AMD Advancing AI 2024 and Astera Labs PCIe Switch Over-hype

AI expectations drive diverging stock prices.

Irrational Analysis is heavily invested in the semiconductor industry.

Please check the ‘about’ page for a list of active positions.

Positions will change over time and are regularly updated.

Opinions are authors own and do not represent past, present, and/or future employers.

All content published on this newsletter is based on public information and independent research conducted since 2011.

This newsletter is not financial advice, and readers should always do their own research before investing in any security.

At the time of publishing, I have no economic interest in Cerebras.

Feel free to contact me via email at: irrational_analysis@proton.me

Big report on Cerebras coming on Sunday.

For now, quick note on the AMD 0.00%↑ event today and the crazy ALAB 0.00%↑ rally off an announcement everyone knew was coming.

AMD

Turin is great but 7:1 consolidation ratio is a little optimistic IMO. 5:1 more realistic.

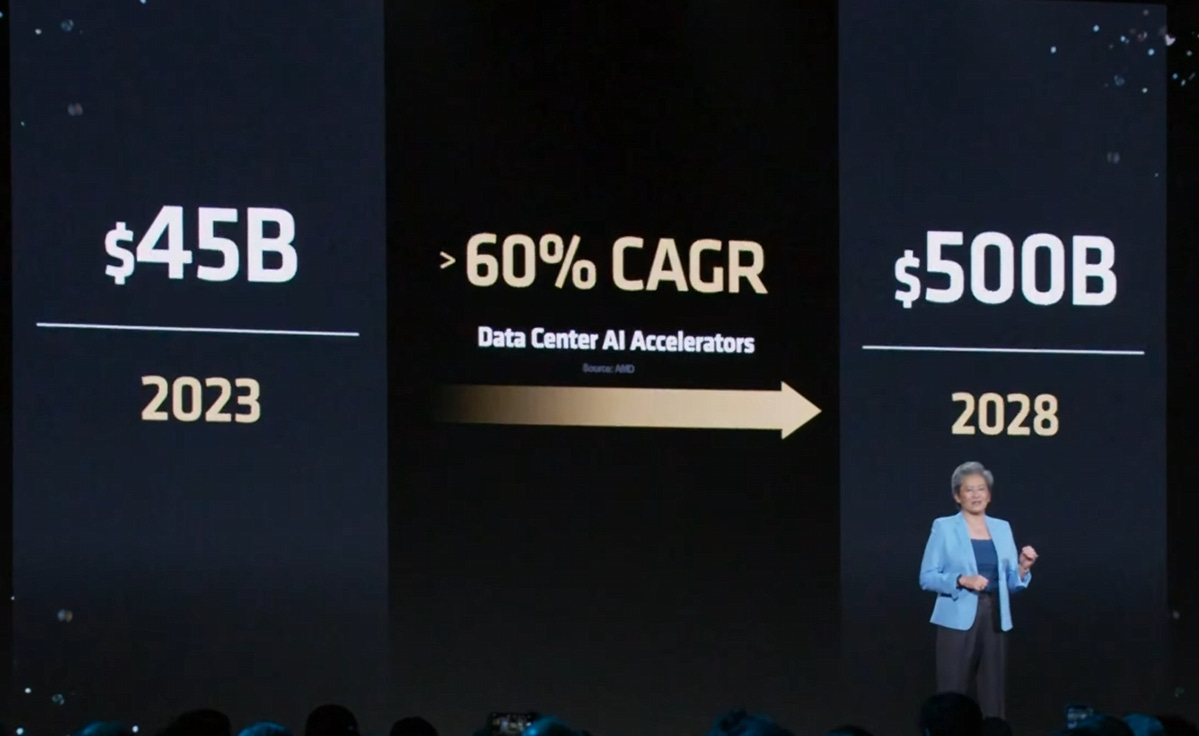

TAM go up so Nvidia stock go up. :)

