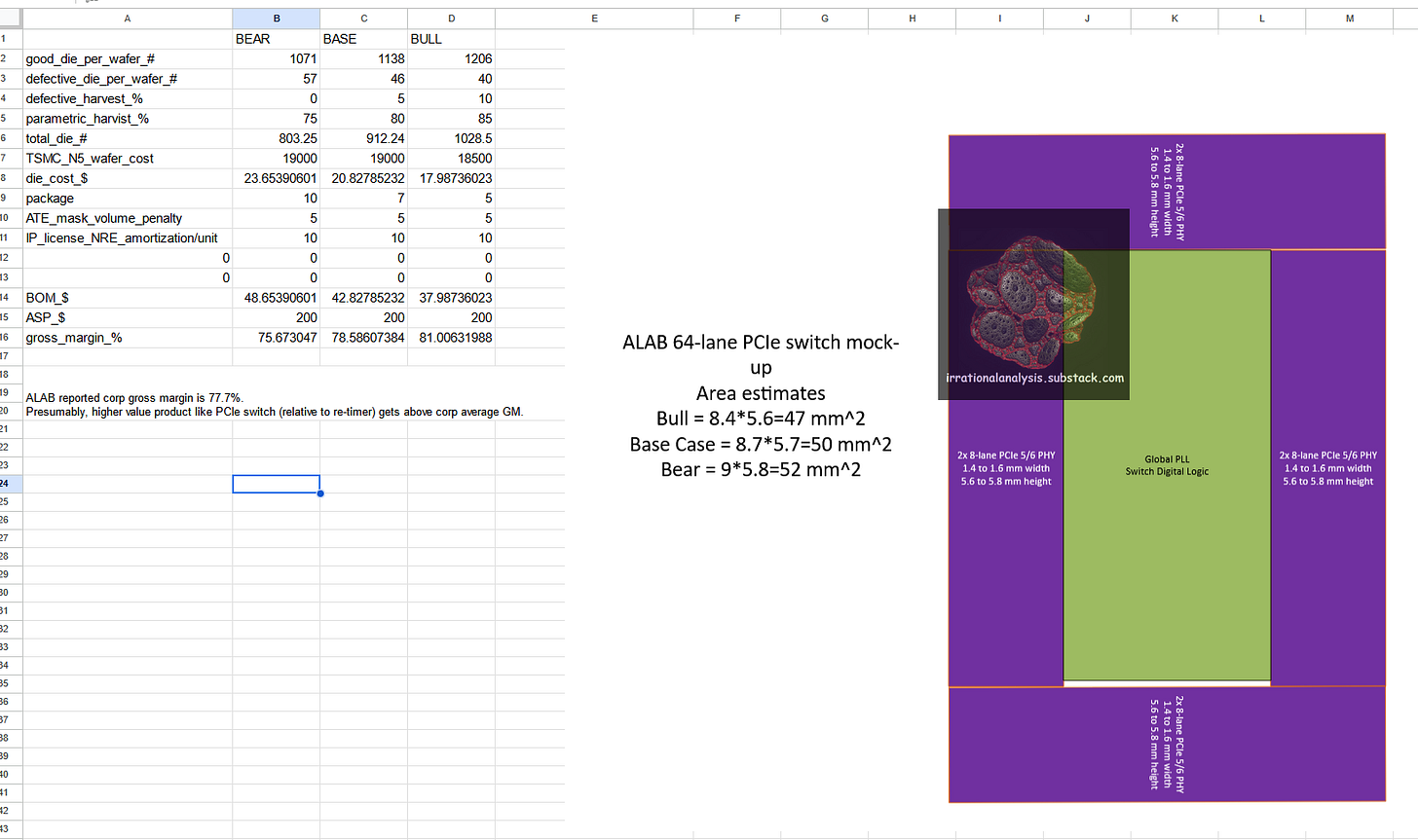

Saw some very high (wrong) ASP estimates for these switches so spent an hour mocking up die size and back-calculating based on gross margins.

Many of these numbers are made up. Feel free to download my low-quality spreadsheet and fiddle with the numbers yourself.

ASP is (in my opinion) between $200 and $350 depending on how many lanes the switch has.

I used public die shots of chips on TSMC N5 process node that had PCIe PHYs on them and built a mock-up in Visio.

Used this die yield calculator: http://cloud.mooreelite.com/tools/die-yield-calculator/index.html

SemiAnalysis recently launched their own that has nicer UI and more options: https://semianalysis.com/die-yield-calculator/

Back-calculating ASP using gross margins, die size, and a basic understanding of semiconductors is not difficult. Stop listening to sell-siders who make up ridiculous ASP “estimates” and do the work.

Fabrinet:

I have traded in and out of Fabrinet several times. They reported good numbers, and the stock tanked briefly for some reason.

The reaction was un-warranted. Some algo pod-brain bullshit must have been going on. Aggressively bought back in via the dip because I am hyper-bullish optics.

My upcoming communication systems post has a section on Fabrinet. This project keeps getting delayed but its gona be so worth the wait.

Wolfspeed:

Sometimes, a chart is so funny that it compels me to cover the stock briefly.

Firing 1/5th of the workforce. Nice.

A significant portion of their balance sheet is going to the employees that get fired. Maybe getting laid off is a blessing in this scenario LOL.

One of their fabs (Durham) is getting completely shut down.

Even after all these drastic actions, the guidance is horrific.

0% non-GAAP gross margins? What the fuck happened here?

IDK why this company is getting CHIPS ACT subsidies. That money should just go to Intel.

Supermicro:

Zooming out…

Supermicro is a “sheet-metal shitco”. Here is the business model and ecosystem.

Gross margins are a reflection of the value a company adds to the product/service. Hardware gross margins of 7-15% are utter garbage.

I am being a bit mean implying these companies only wrap Nvidia GPUs in sheet metal. Obviously, a lot of work goes into power/thermal/serviceability design of these servers. However, the money is not there. All these server OEM and ODM companies are violently destroying each other’s margins and playing the Nvidia GPU allocation game.

Before going over the “business update” transcript from Supermicro, here is some background.

Supermicro was previously de-listed in 2018 for financial non-compliance with Nasdaq exchange listing rules.

They have a long history of very sus behavior. (related party rev, round-tripping, improper early booking, customer stuffing)

The CEO, Charles Liang, has cult-like power and influence.

Rumors in the Bay Area suggest this dude micromanages nearly everything in the company.

Supermicro culture is not good. It’s exactly the kind of culture that looks away at minor fraud (which ballons into bigger problems) in order to please the dear leader.

The most recent auditor (EY) resigned in spectacular fashion.

The question investors need to ask is the following:

Do cults follow [G]enerally [A]ccepted [A]ccounting [P]rinciples?

💩💩💩💩💩💩💩💩💩💩💩💩💩💩💩💩💩💩💩💩💩💩💩💩💩💩💩

Terrible gross margin is deteriorating further.

Supermicro missed on revenue report and guidance for next quarter. Nvidia is obviously throttling supply and sending GPU allocation to other sheet-metal shitcos.

Nvidia does not need Supermicro. There are at least five (5) major replacement companies to ship GPUs to that do not have hilarious legal/compliance risks.

Supermicro needs Nvidia and I see no reason why they won’t get cut off.

More allocation cope.

For Astera, can you explain what is meant by "Fake gross margins from related party revenue via Amazon warrants." I thought they issued warrants to a customer- how would this boost margins?

Supermicro is in a perfect competition with Dell, HP and others. They have no IP or don't add anything valuable - zero competitive position vs peers. I was amazed when it tripled in Q1 and not amazed at its drop since then.