[3/14/25 Market Memo] Macro, Mobile, Markets, and Mercy for Intel

Beware the week leading up to the Ides of March...

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Holy crap so much crazy shit happened this week. I have been extremely busy with real-life things. Finally have some free time.

Several disjoint topics to cover today…

Contents:

Low-Quality Macro Thoughts

Teradyne, GloFo, Tower, and Mobile?

Tactical Short Ideas

Credo

Arista Networks

Marvell

Astera Labs (hello darkness my old friend)

Detailed Thoughts on Intel

[1] Low-Quality Macro Thoughts

I am an electrical engineer by training and profession.

In other words, I have no idea what I am talking about when it comes to economics.

But given the annihilation my 2-2.5x levered long trading account experienced due to Tarif man, I have been forced to form a (probably wrong) opinion on macroeconomics.

Let’s start with the fed funds rate for the last 20 years.

Recessions are marked as the light gray highlights.

Interest rates go up to “slow” the economy and combat inflation.

“Slow” means that Lord Powell wants you to lose your job, become miserable, and spend less.

Obviously, Lord Powell (praise be upon him) cannot say this outright.

So we know why interest rates go up. Now… why do interest rates go down?

Shit hits the fan.

Economic disaster.

Pandemic.

War.

Inflation has gone down enough, and the mythical “soft landing” has been achieved.

You see… Lord Powell is a benevolent god. He wants what is best for all of us. Inflation is bad, but so is excessive unemployment.

A “soft landing” is when the Federal Reserve induces enough demand destruction (via encouraged job losses) to reduce inflation but still remains in control.

Over-doing interest rate driven demand destruction leads to a recession. Too much unemployment.

Enter our new friend…

This is not a politics Substack. I don’t care if TARIFF MAN is right or wrong. What matters is what his administration is doing.

They have several clear public objectives:

Reduce the rate of the 10-year Treasury.

Market forces determine yield (interest) from T-Bills.

Crashing the economy into a recession is one way…

Reduce government spending.

Fire Federal employees. (DOGE)

Cut off funds to contractors. (also DOGE, but some congress)

Practically speaking, I agree with objective #2. Frankly, everyone should embrace government efficiency given our serious debt problem. An efficient Government is a good thing!

Sidenote: I am a registered independent who despises both political parties for completely different reasons.

The problem with the Trump Administration is the…. chaos they are injection into the economy. Uncertainty is very bad. Changing trade policy on a daily (and even hourly) basis is retarded.

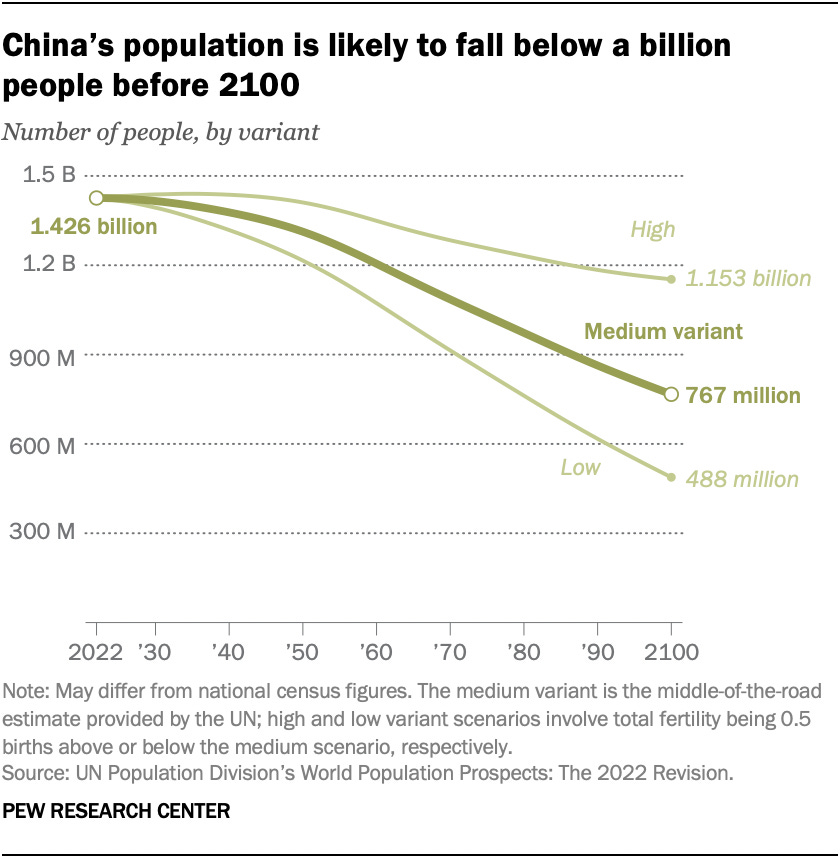

In a way, we (America) are not that different from mainland China.

