Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

Feel free to contact me via email at: irrational_analysis@proton.me

Welcome to the last trading day of 2024.

Just like last year, I am going to share the P&L of my top three largest accounts and all active positions. All holdings greater than 1% also get average price disclosed.

One of the nice things about investing is the personal responsibility assigned to the investor. It deeply concerns me that (statistically speaking) some small percentage of you subscribers might make dumb decisions based on what you read here.

You must understand that I engage in insanely risky behavior. My perspective on risk is very abnormal and, more importantly, I understand the risks I take using my own money.

DO NOT MAKE INVESTMENT OR FINANCIAL DECISIONS SOLELY BASED ON WHAT YOU READ HERE.

YOU MUST DO YOUR OWN RESEARCH AND ACCEPT RESPONSIBILITY FOR YOUR OWN DECISIONS.

Contents:

Performance of Top Three Accounts by NAV

Webull (leveraged trading)

E*TRADE (long only)

Schwab (long only)

Portfolio Update

Mistakes (learning opportunities)

Broadcom Call Option Early Sell

Astera Labs Short

Covered Broadcom and Nvidia Call Option Fails

Not Selling Camtek Bubble

Qualcomm Short Cover Timing

Intel Buy-Write Fail

Tesla Buy-Write Epic Fail

Vertiv Fails

ARM Trial Options Fail

Consolidated Lessons Learned

Looking Forward

[1] Performance of Top Three Accounts by NAV

I have three self-managed accounts that are large enough to be worth sharing.

(min six figures, all 401K accounts are in diversified mutual funds)

