Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

A collection of interesting and noteworthy information from GTC 2025 week.

Softbank Buy Ampere Computing

MediaTek IP Agreement with Nvidia

Nvidia Vera Custom ARM-ISA CPU Core (bad for ARM-LTD)

Cerebras Literal Memecoin

Coreweave IPO Initial Thoughts

S-1 filing of radioactive garbage.

Usable Life: TCO of New Nvidia, Old Nvidia, and ASIC

Google Compiler Team Attrition to Etched

Revolting Micron Chart and Earnings Reaction

SiTime GB300 Content

[1] Softbank Buy Ampere Computing

First, congrats to all the Ampere Computing employees. Your equity should be worthless but you got bailed out at 5-7x.

Now on to the real question.

Why the hell would Softbank/Masa overpay so much for this garbage?

We know from Harlan Sur (JP Morgan) reporting that Softbank has a project “Izanagi” with Broadcom.

Nobody has asked for this pile of advanced-packaged garbage.

Graphcore AI IP (lmao) + Ampere Computing custom v9 CPU cores.

The corporate structure is all you need to know.

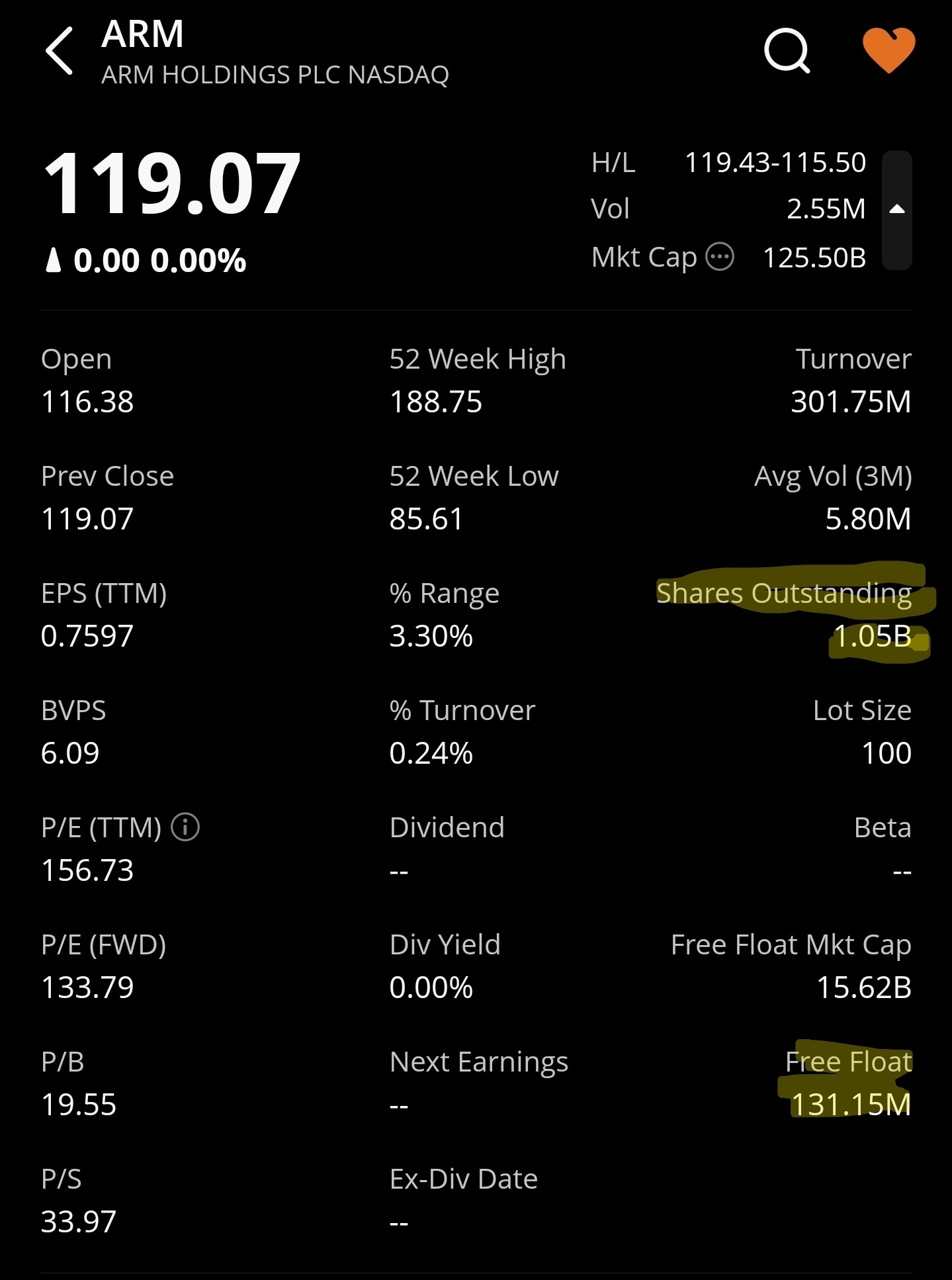

Only a tiny fraction of ARM 0.00%↑ shares are available for trading. The vast majority are still owned by Softbank. This is market distorting. I know several hedge funds who want to short this ticker but are too spinless to follow through. Risk of shorting a stock with such low float is extreme.

Many institutional investors have pinged me about Izanagi. Mostly Broadcom bulls who want this to be some kind of call option.

It literally does not matter if Izanagi is good. Softbank can bury them in the desert like those shitty ET video game cartridges.

The point of Izanagi is to have ARM-LTD recognize v9 royalty revenue and pump the tiny free float.

[2] MediaTek IP Agreement with Nvidia

Multiple Broadcom bulls pinged me on this.

Nobody knows that is going on. Apparently the MediaTek presenter has no idea what IP will actually be available to them. This announcement seems to have come together at the last moment.

This is bad for Broadcom, very bad for Marvell, and somewhat bad for Synopsys/Cadence.

How bad? No idea. Keeping an eye on this.

[3] Nvidia Vera Custom ARM-ISA CPU Core (bad for ARM-LTD)

I want to highlight the deeper themes from this (long-rumored) finally confirmed news.

Remember that “ARM” has many different meanings.

ARM-LTD is the corporation.

ARM-ISA is a licensable “language.”

ARM-RTL aka Neoverse aka Cortex is designs (“a novel”) from ARM-LTD compatible with the ARM-ISA “language”