PRC government lights money on fire, subsidizing endless apartment blocks that nobody wants to live in for a population that is literally about to decline. Massive spend on unproductive infrastructure too.

We Americans pride ourselves on being exceptional. Unlike those filthy commies, we underfund infrastructure until bridges literally collapse due to age.

Excess housing? What a disgusting concept. We use permitting hell to prevent new construction and force our youngest generations to a lifetime of renting with roommates.

But when it comes to fiscal policy, I feel that America and the PRC are quite similar.

Both waste insane amounts of money on unproductive activities.

Apartments… Airports… Bridges…

Bloated Federal Workforce… Contractors… Consultants… Paper Pushers…

In the end, if government spending is not economically productive… does it matter what form the waste manifests itself?

The status quo is unacceptable. Something needs to change, and the Trump administration certainly is change lmao.

Perhaps it does need to get worse before it can get better.

Tread lightly because it’s about to get real spicy.

[2] Teradyne, GloFo, Tower, and Mobile?

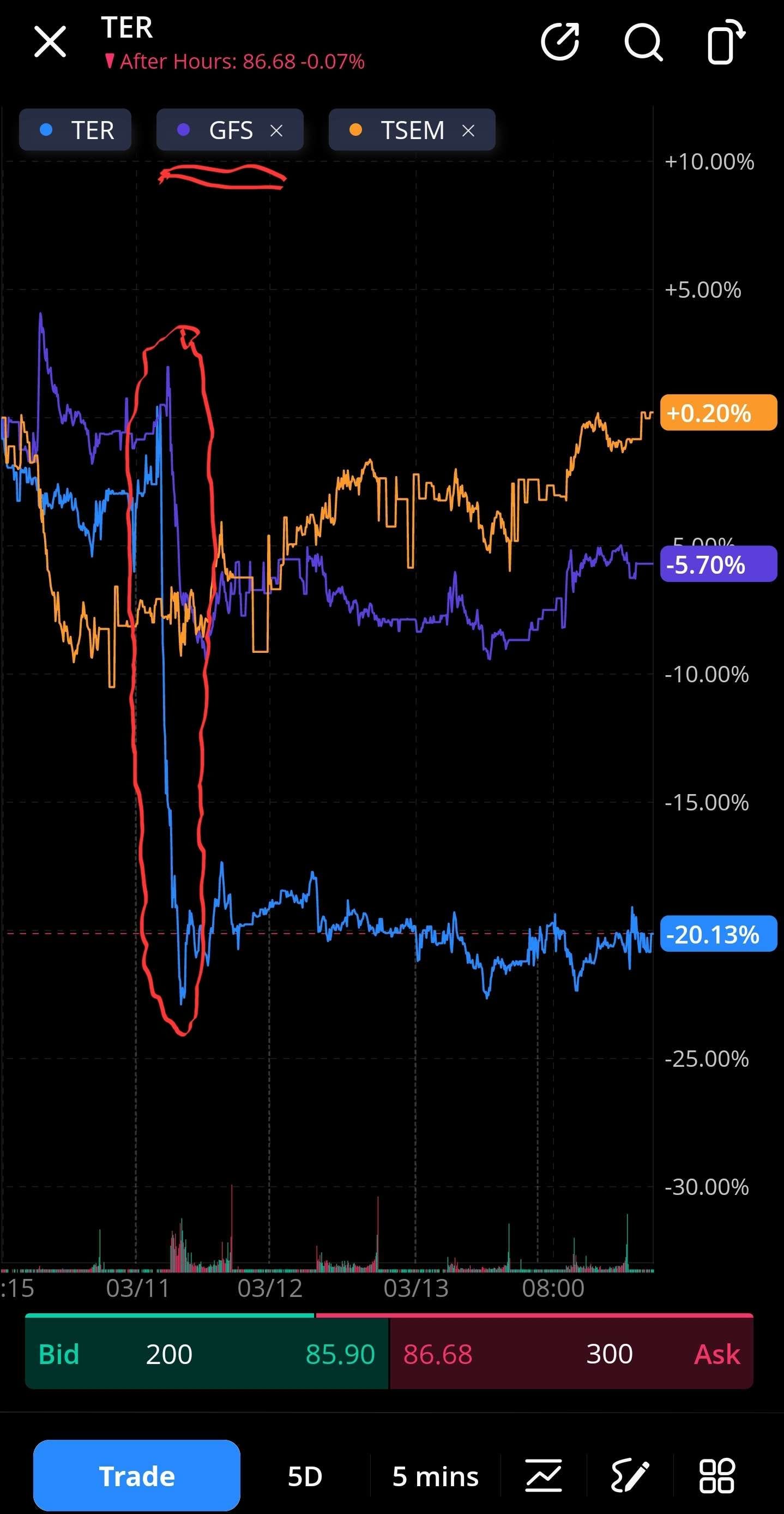

TER 0.00%↑ stock took a massive shit this week.

They held an investor day and all the investors apparently pulled up their Bloomberg terminals and immediately sold.

What got me interested is the wild dispersion between GFS 0.00%↑ and TSEM 0.00%↑ on the same day.

Notice how GloFo stock got annihilated alongside Teradyne while Tower Semi was unphased.

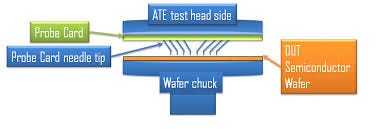

So what does Teradyne do?

