2025 Irrational Ideas

Intentionally dangerous investment ideas.

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Bluntly, the three high-quality “relatively safe” semiconductor investments are TSM 0.00%↑ (2330.TW), AVGO 0.00%↑, and NVDA 0.00%↑… in that order.

But… you don’t crush the market by sticking with safe, obvious ideas.

Note: Full portfolio update will be published on the last trading day of 2024. (December 31st after market close).

Contents:

THE GREAT HBM TRADE

High Bandwidth Memory (HBM) Basics

History of HBM

Samsung Electronics Corporate Structure (important!)

Samsung DS-Memory Failure Timeline

Theoretical Example and Practical Consequences

Contract Theory

The Trade

Photonics Fabs: Tower Semi and GloFo

Marvell, Alchip, Taiwan Rumors, and you…

Astera Labs (sigh)

Credo

Coherent

SiTime Reiteration and Upgrade

MediaTek TPU Opportunity

Executive Summary of Opinions

[1] THE GREAT HBM TRADE

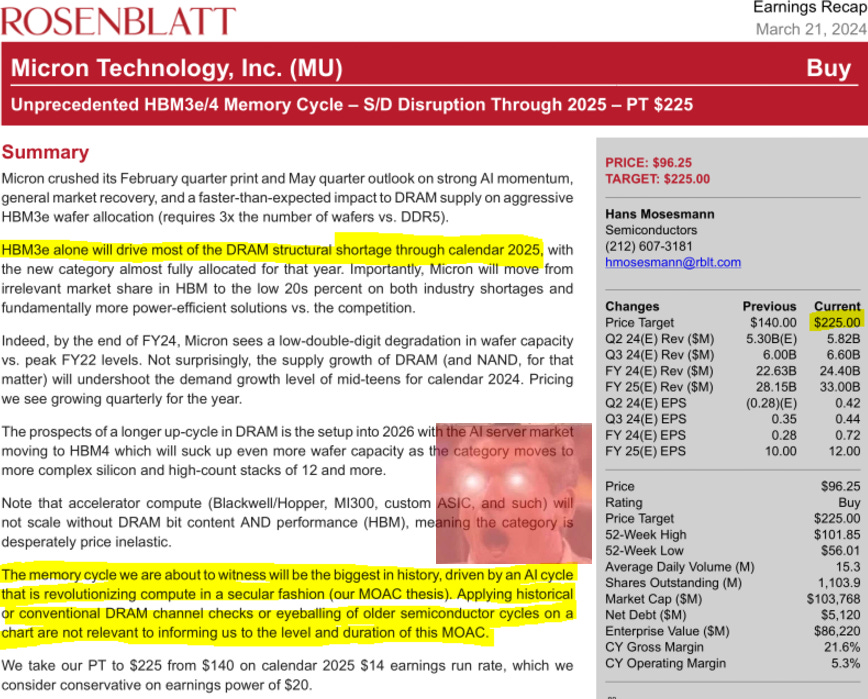

On March 21st, 2024, Hans Mosesmann of Rosenblatt Securities put out a hilarious Micron note with $225/share price target. (1-year PT so March 2025)

It’s safe to say he botched the timing.

Here is a snippet from the note.

Throughout most of 2024, I have been relentlessly trash talking this note every time someone privately asked me about Micron.

The crazy thing is…. I now think Mosesmann is right. He was just early.

What follows in this section is my worst, most dangerous, most insane investment idea to-date. If you don’t have at least two years of options trading experience, this one is not for you!

The Great HBM Trade!

Note: I have trimmed this section to the bare minimum. This means that everything still here is important. Please do not skip anything.

[1.a] High Bandwidth Memory (HBM) Basics

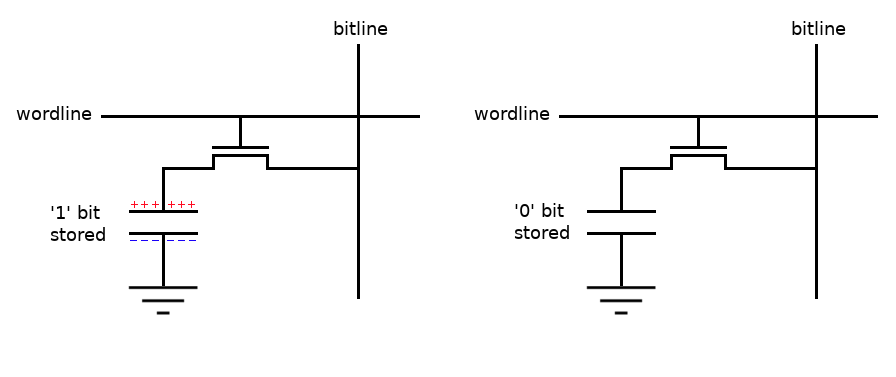

Before talking about HBM, let’s get acquainted with regular DRAM.

DRAM storges data using a capacitor and a transistor.

Organize the bits into cells and you can build larger structures.

