IMPORTANT:

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice and readers should always do their own research before investing in any security.

What an absolutely crazy week.

Lattice

The CEO noped out a month or so back. Now we know why.

LSCC 0.00%↑ makes low-end FPGAs. Not a good market right now. They have been trying to make a new toolchain and ecosystem because the existing one sucks.

They have failed. New toolchain still sucks.

AMD

I shorted AMD 0.00%↑ a couple weeks ago and made 10% gain. Covered right before earnings based on a gut feeling that dumb people will get hyped by MI300/325X guide. That was a good (or lucky) move on my part.

Re-shorted the stock after earnings.

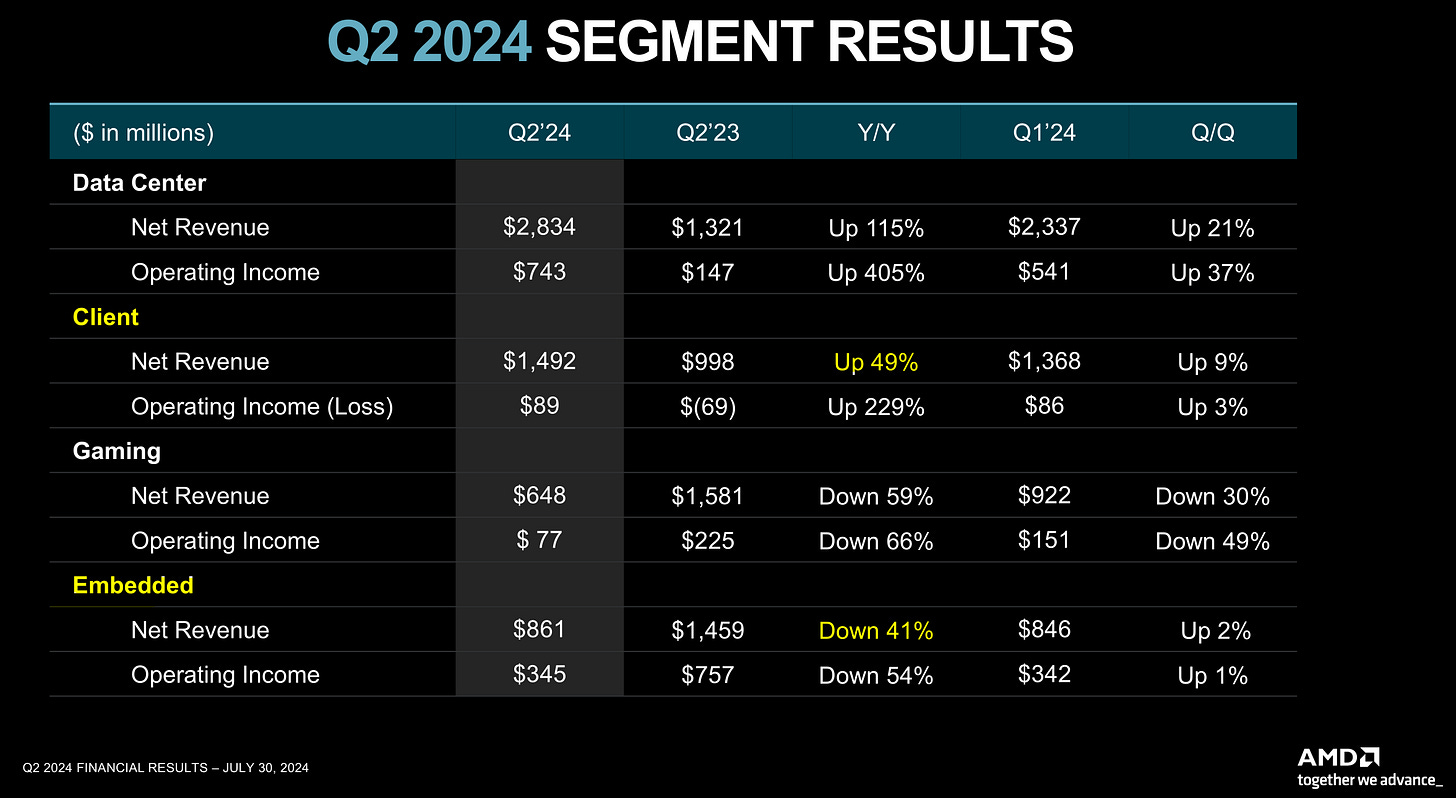

In terms of the stock, nothing matters other than datacenter GPU. All the valuation and price action hinges on this. I remain extremely bearish on AMD datacenter GPU sales. It is my opinion that their sales will implode as soon as Nvidia ramps Blackwell.

When the datacenter GPU story collapses, I will be a buyer of AMD (and not just to cover the short position…) because share gains against INTC 0.00%↑ on client and datacenter CPU remain strong. Embedded (FPGA) will eventually recover and I am a huge fan of Xilinx technology. Xilinx FPGA is the best FPGA.

This is a doge and pump comment by AMD management. The supply chain will be tight in 2025. I wonder who will buy up AMD’s CoWoS allocation once demand for MI300/325 collapses.

ARM

ARM 0.00%↑ got absolutely crushed. 20% drawdown in one day off earnings.

As you can see, the price has reached my orange crayon line. I will be adding to my (small) long position next week. Datacenter story has not changed. Short-term jitters on laptop/PC market penetration (or lack thereof due to Qualcomm’s botched launch) and smartphone volumes is irrelevant to me.

Earnings call transcript was quite boring.

Qualcomm

On the surface, QCOM 0.00%↑ results were great. Stock should be up. It did go up… but plummeted as soon as management started talking, and evading questions.