They make ATE (automated test equipment). This market is a duopoly between them and Advantest.

ATE is a niche within semiconductor testing.

Packaging is expensive. All packaging… not the fancy advanced CoWoS stuff you have probably heard about.

ATE machines take in wafers, smack them with a giant probe card, and analyze all the chips at once. Bad dice are marked and trashed, never making it to the packaging line.

I have worked with a wide variety of equipment in my career but not ATE yet. It seems like fun puzzle. Probe bandwidth and test time are both very limited. Every single wafer needs to run through the same tests so designing the validation flow to min-max cost, yield, and coverage seems interesting.

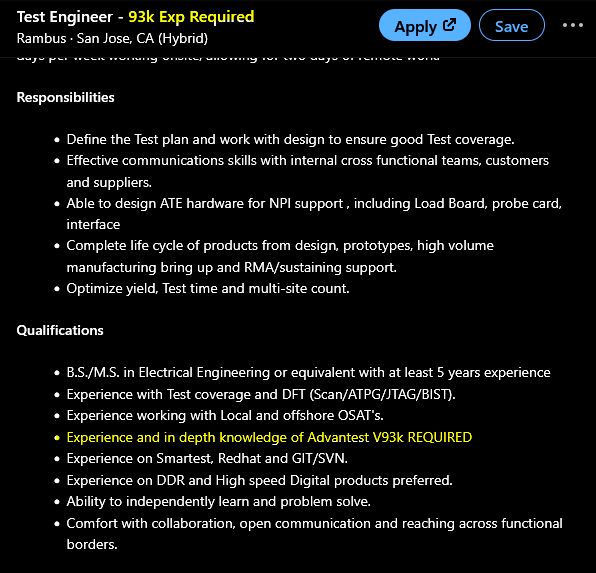

The funny thing is, job reqs for ATE positions tend to be VERY EXPLICATE.

What you need to know is Teradyne sucks at what they do. They are the incompetent member of the duopoly.

Yes, there is end-market concentration in mobile/smartphone SoC.

Blah blah blah.

Teradyne gear is shit. I don’t know why as I have never played with ATE machines before, but this is engineering community consensus.

GloFo and Tower are both exposed to mobile via RFFE. The former is much more exposed. I feel like Teradyne shitting themselves at their own investor day is a bad omen for the mobile market.

Ran this idea by a few professional investor friends and they responded with trash talk directed at Teradyne management.

Some paraphrasing…

Walking investors off a cliff…

No visibility into their customers…

Long-only dumb generalists love to pitch Ter then get chewed up by the market…

Sure, maybe Teradyne management are idiots. The products certainly are no good.