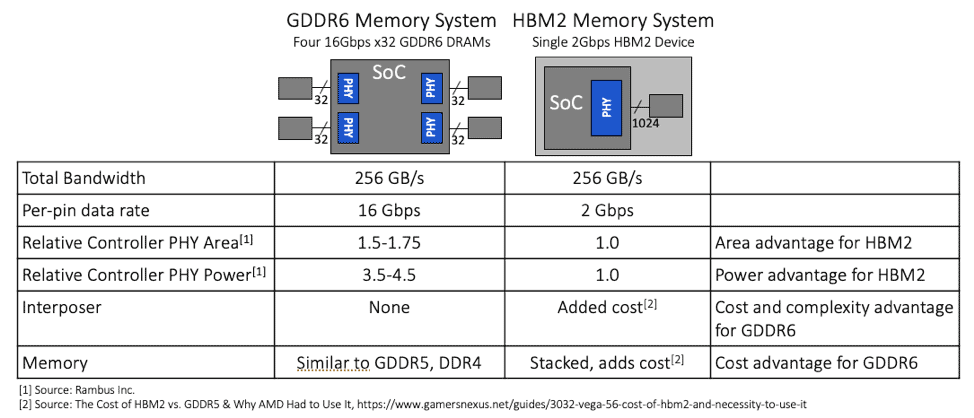

There are a variety of DRAM flavors, but only HBM (the most expensive) is special.

HBM DRAM is way better than regular DRAM.

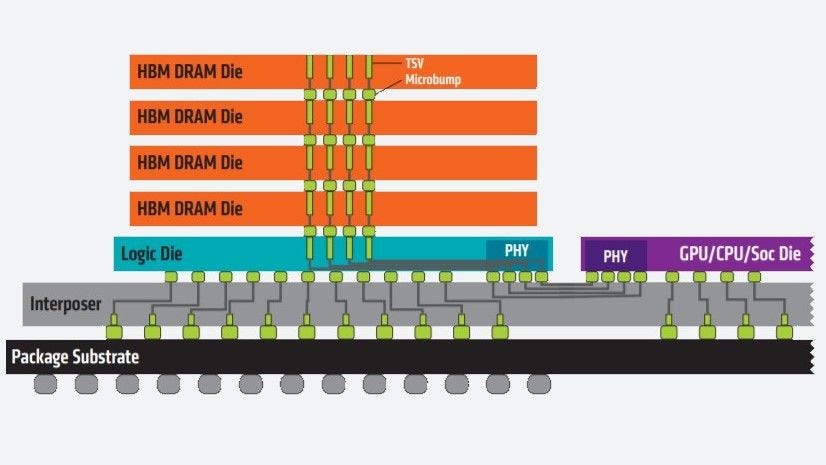

Because it is stacked using Through-Silicon Vias (TSVs).

Practically, you only need to understand two concepts:

Why is HBM more expensive than regular DRAM?

Why is HBM more difficult to make compared to regular DRAM?

You may have heard of the “HBM trade ratio”.

Those TSVs take up more die space. There are also yield losses when stacking the HBM chips for micro-bump packaging.

This results in a capacity trade. DRAM manufacturers can either make ~3X bits worth of DDR5 or 1X bits worth of HBM3E.