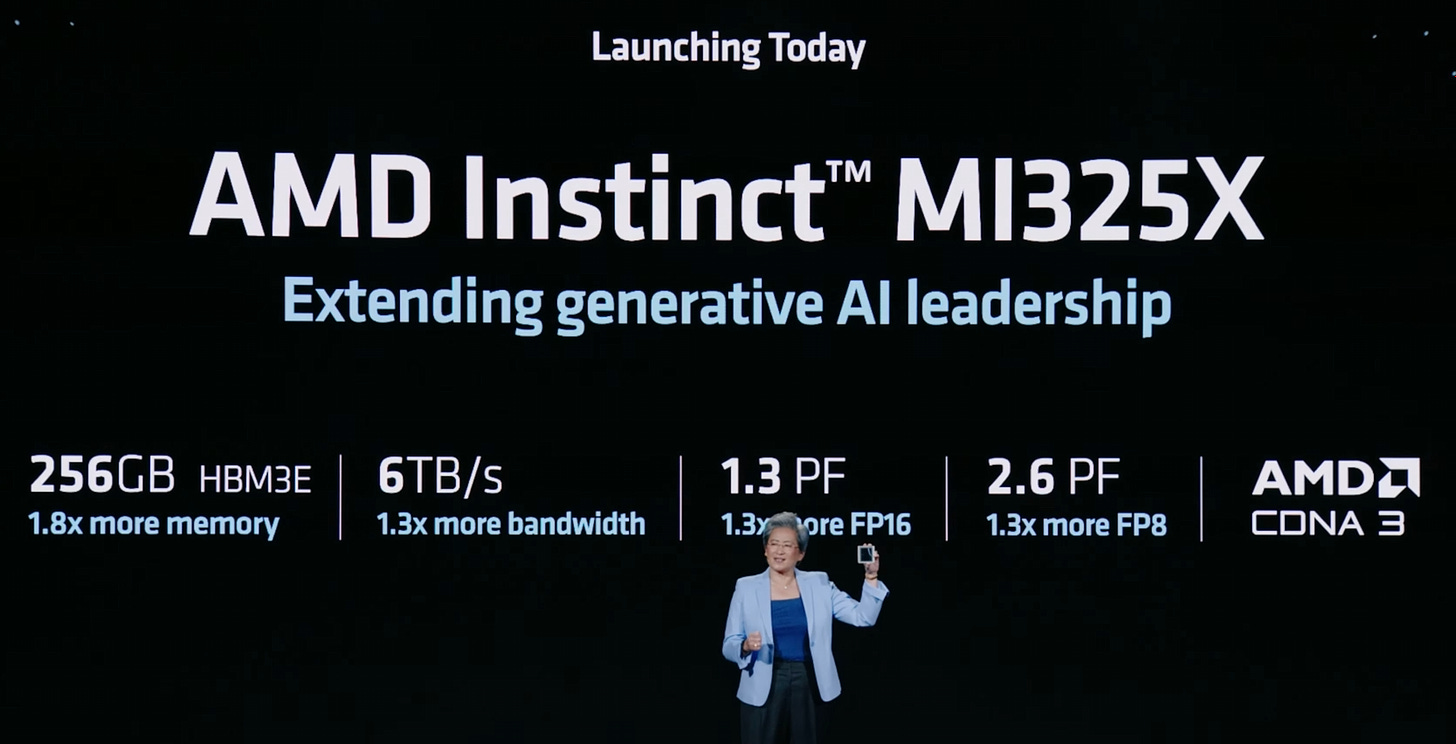

MI325X is a refresh of MI300X. Here is the change list:

Logic dies moved to derivative TSMC node for minor PPA improvements. (<7%)

HBM3E instead of HBM3.

256GB of HBM3E instead of the 288GB expected because Samsung yields are horrible.