You can see the algorithms buying the stock off great numbers, followed by humans dumping the stock as Cristiano Aman and Akash Palkhiwala start talking.

Handsets went well. Better than expected. Current smartphone cycle is good. IDC and Counterpoint sell-through data.

Xiaomi and Vivo (Vivo, Oppo and 1+ are all part of BBK Electronics) growth is great for Qualcomm. Handset results were expected to be good and still beat expectations.

Automotive absolutely crushed it. This is not just good organic growth… it is share gains from someone else. #forshadowing

IoT was bad. Qualcomm likes to hide all their junk businesses in this category. Laptop/PC is booked here. Despite the allegedly great launch of X Elite [THE PC REBORN!!!! BRINGING PERFORMANCE LEADERSHIP BACK TO THE WINDOWS ECOSYSTEM!!!!] the numbers simply are not there.

I bought one of these units and reviewed it. Have big plans for later, from x86-ARM emulation analysis to detailed power efficiency measurements.

Based on the stock chart, the earnings themselves don’t matter. To understand what the hell happened, we must read the earnings call transcript.

Analyst: Please give revenue guidance for PC ramp.

CEO: <word salad with misleading cherry-picked info>

Strike #1

Analyst: Please give revenue guidance for PC ramp.

CFO: oh no we don’t have sell-through info so sorry UwU you just gotta wait until the investor day in November haha haha. we did brag incessantly about how “some models” are sold out but wont give you any actual financial metrics

YOU HAVE SELL-THROUGH DATA. THIS IS HOW YOU KNOW “SOME MODELS ARE SOLD OUT”.

YOU ARE THE ONLY CHIP VENDOR FOR WINDOWS ON ARM RIGHT NOW. WINDOWS 11 ARM EDITION ACTIVATIONS INSTNATLY TELL YOU SELL-THROUGH AS CUSTOMERS TURN THIER NEW MACHINES ON AND CONNECT TO THE INTERNET.

YOU HAVE THIS DATA AND REFUSE TO SHARE IT WITH ANALYSTS BECAUSE IT IS BAD.

Strike #2

Analyst: Please give revenue guidance for PC ramp.

CEO: <word salad with misleading cherry-picked info>

Strike #3

Stock go down.

All after-hours gains from positive earnings evaporate in after-hours and then some. -1.5% from regular trading close.