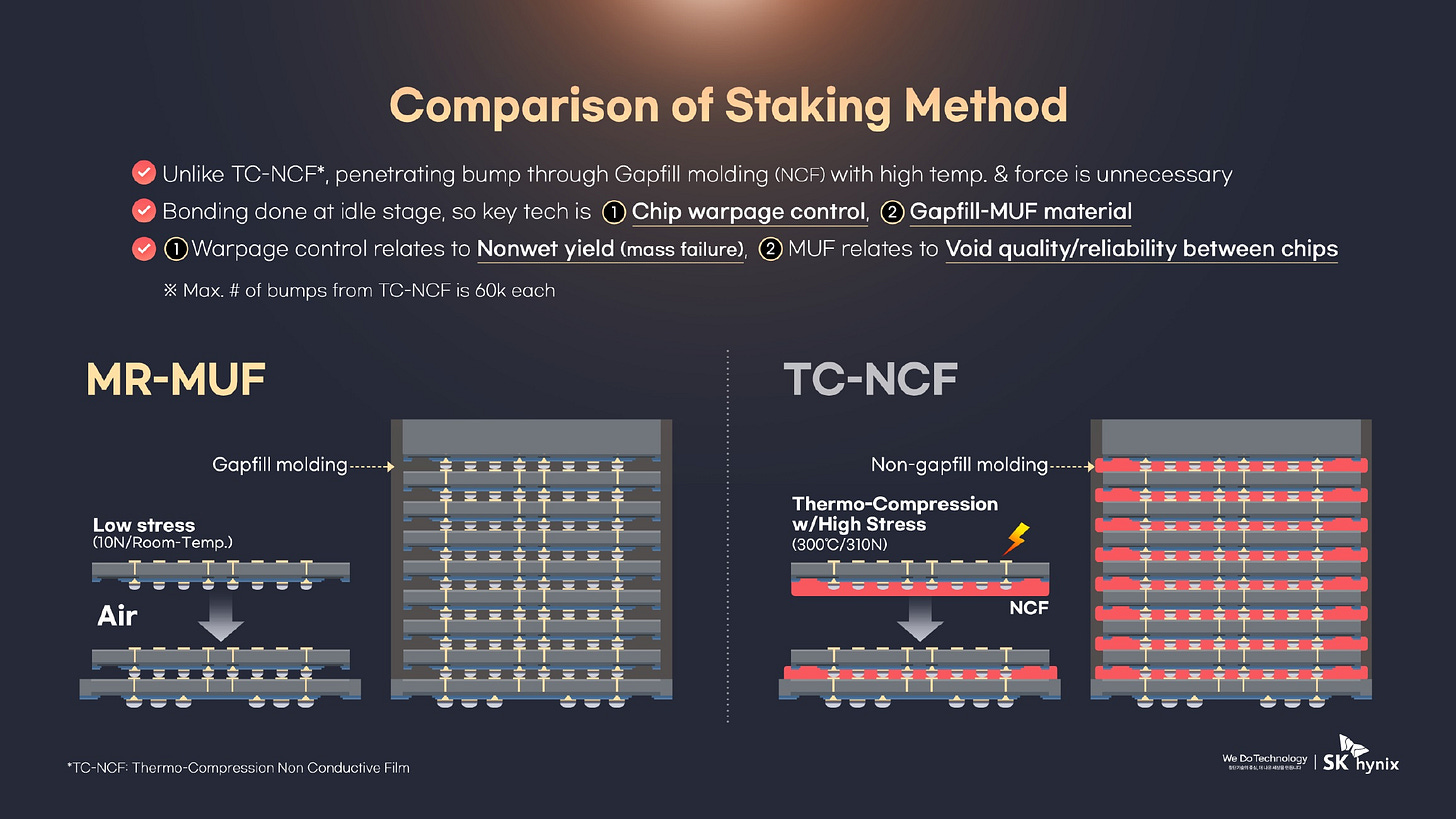

SK Hynix uses MR-MUF packaging while both Samsung DS-Memory and Micron use TC-NCF.

Key Points:

HBM is much more expensive than regular DRAM.

HBM is critical for almost every AI GPU/XPU/ASIC due to much better performance and density.

TSVs and die stacking result in a ~3X wafer intensity.

Stacking die via micro-bumps is very difficult.

Advanced packaging is the bottleneck in HBM production capacity.

[1.b] History of HBM

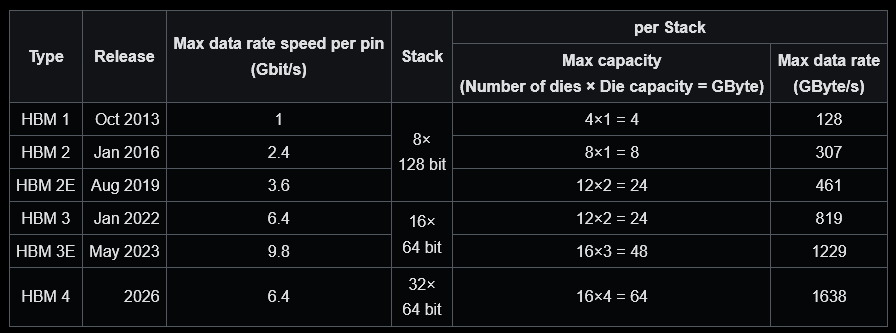

In general, each new generation of HBM introduces one or more of the following:

More/taller stacks. (4-hi, 8-hi, 12-hi, …)

Faster IO speed.

Wider channel width.