But maybe something more structural is going on with smartphones…

[3] Tactical Short Ideas

Disclosure: At the time of writing, I am short all of the stocks mentioned here. However, I trade in and out of shorts very frequently.

[3.a] Credo

CRDO 0.00%↑ is suing a bunch of copper cable companies for patent infringement.

Amusingly, they chose to announce this lawsuit on the same day that Amazon announced warrant agreements with AAOI 0.00%↑ and FN 0.00%↑.

Given that Amazon purchases of active electrical copper cables represents something crazy (86%?) of Credo’s sales… I can see why they might be nervous.

I have wasted 20 minutes of my time reading the three patents Credo is suing over so you don’t have to.

https://patents.google.com/patent/US10877233B1/en?oq=+10%2c877%2c233

https://patents.google.com/patent/US11012252B2/en?oq=11%2c012%2c252+

https://patents.google.com/patent/US11032111B2/en?oq=+11%2c032%2c111

My understanding of legal matters is nearly zero, but I do have a very good understanding of the engineering.

How to phrase this while avoiding a cease-and-desist letter from the Credo losers…

These three patents are boring.

The sheer “loser-energy” given off by this lawsuit is enough for me to short.

[3.b] Arista Networks

Lots of drama around this name because of supply-chain rumors and Meta roadmap decisions.

In truth, I have never bothered to investigate ANET 0.00%↑ because they just seemed like an inferior version of AVGO 0.00%↑ from an investment perspective.

Given the crazy moves, I have taken a small amount of time to research.

Will give you the conclusion up front…

Arista Networks is a sheet-metal shitco in disguise.

First… what is a sheet-metal shitco?

Definition: A Sheet-metal shitco is a company that adds little value to innovative silicon. Typically survives on a 6-11% gross margin while fighting competitors to the death on price.

Examples:

Dell

Supermicro

Hon-Hai (Foxconn)

Invetech

CLS (the white-box switch division)

Amusingly, ANET 0.00%↑ has a lot in common with these doo-doo tier companies, except gross margins.

So what does Arista do to earn those juicy gross margins?

Software stack for…

Broadcom switching silicon.

Turns out, the big customers (Meta) have realized they are over-paying.

Why not go direct to a sheet-metal shitco, have them make the hardware for ~10% gross margin, and hire your own team to make an internal custom AI switching software stack?

(this is a rhetorical question... Arista is getting rekt by this trend)

There is another trend that is working against Arista.

Every earnings slide deck, they have a “haha Cisco is retarded” plot.

And to an extent, this is true. Cisco has been self-immolating in their CORE BUISNESS for quite some time.

In truth, the trends Arista is so gleeful to highlight have occurred because of the silicon. Broadcom merchant switching chips crushing Cisco internal silicon.

Rumor has it that Cisco is going to have a new silicon platform soon. In the meantime, they somehow managed to sign a deal with Nvidia where Cisco software runs on Nvidia switching hardware.

I have no idea why Nvidia agreed to this but whatever. Good for CSCO 0.00%↑.

Arista has to deal with Nvidia aggressively pushing Spectrum-X via bundling, and now they have a potentially resurgence Cisco to deal with.

[3.c] Marvell

Trainium 2 is having lots of problems.

Backplane yield is rumored to be in the 25% range.

Lots of networking and stability issues.

And the best part is the Anthropic hostages are struggling to write kernels for this VLIW trash. I CALLED THIS.

Rumor is that Amazon is moving volume to Trainium 3 which is done by Alchip.

Thats right. Asia Buyside got it right months before everyone else. Shoutout to

.Right now, the only hope for MRVL 0.00%↑ is for Microsoft (the company with the most incompetent ASIC team and a CEO who is slowing CapEx) to go crazy on Maia 2 in H2 2026.

Given the amount of cope around this name, I think it is a fun short.

Also, the CEO is a fucking humanities major.

Humanities major running a semiconductor company.

[3.d] Astera Labs (hello darkness my old friend)

GTC is going to show off the new Nvidia hardware. I think there will be integrated 48-lane PCIe switches inside the new NICs, fully designing-out the Scorpio bullshit narrative.

Higher share of rack-scale solution volume also harms the re-timer business.

Amazon ramp issues (which destroyed Marvell) did not sufficiently impact Astera Labs. No idea why.

ALAB 0.00%↑ is going to blow up OpEx because they cannot rely on meh off-the-shelf SerDes.

Truely insane valuation.