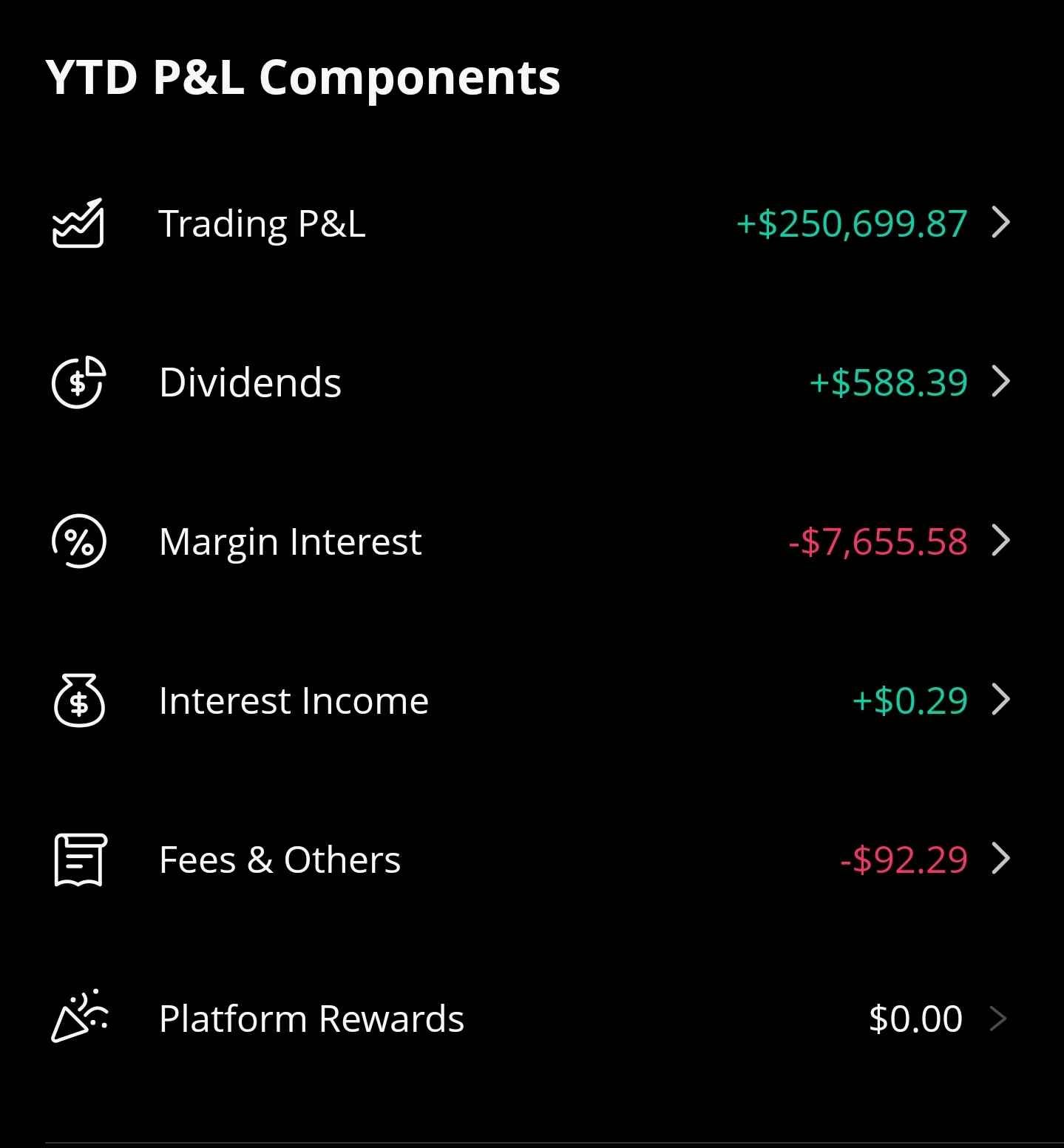

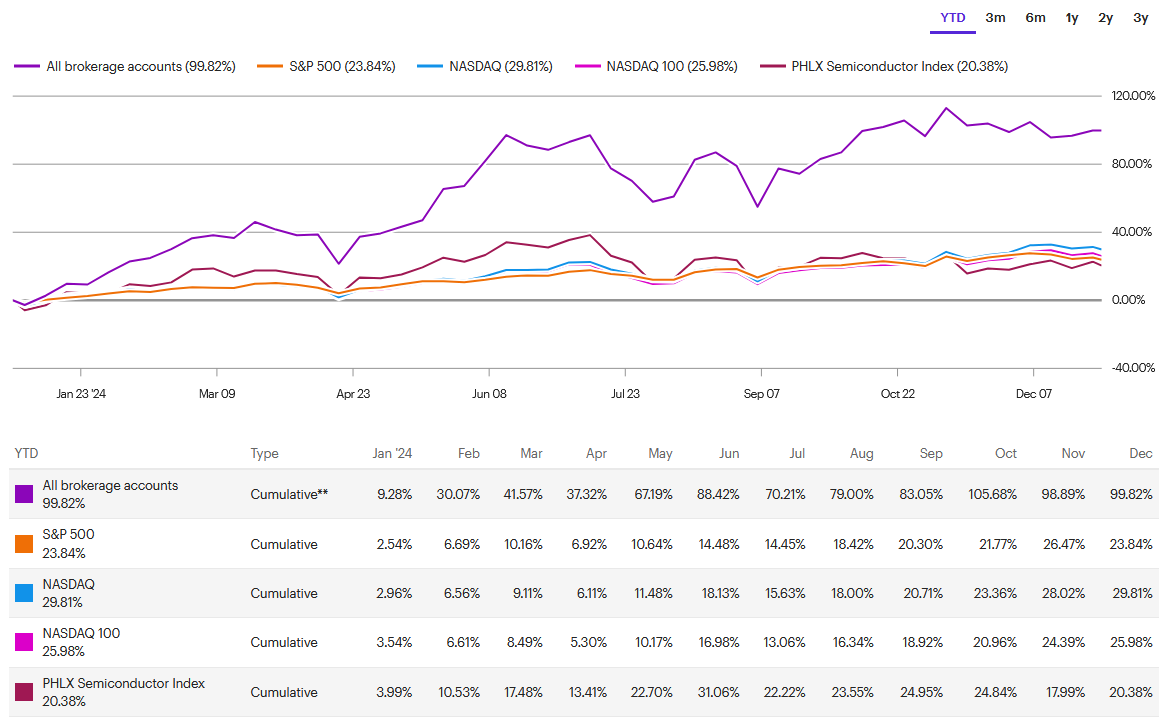

[1.a] Webull (leveraged trading)

Largest account.