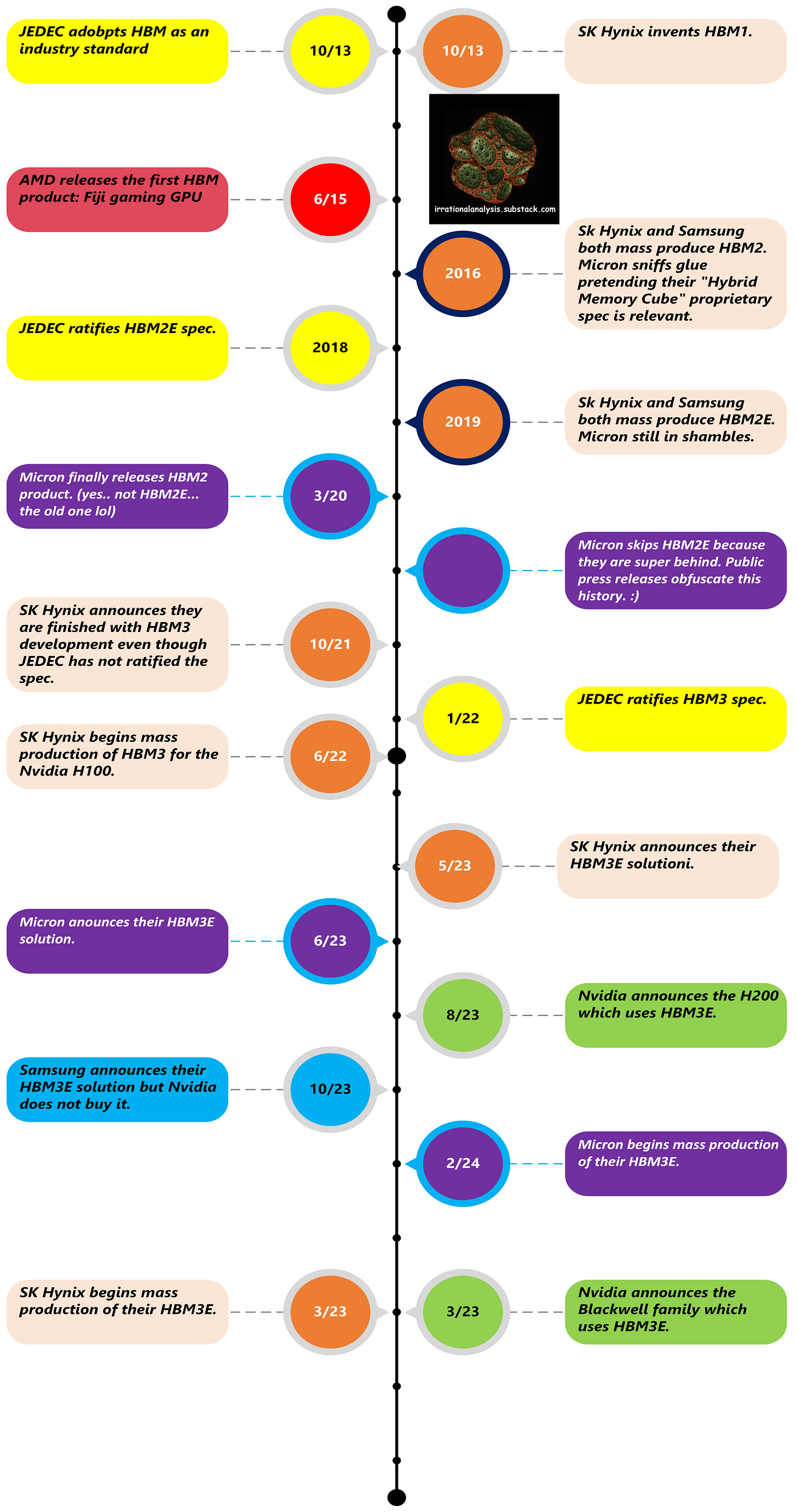

Fundamentally, the engineering challenges tend to be similar from generation to generation. Some companies have skipped a generation or two because they were behind. Existing market demand was supplied by leaders such as SK Hynix.

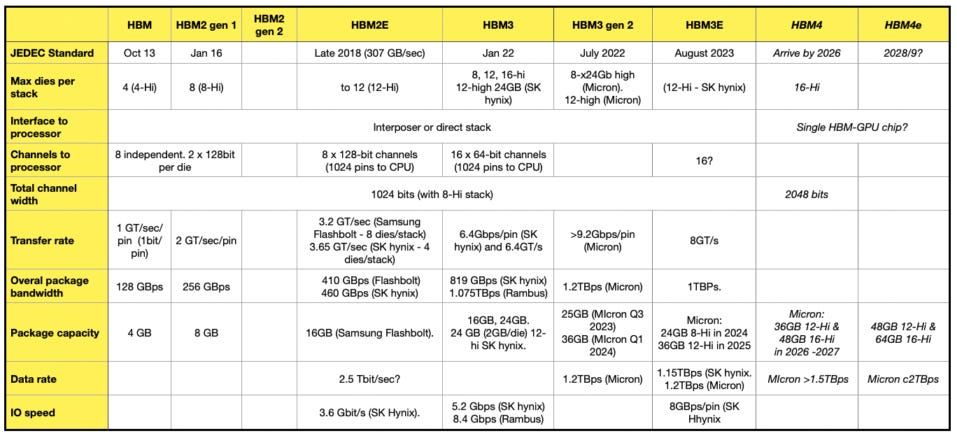

Here is a timeline that may be helpful.

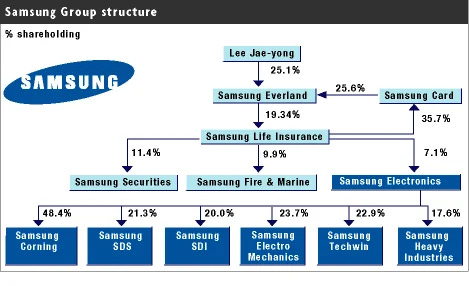

[1.c] Samsung Electronics Corporate Structure (important!)

Samsung is a very large mega-corporation with a complex structure.

We don’t care about any of this shit. Only “Samsung” that matters for this HBM play is Samsung Electronics (005930.KS).

Samsung Electronics is the company people most associate with “Samsung stock”.

This company has its own internal structure that is critical in understanding what has been going on.

Samsung Electronics DX (Device Experiences) makes the regular products you are familiar with. Smartphones for example. My personal smartphone is a Samsung Galaxy S23 ultra. I like it very much. Use the stylus to scribble on stock charts all the time.

Samsung Electronics DS (Device Solutions) has three divisions. All three are dumpster fires right now. To understand why DS is so fucked up, let’s take a look at a Korean journalist’s video.

This dude interviewed 31 current Samsung Electronics DS employees across a wide range of experience levels and backgrounds.

100% of people said Samsung DS is in crisis right now.

Executives rushing to meet short-term performance goals while sacrificing product quality.

Things are so bad, entire departments at Samsung DS are applying to jobs at SK Hynix!

Nobody wants to work at Samsung DS anymore, except for the incompetent executives who created this mess.

What matters for HBM is Samsung Electronics DS, Memory Division. Going forward, I will use Samsung DS-Memory to refer to this specific dumpster fire within Samsung Electronics.

[1.d] Samsung DS-Memory Failure Timeline

Nvidia is desperate for a third supplier of HBM3E to keep prices down.

Samsung DS-Memory has failed Nvidia qualification multiple times in 2024.

[1.e] Theoretical Example and Practical Consequences

Here is something I think everyone has missed. Nobody is talking about this in the correct manner.

Samsung DS-Memory HBM3E is used in AMD MI300/325X and Marvell/Amazon Trainium 2.

How can the same HBM3E chips fail Nvidia qualification over and over again but be used in other products?

The answer is quite simple if you have a basic understanding of semiconductor tuning.

Clock speed is an economic choice.

If you plot chip speed (frequency) against voltage, there will typically be a linear region followed by logarithmic/asymptotic region.

There will be inherent variation across chips so design companies typically pick a “base clock” and use dynamic voltage frequency scaling algorithms (DVFS) to min-max clock speed depending on the workload.

The top 5% of chips might be able to hit a 10% higher clock speed at the same voltage but limiting sales to only 5% of production, AKA 5% yield, would be economically disastrous.

Suppose you (yes you) have some AI GPU/XPU/ASIC and are in need of HBM.

Based on simulations and sample chips from TSMC, you expect 70% of your chips to meet the target frequency at a total power draw of 450W.

You come to me, Irrational Memory, for HBM.

I tell you that my HBM will need 50W of power. Thus, you design a PCB and thermal solution intended for a total system power draw of 50+450=500Watts.

You take some sample HBM units from Irrational Memory and build a few test boards. Design the VRM and PCB around the specifications I told you.