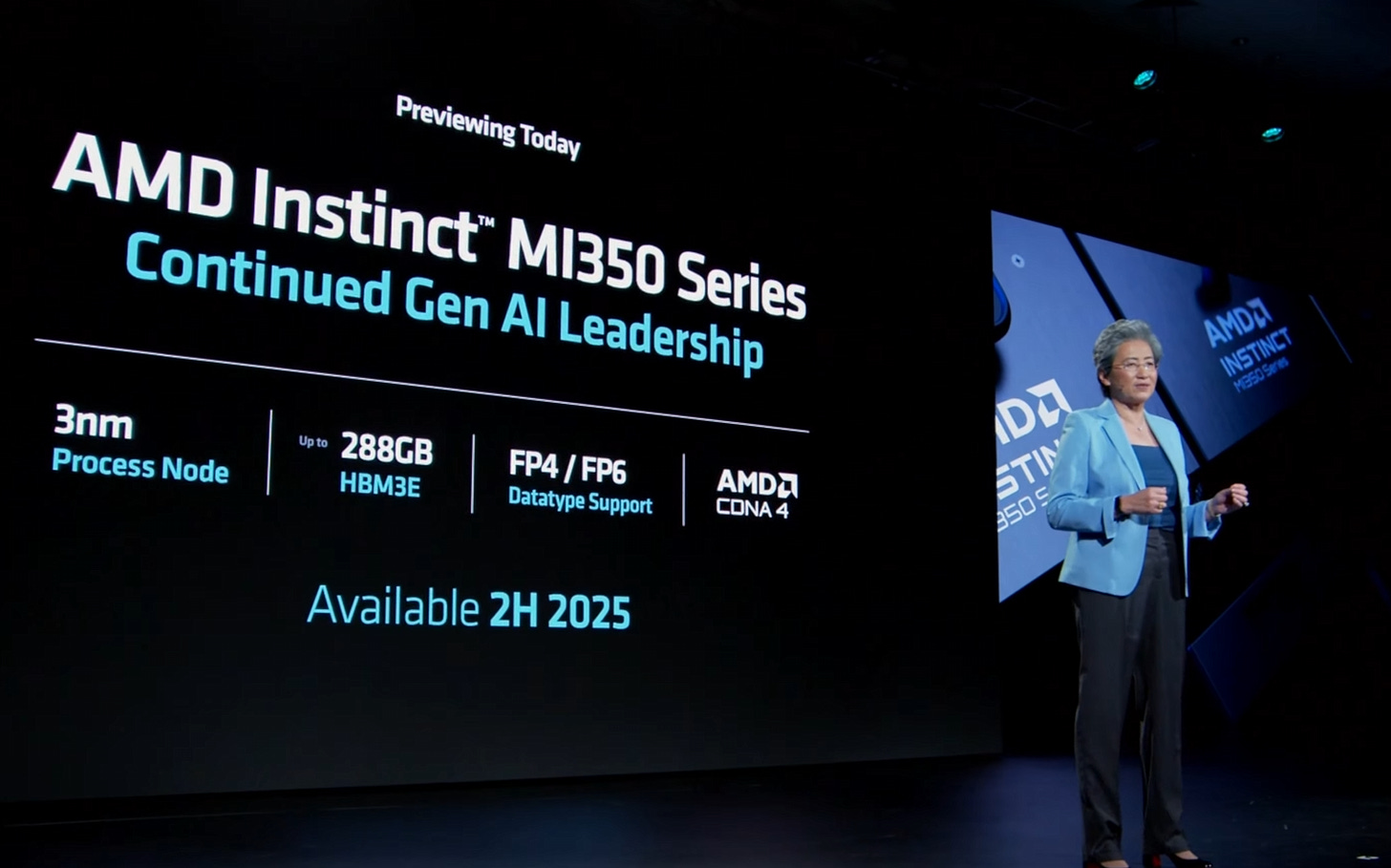

I’m gona go ahead and call this as Q4 2025, not H2 2025. Too slow IMO. Nvidia is 0.5-1 generation ahead.

I find it amusing all of AMD’s comparisons are against the H100 when clearly H200 is the correct comp right now and GB200 will be the correct comp in less than 6 months.