What you need to know is that all ARM-RTL IP is dogshit.

Apple has been repeatedly humiliating all ARM-RTL IP since the A7, released in 2013.

Qualcomm bought Nuvia (CPU IP startup who is mostly ex-Apple) specifically because ARM-RTL is incompetent.

ARM-RTL low-power (A55, A510, A520) IP is so bad that smartphone SoC manufactures are just underclocking the 700-series IP and getting better perf/watt.

For datacenter, ARM-RTL has put out new “Neoverse” branding. Its all garbage just like the Cortex stuff for mobile.

Some engineering teams are just bad at their jobs.

There are five competent CPU microarchitecture (core design) teams in the world right now (no particular order):

Apple

AMD

Intel

Qualcomm

Tenstorrent

*Rivos is vaporware. I have no info on them.

Nvidia is severely bottlenecked by the trash V2 ARM-RTL CPU cores. I have funny stories to share someday.

Nvidia already was not using the low-quality NoC (network-on-chip) IP from ARM-RTL for Grace and now they have completely designed out all ARM-RTL content in Vera.

Royalty rate is going way down on Vera. This is not good for ARM-LTD at all.

[4] Cerebras Literal Memecoin

I managed to sneak into the Cerebras GTC party. It was great eating free dinner on G42’s dime. The tiny tomato soups with the mini grilled cheese was a nice touch.

Spotted Sean Lie and wanted to ask him about SRAM scaling and waferIO limitations aggressively bottlenecking the uneconomical meme batch-1 inference he has concocted. Unfortunately, the food was great and I ran into some friends. Did not want to get kicked out.

They had literal physical meme coins at the party. It feels like aluminum core with some kind of plating. Surely G42 did not pay for actual gold plate…?

I am going to analyze the materials of this meme coin using a friends equipment at some point. Very busy at the moment. Follow me on X/Twitter to find out the results.

[5] Coreweave IPO Initial Thoughts

LOL

Sidenote: For gambling reasons, I want to try and get $10K worth of allocation. Coreweave is not in WeBull IPO center yet. Might have to deposit some money into Robinhood.

[5.a] S-1 filing of radioactive garbage.

Logically, Microsoft Azure directly competes with Coreweave. Why are they such a large customer.

The answer is two-fold:

OpenAI has been demanding capacity much faster than what Microsoft can build out.

Microsoft datacenter team is incompetent. Fucked up water permits and lots of delays.