It turns out, I lied to you.

Irrational Memory HBM chips do not draw a typical 50W of power. Those samples I sent to you were cherry-picked. The silicon characterization report had fabricated data.

In reality, Irrational Memory HBM draws 75-100W of power. Not only is the typical power higher, but the chip-to-chip variation is also higher.

You now have three options:

Refuse to use Irrational Memory HBM.

Lower the clock speed of your logic chip by 15-30%, dramatically harming performance.

If you are multi-sourcing HBM, the SKU stack must be expanded.

Alternatively, a lower tier of product destined for PRC (already performance limited via e-fuse) gets my low-quality HBM.

Limit your logic chip yield to the top 20% of chips instead of the planned 70% of production, killing economics and yield.

In general, there is a self-imposed norm within the semiconductor industry.

Do not lie to customers. It’s bad for business.

It is actually quite easy for individual engineers to cherry-pick/alter/mis-represent/fabricate silicon data.

Alternatively, managers can edit reports before sending them out to customers. The engineers who did the work would never know. Customers are sent the top 5% of chips as initial samples which are not representative of power/performance.

There are no external checks/balances. People involved generally understand basic ethics and that they will be fired 2-4 months later when the customer comes back and asks why their numbers are so different. Why their yields are so bad.

[1.f] Contract Theory

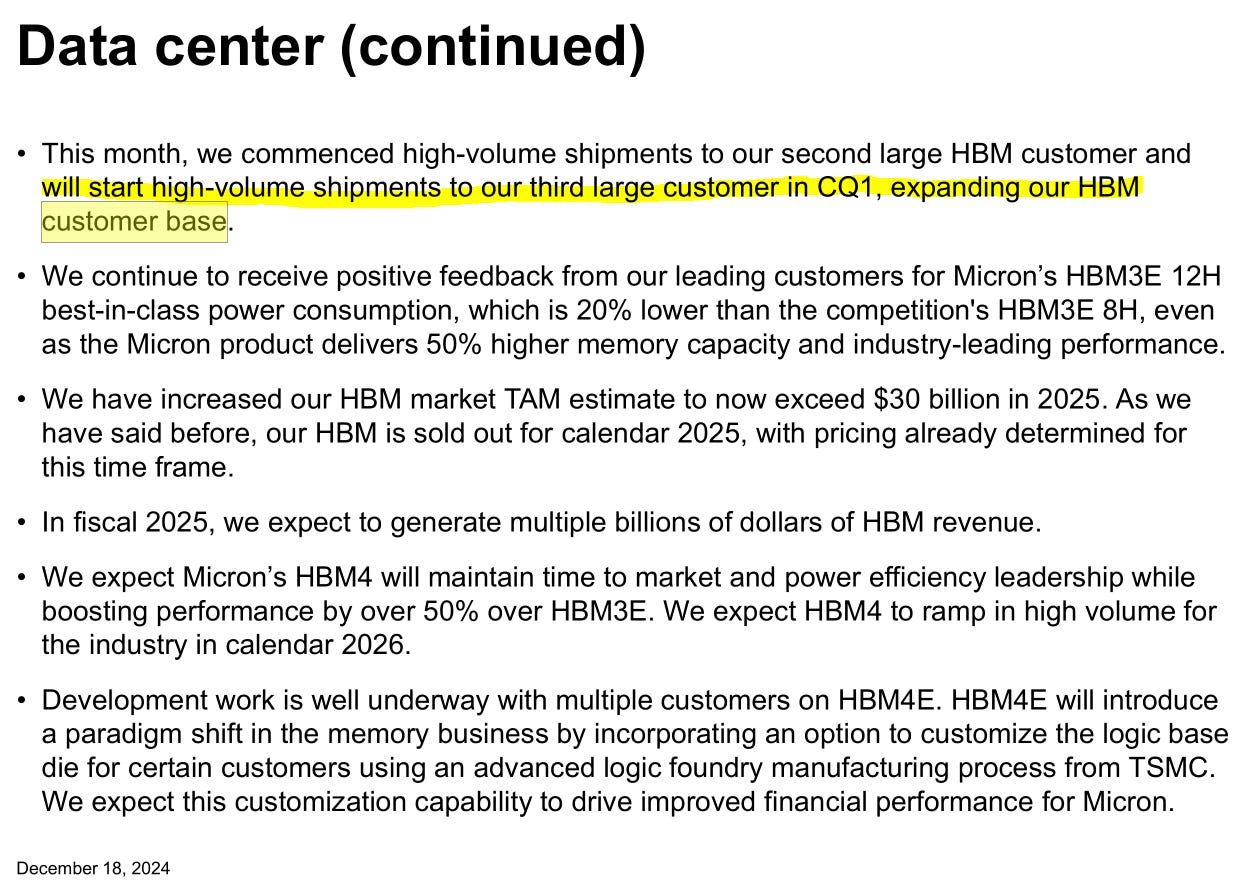

Micron has repeatedly said they sold all their HBM at fixed-price contracts for 2025. All the hopes of ASP increases keep getting dashed.

Looks like Trainium 2.5 is getting Micron supply. Vast majority of the volume is sold to Nvidia though.

But… how do these contracts work? Difficult to say as these are all secret.

Let’s take a guess though.

At the time of signing the contract (H1 2024?) Micron thought it could produce X bits of HBM3E for Nvidia in CY25.

But what if supply increases?

Yields could improve faster than expected.

Advanced packaging tools can come online faster.

In that case, what happens to ASP? Presumably, the price of Micron HBM goes to a floating rate. Market forces would bid up the price.