I wana make back the money I lost shorting this garbage last year.

[4] Detailed Thoughts on Intel

Remember that Lip-Bu Tan (LBP) ragequit from the INTC 0.00%↑ board last year because he thought there was too much retardation.

So the board who disagreed with LBT less than seven months ago has now hired him as CEO.

To those of you who are not within industry, here is some color on Intel…

Widely viewed as the most bloated semiconductor company in existence.

Makes Qualcomm look efficient by comparison.

5x team size…? Try 30x. I am not kidding.

Hiring managers are actively discriminating against current Intel employees.

Logic is that if someone is still there, they either part of the problem or too incompetent to get employment elsewhere.

Multiple hiring managers have told me the quality of candidates from Intel is remarkably low.

I have been privately lobbying every institutional investor I know that the entire management chain (Director and above) at Intel Advanced Packaging department needs to be fired.

No severances. No mercy. National security issue.

Thankfully, LBT is going to make the changes needed.

Another thought is the idiotic super-cope on Flacon Shores and Cougar Shors or whatever the next gen vaporware AI chip is called.

DO NOT WASTE MONEY TAPING OUT FALCON SHORES.

FIRE EVERYONE.

CUT THE ENTIRE dGPU DEPARTMENT.

It is so batshit insane that Intel still thinks they can somehow compete with Nvidia, AMD, and ALL OF THE CUSTOM HYPERSCALER ASIC.

Falcon Shores test chip into a “rack-scale” competitive solution in what… 2028?

The company is on the brink of death.

Hard decisions need to be made.

Cutting the entire dGPU division (gaming, datacenter) is not one of the hard decisions. It is the easiest.

Foundry will survive if CapEx is slashed and 18A is placed on life support for the next 12-18 months.

The PDK is bad. I am tired of fighting Intel shills on Twitter.

No, the mythical 1.0.1 PDK update did not magically fix things.

18A will be a good node… in 12-18 months. There are problems that need to be solved and the smart people at Intel Process Tech are working on it. They need time.

Delusionally screeching that 18A is fine in its current state does not help anyone.

Building trust starts by not spouting bullshit in public when every single person who has seen the PDK knows exactly what is going on.

From an engineering perspective, 18A-P (whatever they call the fixed version of 18A) can easily be superior to TSMC N3P because of backside power delivery.

From an economic perspective, 18A-P can easily be superior to TSMC N2 given the crazy wafer price rumors going around.

I am long the stock. We are on the same side, Intel shill friends.

But building trust is critical if we want IFS to become a real competitor to TSMC in the FOUNDRY ECOSYSTEM.

Honest communication builds trust.

Those on the inside at Intel need to get the memo or face Lip-Bu Tan’s righteous flamethrower.

If I see one more idiotic take about backside-power delivery based on bullshit IEDM papers I am going to lose it.

The real world is much more complicated than the curated toy crap companies show at conferences. 18A in its current state is not anywhere close to better than TSMC N3.

Well, I disagree on the "cutting the GPU.. entirely" part. Here is why:

If the GPU division is definitely bleeding red ink, then yes, amputate ASAP. But, we don't know. They might actually generate positive cash flow.

Battlemage has actually gotten a good reception and uptake. And, their GPUs are produced entirely fabless. So, in many ways, it should be reasonably straightforward for Intel to figure out if the GPU division is currently (!) a drag or a plus for the bottom line. And then, there's this: You can't be in the Notebook/2-in-1 SoC space without a decent iGPU. Not anymore. Object lesson here was Qualcomm's Snapdragon SoC. One major reason for poor reception in the market was (is) the very underwhelming GPU performance. Which was a letdown, as many of us expected their Adreno prowess from their smartphone SoCs to carry over to their notebook SoC - it didn't.

So, you need a decent iGPU with good software support to succeed in the notebook space. Which is a lot more straightforward if that iGPU is derived from a dGPU based on the same architecture. Xe and Xe2 were and are successful as iGPUs. To keep that going, Intel will need a capable GPU team, even if they decide today to exit the dGPU business entirely.

The need to have good iGPU performance in Mobile SoCs will IMHO be even bigger once the first Mediatek/Nvidia SoCs hit that market. Unlike Qualcomm's Snapdragon, that collaboration's SoC will have a capable GPU, with great firmware and driver support from the start.

Where's the proof PDK is still bad?