Benchmark: SMH 0.00%↑, VanEck Market Cap Weighted Semiconductor ETF

Very active trading.

Heavy on OTM options.

Some short selling.

Leverage: YES

First half of 2024 no leverage.

Second half of 2024 at average leverage of 2.2x, peak of 2.7x.

Multiple margin calls this year, mostly related to Astera Labs short fail.

[1.b] E*TRADE (long only)

Second largest account.

Majority of Nvidia shares are here.

Long-only with some lite Nvidia options trading at a net realized loss.

Leverage: NO

[1.c] Schwab (long only)

Third largest account.

Most diversified portfolio.

Most of non-semiconductor investments here.

Lowest proportion of semiconductors.

Surprised by this one lol.

Thanks to the friend who tipped me off about GEV 0.00%↑.

Also... Tesla is stupid but I have shares in a ROTH account so horary for me.

Long-only with zero trading.

Leverage: NO

[2] Portfolio Update

At the time of publishing (December 31st, 2024) I hold the following positions across all accounts.

Have already de-levered and withdrawn all the money needed to pre-pay (over-pay) capital gains taxes. That money is not included. Probably will get a nice chunk of money back in April.

Currently have a large amount of available buying power in Webull. Intend to use it as opportunities arise.

[3] Mistakes (learning opportunities)

There is sufficient information from my post history for you to figure out what the wins are.

Losses (and lessons learned) are far more important in my opinion. Here is every major mistake I made in 2024.

[3.a] Broadcom Call Option Early Sell

I had Broadcom call options (180c 12/20/24) that were up ~150% going into 4QCY24 earnings. Could have made a lot more profit had I held.