Nvidia would be willing to pay a higher price to deny supply to the competing hyperscaler ASICs (sorry AMD, you just not relevant competition lol).

I had a paragraph on how higher HBM prices could harm Nvidia gross margins but Semianalysis had an excellent post on how Nvidia has brilliantly unloaded 12-hi HBM COGS burden upon customers.

Other HBM customers would also be willing to pay a higher price for premium (SK Hynix, Micron) HBM due to lower power draw.

[1.g] The Trade

Let’s take a look at the book-value per share of the three HBM vendors.

Samsung Electronics stock is at a P/B bellow 1. For the readers not familiar with finance stuff, this means the free market thinks Samsung Electronics is worse than worthless.

P/B of 1 means the stock is worth the theoretical liquidation value of all assets.

P/B less than 1 means the business is on fire and disintegrating. Intel stock is also at “oh my god the company is dying” P/B.

What makes Samsung Electronics so entertaining is that short selling is literally illegal in South Korea. Intel stock is pushed down somewhat by short sellers.

There are only two factors that matter for this trade/thesis:

Samsung DS-Memory will continue to be incompetent.

CXMT will only partially destroy the regular DDR5/LPDDR5 (D5) market.

I am 99% confident in factor #1 holding. Present day Samsung DS (all three departments lol) is at a WORSE level of failure than 2016-2021 Intel. Look at what is happening to Intel right now. It’s not going to get better.

At the time of publishing, I do not believe the market has priced in CXMT D5 impact. All the memory stocks are probably going to get hit by 10-15% sometime in H1.

Micron talked down CXMT in the last earnings call. They tried to pretend the problem is only D4 and “low-end” which is 10% of revenue.

Every non-HBM memory market is a commodity. CXMT has the power to singlehandedly cause a down-cycle.

Many finance-land people (sell-side in particular) keep talking about HBM trade ratio causing a structural under-supply situation for D5. Get this hopium shit out of your models. CXMT has killed this ASP growth vector.

CXMT terrifies me. I have a small MU 0.00%↑ call-option position but too scared to make in serious size. Waiting for the market to converge with reality.

Also, I will not be disclosing strike price or expiration dates for my Micron options. These are thinly traded, and it is ethically questionable to share given the risk of subscribers piling into such illiquid options. I have picked deep OTM and far out expiration. Refuse to say more.

Key Points:

For the upside, only HBM matters. Everything else is noise.

CXMT D5 ramp is going to cancel out “HBM trade ratio” hope.

This is the best-case scenario.

I think D5 prices will go down meaningfully in H1.

REMOVE THIS HOPIUM FROM ALL MODELS.

As an American retail trader, I do not have access to South Korean equities.

Institutions who think Samsung Memory-DS will get it together… invert me. Go long 005930.KS and short Micron. I dare you.

Institutions might want to short MU 0.00%↑ and long 000660.KS based on P/B and valuation.

The entire Micron bull-case overlaps with SK Hynix. Professional investors need to make an informed decision on SK vs MU. I do not.

[2] Photonics Fabs: Tower Semi and GloFo

Given how hyper-bullish I am on optics, it makes sense to allocate some capital to a photonics Fab. There are two options: GFS 0.00%↑ and TSEM 0.00%↑

First, why not TSMC or Intel Foundry?

TSMC has a photonic process that is bad. Almost nobody uses it.

Intel Foundry is rumored to have a competitive photonic process node but is literally dying and about to get devoured by private equity vultures. The photonics group will be one of the first teams fired/amputated.

Second, why are photonic process nodes different? The answer (oversimplified) is lasers. Printing lasers on regular CMOS process nodes sucks. Read this excellent post by Vikram Sekar to understand why.

I have struggled to find meaningful differences between GloFo and Tower.

GloFo has a past history of pissing off customers by enforcing wafer-purchase agreements. Stuffing customers.

That alone is a black mark and enough for me to bias in favor of Tower Semiconductor.