Satya Nadella has not been getting along with Sam Altman. He noped out of Stargate and has indicated a desire to spend less and wait for overcapacity to hit the leasing market.

So as an investor you have two options.

Assume Microsoft will logically backstab Coreweave.

Mental gymnastics to convince yourself Coreweave equity is a sane investment.

[5.b] Usable Life: TCO of New Nvidia, Old Nvidia, and ASIC

Mr. Leather Jacket (praise be upon him) said that when Blackwell ramps fully, you (cloud providers) will struggle to give away Hopper GPU hours for free.

He is right.

Also, the bad ASICs (looking at you Trainium 2) are already under extreme financial pressure.

Semianalysis had an excellent piece from ~6 months ago that has legit terrifying data.

https://semianalysis.com/2024/10/03/ai-neocloud-playbook-and-anatomy/

I strongly believe these assumptions are far too optimistic.

Dylan, Doug, Dan, Jeramie, and everyone else who works on the AI Clout TCO model and Datacenter Model products are god-tier. I fully agree with all of their work except the assumptions on usable life of AI GPU.

I have argued with Dylan multiple times on this and his response is basically… “hard enough arguing it’s [usable life] 4 or 5 [years] vs current everyone 6 [years].”

IMO, even 3-years usable (economic… AKA rental price above cost per unit per hour) is optimistic. My base case is 2.5 years with a bear case of 2 year economically usable life.

[6] Google Compiler Team Attrition to Etched

Several very important compiler engineers have recently left Google TPU division for Etched AI.

It is not surprising to hear more top-tier Google engineers leaving. But etched…? I have not taking that one seriously but maybe I should. It would be fun to meet Etched people and learn about the architecture. Several of them are here… subscribed via work emails. Reach out friends. I am much more normal in real life.

[7] Revolting Micron Chart and Earnings Reaction

Margins bad. Rumors of CXMT D5 ramp going well scary. I sold most of my calls at a profit to de-risk. Watching this one closely.

YTD my trading account is down quite a bit but still proud of Micron trading.

We learned nothing new about Micron this week. HBM ramp still slow. Margins shit because of CXMT D5 and other economic pressures.