Missed out on additional $50-80K profit. 🤡

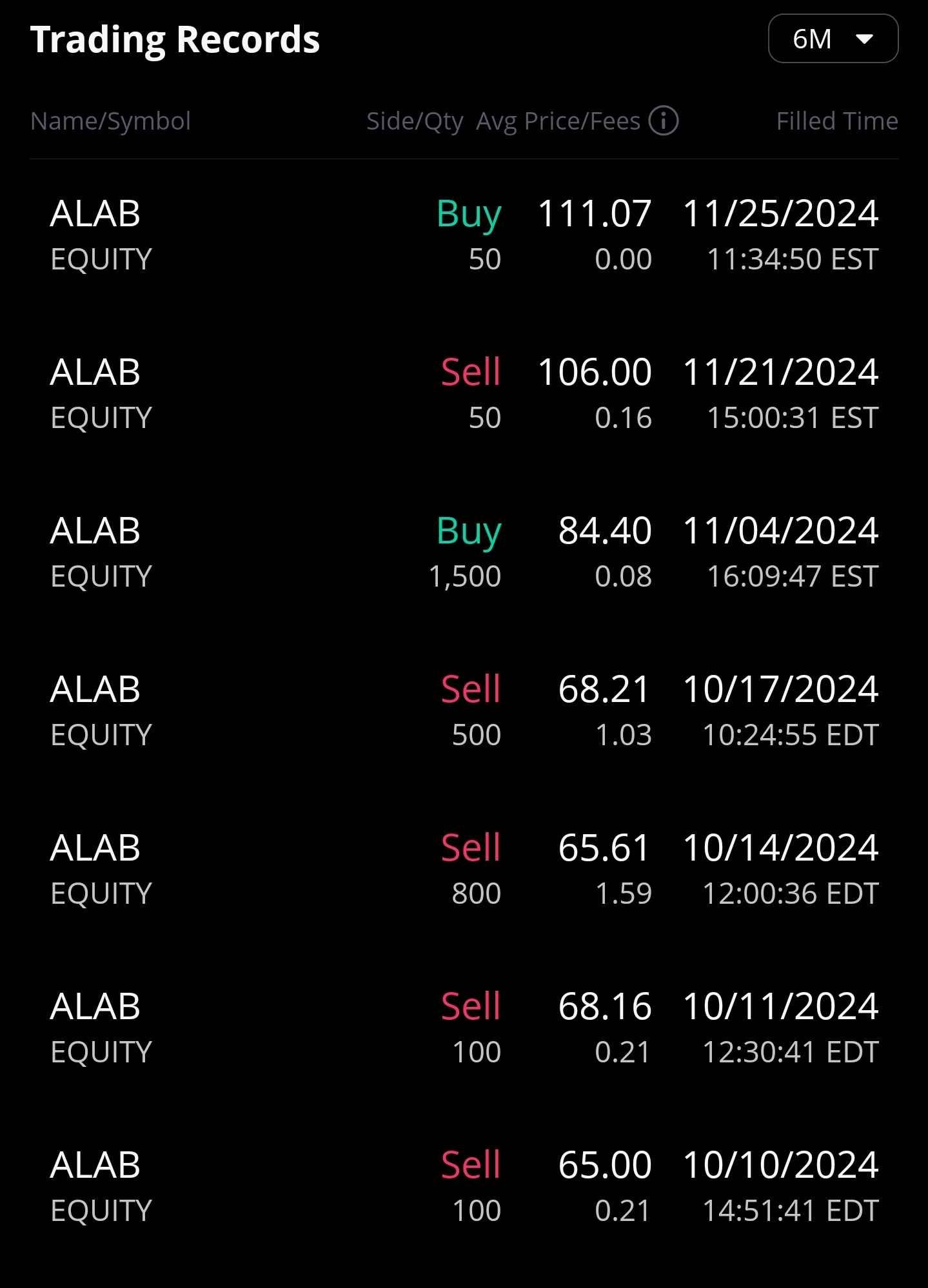

[3.b] Astera Labs Short

My thesis was wrong for several reasons but that is not the primary mistake.

The main mistake was shorting a low-float stock that only allows 1x leverage and stubbornly refusing to de-risk.

Missed out on several other opportunities at the time because my buying power had been vaporized by shorting this garbage.

[3.c] Covered Broadcom and Nvidia Call Option Fails

There are multiple instances this year where I wrote covered calls on Nvidia and Broadcom. Most of the time, this ended terribly. Got crushed with writing AMD covered calls back in 2023 too.

I estimate a net realized loss of $15-20K this year from option writing across all accounts.

[3.d] Not Selling Camtek Bubble

To be clear, I like this stock and still own a bunch. The point is… should have sold, paid taxes, then bought back in.

This is a fail due to stubbornness.