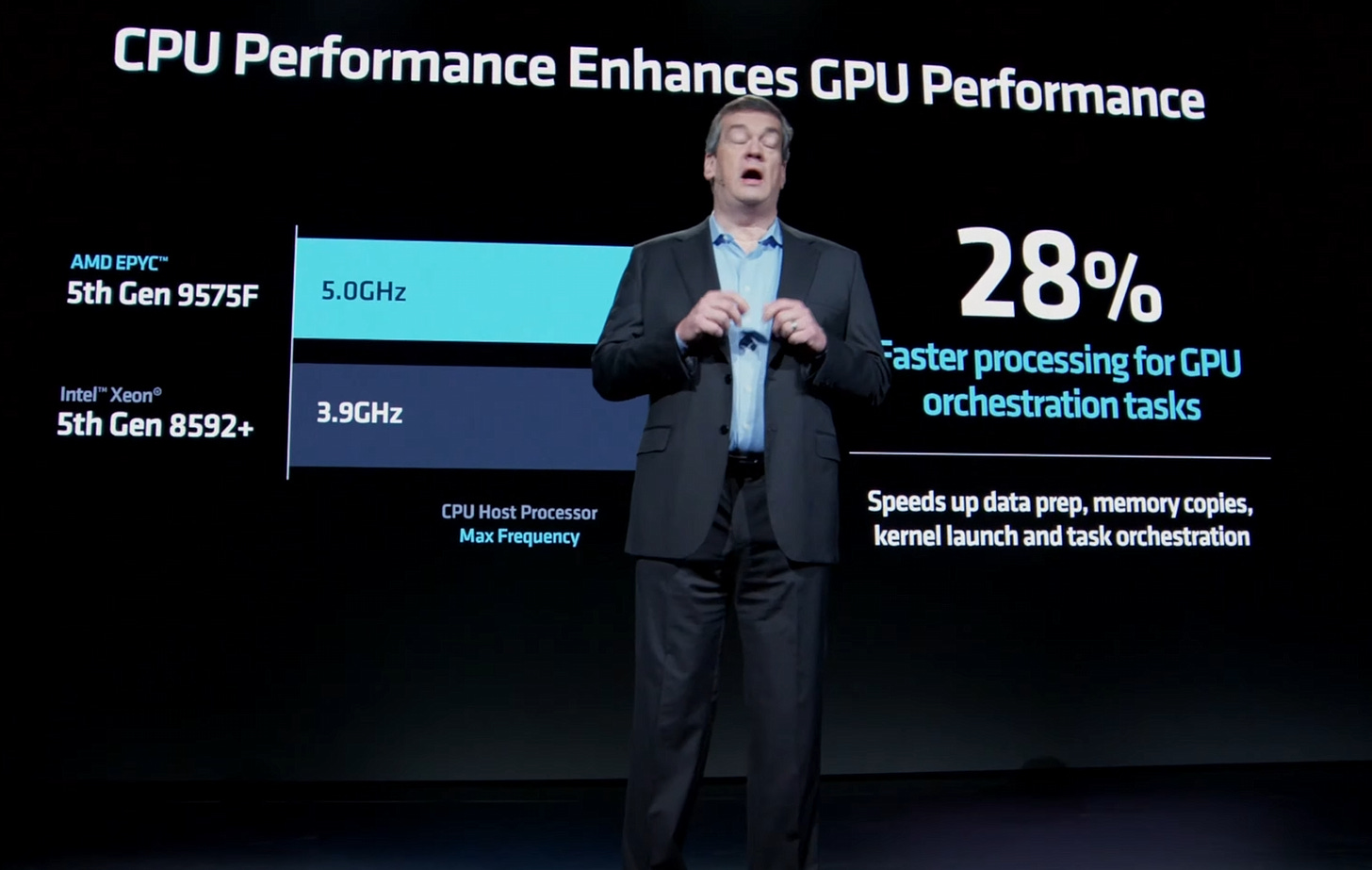

This is not true. Non-uniform latency and driver issues make AMD last place for the CPU socket in AI head nodes. Intel has the advantage here. ARM/Nvidia/Grace will take massive share from both Intel and AMD soon.

AMD bought Pensando for $1.9B back in 2022 and it has gone nowhere unfortunately. Looking forward to 3rd party review of this new Pensando DPU. I am a huge fan of DPUs.

Problem is, these products are highly configurable for specialized workloads, so it is very difficult to evaluate from the outside. Even if I bought one of these things, I would lack the software skills to properly evaluate it.

What AMD 0.00%↑ showed today was not enough. Buy-side was expecting more so the stock tanked. IMO, the competitive positioning is very simple for AMD.

Decisively #3 in the market.

NVDA 0.00%↑ is #1 and will continue to out-grow for the next 12-18 months.

AVGO 0.00%↑ is #2 and may out-grow Nvidia in 2026.

There is a very wide gap between Broadcom/AMD and AMD/4th place.

MI325X will sell ok (probably) next year for specific segments of the inference market.

Model has to be small enough to fit on a single 8x GPU server.

AMD sells at low-enough (45-55%) gross margins to undercut Nvidia.

Nvidia Blackwell supply used for training and high-end inference.

Sell-side is at $7-8B DC GPU revenue for AMD next year. Buy-side is higher. I think both are wrong. AMD will be lucky to sell $4-5B worth of GPUs in the first half of 2025 before Blackwell ramp crushes them. Not shorting yet but getting close.