[3] Marvell, Alchip, Taiwan Rumors, and you…

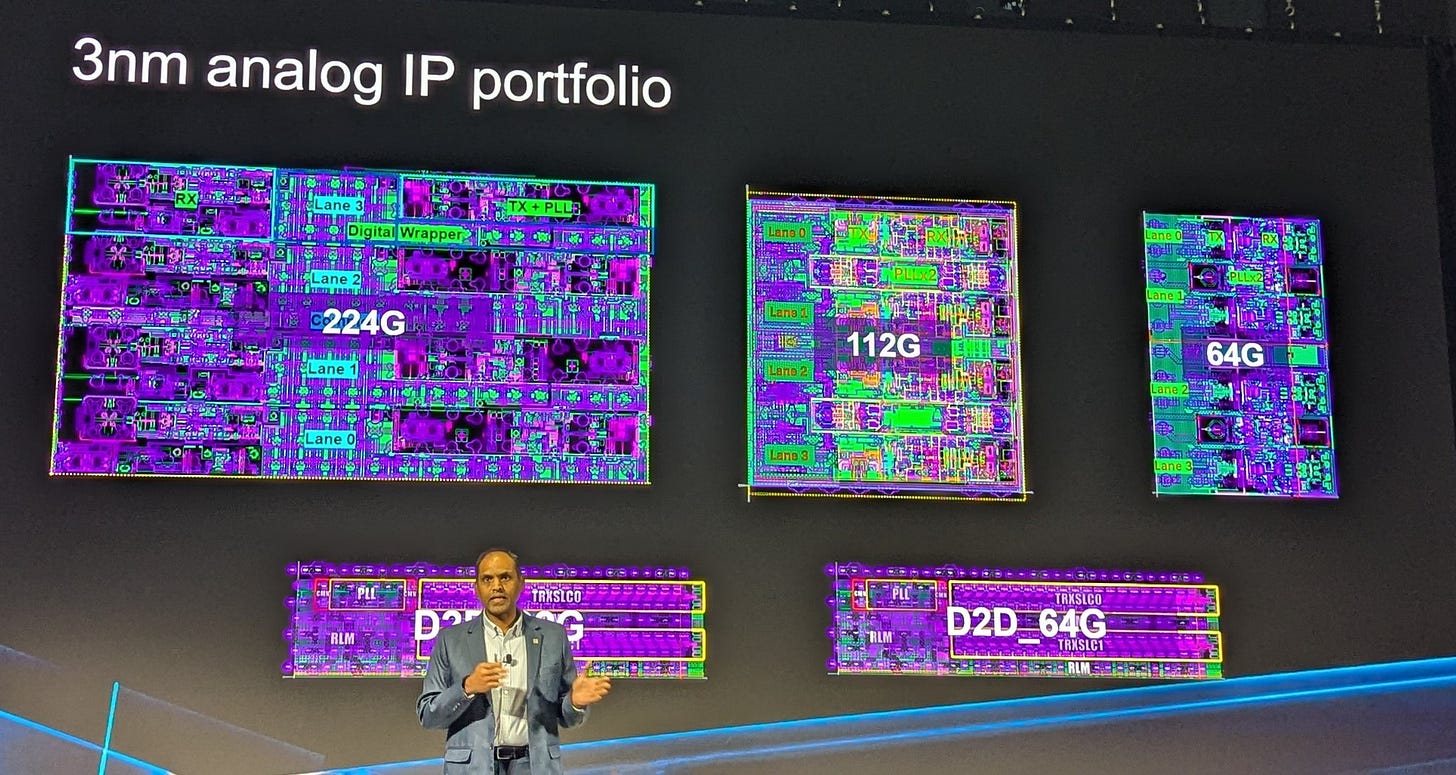

There are rumors Amazon moved Trainium 3 to Alchip because MRVL 0.00%↑ lacks 224G SerDes on TSMC N3. Alchip also allegedly quoted a much lower price.

Marvell had a private analyst day and showed this slide.

I would like to call bullshit.

Let’s zoom in on the 224G IP die shot.

First, the labeling is wrong. PLL is not just on Tx side. They very obviously have Tx and Rx PLLs.

They have some really weird mirroring going on. Regardless, the layout is very suspicious. This looks like an oDSP/C2M optimized IP.

Unlike PCIe, Ethernet/CEI/OIF has many flavors of specification.

I cannot find the 224G equivalent diagram publicly. Do I sound like someone who knows what the 224G diagram looks like based on preliminary standards documents that are behind a paywall that requires corporate login?

The IP MRVL 0.00%↑ showed looks like VSR/XSR/C2M optimized. Amazon almost certainly needs LR/KR for Trainum 3.

Many buy-side contacts ping me saying something along the lines of…

“hey Irrational Analysis… I am meeting with CEO/CFO/CTO of XYZ-corp… any questions you want to ask…?”

I would like every single institutional investor and professional analyst to go ask Marvell management the following very specific questions:

Does your 224G N3 SerDes support LR or KR spec?

Does it support 40 dB of insertion loss?

If the person you are talking to refuses to answer these very specific simple questions, they are trying to bullshit you.

If they don’t know, go find someone who does.

If they say this is “confidential” information, call them out. IEEE/OIF spec is not confidential! This is like a used car salesman saying the number of cylinders in the engine is confidential.

[4] Astera Labs (sigh)

Honestly, it’s kind of un-believable this stock made it to $145/share. Still want to short it again. Probably will lose even more money.

On the upside, if companies such as Amazon skip PCIe6 and jump to PCIe7/UALink, ALAB 0.00%↑ will have the only solution and existing good relationships.

Might be worth a long (trade) if stock corrects to $85-100.

[5] Credo

Credo keeps talking about “deepening customer relationships”.

What does this corpo-speak bullshit mean?

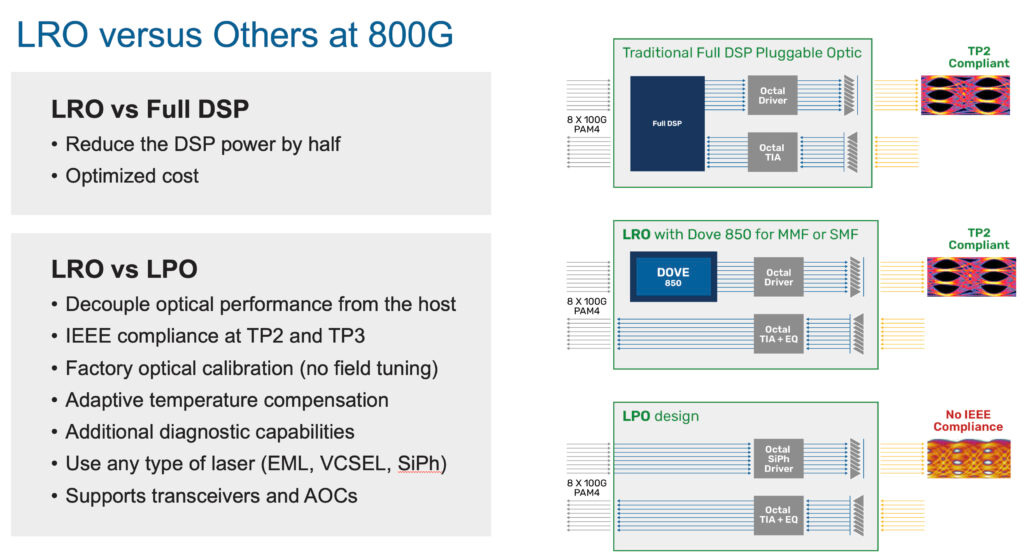

What this Credo slide neglects to mention is that LRO is not IEEE compliant on the Rx side.