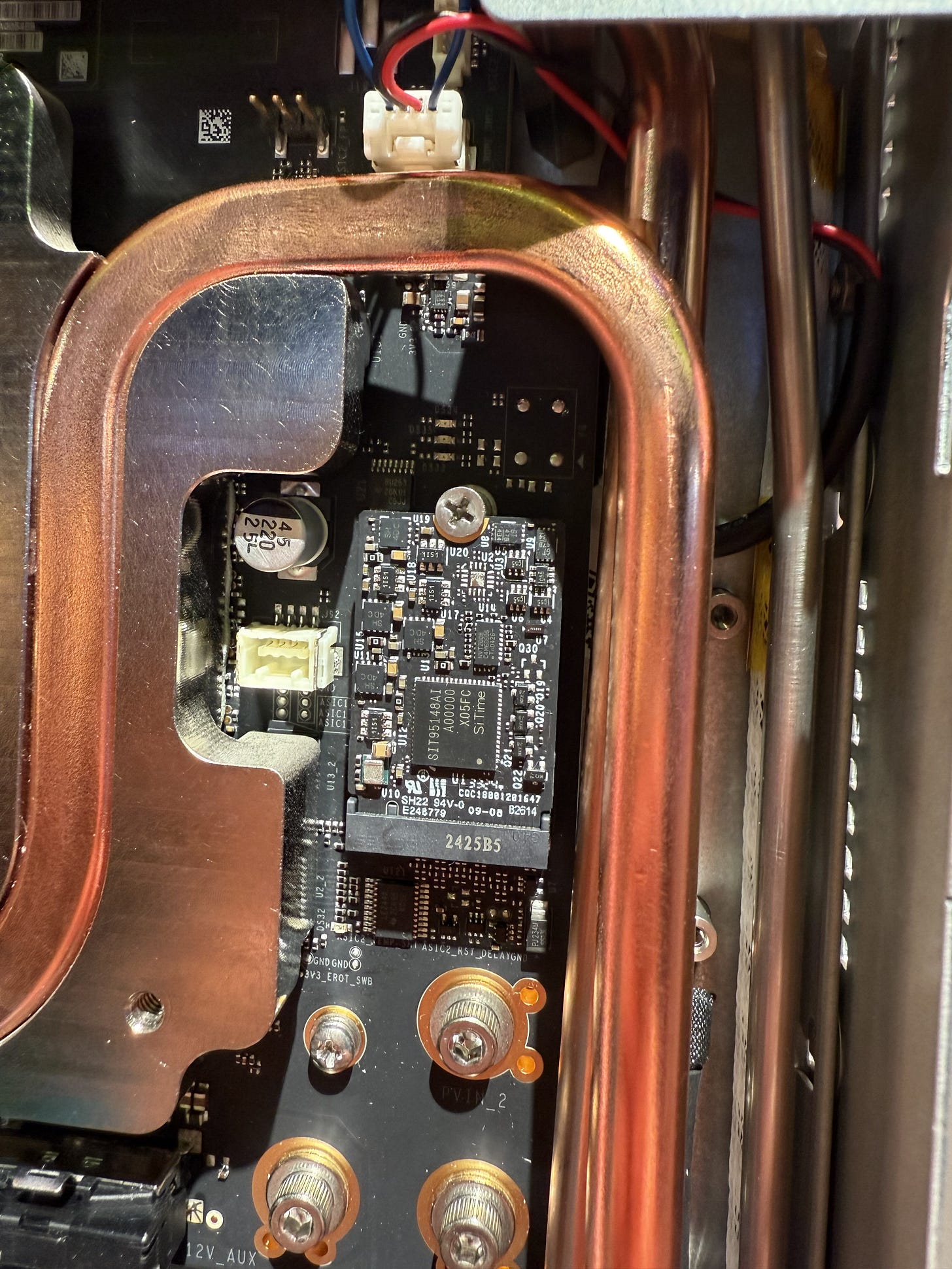

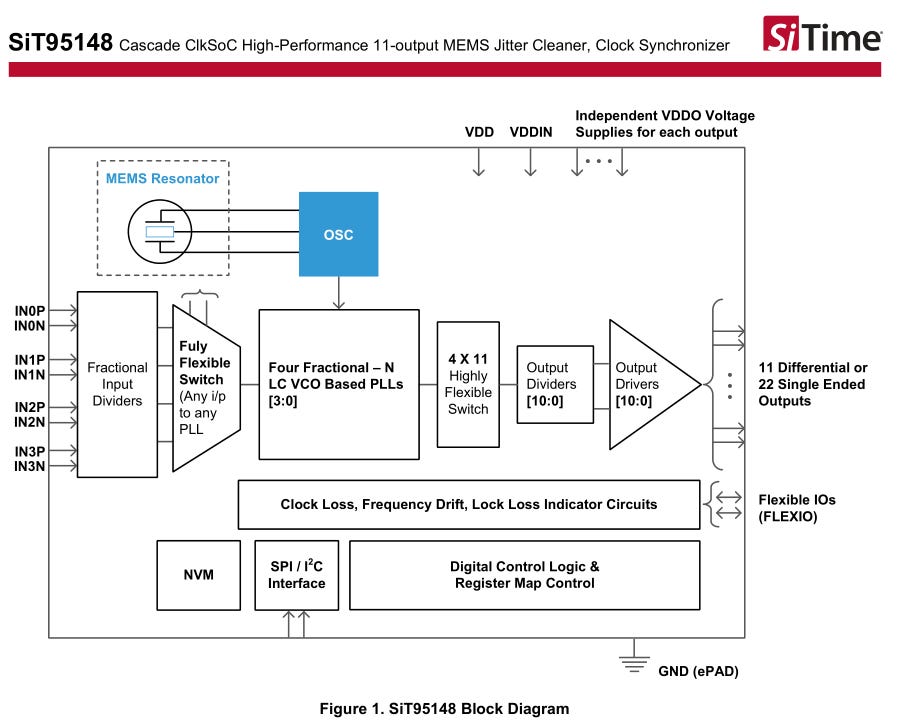

[8] SiTime GB300 Content

Interesting that the timing chip is on a mini M.2 board. Maybe the main PCB did not have enough space to route all the clocks cleanly?

Let’s look at the datasheet

Lots of features. I am curious if Nvidia is using single-ended or differential outputs given how many ports this switch has.

It’s not clear how flexible the switches are. I guess PLLA cannot drive DIVO5?

Hope everyone is doing well out there. I am unfortunately extremely busy.

Maybe old news but this concept was not taught to me on CFA course:-

SoftBank's stake in Arm ~$158 billion

SoftBank's total market value: ~ $77 billion

interesting 👍