Astera Labs

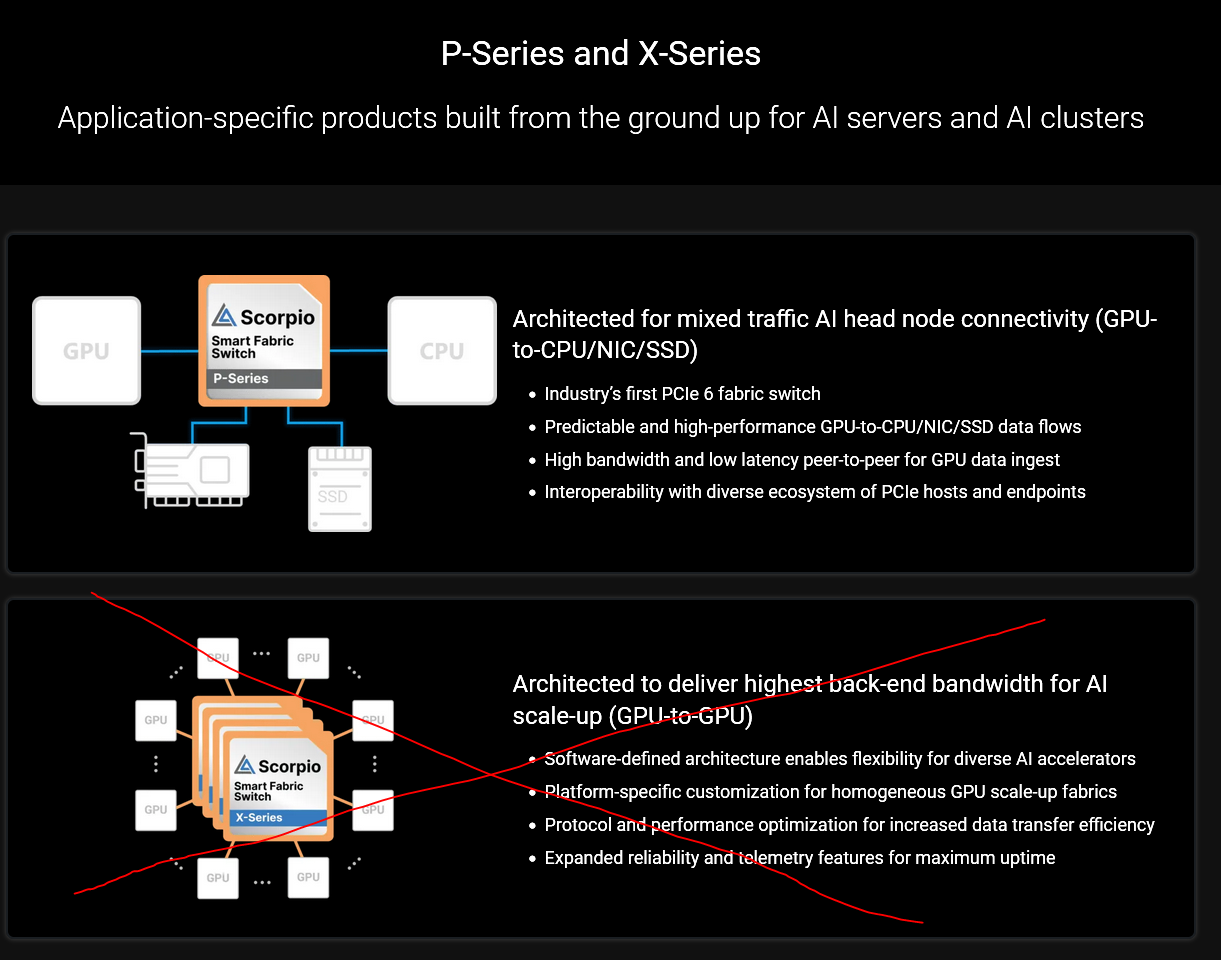

Massive gap-up on an announcement for a product everyone knew was coming. I’m serious. Everyone knew that ALAB was going to launch a PCIe gen6 switch. That is literally the only way they have a chance of offsetting revenue loss on PCIe re-timer content shrink with GB200.

For a very long time, AVGO 0.00%↑ has dominated the PCIe switch market with their acquisition of PLX. It effectively was a monopoly because the only competition, Microtik sucks. As an aside, AMD has poached many engineers from Microtik.

ALAB is coming into this market head-to-head with Broadcom using SerDes IP licensed from an EDA vendor. Broadcom’s IP is much better. Their package design team is better. Their firmware team is better. Their interop testing team is better.

Is ALAB going to get any customer other than Amazon (who has warrants/options that exercise off of purchase volume!) for these PCIe switches? I think not.

PCIe for GPU-GPU scale-up is infuriatingly stupid. Honestly can’t believe some of the nonsense circulating within finance land. Sell-side has completely fallen for this AI headfake. Astera Labs exists because Amazon wants to exercise their super cheap options. It’s the semiconductor version of RIVN 0.00%↑.

I have opened a small short position against ALAB 0.00%↑ at $65/share. Will short more if it keeps going up. This is stupid.

Can you please explain what are the bottlenecks to Blackwell ramp? AFAIK Nvidia said it's sold out through 2025, so isn't AMD the only alternative to non-hyperscalers? I also heard that Nvidia and AMD bought out all of HBM supply through 2025, so how would others even compete without the memory available?

What about AMD semi custom? Do they have any hyperscaler as their client? Why Googl.e and Meta are partnering with Broadcom for their custom AI chips instead with AMD?