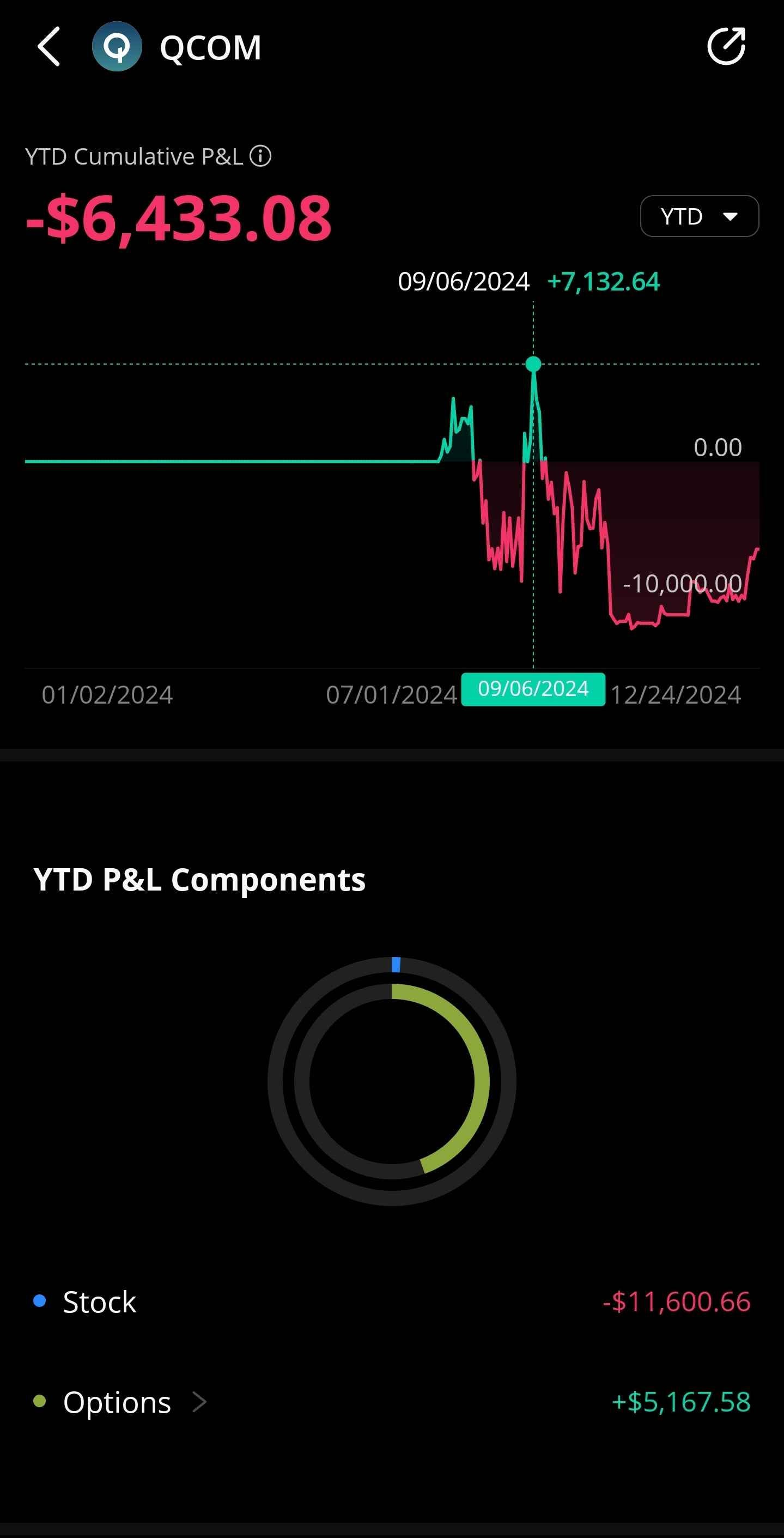

[3.e] Qualcomm Short Cover Timing

Had a very large short position to hedge against the leveraged Broadcom long position.

Stupidly, I did not cover the Qualcomm short leg at profit. Kept holding.

Rookie mistake.

[3.f] Intel Buy-Write Fail

Another example of how writing options as a retail trader is retarded.