A high-end (good N3 design) 112G SerDes is over-built relative to IEEE official spec and can thus handle LRO.

It takes a lot of tuning though. Think a team of engineers spending several months qualifying these LRO chips with every partner SerDes in an AI cluster.

This is what “deepening customer relationships” means. Credo finally got a big LRO customer after months of hard work.

More probably coming.

This stock is dangerous because most of the big investors have no clue what this company does and are blindly following momentum. The slightest miss of spreadsheet/model expectations will kill this stock 30-50% in one day.

[6] Coherent

Out of all the unfamiliar companies I researched for the communications mega-post, COHR 0.00%↑ is the only one that was genuinely interesting. After spending way too much time parsing endless bullshit, I have narrowed down the key differentiation.

Coherent is really good at making low phase-noise lasers.

Modulation order of QAM systems is limited by phase noise. Optical lasers are notoriously sensitive to temperature variation… because of phase shifts/distortion.

Stock is obviously over-bought. If it hits $80 I buy.

[7] SiTime Reiteration and Upgrade

I have previously covered SiTime in a mega-post on communication systems. Please refer to it for technical/engineering coverage. Don’t know what refclk, jitter, and PPM mean? Go read the technical post.

As for the stock, I have become much more bullish and downgraded “relative risk” from “high” to “medium” while maintaining “relative reward” at “very high”.

Here is the all-time stock chart:

You can see the bubble where Apple used SiTime in the iPhone and then kicked them out because of inert gas leakage issues.

Recent run-up is because of three Taiwan supply-chain rumors:

Apple supposedly designing SiTime back into the iPhone.

Possible iPhone content gains (double because SoC needs 100MHz while modem needs 122.88MHz for over-sampling).

Nvidia GB200 design win.

I don’t think any of the pod monkeys who bid up this stock based on supply-chain rumors has a clue **WHY** Nvidia chose SiTime for NVL72 224G products given the terrible jitter performance. They don’t understand the real TAM, enabled by genius 0 PPM system design in proprietary specs:

EVERY SINGLE ACTIVE ELECTRICAL AND OPTICAL CABLE

EVERY SINGLE SYSTEM THAT USES SLIGHTLY OUT-OF-SPEC STANDARDS (hyperscaler systems!!!!!, AWS Elastic Fabric, Google modified Ethernet,…)

There is a massive delta between what the finance people think and engineering reality. Super excited for this one.

Very dangerous though. If either Nvidia or Apple shift orders or fail to meet the hedge fund degenerates expectations, stock tanks 50% easily.

Know who is playing this ticker and why they are here. Understand the risks.

[8] MediaTek TPU Opportunity

There were rumors about a mini-TPU design win for MediaTek back in early 2024. I did not say anything as these were weak/uncorroborated rumors. At this point, so many people have corroborated the same.

It’s real. Everybody knows.

MediaTek has made their own 224G SerDes.

Google has awarded TPUv7E (small, inference).

Original plan was for this chip to be on TSMC N4P but MediaTek failed, as I expected.

Will they succeed on TSMC N3P with an extra year of development? Probably.

Bluntly, I would have already bought into MediaTek stock as a hedge/trade for my massive AVGO 0.00%↑ position. Unfortunately, only Interactive Brokers lets me invest in Taiwanese securities. Don’t want to enable margin trading in IB and have to manage risk in multiple accounts. Keeping a buffer of cash in case Webull margin calls me again lol.

If you have easy access to Taiwanese equities, this is probably a good buy. MediaTek is gaining share against Qualcomm in the traditional smartphone business. The TPU revenue will be insanely accretive to gross margins because it is datacenter (higher value) and does not include royalties to ARM. MediaTek pays the highest royalty rates to ARM in the industry.

Even if they screw up again and TPU v7e gets delayed by another 6 months… stock probably will be fine.

Good balance of risk/reward.

[9] Executive Summary of Opinions

HBM

Crazy trade idea that depends on Samsung DS-Memory continuing to fail.

CXMT D5 ramp can single-handedly destroy the thesis.

Micron and SK Hynix are both longs in my opinion.

Photonics Fabs

Good risk/reward given how incredible optics will be given multi-datacenter training, higher data rate wireline communications, and co-packed optics ramp.

I like Tower Semi more than GloFo primarily because of the latter’s prior history of stuffing customers.

Trainium 3

This is supply-chain bullshit.

Don’t care. Staying out of Marvell and Alchip. Have fun pod monkeys.

Might trade Marvell in H2 2025.

MediaTek

Good risk/reward. (Disclosure: not participating)

Stock probably works even with an additional 6-month delay in TPUv7e.

SiTime

Hyper bullish because of engineering reasons.

Downside risk from hedge funds who bid up the stock on Taiwan rumors.

Coherent

Stock is over-bought. Want to buy corrections.

Low-phase noise lasers is the technical moat.

Credo

Scrappy company that seems to have made inroads on LRO.

Dangerous… but I am holding my shares and might buy more.

Astera Labs

Still have a suicidal urge to short.

Might go long as a trade if it corrects to $85-100.

PCIe7/UAL switching might be a legit pump opportunity.

I’ve been nibbling on ONTO right now since the stock is a bit repressed. Someone I know in the industry likes their software so that’s a plus I guess.

What do you think the probability of LRO being successful at 1.6T is?