Every investor who bought into QCOM 0.00%↑ on the AI PC narrative listened to this extremely evasive management on the call and decided to liquidate.

Mobileye:

MBLY 0.00%↑ got annihilated and rightfully so.

Mobileye’s story is simple. They are hemorrhaging share to Qualcomm’s superior automotive solutions. Better products gain share.

It’s not going to get better for MBLY 0.00%↑. This is a trap. Do not touch. In fact, I might short this garbage.

Intel

INTC 0.00%↑ is a disaster of apocalyptic proportions. The only good news is they finally suspended the dividend. Should have done this years ago but whatever better late than bankrupt.

“Unmatched AI PC Footprint” == we have the most share to lose

Excluding Telco (the largest, most important market for NEX), NEX is doing well.

Uh… are you running production scale hot lots for Meteor Lake…?

No! No! No!

Intel is hemorrhaging share to AMD. (client and datacenter CPU)

Also losing CPU share to Nvidia Grace.

Also losing share to ARM CSS products for Microsoft (Cobolt) and Google/Marvell (Axion).

Also losing share to Amazon Graviton.

Hell, Intel is losing share to Qualcomm too, but QCOM management is too scared to admit that number is still a rounding error, despite the marketing bravado.

MTL production hot lots…????

This is a spicy question from BoA Analyst. Including this snipped because I think it is hilarious.

Some kind of bookkeeping delta between printing volume products in the research fab vs production fabs. Capex and depreciation rules?

Based on prior commentary, it sounds like they are running mass hot lots. Usually, hot lots are used to speed a small number of wafers through the production process for product development. Directionally, you can think of this as instead of waiting 6 months for a new test chip, only wait 3 months. Pay a lot of money to get this speed.

Running high-volume production in hot lot mode is nuts. Intel must be super desperate to print more Meteor Lake at horrible cost base (and thus gross margin) to mitigate share losses to AMD and Qualcomm. Mostly AMD as Qualcomm is terrified of sharing sell-through and revenue guidance to analysts.

Nvidia and AMD buy HBM memory and apply thier gross margin to it.

They don’t have to re-sell the in-package memory at 0% margin.

🙃

Gelsinger’s vPro comments are a very valid answer. Big moat against AMD and Qualcomm encroachment on enterprise laptops.

I suggest all subscribers who work as financial analysts at hedge funds, investment banks, family offices, …. whatever to look into this “flurry of activity”.

HINT HINT WINK WINK COUGH COUGH

Intel Foundry customers are not reluctant at all to put their name out there. The entire industry wants to see a competent second source to TSMC at the leading edge.

TD Cowen analyst is right in his suspicion that foundry customers may be in a “wait and see” approach.

The existing/announced 18A projects are all low-priority trust exercises. Intel tried to be a foundry back in around 2017-2018 with their 10nm node (since rebranded to Intel 7 after six years of delays and epic failure). It was a disaster. Several projects died because of this.

I am working on a historical piece for Intel from 2014-2024 but dayjob and other projects keep taking up my time. The 2018 fiasco is very important in understanding how folks in the semiconductor industry are behaving with respect to modern Intel Foundry.

I would say “send your thoughts and prayers to Intel” but I don’t think that will make a difference. The die has been cast. Intel is doomed from now to H2 2026 at best. Realistically, the business won’t turn around until high-volume 3rd-party 18A production in 2027.

![[1/3] Dell XPS (TributoQC) 13 Review](https://substackcdn.com/image/fetch/$s_!xPDW!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fb4ecb4fc-5e71-46b2-995b-66adecffbac0_842x614.png)

Regarding your point about Meteor Lake hot lots and expense, they said that they accelerated Intel 3 move to Ireland. But Meteor Lake is on TSMC. And Dave said that the main increased expense was Intel 3 move to Ireland. So how do we square this? Or are you trying to say that these are hot lots for the Server CPUs (which are on Intel 3). Or are you saying they are running Meteor Lake hot lots at TSMC? How much does TSMC even allow hot lots to the detriment of other customers?