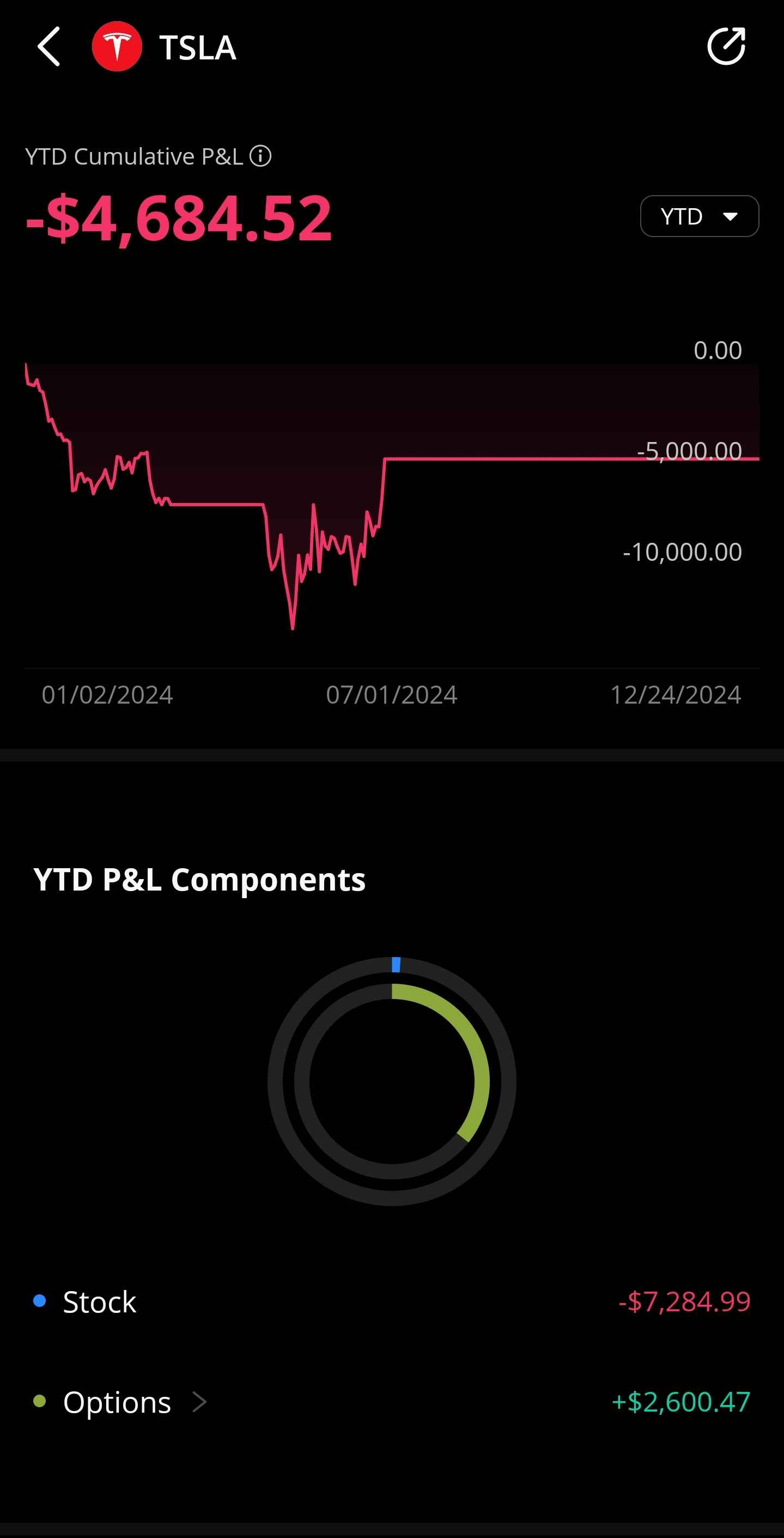

[3.g] Tesla Buy-Write Epic Fail

This one is special. I opened the position right before going on vacation with sporadic internet access. Spent a good chunk of the vacation panicking over this shit instead of… enjoying my vacation.

[3.h] Vertiv Fails

Look at this chart.

Literally managed to buy high and sell low multiple times.

Mr. Book Value must be laughing his ass off.

[3.i] ARM Trial Options Fail

Based on public court documents before the trial started, I thought ARM was going to win. Bought (too many…) call options to gamble on a royalty rate hike upon largest customer.

When it became clear that ARM was going to lose the trial because their lawyers are idiots, I bought some Qualcomm calls as a hedge.

Despite a total victory by Qualcomm, the stock did not move. At this point, I am convinced nothing can make Qualcomm stock go up.

[4] Consolidated Lessons Learned

DO NOT SHORT EQUITIES WITH LESS THAN 2X LEVERAGE.

If needed, limit such shorts to $20-50K max bet.

You think I won’t short Cerebras once they IPO?

Absolutely going to short that trash at some point.

Cover to raise buying power for other opportunities as needed.

DO NOT WRITE COVERED CALLS.

DO NOT BUY-WRITE GARBAGE.

Be less stubborn and sell longs or cover shorts in profit.

Have a bad habit of obsessing over engineering even if a stock has become obviously over-bought.

CAMT 0.00%↑ and COHR 0.00%↑ are good examples of this category of mistake.

Don’t sell an entire profited options position. Keep some in case of tail events like Hock Tan giving erotic TAM forecasts.

[5] Looking Forward

My official 2025 goal is the same as 2024.

Beat SMH 0.00%↑ in my leveraged trading account by at least 30%.

The stretch goal is 200%. (yes, I am serious)

Learned a lot this year. Think I can do much better in 2025. Simply making fewer stupid mistakes would have easily gotten me to 200% over SMH 0.00%↑ in 2024.

With that said, 2024 was pretty good given that I am a hobbyist with a dayjob.

Remember, it’s just money. It’s made up.

You think I’m here for money?

Congrats on a wonderfully successful year and wishing you all the best in 2025! Thank you for everything you've shared and continue to share which helps us all make better informed investment decisions.

Thank you!